Deck 14: Money, Banking, and Money Creation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/203

Play

Full screen (f)

Deck 14: Money, Banking, and Money Creation

1

Money functions as:

A) a store of value.

B) a unit of account.

C) a medium of exchange.

D) all of the above.

A) a store of value.

B) a unit of account.

C) a medium of exchange.

D) all of the above.

all of the above.

2

The paper money used in Canada is:

A) National Bank notes.

B) Treasury notes of 1890.

C) Canada notes.

D) Bank of Canada notes.

A) National Bank notes.

B) Treasury notes of 1890.

C) Canada notes.

D) Bank of Canada notes.

Bank of Canada notes.

3

Demand deposits are:

A) included in M1.

B) not included in either M1 or M2.

C) considered to be a near money.

D) also called notice deposits.

A) included in M1.

B) not included in either M1 or M2.

C) considered to be a near money.

D) also called notice deposits.

included in M1.

4

Coins held in chartered banks are:

A) included in M1,but not in M2.

B) included both in M1 and in M2.

C) included in M2,but not in M1.

D) not part of the nation's money supply.

A) included in M1,but not in M2.

B) included both in M1 and in M2.

C) included in M2,but not in M1.

D) not part of the nation's money supply.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

5

When a consumer wants to compare the price of one product with another,money is primarily functioning as a:

A) store of value.

B) unit of account.

C) chequable deposit.

D) medium of exchange.

A) store of value.

B) unit of account.

C) chequable deposit.

D) medium of exchange.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

6

What function is money serving when you deposit money in a savings account?

A) a store of value

B) a unit of account

C) a chequable deposit

D) a medium of exchange

A) a store of value

B) a unit of account

C) a chequable deposit

D) a medium of exchange

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

7

Refer to the information below.The M1 definition of money comprises item(s):

1)Foreign currency deposits of residents booked in Canada

2)Personal savings deposits

3)Currency (coins and paper money)

4)Demand deposits

5)Government securities

6)Nonpersonal notice deposits

A) 3 only.

B) 2,3,and 6.

C) 3 and 4.

D) 3,4,and 6.

1)Foreign currency deposits of residents booked in Canada

2)Personal savings deposits

3)Currency (coins and paper money)

4)Demand deposits

5)Government securities

6)Nonpersonal notice deposits

A) 3 only.

B) 2,3,and 6.

C) 3 and 4.

D) 3,4,and 6.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

8

When we say that money serves as a medium of exchange,we mean that it is:

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

9

Money eliminates the need for a coincidence of wants primarily through its use as a:

A) unit of account.

B) medium of exchange

C) store of value.

D) standard of confidence.

A) unit of account.

B) medium of exchange

C) store of value.

D) standard of confidence.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

10

What function is money serving when you buy a ticket to a movie?

A) a store of value

B) a unit of account

C) a transaction demand

D) a medium of exchange

A) a store of value

B) a unit of account

C) a transaction demand

D) a medium of exchange

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

11

The functions of money are to serve as a:

A) resource allocator,method for accounting,and means of income distribution.

B) unit of account,store of value,and medium of exchange.

C) determinant of consumption,investment,and government spending.

D) factor of production,exchange,and aggregate supply.

A) resource allocator,method for accounting,and means of income distribution.

B) unit of account,store of value,and medium of exchange.

C) determinant of consumption,investment,and government spending.

D) factor of production,exchange,and aggregate supply.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

12

When we say that money serves as a store of value,we mean that it is:

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

13

If you are estimating your total expenses for school next semester,you are using money as:

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) all of the above.

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) all of the above.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

14

Stock market price quotations best exemplify money serving as a:

A) store of value.

B) unit of account.

C) medium of exchange.

D) index of satisfaction.

A) store of value.

B) unit of account.

C) medium of exchange.

D) index of satisfaction.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

15

A $200 price tag on a cashmere sweater in a department store window is an example of money functioning as a:

A) unit of account.

B) standard of deferred payments.

C) store of value.

D) medium of exchange.

A) unit of account.

B) standard of deferred payments.

C) store of value.

D) medium of exchange.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

16

One major advantage of the medium of exchange function of money is that it allows society to:

A) transfer purchasing power from the present to the future.

B) measure the relative worth of products.

C) escape the complications of barter.

D) use credit cards instead of currency.

A) transfer purchasing power from the present to the future.

B) measure the relative worth of products.

C) escape the complications of barter.

D) use credit cards instead of currency.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

17

In Canada the money supply (M1)is comprised of:

A) coins,paper currency,and demand deposits.

B) currency,notice deposits,and bonds.

C) coins,paper currency,demand deposits,and credit balances with brokers.

D) paper currency,coin,gold certificates,and time deposits.

A) coins,paper currency,and demand deposits.

B) currency,notice deposits,and bonds.

C) coins,paper currency,demand deposits,and credit balances with brokers.

D) paper currency,coin,gold certificates,and time deposits.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

18

If you write a cheque on a Saskatoon bank to purchase a new Honda Civic,you are employing money as:

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) all of the above.

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) all of the above.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

19

Purchasing common stock by writing a cheque best exemplifies money serving as a:

A) store of value.

B) unit of account.

C) medium of exchange.

D) index of satisfaction.

A) store of value.

B) unit of account.

C) medium of exchange.

D) index of satisfaction.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

20

When we say that money serves as a unit of account,we mean that it is:

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

A) a way to keep some of our wealth in a readily spendable form for future use.

B) a means of payment.

C) a monetary unit for measuring and comparing the relative values of goods.

D) declared as legal tender by the government.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

21

In 2011,the value of M2++ in Canada was about:

A) $182 billion.

B) $1092 billion.

C) $233 billion.

D) $2063 billion.

A) $182 billion.

B) $1092 billion.

C) $233 billion.

D) $2063 billion.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

22

1. Foreign currency deposits of residents booked in Canada

2. Personal savings deposits at the chartered banks

3. Currency (coins and paper money)

4. Demand deposits

5. Government securities

6. Non-personal notice deposits at the chartered banks

Refer to the above information. Which of the following is not included in any of the official definitions of money?

A)item 1

B)items 1 and 4

C)no item

D)item 5

2. Personal savings deposits at the chartered banks

3. Currency (coins and paper money)

4. Demand deposits

5. Government securities

6. Non-personal notice deposits at the chartered banks

Refer to the above information. Which of the following is not included in any of the official definitions of money?

A)item 1

B)items 1 and 4

C)no item

D)item 5

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

23

A basic argument for using the M1 concept of money is that:

A) it includes all of the important financial assets that have any degree of liquidity.

B) the government collects data for the components of M1,but does not do so for M2 and M2+.

C) its components are superior to other financial assets as a store of value.

D) its components are directly and immediately spendable.

A) it includes all of the important financial assets that have any degree of liquidity.

B) the government collects data for the components of M1,but does not do so for M2 and M2+.

C) its components are superior to other financial assets as a store of value.

D) its components are directly and immediately spendable.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

24

Near money means:

A) Money substitutes such as credit cards

B) Chequing accounts

C) They are not backed by gold

D) They do not function as a medium of exchange but they serve as a store of value

A) Money substitutes such as credit cards

B) Chequing accounts

C) They are not backed by gold

D) They do not function as a medium of exchange but they serve as a store of value

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

25

Coins and paper money are:

A) debts of Chartered banks and savings institutions.

B) debts of the Bank of Canada.

C) credits of the Bank of Canada.

D) credits of chartered banks and savings institutions.

A) debts of Chartered banks and savings institutions.

B) debts of the Bank of Canada.

C) credits of the Bank of Canada.

D) credits of chartered banks and savings institutions.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

26

One reason that "near-monies" are important is because:

A) they simplify the definition of money and therefore the formulation of monetary policy.

B) they can be easily converted into money or vice versa,and thereby can influence the stability of the economy.

C) they do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy.

D) credit cards synchronize one's expenditures and income,thereby reducing the cash and chequeable deposits one must hold.

A) they simplify the definition of money and therefore the formulation of monetary policy.

B) they can be easily converted into money or vice versa,and thereby can influence the stability of the economy.

C) they do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy.

D) credit cards synchronize one's expenditures and income,thereby reducing the cash and chequeable deposits one must hold.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

27

The major component of the money supply (M1)is:

A) gold certificates.

B) demand deposits.

C) paper money in circulation.

D) coins.

A) gold certificates.

B) demand deposits.

C) paper money in circulation.

D) coins.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

28

The difference between M1 and M2 is that:

A) the former includes notice deposits.

B) the latter includes personal saving deposits and non-personal notice deposits.

C) the latter includes government bonds.

D) the latter includes cash held by chartered banks.

A) the former includes notice deposits.

B) the latter includes personal saving deposits and non-personal notice deposits.

C) the latter includes government bonds.

D) the latter includes cash held by chartered banks.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

29

Currency and coins held within chartered banks are:

A) part of the M2+ definition of the money supply.

B) part of the M2 definition of the money supply.

C) part of the M1 definition of the money supply.

D) not part of the definitions of the money supply.

A) part of the M2+ definition of the money supply.

B) part of the M2 definition of the money supply.

C) part of the M1 definition of the money supply.

D) not part of the definitions of the money supply.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

30

Currency (paper money plus coins)constitute about:

A) 80 percent of our M1 money supply.

B) 55 percent of our M1 money supply.

C) 24% percent of our M1 money supply.

D) 68 percent of our M1 money supply.

A) 80 percent of our M1 money supply.

B) 55 percent of our M1 money supply.

C) 24% percent of our M1 money supply.

D) 68 percent of our M1 money supply.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

31

Demand deposits are classified as money because:

A) they can be readily used in the making of purchases and payment of debts.

B) banks hold currency equal to the value of their outstanding deposits.

C) they are ultimately the obligations of the government.

D) they earn interest income for the depositor.

A) they can be readily used in the making of purchases and payment of debts.

B) banks hold currency equal to the value of their outstanding deposits.

C) they are ultimately the obligations of the government.

D) they earn interest income for the depositor.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

32

In terms of volume or dollar amount,most of the money in our economy is created by:

A) the receipt of gold bullion through international trade and finance.

B) chartered banks and the Bank of Canada.

C) the Royal Canadian mint.

D) the Department of Finance.

A) the receipt of gold bullion through international trade and finance.

B) chartered banks and the Bank of Canada.

C) the Royal Canadian mint.

D) the Department of Finance.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

33

1. Foreign currency deposits of residents booked in Canada

2. Personal savings deposits at the chartered banks

3. Currency (coins and paper money)

4. Demand deposits

5. Government securities

6. Non-personal notice deposits at the chartered banks

Refer to the above information.The M2 definition of money includes:

A) items 1,2,3,and 6.

B) items 3,4,5,and 6.

C) items 2,3,4,and 6.

D) items 1,2,3,and 4.

2. Personal savings deposits at the chartered banks

3. Currency (coins and paper money)

4. Demand deposits

5. Government securities

6. Non-personal notice deposits at the chartered banks

Refer to the above information.The M2 definition of money includes:

A) items 1,2,3,and 6.

B) items 3,4,5,and 6.

C) items 2,3,4,and 6.

D) items 1,2,3,and 4.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

34

Token money is:

A) minted by the Bank of Canada.

B) minted by the Royal Canadian mint.

C) minted by the Treasury of Canada.

D) not considered to be part of the money supply.

A) minted by the Bank of Canada.

B) minted by the Royal Canadian mint.

C) minted by the Treasury of Canada.

D) not considered to be part of the money supply.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

35

The smallest component of the money supply (M1)is:

A) currency.

B) chequable deposits.

C) small time deposits.

D) large time deposits.

A) currency.

B) chequable deposits.

C) small time deposits.

D) large time deposits.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

36

The amount of money reported as M2:

A) is smaller than the amount reported as M1.

B) is larger than the amount reported as M1.

C) excludes coins and currency.

D) includes nonpersonal fixed-term deposits of residents booked in Canada.

A) is smaller than the amount reported as M1.

B) is larger than the amount reported as M1.

C) excludes coins and currency.

D) includes nonpersonal fixed-term deposits of residents booked in Canada.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

37

Refer to the above information.Which of the following is not included in any of the official definitions of money?

A) item 1

B) items 1 and 4

C) no item

D) item 5

A) item 1

B) items 1 and 4

C) no item

D) item 5

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

38

The M2+ definition of the money supply includes:

A) M1 plus the M2.

B) M2 plus the coins and paper money held by the chartered banks.

C) M2 plus the deposits at trust and mortgage companies,credit unions,caisses populaires,and government savings institutions,plus money market mutual funds and life insurance annuities.

D) M2 plus the government securities held by the chartered banks.

A) M1 plus the M2.

B) M2 plus the coins and paper money held by the chartered banks.

C) M2 plus the deposits at trust and mortgage companies,credit unions,caisses populaires,and government savings institutions,plus money market mutual funds and life insurance annuities.

D) M2 plus the government securities held by the chartered banks.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

39

Near-monies are important:

A) because they are likely to affect the level of consumer spending.

B) because they can be converted into chequable deposits and thereby affect macroeconomic stability.

C) because they complicate defining money and therefore complicate the formulation of monetary policy.

D) for all of the above reasons.

A) because they are likely to affect the level of consumer spending.

B) because they can be converted into chequable deposits and thereby affect macroeconomic stability.

C) because they complicate defining money and therefore complicate the formulation of monetary policy.

D) for all of the above reasons.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

40

Demand deposits are:

A) included in M1 but not in M2.

B) considered to be a near-money.

C) included in M1 and in M2.

D) also called notice deposits.

A) included in M1 but not in M2.

B) considered to be a near-money.

C) included in M1 and in M2.

D) also called notice deposits.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements best describes the relationship between the real value or purchasing power of the monetary unit and the price level? The purchasing power of money:

A) and the price level varies inversely.

B) and the price level vary directly during recessions,but inversely during inflations.

C) and the price level vary directly,but not proportionately.

D) and the price level vary directly and proportionately.

A) and the price level varies inversely.

B) and the price level vary directly during recessions,but inversely during inflations.

C) and the price level vary directly,but not proportionately.

D) and the price level vary directly and proportionately.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

42

The value of money varies:

A) inversely with the price level.

B) directly with the volume of employment.

C) directly with the price level.

D) directly with the interest rate.

A) inversely with the price level.

B) directly with the volume of employment.

C) directly with the price level.

D) directly with the interest rate.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

43

If we let P equal the price level expressed as an index number and D equal the value of the dollar,then we can say that:

A) P = D - 1.

B) D = 1/P.

C) 1 = D/P.

D) D = P - 1.

A) P = D - 1.

B) D = 1/P.

C) 1 = D/P.

D) D = P - 1.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

44

Fiat money is valuable because:

A) it is backed by gold.

B) it is fractionally backed by gold.

C) it is generally acceptable.

D) it is convertible to gold.

A) it is backed by gold.

B) it is fractionally backed by gold.

C) it is generally acceptable.

D) it is convertible to gold.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

45

Demand deposits are:

A) debts of chartered banks and other financial institutions.

B) debts of the Bank of Canada.

C) credits of the Bank of Canada.

D) credits of chartered banks and other financial institutions.

A) debts of chartered banks and other financial institutions.

B) debts of the Bank of Canada.

C) credits of the Bank of Canada.

D) credits of chartered banks and other financial institutions.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

46

Other things being equal,we would expect an excessive increase in the supply of money to:

A) increase the purchasing power of each dollar.

B) decrease the purchasing power of each dollar.

C) have no impact upon the purchasing power of the dollar.

D) cause the price level to fall.

A) increase the purchasing power of each dollar.

B) decrease the purchasing power of each dollar.

C) have no impact upon the purchasing power of the dollar.

D) cause the price level to fall.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

47

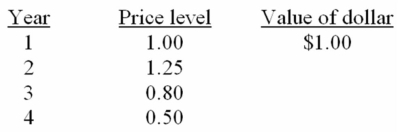

Refer to the above information.The value of the dollar in year 3 is:

A) $1.00.

B) $1.25.

C) $.80.

D) $.50.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

48

The prime rate is:

A) the interest rate charged by the chartered banks in Canada for lending to their best corporate customers.

B) the interest rate charged by the chartered banks in Canada for lending to other financial intermediaries.

C) the interest rate charged by the chartered banks in Canada for lending to the Federal government.

D) the interest rate charged by the chartered banks in Canada for lending to the trust companies.

A) the interest rate charged by the chartered banks in Canada for lending to their best corporate customers.

B) the interest rate charged by the chartered banks in Canada for lending to other financial intermediaries.

C) the interest rate charged by the chartered banks in Canada for lending to the Federal government.

D) the interest rate charged by the chartered banks in Canada for lending to the trust companies.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

49

The two basic functions of the Canadian chartered banks and saving institutions are:

A) making loans to the public and the federal government.

B) holding the money deposits of businesses and households,and making loans to the public.

C) holding the money deposits of businesses and households,and lending to the federal government.

D) creating money and lending to the federal government.

A) making loans to the public and the federal government.

B) holding the money deposits of businesses and households,and making loans to the public.

C) holding the money deposits of businesses and households,and lending to the federal government.

D) creating money and lending to the federal government.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

50

When we say that the Canadian banking system is fractional reserve system,it means:

A) chartered banks loan out only a small fraction of their deposits.

B) chartered banks have to keep a large percentage of their deposit to meet everyday cash withdrawals.

C) chartered banks loan out the entire deposits and do not have to meet their everyday cash withdrawal.

D) chartered banks loan out most of their deposits,keeping only a small percentage of their deposits to meet everyday cash withdrawals.

A) chartered banks loan out only a small fraction of their deposits.

B) chartered banks have to keep a large percentage of their deposit to meet everyday cash withdrawals.

C) chartered banks loan out the entire deposits and do not have to meet their everyday cash withdrawal.

D) chartered banks loan out most of their deposits,keeping only a small percentage of their deposits to meet everyday cash withdrawals.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

51

If the price index rises from 100 to 130,the value of the dollar will fall by about:

A) 15 percent.

B) 19 percent.

C) 30 percent.

D) 23 percent.

A) 15 percent.

B) 19 percent.

C) 30 percent.

D) 23 percent.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

52

A 15 percent increase in the price

A) increases the value of a dollar by 15 percent.

B) decreases the value of a dollar by about 13 percent.

C) decreases the value of a dollar by 15 percent.

D) decreases the value of a dollar by about 8 percent.

A) increases the value of a dollar by 15 percent.

B) decreases the value of a dollar by about 13 percent.

C) decreases the value of a dollar by 15 percent.

D) decreases the value of a dollar by about 8 percent.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

53

The purchasing power of the dollar:

A) has been increasing in recent years because of economic growth.

B) varies directly with the cost-of-living index.

C) is inversely related to the level of aggregate demand.

D) is the reciprocal of the price level.

A) has been increasing in recent years because of economic growth.

B) varies directly with the cost-of-living index.

C) is inversely related to the level of aggregate demand.

D) is the reciprocal of the price level.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

54

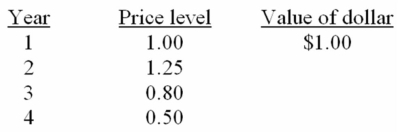

Refer to the above information.The value of the dollar in year 2 is:

A) $1.25.

B) $1.33.

C) $.80.

D) $1.00.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

55

A $20 bill is an example of:

A) legal tender.

B) fiat money.

C) a store of value.

D) all of the above.

A) legal tender.

B) fiat money.

C) a store of value.

D) all of the above.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

56

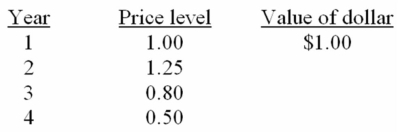

Refer to the above information.The value of the dollar in year 4 is:

A) $.25.

B) $.33.

C) $.50.

D) $2.00.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

57

If the price index rises from 100 to 120,the value of the dollar:

A) may either rise or fall.

B) will rise by 16.67 percent.

C) will fall by 16.67 percent.

D) will rise by 20 percent.

A) may either rise or fall.

B) will rise by 16.67 percent.

C) will fall by 16.67 percent.

D) will rise by 20 percent.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

58

The money supply is "backed":

A) by the government's ability to control the supply of money and therefore to keep its value relatively stable.

B) by government bonds.

C) dollar-for-dollar with gold and silver.

D) dollar-for-dollar with gold bullion.

A) by the government's ability to control the supply of money and therefore to keep its value relatively stable.

B) by government bonds.

C) dollar-for-dollar with gold and silver.

D) dollar-for-dollar with gold bullion.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

59

Currency and demand deposits are money because:

A) they are backed by a precious metal.

B) the government asserts that they are.

C) they are "resting" in a chartered bank vault.

D) they can be redeemed for an intrinsically valuable commodity such as gold.

A) they are backed by a precious metal.

B) the government asserts that they are.

C) they are "resting" in a chartered bank vault.

D) they can be redeemed for an intrinsically valuable commodity such as gold.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

60

If the value of the dollar is falling,then it follows that:

A) the price index is falling.

B) the price index is rising.

C) real incomes are falling.

D) interest rates are rising.

A) the price index is falling.

B) the price index is rising.

C) real incomes are falling.

D) interest rates are rising.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is not correct?

A) The actual cash reserves of a chartered bank equal its excess plus its desired reserves.

B) A bank's assets plus its net worth equal its liabilities.

C) When borrowers repay bank loans,the supply of money is reduced.

D) A single chartered bank can safely lend an amount equal to its excess reserves.

A) The actual cash reserves of a chartered bank equal its excess plus its desired reserves.

B) A bank's assets plus its net worth equal its liabilities.

C) When borrowers repay bank loans,the supply of money is reduced.

D) A single chartered bank can safely lend an amount equal to its excess reserves.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

62

A bank owns a 10-story office building.In the bank's balance sheet,this would be an example of:

A) an asset.

B) a liability.

C) stock shares.

D) a chequable deposit.

A) an asset.

B) a liability.

C) stock shares.

D) a chequable deposit.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

63

What is one significant characteristic of fractional reserve banking?

A) Banks are not subject to "panics" or "runs."

B) Banks use deposit insurance for loans to customers.

C) Bank loans will be equal to the amount of gold on deposit.

D) Banks can create money through lending their reserves.

A) Banks are not subject to "panics" or "runs."

B) Banks use deposit insurance for loans to customers.

C) Bank loans will be equal to the amount of gold on deposit.

D) Banks can create money through lending their reserves.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

64

Which one of the following is presently preventing bank panics in Canada?

A) the reserve requirement

B) the fractional reserve system

C) the gold standard

D) deposit insurance

A) the reserve requirement

B) the fractional reserve system

C) the gold standard

D) deposit insurance

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

65

Under the Canadian federal law,the institution that is in charge of inter-bank cheque system is called:

A) Canadian Financial Association.

B) Canadian Banking Association.

C) Canadian Payments Association.

D) Canadian Chartered Banks Association.

A) Canadian Financial Association.

B) Canadian Banking Association.

C) Canadian Payments Association.

D) Canadian Chartered Banks Association.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

66

Beside chartered banks,the Canadian banking system is supplemented by other financial intermediaries.These institutions include:

A) loan companies,trust companies,credit unions,and caisses populaires.

B) trust companies,the Bank of Canada and small size chartered banks.

C) trust companies,credit unions,and the Bank of Canada.

D) loan companies,trust companies and foreign banks.

A) loan companies,trust companies,credit unions,and caisses populaires.

B) trust companies,the Bank of Canada and small size chartered banks.

C) trust companies,credit unions,and the Bank of Canada.

D) loan companies,trust companies and foreign banks.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

67

A bank which has assets of $85 billion and a net worth of $10 billion must have:

A) liabilities of $75 billion.

B) excess reserves of $10 billion.

C) liabilities of $10 billion.

D) excess reserves of $75 billion.

A) liabilities of $75 billion.

B) excess reserves of $10 billion.

C) liabilities of $10 billion.

D) excess reserves of $75 billion.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

68

Mortgage-backed securities are:

A) stocks backed by mortgage payments.

B) bonds backed by mortgage payments.

C) homes that are backed by mortgage payments.

D) mortgages that are backed by the government.

A) stocks backed by mortgage payments.

B) bonds backed by mortgage payments.

C) homes that are backed by mortgage payments.

D) mortgages that are backed by the government.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

69

Subprime mortgage loans refer to:

A) low-interest rate loans by financial institutions to home buyers with higher-than -average credit risk.

B) high-interest rate loans by financial institutions to home buyers with higher-than -average credit risk.

C) high-interest rate loans by financial institutions to home buyers with no credit risk.

D) high-interest rate loans by financial institutions to home buyers with lower-than -average credit risk.

A) low-interest rate loans by financial institutions to home buyers with higher-than -average credit risk.

B) high-interest rate loans by financial institutions to home buyers with higher-than -average credit risk.

C) high-interest rate loans by financial institutions to home buyers with no credit risk.

D) high-interest rate loans by financial institutions to home buyers with lower-than -average credit risk.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

70

The claims of the owners of a firm against the firm's assets are called:

A) working capital.

B) assets.

C) net worth.

D) liabilities.

A) working capital.

B) assets.

C) net worth.

D) liabilities.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

71

In the fractional reserve banking system:

A) half of the total money supply is held in reserves as currency

B) a fraction of the total money supply is held in reserves as currency.

C) an amount equal to the total money supply is held in reserves as currency.

D) no fraction of the total money supply is held in reserves as currency.

A) half of the total money supply is held in reserves as currency

B) a fraction of the total money supply is held in reserves as currency.

C) an amount equal to the total money supply is held in reserves as currency.

D) no fraction of the total money supply is held in reserves as currency.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

72

The goldsmith's ability to create money was based on the fact that:

A) withdrawals of gold tended to exceed deposits of gold in any given time period.

B) consumers and merchants preferred to use gold for transactions,rather than paper money.

C) the goldsmith was required to keep 100 percent gold reserves.

D) paper money was rarely redeemed for gold.

A) withdrawals of gold tended to exceed deposits of gold in any given time period.

B) consumers and merchants preferred to use gold for transactions,rather than paper money.

C) the goldsmith was required to keep 100 percent gold reserves.

D) paper money was rarely redeemed for gold.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

73

A bank which has liabilities of $150 billion and a net worth of $20 billion must have:

A) excess reserves of $130 billion.

B) assets of $150 billion.

C) excess reserves of $150 billion.

D) assets of $170 billion.

A) excess reserves of $130 billion.

B) assets of $150 billion.

C) excess reserves of $150 billion.

D) assets of $170 billion.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following describes the fundamental identity embodied in a balance sheet?

A) Net Worth plus Assets equal Liabilities

B) Assets plus Liabilities equal Net Worth

C) Assets equal Liabilities plus Net Worth

D) Assets plus Reserves equal Net Worth

A) Net Worth plus Assets equal Liabilities

B) Assets plus Liabilities equal Net Worth

C) Assets equal Liabilities plus Net Worth

D) Assets plus Reserves equal Net Worth

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

75

The cause of the skyrocketing mortgage default rates was:

A) government programs that encouraged and subsidized home ownership for renters.

B) declining real estate values.

C) bad incentives provided by mortgage-backed bonds.

D) all of the above.

A) government programs that encouraged and subsidized home ownership for renters.

B) declining real estate values.

C) bad incentives provided by mortgage-backed bonds.

D) all of the above.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

76

Securatization is:

A) the process of slicing up and bundling groups of loans,mortgages,corporate bonds and other financial debts into distinct new securities.

B) the securing of loans,mortgages,corporate bonds and other financial debts by governments.

C) a guarantee that loans,mortgages,corporate bonds and other financial debts were secure.

D) the process of securing loans,mortgages,corporate bonds and other financial debts by insurance companies.

A) the process of slicing up and bundling groups of loans,mortgages,corporate bonds and other financial debts into distinct new securities.

B) the securing of loans,mortgages,corporate bonds and other financial debts by governments.

C) a guarantee that loans,mortgages,corporate bonds and other financial debts were secure.

D) the process of securing loans,mortgages,corporate bonds and other financial debts by insurance companies.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

77

When the receipts given by goldsmiths to depositors were used to make purchases:

A) the gold standard was created.

B) existing banking laws were violated.

C) the receipts became in effect paper money.

D) a fractional reserve banking system was created.

A) the gold standard was created.

B) existing banking laws were violated.

C) the receipts became in effect paper money.

D) a fractional reserve banking system was created.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

78

Most modern banking systems are based on:

A) money of intrinsic value.

B) commodity money.

C) 100 percent reserves.

D) fractional reserves.

A) money of intrinsic value.

B) commodity money.

C) 100 percent reserves.

D) fractional reserves.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

79

If a bank has liabilities exceeding its net worth:

A) it will not be able to meet its desired reserve ratio.

B) it is considered to be insolvent.

C) it most likely is a heavy borrower from the Bank of Canada.

D) none of the above is necessarily true.

A) it will not be able to meet its desired reserve ratio.

B) it is considered to be insolvent.

C) it most likely is a heavy borrower from the Bank of Canada.

D) none of the above is necessarily true.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck

80

The chartered banking system can lend by a multiple of its excess reserves primarily because:

A) its reserves are on deposit with the Bank of Canada

B) its reserves are highly liquid assets.

C) it loses reserves when it extends credit.

D) its reserves are fractional.

A) its reserves are on deposit with the Bank of Canada

B) its reserves are highly liquid assets.

C) it loses reserves when it extends credit.

D) its reserves are fractional.

Unlock Deck

Unlock for access to all 203 flashcards in this deck.

Unlock Deck

k this deck