Deck 22: Real Estate Investment Performance and Portfolio Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/33

Play

Full screen (f)

Deck 22: Real Estate Investment Performance and Portfolio Considerations

1

When comparing investment alternatives,the standard deviation is deemed to be a measure of risk.

True

2

The NCREIF Property Index includes property value increases or decreases only when properties are sold since the sale price is the only true measure of market value.

False

3

Both levered and unlevered properties are included in the NCREIF Property Index.

False

4

The optimal portfolio is obtained by combining a group of securities which,by themselves,offer the highest returns with the lowest risk.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

5

Much like the securities markets,there is a large,centralized collection of real estate transactions and operating income data.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

6

The NCREIF index measures the investment performance of real estate by using actual sale prices.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

7

Consider an investment held over three years with a return of +20 percent in the first year,−25 percent in the second year,and +20 percent in the third year.What is the geometric mean return on the investment?

A)−2.6%

B)+2.6%

C)+5.0%

D)+8.0%

A)−2.6%

B)+2.6%

C)+5.0%

D)+8.0%

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

8

What statistical concept do many portfolio managers use to represent risk when considering investment performance?

A)The standard deviation of returns

B)The difference,or "spread," between the highest value over the holding period and the lowest value over the holding period

C)The geometric mean return

D)The coefficient of variation

A)The standard deviation of returns

B)The difference,or "spread," between the highest value over the holding period and the lowest value over the holding period

C)The geometric mean return

D)The coefficient of variation

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

9

An investor in a mortgage REIT is basically buying equity shares of an entity whose assets are mainly mortgages.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

10

The sources of data for real estate performance evaluation are security prices for REIT shares and the value of individual properties that are owned by pension plan sponsors.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

11

It is difficult to compare the investment performance of real estate with stocks and bonds because when investment properties do sell,the sale price is generally not publicly available.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

12

In comparison to investment portfolios comprised entirely of corporate stocks and bonds,portfolios which include some form of real estate investment tend to offer higher returns for each level of risk.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

13

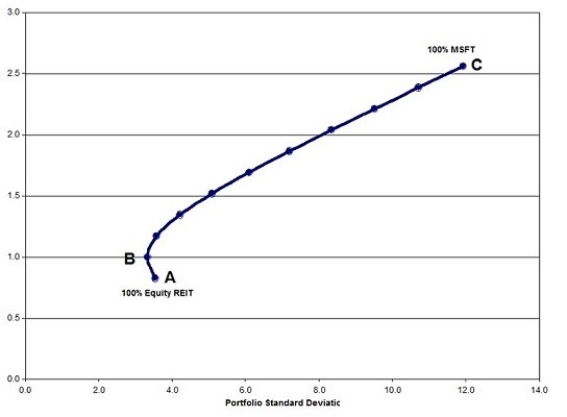

Assume you have a choice between investing in either an equity REIT or Microsoft stock (MSFT)or a combination of the two.Which point in the figure above is NOT on the efficient portfolio frontier?

Assume you have a choice between investing in either an equity REIT or Microsoft stock (MSFT)or a combination of the two.Which point in the figure above is NOT on the efficient portfolio frontier?A)A

B)B

C)C

D)All points are on the efficient portfolio frontier

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

14

If two securities have the same positive mean returns and they are perfectly,negatively correlated,an investor in such securities will earn a positive return with zero risk.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

15

Why does including REITs in a portfolio containing S&P 500 securities produce diversification benefits?

A)Real estate investment returns are highly correlated with returns for stocks

B)Real estate investment returns are not highly correlated with returns for stocks

C)Real estate investment returns are not subject to federal income taxes

D)Real estate investment returns do not change much from year to year

A)Real estate investment returns are highly correlated with returns for stocks

B)Real estate investment returns are not highly correlated with returns for stocks

C)Real estate investment returns are not subject to federal income taxes

D)Real estate investment returns do not change much from year to year

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

16

As long as the coefficient of correlation between two stocks is less than +1,some reduction in risk can be obtained by combining the securities.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

17

The holding period return and geometric mean return calculations will yield the same result for holding periods longer than two years.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

18

When used to evaluate the performance of an investment,the geometric mean is considered to be superior to the arithmetic mean.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

19

Consider an investment held over three years with a return of +20 percent in the first year,−25 percent in the second year,and +20 percent in the third year.What is the arithmetic mean return on the investment?

A)−2.6%

B)+2.6%

C)+5.0%

D)+8.0%

A)−2.6%

B)+2.6%

C)+5.0%

D)+8.0%

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

20

The data sources used to produce investment returns on investment properties include the:

A)National Association of Real Estate Professionals (NAREP)

B)National Association of Real Estate Investment Trusts (NAREIT)

C)National Board of Realtors (NBR)

D)All of the above

A)National Association of Real Estate Professionals (NAREP)

B)National Association of Real Estate Investment Trusts (NAREIT)

C)National Board of Realtors (NBR)

D)All of the above

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1st,an investor purchases security A for $105.Over the next four months,dividends totaling $15 were paid on security A.On March 31st,security A was sold for $120.What is the holding period return for security A?

A)0.0%

B)14.3%

C)25.0%

D)28.6%

A)0.0%

B)14.3%

C)25.0%

D)28.6%

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

22

The unit of measure that is used by portfolio managers to measure returns for individual securities on a periodic basis is the:

A)Return on investment (ROI)

B)Holding period return (HPR)

C)Geometric mean return

D)Arithmetic mean return

A)Return on investment (ROI)

B)Holding period return (HPR)

C)Geometric mean return

D)Arithmetic mean return

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

23

The optimal combination of securities that provides the greatest amount of return for each level of risk is known as:

A)The expected frontier

B)The economic frontier

C)The efficient frontier

D)None of the above

A)The expected frontier

B)The economic frontier

C)The efficient frontier

D)None of the above

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

24

One would see the greatest amount of diversification from two securities that are:

A)Positively correlated

B)Negatively correlated

C)Not correlated

D)Perfectly correlated

A)Positively correlated

B)Negatively correlated

C)Not correlated

D)Perfectly correlated

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

25

Assume a portfolio is comprised of two securities,A and B,whose standard deviations are 0.0412 and 0.0721,respectively.If their covariance is 0.002,what is their coefficient of correlation?

A)0.005

B)0.115

C)0.673

D)1.485

A)0.005

B)0.115

C)0.673

D)1.485

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

26

The variability on an asset's returns represents:

A)Flexibility

B)Profitability

C)Risk

D)Default

A)Flexibility

B)Profitability

C)Risk

D)Default

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

27

The NCREIF Property Index can be characterized by each of the following EXCEPT:

A)The index includes only properties with no outstanding mortgage debt

B)The information used in compiling the index is contributed by members of the NCREIF

C)The index reflects payments to both property managers and portfolio asset managers

D)All of the above are true

A)The index includes only properties with no outstanding mortgage debt

B)The information used in compiling the index is contributed by members of the NCREIF

C)The index reflects payments to both property managers and portfolio asset managers

D)All of the above are true

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

28

If the returns of two securities are compared over time and there appears to be no relationship between their movements,what is the likely value of their coefficient of correlation?

A)+1

B)−1

C)0

D)+∞ (infinity)

A)+1

B)−1

C)0

D)+∞ (infinity)

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

29

Regarding real estate investments,risk that is associated with the type of property and its location,design,lease structure,and so on can be thought of as:

A)Marketability risk

B)Liquidity risk

C)Business risk

D)Interest rate risk

A)Marketability risk

B)Liquidity risk

C)Business risk

D)Interest rate risk

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

30

Geometric mean returns are:

A)Simple averages of holding period returns

B)Expressed as compound rates of interest

C)More applicable when no specific time interval is considered to be any more important than another

D)Widely used in statistical studies spanning very long periods of time

A)Simple averages of holding period returns

B)Expressed as compound rates of interest

C)More applicable when no specific time interval is considered to be any more important than another

D)Widely used in statistical studies spanning very long periods of time

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is a major property category associated with the NCREIF Index:

A)Apartment complexes

B)Office buildings

C)Hotels

D)All of the above

A)Apartment complexes

B)Office buildings

C)Hotels

D)All of the above

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following provides a measure of the extent to which returns tend to move together or have no relationships?

A)The coefficient of determination

B)The variance

C)The coefficient of variation

D)The coefficient of correlation

A)The coefficient of determination

B)The variance

C)The coefficient of variation

D)The coefficient of correlation

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

33

The coefficient of variation,also known as the risk-to-reward ratio,is defined as:

A)The standard deviation of returns divided by the mean return

B)The variance of return multiplied by the mean return

C)The variance of returns divided by the standard deviation of returns

D)None of the above

A)The standard deviation of returns divided by the mean return

B)The variance of return multiplied by the mean return

C)The variance of returns divided by the standard deviation of returns

D)None of the above

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck