Deck 25: Corporate Governance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/53

Play

Full screen (f)

Deck 25: Corporate Governance

1

Corporate governance is the system of controls designed to minimize conflicts between bondholders and shareholders.

False

2

What is the difference among inside,grey,and outside directors?

Inside directors are employees,former employees,or family members of employees.Grey directors are people who are not as directly connected to the firm as insiders are,but who have existing or potential business relationships with the firm.For example,bankers,lawyers,and consultants who are already retained by the firm,or who would be interested in being retained,may sit on a board.Thus their judgment could be compromised by their desire to keep the CEO happy.Finally,all other directors are considered outside (or independent)directors and are the most likely to make decisions solely in the interests of the shareholders.

3

How do securities analysts provide outside monitoring of a corporation?

Since analysts collect extensive information and become experts in the firm,they are in a position to uncover irregularities.They are also able to ask questions of CEOs and CFOs during earnings releases.

4

According to the findings of researchers in the field,which of the following is most likely to be an effective board of directors?

A)a small board with a large proportion of directors who are not employed by the company or other companies with which it does business

B)a small board with a large proportion of directors who are employed by the company or another company that has a business relationship with the company

C)a large board on which most directors have served a long time

D)a large board on which most directors are employees

E)a small board with a small proportion of outside directors

A)a small board with a large proportion of directors who are not employed by the company or other companies with which it does business

B)a small board with a large proportion of directors who are employed by the company or another company that has a business relationship with the company

C)a large board on which most directors have served a long time

D)a large board on which most directors are employees

E)a small board with a small proportion of outside directors

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

5

Directors who are employees,former employees,or family members of employees are called:

A)managing directors.

B)independent directors.

C)inside directors.

D)grey directors.

E)unelected directors.

A)managing directors.

B)independent directors.

C)inside directors.

D)grey directors.

E)unelected directors.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

6

What is corporate governance?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

7

Why is monitoring the firm's managers more closely an imperfect solution to the conflict of interest problem?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

8

Directors who are NOT as directly connected to the firm but who have existing or potential business relationships with the firm are called:

A)grey directors.

B)independent directors.

C)advising directors.

D)inside directors.

E)unelected directors.

A)grey directors.

B)independent directors.

C)advising directors.

D)inside directors.

E)unelected directors.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

9

Tammy is a member of the Board of Directors of Moon Corporation.Her husband is the manager of a large division.What type of director is Tammy?

A)inside director

B)outside director

C)grey director

D)resident director

E)unelected director

A)inside director

B)outside director

C)grey director

D)resident director

E)unelected director

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

10

Which monitors of a firm,other than the board of directors,become experts in the firm and are in a position to detect irregularities first?

A)securities analysts

B)lenders

C)employees

D)regulators

E)shareholders

A)securities analysts

B)lenders

C)employees

D)regulators

E)shareholders

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

11

Which monitors of a firm,other than the board of directors,are most likely to detect outright fraud?

A)securities analysts

B)lenders

C)employees

D)regulators

E)shareholders

A)securities analysts

B)lenders

C)employees

D)regulators

E)shareholders

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

12

What is the drawback of having more independent directors on the board?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is an example of an agency problem?

A)managers not working as diligently if they are not the sole owner of the business

B)the board of directors firing an incompetent manager

C)the manager owning a great deal of stock in the company

D)a corporate raider attempting to purchase the company

E)managers using cash to increase dividends

A)managers not working as diligently if they are not the sole owner of the business

B)the board of directors firing an incompetent manager

C)the manager owning a great deal of stock in the company

D)a corporate raider attempting to purchase the company

E)managers using cash to increase dividends

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

14

When the ownership of a corporation is widely held,no one shareholder has the incentive to bear the cost of monitoring the firm's managers.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

15

What is a captured board?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

16

The least costly solution to the conflict of interest problem is simply to monitor the firm's managers closely.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

17

In the absence of monitoring,conflict of interest between managers and owners can be mitigated by closely aligning their interests through the managers' compensation policy.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

18

What is the cost of aligning managers' interests with those of shareholders?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

19

Directors who are NOT employees,former employees,or family members of employees and who do not have existing or potential business relationships with the firm are called:

A)monitoring directors.

B)independent directors.

C)grey directors.

D)inside directors.

E)unelected directors.

A)monitoring directors.

B)independent directors.

C)grey directors.

D)inside directors.

E)unelected directors.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

20

When a board's monitoring duties have been compromised by connections or perceived loyalties to management,it is said to be:

A)a dysfunctional board.

B)an institutional board.

C)a failed board.

D)a divided board.

E)a captured board.

A)a dysfunctional board.

B)an institutional board.

C)a failed board.

D)a divided board.

E)a captured board.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

21

What is backdating?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

22

What is the role of takeovers in corporate governance?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

23

The optimal level of sensitivity of a manager's compensation to the firm's performance depends on the manager's level of risk aversion.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

24

Insider trading happens when an employee of the firm trades,buys,or sells the firm's stock based on public information.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

25

Examples of cross-holdings include: I.Japanese keiretsu

A)I,II,and IV

B)I,II,and III

C)I and IV

D)I,II,III,and IV

E)II and III

A)I,II,and IV

B)I,II,and III

C)I and IV

D)I,II,III,and IV

E)II and III

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

26

What are the main provisions of the DODD Frank Act?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

27

One of the most critical inputs to the monitoring process is accurate information.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

28

The most extreme form of direct action that shareholders can take is:

A)a resolution.

B)to privately approach the board.

C)a "no" vote.

D)a proxy contest.

E)a "say-on-pay" vote.

A)a resolution.

B)to privately approach the board.

C)a "no" vote.

D)a proxy contest.

E)a "say-on-pay" vote.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

29

Why is insider trading problematic?

A)If insiders trade on their information,they cause unnecessary share price fluctuations that drive away outside investors.

B)If insiders trade on their information,the firm is automatically fined and there will be a net loss in firm value.

C)If insiders trade on their information,outside investors will benefit from the increase in the share price and thus there is a free rider problem.

D)If insiders trade on their information,it increases the conflicts between shareholders and managers.

E)If insiders trade on their information,their profits come at the expense of outside investors,making outside investors less willing to invest in corporations.

A)If insiders trade on their information,they cause unnecessary share price fluctuations that drive away outside investors.

B)If insiders trade on their information,the firm is automatically fined and there will be a net loss in firm value.

C)If insiders trade on their information,outside investors will benefit from the increase in the share price and thus there is a free rider problem.

D)If insiders trade on their information,it increases the conflicts between shareholders and managers.

E)If insiders trade on their information,their profits come at the expense of outside investors,making outside investors less willing to invest in corporations.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

30

What is a proxy contest?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

31

The relationship between managerial ownership and firm value is unlikely to be the same for every firm,or even for different executives of the same firm.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

32

How does shareholder voice serve to discipline poorly performing managers?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

33

Describe the main requirements of the Sarbanes-Oxley Act of 2002.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

34

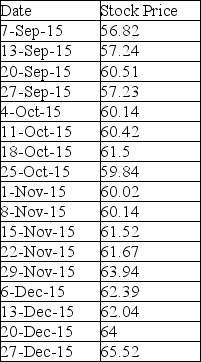

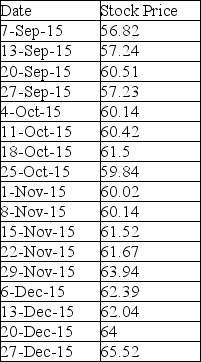

Use the table for the question(s)below.

The following are the week-ending stock prices that occurred during the quarter:

Billy,the CEO of Movin On Up Company,was granted stock options with an exercise price of $55.00 per share.Refer to the week-ending stock prices that occurred during the quarter.If Movin On Up engaged in the practice of backdating,which of the following is the most likely exercise price for Billy's options?

A)$65.52

B)$67.50

C)$65.00

D)$56.82

E)$57.23

The following are the week-ending stock prices that occurred during the quarter:

Billy,the CEO of Movin On Up Company,was granted stock options with an exercise price of $55.00 per share.Refer to the week-ending stock prices that occurred during the quarter.If Movin On Up engaged in the practice of backdating,which of the following is the most likely exercise price for Billy's options?

A)$65.52

B)$67.50

C)$65.00

D)$56.82

E)$57.23

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following countries has employees appoint some board members?

A)Canada

B)the United States

C)Turkey

D)Germany

E)Australia

A)Canada

B)the United States

C)Turkey

D)Germany

E)Australia

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

36

________ is a person making a trade based on privileged information.

A)Rogue trading

B)Illegal trading

C)Standard trading

D)Insider trading

E)Exchange trading

A)Rogue trading

B)Illegal trading

C)Standard trading

D)Insider trading

E)Exchange trading

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

37

Academic studies have shown that greater managerial ownership is associated with greater value-reducing actions by managers.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

38

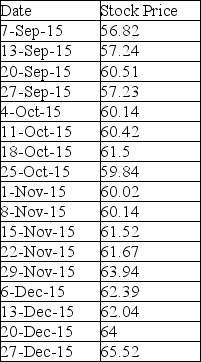

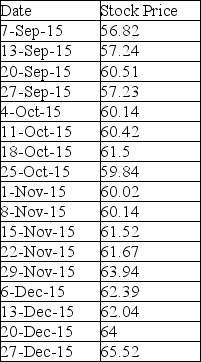

Use the table for the question(s)below.

The following are the week-ending stock prices that occurred during the quarter:

Billy,the CEO of Movin On Up Company,was granted stock options with an exercise price of $62.04 per share.Refer to the week-ending stock prices that occurred during the quarter.What is the most likely date on which the stock options were awarded?

A)13-Sep-15

B)11-Oct-15

C)13-Dec-15

D)25-Oct-15

E)7-Sep-15

The following are the week-ending stock prices that occurred during the quarter:

Billy,the CEO of Movin On Up Company,was granted stock options with an exercise price of $62.04 per share.Refer to the week-ending stock prices that occurred during the quarter.What is the most likely date on which the stock options were awarded?

A)13-Sep-15

B)11-Oct-15

C)13-Dec-15

D)25-Oct-15

E)7-Sep-15

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

39

What are some of the negative effects of increasing the sensitivity of managerial pay to firm performance?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

40

Activist investors can only achieve their goals by putting their issues to a shareholder vote.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

41

Explain what it means for a firm to have dual class shares.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

42

The conflict of interest that arises when a shareholder who has a controlling interest in multiple firms moves profits away from companies in which he has relatively less cash flow rights toward firms in which he has relatively more cash flow rights is called:

A)expropriation.

B)earnings management.

C)tunnelling.

D)profit mining.

E)cash extraction.

A)expropriation.

B)earnings management.

C)tunnelling.

D)profit mining.

E)cash extraction.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

43

The Smith family has a 62% stake in A company and A company has a 34% stake in B company.Finally,B company has a 29% stake in C company.What percentage ownership does the Smith family have in C company?

A)21%

B)18%

C)10%

D)29%

E)6%

A)21%

B)18%

C)10%

D)29%

E)6%

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

44

Describe the "stakeholder" model of corporate governance.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

45

The Smith family has a 55% stake in A company and A company has a 64% stake in B company.Finally,B company has a 51% stake in C company.What percentage ownership does the Smith family have in C company?

A)33%

B)28%

C)55%

D)51%

E)18%

A)33%

B)28%

C)55%

D)51%

E)18%

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

46

One way for families to gain control over firms,even when they do not own more than half the shares,is to issue:

A)dual class shares.

B)more debt.

C)more equity.

D)restricted shares.

E)commercial paper.

A)dual class shares.

B)more debt.

C)more equity.

D)restricted shares.

E)commercial paper.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following best describes a pyramid structure?

A)an investor owns less than 50% of a company,and this company owns less than 50% of another company

B)an investor owns more than 50% of a company,and this company owns less than 50% of another company

C)an investor owns more than 50% of a company,and this company owns more than 50% of another company

D)an investor owns less than 50% of a company,and this company owns more than 50% of another company

E)an investor owns less than 50% of a company,and this company owns 100% of another company

A)an investor owns less than 50% of a company,and this company owns less than 50% of another company

B)an investor owns more than 50% of a company,and this company owns less than 50% of another company

C)an investor owns more than 50% of a company,and this company owns more than 50% of another company

D)an investor owns less than 50% of a company,and this company owns more than 50% of another company

E)an investor owns less than 50% of a company,and this company owns 100% of another company

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

48

How does a pyramid structure work?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

49

Having a founder and top executive also be a major shareholder:

A)always results in agency conflicts that are bad for minority shareholders.

B)can sometimes,as in the case of Google,have benefits that outweigh the costs.

C)is illegal in Canada and most other industrialized countries.

D)is never beneficial to employees.

E)inevitably leads to insider trading.

A)always results in agency conflicts that are bad for minority shareholders.

B)can sometimes,as in the case of Google,have benefits that outweigh the costs.

C)is illegal in Canada and most other industrialized countries.

D)is never beneficial to employees.

E)inevitably leads to insider trading.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

50

The Smith family has a 45% stake in A company and A company has a 75% stake in B company.Finally,B company has a 35% stake in C company.What percentage ownership does the Smith family have in C company?

A)21%

B)12%

C)34%

D)26%

E)16%

A)21%

B)12%

C)34%

D)26%

E)16%

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

51

What is tunnelling?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

52

In many countries outside the United States,the central conflict is not between managers and shareholders,but instead between ________ and ________.

A)managers,regulators

B)the board of directors,shareholders

C)controlling shareholders,minority shareholders

D)insiders,outsiders

E)managers,the board of directors

A)managers,regulators

B)the board of directors,shareholders

C)controlling shareholders,minority shareholders

D)insiders,outsiders

E)managers,the board of directors

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

53

The costs and benefits of a corporate governance structure:

A)are the same in all countries.

B)are the same for all companies within a country.

C)depend on cultural norms.

D)are not important in maximizing shareholder wealth.

E)are easily quantified.

A)are the same in all countries.

B)are the same for all companies within a country.

C)depend on cultural norms.

D)are not important in maximizing shareholder wealth.

E)are easily quantified.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck