Deck 15: OL: Operating Liabilities and Contingencies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/12

Play

Full screen (f)

Deck 15: OL: Operating Liabilities and Contingencies

1

If the warranty is required by law,it is more likely to be an base warranty.

True

2

Accounting for product warranty costs under an base warranty ________.

A)is required for income tax purposes

B)charges an expense account when the seller performs in compliance with the warranty

C)is frequently justified on the basis of expediency when warranty costs are immaterial

D)should be used whenever the warranty is an integral and inseparable part of the sale

A)is required for income tax purposes

B)charges an expense account when the seller performs in compliance with the warranty

C)is frequently justified on the basis of expediency when warranty costs are immaterial

D)should be used whenever the warranty is an integral and inseparable part of the sale

D

3

An assurance-type warranty is also referred to as an extended warranty.

False

4

Which of the following best describes the accounting for base warranty costs?

A)expensed when paid

B)expensed when obligations are probable and estimable

C)expensed based on estimate in year of sale

D)expensed when warranty claims are certain

A)expensed when paid

B)expensed when obligations are probable and estimable

C)expensed based on estimate in year of sale

D)expensed when warranty claims are certain

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

5

Warranties that cover longer time periods are more likely to be base warranties.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

6

Big Dots provides a one-year warranty with all its products it sells.It estimates that it will sell 350,000 units of its product for the year ended December 31,2016,and that its total revenue for the product will be $105,000,000.It also estimates that 75% of the product will have no defects,5% will have major defects,and 20% will have minor defects.The cost of a minor defect is estimated to be $6 for each product repaired,and the cost for a major defect cost is about $21.The company also estimates that the minimum amount of warranty expense will be $1,500,000 and the maximum will be $6,000,000.Prepare the journal entry for 2016 under the warranty.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

7

Because the sale of a extended warranty increases sales revenue,the seller should recognize the expense of providing that warranty in the year of sale.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

8

Describe how to account for warranty costs if the warranty is determined to be a extended warranty? A base warranty?

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

9

A extended warranty exists if the customer has the option to purchase the warranty separately.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

10

When a company sells the extended warranty contract,it records a liability for unearned revenue.

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

11

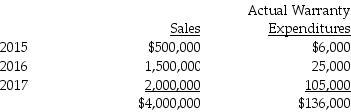

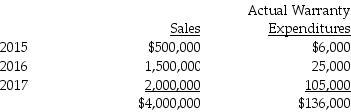

During 2015,Blevert Co.introduced a new line of machines that carry a three-year warranty against manufacturer's defects.Based on industry experience,warranty costs are estimated at 1% of sales in the year of sale,3% in the year after sale,and 5% in the second year after sale.Sales and actual warranty expenditures for the first three-year period were as follows:  What amount should Blevert report as a liability at December 31,2017?

What amount should Blevert report as a liability at December 31,2017?

A)$11,000

B)$20,000

C)$125,000

D)$224,000

What amount should Blevert report as a liability at December 31,2017?

What amount should Blevert report as a liability at December 31,2017?A)$11,000

B)$20,000

C)$125,000

D)$224,000

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck

12

In an extended warranty,warranty revenue is ________.

A)not recognized

B)recognized equally over the warranty period

C)recognized only in the last year of the warranty period

D)recognized in the year of sale

A)not recognized

B)recognized equally over the warranty period

C)recognized only in the last year of the warranty period

D)recognized in the year of sale

Unlock Deck

Unlock for access to all 12 flashcards in this deck.

Unlock Deck

k this deck