Deck 22: The Master Budget and Responsibility Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

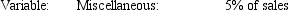

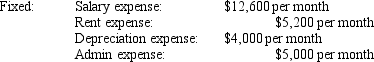

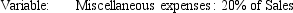

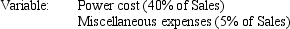

Question

Question

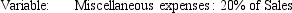

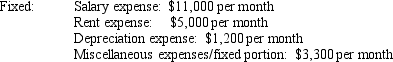

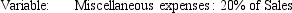

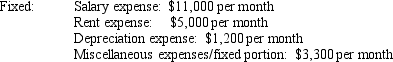

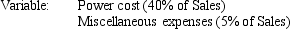

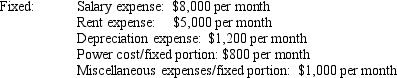

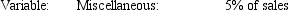

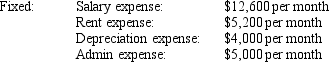

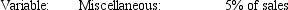

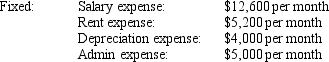

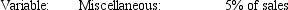

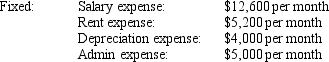

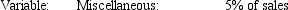

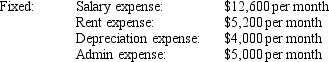

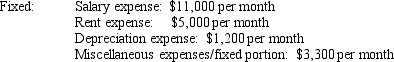

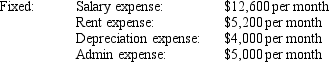

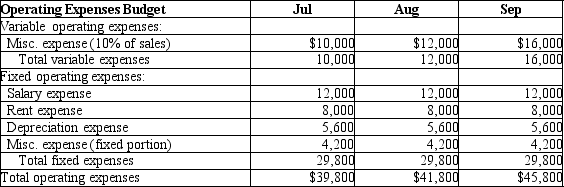

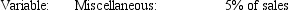

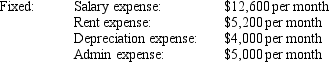

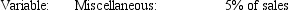

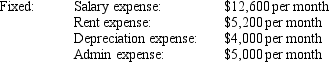

Question

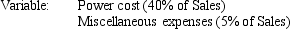

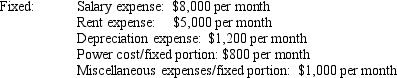

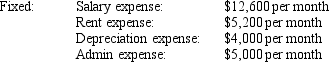

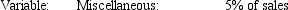

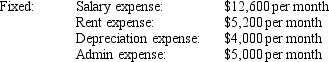

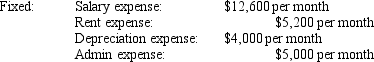

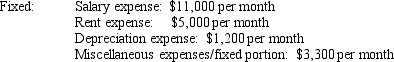

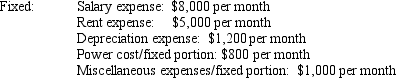

Question

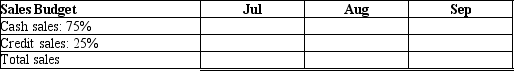

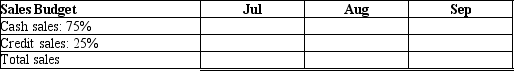

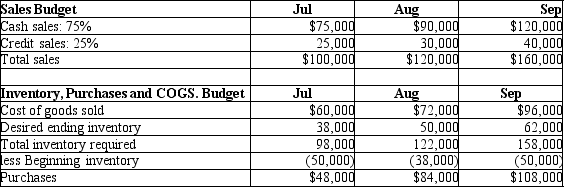

Question

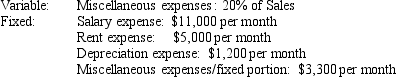

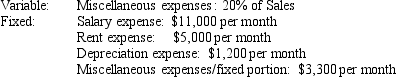

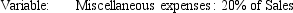

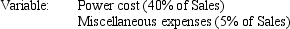

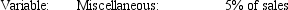

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

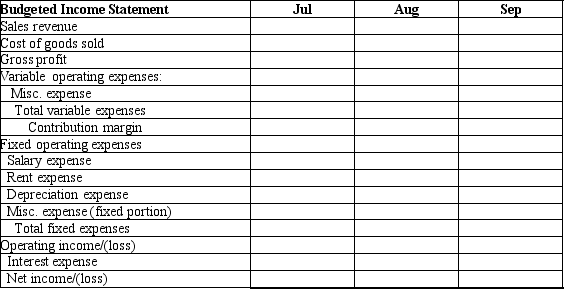

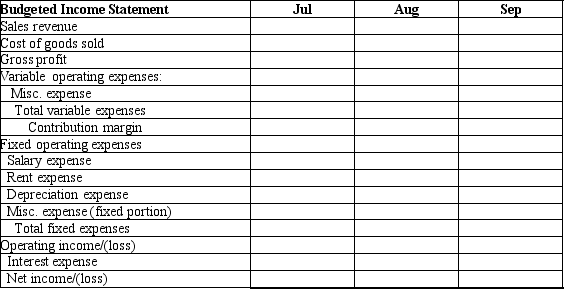

Question

Question

Question

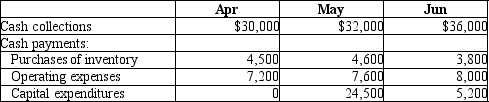

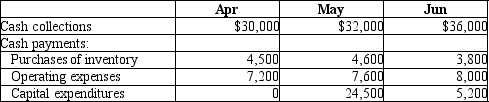

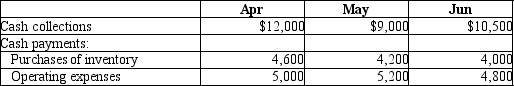

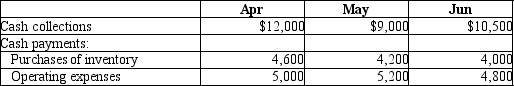

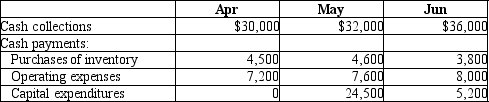

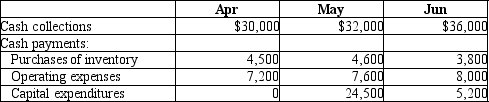

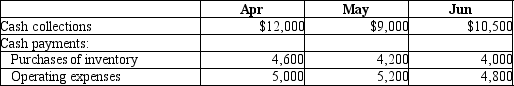

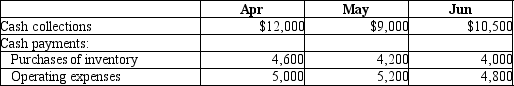

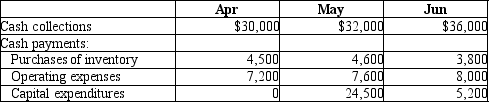

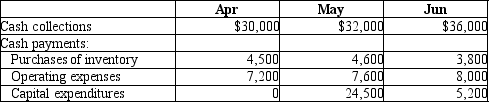

Question

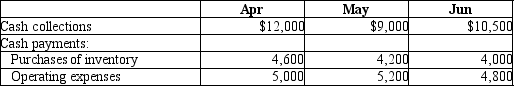

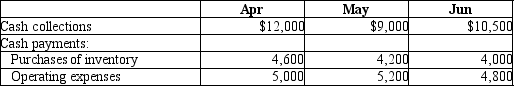

Question

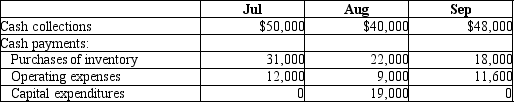

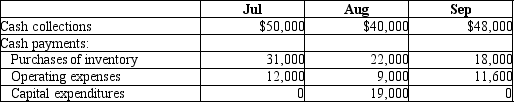

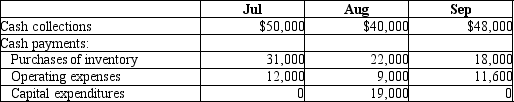

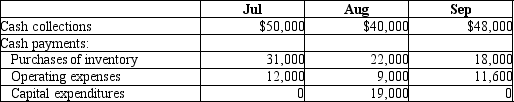

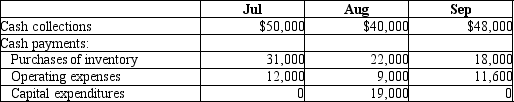

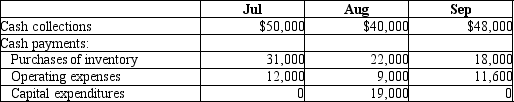

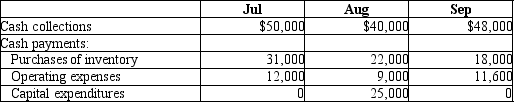

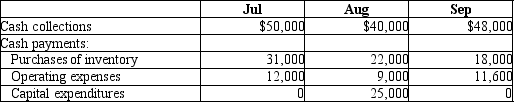

Question

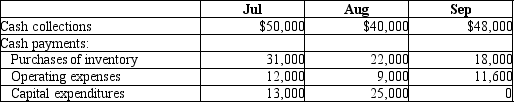

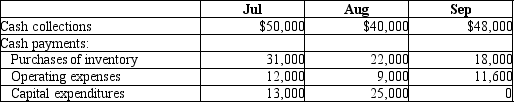

Question

Question

Question

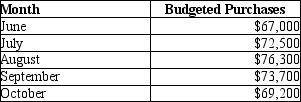

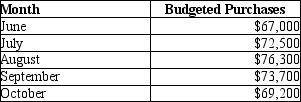

Question

Question

Question

Question

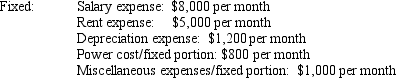

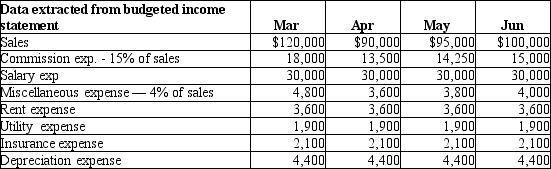

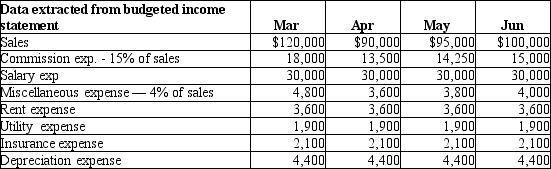

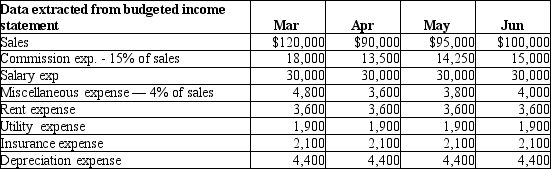

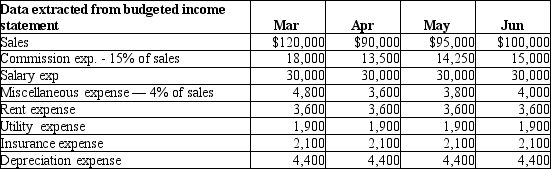

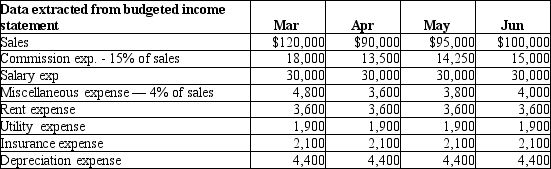

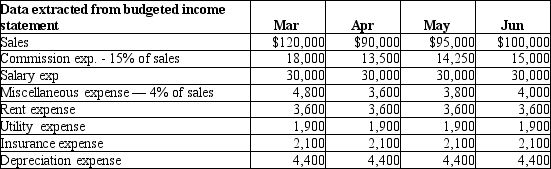

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/157

Play

Full screen (f)

Deck 22: The Master Budget and Responsibility Accounting

1

The capital expenditure budget is part of the operating budget.

False

2

The capital expenditure budget stands alone and is not part of either the operating budget or the financial budget.

True

3

A budget focuses primarily on financial information, but does not reflect specific business strategies.

False

4

Which of the following is an example of the benchmarking function of a budget?

A)A budget demands integrated input from different business units and functions.

B)Budgeting requires close cooperation between accountants and operational personnel.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

A)A budget demands integrated input from different business units and functions.

B)Budgeting requires close cooperation between accountants and operational personnel.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

5

The starting point in the budgeting process is the preparation of the:

A)cash budget.

B)budgeted statement of cash flows.

C)sales budget.

D)budgeted income statement.

A)cash budget.

B)budgeted statement of cash flows.

C)sales budget.

D)budgeted income statement.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following budgets focuses on the income statement and its supporting schedules?

A)Operating budget

B)Cash budget

C)Capital expenditures budget

D)Sales budget

A)Operating budget

B)Cash budget

C)Capital expenditures budget

D)Sales budget

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

7

Management must get employees to accept the budget's goals in order to effectively use the budget as a benchmark for evaluating performance.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

8

The production budget must be prepared before any other component of the operating budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

9

Budgeting is a technique that is used to plan for future cash inflows and outflows.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a characteristic of the budgeting process?

A)The budget process aids in performance evaluation.

B)The budget process helps coordinate the activities of the organization.

C)The budget process forces management to plan ahead.

D)The budget process ensures that the business will make a profit.

A)The budget process aids in performance evaluation.

B)The budget process helps coordinate the activities of the organization.

C)The budget process forces management to plan ahead.

D)The budget process ensures that the business will make a profit.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

11

Budgets provide benchmarks that help managers evaluate performance.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an example of the coordination and communication function of a budget?

A)A budget demands integrated input from different business units and functions.

B)Employees are motivated to achieve the goals set by the budget.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

A)A budget demands integrated input from different business units and functions.

B)Employees are motivated to achieve the goals set by the budget.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

13

The master budget includes 3 components-the operating budget, the capital expenditures budget and the financial budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

14

A budgeted income statement is based on estimated amounts and not actual amounts.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

15

A goal of the budgeting process is to communicate a consistent set of plans throughout the company.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

16

In preparing an operating budget, the sales budget is prepared first. Which of the following is the last component of the operating budget?

A)Capital expenditures

B)Budgeted income statement

C)Operating expenses

D)Inventory, purchases and cost of goods sold

A)Capital expenditures

B)Budgeted income statement

C)Operating expenses

D)Inventory, purchases and cost of goods sold

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an example of the planning function of a budget?

A)A budget demands integrated input from different business units and functions.

B)Employees are motivated to achieve the goals set by the budget.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

A)A budget demands integrated input from different business units and functions.

B)Employees are motivated to achieve the goals set by the budget.

C)Budget figures are used to evaluate the performance of managers.

D)The budget outlines a specific course of action for the coming period.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements about budgeting is INCORRECT?

A)Budgeting is an accounting function and does not need involvement of operations personnel.

B)Budgeting is an aid to planning and control.

C)Budgets help to coordinate the activities of the entire organization.

D)Budgets promote communication and coordination between departments.

A)Budgeting is an accounting function and does not need involvement of operations personnel.

B)Budgeting is an aid to planning and control.

C)Budgets help to coordinate the activities of the entire organization.

D)Budgets promote communication and coordination between departments.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

19

In preparing an operating budget, the sales budget is prepared first. Which of the following is prepared next?

A)Capital expenditures

B)Budgeted income statement

C)Operating expenses

D)Inventory, purchases and cost of goods sold

A)Capital expenditures

B)Budgeted income statement

C)Operating expenses

D)Inventory, purchases and cost of goods sold

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

20

A goal of the budgeting process is to assist managers with coordinating and implementing the business plan.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following describes the sales budget?

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

22

The financial budget includes all of the following EXCEPT the:

A)budgeted balance sheet.

B)budgeted income statement.

C)cash budget.

D)budgeted statement of cash flows.

A)budgeted balance sheet.

B)budgeted income statement.

C)cash budget.

D)budgeted statement of cash flows.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

23

Argyle Company forecasts sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of the cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in January?

A)$21,000

B)$22,100

C)$26,400

D)$23,400

A)$21,000

B)$22,100

C)$26,400

D)$23,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

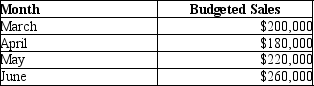

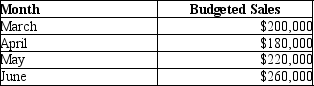

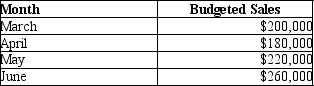

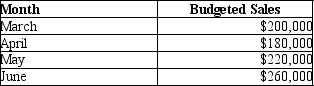

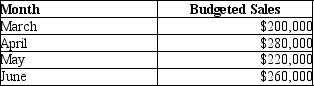

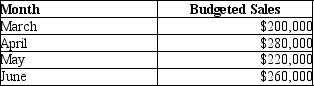

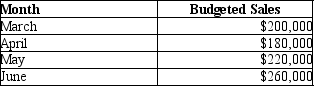

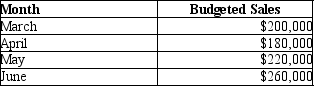

24

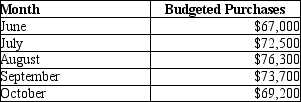

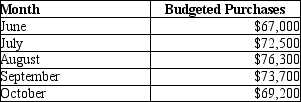

Norton Company prepared the following sales budget:  Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?

A)$36,000

B)$39,600

C)$43,200

D)$46,800

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. What is the desired beginning inventory on June 1?A)$36,000

B)$39,600

C)$43,200

D)$46,800

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

25

Lan Corporation had beginning inventory of $42,000 and expects cost of sales of $96,000 units during the month. Desired ending inventory is $31,000. How much inventory should Lan Corporation purchase?

A)$65,000

B)$73,000

C)$85,000

D)$107,000

A)$65,000

B)$73,000

C)$85,000

D)$107,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following describes the cash budget?

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

27

In order to prepare a budgeted income statement, several other budgets need to be prepared first. Which of the following is NOT one of the budgets needed to prepare the budgeted income statement?

A)Capital expenditures

B)Sales

C)Operating expenses

D)Inventory, purchases and cost of goods sold

A)Capital expenditures

B)Sales

C)Operating expenses

D)Inventory, purchases and cost of goods sold

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

28

A department store has budgeted cost of sales of $36,000 for its men's suits in March. Management also wants to have $15,000 of men's suits in inventory at the end of March to prepare for the summer season. Beginning inventory of men's suits for March is expected to be $9,000. What dollar amount of men's suits should be purchased in March?

A)$42,000

B)$45,000

C)$51,000

D)$60,000

A)$42,000

B)$45,000

C)$51,000

D)$60,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is TRUE about the operating budget?

A)It is a part of the financial budget.

B)It includes the capital expenditures budget.

C)It includes the operating expenses budget.

D)Its final component is the cash budget.

A)It is a part of the financial budget.

B)It includes the capital expenditures budget.

C)It includes the operating expenses budget.

D)Its final component is the cash budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

30

Norton Company prepared the following sales budget:  Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of March?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of March?

A)$214,400

B)$123,900

C)$134,400

D)$99,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of March?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of March?A)$214,400

B)$123,900

C)$134,400

D)$99,700

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is TRUE about the capital expenditures budget?

A)It is a part of the financial budget.

B)It must be completed before the budgeted income statement is prepared.

C)It includes the sales budget.

D)It must be completed before the cash budget can be prepared.

A)It is a part of the financial budget.

B)It must be completed before the budgeted income statement is prepared.

C)It includes the sales budget.

D)It must be completed before the cash budget can be prepared.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

32

Budgeted operating expenses for the current year include the expiration of insurance that was paid for in a previous period.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following describes the operating expenses budget?

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

34

Argyle Company forecasts sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in February?

A)$21,000

B)$22,100

C)$26,400

D)$23,400

A)$21,000

B)$22,100

C)$26,400

D)$23,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

35

Argyle Company forecasts Sales of $50,000 in January, $60,000 in February, $70,000 in March, and $75,000 in April. The inventory balance at January 1 is $12,000. Cost of goods sold is budgeted at 40% of sales revenue. Argyle wishes to have inventory levels at the end of each month equal to 60% of the cost of goods sold for the following month, plus a "safety cushion" of $1,000. How much should be budgeted for inventory purchases in March?

A)$21,000

B)$22,100

C)$29,200

D)$23,400

A)$21,000

B)$22,100

C)$29,200

D)$23,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

36

Liu Electronics budgeted sales of $400,000 for the month of November; cost of goods sold is equal to 65% of sales. Beginning inventory for November was $80,000 and ending inventory for November should be $72,000. How much are the budgeted purchases for November?

A)$252,000

B)$254,800

C)$264,800

D)$265,200

A)$252,000

B)$254,800

C)$264,800

D)$265,200

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

37

Norton Company prepared the following sales budget:  Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of May?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of May?

A)$139,200

B)$123,900

C)$108,200

D)$90,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of May?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of May?A)$139,200

B)$123,900

C)$108,200

D)$90,700

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

38

Norton Company prepared the following sales budget:  Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of April?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of April?

A)$157,200

B)$123,900

C)$134,400

D)$99,700

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of April?

Cost of goods sold is budgeted at 60% of sales, and the inventory at the end of February was $36,000. Desired inventory levels at the end of each month are 30% of the next month's cost of goods sold. How much are the budgeted purchases for the month of April?A)$157,200

B)$123,900

C)$134,400

D)$99,700

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following describes the inventory, purchases, and cost of goods sold budget?

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

A)It aids in planning to ensure the company has adequate inventory on hand.

B)It captures the variable and fixed expenses of the business.

C)It depicts the breakdown of sales based on terms of collection.

D)It helps in planning to ensure the business has adequate cash.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is TRUE about the financial budget?

A)It includes the capital expenditures budget.

B)It must be completed before the budgeted income statement is prepared.

C)It includes the sales budget.

D)It includes the cash budget and the budgeted balance sheet.

A)It includes the capital expenditures budget.

B)It must be completed before the budgeted income statement is prepared.

C)It includes the sales budget.

D)It includes the cash budget and the budgeted balance sheet.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

41

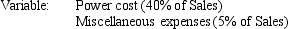

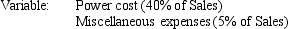

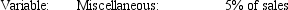

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

How much is the operating net income/(loss)for February?

How much is the operating net income/(loss)for February?

A)$3,500

B)$1,450

C)($500)

D)$7,500

How much is the operating net income/(loss)for February?

How much is the operating net income/(loss)for February?A)$3,500

B)$1,450

C)($500)

D)$7,500

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

42

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold. How much are budgeted purchases for March?

A)$22,800

B)$27,300

C)$29,700

D)$24,900

A)$22,800

B)$27,300

C)$29,700

D)$24,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

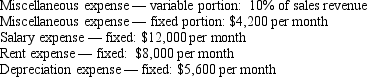

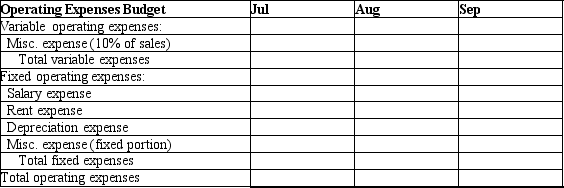

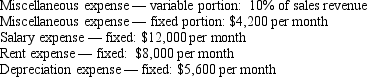

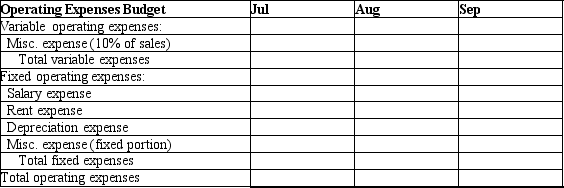

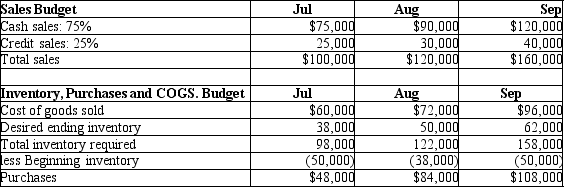

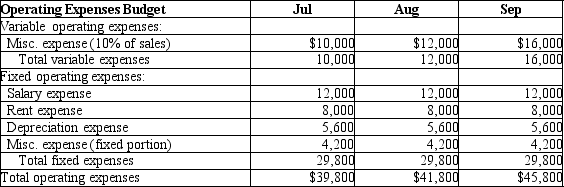

43

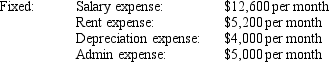

Hi-value Products Company is creating an operating budget for the 3rd quarter, and is now preparing the operating expense budget. Assumptions for operating expenses are as follows:

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Using the format below, please prepare an operating expense budget.

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.

Sales for July, August and September were budgeted at $100.000, $120,000, and $160,000.Using the format below, please prepare an operating expense budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

44

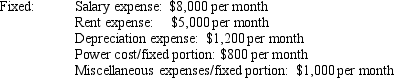

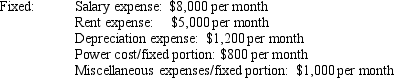

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

How much is the total operating expense for February?

How much is the total operating expense for February?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

How much is the total operating expense for February?

How much is the total operating expense for February? A)$38,500

B)$47,500

C)$41,700

D)$43,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

45

Hi-value Products Company is creating an operating budget for the 3rd quarter and will begin with a sales budget. Budgeted sales are $100,000 in July, $120,000 in August, and $160,000 in September. 75% of sales are cash and 25% of sales are on account. Please use the following format and prepare a sales budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

46

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much is the net operating income/(loss)in October?

How much is the net operating income/(loss)in October?

A)$6,200

B)$11,700

C)$7,480

D)$8,950

How much is the net operating income/(loss)in October?

How much is the net operating income/(loss)in October? A)$6,200

B)$11,700

C)$7,480

D)$8,950

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

47

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

How much is the operating net income/(loss)for March?

How much is the operating net income/(loss)for March?

A)$3,500

B)$1,450

C)($500)

D)$7,500

How much is the operating net income/(loss)for March?

How much is the operating net income/(loss)for March? A)$3,500

B)$1,450

C)($500)

D)$7,500

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

48

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

How much is the total operating expense for March?

How much is the total operating expense for March?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

How much is the total operating expense for March?

How much is the total operating expense for March? A)$38,500

B)$47,500

C)$41,700

D)$43,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

49

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much are the total operating expenses in November?

How much are the total operating expenses in November?

A)$29,800

B)$30,300

C)$30,050

D)$29,990

How much are the total operating expenses in November?

How much are the total operating expenses in November? A)$29,800

B)$30,300

C)$30,050

D)$29,990

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

50

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much is the net operating income/(loss)in December?

How much is the net operating income/(loss)in December?

A)$6,200

B)$11,700

C)$7,480

D)$8,950

How much is the net operating income/(loss)in December?

How much is the net operating income/(loss)in December? A)$6,200

B)$11,700

C)$7,480

D)$8,950

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

51

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much are the total operating expenses in December?

How much are the total operating expenses in December?

A)$29,800

B)$30,300

C)$30,050

D)$29,990

How much are the total operating expenses in December?

How much are the total operating expenses in December?A)$29,800

B)$30,300

C)$30,050

D)$29,990

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

52

Bartholomew Manufacturing Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Cost of goods sold is budgeted at 40% of Sales. Variable and fixed expenses are as follows:

How much is the operating net income/(loss)for January?

How much is the operating net income/(loss)for January?

A)$3,500

B)$1,450

C)( $500)

D)$7,500

How much is the operating net income/(loss)for January?

How much is the operating net income/(loss)for January? A)$3,500

B)$1,450

C)( $500)

D)$7,500

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

53

The cash budget can be prepared before the sales budget.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

54

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold. How much are budgeted purchases for January?

A)$22,800

B)$27,300

C)$29,700

D)$24,900

A)$22,800

B)$27,300

C)$29,700

D)$24,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

55

The budgeted cash collections for the current month typically take into consideration collections pertaining to credit sales of prior months.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

56

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

How much is the total operating expense for January?

How much is the total operating expense for January?

A)$38,500

B)$47,500

C)$41,700

D)$43,000

How much is the total operating expense for January?

How much is the total operating expense for January? A)$38,500

B)$47,500

C)$41,700

D)$43,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

57

Caskill Company forecasts $40,000 of sales in January, $38,000 in February, $30,000 in March, and $32,000 in April. Cost of goods sold is budgeted at 75% of sales. Caskill should have inventory on hand at the end of each month equal to $5,000 plus 20% of the following month's cost of goods sold. How much are budgeted purchases for February?

A)$22,800

B)$27,300

C)$29,700

D)$24,900

A)$22,800

B)$27,300

C)$29,700

D)$24,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

58

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much is the net operating income/(loss)in November?

How much is the net operating income/(loss)in November?

A)$6,200

B)$11,700

C)$7,480

D)$8,950

How much is the net operating income/(loss)in November?

How much is the net operating income/(loss)in November? A)$6,200

B)$11,700

C)$7,480

D)$8,950

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

59

Hi-value Products Company is creating an operating budget for the 3rd quarter. Please review the following budgets:

Using the format below, please prepare a budgeted income statement.

Using the format below, please prepare a budgeted income statement.

Using the format below, please prepare a budgeted income statement.

Using the format below, please prepare a budgeted income statement.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

60

Dahl Manufacturing is making its operating budget for the 4th quarter of 2012. Sales are forecast at $60,000 in October, $65,000 in November, and $70,000 in December. Cost of goods sold it 40% of sales. Expenses are budgeted as follows:

How much are the total operating expenses in October?

How much are the total operating expenses in October?

A)$29,800

B)$30,300

C)$30,050

D)$29,990

How much are the total operating expenses in October?

How much are the total operating expenses in October? A)$29,800

B)$30,300

C)$30,050

D)$29,990

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

61

The cash budget may be used to determine whether a company will need additional financing for the coming period.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

62

California Products Company has the following data as part of its budget for the 2nd quarter:  The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?

A)$26,500

B)$40,800

C)$33,900

D)$21,800

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at April 30?A)$26,500

B)$40,800

C)$33,900

D)$21,800

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

63

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:  There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of June?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of June?

A)$22,000

B)$21,900

C)$23,700

D)$22,400

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of June?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of June?A)$22,000

B)$21,900

C)$23,700

D)$22,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

64

Zygot Biotech Company is budgeting for the 3rd quarter, and provide the following data:  The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of August?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of August?

A)$21,000

B)$12,600

C)$18,000

D)$2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of August?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of August?A)$21,000

B)$12,600

C)$18,000

D)$2,600

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

65

AAA Company is preparing its 3rd quarter budget and provides the following data:  Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

How much cash shortfall will the company have at the end of July, before financing?

A)$2,000

B)$6,500

C)$5,000

D)$1,250

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.

Cash balance at June 30 is projected to be $4,000. The company is required to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and pays interest monthly at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. Loan balance should be repaid in increments of $5,000 when there is surplus cash.How much cash shortfall will the company have at the end of July, before financing?

A)$2,000

B)$6,500

C)$5,000

D)$1,250

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

66

Fast Foods has budgeted sales for June and July at $520,000 and $480,000, respectively. Sales are 80% credit, of which 50% is collected in the month of sale and 50% is collected in the following month. What is the accounts receivable balance on July 31?

A)$192,000

B)$240,000

C)$384,000

D)$400,000

A)$192,000

B)$240,000

C)$384,000

D)$400,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

67

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:  There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of May?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of May?

A)$22,000

B)$21,900

C)$23,700

D)$22,400

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of May?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of May?A)$22,000

B)$21,900

C)$23,700

D)$22,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

68

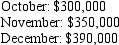

Della Company prepared the following purchases budget:  All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

What are the total cash payments made in October for purchases?

A)$77,680

B)$79,480

C)$69,330

D)$74,290

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.What are the total cash payments made in October for purchases?

A)$77,680

B)$79,480

C)$69,330

D)$74,290

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

69

The budgeted "Cash payments for purchases" must be completed before the "Inventory, Purchases and Cost of goods sold budget" can be prepared.

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

70

Zygot Biotech Company is budgeting for the 3rd quarter, and provides the following data:  The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of July?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of July?

A)$21,000

B)$12,600

C)$18,000

D)$2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of July?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of July?A)$21,000

B)$12,600

C)$18,000

D)$2,600

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

71

California Products Company has the following data as part of its budget for the 2nd quarter:  The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

A)$26,500

B)$40,800

C)$33,900

D)$21,800

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?A)$26,500

B)$40,800

C)$33,900

D)$21,800

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

72

Craig Manufacturing Company's budgeted income statement includes the following data:  The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of April?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.How much is the total of the budgeted cash payments for operating expenses for the month of April?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

73

Craig Manufacturing Company's budgeted income statement includes the following data:  The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of May?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.How much is the total of the budgeted cash payments for operating expenses for the month of May?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

74

Craig Manufacturing Company's budgeted income statement includes the following data:

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

How much is the total of the budgeted cash payments for operating expenses for the month of June?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.

The budget assumes that 60% of commission expenses are paid in the month they were incurred and the remaining 40% are paid one month later. In addition, 50% of salary expenses are paid in the month incurred and the remaining 50% are paid one month later. Miscellaneous expenses, rent expense and utility expenses are assumed to be paid in the same month in which they are incurred. Insurance was prepaid for the year on January 1.How much is the total of the budgeted cash payments for operating expenses for the month of June?

A)$54,200

B)$53,250

C)$54,400

D)$53,900

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

75

Berkeley Products has a cash balance of $20,000 at April 1, 2011. They are now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows:  There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of April?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of April?

A)$22,000

B)$21,900

C)$23,700

D)$22,400

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of April?

There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, what is the projected cash balance at the end of April?A)$22,000

B)$21,900

C)$23,700

D)$22,400

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

76

California Products Company has the following data as part of its budget for the 2nd quarter:  The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?

A)$26,500

B)$40,800

C)$33,900

D)$21,800

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at May 31?A)$26,500

B)$40,800

C)$33,900

D)$21,800

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

77

Zygot Biotech Company is budgeting for the 3rd quarter, and provide the following data:  The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of September?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of September?

A)$21,000

B)$12,600

C)$18,000

D)$2,600

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of September?

The cash balance at June 30 is projected to be $5,600. There are no financing transactions planned in the 3rd quarter. What is the projected cash balance at the end of September?A)$21,000

B)$12,600

C)$18,000

D)$2,600

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

78

Della Company prepared the following purchases budget:  All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

What are the total cash payments made in August for purchases?

A)$72,630

B)$70,680

C)$70,520

D)$63,500

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.

All purchases are paid for as follows: 10% in the month of purchase, 50% in the following month, and 40% two months after purchase.What are the total cash payments made in August for purchases?

A)$72,630

B)$70,680

C)$70,520

D)$63,500

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

79

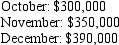

Walnut Company's budgeted inventory purchases are as follows:  Walnut pays for 20% of their purchases during the month of purchase, 70% during the month following the purchase, and the remaining 10% two months after the month of purchase. What is the budgeted accounts payable balance on December 31st?

Walnut pays for 20% of their purchases during the month of purchase, 70% during the month following the purchase, and the remaining 10% two months after the month of purchase. What is the budgeted accounts payable balance on December 31st?

A)$312,000

B)$347,000

C)$390,000

D)$425,000

Walnut pays for 20% of their purchases during the month of purchase, 70% during the month following the purchase, and the remaining 10% two months after the month of purchase. What is the budgeted accounts payable balance on December 31st?

Walnut pays for 20% of their purchases during the month of purchase, 70% during the month following the purchase, and the remaining 10% two months after the month of purchase. What is the budgeted accounts payable balance on December 31st?A)$312,000

B)$347,000

C)$390,000

D)$425,000

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck

80

Felton Manufacturing provides the following data excerpted from its 3rd quarter budget:  The cash balance at June 30 is projected to be $4,000. Based on the above data, how much cash shortfall is the company projected to have at the end of August?

The cash balance at June 30 is projected to be $4,000. Based on the above data, how much cash shortfall is the company projected to have at the end of August?

A)$6,500

B)$2,700

C)$5,000

D)$4,770

The cash balance at June 30 is projected to be $4,000. Based on the above data, how much cash shortfall is the company projected to have at the end of August?

The cash balance at June 30 is projected to be $4,000. Based on the above data, how much cash shortfall is the company projected to have at the end of August?A)$6,500

B)$2,700

C)$5,000

D)$4,770

Unlock Deck

Unlock for access to all 157 flashcards in this deck.

Unlock Deck

k this deck