Deck 11: Capital Budgeting Cash Flows and Risk Refinements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

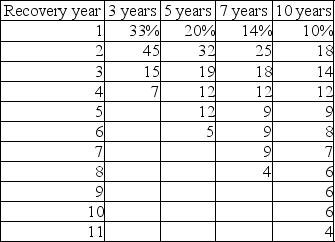

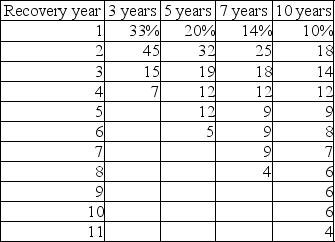

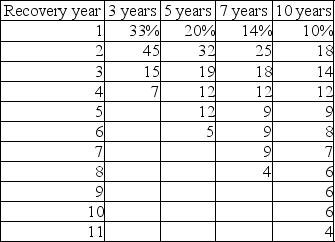

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/184

Play

Full screen (f)

Deck 11: Capital Budgeting Cash Flows and Risk Refinements

1

A sunk cost is a cash flow that could be realized from the best alternative use of an owned asset.

False

2

Initial cash outflows and subsequent operating cash inflows for a project are referred to as ________.

A)necessary cash flows

B)relevant cash flows

C)perpetual cash flows

D)ordinary cash flows

A)necessary cash flows

B)relevant cash flows

C)perpetual cash flows

D)ordinary cash flows

relevant cash flows

3

The three major cash flow components include the initial investment,nonoperating cash flows,and terminal cash flow.

False

4

The relevant cash flows for a proposed capital expenditure are the incremental after-tax cash outflows and resulting subsequent inflows.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

5

Companies involved in international capital budgeting projects can minimize political risks by structuring the investment as a joint venture and selecting a well-connected local partner.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

6

Relevant cash flows for a project are best described as ________.

A)incidental cash flows

B)incremental cash flows

C)sunk cash flows

D)contingent cash flows

A)incidental cash flows

B)incremental cash flows

C)sunk cash flows

D)contingent cash flows

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

7

When making replacement decisions,the development of relevant cash flows is complicated when compared to expansion decisions,due to the need to calculate ________ cash inflows.

A)conventional

B)opportunity

C)incremental

D)sunk

A)conventional

B)opportunity

C)incremental

D)sunk

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

8

Incremental cash flows represent the additional cash flows expected as a direct result of the proposed project.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

9

Opportunity costs should be included as cash outflows when determining a project's incremental cash flows.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

10

Relevant cash flows are the incremental cash outflows and inflows associated with a proposed capital expenditure.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

11

Sunk costs are cash outlays that have already been made and therefore have no effect on the cash flows relevant to the current decision.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

12

Accounting figures and cash flows are not necessarily the same due to the presence of certain non-cash expenditures on a firm's income statement.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

13

Companies involved in international capital budgeting projects can minimize the long-term currency risk by financing the foreign investment at least partly in the local capital markets.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

14

In developing the cash flows for an expansion project,the analysis is the same as the analysis for replacement projects where ________.

A)all cash flows from the old assets are equal

B)prior cash flows are irrelevant

C)all cash flows from the old asset are zero

D)cash inflows equal cash outflows

A)all cash flows from the old assets are equal

B)prior cash flows are irrelevant

C)all cash flows from the old asset are zero

D)cash inflows equal cash outflows

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

15

Please explain the difference between a sunk cost and an opportunity cost and give an example of each type of cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

16

The three major cash flow components include the initial investment,operating cash flows,and terminal cash flow.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

17

A sunk cost is a cash outlay that has already been made and cannot be recovered.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

18

Should financing costs such as the returns paid to bondholders and stockholders be considered in computing after-tax operating cash flows? Why or why not?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

19

An opportunity cost is a cash flow that could be realized from the best alternative use of an owned asset.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

20

Cash outlays that had been previously made and have no effect on the cash flows relevant to a current decision are called ________.

A)incremental historical costs

B)incremental past expenses

C)opportunity costs foregone

D)sunk costs

A)incremental historical costs

B)incremental past expenses

C)opportunity costs foregone

D)sunk costs

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

21

The change in net working capital when evaluating a capital budgeting decision is ________.

A)the change in fixed liabilities minus the change in fixed assets

B)the increase in current assets

C)the increase in current liabilities

D)the change in current assets minus the change in current liabilities

A)the change in fixed liabilities minus the change in fixed assets

B)the increase in current assets

C)the increase in current liabilities

D)the change in current assets minus the change in current liabilities

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following basic variables must be considered in determining the initial investment associated with a capital expenditure?

A)incremental annual savings produced by the new asset

B)cash flows generated by the new investment

C)proceeds from the sale of an existing asset

D)profits on the sale of an existing asset

A)incremental annual savings produced by the new asset

B)cash flows generated by the new investment

C)proceeds from the sale of an existing asset

D)profits on the sale of an existing asset

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

23

Net working capital is the difference between a firm's total assets and its total liabilities.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

24

If accounts receivable increase by $1,000,000,inventory decreases by $500,000,and accounts payable increase by $500,000,net working capital would ________.

A)decrease by $500,000

B)increase by $1,500,000

C)increase by $2,000,000

D)experience no change

A)decrease by $500,000

B)increase by $1,500,000

C)increase by $2,000,000

D)experience no change

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

25

When evaluating a capital budgeting project,installation costs of a new machine must be considered as part of ________.

A)the operating cash inflows

B)the initial investment

C)the incremental operating cash inflows

D)the operating cash outflows

A)the operating cash inflows

B)the initial investment

C)the incremental operating cash inflows

D)the operating cash outflows

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following would be used in the computation of an initial investment?

A)the annual after-tax inflow expected from the investment

B)the initial purchase price of the investment

C)the historic cost of the existing investment

D)the profits from the new investment

A)the annual after-tax inflow expected from the investment

B)the initial purchase price of the investment

C)the historic cost of the existing investment

D)the profits from the new investment

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

27

Cash flows that could be realized from the best alternative use of an owned asset are called ________.

A)incremental costs

B)lost resale opportunities

C)opportunity costs

D)sunk costs

A)incremental costs

B)lost resale opportunities

C)opportunity costs

D)sunk costs

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

28

A corporation is considering expanding operations to meet growing demand.With the capital expansion the current accounts are expected to change.Management expects cash to increase by $10,000,accounts receivable by $20,000,and inventories by $30,000.At the same time accounts payable will increase by $40,000,accruals by $30,000,and long-term debt by $80,000.The change in net working capital is ________.

A)an increase of $10,000

B)a decrease of $10,000

C)a decrease of $90,000

D)an increase of $80,000

A)an increase of $10,000

B)a decrease of $10,000

C)a decrease of $90,000

D)an increase of $80,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

29

In evaluating the initial investment for a capital budgeting project,________.

A)an increase in net working capital is considered a cash inflow

B)a decrease in net working capital is considered a cash outflow

C)an increase in net working capital is considered a cash outflow

D)net working capital does not have to be considered

A)an increase in net working capital is considered a cash inflow

B)a decrease in net working capital is considered a cash outflow

C)an increase in net working capital is considered a cash outflow

D)net working capital does not have to be considered

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

30

Calculate the book value of the existing press being replaced.(See Table 11.1)

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

31

A corporation is considering expanding operations to meet growing demand.With the capital expansion,the current accounts are expected to change.Management expects cash to increase by $20,000,accounts receivable by $40,000,and inventories by $60,000.At the same time accounts payable will increase by $50,000,accruals by $10,000,and long-term debt by $100,000.The change in net working capital is ________.

A)an increase of $120,000

B)a decrease of $60,000

C)a decrease of $120,000

D)an increase of $60,000

A)an increase of $120,000

B)a decrease of $60,000

C)a decrease of $120,000

D)an increase of $60,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

32

An important cash inflow in the analysis of initial cash flows for a replacement project is ________.

A)taxes

B)the cost of the new asset

C)installation cost

D)the sale value of the old asset

A)taxes

B)the cost of the new asset

C)installation cost

D)the sale value of the old asset

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

33

If an investment in a new asset results in a change in current assets that exceeds the change in current liabilities,this change in net working capital represents an initial cash outflow.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

34

The change in net working capital-regardless of whether an increase or decrease-is not taxable because it merely involves a net buildup or net reduction of current accounts.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

35

Calculate the tax effect from the sale of the existing asset.(See Table 11.1)

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

36

The basic cash flows that must be considered when determining the initial investment associated with a capital expenditure are the installed cost of the new asset,the after-tax proceeds (if any)from the sale of an old asset,and the change (if any)in net working capital.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

37

If a new asset is being considered as a replacement for an old asset,the relevant cash flows would be found by adding the operating cash flows from the old asset to the operating cash flows from the new asset.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

38

Calculate the initial investment of the new asset.(See Table 11.1)

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

39

Under MACRS depreciation,the depreciable value of an asset is equal to the asset's purchase price minus any installation costs.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

40

To calculate the initial investment,we subtract all cash inflows occurring at time zero from all cash outflows occurring at time zero.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

41

The tax treatment regarding the sale of existing assets that are sold for more than the book value but less than the original purchase price results in a(n)________.

A)ordinary tax benefit

B)capital gain tax liability

C)recaptured depreciation taxed as ordinary income

D)capital gain tax liability and recaptured depreciation taxed as ordinary income

A)ordinary tax benefit

B)capital gain tax liability

C)recaptured depreciation taxed as ordinary income

D)capital gain tax liability and recaptured depreciation taxed as ordinary income

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose the tax law changes to allow firms to immediately and fully deduct the cost of investments they make rather than depreciating them under the MACRS system.If all else remains the same,this change would tend to increase the NPV of an investment project.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

43

Recaptured depreciation is the portion of the sale price that is below the book value.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

44

A corporation has decided to replace an existing asset with a newer model.Two years ago,the existing asset originally cost $30,000 and was being depreciated under MACRS using a five-year recovery period.The existing asset can be sold for $25,000.The new asset will cost $75,000 and will also be depreciated under MACRS using a five-year recovery period.If the assumed tax rate is 40 percent on ordinary income and capital gains,the initial investment is ________.

A)$42,000

B)$52,440

C)$54,240

D)$50,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

45

All other factors held constant,the longer the firm must take to depreciate the initial cost of an investment project,the higher will be the project's NPV.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

46

Recaptured depreciation is the portion of the sale price that is in excess of the initial purchase price.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

47

If an asset is depreciable and used in business,any loss on the sale of the asset is tax-deductible only against other capital gains income,not against ordinary income.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

48

If an asset is sold for more than its initial purchase price,the gain on the sale is composed of two parts: a capital gain and recaptured depreciation.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

49

In case of an existing asset which is depreciable and is used in business and is sold for a price equal to its initial purchase price,the difference between the sales price and its book value is considered as recaptured depreciation and will be taxed as ordinary income.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

50

If an asset is sold for less than its book value,the loss on the sale may be used to offset ordinary operating income provided the asset is used in the business.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

51

John has an extra bedroom in his house that he occasionally rents out using the service Airbnb.John charges $100 per night,and his room is occupied by a renter approximately 100 nights per year.He thinks that if he repaints the room the photos he posts on Airbnb to draw customers will be more attractive,allowing him to charge $110 dollars per night and to rent the room for 120 nights per year.John's tax rate is 28%.What is the annual,after-tax,incremental revenue that John expects from his painting project?

A)$13,200

B)$9,504

C)$3,200

D)$2,304

A)$13,200

B)$9,504

C)$3,200

D)$2,304

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

52

If an asset is sold for book value,the gain on the sale is composed of two parts: a capital gain and accumulated depreciation.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

53

The tax treatment regarding the sale of existing assets that are sold for more than the original purchase price results in ________.

A)an ordinary tax benefit

B)no tax benefit or liability

C)a recaptured depreciation taxed as ordinary income

D)a capital gain tax liability

A)an ordinary tax benefit

B)no tax benefit or liability

C)a recaptured depreciation taxed as ordinary income

D)a capital gain tax liability

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

54

Capital gain is the portion of the sale price that is in excess of the initial purchase price.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

55

The book value of an asset is equal to the ________.

A)fair market value minus the accounting value

B)original purchase price plus annual depreciation expense

C)original purchase price minus accumulated depreciation

D)depreciated value plus recaptured depreciation

A)fair market value minus the accounting value

B)original purchase price plus annual depreciation expense

C)original purchase price minus accumulated depreciation

D)depreciated value plus recaptured depreciation

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

56

The book value of an asset is equal to its installed cost of asset minus the accumulated depreciation.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

57

All other factors held constant,the higher the tax rate that firms must pay,the more valuable are depreciation deductions.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

58

This year a certain investment project generated revenue of $200,000.Other expenses (excluding depreciation and interest expense)totalled $100,000.Depreciation expense was $50,000 and interest expense was $10,000.The firm faces a tax rate of 21%.What is the project's after-tax operating cash flow this year?

A)$89,500

B)$81,600

C)$129,000

D)$79,000

A)$89,500

B)$81,600

C)$129,000

D)$79,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

59

A corporation has decided to replace an existing asset with a newer model.Two years ago,the existing asset originally cost $70,000 and was being depreciated under MACRS using a five-year recovery period.The existing asset can be sold for $30,000.The new asset will cost $80,000 and will also be depreciated under MACRS using a five-year recovery period.If the assumed tax rate is 40 percent on ordinary income and capital gains,the initial investment is ________.

A)$48,560

B)$44,360

C)$49,240

D)$27,600

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

60

In terms of an investment project's operating cash flows,depreciation deductions are irrelevant because they do not represent an outlay of cash.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

61

Compute the initial purchase price for an asset with book value of $34,800 and total accumulated depreciation of $85,200.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

62

The cash flow pattern for the capital investment proposal is ________.(See Table 11.3)

A)a mixed stream and conventional

B)a mixed stream and nonconventional

C)a perpetuity and conventional

D)an annuity and nonconventional

A)a mixed stream and conventional

B)a mixed stream and nonconventional

C)a perpetuity and conventional

D)an annuity and nonconventional

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

63

A loss on the sale of an asset that is depreciable and used in business is ________; a loss on the sale of a non-depreciable asset is ________.

A)deductible from capital gains income; deductible from ordinary income

B)deductible from ordinary income; deductible only against capital gains

C)a credit against the tax liability; not deductible

D)not deductible; deductible only against capital gains

A)deductible from capital gains income; deductible from ordinary income

B)deductible from ordinary income; deductible only against capital gains

C)a credit against the tax liability; not deductible

D)not deductible; deductible only against capital gains

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

64

A corporation is selling an existing asset for $1,000.The asset,when purchased,cost $10,000,was being depreciated under MACRS using a five-year recovery period,and has been depreciated for four full years.If the assumed tax rate is 40 percent on ordinary income and capital gains,the tax effect of this transaction is ________.

A)$0 tax liability

B)$1,100 tax liability

C)$3,600 tax liability

D)$280 tax benefit

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

65

A corporation is selling an existing asset for $1,700.The asset,when purchased,cost $10,000,was being depreciated under MACRS using a five-year recovery period,and has been depreciated for four full years.If the assumed tax rate is 40 percent on ordinary income and capital gains,the tax effect of this transaction is ________.

A)$0 tax liability

B)$840 tax liability

C)$3,160 tax liability

D)$3,160 tax benefit

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

66

The portion of an asset's sale price that is below its book value and below its initial purchase price is called ________.

A)a capital gain

B)recaptured depreciation

C)a capital loss

D)book value

A)a capital gain

B)recaptured depreciation

C)a capital loss

D)book value

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

67

A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow.The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $15,000.The machine has an original purchase price of $80,000,installation cost of $20,000,and will be depreciated under the five-year MACRS.Net working capital is expected to decline by $5,000.The firm has a 40 percent tax rate on ordinary income and long-term capital gain.The terminal cash flow is ________.

A)$24,000

B)$16,000

C)$14,000

D)$26,000

A)$24,000

B)$16,000

C)$14,000

D)$26,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following must be considered in computing the terminal value of a replacement project?

A)operating cash flow for the final year

B)after-tax proceeds from the sale of a new asset

C)before-tax proceeds from the sale of an old asset

D)before-tax proceeds from the sale of a new asset

A)operating cash flow for the final year

B)after-tax proceeds from the sale of a new asset

C)before-tax proceeds from the sale of an old asset

D)before-tax proceeds from the sale of a new asset

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

69

The portion of an asset's sale price that is above its book value and below its initial purchase price is called ________.

A)a capital gain

B)recaptured depreciation

C)a capital loss

D)book value

A)a capital gain

B)recaptured depreciation

C)a capital loss

D)book value

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

70

The tax effect on the sale of the existing asset results in ________.(See Table 11.3)

A)$800 tax benefit

B)$1,000 tax liability

C)$1,100 tax liability

D)$6,000 tax liability

A)$800 tax benefit

B)$1,000 tax liability

C)$1,100 tax liability

D)$6,000 tax liability

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

71

A firm is selling an existing asset for $5,000.The asset,when purchased,cost $10,000,was being depreciated under MACRS using a five-year recovery period and has been depreciated for four full years.If the assumed tax rate is 40 percent on ordinary income and capital gains,the tax effect of this transaction is ________.

A)$0 tax liability

B)$1,320 tax liability

C)$1,160 tax liability

D)$2,000 tax benefit

A)$0 tax liability

B)$1,320 tax liability

C)$1,160 tax liability

D)$2,000 tax benefit

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

72

The tax treatment regarding the sale of existing assets that are sold for their book value results in ________.

A)an ordinary tax benefit

B)no tax benefit or liability

C)recaptured depreciation taxed as ordinary income

D)a capital gain tax liability and recaptured depreciation taxed as ordinary income

A)an ordinary tax benefit

B)no tax benefit or liability

C)recaptured depreciation taxed as ordinary income

D)a capital gain tax liability and recaptured depreciation taxed as ordinary income

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

73

The tax treatment regarding the sale of existing assets that are sold for less than the book value results in ________.

A)an ordinary tax benefit

B)a capital loss tax benefit

C)recaptured depreciation taxed as ordinary income

D)a capital gain tax liability and recaptured depreciation taxed as ordinary income

A)an ordinary tax benefit

B)a capital loss tax benefit

C)recaptured depreciation taxed as ordinary income

D)a capital gain tax liability and recaptured depreciation taxed as ordinary income

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

74

The book value of the existing asset is ________.(See Table 11.3)

A)$7,250

B)$15,000

C)$21,250

D)$25,000

A)$7,250

B)$15,000

C)$21,250

D)$25,000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

75

A machine was purchased two years ago for $120,000 and can be sold for $50,000 today.The machine has been depreciated using the MACRS 5-year recovery period and the firm pays 40 percent taxes on both ordinary income and capital gains.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

76

A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow.The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000.The machine has an original purchase price of $80,000,installation cost of $20,000,and will be depreciated under the five-year MACRS.Net working capital is expected to decline by $5,000.The firm has a 40 percent tax rate on ordinary income and long-term capital gain.The terminal cash flow is ________.

A)$5,800

B)$7,800

C)$8,200

D)$6,200

A)$5,800

B)$7,800

C)$8,200

D)$6,200

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

77

A corporation is selling an existing asset for $21,000.The asset,when purchased,cost $10,000,was being depreciated under MACRS using a five-year recovery period,and has been depreciated for four full years.If the assumed tax rate is 40 percent on ordinary income and capital gains,the tax effect of this transaction is ________.

A)$0 tax liability

B)$7,560 tax liability

C)$4,400 tax liability

D)$7,720 tax liability

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

78

An asset was purchased three years ago for $100,000 and can be sold for $40,000 today.The asset has been depreciated using the MACRS 5-year recovery period and the firm pays 40 percent taxes on both ordinary income and capital gain.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

79

Compute the depreciation values for an asset which costs $55,000 and requires $5,000 in installation costs using MACRS 5-year recovery period.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

80

A mixer was purchased two years ago for $120,000 and can be sold for $125,000 today.The mixer has been depreciated using the MACRS 5-year recovery period and the firm pays 40 percent taxes on both ordinary income and capital gain.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

(a)Compute recaptured depreciation and capital gain (loss),if any.

(b)Find the firm's tax liability.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck