Deck 9: Characterizing Risk and Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 9: Characterizing Risk and Return

1

Which of these is the investor's combination of securities that achieves the highest expected return for a given risk level?

A) Efficient portfolio

B) Modern portfolio

C) Optimal portfolio

D) Total portfolio

A) Efficient portfolio

B) Modern portfolio

C) Optimal portfolio

D) Total portfolio

Optimal portfolio

2

We commonly measure the risk-return relationship using which of the following?

A) Coefficient of variation

B) Correlation coefficient

C) Standard deviation

D) Expected returns

A) Coefficient of variation

B) Correlation coefficient

C) Standard deviation

D) Expected returns

Coefficient of variation

3

Which of these is the dollar return characterized as a percentage of money invested?

A) Average return

B) Dollar return

C) Market return

D) Percentage return

A) Average return

B) Dollar return

C) Market return

D) Percentage return

Percentage return

4

Which of these is a measure summarizing the overall past performance of an investment?

A) Average return

B) Dollar return

C) Market return

D) Percentage return

A) Average return

B) Dollar return

C) Market return

D) Percentage return

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

To find the percentage return of an investment:

A) multiply the dollar return by the investment's value at the beginning of the period.

B) divide the dollar return by the investment's value at the beginning of the period.

C) multiply the dollar return by the investment's value at the end of the period.

D) divide the dollar return by the investment's value at the end of the period.

A) multiply the dollar return by the investment's value at the beginning of the period.

B) divide the dollar return by the investment's value at the beginning of the period.

C) multiply the dollar return by the investment's value at the end of the period.

D) divide the dollar return by the investment's value at the end of the period.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is another term for market risk?

A) Firm specific risk

B) Modern portfolio risk

C) Nondiversifiable risk

D) Total risk

A) Firm specific risk

B) Modern portfolio risk

C) Nondiversifiable risk

D) Total risk

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is an index that tracks 500 companies,which allows for a great deal of diversification?

A) Nasdaq

B) Fortune 500

C) S&P 500

D) Wall Street Journal

A) Nasdaq

B) Fortune 500

C) S&P 500

D) Wall Street Journal

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

MedTech Corp.stock was $50.95 per share at the end of last year.Since then,it paid a $0.45 per share dividend.The stock price is currently $62.50.If you owned 500 shares of MedTech,what was your percent return?

A) 7.20 percent

B) 8.83 percent

C) 22.67 percent

D) 23.55 percent

A) 7.20 percent

B) 8.83 percent

C) 22.67 percent

D) 23.55 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is defined as the portion of total risk that is attributable to firm or industry factors and can be reduced through diversification?

A) Firm specific risk

B) Market risk

C) Modern portfolio risk

D) Total risk

A) Firm specific risk

B) Market risk

C) Modern portfolio risk

D) Total risk

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is the concept and procedure for combining securities into a portfolio to minimize risk?

A) Firm specific theory

B) Modern portfolio theory

C) Optimal portfolio theory

D) Total portfolio theory

A) Firm specific theory

B) Modern portfolio theory

C) Optimal portfolio theory

D) Total portfolio theory

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Which of these includes any capital gain (or loss)that occurred as well as any income that you received from a specific investment?

A) Average return

B) Dollar return

C) Market return

D) Portfolio

A) Average return

B) Dollar return

C) Market return

D) Portfolio

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is defined as the volatility of an investment,which includes firm specific risk as well as market risk?

A) Diversifiable risk

B) Market risk

C) Standard deviation

D) Total risk

A) Diversifiable risk

B) Market risk

C) Standard deviation

D) Total risk

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following makes this a true statement: The shape of the efficient frontier implies that:

A) diminishing returns apply to risk-taking in the investment world.

B) increasing returns apply to risk-taking in the investment world.

C) returns are not impacted by risk-taking in the investment world.

D) None of the options complete the sentence to make it true.

A) diminishing returns apply to risk-taking in the investment world.

B) increasing returns apply to risk-taking in the investment world.

C) returns are not impacted by risk-taking in the investment world.

D) None of the options complete the sentence to make it true.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

Which of these is a measure of risk to reward earned by an investment over a specific period of time?

A) Coefficient of variation

B) Market deviation

C) Standard deviation

D) Total variation

A) Coefficient of variation

B) Market deviation

C) Standard deviation

D) Total variation

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Which of these is the portion of total risk that is attributable to overall economic factors?

A) Firm specific risk

B) Market risk

C) Modern portfolio risk

D) Total risk

A) Firm specific risk

B) Market risk

C) Modern portfolio risk

D) Total risk

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is a measurement of the co-movement between two variables that ranges between -1 and +1?

A) Coefficient of variation

B) Correlation

C) Standard deviation

D) Total risk

A) Coefficient of variation

B) Correlation

C) Standard deviation

D) Total risk

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

Which statement is true?

A) The larger the standard deviation, the lower the total risk.

B) The larger the standard deviation, the higher the total risk.

C) The larger the standard deviation, the more portfolio risk.

D) The standard deviation is not an indication of total risk.

A) The larger the standard deviation, the lower the total risk.

B) The larger the standard deviation, the higher the total risk.

C) The larger the standard deviation, the more portfolio risk.

D) The standard deviation is not an indication of total risk.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

Which of these is the term for portfolios with the highest return possible for each risk level?

A) Efficient portfolios

B) Modern portfolios

C) Optimal portfolios

D) Total portfolios

A) Efficient portfolios

B) Modern portfolios

C) Optimal portfolios

D) Total portfolios

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Which of these is defined as a combination of investment assets held by an investor?

A) Bundle

B) Market basket

C) Portfolio

D) All of the options

A) Bundle

B) Market basket

C) Portfolio

D) All of the options

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Which of these statements is true?

A) When people purchase a stock, they know exactly what their dollar and percent return are going to be.

B) Many people purchase stocks as they find comfort in the certainty for this safe form of investing.

C) When people purchase a stock, they know the short-term return, but not the long-term return.

D) When people purchase a stock, they do not know what their return is going to be-either short term or in the long run.

A) When people purchase a stock, they know exactly what their dollar and percent return are going to be.

B) Many people purchase stocks as they find comfort in the certainty for this safe form of investing.

C) When people purchase a stock, they know the short-term return, but not the long-term return.

D) When people purchase a stock, they do not know what their return is going to be-either short term or in the long run.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

WayCo stock was $75 per share at the end of last year.Since then,it paid a $3 per share dividend last year.The stock price is currently $70.If you owned 200 shares of WayCo,what was your percent return?

A) −6.67 percent

B) −2.67 percent

C) 4.00 percent

D) 4.29 percent

A) −6.67 percent

B) −2.67 percent

C) 4.00 percent

D) 4.29 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

Year to date,Company Y had earned a 10.8 percent return.During the same time period,Company R earned 12.20 percent and Company C earned −1.56 percent.If you have a portfolio made up of 45 percent Y,35 percent R,and 20 percent C,what is your portfolio return?

A) 7.15 percent

B) 8.19 percent

C) 8.82 percent

D) 9.44 percent

A) 7.15 percent

B) 8.19 percent

C) 8.82 percent

D) 9.44 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 10 percent and standard deviation of 15 percent.The average return and standard deviation of Idol Staff are 15 percent and 25 percent; and of Poker-R-Us are 12 percent and 35 percent.

A) Rail Haul, Idol Staff, Poker-R-Us

B) Idol Staff, Poker-R-Us, Rail Haul

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Rail Haul, Poker-R-Us

A) Rail Haul, Idol Staff, Poker-R-Us

B) Idol Staff, Poker-R-Us, Rail Haul

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Rail Haul, Poker-R-Us

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

An investor owns $10,000 of Adobe Systems stock,$15,000 of Dow Chemical,and $25,000 of Office Depot.What are the portfolio weights of each stock?

A) Adobe System = 0.3333, Dow Chemical = 0.3333, Office Depot = 0.3333

B) Adobe System = 0.2, Dow Chemical = 0.3, Office Depot = 0.5

C) Adobe System = 0.3, Dow Chemical = 0.2, Office Depot = 0.5

D) Adobe System = 0.2667, Dow Chemical = 0.3333, Office Depot = 0.4

A) Adobe System = 0.3333, Dow Chemical = 0.3333, Office Depot = 0.3333

B) Adobe System = 0.2, Dow Chemical = 0.3, Office Depot = 0.5

C) Adobe System = 0.3, Dow Chemical = 0.2, Office Depot = 0.5

D) Adobe System = 0.2667, Dow Chemical = 0.3333, Office Depot = 0.4

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Rx Corp.stock was $60.00 per share at the end of last year.Since then,it paid a $1.00 per share dividend last year.The stock price is currently $62.50.If you owned 400 shares of Rx,what was your percent return?

A) 1.67 percent

B) 4.17 percent

C) 5.60 percent

D) 5.83 percent

A) 1.67 percent

B) 4.17 percent

C) 5.60 percent

D) 5.83 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

The past five monthly returns for K and Company are 4.25 percent,4.13 percent,−2.05 percent,3.25 percent,and 7.25 percent.What is the average monthly return?

A) 1.403 percent

B) 1.744 percent

C) 3.366 percent

D) 4.186 percent

A) 1.403 percent

B) 1.744 percent

C) 3.366 percent

D) 4.186 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

Rank the following three stocks by their level of total risk,highest to lowest.Rail Haul has an average return of 10 percent and standard deviation of 15 percent.The average return and standard deviation of Idol Staff are 15 percent and 25 percent; and of Poker-R-Us are 12 percent and 35 percent.

A) Rail Haul, Poker-R-Us, Idol Staff

B) Idol Staff, Poker-R-Us, Rail Haul

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Rail Haul, Poker-R-Us

A) Rail Haul, Poker-R-Us, Idol Staff

B) Idol Staff, Poker-R-Us, Rail Haul

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Rail Haul, Poker-R-Us

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

The past five monthly returns for K and Company are 2.28 percent,2.64 percent,−1.05 percent,4.25 percent,and 9.25 percent.What is the average monthly return?

A) 1.45 percent

B) 1.62 percent

C) 3.47 percent

D) 3.89 percent

A) 1.45 percent

B) 1.62 percent

C) 3.47 percent

D) 3.89 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Determine which one of these three portfolios dominates another.Name the dominated portfolio and the portfolio that dominates it.Portfolio Blue has an expected return of 13 percent and risk of 17 percent.The expected return and risk of portfolio Yellow are 15 percent and 19 percent,and for the Purple portfolio are 12 percent and 18 percent.

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Blue dominates portfolio Purple

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Blue dominates portfolio Purple

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

The past five monthly returns for PG Company are 3.25 percent,−1.45 percent,4.35 percent,6.49 percent,and 3.75 percent.What is the average monthly return?

A) 1.366 percent

B) 1.608 percent

C) 3.278 percent

D) 3.858 percent

A) 1.366 percent

B) 1.608 percent

C) 3.278 percent

D) 3.858 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Year-to-date,Company O had earned a −2.10 percent return.During the same time period,Company V earned 8.00 percent and Company M earned 6.25 percent.If you have a portfolio made up of 40 percent Company O,30 percent Company V,and 30 percent Company M,what is your portfolio return?

A) 3.435 percent

B) 5.115 percent

C) 12.15 percent

D) 16.35 percent

A) 3.435 percent

B) 5.115 percent

C) 12.15 percent

D) 16.35 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Determine which one of these three portfolios dominates another.Name the dominated portfolio and the portfolio that dominates it.Portfolio Blue has an expected return of 14 percent and risk of 19 percent.The expected return and risk of portfolio Yellow are 15 percent and 18 percent,and for the Purple portfolio are 16 percent and 21 percent.

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Yellow dominates portfolio Blue

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Yellow dominates portfolio Blue

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

TechNo stock was $25 per share at the end of last year.Since then,it paid a $1.50 per share dividend last year.The stock price is currently $23.If you owned 300 shares of TechNo,what was your percent return?

A) −2 percent

B) −8 percent

C) 6 percent

D) 6.5 percent

A) −2 percent

B) −8 percent

C) 6 percent

D) 6.5 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 8 percent and standard deviation of 10 percent.The average return and standard deviation of Idol Staff are 10 percent and 20 percent; and of Poker-R-Us are 6 percent and 15 percent.

A) Rail Haul, Idol Staff, Poker-R-Us

B) Idol Staff, Rail Haul, Poker-R-Us

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Poker-R-Us, Rail Haul

A) Rail Haul, Idol Staff, Poker-R-Us

B) Idol Staff, Rail Haul, Poker-R-Us

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Poker-R-Us, Rail Haul

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

An investor owns $2,000 of Adobe Systems stock,$4,000 of Dow Chemical,and $6,000 of Office Depot.What are the portfolio weights of each stock?

A) Adobe System = 0.3333, Dow Chemical = 0.3333, Office Depot = 0.3333

B) Adobe System = 0.1667, Dow Chemical = 0.3333, Office Depot = 0.5

C) Adobe System = 0.3333, Dow Chemical = 0.1667, Office Depot = 0.5

D) Adobe System = 0.2, Dow Chemical = 0.4, Office Depot = 0.6

A) Adobe System = 0.3333, Dow Chemical = 0.3333, Office Depot = 0.3333

B) Adobe System = 0.1667, Dow Chemical = 0.3333, Office Depot = 0.5

C) Adobe System = 0.3333, Dow Chemical = 0.1667, Office Depot = 0.5

D) Adobe System = 0.2, Dow Chemical = 0.4, Office Depot = 0.6

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Determine which one of these three portfolios dominates another.Name the dominated portfolio and the portfolio that dominates it.Portfolio Blue has an expected return of 7 percent and risk of 10 percent.The expected return and risk of portfolio Yellow are 13 percent and 10 percent,and for the Purple portfolio are 9 percent and 14 percent.

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Yellow dominates portfolio Blue

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

A) Portfolio Blue dominates portfolio Yellow

B) Portfolio Yellow dominates portfolio Blue

C) Portfolio Purple dominates portfolio Blue

D) Portfolio Purple dominates portfolio Yellow

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Year to date,Company Y had earned a 7 percent return.During the same time period,Company R earned 9.25 percent and Company C earned −2.25 percent.If you have a portfolio made up of 35 percent Y,40 percent R,and 25 percent C,what is your portfolio return?

A) 4.6667 percent

B) 6.1667 percent

C) 5.5875 percent

D) 12.6625 percent

A) 4.6667 percent

B) 6.1667 percent

C) 5.5875 percent

D) 12.6625 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

The standard deviation of the past five monthly returns for K and Company are 4.25 percent,4.13 percent,−2.05 percent,3.25 percent,and 7.75 percent.What is the standard deviation?

A) 1.40 percent

B) 3.37 percent

C) 3.53 percent

D) 16.83 percent

A) 1.40 percent

B) 3.37 percent

C) 3.53 percent

D) 16.83 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

Rank the following three stocks by their level of total risk,highest to lowest.Rail Haul has an average return of 8 percent and standard deviation of 10 percent.The average return and standard deviation of Idol Staff are 10 percent and 20 percent; and of Poker-R-Us are 6 percent and 15 percent.

A) Rail Haul, Poker-R-Us, Idol Staff

B) Idol Staff, Rail Haul, Poker-R-Us

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Poker-R-Us, Rail Haul

A) Rail Haul, Poker-R-Us, Idol Staff

B) Idol Staff, Rail Haul, Poker-R-Us

C) Poker-R-Us, Idol Staff, Rail Haul

D) Idol Staff, Poker-R-Us, Rail Haul

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

Noble stock was $60.00 per share at the end of last year.Since then,it paid a $2.00 per share dividend last year.The stock price is currently $58.If you owned 400 shares of Noble,what was your percent return?

A) −3.33 percent

B) 0 percent

C) 3.33 percent

D) 3.45 percent

A) −3.33 percent

B) 0 percent

C) 3.33 percent

D) 3.45 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

Rank the following three stocks by their total risk level,highest to lowest.Night Ryder has an average return of 14 percent and standard deviation of 30 percent.The average return and standard deviation of WholeMart are 12 percent and 25 percent; and of Fruit Fly are 25 percent and 40 percent.

A) Fruit Fly, Night Ryder, WholeMart

B) Night Ryder, WholeMart, Fruit Fly

C) WholeMart, Fruit Fly, Night Ryder

D) WholeMart, Night Ryder, Fruit Fly

A) Fruit Fly, Night Ryder, WholeMart

B) Night Ryder, WholeMart, Fruit Fly

C) WholeMart, Fruit Fly, Night Ryder

D) WholeMart, Night Ryder, Fruit Fly

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

At the beginning of the month,you owned $8,000 of Company G,$8,000 of Company S,and $3,000 of Company N.The monthly returns for Company G,Company S,and Company N were 7.80 percent,1.50 percent,and −0.75 percent.What is your portfolio return?

A) 2.85 percent

B) 3.80 percent

C) 4.03 percent

D) 8.55 percent

A) 2.85 percent

B) 3.80 percent

C) 4.03 percent

D) 8.55 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

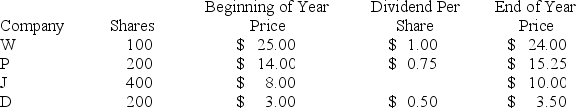

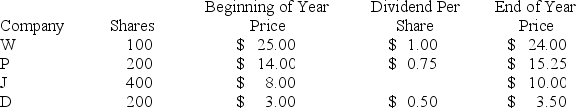

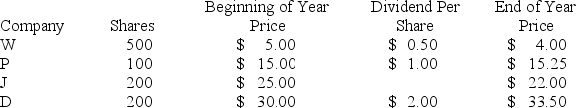

The following table shows your stock positions at the beginning of the year,the dividends that each stock paid during the year,and the stock prices at the end of the year.What is your portfolio percentage return?

A) 3.85 percent

B) 11.54 percent

C) 15.38 percent

D) 17.58 percent

A) 3.85 percent

B) 11.54 percent

C) 15.38 percent

D) 17.58 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

The standard deviation of the past five monthly returns for PG Company are 2.75 percent,−0.75 percent,4.15 percent,6.29 percent,and 3.84 percent.What is the standard deviation?

A) 2.309 percent

B) 2.581 percent

C) 3.256 percent

D) 3.406 percent

A) 2.309 percent

B) 2.581 percent

C) 3.256 percent

D) 3.406 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

If you own 600 shares of Alaska Corporation at $23.25,450 shares of Best Company at $34.50,and 150 shares of Motor Company at $6.95,what are the portfolio weights of each stock?

A) Alaska = 0.6000, Best = 0.4500, Motor = 0.1500

B) Alaska = 0.3594, Best = 0.5332, Motor = 0.1074

C) Alaska = 0.4571, Best = 0.5087, Motor = 0.0342

D) Alaska = 0.2325, Best = 0.3450, Motor = 0.0695

A) Alaska = 0.6000, Best = 0.4500, Motor = 0.1500

B) Alaska = 0.3594, Best = 0.5332, Motor = 0.1074

C) Alaska = 0.4571, Best = 0.5087, Motor = 0.0342

D) Alaska = 0.2325, Best = 0.3450, Motor = 0.0695

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

Sprint Nextel Corp.stock ended the previous year at $25.00 per share.It paid a $2.57 per share dividend last year.It ended last year at $18.89.If you owned 650 shares of Sprint,what was your dollar return and percent return?

A) $2,960; 11.13 percent

B) −$4,960; −16.13 percent

C) −$3,960; −15.13 percent

D) −$2,301; −14.16 percent

A) $2,960; 11.13 percent

B) −$4,960; −16.13 percent

C) −$3,960; −15.13 percent

D) −$2,301; −14.16 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

If you own 400 shares of Air Line Inc.at $44.50,500 shares of BuyRite at $52.90,and 100 shares of MotorCity at $9.25,what are the portfolio weights of each stock?

A) Air Line = 0.3333, BuyRite = 0.3333, MotorCity = 0.3333

B) Air Line = 0.40, BuyRite = 0.50, MotorCity = 0.10

C) Air Line = 0.3940, BuyRite = 0.5855, MotorCity = 0.0205

D) Air Line = 0.4173, BuyRite = 0.4960, MotorCity = 0.0867

A) Air Line = 0.3333, BuyRite = 0.3333, MotorCity = 0.3333

B) Air Line = 0.40, BuyRite = 0.50, MotorCity = 0.10

C) Air Line = 0.3940, BuyRite = 0.5855, MotorCity = 0.0205

D) Air Line = 0.4173, BuyRite = 0.4960, MotorCity = 0.0867

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

If you own 100 shares of Air Line Inc.at $42.50,250 shares of BuyRite at $53.25,and 350 shares of MotorCity at $7.75,what are the portfolio weights of each stock?

A) Air Line = 0.3333, BuyRite = 0.3333, MotorCity = 0.3333

B) Air Line = 0.10, BuyRite = 0.25, MotorCity = 0.35

C) Air Line = 0.2096, BuyRite = 0.6566, MotorCity = 0.1338

D) Air Line = 0.1429, BuyRite = 0.3571, MotorCity = 0.5000

A) Air Line = 0.3333, BuyRite = 0.3333, MotorCity = 0.3333

B) Air Line = 0.10, BuyRite = 0.25, MotorCity = 0.35

C) Air Line = 0.2096, BuyRite = 0.6566, MotorCity = 0.1338

D) Air Line = 0.1429, BuyRite = 0.3571, MotorCity = 0.5000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Compute the standard deviation of the five monthly returns for PG&E: 1.25 percent,−1.50 percent,4.25 percent,3.75 percent,and 1.98 percent.

A) 1.876 percent

B) 1.946 percent

C) 2.046 percent

D) 2.287 percent

A) 1.876 percent

B) 1.946 percent

C) 2.046 percent

D) 2.287 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

The past five monthly returns for PG Company are 1.25 percent,−1.50 percent,4.25 percent,3.75 percent,and 1.98 percent.What is the average monthly return?

A) 1.946 percent

B) 2.546 percent

C) 9.73 percent

D) 12.73 percent

A) 1.946 percent

B) 2.546 percent

C) 9.73 percent

D) 12.73 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

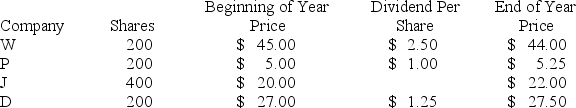

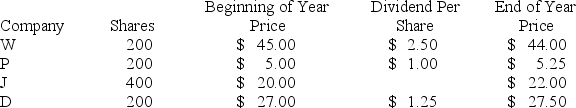

The following table shows your stock positions at the beginning of the year,the dividends that each stock paid during the year,and the stock prices at the end of the year.What is your portfolio percentage return?

A) 3.21 percent

B) 4.06 percent

C) 7.26 percent

D) 8.97 percent

A) 3.21 percent

B) 4.06 percent

C) 7.26 percent

D) 8.97 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 10 percent and standard deviation of 19 percent.The average return and standard deviation of Idol Staff are 12 percent and 22 percent; and of Poker-R-Us are 11 percent and 25 percent.

A) Idol Staff, Rail Haul, Poker-R-Us

B) Rail Haul, Idol Staff, Poker-R-Us

C) Idol Staff, Poker-R-Us, Rail Haul

D) Poker-R-Us, Rail Haul, Idol Staff

A) Idol Staff, Rail Haul, Poker-R-Us

B) Rail Haul, Idol Staff, Poker-R-Us

C) Idol Staff, Poker-R-Us, Rail Haul

D) Poker-R-Us, Rail Haul, Idol Staff

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

You have $15,040 to invest.You want to purchase shares of Company Air at $42.50,Company B at $51.50,and Company F at $9.75.How many shares of each company should you purchase so that your portfolio consists of 20 percent Company A,40 percent Company B,and 40 percent Company F? Report only whole stock shares.

A) Company A = 20 shares, Company B = 40 shares, Company F = 40 shares

B) Company A = 85 shares, Company B = 21 shares, Company F = 39 shares

C) Company A = 71 shares, Company B = 117 shares, Company F = 617 shares

D) Company A = 353 shares, Company B = 291 shares, Company F = 1538 shares

A) Company A = 20 shares, Company B = 40 shares, Company F = 40 shares

B) Company A = 85 shares, Company B = 21 shares, Company F = 39 shares

C) Company A = 71 shares, Company B = 117 shares, Company F = 617 shares

D) Company A = 353 shares, Company B = 291 shares, Company F = 1538 shares

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

You have $45,050 to invest.You want to purchase shares of Company Air at $10.25,Company B at $15.10,and Company F at $9.05.How many shares of each company should you purchase so that your portfolio consists of 30 percent Company A,50 percent Company B,and 20 percent Company F? Report only whole stock shares.

A) Company A = 30 shares, Company B = 50 shares, Company F = 20 shares

B) Company A = 44 shares, Company B = 30 shares, Company F = 50 shares

C) Company A = 308 shares, Company B = 755 shares, Company F = 181 shares

D) Company A = 1,318 shares, Company B = 1,490 shares, Company F = 995 shares

A) Company A = 30 shares, Company B = 50 shares, Company F = 20 shares

B) Company A = 44 shares, Company B = 30 shares, Company F = 50 shares

C) Company A = 308 shares, Company B = 755 shares, Company F = 181 shares

D) Company A = 1,318 shares, Company B = 1,490 shares, Company F = 995 shares

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

FedEx Corp.stock ended the previous year at $113.39 per share.It paid a $0.40 per share dividend last year.It ended last year at $126.69.If you owned 300 shares of FedEx,what was your dollar return and percent return?

A) $3,990; 11.73 percent

B) $4,110; 12.08 percent

C) $4,250; 12.29 percent

D) $2,009; 9.13 percent

A) $3,990; 11.73 percent

B) $4,110; 12.08 percent

C) $4,250; 12.29 percent

D) $2,009; 9.13 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

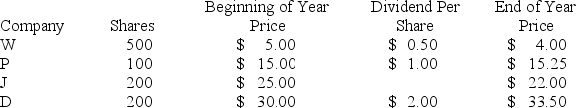

The following table shows your stock positions at the beginning of the year,the dividends that each stock paid during the year,and the stock prices at the end of the year.What is your portfolio percentage return?

A) 2.50 percent

B) 5.83 percent

C) 10.50 percent

D) 13.83 percent

A) 2.50 percent

B) 5.83 percent

C) 10.50 percent

D) 13.83 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

At the beginning of the month,you owned $6,000 of Company G,$8,000 of Company S,and $1,000 of Company N.The monthly returns for Company G,Company S,and Company N were 7.25 percent,−1.50 percent,and −0.23 percent.What is your portfolio return?

A) 1.84 percent

B) 2.08 percent

C) 3.71 percent

D) 5.52 percent

A) 1.84 percent

B) 2.08 percent

C) 3.71 percent

D) 5.52 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

Rank the following three stocks by their risk-return relationship,best to worst.Night Ryder has an average return of 33 percent and standard deviation of 40 percent.The average return and standard deviation of WholeMart are 10 percent and 20 percent; and of Fruit Fly are 19 percent and 33 percent.

A) Night Ryder, WholeMart, Fruit Fly

B) WholeMart, Fruit Fly, Night Ryder

C) Night Ryder, Fruit Fly, WholeMart

D) Fruit Fly, Whole Mart, Night Ryder

A) Night Ryder, WholeMart, Fruit Fly

B) WholeMart, Fruit Fly, Night Ryder

C) Night Ryder, Fruit Fly, WholeMart

D) Fruit Fly, Whole Mart, Night Ryder

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

If you own 1,000 shares of Alaska Corporation at $19.95,250 shares of Best Company at $17.50,and 250 shares of Motor Company at $2.50,what are the portfolio weights of each stock?

A) Alaska = 0.1000, Best = 0.2500, Motor = 0.2500

B) Alaska = 0.4994, Best = 0.4380, Motor = 0.0626

C) Alaska = 0.7996, Best = 0.1754, Motor = 0.0250

D) Alaska = 0.1995, Best = 0.1750, Motor = 0.0250

A) Alaska = 0.1000, Best = 0.2500, Motor = 0.2500

B) Alaska = 0.4994, Best = 0.4380, Motor = 0.0626

C) Alaska = 0.7996, Best = 0.1754, Motor = 0.0250

D) Alaska = 0.1995, Best = 0.1750, Motor = 0.0250

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

The standard deviation of the past five monthly returns for K and Company are 2.28 percent,2.64 percent,−1.05 percent,4.25 percent,and 9.25 percent.What is the standard deviation?

A) 1.45 percent

B) 1.62 percent

C) 3.47 percent

D) 3.76 percent

A) 1.45 percent

B) 1.62 percent

C) 3.47 percent

D) 3.76 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

At the beginning of the month,you owned $15,500 of General Motors,$4,500 of Starbucks,and $9,000 of Nike.The monthly returns for General Motors,Starbucks,and Nike were 7.10 percent,−1.36 percent,and −0.54 percent.What is your portfolio return?

A) −1.12 percent

B) 1.17 percent

C) 2.54 percent

D) 3.42 percent

A) −1.12 percent

B) 1.17 percent

C) 2.54 percent

D) 3.42 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

If you own 400 shares of Xerox at $15.00,500 shares of Qwest at $10.00,and 350 shares of Liz Claiborne at $45.00,what are the portfolio weights of each stock?

A) Weight of Xerox: 22.43 percent; Weight of Qwest: 11.09 percent; Weight of Liz Claiborne: 58.88 percent

B) Weight of Xerox: 34.67 percent; Weight of Qwest: 16.69 percent; Weight of Liz Claiborne: 48.64 percent

C) Weight of Xerox: 22.43 percent; Weight of Qwest: 18.69 percent; Weight of Liz Claiborne: 58.88 percent

D) Weight of Xerox: 36.98 percent; Weight of Qwest: 61.07 percent; Weight of Liz Claiborne: 1.95 percent

A) Weight of Xerox: 22.43 percent; Weight of Qwest: 11.09 percent; Weight of Liz Claiborne: 58.88 percent

B) Weight of Xerox: 34.67 percent; Weight of Qwest: 16.69 percent; Weight of Liz Claiborne: 48.64 percent

C) Weight of Xerox: 22.43 percent; Weight of Qwest: 18.69 percent; Weight of Liz Claiborne: 58.88 percent

D) Weight of Xerox: 36.98 percent; Weight of Qwest: 61.07 percent; Weight of Liz Claiborne: 1.95 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

An investor owns $8,000 of Adobe Systems stock,$5,000 of Dow Chemical,and $3,000 of Office Depot.What are the portfolio weights of each stock?

A) Adobe: 0.5; Dow Chemical: 0.31; Office Depot: 0.19

B) Adobe: 0.5; Dow Chemical: 0.32; Office Depot: 0.18

C) Adobe: 0.5; Dow Chemical: 0.13; Office Depot: 0.27

D) Adobe: 0.5; Dow Chemical: 0.19; Office Depot: 0.31

A) Adobe: 0.5; Dow Chemical: 0.31; Office Depot: 0.19

B) Adobe: 0.5; Dow Chemical: 0.32; Office Depot: 0.18

C) Adobe: 0.5; Dow Chemical: 0.13; Office Depot: 0.27

D) Adobe: 0.5; Dow Chemical: 0.19; Office Depot: 0.31

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is correct regarding the total risk of a company?

A) A company can change its risk level over time.

B) Some firms are riskier because they offer many different products and/or services.

C) Companies can change their risk by reducing the amount of money they have borrowed.

D) None of the statements are correct.

A) A company can change its risk level over time.

B) Some firms are riskier because they offer many different products and/or services.

C) Companies can change their risk by reducing the amount of money they have borrowed.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements is correct?

A) A dominant portfolio has the best risk-return relationship as compared to other portfolios.

B) It is not necessarily true that when an investment achieves a high return that it is risky.

C) A low standard deviation means that the investment is less likely to achieve high returns, which means that it is more risky.

D) None of the statements are correct.

A) A dominant portfolio has the best risk-return relationship as compared to other portfolios.

B) It is not necessarily true that when an investment achieves a high return that it is risky.

C) A low standard deviation means that the investment is less likely to achieve high returns, which means that it is more risky.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following statements is correct?

A) The dollar return is a more useful measure to compare performance because it more accurately reflects the change in wealth of the investor.

B) A dominant portfolio is one that has the highest risk and highest return within a set of portfolios.

C) By adding stocks to your portfolio, it is possible to effectively eliminate nearly all of the market risk.

D) None of the statements are correct.

A) The dollar return is a more useful measure to compare performance because it more accurately reflects the change in wealth of the investor.

B) A dominant portfolio is one that has the highest risk and highest return within a set of portfolios.

C) By adding stocks to your portfolio, it is possible to effectively eliminate nearly all of the market risk.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

If you own 300 shares of Alaska Air at $15.88,250 shares of Best Buy at $151.00,and 1,150 shares of Ford Motor at $3.51,what are the portfolio weights of each stock?

A) Weight of Alaska Air: 10.23 percent; Weight of Best Buy: 81.09 percent; Weight of Ford Motor: 8.67 percent

B) Weight of Alaska Air: 6.23 percent; Weight of Best Buy: 71.09 percent; Weight of Ford Motor: 22.67 percent

C) Weight of Alaska Air: 15.23 percent; Weight of Best Buy: 81.09 percent; Weight of Ford Motor: 3.67 percent

D) Weight of Alaska Air: 20.23 percent; Weight of Best Buy: 76.09 percent; Weight of Ford Motor: 3.67 percent

A) Weight of Alaska Air: 10.23 percent; Weight of Best Buy: 81.09 percent; Weight of Ford Motor: 8.67 percent

B) Weight of Alaska Air: 6.23 percent; Weight of Best Buy: 71.09 percent; Weight of Ford Motor: 22.67 percent

C) Weight of Alaska Air: 15.23 percent; Weight of Best Buy: 81.09 percent; Weight of Ford Motor: 3.67 percent

D) Weight of Alaska Air: 20.23 percent; Weight of Best Buy: 76.09 percent; Weight of Ford Motor: 3.67 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

Jenna receives an investment newsletter that recommends that she invest in a stock that has doubled the return of the S&P 500 in the last two months.It also claims that this stock is a "safe bet" for the future.Which of the following statements is correct regarding this information?

A) This investment newsletter is most likely correct because they most likely have some special knowledge about the stock.

B) The investment newsletter contains contrary information since the stock must be a high risk and therefore cannot also be a "safe bet."

C) It is common for individual stocks to double the return of the S&P 500 and still be a "safe bet."

D) None of the statements are correct.

A) This investment newsletter is most likely correct because they most likely have some special knowledge about the stock.

B) The investment newsletter contains contrary information since the stock must be a high risk and therefore cannot also be a "safe bet."

C) It is common for individual stocks to double the return of the S&P 500 and still be a "safe bet."

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Year-to-date,Oracle had earned a 15.0 percent return.During the same time period,Valero Energy earned -12.96 percent and McDonald's earned 1.80 percent.If you have a portfolio made up of 50 percent Oracle,10 percent Valero Energy,and 40 percent McDonald's,what is your portfolio return?

A) 6.14 percent

B) 4.86 percent

C) 5.86 percent

D) 6.92 percent

A) 6.14 percent

B) 4.86 percent

C) 5.86 percent

D) 6.92 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

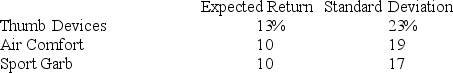

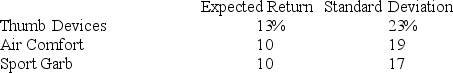

Consider the characteristics of the following three stocks:  The correlation between Thumb Devices and Air Comfort is −0.12.The correlation between Thumb Devices and Sport Garb is 0.89.The correlation between Air Comfort and Sport Garb is −0.85.If you can pick only two stocks for your portfolio,which would you pick? Why?

The correlation between Thumb Devices and Air Comfort is −0.12.The correlation between Thumb Devices and Sport Garb is 0.89.The correlation between Air Comfort and Sport Garb is −0.85.If you can pick only two stocks for your portfolio,which would you pick? Why?

A) Combine Thumb Devices and Sport Garb because they have a high correlation.

B) Combine Thumb Devices and Air Comfort because of high standard deviations.

C) Combine Air Comfort and Sport Garb due to negative correlation.

D) Combine Thumb Devices and Sport Garb because Thumb Devices has the highest return and Sport Garb has the lowest standard deviation.

The correlation between Thumb Devices and Air Comfort is −0.12.The correlation between Thumb Devices and Sport Garb is 0.89.The correlation between Air Comfort and Sport Garb is −0.85.If you can pick only two stocks for your portfolio,which would you pick? Why?

The correlation between Thumb Devices and Air Comfort is −0.12.The correlation between Thumb Devices and Sport Garb is 0.89.The correlation between Air Comfort and Sport Garb is −0.85.If you can pick only two stocks for your portfolio,which would you pick? Why?A) Combine Thumb Devices and Sport Garb because they have a high correlation.

B) Combine Thumb Devices and Air Comfort because of high standard deviations.

C) Combine Air Comfort and Sport Garb due to negative correlation.

D) Combine Thumb Devices and Sport Garb because Thumb Devices has the highest return and Sport Garb has the lowest standard deviation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Jane Adams invests all her money in the stock of one firm.Which of the following must be true?

A) Her return will have more volatility than the return in the overall stock market.

B) Her return will have less volatility than the return in the overall stock market.

C) Her return will have the same volatility as the return in the overall stock market.

D) There is no relationship between her return and the return in the overall stock market.

A) Her return will have more volatility than the return in the overall stock market.

B) Her return will have less volatility than the return in the overall stock market.

C) Her return will have the same volatility as the return in the overall stock market.

D) There is no relationship between her return and the return in the overall stock market.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is correct with regards to diversification?

A) Diversifying reduces the return of the portfolio.

B) Diversifying reduces the market risk of the portfolio.

C) Diversifying reduces the dollar return of the portfolio.

D) None of the statements are correct.

A) Diversifying reduces the return of the portfolio.

B) Diversifying reduces the market risk of the portfolio.

C) Diversifying reduces the dollar return of the portfolio.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

The past five monthly returns for PG&E are 12.14 percent,−11.37 percent,3.77 percent,6.47 percent,and 3.58 percent.What is the average monthly return?

A) 2.92 percent

B) 1.21 percent

C) −3.46 percent

D) 3.17 percent

A) 2.92 percent

B) 1.21 percent

C) −3.46 percent

D) 3.17 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

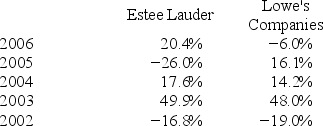

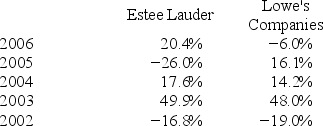

74

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return,standard deviation,and coefficient of variation.

Compute each stock's average return,standard deviation,and coefficient of variation.

A) Estee Lauder: 9.02 percent; 17.99 percent; 2.00 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

B) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

C) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 25.46 percent; 2.39

D) Estee Lauder: 10.7 percent; 17.79 percent; 1.66 and Lowe's Companies: 12.64 percent; 18.99 percent; 1.50

Compute each stock's average return,standard deviation,and coefficient of variation.

Compute each stock's average return,standard deviation,and coefficient of variation.A) Estee Lauder: 9.02 percent; 17.99 percent; 2.00 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

B) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 18.99 percent; 1.78

C) Estee Lauder: 9.02 percent; 30.69 percent; 3.4 and Lowe's Companies: 10.66 percent; 25.46 percent; 2.39

D) Estee Lauder: 10.7 percent; 17.79 percent; 1.66 and Lowe's Companies: 12.64 percent; 18.99 percent; 1.50

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

You have $10,000 to invest.You want to purchase shares of Alaska Air at $50.00,Best Buy at $50.00,and Ford Motor at $10.00.How many shares of each company should you purchase so that your portfolio consists of 25 percent Alaska Air,40 percent Best Buy,and 35 percent Ford Motor? Report only whole stock shares.

A) 50 shares of Alaska Air, 80 shares of Best Buy, and 300 shares of Ford Motor

B) 50 shares of Alaska Air, 80 shares of Best Buy, and 350 shares of Ford Motor

C) 40 shares of Alaska Air, 90 shares of Best Buy, and 300 shares of Ford Motor

D) 75 shares of Alaska Air, 40 shares of Best Buy, and 350 shares of Ford Motor

A) 50 shares of Alaska Air, 80 shares of Best Buy, and 300 shares of Ford Motor

B) 50 shares of Alaska Air, 80 shares of Best Buy, and 350 shares of Ford Motor

C) 40 shares of Alaska Air, 90 shares of Best Buy, and 300 shares of Ford Motor

D) 75 shares of Alaska Air, 40 shares of Best Buy, and 350 shares of Ford Motor

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

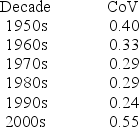

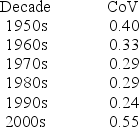

76

Consider the risk-return relationship in T-bills during each decade since 1950.Given this data,which of the following statements is correct?

A) The best risk-return relationship was during the 1950s.

B) The best risk-return relationship was during the 1990s.

C) Since T-bills are backed by the full faith of the U.S. government, computing the risk-return relationship for them is invalid.

D) None of the statements are correct.

A) The best risk-return relationship was during the 1950s.

B) The best risk-return relationship was during the 1990s.

C) Since T-bills are backed by the full faith of the U.S. government, computing the risk-return relationship for them is invalid.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements is correct?

A) A single stock has a lot of diversifiable risk.

B) A single stock has more market risk than a diversified portfolio of stocks.

C) Bonds and stocks have a high correlation because they are both financial assets.

D) None of the statements are correct.

A) A single stock has a lot of diversifiable risk.

B) A single stock has more market risk than a diversified portfolio of stocks.

C) Bonds and stocks have a high correlation because they are both financial assets.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Compute the standard deviation of Kohl's monthly returns.The past five monthly returns for Kohl's are 5.55 percent,8.62 percent,−4.44 percent,−1.52 percent,and 9.75 percent.

A) 4.92 percent

B) 5.07 percent

C) 6.28 percent

D) 6.12 percent

A) 4.92 percent

B) 5.07 percent

C) 6.28 percent

D) 6.12 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is correct regarding the coefficient of variation?

A) It measures the amount of standard deviation for each one percent of covariance.

B) It measures the amount of return achieved for each one percent of risk taken.

C) It measures the amount of risk taken for each one percent of return achieved.

D) None of the statements are correct.

A) It measures the amount of standard deviation for each one percent of covariance.

B) It measures the amount of return achieved for each one percent of risk taken.

C) It measures the amount of risk taken for each one percent of return achieved.

D) None of the statements are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

The past five monthly returns for Kohl's are 2.55 percent,−8.62 percent,−14.44 percent,−1.52 percent,and 4.75 percent.What is the average monthly return?

A) 2.21 percent

B) 1.21 percent

C) −3.46 percent

D) −6.17 percent

A) 2.21 percent

B) 1.21 percent

C) −3.46 percent

D) −6.17 percent

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck