Deck 19: Accounting for Income Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

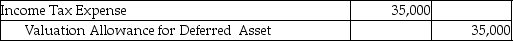

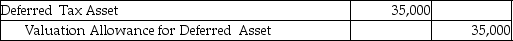

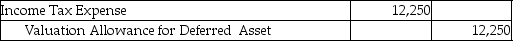

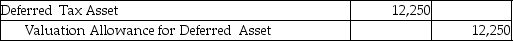

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 19: Accounting for Income Taxes

1

Book income refers to the amount of income reported on a company's tax return.

False

2

The amount of income that a company reports on its tax return is know as ________.

A)refundable income

B)taxable income

C)deductible income

D)net income

A)refundable income

B)taxable income

C)deductible income

D)net income

B

3

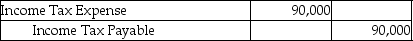

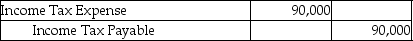

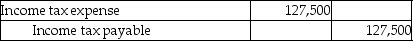

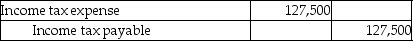

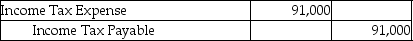

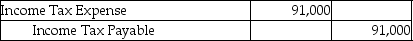

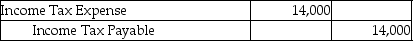

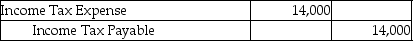

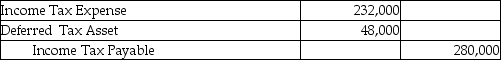

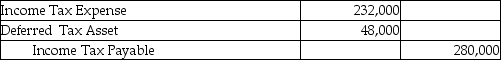

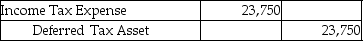

Tom-Kat Inc.'s income before taxes is $340,000 and its tax rate is 30%.Tom-Kat included $40,000 of interest from municipal bonds in the $340,000.There are no other book-tax differences.What is the journal entry to record income tax expense?

A)

B)

C)

D)

A)

B)

C)

D)

A

4

Lyon Group's income before taxes is $450,000 and its tax rate is 30%.Lyon included $30,000 in fines and penalties in the $450,000.There are no other book-tax differences.What is the income tax liability for Lyon Group?

A)$135,000

B)$144,000

C)$126,000

D)$141,000

A)$135,000

B)$144,000

C)$126,000

D)$141,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

Taxable income refers to the amount of income reported on a company's tax return.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

Betta Group's net income after taxes is $300,000 and its tax rate is 40%.Assuming no book-tax income difference,what is Betta's taxes payable?

A)$120,000

B)$200,000

C)$750,000

D)$500,000

A)$120,000

B)$200,000

C)$750,000

D)$500,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

The amount of income a company reports in its financial statements is known as ________.

A)book income

B)net operable income

C)taxable income

D)revenue income

A)book income

B)net operable income

C)taxable income

D)revenue income

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

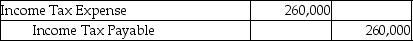

TLR Productions has book income of $650,000,and a tax rate of 35%.Assuming there is no book-tax income difference,what is TLR's income tax expense?

A)$195,000

B)$227,500

C)$260,000

D)$422,500

A)$195,000

B)$227,500

C)$260,000

D)$422,500

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

________ differences between book income and taxable income result in an effective tax rate that differs from the statutory tax rate.

A)Temporary

B)Permanent

C)Short-term

D)Long-term

A)Temporary

B)Permanent

C)Short-term

D)Long-term

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

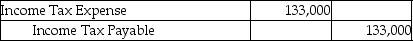

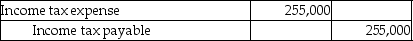

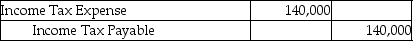

10

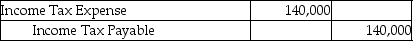

Greene Co.has book income of $425,000,and a tax rate of 30%.Assuming there is no book-tax income difference,what will the journal entry be to record the income tax expense?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

Caesar Corporation reports municipal interest income on their financial statements.What (if any)book-tax difference will result?

A)Temporary difference - book income greater than taxable income.

B)Temporary difference - taxable income greater than book income.

C)Permanent difference - book income greater than taxable income.

D)No difference - municipal interest is taxable income.

A)Temporary difference - book income greater than taxable income.

B)Temporary difference - taxable income greater than book income.

C)Permanent difference - book income greater than taxable income.

D)No difference - municipal interest is taxable income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

The statutory tax rate is the legally imposed rate in a given taxing jurisdiction.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

S & C Inc.'s income tax payable is $270,000 and its tax rate is 40%.Assuming no book-tax income difference,what is S & C's net income?

A)$450,000

B)$108,000

C)$378,000

D)$675,000

A)$450,000

B)$108,000

C)$378,000

D)$675,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

U.S.GAAP requires companies to reconcile the federal statutory income tax rate to the effective tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

Dante Inc.reported fines and penalties on their income statement this year.What (if any)book-tax difference will result?

A)Temporary difference - book income less than taxable income.

B)Permanent difference - book income greater than taxable income.

C)Permanent difference - book income less than taxable income.

D)No difference - fines and penalties are tax deductible.

A)Temporary difference - book income less than taxable income.

B)Permanent difference - book income greater than taxable income.

C)Permanent difference - book income less than taxable income.

D)No difference - fines and penalties are tax deductible.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements best describes the effective tax rate?

A)It is the legally imposed rate in a given taxing jurisdiction.

B)It can be calculated by dividing income tax expense by book income before taxes.

C)It changes annually based on provisions from Congress.

D)It is calculated as book income divided by taxable income.

A)It is the legally imposed rate in a given taxing jurisdiction.

B)It can be calculated by dividing income tax expense by book income before taxes.

C)It changes annually based on provisions from Congress.

D)It is calculated as book income divided by taxable income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

TNT Corporation's income tax payable is $210,000 and its tax rate is 35%.Assuming no book-tax income difference,what is TNT's net income?

A)$73,500

B)$210,000

C)$600,000

D)$323,076

A)$73,500

B)$210,000

C)$600,000

D)$323,076

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

The effective tax rate is the legally imposed rate in a given taxing jurisdiction.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

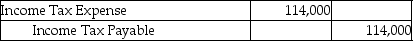

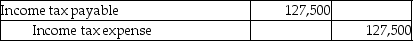

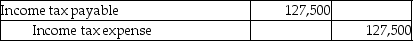

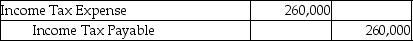

Brown Inc.'s net income after taxes is $260,000 and its tax rate is 35%.Assuming no book-tax income difference,what is the journal entry to record income tax expense?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

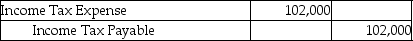

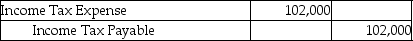

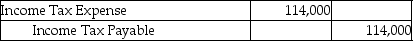

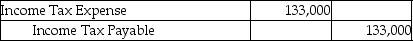

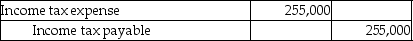

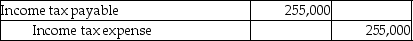

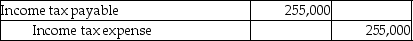

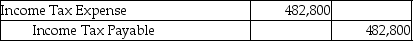

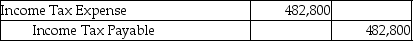

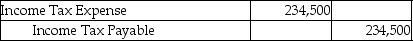

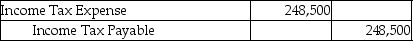

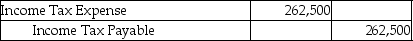

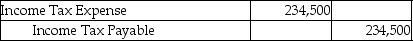

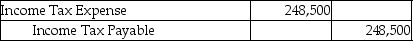

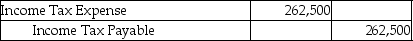

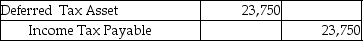

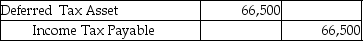

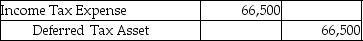

Charmed Inc.'s income before taxes is $710,000 and its tax rate is 35%.Charmed included $40,000 in non-deductible life insurance premiums in the $710,000.There are no other book-tax differences.What is the journal entry to record income tax expense?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

Betz Corporation's income before taxes is $725,000 and its tax rate is 40%.Included in this amount is $50,000 in municipal bond interest and $15,000 in officers' life insurance.There are no other book-tax differences.Prepare the journal entry to record income tax expense and a reconciliation of the statutory tax rate to the effective tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

When a company depreciates a fixed asset at a faster rate for tax purposes than book purposes,this creates a ________.

A)deferred tax asset

B)higher tax basis than book basis of assets in the early years

C)deferred tax liability

D)lower tax basis than book basis of liabilities in the early years

A)deferred tax asset

B)higher tax basis than book basis of assets in the early years

C)deferred tax liability

D)lower tax basis than book basis of liabilities in the early years

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

Refer to Kravitz Corporation.What is Kravitz' effective income tax rate?

A)32.9%

B)32.5%

C)35%

D)37.5%

A)32.9%

B)32.5%

C)35%

D)37.5%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

Piper Inc.'s income before taxes is $550,000 and its tax rate is 40%.Piper included $30,000 of interest from municipal bonds in the $550,000.There are no other book-tax differences.Prepare the journal entry to record income tax expense and a reconciliation of the statutory tax rate to the effective tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

Refer to Kravitz Corporation.What is Kravitz' taxable income?

A)$860,000

B)$790,000

C)$800,000

D)$810,000

A)$860,000

B)$790,000

C)$800,000

D)$810,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

Under U.S.GAAP,companies generally use a balance-sheet approach to account for temporary differences between book and tax treatment of transactions.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

Refer to Kraviz Corporation.What is the net amount of Kravitz' book-tax difference?

A)Book income that is $50,000 greater than taxable income

B)Book income that is $60,000 greater than taxable income

C)Taxable income that is $10,000 greater than book income

D)Taxable income that is $50,000 greater than book income

A)Book income that is $50,000 greater than taxable income

B)Book income that is $60,000 greater than taxable income

C)Taxable income that is $10,000 greater than book income

D)Taxable income that is $50,000 greater than book income

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

Gallagher Corporation's book income before taxes is $600,000 and its tax rate is 35%.Included in the income before taxes is $50,000 in fines and penalties.There are no other book-tax differences.Prepare the journal entry to record income tax expense and a reconciliation of the statutory tax rate to the effective tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

A deferred tax asset represents a future reduction in income taxes payable.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

Purrfect Pet Industries' income before taxes is $800,000 and its tax rate is 40%.Purrfect Pet included $50,000 of fully deductible inter-corporate dividends received in the $800,000.There are no other book-tax differences.What is the income tax liability for Purrfect Pet?

A)$320,000

B)$340,000

C)$280,000

D)$300,000

A)$320,000

B)$340,000

C)$280,000

D)$300,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Under U.S.GAAP,if a firm writes down inventory for obsolescence,which of the following is created?

A)a deferred tax asset

B)a deferred tax liability

C)a book basis of assets that is greater than the tax basis

D)a book basis of liabilities that is less than the tax basis

A)a deferred tax asset

B)a deferred tax liability

C)a book basis of assets that is greater than the tax basis

D)a book basis of liabilities that is less than the tax basis

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

Temporary differences cause the effective income tax rate to vary from the statutory rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

Blue Company's income before taxes is $400,000 and its tax rate is 40%.Blue included $40,000 of fines and penalties in the $400,000.There are no other book-tax differences.What is the effective tax rate for Blue Company?

A)36%

B)40%

C)44%

D)48%

A)36%

B)40%

C)44%

D)48%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

A deferred tax asset exists when ________.

A)the book basis of assets is greater than the tax basis of assets

B)the book basis of liabilities is greater than the tax basis of liabilities

C)the book basis of assets is equal to the tax basis of assets

D)the book basis of liabilities is less than the tax basis of liabilities

A)the book basis of assets is greater than the tax basis of assets

B)the book basis of liabilities is greater than the tax basis of liabilities

C)the book basis of assets is equal to the tax basis of assets

D)the book basis of liabilities is less than the tax basis of liabilities

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

Danio Inc.'s income before taxes is $350,000 and its tax rate is 30%.Danio included $20,000 of interest from municipal bonds in the $350,000.There are no other book-tax differences.What is the effective tax rate for Danio Inc.?

A)26%

B)28%

C)30%

D)32%

A)26%

B)28%

C)30%

D)32%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

All of the following are examples of temporary book-tax differences except ________.

A)amortization of goodwill

B)write off of bad debt expense

C)installment sale revenues

D)receipt of municipal bond interest

A)amortization of goodwill

B)write off of bad debt expense

C)installment sale revenues

D)receipt of municipal bond interest

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

Under U.S.GAAP,companies generally use a cash flow approach to account for temporary differences between book and tax treatment of transactions.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

Temporary differences between the book and tax treatment of transactions create deferred tax assets or deferred tax liabilities.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

When a company pays taxes that were previously recorded as a deferred tax liability,the temporary difference ________.

A)originates

B)reverses

C)increases

D)decreases

A)originates

B)reverses

C)increases

D)decreases

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

All of the following are examples of temporary book-tax differences except ________.

A)contingent liabilities

B)depreciation

C)product warranty costs

D)payment of premiums for life insurance

A)contingent liabilities

B)depreciation

C)product warranty costs

D)payment of premiums for life insurance

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

Discuss the relationship between temporary differences,the statutory and effective tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

The contra-asset to the deferred tax asset account is called ________.

A)income tax benefit

B)valuation allowance

C)deferred tax liability

D)allowance for doubtful accounts

A)income tax benefit

B)valuation allowance

C)deferred tax liability

D)allowance for doubtful accounts

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

The Wolf Group recorded a deferred tax asset of $50,000 due to a basis difference in warranty liabilities.Management has assessed that it is more likely than not that the firm will not realize 30% of the deferred tax asset.After recording the valuation allowance,Wolf's net income will ________ and assets will ________.

A)increase by $15,000; decrease by $50,000

B)increase by $15,000; increase by $15,000

C)decrease by $50,000; increase by $15,000

D)decrease by $15,000; decrease by $15,000

A)increase by $15,000; decrease by $50,000

B)increase by $15,000; increase by $15,000

C)decrease by $50,000; increase by $15,000

D)decrease by $15,000; decrease by $15,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

Cougar,Inc.,an IFRS reporter,estimates a deferred tax asset of $60,000 due to a basis difference in warranty liabilities.Management has assessed that it is probable that the firm will not realize 40% of the deferred tax asset.After recording the net deferred tax asset,Cougar's net income will ________ and assets will ________.

A)increase by $24,000; increase by $24,000

B)decrease by $24,000; decrease by $24,000

C)increase by $60,000; decrease by $60,000

D)decrease by $60,000; increase by $60,000

A)increase by $24,000; increase by $24,000

B)decrease by $24,000; decrease by $24,000

C)increase by $60,000; decrease by $60,000

D)decrease by $60,000; increase by $60,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

If the valuation allowance is decreased,there is a(n)________ to income tax expense and a(n)________ to income tax benefit.

A)decrease; increase

B)increase; increase

C)increase; decrease

D)decrease; decrease

A)decrease; increase

B)increase; increase

C)increase; decrease

D)decrease; decrease

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

Under U.S.GAAP,when a firm determines that all or a portion of a deferred tax asset is not realizable,they will use a valuation allowance to reduce the balance.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

When assessing realizability of deferred tax assets,management must consider positive and negative evidence.Which of the following would be considered negative evidence?

A)existing contracts or firm sales backlog

B)a carryback or carryforward period that is so brief it could limit realization of tax benefits

C)taxable income in prior carryback year(s)if carryback is permitted under the tax law

D)a strong earnings history exclusive of the loss that created the future deductible amount

A)existing contracts or firm sales backlog

B)a carryback or carryforward period that is so brief it could limit realization of tax benefits

C)taxable income in prior carryback year(s)if carryback is permitted under the tax law

D)a strong earnings history exclusive of the loss that created the future deductible amount

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

S & C Company reported $200,000 depreciation on its 2015 tax return; however,they reported $50,000 depreciation expense on their 2015 income statement.The difference in depreciation is a temporary difference that will reverse over time.Assuming S & C's tax rate is constant at 30%,what amount should be added to the deferred income tax liability in S & C's December 31,2015,balance sheet?

A)$15,000

B)$45,000

C)$60,000

D)$75,000

A)$15,000

B)$45,000

C)$60,000

D)$75,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

What should Greene Co.record as its deferred tax liability for 2015?

A)$0

B)$4,350

C)$84,150

D)$88,500

A)$0

B)$4,350

C)$84,150

D)$88,500

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

Bach.Co.presents the following information for 2015 and 2016.

2015 information:

Sales on account in the amount of $645,000

Warranty expense and associated liability in the amount of $125,000

No other expenses incurred.

2016 information:

Sales on account in the amount of $225,000

Warranty repairs made in the amount of $65,000

No expenses incurred.

Prepare the journal entries for 2015 and 2016 to record the sales,warranty,and income tax transactions,assume a 40% tax rate.

2015 information:

Sales on account in the amount of $645,000

Warranty expense and associated liability in the amount of $125,000

No other expenses incurred.

2016 information:

Sales on account in the amount of $225,000

Warranty repairs made in the amount of $65,000

No expenses incurred.

Prepare the journal entries for 2015 and 2016 to record the sales,warranty,and income tax transactions,assume a 40% tax rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

When assessing realizability of deferred tax assets,management must consider positive and negative evidence.All of the following would be considered positive evidence except ________.

A)taxable income in prior carryback year(s)if carryback is permitted under the tax law

B)future reversals of existing taxable temporary differences

C)unsettled circumstances that could adversely affect future operations

D)an excess of appreciated asset value over the tax basis of the entity's net assets

A)taxable income in prior carryback year(s)if carryback is permitted under the tax law

B)future reversals of existing taxable temporary differences

C)unsettled circumstances that could adversely affect future operations

D)an excess of appreciated asset value over the tax basis of the entity's net assets

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

When defining the portion of a deferred tax asset that a firm will not realize,IFRS uses the term ________.

A)likely

B)possible

C)more likely than not

D)probable

A)likely

B)possible

C)more likely than not

D)probable

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

What should Greene Co.record as its federal income tax liability for 2015?

A)$88,500

B)$91,450

C)$84,150

D)$92,850

A)$88,500

B)$91,450

C)$84,150

D)$92,850

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

There are questions as to whether or not deferred tax assets and liabilities should be recorded.Based on your understanding of the concepts and accounting terminology - are deferred tax assets and tax liabilities real assets and liabilities?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Inferno Inc.is embroiled in a lawsuit.In 2015 they recognize that a loss of $45,000 is probable.Given a tax rate of 40%,how will this be treated in the accounting records?

A)deferred tax asset of $18,000

B)deferred tax liability of $18,000

C)deferred tax asset of $45,000

D)deferred tax liability of $45,000

A)deferred tax asset of $18,000

B)deferred tax liability of $18,000

C)deferred tax asset of $45,000

D)deferred tax liability of $45,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

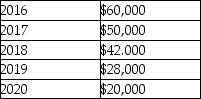

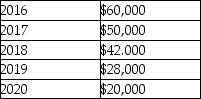

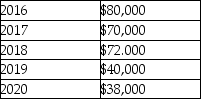

On December 31,2015,The Magic Flute Company reports liabilities with a tax basis of $800,000 and a book basis of $600,000.There was no difference in the asset basis.The difference in liability basis arose from temporary differences that would reverse in the following years:  Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.

Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.

A)liability; $64,500

B)asset; $70,000

C)liability; $74,500

D)asset; $80,000

Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.

Assuming a tax rate of 35% for 2015 - 2017 and a rate of 40% for 2018 - 2020,The Magic Flute Co.should report a deferred tax ________ in the amount of ________ on December 31,2015.A)liability; $64,500

B)asset; $70,000

C)liability; $74,500

D)asset; $80,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

IFRS uses a two step process in recording the realizability of deferred tax assets.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

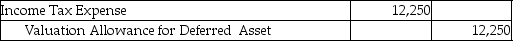

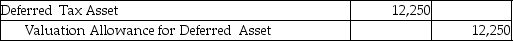

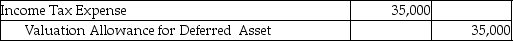

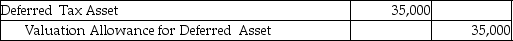

Violet,Inc.recorded a deferred tax asset of $35,000 due to a basis difference in warranty liabilities.Management has assessed that it is more likely than not that the firm will not realize 35% of the deferred tax asset.What is the necessary journal entries to record the valuation allowance?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

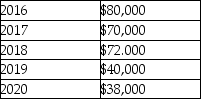

On December 31,2015,Big Bear Corporation reports liabilities with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the asset basis.The difference in liability basis arose from temporary differences that would reverse in the following years:  Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?

Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?

A)deferred tax liability of $90,000

B)deferred tax asset of $90,000

C)deferred tax liability of $93,900

D)deferred tax asset of $93,900

Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?

Assuming a tax rate of 30% for 2015 - 2018 and a rate of 35% for 2019 - 2020,what should Big Bear report on its balance sheet on December 31,2015?A)deferred tax liability of $90,000

B)deferred tax asset of $90,000

C)deferred tax liability of $93,900

D)deferred tax asset of $93,900

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

Gustav,Inc.uses the accrual basis to account for all sales transactions.Sales for 2015 total $500,000.Included in this amount is $75,000 in receivables from sales on installment.Installment sales are considered revenue for book purposes,but not for tax purposes.Operating expenses total $150,000 and are treated the same for book and tax purposes.

Complete the following:

a.What is the book basis of the installment sales receivable?

b.What is the tax basis of the installment sales receivable?

c.Assuming a 30% tax rate,compute income tax expense,the deferred tax provision,and income tax payable for 2015.

d.Prepare the journal entry to record the 2015 income tax expense.

Complete the following:

a.What is the book basis of the installment sales receivable?

b.What is the tax basis of the installment sales receivable?

c.Assuming a 30% tax rate,compute income tax expense,the deferred tax provision,and income tax payable for 2015.

d.Prepare the journal entry to record the 2015 income tax expense.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

Tetra Corp.recorded book income of $225,000 in 2015.It does not have any permanent differences and the only temporary difference relates to $45,000 unearned income that it recorded for book purposes.Tetra anticipates satisfying this liability equally over the following three years.The current enacted tax rate is 38%.The enacted tax rates for the following three years are 35%,40%,and 45%,respectively.Under U.S.GAAP,what deferred tax amount should Tetra Corp.record for this temporary difference?

A)$16,950

B)$17,100

C)$18,000

D)$20,250

A)$16,950

B)$17,100

C)$18,000

D)$20,250

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

In 2015 Charmed,Inc.recorded book income of $370,000.The company's only temporary difference relates to a $60,000 installment sale that it recorded for book purposes; there are no permanent differences.Charmed anticipates receiving payments equally over the following three years.The current enacted tax rate in 2015 is 35%.The substantively enacted tax rates for the following three years are 30%,35%,and 38%,respectively. Under U.S.GAAP,what deferred tax amount should Charmed record for this temporary difference?

A)$20,000

B)$20,600

C)$21,000

D)$21,600

A)$20,000

B)$20,600

C)$21,000

D)$21,600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

Red Lantern Corp.reported a net deferred tax asset balance of $247,000 resulting from an estimated warranty expense accrual for book purposes.The enacted statutory tax rate related to this balance changed from 38% to 32%,effective immediately.Prepare the necessary journal entry to account for this change in tax rates.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

When will a company remeasure deferred tax accounts?

A)when there is a change in the statutory income tax rate

B)when there is a change in the state income tax rate

C)when there is a change in the effective income tax rate

D)There is no reason to remeasure a deferred tax account.

A)when there is a change in the statutory income tax rate

B)when there is a change in the state income tax rate

C)when there is a change in the effective income tax rate

D)There is no reason to remeasure a deferred tax account.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

When a company adjusts the balance of a deferred tax account to reflect changes in the tax rate,prior-period financial statements will need to be adjusted to reflect this.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

The adjustment for a change in tax rates is treated as a change in accounting estimate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

In 2014,Squirrel Corp.recorded book income of $175,000.It has one temporary difference which relates to a $50,000 warranty expense that it recorded for book purposes,and no permanent differences.Squirrel anticipates satisfying this liability equally over the following two years.The current enacted tax rate is 40%.The enacted tax rates for the following four years are 30%,35%,30% and 40%,respectively.Under U.S.GAAP,what deferred tax amount should Squirrel Corp.record for this temporary difference?

A)$16,250

B)$16,875

C)$17,500

D)$17,875

A)$16,250

B)$16,875

C)$17,500

D)$17,875

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

S & C Company's net income before taxes is $400,000,and income tax expense is $125,000.S & C records a valuation allowance of $25,000.What is S & C's effective tax rate before and after recording the valuation allowance?

A)31% and 25% respectively

B)25% and 33% respectively

C)31% and 38% respectively

D)There would not be a change in ETR because these are due to temporary differences.

A)31% and 25% respectively

B)25% and 33% respectively

C)31% and 38% respectively

D)There would not be a change in ETR because these are due to temporary differences.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

If a company chooses to carryback a net operating loss (NOL),but is not able to fully offset the loss,they will ________.

A)forgo the carryback option and carryforward the entire NOL

B)forfeit the unused amount

C)carry forward the remaining balance

D)both A & C are viable options

A)forgo the carryback option and carryforward the entire NOL

B)forfeit the unused amount

C)carry forward the remaining balance

D)both A & C are viable options

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

Lyon Ltd.,a U.S.GAAP reporter,provides the following information:

Sales on account $800,000

Associated warranty expense/liability $200,000

No warranty repairs made to date; under law - Lyon cannot deduct warranty expense for tax purposes until repairs are made.

Management estimates that it is more likely than not that the firm will not realize 25% of the deferred tax asset.

Tax rate of 35%

Prepare a simplified income statement,including the effective tax rate,both with and without the valuation allowance.

Sales on account $800,000

Associated warranty expense/liability $200,000

No warranty repairs made to date; under law - Lyon cannot deduct warranty expense for tax purposes until repairs are made.

Management estimates that it is more likely than not that the firm will not realize 25% of the deferred tax asset.

Tax rate of 35%

Prepare a simplified income statement,including the effective tax rate,both with and without the valuation allowance.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

When a company carries forward a net operating loss (NOL),the income tax expense will be reduced in future years,but not income tax payable.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

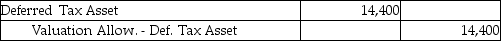

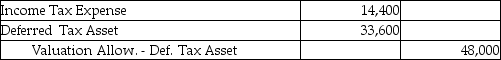

Blue Corporation is an IFRS reporter.Blue's income before taxes is $700,000 and the company estimates a deferred tax asset of $48,000 due to a basis difference in warranty liabilities.Management has assessed that it is probable that it will not realize 30% of the deferred tax asset.Assuming a 40% tax rate,how should the realizable deferred tax asset be recorded?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

Piper,Inc.reported a net deferred tax asset balance of $190,000 resulting from an estimated warranty expense accrual for book purposes.The total book-tax difference related to the bases of the estimated warranty liability is $475,000.The enacted statutory tax rate related to this balance changed from 40% to 35%,effective immediately.What journal entry will Piper need to make to adjust for this change in tax rates?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

In which of the following instances would a company most likely choose the carryforward option for a net operating loss?

A)The company expects lower tax rates in the future compared to the past.

B)The company expects higher tax rates in the future compared to the past.

C)The company expects lower earnings in the future compared to the past.

D)The company expects higher losses in the future compared to the past.

A)The company expects lower tax rates in the future compared to the past.

B)The company expects higher tax rates in the future compared to the past.

C)The company expects lower earnings in the future compared to the past.

D)The company expects higher losses in the future compared to the past.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

Tommy Corp.reported a net deferred tax asset balance of $185,000 resulting from an estimated warranty expense accrual for book purposes.The total book-tax difference related to the bases of the estimated warranty liability is $500,000.The enacted statutory tax rate related to this balance changed from 37% to 32%,effective immediately.By what amount will the deferred asset balance change?

A)increase by $31,500

B)decrease by $25,000

C)increase by $25,000

D)decrease by $31,500

A)increase by $31,500

B)decrease by $25,000

C)increase by $25,000

D)decrease by $31,500

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

In 2015 Charmed,Inc.recorded book income of $370,000.The company's only temporary difference relates to a $60,000 installment sale that it recorded for book purposes; there are no permanent differences.Charmed anticipates receiving payments equally over the following three years.The current enacted tax rate in 2015 is 35%.The substantively enacted tax rates for the following three years are 30%,35%,and 38%,respectively. Under IFRS,what deferred tax amount should Charmed record for this temporary difference?

A)$20,000

B)$20,600

C)$21,000

D)$21,600

A)$20,000

B)$20,600

C)$21,000

D)$21,600

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

Clunker Car Corporation reported a $3 million contingent liability on its 2015 financial statements from a lawsuit over faulty ignition switches.The tax rate for 2015 is 40%; however the enacted tax rates for the following three years is 37%,35%,and 33% respectively.

How will the deferred tax asset be measured if the case is resolved in 2016?

How will it be measured if the case is resolved in 2018?

What accounts for this difference?

How will the deferred tax asset be measured if the case is resolved in 2016?

How will it be measured if the case is resolved in 2018?

What accounts for this difference?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

When a company adjusts the balance of a deferred tax account to reflect changes in their tax rate,this impacts ________.

A)income tax expense

B)income tax payable

C)effective tax rate

D)both A and C

A)income tax expense

B)income tax payable

C)effective tax rate

D)both A and C

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

The Betta Group reports income before taxes in the amount of $625,000 and has a 30% tax rate.Additionally,the company estimates a deferred tax asset of $45,000 due to a basis difference in warranty liabilities.After reviewing all available evidence,management determines that only 60% of this amount will ultimately result in tax-deductible expenses over the warranty period.

Prepare the necessary journal entries to record the tax provision and valuation allowance for Betta Group under (a)U.S.GAAP and (b)IFRS.

Prepare the necessary journal entries to record the tax provision and valuation allowance for Betta Group under (a)U.S.GAAP and (b)IFRS.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

List the four possible sources of taxable income that a company should consider when assessing the realizability of a deferred tax asset under U.S.GAAP.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck