Deck 1: An Introduction to Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/54

Play

Full screen (f)

Deck 1: An Introduction to Finance

1

A financial security is

A) a jail term for a financial manager that has committed fraud.

B) a contract that is created only when a new stock is issued to the public.

C) a financial contract created whenever funds are transferred.

D) a contract that is created only when a new bond is first sold.

A) a jail term for a financial manager that has committed fraud.

B) a contract that is created only when a new stock is issued to the public.

C) a financial contract created whenever funds are transferred.

D) a contract that is created only when a new bond is first sold.

C

2

Which of the following is NOT a financial intermediary?

A) chartered banks

B) insurance companies

C) pension funds

D) mutual funds

A) chartered banks

B) insurance companies

C) pension funds

D) mutual funds

D

3

What is the major proportion of Canadian households' financial assets?

A) stocks and bonds

B) deposits

C) foreign investment

D) claims on retirement and insurance funds

A) stocks and bonds

B) deposits

C) foreign investment

D) claims on retirement and insurance funds

D

4

Entities that invest funds on behalf of others and change the nature of the transactions are called

A) brokers.

B) financial intermediaries.

C) dealers.

D) market intermediaries.

A) brokers.

B) financial intermediaries.

C) dealers.

D) market intermediaries.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

5

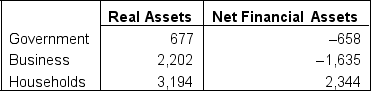

You are provided with the following hypothetical information regarding the real and financial assets in Canada for 2015 (numbers in $ billions):

What is the value of the net financial assets owned by non-residents for 2015?

A) $901 billion

B) $51 billion

C) $2,293 billion

D) There is not enough information to answer the question.

What is the value of the net financial assets owned by non-residents for 2015?

A) $901 billion

B) $51 billion

C) $2,293 billion

D) There is not enough information to answer the question.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

6

Although Canadian banks are involved in almost all areas of the financial system,which of the following is their core activity?

A) stock market investment activity

B) retirement planning

C) wealth management

D) taking deposits and lending funds

A) stock market investment activity

B) retirement planning

C) wealth management

D) taking deposits and lending funds

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

7

Human capital is

A) based on only the current skills, but not the education, of a country's citizens.

B) based on only the education, but not the current skills, of a country's citizens.

C) based on the skills and capital of citizens and should be included in a country's wealth.

D) difficult to measure and should therefore not be included in a country's wealth.

A) based on only the current skills, but not the education, of a country's citizens.

B) based on only the education, but not the current skills, of a country's citizens.

C) based on the skills and capital of citizens and should be included in a country's wealth.

D) difficult to measure and should therefore not be included in a country's wealth.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

8

The three intermediation channels that transfer money from lenders to borrowers are

A) direct, indirect, and financial intermediation.

B) direct, indirect, and monetary intermediation.

C) direct, financial, and monetary intermediation.

D) indirect, financial, and monetary intermediation.

A) direct, indirect, and financial intermediation.

B) direct, indirect, and monetary intermediation.

C) direct, financial, and monetary intermediation.

D) indirect, financial, and monetary intermediation.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

9

Finance is the study of how and under what terms

A) savings are allocated between lenders and borrowers.

B) investments are allocated between investors and brokers.

C) institutions with excess money make share purchase decisions.

D) households allocate money between spending and saving.

A) savings are allocated between lenders and borrowers.

B) investments are allocated between investors and brokers.

C) institutions with excess money make share purchase decisions.

D) households allocate money between spending and saving.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT one of the main functions performed by mutual funds?

A) pooling sums of money to make investments

B) paying out premiums to their clients

C) providing professional management expertise

D) acting as a "pass-through" for individuals to invest in the equity and debt markets

A) pooling sums of money to make investments

B) paying out premiums to their clients

C) providing professional management expertise

D) acting as a "pass-through" for individuals to invest in the equity and debt markets

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

11

An example of direct intermediation would be

A) an individual borrowing money from a bank.

B) an individual borrowing money from her mother.

C) an individual using a real estate broker to finance her home purchase.

D) a stockbroker selling securities to an individual.

A) an individual borrowing money from a bank.

B) an individual borrowing money from her mother.

C) an individual using a real estate broker to finance her home purchase.

D) a stockbroker selling securities to an individual.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

12

In the following list,which item is a financial asset?

A) land

B) bond

C) building

D) inventory

A) land

B) bond

C) building

D) inventory

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

13

In Canada,the primary provider of funds to business and government is (are)

A) international banks.

B) large Canadian banks.

C) the household sector.

D) market intermediaries.

A) international banks.

B) large Canadian banks.

C) the household sector.

D) market intermediaries.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following items is NOT a real asset?

A) land

B) television

C) bond

D) gold mine

A) land

B) television

C) bond

D) gold mine

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

15

Joe has just borrowed $5,000 from his aunt in order to make a down payment on a car.This borrowing transaction is an example of

A) indirect intermediation.

B) direct intermediation.

C) external intermediation.

D) market transaction.

A) indirect intermediation.

B) direct intermediation.

C) external intermediation.

D) market transaction.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

16

What is the main difference between real assets and financial assets?

A) Real assets are tangible and financial assets are intangible.

B) Real assets have known values, while the values of financial assets are not known.

C) Real assets are intangible and financial assets are tangible.

D) Real assets have unknown values, while the values of financial assets are known.

A) Real assets are tangible and financial assets are intangible.

B) Real assets have known values, while the values of financial assets are not known.

C) Real assets are intangible and financial assets are tangible.

D) Real assets have unknown values, while the values of financial assets are known.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following does NOT appear as an item on Canada's balance sheet,as presented in the text?

A) non-residential structures

B) net worth or equity

C) net foreign liabilities

D) net foreign assets

A) non-residential structures

B) net worth or equity

C) net foreign liabilities

D) net foreign assets

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

18

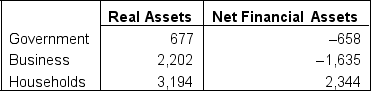

If Canadian households,in aggregate,own real assets with a market value of $3.194 trillion,and also own net financial assets with a market value of $2.344 trillion,the total net assets of Canadian households have a market value of

A) $3.194 trillion

B) $5.538 trillion

C) $-0.850 trillion

D) $0.850 trillion

A) $3.194 trillion

B) $5.538 trillion

C) $-0.850 trillion

D) $0.850 trillion

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

19

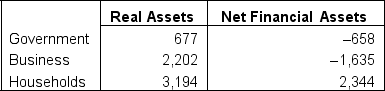

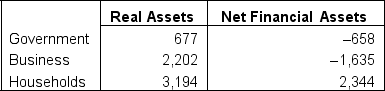

Given the following hypothetical information regarding the real and financial assets in Canada for 2015 (numbers in $ billions):

What is the value of the total net assets in Canada for 2015?

A) $5,842 billion

B) $6,086 billion

C) $6,124 billion

D) $6,105 billion

What is the value of the total net assets in Canada for 2015?

A) $5,842 billion

B) $6,086 billion

C) $6,124 billion

D) $6,105 billion

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following sectors is NOT a user of savings in the economy?

A) business sector

B) household sector

C) government sector

D) banking sector

A) business sector

B) household sector

C) government sector

D) banking sector

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

21

Financial markets are usually classified by the type and maturity of the financial assets traded.The two main classifications are as follows:

A) bond market and money market.

B) money market and capital market.

C) bond market and foreign-exchange market.

D) commodity market and capital market.

A) bond market and money market.

B) money market and capital market.

C) bond market and foreign-exchange market.

D) commodity market and capital market.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following was NOT one of the major objectives in the restructuring of the Canadian stock exchanges in 1999 and 2000?

A) to create a Canadian market for NASDAQ-listed companies

B) to combine all futures and options trading on one exchange

C) to make the TSX the official exchange for the trading of Canadian senior stocks

D) to create a single national exchange for trading in junior company stocks

A) to create a Canadian market for NASDAQ-listed companies

B) to combine all futures and options trading on one exchange

C) to make the TSX the official exchange for the trading of Canadian senior stocks

D) to create a single national exchange for trading in junior company stocks

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

23

Since March 2000 the Montreal Exchange (ME)has functioned as Canada's national market for

A) hedge funds.

B) publicly traded stocks.

C) derivatives.

D) T-bills.

A) hedge funds.

B) publicly traded stocks.

C) derivatives.

D) T-bills.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

24

A market where transactions are made directly between large institutions and wealthy individuals that bypass brokers and dealers is an example of

A) the primary market.

B) the secondary market.

C) the third market.

D) the fourth market.

A) the primary market.

B) the secondary market.

C) the third market.

D) the fourth market.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

25

Which is the only province where trades in unlisted securities need to be reported?

A) British Columbia

B) Quebec

C) Alberta

D) Ontario

A) British Columbia

B) Quebec

C) Alberta

D) Ontario

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

26

The main difference between exchanges and dealer/OTC markets is

A) exchanges are a part of the primary market, while dealer and OTC markets are part of the secondary market.

B) transactions in dealer markets are conducted entirely by humans, not electronically.

C) exchanges have a physical location while dealer and OTC markets do not.

D) All of the above are differences between exchanges and dealer markets.

A) exchanges are a part of the primary market, while dealer and OTC markets are part of the secondary market.

B) transactions in dealer markets are conducted entirely by humans, not electronically.

C) exchanges have a physical location while dealer and OTC markets do not.

D) All of the above are differences between exchanges and dealer markets.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

27

Though they are classified as equity,why are preferred shares also similar to debt?

A) Both carry the same interest rate.

B) Dividends on preferred shares must be paid out before any common share dividends.

C) The voting structures for preferred shares and debt are equivalent.

D) Preferred shares have similar maturity structures to debt.

A) Both carry the same interest rate.

B) Dividends on preferred shares must be paid out before any common share dividends.

C) The voting structures for preferred shares and debt are equivalent.

D) Preferred shares have similar maturity structures to debt.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

28

Which one of the following is NOT a function of brokers?

A) Manage money for clients.

B) Make the market work.

C) Charge a fee for their services.

D) Assist with the transaction process.

A) Manage money for clients.

B) Make the market work.

C) Charge a fee for their services.

D) Assist with the transaction process.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

29

How do governments obtain the majority of their short- and long-term financing?

A) T-bills and Canada Savings Bonds

B) T-bills, traditional bonds, and Canada Savings Bonds

C) T-bills, equity, and traditional bonds

D) traditional bonds and Canada Savings Bonds

A) T-bills and Canada Savings Bonds

B) T-bills, traditional bonds, and Canada Savings Bonds

C) T-bills, equity, and traditional bonds

D) traditional bonds and Canada Savings Bonds

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is NOT an example of a capital market security?

A) bond

B) debenture

C) common equity

D) T-bill

A) bond

B) debenture

C) common equity

D) T-bill

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

31

All common shares are comprised of which two components?

A) ownership and voting rights

B) ownership and dividend rights

C) voting and dividend rights

D) dividend and yield rights

A) ownership and voting rights

B) ownership and dividend rights

C) voting and dividend rights

D) dividend and yield rights

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

32

An example of a non-marketable financial asset is a

A) demand deposit.

B) T-bill.

C) commercial paper.

D) common share.

A) demand deposit.

B) T-bill.

C) commercial paper.

D) common share.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

33

Why can't the Canadian government issue equity?

A) because assets belong to all Canadians

B) it is not listed in the financial markets

C) it has too much debt

D) because expenditures exceed revenues

A) because assets belong to all Canadians

B) it is not listed in the financial markets

C) it has too much debt

D) because expenditures exceed revenues

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is NOT a component of debt securities?

A) maturity

B) repayment

C) dividends

D) interest payments

A) maturity

B) repayment

C) dividends

D) interest payments

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

35

Of the following list,who are the dominant players in the money market?

I)individuals

II)corporations

III)governments

A) I and II

B) I and III

C) II and III

D) I, II, and III

I)individuals

II)corporations

III)governments

A) I and II

B) I and III

C) II and III

D) I, II, and III

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

36

Who are the biggest borrowers and lenders in Canada,respectively?

A) government and households

B) government and banks

C) banks and mutual funds

D) Crown corporations and banks

A) government and households

B) government and banks

C) banks and mutual funds

D) Crown corporations and banks

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

37

The exchange that acts as the Canadian national derivatives market and conducts all options and futures trading is called the

A) Bourse de Montreal.

B) Winnipeg Commodity Exchange.

C) TSX Venture.

D) Alpha Exchange.

A) Bourse de Montreal.

B) Winnipeg Commodity Exchange.

C) TSX Venture.

D) Alpha Exchange.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is an existing stock exchange in Canada?

A) Toronto Stock Exchange (TSX)

B) Montreal Exchange (ME)

C) Vancouver Stock Exchange (VSE)

D) Winnipeg Stock Exchange (WSE)

A) Toronto Stock Exchange (TSX)

B) Montreal Exchange (ME)

C) Vancouver Stock Exchange (VSE)

D) Winnipeg Stock Exchange (WSE)

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

39

What was NOT a reason for the credit crunch of 2008-09?

A) mistrust between financial intermediaries

B) illiquidity of debt markets

C) the arrest of Bernard Madoff

D) bankruptcy of one of the leading financial institutions

A) mistrust between financial intermediaries

B) illiquidity of debt markets

C) the arrest of Bernard Madoff

D) bankruptcy of one of the leading financial institutions

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

40

Two examples of marketable assets include

A) savings accounts and demand deposits held at financial institutions.

B) provincial and federal savings bonds.

C) demand deposits and provincial savings bonds.

D) equity securities and T-bills.

A) savings accounts and demand deposits held at financial institutions.

B) provincial and federal savings bonds.

C) demand deposits and provincial savings bonds.

D) equity securities and T-bills.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

41

The spread of the financial crisis in the autumn of 2008 was NOT augmented by

A) linkages between global financial markets.

B) the cross listing of firms in different markets.

C) the consolidation of the global financial system.

D) excessive debt of the government.

A) linkages between global financial markets.

B) the cross listing of firms in different markets.

C) the consolidation of the global financial system.

D) excessive debt of the government.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

42

Explain what an auction market is and how it works.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

43

Define and describe the difference between the third and fourth markets.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

44

Why is the secondary market important?

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

45

What are the differences between the primary markets and the secondary markets?

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

46

If the stock of a listed firm decreases by 50 percent,what does it mean to the shareholders?

A) Their ownership of the firm will decrease by 50 percent.

B) Total value of their holdings decreases by 50 percent.

C) The debt of the firm decreases by 50 percent.

D) nothing

A) Their ownership of the firm will decrease by 50 percent.

B) Total value of their holdings decreases by 50 percent.

C) The debt of the firm decreases by 50 percent.

D) nothing

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

47

What is an over-the-counter market? Do all bonds in Canada trade over-the-counter?

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

48

The two sectors that are normally regarded as the lowest risk in the financial market are

A) T-bills and loans extended to PIIGS countries.

B) demand deposits and loans to countries that have taken austerity measures.

C) household mortgages and government debt.

D) government debt and foreign company borrowings.

A) T-bills and loans extended to PIIGS countries.

B) demand deposits and loans to countries that have taken austerity measures.

C) household mortgages and government debt.

D) government debt and foreign company borrowings.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

49

The consolidation of U.S.and global stock markets has

A) been increasing recently, as shown by the merger of the NYSE and Euronext.

B) been decreasing recently, as shown by the decrease in multi-listed stocks.

C) led to lower risk in investments because markets have become less interdependent.

D) led to increased reliance on human interactions in securities trading.

A) been increasing recently, as shown by the merger of the NYSE and Euronext.

B) been decreasing recently, as shown by the decrease in multi-listed stocks.

C) led to lower risk in investments because markets have become less interdependent.

D) led to increased reliance on human interactions in securities trading.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

50

How do financial intermediaries help those with "too much money today" and those with "not enough money today"?

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is NOT a benefit of global financial markets?

A) They represent important sources of funds for borrowers.

B) They provide diversification benefits to Canadian investors.

C) Canadian companies can list their shares in different markets.

D) The value of Canadian shares becomes more stable.

A) They represent important sources of funds for borrowers.

B) They provide diversification benefits to Canadian investors.

C) Canadian companies can list their shares in different markets.

D) The value of Canadian shares becomes more stable.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

52

Which is the world's largest and most famous stock market?

A) New York Stock Exchange (NYSE)

B) Toronto Stock Exchange (TSX)

C) Tokyo Stock Exchange (TSE)

D) London Stock Exchange (LSE)

A) New York Stock Exchange (NYSE)

B) Toronto Stock Exchange (TSX)

C) Tokyo Stock Exchange (TSE)

D) London Stock Exchange (LSE)

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

53

Explain why primary markets are the key to the wealth creation process.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

54

Explain the gravity of the situation of pension holders in Quebec after the loss of 25 percent of La Caisse de Depot's portfolio (pension fund manager of Quebec)in 2008.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck