Deck 11: Intercorporate Investments and Consolidations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

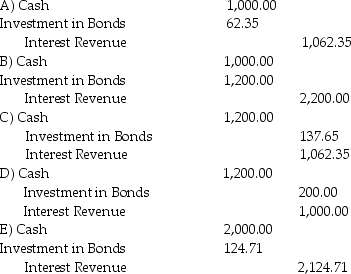

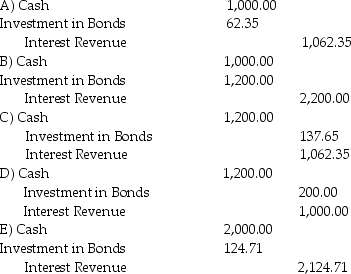

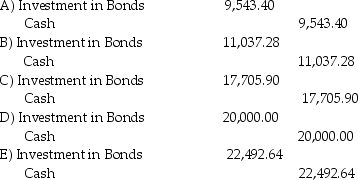

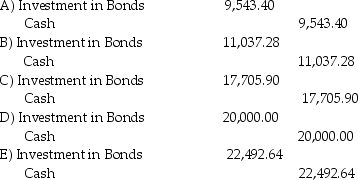

Question

Question

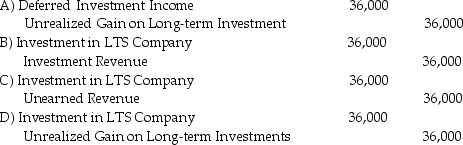

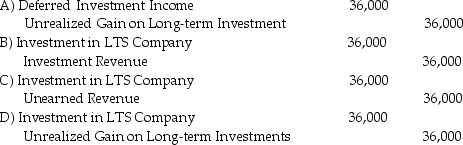

Question

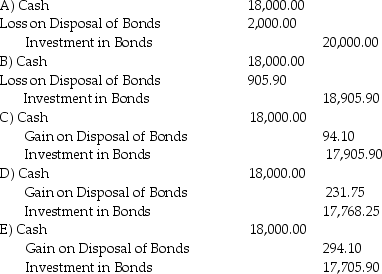

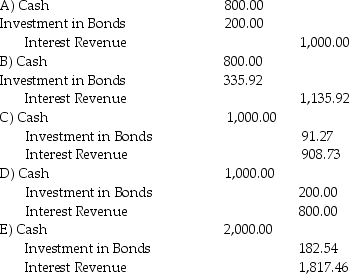

Question

Question

Question

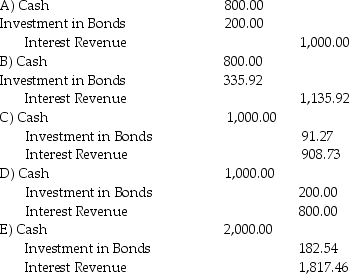

Question

Question

Question

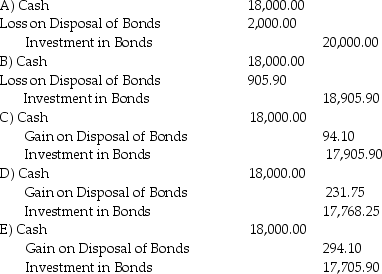

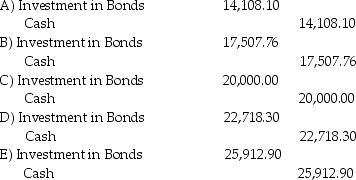

Question

Question

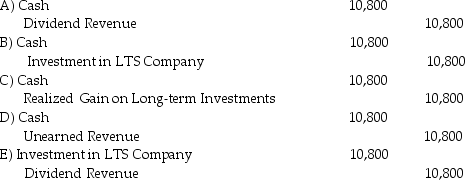

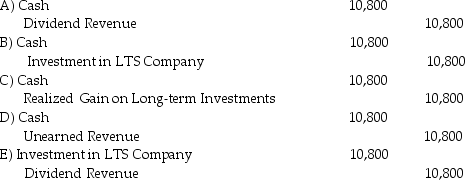

Question

Question

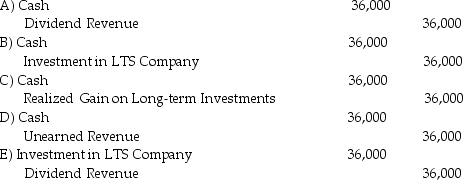

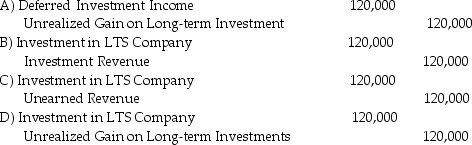

Question

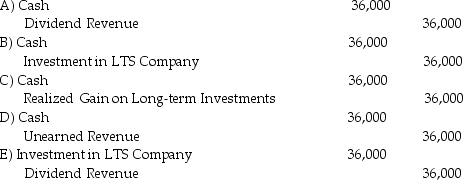

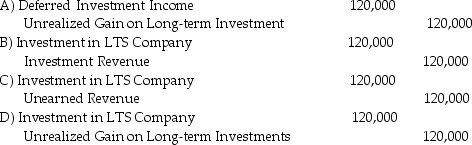

Question

Question

Question

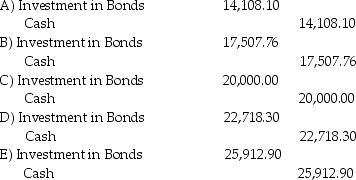

Question

Question

Question

Question

Question

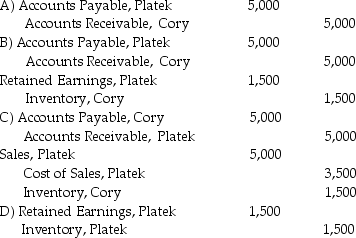

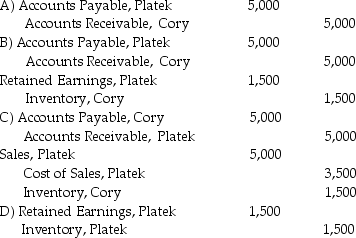

Question

Question

Question

Question

Question

Question

Question

Question

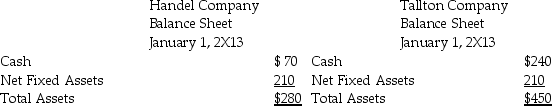

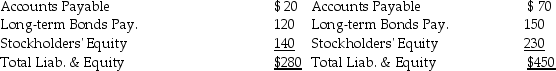

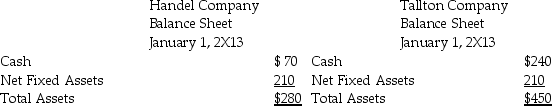

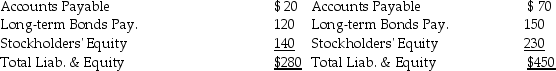

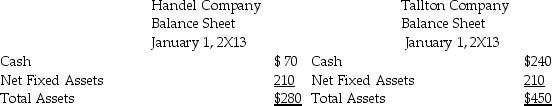

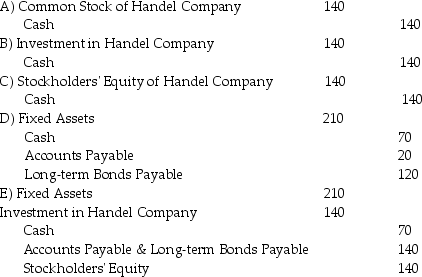

Question

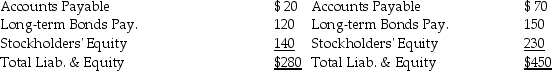

Question

Question

Question

Question

Question

Question

Question

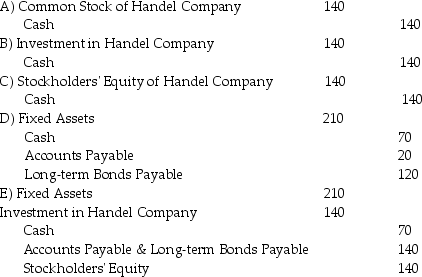

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 11: Intercorporate Investments and Consolidations

1

________ are government- and business-issued notes and bonds with maturities of 1 year or less.

A)Certificates of deposit

B)Commercial paper

C)U)S.Treasury obligations

D)Cash equivalents

E)Short-term debt securities

A)Certificates of deposit

B)Commercial paper

C)U)S.Treasury obligations

D)Cash equivalents

E)Short-term debt securities

E

2

________ are debt securities that the investor expects to hold until maturity.

A)Short-term equity securities

B)Trading securities

C)Cash equivalents

D)Available-for-sale securities

E)Held-to-maturity securities

A)Short-term equity securities

B)Trading securities

C)Cash equivalents

D)Available-for-sale securities

E)Held-to-maturity securities

E

3

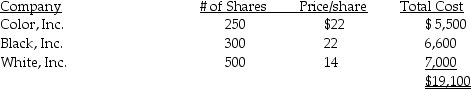

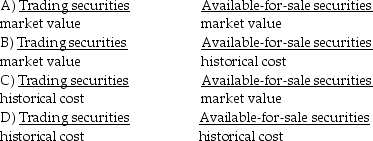

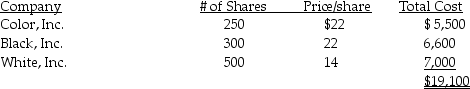

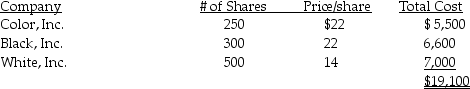

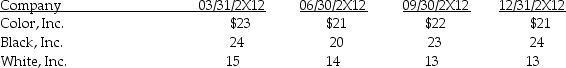

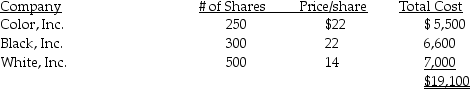

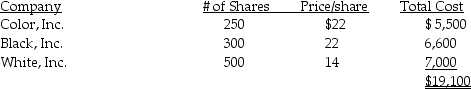

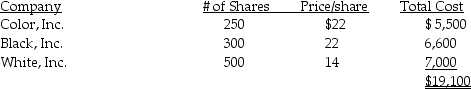

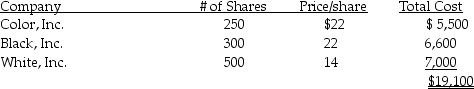

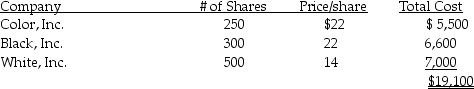

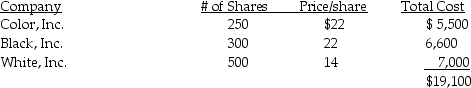

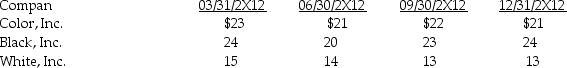

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

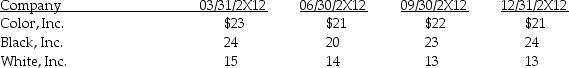

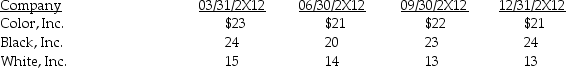

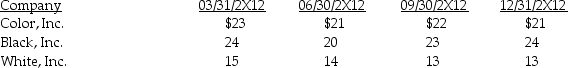

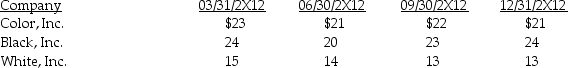

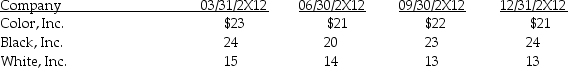

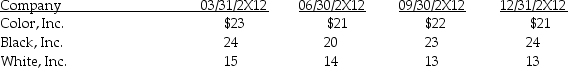

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net increase or decrease included in Accumulated Other Comprehensive Income in the stockholders' equity section of the balance sheet for the three month period ending September 30,2X12?

A)$-0-

B)$(200)

C)$(400)

D)$200

E)$400

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net increase or decrease included in Accumulated Other Comprehensive Income in the stockholders' equity section of the balance sheet for the three month period ending September 30,2X12?

A)$-0-

B)$(200)

C)$(400)

D)$200

E)$400

E

4

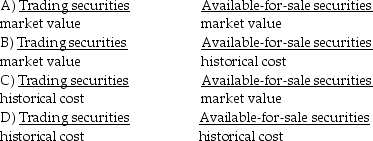

Trading securities and available-for-sale securities are reported on the balance sheet as:

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is false?

A)Trading securities are short-term investments with unrealized gains and losses due to changes in market value that are recognized in the income statement.

B)The unrealized gains and losses from changes in market value of available-for-sale securities are not recognized in the income statement,but rather are carried in a separate account in the stockholders' equity section.

C)Held-to-maturity securities are always classified as long-term investments.

D)Available for sale securities are accounted for at market value.

E)Held-to-maturity securities are accounted for at amortized cost.

A)Trading securities are short-term investments with unrealized gains and losses due to changes in market value that are recognized in the income statement.

B)The unrealized gains and losses from changes in market value of available-for-sale securities are not recognized in the income statement,but rather are carried in a separate account in the stockholders' equity section.

C)Held-to-maturity securities are always classified as long-term investments.

D)Available for sale securities are accounted for at market value.

E)Held-to-maturity securities are accounted for at amortized cost.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending March 31,2X12?

A)$250

B)$(250)

C)$900

D)$1,100

E)$2,000

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending March 31,2X12?

A)$250

B)$(250)

C)$900

D)$1,100

E)$2,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Accumulated other comprehensive income in stockholders' equity shows the difference between historical cost and market for which account(s)?

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Trading securities and available-for-sale securities

E)Trading securities and held-to-maturity securities

A)Trading securities

B)Held-to-maturity securities

C)Available-for-sale securities

D)Trading securities and available-for-sale securities

E)Trading securities and held-to-maturity securities

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

Consolidated financial statements

A)are used to offset gains and losses on the parent company's income statement.

B)combine the financial records of two or more separate legal entities.

C)make clear distinctions between principal and secondary long-term asset owners.

D)provide a depiction of process costs.

E)must provide predetermined overhead costs with earnings per share in the annual report.

A)are used to offset gains and losses on the parent company's income statement.

B)combine the financial records of two or more separate legal entities.

C)make clear distinctions between principal and secondary long-term asset owners.

D)provide a depiction of process costs.

E)must provide predetermined overhead costs with earnings per share in the annual report.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending December 31,2X12?

A)$(500)

B)$-0-

C)$(250)

D)$300

E)$500

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending December 31,2X12?

A)$(500)

B)$-0-

C)$(250)

D)$300

E)$500

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net increase or decrease included in Accumulated Other Comprehensive Income in the stockholders' equity section of the balance sheet for the 3 month period ending March 31,2X12?

A)$(200)

B)$200

C)$900

D)$1,100

E)$2,000

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net increase or decrease included in Accumulated Other Comprehensive Income in the stockholders' equity section of the balance sheet for the 3 month period ending March 31,2X12?

A)$(200)

B)$200

C)$900

D)$1,100

E)$2,000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

________ are current investments in equity or debt securities held for short-term profit.

A)Short-term equity securities

B)Trading securities

C)Held-to-maturity securities

D)Available-for-sale securities

E)Cash equivalents

A)Short-term equity securities

B)Trading securities

C)Held-to-maturity securities

D)Available-for-sale securities

E)Cash equivalents

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net gain or loss reported on the income statement of Eleston Printing for the three month period ending June 30,2X12?

A)$250

B)$(400)

C)$(200)

D)$(1,300)

E)($500)

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net gain or loss reported on the income statement of Eleston Printing for the three month period ending June 30,2X12?

A)$250

B)$(400)

C)$(200)

D)$(1,300)

E)($500)

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

________ are investments in debt securities that are not held for active trading but that may be sold before maturity.

A)Short-term equity securities

B)Held-to-maturity securities

C)Trading securities

D)Available-for-sale securities

E)Cash equivalents

A)Short-term equity securities

B)Held-to-maturity securities

C)Trading securities

D)Available-for-sale securities

E)Cash equivalents

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

Natin Filling Corporation purchased 20,$1,000 6% U.S.Treasury bonds for $18,600,as a short-term investment on December 16,2X13.Natin classified these bonds as available-for-sale securities on their balance sheet.On December 31,2X14,the U.S.Treasury bonds were trading at 94 (94% of face value).The rise in market price is believed to be a temporary fluctuation.Which of the following statements is correct?

A)Since it is a temporary fluctuation,no gain is recognized.

B)Since the bonds are still owned by Natin Filling Corporation,no gain is recognized.

C)Because Natin Filling Corpoation bought US Treasury bonds,which are risk-free,no gain is recognized.

D)A gain of $200 is recognized as a stockholders' equity account,therefore there is no income statement effect.

E)A gain of $200 is recognized on the income statement.

A)Since it is a temporary fluctuation,no gain is recognized.

B)Since the bonds are still owned by Natin Filling Corporation,no gain is recognized.

C)Because Natin Filling Corpoation bought US Treasury bonds,which are risk-free,no gain is recognized.

D)A gain of $200 is recognized as a stockholders' equity account,therefore there is no income statement effect.

E)A gain of $200 is recognized on the income statement.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

If an investment is to be held only for a short time,it should be classified on the balance sheet as a ________.

A)current liability

B)noncurrent asset,which appears in a separate investments category

C)noncurrent asset,which appears as part of other assets below the plant assets category

D)current asset

E)liquid asset

A)current liability

B)noncurrent asset,which appears in a separate investments category

C)noncurrent asset,which appears as part of other assets below the plant assets category

D)current asset

E)liquid asset

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following securities are accounted for at market value? 1.Trading securities

2)Held-to-maturity securities

3)Available for sale securities

A)1 only

B)2 only

C)3 only

D)1 and 3

E)1 and 2

2)Held-to-maturity securities

3)Available for sale securities

A)1 only

B)2 only

C)3 only

D)1 and 3

E)1 and 2

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

Eleston Printing acquired the following short-term equity securities on January 1,2X12:  The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows:

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending September 30,2X12?

A)$(400)

B)$250

C)$-0-

D)$(250)

E)$400

The quarter-end prices per share were as follows:

The quarter-end prices per share were as follows: Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.

Eleston Printing considers Color,Inc.stock to be a trading security and Black,Inc.and White,Inc.to be available-for-sale securities.What will be the net gain or loss reported on the income statement of Eleston Printing for the 3 month period ending September 30,2X12?

A)$(400)

B)$250

C)$-0-

D)$(250)

E)$400

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

The method of accounting for trading securities and available-for-sale securities in which the assets are valued at market value on the balance sheet is known as the

A)balance sheet method.

B)market method.

C)equity method.

D)consolidated method.

E)maturity method.

A)balance sheet method.

B)market method.

C)equity method.

D)consolidated method.

E)maturity method.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

When deciding whether to report an investment among current or long-term assets,companies base their decision on their purpose or intent when holding the investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

The key to classifying a marketable security as short-term is

A)whether or not it is a government issued security.

B)whether or not management has a written contract to sell the asset within the next 3 months.

C)the type of security held (i.e.,Is it a note,bond,or stock?).

D)whether or not management expects to convert it into cash within a year after the date on the balance sheet (or operating cycle if longer).

E)the small dollar amount.

A)whether or not it is a government issued security.

B)whether or not management has a written contract to sell the asset within the next 3 months.

C)the type of security held (i.e.,Is it a note,bond,or stock?).

D)whether or not management expects to convert it into cash within a year after the date on the balance sheet (or operating cycle if longer).

E)the small dollar amount.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

On September 1,2X12,Tundra Greenhouses purchased available-for-sale securities consisting of common and preferred stocks.The portfolio consists of 100 shares of Blooming Company (purchased at $37 per share)and 305 shares of Leaf Company (purchased at $29 per share).The market value of the securities on a per share basis on September 30 were $35 for Blooming and $26 for Leaf.Prepare the journal entry that will need to be made on September 30,20X12.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

Debt security investments include short-term obligations of banks and short-term notes payable issued by large corporations with top credit ratings.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

Available-for-sale securities are debt securities that the company purchases with the intent to hold them until they mature.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

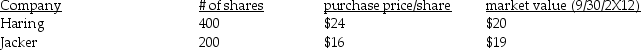

On September 1,2X12,Yelter Oil purchased trading securities consisting of common and preferred stocks.The portfolio consists of:

What will be the net gain or loss recorded on Yelter Oil's income statement for the quarter ended September 30,2X12?

What will be the net gain or loss recorded on Yelter Oil's income statement for the quarter ended September 30,2X12?

What will be the net gain or loss recorded on Yelter Oil's income statement for the quarter ended September 30,2X12?

What will be the net gain or loss recorded on Yelter Oil's income statement for the quarter ended September 30,2X12?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Trading securities include both debt and equity securities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Marketable securities are notes,bonds,or stocks that can be readily sold on stock exchanges or over-the-counter markets.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

Increases in the market value of available-for-sale securities increase total stockholders' equity,but increases in the market value of trading securities do not increase total stockholders' equity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

The accounting for investments differs depending upon the purpose of the investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Even if a company holds part of its portfolio of short-term investments for more than 1 year,that portion of the portfolio will not be reclassified as a long-term investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

If bonds are purchased at less than face value,then the amortization of the discount ________ the interest revenue of the investors.

A)increases

B)decreases

C)does not change

D)increases or decreases depending on the current market rate

E)Cannot be determined without more information

A)increases

B)decreases

C)does not change

D)increases or decreases depending on the current market rate

E)Cannot be determined without more information

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Debt securities classified as available-for-sale securities are carried at amortized cost on the balance sheet.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Comprehensive income includes both net income and the change in market value of available-for-sale securities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

As the market value of trading securities changes,companies report the gains from increases in market value and losses from decreases in market value on the income statement.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

As the market value of available-for-sale securities changes,companies report the gains from increases in market value and losses from decreases in market value on the income statement.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

Bond discounts are amortized by taking the difference between the

A)interest based on the effective interest rate and the interest based on the coupon interest rate.

B)interest based on the nominal interest rate and the interest based on the coupon interest rate.

C)interest based on the stated rate of interest and the interest based on the coupon interest rate.

D)interest based on the effective interest rate and the interest based on the market rate of interest.

E)interest based on the nominal interest rate and the interest based on the stated rate of interest.

A)interest based on the effective interest rate and the interest based on the coupon interest rate.

B)interest based on the nominal interest rate and the interest based on the coupon interest rate.

C)interest based on the stated rate of interest and the interest based on the coupon interest rate.

D)interest based on the effective interest rate and the interest based on the market rate of interest.

E)interest based on the nominal interest rate and the interest based on the stated rate of interest.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

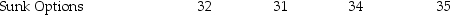

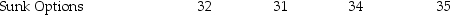

Direct Solutions held two securities.Direct Solutions purchased 100 Bucket Organization,Inc.,securities on January 1,2X09 for $15 per share and classified it as a trading security and purchased 80 Sunk Options Company securities on the same day for $34 per share and classified it as an available-for-sale security.Market values for both securities as of December 31,for 2X09,2X10,2X11,2X12 follow.

1.Prepare journal entries for the investment in Bucket Organization,Inc.as of

1.Prepare journal entries for the investment in Bucket Organization,Inc.as of

a.December 31,2X09.

b.December 31,2X10.

c.December 31,2X11.

d.December 31,2X12.

2.Prepare journal entries for the investment in Sunk Options Company as of the dates in (1)above.

3.Where would gains and losses recorded in (1)and (2)above be reported for:

a.Bucket Organization,Inc.?

b.Sunk Options Company?

1.Prepare journal entries for the investment in Bucket Organization,Inc.as of

1.Prepare journal entries for the investment in Bucket Organization,Inc.as ofa.December 31,2X09.

b.December 31,2X10.

c.December 31,2X11.

d.December 31,2X12.

2.Prepare journal entries for the investment in Sunk Options Company as of the dates in (1)above.

3.Where would gains and losses recorded in (1)and (2)above be reported for:

a.Bucket Organization,Inc.?

b.Sunk Options Company?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

The market method applies to short-term debt securities classified as trading securities and,as a result,a drop in market value below cost will result in a write-down of the investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

Held-to-maturity securities are equity securities that the company purchases with the intent to hold them to a maturity date.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

U.S.Treasury obligations are interest-bearing notes,bonds,and bills issued by the U.S.federal government.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

Held-to-maturity securities are carried on the balance sheet at amortized cost.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.If the bonds were purchased by Soothing Massage Company to yield 12% and were acquired for $17,705.90,what is the journal entry to be made by Soothing Massage Company with respect to interest on June 30,2X13?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

The investor will increase Interest Revenue when the discount on a held-to-maturity security is amortized.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

Highland Cutlery acquired as a long-term investment some of the common stock of LTS Company on December 31,2X12.During 2X13,LTS Company had net income of $300,000 and declared and paid cash dividends of $90,000.What journal entry would Highland Cutlery make for 2X13 to recognize the net income of LTS Company,assuming that Highland Cutlery acquired 12% of the outstanding common stock of LTS Company?

E)No journal entry is necessary.

E)No journal entry is necessary.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.If the bonds were purchased by Soothing Massage Company to yield 12% and were acquired for $17,705.90,what journal entry would Soothing Massage Company make on June 30,2X13,if the company sold the bonds for $18,000.00? Assume the bonds were sold after Soothing Massage Company properly recorded the receipt of the June 30,2X13,interest payment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

If a company calls a bond early and the carrying value of the bond is less than the cash received by the investor for the bond,the difference for the issuing company

A)decreases bonds payable.

B)increases bonds payable.

C)is not recognized.

D)is a gain.

E)is a loss.

A)decreases bonds payable.

B)increases bonds payable.

C)is not recognized.

D)is a gain.

E)is a loss.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

If bonds are purchased at more than face value,then the amortization of the premium ________ the interest revenue of the investors.

A)increases or decreases depending on the current market rate

B)increases

C)decreases

D)does not change

E)Cannot be determined without more information

A)increases or decreases depending on the current market rate

B)increases

C)decreases

D)does not change

E)Cannot be determined without more information

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.If the bonds were purchased by Soothing Massage Company to yield 8% and were acquired for $22,718.30,what is the interest revenue to be recognized by Soothing Massage Company with respect to interest on December 31,2X13?

A)$1,817.46

B)$905.08

C)$908.73

D)$1,000.00

E)$800.00

A)$1,817.46

B)$905.08

C)$908.73

D)$1,000.00

E)$800.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

The investor will debit Investment in Bonds when the premium on a held-to-maturity security is amortized.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

If the level of ownership changes such that the investor must change the accounting method to report the investment,the investor should

A)continue to use the same method to abide by the consistency principle

B)continue to use the same method,but change the book value of the investment going forward

C)discontinue the old method and sell the investment

D)discontinue the old method and adopt the new method going forward

E)none of the above

A)continue to use the same method to abide by the consistency principle

B)continue to use the same method,but change the book value of the investment going forward

C)discontinue the old method and sell the investment

D)discontinue the old method and adopt the new method going forward

E)none of the above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.If the bonds were purchased by Soothing Massage Company to yield 8%,and were acquired for $22,718.30,what is the journal entry to be made by Soothing Massage Company with respect to interest on June 30,2X13?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

On January 1,20X9,Stack 'em Up acquired a $550,000 face value bond.The bond has a 10% coupon rate and pays interest semi-annually every June 30 and December 31.The bond matures in 10 years.Stack 'em Up acquired the bond at a price that would yield 8%.Using the present value tables,determine the balance sheet presentation of the bond on the December 31,20X9,balance sheet of Stack 'em Up.The company plans to hold the bond until maturity.The company uses the effective interest method of discount or premium amortization.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Highland Cutlery acquired as a long-term investment some of the common stock of LTS Company on December 31,2X12.During 2X13,LTS Company had net income of $300,000 and declared and paid cash dividends of $90,000.What journal entry would Highland Cutlery make for 2X13 to recognize dividends received from LTS Company,assuming Highland Cutlery acquired 40% of the outstanding stock of LTS Company?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

If an investor acquires a 10% long-term bond at a price that yields the investor 12%,interest revenue will decrease over the life of the bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

Highland Cutlery acquired as a long-term investment some of the common stock of LTS Company on December 31,2X12.During 2X13,LTS Company had net income of $300,000 and declared and paid cash dividends of $90,000.What journal entry would Highland Cutlery make for 2X13 to recognize the net income of LTS Company,assuming that Highland Cutlery acquired 40% of the outstanding common stock of LTS Company?

E)No journal entry is necessary.

E)No journal entry is necessary.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Highland Cutlery acquired as a long-term investment some of the common stock of LTS Company on December 31,2X12.During 2X13,LTS Company had net income of $300,000 and declared and paid cash dividends of $90,000.What journal entry would Highland Cutlery make for 2X13 to recognize dividends received from LTS Company,assuming Highland Cutlery acquired 12% of the outstanding stock of LTS Company?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Although the issuer of bonds typically keeps a separate account for unamortized discounts and premiums,investors do not.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

Palatino Ranchers acquired a $300,000 15-year,10% callable bond on January 1,20X9,for cash of $258,702.The bond was acquired at a price to yield 12%.The bond pays interest every June 30 and December 31.On December 31,20X9,after interest had been received,the bond owned by Palatino Ranchers was called at a price of 101 (101% of face value).Assume the company intends to hold the bond until maturity and the company uses the effective interest method of discount or premium amortization.

Prepare the appropriate journal entry for each of the following events:

a.The purchase of the bond on January 1,20X9

b.The receipt of the June 30,20X9,interest payment

c.The receipt of the December 31,20X9,interest payment

d.The bond being called on December 31,20X9

Prepare the appropriate journal entry for each of the following events:

a.The purchase of the bond on January 1,20X9

b.The receipt of the June 30,20X9,interest payment

c.The receipt of the December 31,20X9,interest payment

d.The bond being called on December 31,20X9

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.What is the journal entry to be made by Soothing Massage Company on January 1,2X13,if the bonds were purchased at a price to yield 12%?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.What is the journal entry to be made by Soothing Massage Company on January 1,2X13,if the bonds were purchased at a price to yield 8%?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

On January 1,2X13,Soothing Massage Company acquired,as a long-term investment,20 bonds with a face value of $1,000 each.The bonds have a 10-year life,a 10% coupon rate,and pay interest semi-annually every June 30 and December 31.If the bonds were purchased by Soothing Massage Company to yield 12%,and were acquired for $17,705.90,what is the interest revenue to be recognized by Soothing Massage Company with respect to the interest to be received on December 31,2X13?

A)$1,200.00

B)$1,062.35

C)$1,066.10

D)$1,000.00

E)$2,124.71

A)$1,200.00

B)$1,062.35

C)$1,066.10

D)$1,000.00

E)$2,124.71

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

Under the market method,the investor recognizes revenue when dividends are received.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Under the equity method,the investor recognizes revenue based upon an appropriate share of the investee's net income.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Platek Enterprises is 100% owned by Cory Industries.On December 30,2X13,Platek sold inventory,costing $3,500 on account to Cory for $5,000.Platek uses a perpetual inventory system.What consolidation journal entry,if any,is needed on December 31,2X13,as a result of this transaction?

E)No journal entry is necessary.

E)No journal entry is necessary.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

GAAP allow investments under the equity method to be carried at adjusted cost or current market value on the balance sheet.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

A spin-off is when

A)a company buys a security for a very short period of time and then sells it.

B)a bond is retired through the issuance of another bond.

C)part of a company which is usually a distinct business unit is separated from the parent company and shares of the divested company are distributed to the parent's stockholders.

D)a company acquires another company in a different industry.

E)a company acquires another company in the same industry.

A)a company buys a security for a very short period of time and then sells it.

B)a bond is retired through the issuance of another bond.

C)part of a company which is usually a distinct business unit is separated from the parent company and shares of the divested company are distributed to the parent's stockholders.

D)a company acquires another company in a different industry.

E)a company acquires another company in the same industry.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Tell Tale Books acquired all the stock of Ringlet Publishing by purchasing the shares from their current owners for $50 million paid in cash.Ringlet Publishing has assets with a fair value of $50 million.How would Ringlet Publishing account for the acquisition?

A)No journal entry is necessary.

B)Ringlet Publishing would increase Cash by $50 million and decrease Property,Plant,and Equipment by $50 million.

C)Ringlet Publishing would increase Cash by $50 million and increase Paid-in Capital by $50 million.

D)Ringlet Publishing would increase Cash by $20 million and decrease Property,Plant,and Equipment by $20 million.

E)Ringlet Publishing would increase Cash by $50 million; decrease Property,Plant,and Equipment by $20 million; and increase Paid-in Capital by $30 million.

A)No journal entry is necessary.

B)Ringlet Publishing would increase Cash by $50 million and decrease Property,Plant,and Equipment by $50 million.

C)Ringlet Publishing would increase Cash by $50 million and increase Paid-in Capital by $50 million.

D)Ringlet Publishing would increase Cash by $20 million and decrease Property,Plant,and Equipment by $20 million.

E)Ringlet Publishing would increase Cash by $50 million; decrease Property,Plant,and Equipment by $20 million; and increase Paid-in Capital by $30 million.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

When equity ownership of another company is below 20%,the market method is required.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

A subsidiary is a corporation owned or controlled by a parent company through the ownership of

A)more than 10% of the voting stock.

B)more than 20% of the voting stock.

C)more than 25% of the voting stock.

D)more than 50% of the voting stock.

E)100% of the voting stock.

A)more than 10% of the voting stock.

B)more than 20% of the voting stock.

C)more than 25% of the voting stock.

D)more than 50% of the voting stock.

E)100% of the voting stock.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Market Research Syndicate acquired 100 shares of Catskill Tools for $450,000 on January 1,2X13.During 2X13,Catskill Tools declared and paid a total of $8,000 in dividends and reported net income of $50,000.Market Research Syndicate plans on holding the investment for a long time.

1.Assuming Market Research Syndicate owns 40% of Catskill Tools,prepare journal entries for Market Research Syndicate for the following events:

a)acquisition

b)recognition of net income

c)dividends

2.Assuming Market Research Syndicate owns 10% of Catskill Tools,prepare journal entries for Market Research Syndicate for the following events:

a)acquisition

b)recognition of net income

c)dividends

1.Assuming Market Research Syndicate owns 40% of Catskill Tools,prepare journal entries for Market Research Syndicate for the following events:

a)acquisition

b)recognition of net income

c)dividends

2.Assuming Market Research Syndicate owns 10% of Catskill Tools,prepare journal entries for Market Research Syndicate for the following events:

a)acquisition

b)recognition of net income

c)dividends

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Hybud Recreation Center acquired all the stock of Cloverleaf Floors by purchasing the shares from their current owners for $400,000 paid in cash.Cloverleaf Floors has assets with a fair value of $400,000.How would Hybud Recreation Center account for the acquisition?

A)Hybud would increase Paid-in Capital by $400,000 and decrease Cash by $400,000.

B)Hybud would increase Property,Plant,and Equipment by $400,000 and decrease Cash by $400,000.

C)Hybud would increase Investment in Cloverleaf Floors by $400,000 and decrease Cash by $400,000.

D)Hybud would decrease Property,Plant,and Equipment by $400,000 and decrease Cash by $400,000.

E)Hybud would not need to make a journal entry.

A)Hybud would increase Paid-in Capital by $400,000 and decrease Cash by $400,000.

B)Hybud would increase Property,Plant,and Equipment by $400,000 and decrease Cash by $400,000.

C)Hybud would increase Investment in Cloverleaf Floors by $400,000 and decrease Cash by $400,000.

D)Hybud would decrease Property,Plant,and Equipment by $400,000 and decrease Cash by $400,000.

E)Hybud would not need to make a journal entry.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

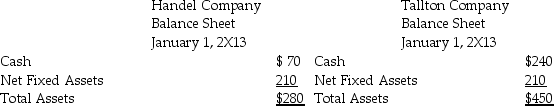

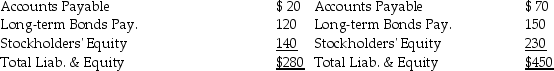

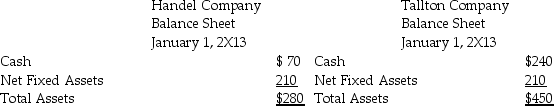

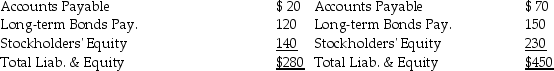

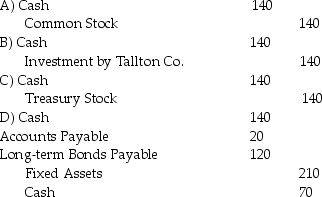

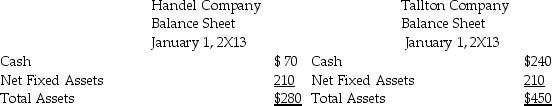

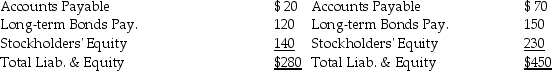

Presented below are the balance sheets of Tallton Company and Handel Company at January 1,2X13:

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

Which of the following statements regarding the consolidated balance sheet immediately after the acquisition is not correct?

A)Total liabilities will be $360.

B)Total cash will be $170.

C)Total assets will be $730.

D)Total net fixed assets will be $420.

E)Total stockholders' equity will be $230.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.Which of the following statements regarding the consolidated balance sheet immediately after the acquisition is not correct?

A)Total liabilities will be $360.

B)Total cash will be $170.

C)Total assets will be $730.

D)Total net fixed assets will be $420.

E)Total stockholders' equity will be $230.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Presented below are the balance sheets of Tallton Company and Handel Company at January 1,2X13:

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

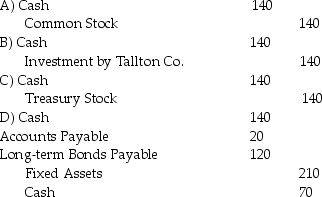

What journal entry will Handel Company make on January 1,2X13?

E)No journal entry is necessary.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.What journal entry will Handel Company make on January 1,2X13?

E)No journal entry is necessary.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following ownership percentages is the correct one(s)for deciding whether an investor has significant influence over an investee?

A)up to 20%

B)up to 50%

C)between 20% and 50%

D)between 25% and 50%

E)above 20%

A)up to 20%

B)up to 50%

C)between 20% and 50%

D)between 25% and 50%

E)above 20%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

The major reason for using the equity method instead of the market method for an investment is that the equity method does a better job of recognizing increases or decreases in the economic resources that the investor can influence.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

When a company owns 20% to 50% of the voting stock in another company,the market method generally will not reflect the economic relationship between the investor and the investee.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

An affiliated company is one that has 20% to 50% of its voting shares owned by another company.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

GAAP requires companies using the equity method to report equity investments on the balance sheet at market.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements is false in regards to the consolidation of financial statements?

A)GAAP and IFRS have different consolidation requirements.

B)Under GAAP,completion of consolidated financial statements occurs when a parent company has control over another company.

C)Under GAAP,a parent company may own less than 50% of the voting shares of another company yet still qualify to consolidate financial statements.

D)Under GAAP,consolidation is generally restricted to situations where a parent company has control of over 20% of the voting shares of another company.

E)Under GAAP,there are circumstances when a parent company owns a majority of the voting stock of another company but does not prepare consolidated financial statements.

A)GAAP and IFRS have different consolidation requirements.

B)Under GAAP,completion of consolidated financial statements occurs when a parent company has control over another company.

C)Under GAAP,a parent company may own less than 50% of the voting shares of another company yet still qualify to consolidate financial statements.

D)Under GAAP,consolidation is generally restricted to situations where a parent company has control of over 20% of the voting shares of another company.

E)Under GAAP,there are circumstances when a parent company owns a majority of the voting stock of another company but does not prepare consolidated financial statements.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Presented below are the balance sheets of Tallton Company and Handel Company at January 1,2X13:

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

What journal entry will Tallton Company make on January 1,2X13?

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.

On January 1,2X13,Tallton Company acquired 100% of the outstanding common stock of Handel Company for $140 in cash.Assume the book value of Handel's assets and liabilities equals the market value.What journal entry will Tallton Company make on January 1,2X13?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

Under the market method,the investment in another company's stock is recorded at acquisition cost and is adjusted for the investor's share of dividends and for any earnings or losses experienced by the investee after the date of investment.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck