Deck 11: Managing Bond Portfolios

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 11: Managing Bond Portfolios

1

You find a 5 year AA Xerox bond priced to yield 6%.You find a similar risk 5 year Canon bond priced to yield 6.5%.To take advantage of this you should do which of the following?

A) Short the Canon bond and buy the Xerox bond

B) Buy the Canon bond and short the Xerox bond

C) Short both the Canon bond and the Xerox bond

D) Buy both the Canon bond and the Xerox bond

A) Short the Canon bond and buy the Xerox bond

B) Buy the Canon bond and short the Xerox bond

C) Short both the Canon bond and the Xerox bond

D) Buy both the Canon bond and the Xerox bond

B

2

As a result of bond convexity an increase in a bond's price when yield to maturity falls is ________ the price decrease resulting from an increase in yield of equal magnitude.

A) greater than

B) equivalent to

C) smaller than

D) The answer is indeterminate.

A) greater than

B) equivalent to

C) smaller than

D) The answer is indeterminate.

A

3

All else equal,bond price volatility is greater for __________.

A) higher coupon rates

B) lower coupon rates

C) shorter maturity

D) lower default risk

A) higher coupon rates

B) lower coupon rates

C) shorter maturity

D) lower default risk

B

4

A pension fund must pay out $1 million next year,$2 million the following year and then $3 million the year after that.If the discount rate is 8% what is the duration of this set of payments?

A) 2.00 years

B) 2.15 years

C) 2.29 years

D) 2.53 years

A) 2.00 years

B) 2.15 years

C) 2.29 years

D) 2.53 years

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

Target date immunization would primarily be of interest to _________.

A) banks

B) mutual funds

C) pension funds

D) individual investors

A) banks

B) mutual funds

C) pension funds

D) individual investors

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

A forecast of bond returns based largely on a prediction of the yield curve at the end of the investment horizon is called a _________.

A) contingent immunization

B) dedication strategy

C) duration analysis

D) horizon analysis

A) contingent immunization

B) dedication strategy

C) duration analysis

D) horizon analysis

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

Duration is a concept that is useful in assessing a bond's _________.

A) credit risk

B) liquidity risk

C) price volatility

D) convexity risk

A) credit risk

B) liquidity risk

C) price volatility

D) convexity risk

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

A pension fund has an average duration of its liabilities equal to 15 years.The fund is looking at 5 year maturity zero coupon bonds and 4% yield perpetuities to immunize its interest rate risk.How much of its portfolio should it allocate to the zero coupon bonds to immunize if there are no other assets funding the plan?

A) 52%

B) 48%

C) 33%

D) 25%

A) 52%

B) 48%

C) 33%

D) 25%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

A portfolio manager believes interest rates will drop and decides to sell short duration bonds and buy long duration bonds.This is an example of __________ swap.

A) a pure yield pick up

B) a rate anticipation

C) a substitution

D) an inter-market spread

A) a pure yield pick up

B) a rate anticipation

C) a substitution

D) an inter-market spread

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

A bond's price volatility _________ at a/an _________ rate as maturity increases.

A) increases; increasing

B) increases; decreasing

C) decreases; increasing

D) decreases; decreasing

A) increases; increasing

B) increases; decreasing

C) decreases; increasing

D) decreases; decreasing

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

All other things equal,which of the following has the longest duration?

A) A 21 year bond with a 10% coupon yielding 10%

B) A 20 year bond with a 10% coupon yielding 11%

C) A 21 year zero coupon bond yielding 10%

D) A 20 year zero coupon bond yielding 11%

A) A 21 year bond with a 10% coupon yielding 10%

B) A 20 year bond with a 10% coupon yielding 11%

C) A 21 year zero coupon bond yielding 10%

D) A 20 year zero coupon bond yielding 11%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

The duration of a perpetuity varies _______ with interest rates.

A) directly

B) inversely

C) convexly

D) randomly

A) directly

B) inversely

C) convexly

D) randomly

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

______________ is an important characteristic of the relationship between bond prices and yields.

A) Convexity

B) Concavity

C) Complexity

D) Linearity

A) Convexity

B) Concavity

C) Complexity

D) Linearity

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

A portfolio manager sells treasury bonds and buys corporate bonds because the spread between corporate and Treasury bond yields is higher than its historical average.This is an example of __________ swap.

A) a pure yield pick up

B) a rate anticipation

C) a substitution

D) an intermarket spread

A) a pure yield pick up

B) a rate anticipation

C) a substitution

D) an intermarket spread

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

Because of convexity,when interest rates change the actual bond price will ____________ the bond price predicted by duration.

A) always be higher than

B) sometimes be higher than

C) always be lower than

D) sometimes be lower than

A) always be higher than

B) sometimes be higher than

C) always be lower than

D) sometimes be lower than

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

Bond prices are _______ sensitive to changes in yield when the bond is selling at a _______ initial yield to maturity.

A) more; lower

B) more; higher

C) less; lower

D) equally; higher or lower

A) more; lower

B) more; higher

C) less; lower

D) equally; higher or lower

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

The pioneer of the duration concept was _________.

A) Eugene Fama

B) John Herzog

C) Frederick Macaulay

D) Harry Markowitz

A) Eugene Fama

B) John Herzog

C) Frederick Macaulay

D) Harry Markowitz

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

All other things equal,which of the following has the shortest duration?

A) A 30 year bond with a 10% coupon

B) A 20 year bond with a 9% coupon

C) A 20 year bond with a 7% coupon

D) A 10 year zero coupon bond

A) A 30 year bond with a 10% coupon

B) A 20 year bond with a 9% coupon

C) A 20 year bond with a 7% coupon

D) A 10 year zero coupon bond

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

The duration of a 5-year zero coupon bond is ____ years.

A) 4.5

B) 5.0

C) 5.5

D) 3.5

A) 4.5

B) 5.0

C) 5.5

D) 3.5

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

All other things equal,which of the following has the longest duration?

A) A 30 year bond with a 10% coupon

B) A 20 year bond with a 9% coupon

C) A 20 year bond with a 7% coupon

D) A 10 year zero coupon bond

A) A 30 year bond with a 10% coupon

B) A 20 year bond with a 9% coupon

C) A 20 year bond with a 7% coupon

D) A 10 year zero coupon bond

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

An increase in a bond's yield to maturity results in a price decline that is ________ the price increase resulting from a decrease in yield of equal magnitude.

A) greater than

B) equivalent to

C) smaller than

D) The answer is indeterminate

A) greater than

B) equivalent to

C) smaller than

D) The answer is indeterminate

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

A bond swap made in response to forecasts of interest rate changes is called ______.

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

All other things equal,a bond's duration is _________.

A) higher when the yield to maturity is higher

B) lower when the yield to maturity is higher

C) the same at all yield rates

D) indeterminable when the yield to maturity is high

A) higher when the yield to maturity is higher

B) lower when the yield to maturity is higher

C) the same at all yield rates

D) indeterminable when the yield to maturity is high

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

Pension fund managers can generally best bring about an effective reduction in their interest rate risk by holding ___________________.

A) long maturity bonds

B) long duration bonds

C) short maturity bonds

D) short duration bonds

A) long maturity bonds

B) long duration bonds

C) short maturity bonds

D) short duration bonds

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

The exchange of one bond for a bond with similar attributes but more attractively priced is called ______________.

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

A bank has an average duration of its liabilities equal to 2 years.The bank's average duration of its assets is 3.5 years.The bank's market value of equity is at risk if _______________________.

A) interest rates fall

B) credit spreads fall

C) interest rates rise

D) the price of all fixed income securities rises

A) interest rates fall

B) credit spreads fall

C) interest rates rise

D) the price of all fixed income securities rises

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

In the context of a bond portfolio,price risk and reinvestment rate risk exactly cancel out at a time horizon equal to ____.

A) the average bond maturity in the portfolio

B) the duration of the portfolio

C) the difference between the shortest duration and longest duration of the individual bonds in the portfolio

D) the average of the shortest duration and longest duration of the bonds in the portfolio

A) the average bond maturity in the portfolio

B) the duration of the portfolio

C) the difference between the shortest duration and longest duration of the individual bonds in the portfolio

D) the average of the shortest duration and longest duration of the bonds in the portfolio

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

You have purchased a Guaranteed Investment contracts (GICs)from an insurance firm that promises to pay you a 5% compound rate of return per year for 6 years.If you pay $10,000 for the GIC today and receive no interest along the way you will get __________ in 6 years (to the nearest dollar).

A) $12,565

B) $13,000

C) $13,401

D) $13,676

A) $12,565

B) $13,000

C) $13,401

D) $13,676

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

You own a bond that has a duration of 6 years.Interest rates are currently 7% but you believe the Fed is about to increase interest rates by 25 basis points.Your predicted price change on this bond is ________.

A) +1.40%

B) -1.40%

C) -2.51%

D) +2.51%

A) +1.40%

B) -1.40%

C) -2.51%

D) +2.51%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

Given its time to maturity the duration of a zero coupon bond is _________.

A) higher when the discount rate is higher

B) higher when the discount rate is lower

C) lowest when the discount rate is equal to the risk free rate

D) the same regardless of the discount rate

A) higher when the discount rate is higher

B) higher when the discount rate is lower

C) lowest when the discount rate is equal to the risk free rate

D) the same regardless of the discount rate

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not a type of bond swap used in active portfolio management?

A) Inter-market spread swap

B) Substitution swap

C) Rate anticipation swap

D) Asset-liability swap

A) Inter-market spread swap

B) Substitution swap

C) Rate anticipation swap

D) Asset-liability swap

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

Rank the interest sensitivity of the following from most sensitive to an interest rate change to the least sensitive.

I)8% coupon,noncallable 20 year maturity,par bond

II)9% coupon,currently callable 20 year maturity,premium bond

III)Zero coupon,30 year maturity bond

A) I, II, III

B) II, III, I

C) III, I, II

D) III, II, I

I)8% coupon,noncallable 20 year maturity,par bond

II)9% coupon,currently callable 20 year maturity,premium bond

III)Zero coupon,30 year maturity bond

A) I, II, III

B) II, III, I

C) III, I, II

D) III, II, I

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

The duration rule always ________ the value of a bond following a change in its yield.

A) under-estimates

B) provides an unbiased estimate of

C) over-estimates

D) The estimated price may be biased either upward or downward, depending on whether the bond is trading at a discount or a premium

A) under-estimates

B) provides an unbiased estimate of

C) over-estimates

D) The estimated price may be biased either upward or downward, depending on whether the bond is trading at a discount or a premium

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

Banks and other financial institutions can best manage interest rate risk by _____________.

A) maximizing the duration of assets and minimizing the duration of liabilities

B) minimizing the duration of assets and maximizing the duration of liabilities

C) matching the durations of their assets and liabilities

D) matching the maturities of their assets and liabilities

A) maximizing the duration of assets and minimizing the duration of liabilities

B) minimizing the duration of assets and maximizing the duration of liabilities

C) matching the durations of their assets and liabilities

D) matching the maturities of their assets and liabilities

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

All other things equal,a bond's duration is _________.

A) higher when the coupon rate is higher

B) lower when the coupon rate is higher

C) the same when the coupon rate is higher

D) indeterminate when the coupon rate is high

A) higher when the coupon rate is higher

B) lower when the coupon rate is higher

C) the same when the coupon rate is higher

D) indeterminate when the coupon rate is high

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

Bond portfolio immunization techniques balance ________ and ________ risk.

A) price; reinvestment

B) price; liquidity

C) credit; reinvestment

D) credit; liquidity

A) price; reinvestment

B) price; liquidity

C) credit; reinvestment

D) credit; liquidity

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

In a pure yield pickup swap,________ bonds are exchanged for _________ bonds.

A) longer duration; shorter duration

B) shorter duration; longer duration

C) high coupon; high yield

D) low yield; high yield

A) longer duration; shorter duration

B) shorter duration; longer duration

C) high coupon; high yield

D) low yield; high yield

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

Where Y = yield to maturity,the duration of a perpetuity would be _________.

A) Y

B) Y/(1 + Y)

C) 1/Y

D) (1 + Y)/Y

A) Y

B) Y/(1 + Y)

C) 1/Y

D) (1 + Y)/Y

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

The duration of a portfolio of bonds can be calculated as _______________.

A) the coupon weighted average of the durations of the individual bonds in the portfolio

B) the yield weighted average of the durations of the individual bonds in the portfolio

C) the value weighed average of the durations of the individual bonds in the portfolio

D) averages of the durations of the longest and shortest duration bonds in the portfolio

A) the coupon weighted average of the durations of the individual bonds in the portfolio

B) the yield weighted average of the durations of the individual bonds in the portfolio

C) the value weighed average of the durations of the individual bonds in the portfolio

D) averages of the durations of the longest and shortest duration bonds in the portfolio

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

Moving to higher yield bonds,usually with longer maturities is called ________.

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

A) a substitution swap

B) an intermarket spread swap

C) rate anticipation swap

D) pure yield pickup swap

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

When interest rates increase,the duration of a 20-year bond selling at a premium _________.

A) increases

B) decreases

C) remains the same

D) increases at first, then declines

A) increases

B) decreases

C) remains the same

D) increases at first, then declines

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

Compute the modified duration of a 9% coupon,3-year corporate bond with a yield to maturity of 12%.

A) 2.45

B) 2.75

C) 2.88

D) 3.00

A) 2.45

B) 2.75

C) 2.88

D) 3.00

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

A bond currently has a price of $1,050.The yield on the bond is 6.00%.If the yield increases 25 basis points,the price of the bond will go down to $1,030.The duration of this bond is ____ years.

A) 7.46

B) 8.08

C) 9.02

D) 10.11

A) 7.46

B) 8.08

C) 9.02

D) 10.11

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

A 20-year maturity bond pays interest of $90 once per year and has a face value of $1,000.Its yield to maturity is 10%.Over the upcoming year,you expect interest rates to decline and that the yield to maturity on this bond will only be 8% a year from now.Using horizon analysis,the return you expect to earn by holding this bond over the upcoming year is _________.

A) 10.0%

B) 12.0%

C) 21.6%

D) 29.6%

A) 10.0%

B) 12.0%

C) 21.6%

D) 29.6%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

Duration facilitates the comparison of bonds with differing ___________.

A) default risk

B) conversion ratios

C) maturities

D) yields to maturity

A) default risk

B) conversion ratios

C) maturities

D) yields to maturity

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

A bond pays annual interest. Its coupon rate is 9%. Its value at maturity is $1,000. It matures in four years. Its yield to maturity is currently 6%.

The duration of this bond is _______ years.

A) 2.44

B) 3.23

C) 3.56

D) 4.10

The duration of this bond is _______ years.

A) 2.44

B) 3.23

C) 3.56

D) 4.10

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

A fixed income portfolio manager sets a minimum acceptable rate of return on the bond portfolio at 5% per year over the next 4 years.The portfolio is currently worth $10 million.One year later interest rates are at 6%.What is the portfolio value trigger point at this time that would require him to immunize the portfolio?

A) $12,155,063

B) $10,205,625

C) $9,627,948

D) $10,500,000

A) $12,155,063

B) $10,205,625

C) $9,627,948

D) $10,500,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

Compute the duration of an 8%,5-year corporate bond with a par value of $1000 if yield to maturity of 10%.

A) 3.92

B) 4.28

C) 4.55

D) 5.00

A) 3.92

B) 4.28

C) 4.55

D) 5.00

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

A bond has a current price of $1,030.The yield on the bond is 8.00%.If the yield changes from 8.00% to 8.10%,the price of the bond will go down to $1,025.88.The modified duration of this bond is _________.

A) 4.32

B) 4.00

C) 3.25

D) 3.75

A) 4.32

B) 4.00

C) 3.25

D) 3.75

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

To create a portfolio with a duration of 4 years using a 5 year zero-coupon bond and a 3 year 8% annual coupon bond with a yield to maturity of 10%,one would have to invest ________ of the portfolio value in the zero-coupon bond.

A) 50%

B) 55%

C) 60%

D) 75%

A) 50%

B) 55%

C) 60%

D) 75%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

A bond has a maturity of 12 years,a duration of 9.5 years at a promised yield rate of 8%.What is the bond's modified duration?

A) 12 years

B) 11.1 years

C) 9.5 years

D) 8.8 years

A) 12 years

B) 11.1 years

C) 9.5 years

D) 8.8 years

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

The duration of a bond normally increases with an increase in _________.

I)term-to-maturity

II)yield-to-maturity.

III)coupon rate

A) I only

B) I and II only

C) II and III only

D) I, II and III

I)term-to-maturity

II)yield-to-maturity.

III)coupon rate

A) I only

B) I and II only

C) II and III only

D) I, II and III

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

A bond pays annual interest. Its coupon rate is 9%. Its value at maturity is $1,000. It matures in four years. Its yield to maturity is currently 6%.

The modified duration of this bond is ______ years.

A) 4.00

B) 3.56

C) 3.36

D) 3.05

The modified duration of this bond is ______ years.

A) 4.00

B) 3.56

C) 3.36

D) 3.05

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

An investor who expects declining interest rates would maximize their capital gain by purchasing a bond that has a ___ coupon and a ___ term to maturity.

A) low; long

B) high; short

C) high; long

D) zero; long

A) low; long

B) high; short

C) high; long

D) zero; long

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

A perpetuity pays $100 each and every year forever.The duration of this perpetuity will be __________ if its yield is 9%.

A) 7

B) 9

C) 9.39

D) 12.11

A) 7

B) 9

C) 9.39

D) 12.11

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

An 8%,30-year bond has a yield-to-maturity of 10% and a modified duration of 8.0 years.If the market yield drops by 15 basis points,there will be a __________ in the bond's price.

A) 1.15% decrease

B) 1.20% increase

C) 1.53% increase

D) 2.43% decrease

A) 1.15% decrease

B) 1.20% increase

C) 1.53% increase

D) 2.43% decrease

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following set of conditions will result in a bond with the greatest price volatility?

A) A high coupon and a short maturity.

B) A high coupon and a long maturity.

C) A low coupon and a short maturity.

D) A low coupon and a long maturity.

A) A high coupon and a short maturity.

B) A high coupon and a long maturity.

C) A low coupon and a short maturity.

D) A low coupon and a long maturity.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

A bond with a 9-year duration is worth $1,080.00 and its yield to maturity is 8%.If the yield to maturity falls to 7.84%,you would predict that the new value of the bond will be _________.

A) $1,035

B) $1,036

C) $1,094

D) $1,124

A) $1,035

B) $1,036

C) $1,094

D) $1,124

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

A bank has $50 million in assets,$47 million in liabilities and $3 million in shareholders' equity.If the duration of its liabilities are 1.3 and the bank wants to immunize its net worth against interest rate risk and thus set the duration of equity equal to zero,it should select assets with an average duration of _________.

A) 1.22

B) 1.50

C) 1.60

D) 2.00

A) 1.22

B) 1.50

C) 1.60

D) 2.00

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

The historical yield spread between the AA bond and the AAA bond has been 25 basis points.Currently the spread is only 9 basis points.If you believe the spread will soon return to its historical levels you should ________________________.

A) buy the AA and short the AAA

B) buy both the AA and the AAA

C) buy the AAA and short the AA

D) short both the AA and the AAA

A) buy the AA and short the AAA

B) buy both the AA and the AAA

C) buy the AAA and short the AA

D) short both the AA and the AAA

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

If you choose a zero coupon bond with a maturity that matches your investment horizon which of the following statements is/are correct?

I)You will have no interest rate risk on this bond.

II)Absent default,you can be sure you will earn the promised yield rate.

III)The duration of your bond is less than the time to your investment horizon.

A) I only

B) I and II only

C) II and III only

D) I, II and III

I)You will have no interest rate risk on this bond.

II)Absent default,you can be sure you will earn the promised yield rate.

III)The duration of your bond is less than the time to your investment horizon.

A) I only

B) I and II only

C) II and III only

D) I, II and III

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

As compared with equivalent maturity bonds selling at par,deep discount bonds will have ________.

A) greater reinvestment risk

B) greater price volatility

C) less call protection

D) shorter average maturity

A) greater reinvestment risk

B) greater price volatility

C) less call protection

D) shorter average maturity

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

The duration is independent of the coupon rate only for which one of the following?

A) Discount bonds

B) Premium bonds

C) Perpetuities

D) Short term bonds

A) Discount bonds

B) Premium bonds

C) Perpetuities

D) Short term bonds

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

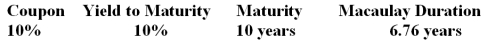

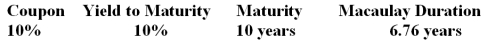

64

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

If the bond's coupon was smaller than 10%,the modified duration would be _____ compared to the original modified duration.

A) larger

B) unchanged

C) smaller

D) There is not enough information to determine the direction of change

If the bond's coupon was smaller than 10%,the modified duration would be _____ compared to the original modified duration.

A) larger

B) unchanged

C) smaller

D) There is not enough information to determine the direction of change

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

What strategy might an insurance company employ to ensure that it will be able to meet the obligations of annuity holders?

A) Cash flow matching

B) Index tracking

C) Yield pickup swaps

D) Substitution swap

A) Cash flow matching

B) Index tracking

C) Yield pickup swaps

D) Substitution swap

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

Immunization of coupon paying bonds is not a passive strategy because

I)the portfolio must be rebalanced every time interest rates change

II)the portfolio must be rebalanced over time even if interest rates don't change

III)convexity implies duration based immunization strategies don't work

A) I only

B) I and II only

C) II only

D) I, II and III

I)the portfolio must be rebalanced every time interest rates change

II)the portfolio must be rebalanced over time even if interest rates don't change

III)convexity implies duration based immunization strategies don't work

A) I only

B) I and II only

C) II only

D) I, II and III

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

You have an investment horizon of 6 years.You choose to hold a bond with a duration of 6 years and continue to match your investment horizon and duration throughout your holding period.Your realized rate of return will be the same as the promised yield on the bond if

I)interest rates increase

II)interest rates stay the same

III)interest rates fall

A) I only

B) II only

C) I and II only

D) I, II and III

I)interest rates increase

II)interest rates stay the same

III)interest rates fall

A) I only

B) II only

C) I and II only

D) I, II and III

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

A 20 year maturity corporate bond has a 6.5% coupon rate (the coupons are paid annually).The bond currently sells for $925.50.A bond market analyst forecasts that in five years yield rates on these bonds will be at 7.0%.You believe that you will be able to reinvest the coupons earned over the next five years at a 6% rate of return.What is your expected annual compound rate of return if you plan on selling the bond in five years?

A) 7.37%

B) 7.56%

C) 8.12%

D) 8.54%

A) 7.37%

B) 7.56%

C) 8.12%

D) 8.54%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

When bonds sell above par,what is the relationship of price sensitivity to rising interest rates?

A) Price volatility increases at an increasing rate

B) Price volatility increases at a decreasing rate

C) Price volatility decreases at a decreasing rate

D) Price volatility decreases at an increasing rate

A) Price volatility increases at an increasing rate

B) Price volatility increases at a decreasing rate

C) Price volatility decreases at a decreasing rate

D) Price volatility decreases at an increasing rate

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

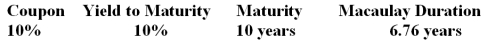

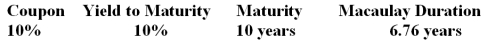

70

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

If the yield to maturity decreases to 8.045% the expected percentage change in the price of the bond using Macauley's duration would be ____,while the expected percentage change in the price of the bond using modified duration would be ____.

A) 11%, 12%

B) 12%, 11%

C) 12%, 12%

D) 11%, 11%

If the yield to maturity decreases to 8.045% the expected percentage change in the price of the bond using Macauley's duration would be ____,while the expected percentage change in the price of the bond using modified duration would be ____.

A) 11%, 12%

B) 12%, 11%

C) 12%, 12%

D) 11%, 11%

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

A zero coupon bond is selling at a deep discount price of $430.00.It matures in 13 years.If the yield to maturity of the bond is 6.7%,what is the duration of the bond?

A) 6.7 years

B) 8.0 years

C) 10 years

D) 13 years

A) 6.7 years

B) 8.0 years

C) 10 years

D) 13 years

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

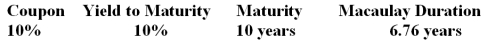

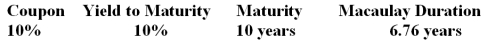

72

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

The modified duration for the Steel Pier bond is ______.

A) 6.15 years

B) 5.95 years

C) 6.49 years

D) 9.09 years

The modified duration for the Steel Pier bond is ______.

A) 6.15 years

B) 5.95 years

C) 6.49 years

D) 9.09 years

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

You have an investment horizon of 6 years.You choose to hold a bond with a duration of 4 years.Your realized rate of return will be larger than the promised yield on the bond if ___________________.

A) interest rates increase

B) interest rates stay the same

C) interest rates fall

D) one can't tell with the information given

A) interest rates increase

B) interest rates stay the same

C) interest rates fall

D) one can't tell with the information given

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

Which one of the following statements correctly describes the weights used in the Macaulay duration calculation? The weight in year t is equal to ____________.

A) the dollar amount of the investment received in year t

B) the percentage of the future value of the investment received in year t

C) the present value of the dollar amount of the investment received in year t

D) the percentage of the total present value of the investment received in year t

A) the dollar amount of the investment received in year t

B) the percentage of the future value of the investment received in year t

C) the present value of the dollar amount of the investment received in year t

D) the percentage of the total present value of the investment received in year t

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

If an investment returns a higher percentage of your money back sooner it will ______.

A) be less price volatile

B) have a higher credit rating

C) be less liquid

D) have a higher modified duration

A) be less price volatile

B) have a higher credit rating

C) be less liquid

D) have a higher modified duration

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

You have an investment that in today's dollars returns 15% of your investment in year 1,12% in year two,9% in year 3 and the remainder in year 4.What is the duration of this investment?

A) 4 years

B) 3.50 years

C) 3.22 years

D) 2.95 years

A) 4 years

B) 3.50 years

C) 3.22 years

D) 2.95 years

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

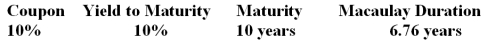

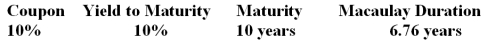

77

Steel Pier Company has issued bonds that pay semiannually with the following characteristics:

If the maturity of the bond was less than 10 years,the modified duration would be _____ compared to the original modified duration.

A) larger

B) unchanged

C) smaller

D) There is not enough information to determine the direction of change

If the maturity of the bond was less than 10 years,the modified duration would be _____ compared to the original modified duration.

A) larger

B) unchanged

C) smaller

D) There is not enough information to determine the direction of change

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

Market economists all predict a rise in interest rates.An astute bond manager wishing to maximize her capital gain might employ which strategy?

A) Switch from low duration to high duration bonds.

B) Switch from high duration to low duration bonds.

C) Switch from high grade to low grade bonds.

D) Switch from low coupon to high coupon bonds.

A) Switch from low duration to high duration bonds.

B) Switch from high duration to low duration bonds.

C) Switch from high grade to low grade bonds.

D) Switch from low coupon to high coupon bonds.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

You have an investment horizon of 6 years.You choose to hold a bond with a duration of 10 years.Your realized rate of return will be larger than the promised yield on the bond if ___________________.

A) interest rates increase

B) interest rates stay the same

C) interest rates fall

D) one can't tell with the information given

A) interest rates increase

B) interest rates stay the same

C) interest rates fall

D) one can't tell with the information given

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

A bond portfolio manager notices a hump in the yield curve at the five year point.How might a bond manager take advantage of this event?

A) Buy the 5 year bonds and short the surrounding maturity bonds

B) Buy the 5 year bonds and buy the surrounding maturity bonds

C) Short the 5 year bonds and short the surrounding maturity bonds

D) Short the 5 year bonds and buy the surrounding maturity bonds

A) Buy the 5 year bonds and short the surrounding maturity bonds

B) Buy the 5 year bonds and buy the surrounding maturity bonds

C) Short the 5 year bonds and short the surrounding maturity bonds

D) Short the 5 year bonds and buy the surrounding maturity bonds

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck