Deck 11: Forwards,futures,and Swaps

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 11: Forwards,futures,and Swaps

1

When does counterparty risk arise?

A) When the spot price increases.

B) When the investor takes a naked position.

C) When the speculator loses to the counter party.

D) When the counterparty defaults.

A) When the spot price increases.

B) When the investor takes a naked position.

C) When the speculator loses to the counter party.

D) When the counterparty defaults.

D

2

What condition is necessary to create a synthetic forward contract?

A) A hedging position.

B) Exposure to changes in exchange rates

C) Interest rate parity

D) Speculating in the market

A) A hedging position.

B) Exposure to changes in exchange rates

C) Interest rate parity

D) Speculating in the market

C

3

The six-month forward rate is C$ 1.00 per US$.Ahmed assumes a 1,000 long position in the forward contract and his profit in six months is C$30.00.What is the spot rate in six months?

a) C$ 1.030 per US$

b) C$ 1.031 per US$

c) C$ 1.029 per US$

d) C$ 0.970 per US$

a) C$ 1.030 per US$

b) C$ 1.031 per US$

c) C$ 1.029 per US$

d) C$ 0.970 per US$

a,C$ 1.030 per US$ ST = (Profit/n)+ F = (30/1,000)+ 1.00 = 1.030

4

Profit from a long position in a forward is:

A) (X - ST)

B) [ST - F] × n

C) (ST - X)

D) [F - ST] × n

A) (X - ST)

B) [ST - F] × n

C) (ST - X)

D) [F - ST] × n

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

Xin is selling his transformer over the internet for C$500.An interested buyer says he is willing to pay 360 euro in six months.What position should Xin take to eliminate his foreign exchange exposure?

A) 500 long Canadian forward contract

B) 500 short Canadian forward contract

C) 360 long euro forward contract

D) 360 short euro forward contract

A) 500 long Canadian forward contract

B) 500 short Canadian forward contract

C) 360 long euro forward contract

D) 360 short euro forward contract

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

Assume the following: Current Spot Rate C$1.10 per $US; Future Spot Rate C$1.1063 per $US; Forward Rate C$1.1044 per $US; Exposure $100,000 US.What are the profits in Canadian dollars of covering the long position?

a) C$110

b) C$116

c) C$114

d) C$190

a) C$110

b) C$116

c) C$114

d) C$190

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

Assume perfect foresight.The current spot rate is C$2.037 per British pound.The 3-month forward rate is C$2.0383.The spot rate in three months will be C$2.04 per pound.What position must an investor assume in order to make a profit of $17.00?

a) Pound 13,077 short position

b) Pound 10,000 long position

c) Pound 10,000 short position

d) Pound 13,077 long position

a) Pound 13,077 short position

b) Pound 10,000 long position

c) Pound 10,000 short position

d) Pound 13,077 long position

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose Montreal Import Company has to pay a foreign supplier 400,000 euros in one year and decides to hedge their position by entering into a forward contract.What is the appropriate forward position?

A) 400,000 short euro forward contract

B) 200,000 euro forward contract

C) 400,000 long euro forward contract

D) not enough information provided to identify an answer

A) 400,000 short euro forward contract

B) 200,000 euro forward contract

C) 400,000 long euro forward contract

D) not enough information provided to identify an answer

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

Magdalena assumes a US$ 2,000 short position in a 1-year US forward contract

(F = C$1.0312 per US).If the spot rate in one year is (a)C$1.04 per US (b)C$1.03 per US,what will her profit (loss)be in each case?

a) - C$8.8, 1.2

b) - C$20, 2.4

c) C$17.6, - 2.4

d) - C$17.6, 2.4

(F = C$1.0312 per US).If the spot rate in one year is (a)C$1.04 per US (b)C$1.03 per US,what will her profit (loss)be in each case?

a) - C$8.8, 1.2

b) - C$20, 2.4

c) C$17.6, - 2.4

d) - C$17.6, 2.4

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Given: the future spot rate C$0.00965 per yen; the current spot rate C$0.0088 per yen and the forward rate C$0.009721 per yen.Determine the cost (proceeds)in Canadian dollars to eliminate foreign exchange exposure for 100,000 yen to be paid to a foreign supplier.

a) Cost C$965.00

b) Cost C$880.00

c) Cost C$972.10

d) Proceeds C$880.00

a) Cost C$965.00

b) Cost C$880.00

c) Cost C$972.10

d) Proceeds C$880.00

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

What is the "cost of carry" equivalent for exchange rates?

A) The forward rate

B) The interest rate in the host country

C) The interest rate in the foreign country

D) The interest rate difference between the host and foreign countries

A) The forward rate

B) The interest rate in the host country

C) The interest rate in the foreign country

D) The interest rate difference between the host and foreign countries

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

Marie has done some research and found that the spot rate is C$1.4039 per euro.Her neighbour told her that the three-month forward rate is C$1.44 per euro.If Marie assumes a 1,000 euro long position in the forward contract,what will her profit (loss)be if the spot rate in 3 months is C$1.45 per euro?

a) C$46.10

b) - C$10.00

c) C$10.00

d) C$36.10

a) C$46.10

b) - C$10.00

c) C$10.00

d) C$36.10

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

A tailor-made contract with a price that is established today for future delivery is called a ___________.

A) futures contract

B) forward contract

C) spot contract

D) call option

A) futures contract

B) forward contract

C) spot contract

D) call option

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Forward contracts can be used either to hedge or to speculate.These actions:

A) increase risk in both cases.

B) decrease risk in both cases.

C) spread or minimize risk in both cases.

D) none of the above.

A) increase risk in both cases.

B) decrease risk in both cases.

C) spread or minimize risk in both cases.

D) none of the above.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

Forward contracts:

A) trade in an open market.

B) establish a price paid tomorrow for something today.

C) offer delivery of a commodity by sellers in the future.

D) are traded on OTC markets.

A) trade in an open market.

B) establish a price paid tomorrow for something today.

C) offer delivery of a commodity by sellers in the future.

D) are traded on OTC markets.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

Assume the spot exchange rate today is C$1.02 per $US,while the three-month forward rate is C$1.06 per $US.What will be the profit for an investor who takes a $US100,000 short position in the forward contract if the spot rate in three months equals 1.05?

a) C$1,000

b) - C$1,000

c) C$4,000

d) - C$4,000

a) C$1,000

b) - C$1,000

c) C$4,000

d) - C$4,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following carries storage costs?

A) Futures on stocks

B) Futures on exchange rates

C) Futures on commodities

D) Futures on interest rates

A) Futures on stocks

B) Futures on exchange rates

C) Futures on commodities

D) Futures on interest rates

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

Assume the following: Current 1-year Japanese interest rate 3.0%; Current 1-year Canadian interest rate 5.0%; Current spot rate C$0.01 per yen.Estimate the 1-year forward exchange rate using interest rate parity.

a) C$0.0102 per yen

b) C$0.0098 per yen

c) C$1.0194 per yen

d) C$0.9810 per yen

a) C$0.0102 per yen

b) C$0.0098 per yen

c) C$1.0194 per yen

d) C$0.9810 per yen

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

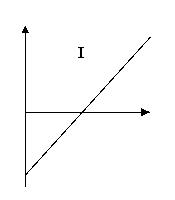

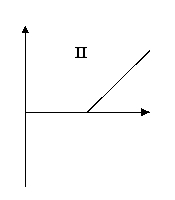

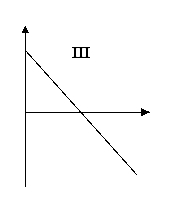

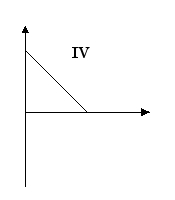

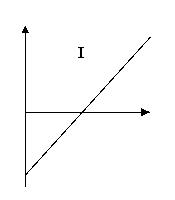

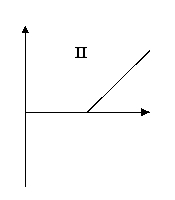

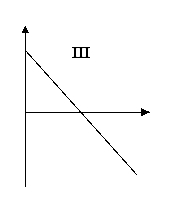

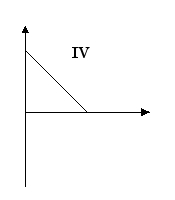

19

Which is a graph of a short position in a forward contract?

A) I

B) II

C) III

D) IV

A) I

B) II

C) III

D) IV

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

Profit from a short position in a forward is:

A) (X - ST)

B) [ST - F] × n

C) (ST - X)

D) [F - ST] × n

A) (X - ST)

B) [ST - F] × n

C) (ST - X)

D) [F - ST] × n

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

What is a relatively small (in terms of the contract value)deposit made with the clearinghouse?

A) Maintenance margin

B) Margin call

C) Initial margin

D) Daily resettlement

A) Maintenance margin

B) Margin call

C) Initial margin

D) Daily resettlement

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following are classified as commodities for the purpose of futures contracts?

I)Silver

II)Wheat

III)Weather derivatives

A) I, II

B) II, III

C) I, III

D) I, II, III

I)Silver

II)Wheat

III)Weather derivatives

A) I, II

B) II, III

C) I, III

D) I, II, III

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

Wheat is selling for $25 spot.Storage costs are $2 for the year,and financing costs are 5% per year.What is the forward price for a one-year forward contract for wheat?

a) $25.00

b) $26.25

c) $25.13

d) $28.25

a) $25.00

b) $26.25

c) $25.13

d) $28.25

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

Montreal First Bank is selling forward contracts on the USD/CAD exchange market.What exchange rate would they require for a three-month forward rate,if the spot rate is C$ 1.0200/USD and the interest rates are 3% and 2.5% in Canada and the US respectively?

a) C$1.0249

b) C$1.0213

c) C$1.0187

d) C$1.0200

a) C$1.0249

b) C$1.0213

c) C$1.0187

d) C$1.0200

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following statements to answer this question:

I)Credit default swaps (CDS)is a default premium on debt issue.

II)Credit default swaps (CDS)are insurance on the default of issuers of the debt.

A) I is correct, II is incorrect

B) I and II are correct

C) I and II are incorrect

D) I is incorrect, and II is correct

I)Credit default swaps (CDS)is a default premium on debt issue.

II)Credit default swaps (CDS)are insurance on the default of issuers of the debt.

A) I is correct, II is incorrect

B) I and II are correct

C) I and II are incorrect

D) I is incorrect, and II is correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

Use the following statements to answer this question:

I)Forward contacts are more affected by credit risk than future contracts.

II)Clearinghouses improve the level of risk associated with futures transactions.

A) I and II are correct

B) I and II are incorrect

C) I is correct and II is incorrect

D) I is incorrect and II is correct

I)Forward contacts are more affected by credit risk than future contracts.

II)Clearinghouses improve the level of risk associated with futures transactions.

A) I and II are correct

B) I and II are incorrect

C) I is correct and II is incorrect

D) I is incorrect and II is correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

Interest rate swaps allow one party to exchange:

A) a floating interest rate for a fixed interest rate over the contract term.

B) a fixed interest rate for a lower fixed interest rate over the contract term.

C) a floating interest rate for a lower floating value over the contract term.

D) all of the above.

A) a floating interest rate for a fixed interest rate over the contract term.

B) a fixed interest rate for a lower fixed interest rate over the contract term.

C) a floating interest rate for a lower floating value over the contract term.

D) all of the above.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

The dollar amount upon which a contract is valued is referred to as:

A) settlement price

B) initial margin

C) strike price

D) notional amount

A) settlement price

B) initial margin

C) strike price

D) notional amount

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Montreal First Bank is selling forward contracts on the CAD/USD market.What exchange rate will they require for a three-month forward rate,if the spot rate is C$0.9800/USD,and the interest rates are 3% and 2.5% in Canada and the US respectively?

a) C$0.9752

b) C$0.9788

c) C$0.9812

d) C$0.9800

a) C$0.9752

b) C$0.9788

c) C$0.9812

d) C$0.9800

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

By definition LIBOR is:

A) the long-term inter-bank option rate

B) the London inter-bank optimal rate

C) the limited inter-bank offer rate

D) the London inter-bank offered rate

A) the long-term inter-bank option rate

B) the London inter-bank optimal rate

C) the limited inter-bank offer rate

D) the London inter-bank offered rate

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

David estimated a six-month forward rate of C$1.01 per US$.The six-month US$ interest rate is currently 4%.If David's estimate is based on IRP,what was the observed current six-month Canadian interest rate,if the spot rate is C$1.02 per US$?

a) 5.03%

b) 2.03%

c) 2.98%

d) 2.05%

a) 5.03%

b) 2.03%

c) 2.98%

d) 2.05%

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

If the bank could borrow at a fixed rate of 10% for 5 years,what is the notional principal of the swap if the interest fixed payment is $5 million per year?

a) $80 million

b) $50 million

c) $75 million

d) $80 million

a) $80 million

b) $50 million

c) $75 million

d) $80 million

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following statements to answer this question:

I)Credit default swaps (CDS)are insurance on the default of issuers of the debt.

II)The CDS market is heavily regulated to limit excessive exposure to risk.

A) I is correct, II is incorrect

B) I and II are correct

C) I and II are incorrect

D) I is incorrect, and II is correct

I)Credit default swaps (CDS)are insurance on the default of issuers of the debt.

II)The CDS market is heavily regulated to limit excessive exposure to risk.

A) I is correct, II is incorrect

B) I and II are correct

C) I and II are incorrect

D) I is incorrect, and II is correct

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

An investor enters into a long position in 10,000 futures contracts of oil with a $50,000 initial margin and has a maintenance margin that is 75 percent of this amount.The futures price associated with this contract is $100.Assuming the price of the underlying asset decreases to $98,what is the margin call?

a) $50,000

b) $37,500

c) $7,500

d) No margin required

a) $50,000

b) $37,500

c) $7,500

d) No margin required

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

Assume the following: underlying asset spot $200,storage cost $20,and financing costs 5% per year.Calculate the cost of carry.

a) $20

b) 0.15

c) 0.105

d) 0.10

a) $20

b) 0.15

c) 0.105

d) 0.10

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

Characteristics of futures contracts include

I)traded on an exchange

II)settled on maturity date

III)initial margin and maintenance margin required

IV)standardized contracts

A) I, II, III, IV

B) II, III, IV

C) I, III, IV

D) I, II,III, IV

I)traded on an exchange

II)settled on maturity date

III)initial margin and maintenance margin required

IV)standardized contracts

A) I, II, III, IV

B) II, III, IV

C) I, III, IV

D) I, II,III, IV

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following are classified as investment for the purpose of futures contracts?

I)Silver

II)Wheat

III)Weather derivatives

IV)Bond

A) I, II

B) II, III

C) I, III

D) I, II, III

E) IV

I)Silver

II)Wheat

III)Weather derivatives

IV)Bond

A) I, II

B) II, III

C) I, III

D) I, II, III

E) IV

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following refers to the cost or benefits from a forward position in a storable commodity?

I)Storage cost

II)Convenience yield

III)Cost of carry

A) I, II, III

B) I, II

C) II, III

D) I, III

I)Storage cost

II)Convenience yield

III)Cost of carry

A) I, II, III

B) I, II

C) II, III

D) I, III

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

What is the open interest in the market above?

a) 6

b) 12

c) 0

d) more information required

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

A "fixed for floating" interest rate swap is also referred to as:

A) plain vanilla

B) fixed swap

C) currency swap

D) plain swap

A) plain vanilla

B) fixed swap

C) currency swap

D) plain swap

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

What are the differences between forwards and futures contracts?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

In order to estimate the forward rate for year 1.5 one needs

I)1-year zero

II)1.5-year zero

III)2-year zero

A) I, III

B) I, II, III

C) I, II

D) II, III

I)1-year zero

II)1.5-year zero

III)2-year zero

A) I, III

B) I, II, III

C) I, II

D) II, III

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

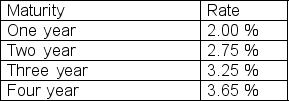

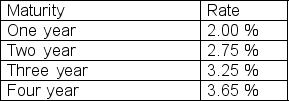

Find the one-year forward rate for year three given the following zero coupon rates:

a) 3.51%

b) 4.26%

c) 4.86%

d) 4.56%

a) 3.51%

b) 4.26%

c) 4.86%

d) 4.56%

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Find the forward price for one forward contract for gold that is selling for $1,449 spot,if the storage cost is $10 for the year and financing cost is 10% per year.

Answer

c = [ (0.10 x $1,449)+10)/1,449 = 0.1069

F = (1+0.1069)x 1,449 = $1,603.90

Type: Calculation

Answer

c = [ (0.10 x $1,449)+10)/1,449 = 0.1069

F = (1+0.1069)x 1,449 = $1,603.90

Type: Calculation

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

Explain how derivatives led to the worst recession in the post second world war era.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

Nanci enters into a long position in 6,000 futures contracts that require a $6,000 initial margin and has a maintenance margin that is 75% of this amount.The futures price associated with this contract is $10.Assume that the spot price of the underlying asset closes at the following prices for the next five days: $10.50,$10.75,$11.00,$9.75 and $9.25.Estimate the daily profit (loss)for Nanci as well as her equity position.(Assume no cash deposits or withdrawals are made from the account.)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

Company JH enters a swap to pay a fixed rate of 12% and the counterparty MI will pay a floating rate of LIBOR + 0.3%.What are the net payments (in %)from JH's point of view given that LIBOR for the next five periods equals: 8.0,9.0,11.0,12.0,12.3

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

Ronald's company enters a 3-year,$10,000 plain vanilla interest rate swap and agrees to pay LIBOR and receive a fixed rate of 5%.Payments are to be exchanged every six months.Determine the semi-annual payments that Ronald must receive,assuming LIBOR has the following values for each six-month period beginning now: 5%,5.5%,6%,4.75%,4.25%,4%.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

Estimate the year 1 forward rate given:

2 year zero will earn 3%

1 year zero will earn 2.5%

a) 2.0%

b) 0.5%

c) 3.5%

d) - 3.4%

2 year zero will earn 3%

1 year zero will earn 2.5%

a) 2.0%

b) 0.5%

c) 3.5%

d) - 3.4%

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

Assume company L wants to pay a floating rate and company N wants to pay a fixed rate.Company L is quoted 11% fixed-rate financing or a floating rate of LIBOR + 0.3%.In contrast,company N is quoted a fixed-rate financing at 14% and a floating rate financing at LIBOR + 0.75%.Calculate the net savings (%)to both parties if a swap is entered into between L and N if N pays L 12.0% and L pays N LIBOR.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

An exchange of an interest rate return for the total return on an equity index,plus or minus a spread is called:

A) a total return swap.

B) an interest rate swap.

C) a credit default swap.

D) a return forward.

A) a total return swap.

B) an interest rate swap.

C) a credit default swap.

D) a return forward.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

In order to estimate the forward rate for year six one needs

I)5-year zero

II)6-year zero

III)4-year zero

A) I, III

B) I, II, III

C) I, II

D) II, III

I)5-year zero

II)6-year zero

III)4-year zero

A) I, III

B) I, II, III

C) I, II

D) II, III

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

Matthew enters into an FRA with the local bank.The current one year forward rate is 4%.If the yield on a one year T-Bill in one year is 3.5%,what payment will be made to settle the agreement?

a) Matthew would pay the bank 0.5%.

b) Matthew will use the market rate rather than the FRA rate.

c) The bank would pay Matthew 0.5%.

d) Matthew would not exercise his option.

a) Matthew would pay the bank 0.5%.

b) Matthew will use the market rate rather than the FRA rate.

c) The bank would pay Matthew 0.5%.

d) Matthew would not exercise his option.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

Credit default swap is classified as:

A) an exchange-traded transaction.

B) an over-the-counter transaction.

C) none of the above.

A) an exchange-traded transaction.

B) an over-the-counter transaction.

C) none of the above.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

An investor enters a short position worth $10,000 in futures contracts that require a maintenance margin that is 50% of this amount.The spot price of the underlying asset closes at the following prices for the next five days: $20.50,$20.75,$21.00,$20.75 and $20.00,and the current spot is $21.00.On what days will the investor receive a margin call and why? (Assume no deposits or withdrawals.)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck