Deck 20: Accounting for Employee Compensation and Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 20: Accounting for Employee Compensation and Benefits

1

Which of the following statements regarding stock options is true?

A)An employee will exercise a stock option only when the current market price of the stock is less than the option price.

B)Unexercised options may be sold or transferred in the open market.

C)Employee stock options are a restricted form of a call option.

D)Companies expense stock-based compensation at the fair value of the stock on the expected date of exercise.

A)An employee will exercise a stock option only when the current market price of the stock is less than the option price.

B)Unexercised options may be sold or transferred in the open market.

C)Employee stock options are a restricted form of a call option.

D)Companies expense stock-based compensation at the fair value of the stock on the expected date of exercise.

C

2

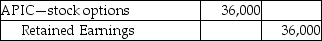

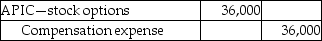

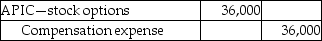

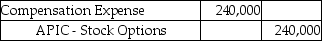

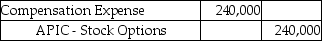

For an equity-classified award,what journal entry is made at the date of grant?

A) APIC-Stock Options

APIC-Stock Options

B) APIC-Stock Options

APIC-Stock Options

C) Common Stock

Common Stock

D) Deferred Compensation

Deferred Compensation

A)

APIC-Stock Options

APIC-Stock OptionsB)

APIC-Stock Options

APIC-Stock OptionsC)

Common Stock

Common StockD)

Deferred Compensation

Deferred CompensationA

3

The fair value of stock options on the date of grant is usually readily determinable.

False

4

The value of forfeited stock options reduce compensation expense.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

If an unexpected forfeiture of options occurs under a stock option plan,the change in compensation is treated as ________.

A)a change in estimate

B)an adjustment to additional paid in capital

C)an adjustment to deferred compensation

D)a change in other comprehensive income

A)a change in estimate

B)an adjustment to additional paid in capital

C)an adjustment to deferred compensation

D)a change in other comprehensive income

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

The initial journal entry to record an equity-classified award increases stockholders' equity on the balance sheet.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true regarding equity classified awards?

A)Compensation expense is modified when the fair value of the options changes.

B)Deferred compensation expense is increased when when service is rendered.

C)Employees will exercise options when they are out of the money.

D)Contributed capital is a form of donated capital.

A)Compensation expense is modified when the fair value of the options changes.

B)Deferred compensation expense is increased when when service is rendered.

C)Employees will exercise options when they are out of the money.

D)Contributed capital is a form of donated capital.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

Compensation expense associated with stock options is ________.

A)based upon the book value of the options

B)based upon the estimated fair value of the options

C)recorded on the date that the options are granted

D)allocated as expense over the time period until the options expire

A)based upon the book value of the options

B)based upon the estimated fair value of the options

C)recorded on the date that the options are granted

D)allocated as expense over the time period until the options expire

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

A stock option plan is generally revalued whenever there is a change in the estimated percentage of options that will be forfeited.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

The fixed price paid by an employee to acquire a share of stock under an option plan is the ________.

A)exercise price

B)market price

C)historical price

D)book price

A)exercise price

B)market price

C)historical price

D)book price

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

An employee will generally exercise stock options only when the current market price is above the exercise price of the option.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

An employee who receives an equity-classified award has the right to receive shares of stock.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following items is not specified by a compensation arrangement?

A)number of options granted

B)original stock price

C)exercise price

D)vesting period

A)number of options granted

B)original stock price

C)exercise price

D)vesting period

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

What is the most important accounting objective for equity classified awards?

A)Measuring their fair value for balance sheet purposes.

B)Determining the correct amount of compensation expense during the service period.

C)Disclosing increases and decreases in the value of the stock options held at the end of each accounting period.

D)Determining the change in the number of stock options that will eventually be exercised.

A)Measuring their fair value for balance sheet purposes.

B)Determining the correct amount of compensation expense during the service period.

C)Disclosing increases and decreases in the value of the stock options held at the end of each accounting period.

D)Determining the change in the number of stock options that will eventually be exercised.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

Equity classified awards should be reported as compensation expense ________.

A)using the book value method

B)at the date of grant

C)using the fair value method

D)at the date of exercise

A)using the book value method

B)at the date of grant

C)using the fair value method

D)at the date of exercise

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

The compensation associated with equity classified awards is ________.

A)the estimated book value of the options

B)the estimated fair value of the options

C)allocated to compensation expense until the options expire

D)recorded as compensation expense when the options are granted

A)the estimated book value of the options

B)the estimated fair value of the options

C)allocated to compensation expense until the options expire

D)recorded as compensation expense when the options are granted

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

The first step in measuring compensation expense from granting employee stock options is to determine the fair value on the date of grant.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

When compensation is recognized under an equity classified award,expiration of stock options is treated as ________.

A)a prior period adjustment

B)an adjustment to compensation expense

C)an adjustment to shareholder's equity

D)a change in accounting estimate

A)a prior period adjustment

B)an adjustment to compensation expense

C)an adjustment to shareholder's equity

D)a change in accounting estimate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

List and explain the factors that are important in accounting for stock-based compensation plans.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

The initial journal entry to record an equity-classified award serves as a disclosure for a stock option plan.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

When liability-classified stock options expire,additional paid in capital is increased.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

Refer to Walker Corporation.Assuming that all compensation expense has been recorded,record the journal entry to reflect the expiration of 3,000 options that were never exercised.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

What is the total compensation cost for this plan?

A)$80,000

B)$160,000

C)$240,000

D)$480,000

A)$80,000

B)$160,000

C)$240,000

D)$480,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

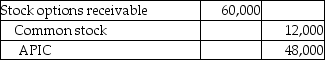

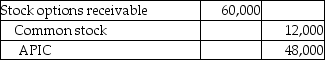

What is the journal entry to record the exercise of 85% of the options during Year 4 when the market price of the stock was $10.

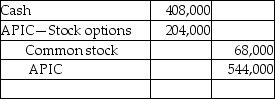

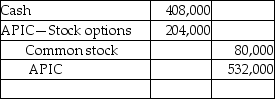

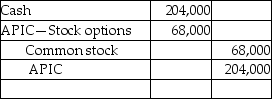

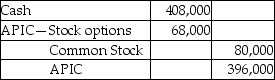

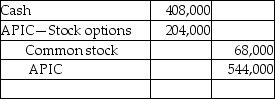

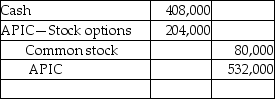

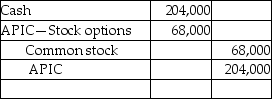

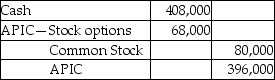

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

List the conditions in which employee compensation is classified as a liability under liability classified awards.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Refer to Walker Corporation.On April 1,Year 7,when the market price of Walker's stock was $20 per share,15,000 of the options were exercised.Make the appropriate journal entry to record this transaction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

Refer to Walker Corporation.Make the journal entries to record the granting of the options and the compensation for Year 1.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

On January 1,Year 1,Gallagher Corporation issued stock options for 300,000 shares to a division manager.The options have an estimated fair value of $6 each.These options are not exercisable unless division revenue increases by 8% in four years.Gallagher estimates that it is probable that the goal will be achieved.What is pretax compensation expense for year 1?

A)$0

B)$450,000

C)$600,000

D)$1,800,000

A)$0

B)$450,000

C)$600,000

D)$1,800,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1,Year 1,Davenport Corporation granted an employee an option to purchase 10,000 of Davenport's $10 par common stock at $30 per share.The options became exercisable on December 31,Year 3,after the employee completed three years of service.The option was exercised on February 1,Year 4.The market prices of Davenport's stock were as follows: January 1,Year 1,$40; December 31,Year 3,$60; and February 1,Year 4,$55.An options pricing model estimated the value of the options at $12 each on the grant date.For Year 1,Davenportt should recognize compensation expense of ________.

A)$0

B)$40,000

C)$100,000

D)$120,000

A)$0

B)$40,000

C)$100,000

D)$120,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

On January 1,Year 1,Freeman Corporation granted stock options to key employees which allowed these employees to purchase 90,000 shares of the corporation's common stock at $30 per share.These options are intended to compensate employees for the next three years.The options may be exercised within a four-year period beginning January 1,Year 4,by the grantees still employed by the company.No options were terminated during Year 1,but Freeman does have an experience of 5% forfeitures over the life of the stock options.The market price of the stock was $35 per share at the date of grant.Freeman used an appropriate pricing model and estimated the value oh an option at $15.What amount should be charged to compensation expense for the year ended December 31,Year 1?

A)$324,000

B)$337,500

C)$427,500

D)$450,000

A)$324,000

B)$337,500

C)$427,500

D)$450,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

When a company grants a liability-classified award,it does not make an entry at the grant date.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements about liability-classified awards is true?

A)When a company records compensation expense,it will adjust additional paid in capital at the grant date.

B)In accounting for liability-classified awards,a company records deferred compensation at the grant date.

C)The value of a liability-classified award is typically based on the company's equity.

D)The value of liability classified awards remains unchanged until the award is settled.

A)When a company records compensation expense,it will adjust additional paid in capital at the grant date.

B)In accounting for liability-classified awards,a company records deferred compensation at the grant date.

C)The value of a liability-classified award is typically based on the company's equity.

D)The value of liability classified awards remains unchanged until the award is settled.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

An employee who is awarded stock appreciation rights must purchase the related shares.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

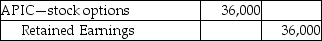

What is the entry to record the expiration of 15% of the options on December 31,Year 5?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

What amount should Fields recognize as compensation expense for Year 1?

A)$0

B)$300,000

C)$450,000

D)$900,000

A)$0

B)$300,000

C)$450,000

D)$900,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a situation in which employee compensation is classified as a liability?

A)The option is granted for the acquisition of securities classified as equity securities.

B)The option is granted for the acquisition of securities classified as liabilities,such as redeemable preferred stock

C)The employee can sell back the acquired shares to the employer corporation at the exercise price within a reasonable period of time.

D)The compensation is in the form of stock appreciation rights.

A)The option is granted for the acquisition of securities classified as equity securities.

B)The option is granted for the acquisition of securities classified as liabilities,such as redeemable preferred stock

C)The employee can sell back the acquired shares to the employer corporation at the exercise price within a reasonable period of time.

D)The compensation is in the form of stock appreciation rights.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

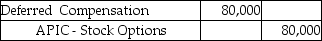

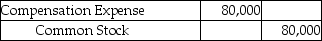

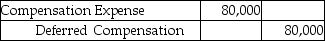

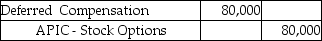

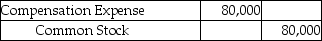

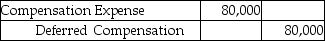

What is the journal entry to record compensation expense for Year 1?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

The carrying value value of liability-classified awards are not adjusted for changes in fair value.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

An employee will not redeem a liability-classified award when the stock is out of the money.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

If unexpected turnover in Year 2 caused Fields to estimate that 15% of the options would be forfeited,what amount of compensation expense should Fields recognize in Year 2?

A)$0

B)$210,000

C)$300,000

D)$600,000

A)$0

B)$210,000

C)$300,000

D)$600,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

In a non-contributory pension plan,employees must fund some or all pension benefits.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a method of measuring a company's pension benefit obligation to a company?

A)projected benefit obligation

B)vested benefit obligation

C)future benefit obligation

D)accumulated benefit obligation

A)projected benefit obligation

B)vested benefit obligation

C)future benefit obligation

D)accumulated benefit obligation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not a characteristic of a restricted stock plan?

A)The employee cannot sell the awarded shares until the vesting period has expired.

B)A restricted stock plan has value as long as the underlying shares are selling above zero.

C)Restricted shares are not stock options.

D)The employee is taxed on the stock award when it is granted.

A)The employee cannot sell the awarded shares until the vesting period has expired.

B)A restricted stock plan has value as long as the underlying shares are selling above zero.

C)Restricted shares are not stock options.

D)The employee is taxed on the stock award when it is granted.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

In non-compensatory employee stock purchase plans,a company will record the amount of the discount below the regular market price as compensation expense.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

The accumulated benefit obligation reflects only current salary levels.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements regarding disclosures for stock-based compensation plans is false?

A)An entity is required to disclose the intrinsic values of outstanding stock and options granted.

B)The effect on the stock-based compensation plans on the entity's cash flows must be disclosed.

C)An entity must disclose information only for vested shares that are exercised and exercisable.

D)An entity must provide a reconciliation of beginning and ending amounts for the number and weighted average exercise price of share options.

A)An entity is required to disclose the intrinsic values of outstanding stock and options granted.

B)The effect on the stock-based compensation plans on the entity's cash flows must be disclosed.

C)An entity must disclose information only for vested shares that are exercised and exercisable.

D)An entity must provide a reconciliation of beginning and ending amounts for the number and weighted average exercise price of share options.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

Under a defined contribution pension plan,the contribution is fixed but benefits can vary.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

List the four key areas that minimum disclosures for stock-based compensation plans must address.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

The vested benefit obligation uses future salary levels.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

Restricted stock plans are less dilutive than stock option plans.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Teague Corporation permits any of its employees to buy shares directly from the company through payroll deduction.There are no brokerage fees and shares can be purchased at a 10% discount.During July,employees purchased 15,000 shares at a time when the established market price was $25 per share.Teague will record compensation expense associated with July purchases of ________.

A)$0

B)$37,500

C)$318,750

D)$375,000

A)$0

B)$37,500

C)$318,750

D)$375,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

To account for stock appreciation rights,a company records compensation expense and a related liability.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

In what ways must an accountant exercise judgment in relation to stock-based compensation plans?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is true regarding share appreciation rights (SAR)payable in cash?

A)Changes in estimated total compensation are recorded as prior period adjustments.

B)The amount of compensation under the SAR plan is unknown until the rights are actually exercised.

C)At the time of exercise a participant may receive either cash or common stock.

D)Deferred compensation expense is recorded at the time the share appreciation rights are granted.

A)Changes in estimated total compensation are recorded as prior period adjustments.

B)The amount of compensation under the SAR plan is unknown until the rights are actually exercised.

C)At the time of exercise a participant may receive either cash or common stock.

D)Deferred compensation expense is recorded at the time the share appreciation rights are granted.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

Companies are required to disclose the intrinsic values of outstanding stock and options granted.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

Accountants must make a judgment about the probability of forfeiture in a stock-based compensation plan.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following conditions is not required for an employee stock purchase plan to be non-compensatory?

A)The plan is made available to substantially all employees.

B)After the plan is established,there is a maximum one month period to elect to participate in the plan.

C)The discount is not larger than 5% of the open market price.

D)Top-level employees may purchase no more than a set percentage of shares available.

A)The plan is made available to substantially all employees.

B)After the plan is established,there is a maximum one month period to elect to participate in the plan.

C)The discount is not larger than 5% of the open market price.

D)Top-level employees may purchase no more than a set percentage of shares available.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

Under a defined benefit pension plan,employees are responsible for losses on plan assets.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

The compensation associated with a share of stock under a restricted stock plan is computed as ________.

A)the market price of a share of a similar security

B)the book value of an unrestricted share of the same stock

C)the market price of an unrestricted share of the same stock

D)the book value of a share of similar stock

A)the market price of a share of a similar security

B)the book value of an unrestricted share of the same stock

C)the market price of an unrestricted share of the same stock

D)the book value of a share of similar stock

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

In a contributory pension plan,employees must fund some or all of their pension costs.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

Prior service cost is recognized as pension expense over a period of several years under US GAAP.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is a way of measuring the pension benefit obligation?

A)employer benefit obligation

B)retiree benefit obligation

C)projected benefit obligation

D)future benefit obligation

A)employer benefit obligation

B)retiree benefit obligation

C)projected benefit obligation

D)future benefit obligation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is a characteristic of the projected benefit obligation measurement?

A)It considers only vested employees.

B)It uses projected future salary levels.

C)It is the smallest estimate of the projected benefit obligation.

D)It considers only current employees.

A)It considers only vested employees.

B)It uses projected future salary levels.

C)It is the smallest estimate of the projected benefit obligation.

D)It considers only current employees.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Net pension liability is decreased by ________.

A)amortization of prior service costs

B)service costs

C)expected return on plan assets

D)amortization of net gain in other comprehensive net income

A)amortization of prior service costs

B)service costs

C)expected return on plan assets

D)amortization of net gain in other comprehensive net income

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is a characteristic of a defined benefit pension plan?

A)It raises few accounting issues for employers.

B)Retirement benefits are based on the plan benefit formula.

C)It is simple to construct.

D)Retirement benefits are contingent on how much an employee has accumulated in a retirement account.

A)It raises few accounting issues for employers.

B)Retirement benefits are based on the plan benefit formula.

C)It is simple to construct.

D)Retirement benefits are contingent on how much an employee has accumulated in a retirement account.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

The portion of the obligation than plan participants are entitled to receive regardless of their continued employment is called the ________.

A)retiree benefit obligation

B)projected benefit obligation

C)accumulated benefit obligation

D)vested benefit obligation

A)retiree benefit obligation

B)projected benefit obligation

C)accumulated benefit obligation

D)vested benefit obligation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

The difference between pension plan assets and the PBO is equal to the funded status of the plan.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

A net pension liability is the excess of the projected benefit obligation over the plan assets.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

Net pension liability is increased by ________.

A)employer contributions to plan assets

B)service costs

C)expected return on plan assets

D)amortization of prior service costs

A)employer contributions to plan assets

B)service costs

C)expected return on plan assets

D)amortization of prior service costs

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is not a factor in calculating a defined benefit?

A)percentage of salary

B)current salary level

C)return on plan assets

D)credits for years of service

A)percentage of salary

B)current salary level

C)return on plan assets

D)credits for years of service

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

Prior service cost is recognized as pension expense over a period of several years under IFRS.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

Under a defined benefit plan,the contribution is fixed but benefits can vary.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is not a key element of a defined benefit pension plan?

A)amortization of future benefit obligations

B)service cost

C)expected return on plan assets

D)interest on projected benefit obligation

A)amortization of future benefit obligations

B)service cost

C)expected return on plan assets

D)interest on projected benefit obligation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

The projected benefit obligation (PBO)is decreased by ________.

A)payment of retirement benefits

B)a return on plan assets that is higher than expected

C)an increase in the average life expectancy of employees

D)a decrease in the actuary's assumed discount rate

A)payment of retirement benefits

B)a return on plan assets that is higher than expected

C)an increase in the average life expectancy of employees

D)a decrease in the actuary's assumed discount rate

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following measures of benefit does the FASB require for pension computations?

A)vested benefit obligation

B)accumulated benefit obligation

C)projected benefit obligation

D)future benefit obligation

A)vested benefit obligation

B)accumulated benefit obligation

C)projected benefit obligation

D)future benefit obligation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

List and explain the three methods used to measure a company's pension obligation to its employees.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

Under the corridor approach,a company only amortizes the net accumulated gain or loss when the beginning accumulated unamortized balance of the net gain or loss exceeds the corridor.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is a characteristic of a defined contribution plan?

A)Employee contributions are typically based upon salary levels.

B)Employers must make contributions for prior service costs to a defined contribution plan.

C)Pension plan assets draw interest that may be used to reduce annual contributions to the plan.

D)Employers bear the risk of loss on pension fund assets.

A)Employee contributions are typically based upon salary levels.

B)Employers must make contributions for prior service costs to a defined contribution plan.

C)Pension plan assets draw interest that may be used to reduce annual contributions to the plan.

D)Employers bear the risk of loss on pension fund assets.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Interest cost will ________.

A)increase pension expense and reduce plan assets

B)increase the PBO and reduce plan assets

C)increase the PBO and increase pension expense

D)increase pension expense and reduce the return on plan assets

A)increase pension expense and reduce plan assets

B)increase the PBO and reduce plan assets

C)increase the PBO and increase pension expense

D)increase pension expense and reduce the return on plan assets

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is a characteristic of the accumulated benefit obligation measurement?

A)It considers only vested employees.

B)It does not use projected future salary levels.

C)It is required by GAAP for measurement of the pension obligation.

D)It considers only current employees.

A)It considers only vested employees.

B)It does not use projected future salary levels.

C)It is required by GAAP for measurement of the pension obligation.

D)It considers only current employees.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck