Deck 19: Returns, Index Numbers, and Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

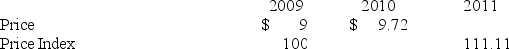

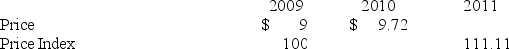

Question

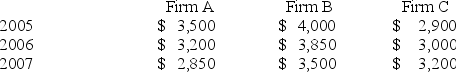

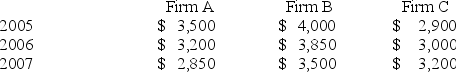

Question

Question

Question

Question

Question

Question

Question

Question

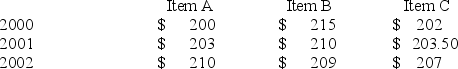

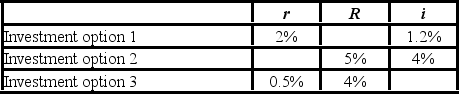

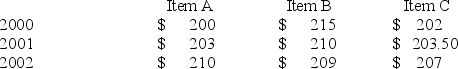

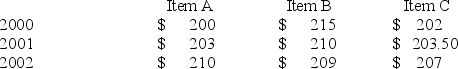

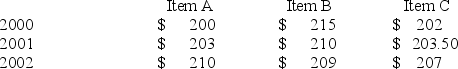

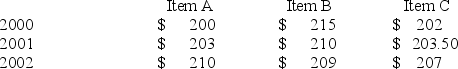

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

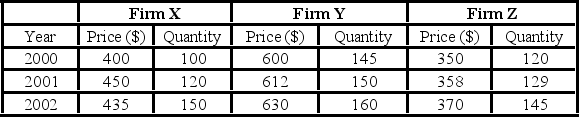

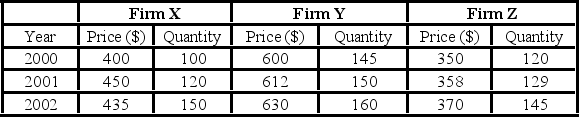

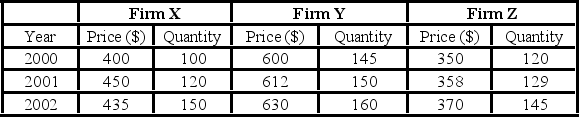

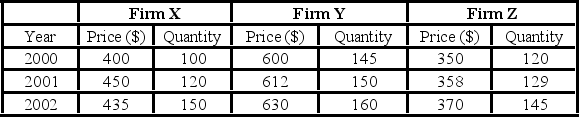

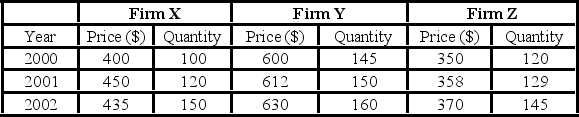

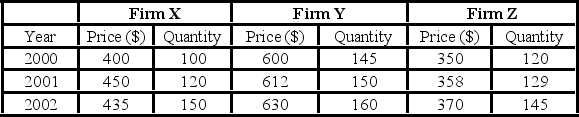

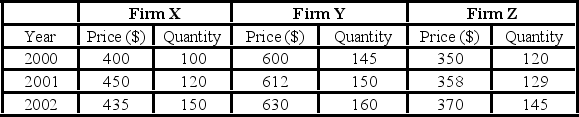

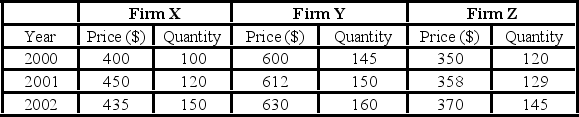

Question

Question

Question

Question

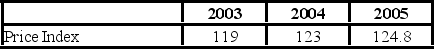

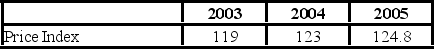

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 19: Returns, Index Numbers, and Inflation

1

The aggregate price index is used to represent relative price movements for a group of items.

True

2

An unweighted price index for different types of properties will unfairly treat all property prices equally.

True

3

The Laspeyres price index uses the quantities evaluated in the base period to compute the weighted aggregate price index.

True

4

The Consumer Price Index (CPI) and the Producer Price Index (PPI) must always move in sync with each other.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

Index numbers provide direct comparisons of prices not only with respect to the base year, but also between non-base years.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

Rates of return expressed in nominal terms do not represent a true picture because they are not adjusted for inflation.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

The Laspeyres and Paasche indices tend to differ when the length of time between the periods increases since the relative quantities of items adjust to the changes in consumer demand over time.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

The ________ equation is a theoretical relationship between nominal returns, real returns, and the expected inflation rate.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

Because both the Laspeyres and Paasche indices are weighted aggregate price indices, they will yield the same value for a given evaluation period.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

As long as an investor does not sell an asset, there is no capital gain or loss involved.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

If the nominal rate of return is positive, then the real rate of return must also be positive.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

The income component is ________ for stocks, interest for bonds, and rental income for a real estate investments.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

The only possible income from an investment is the direct cash payment from the underlying asset.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

The ________ component is the capital gain or loss resulting from an increase or decrease in the value of the asset.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

If the year 2000 is used as a base year and the value of the price index in 2001 is 105, it implies that there was a 5% increase in the price level in 2001.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

An index number is an easy-to-interpret numerical value that reflects a ________ change in price or quantity from a base price.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Price indices are used to remove the effect of inflation so that business and economic time series can be evaluated in a more meaningful way.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

The weighted aggregate price index assigns a lower weight to the items that are sold in higher quantities.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

There is no need to have a constant base value for a price index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

When the expected inflation rate is relatively low, a reasonable ________ to the Fisher equation is r = R - i.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

Emily Myers purchased a share of company X at $700 one year ago and earned a dividend of $50 during the year. The share is trading now at $850. Calculate Emily's return from investment if she sells her share at $850.

A) 7.14%

B) 21.43%

C) 28.57%

D) 14.29%

A) 7.14%

B) 21.43%

C) 28.57%

D) 14.29%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

The adjusted close price of a share is now $67. A year back, the adjusted close price of the same share was $50. What is the investment percent return for someone who holds 10 of these shares today?

A) 34%

B) 17%

C) 20%

D) 25.37%

A) 34%

B) 17%

C) 20%

D) 25.37%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the below is not required to compute an investment return?

A) Interest rate

B) Price of the asset at purchase

C) Price of the asset at sale

D) Distributed income

A) Interest rate

B) Price of the asset at purchase

C) Price of the asset at sale

D) Distributed income

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following types of returns capture the changes in purchasing power?

A) Nominal returns

B) Real returns

C) Income yield

D) Capital gains yield

A) Nominal returns

B) Real returns

C) Income yield

D) Capital gains yield

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

A ________ series is obtained by adjusting the given time series for changes in prices, or inflation.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

If the average price for gasoline in 2001 and 2006 was $1.46 per gallon and $2.59, respectively, the simple price index for 2006 is ________%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is true of investment returns?

A) A change in the price of the underlying asset usually has no impact on returns to investment.

B) Income yield always accounts for the bulk of the returns from an investment.

C) The higher the price of the asset during the time of purchase, the lower the returns from that investment.

D) The higher the income yield, the lower the overall returns from that investment.

A) A change in the price of the underlying asset usually has no impact on returns to investment.

B) Income yield always accounts for the bulk of the returns from an investment.

C) The higher the price of the asset during the time of purchase, the lower the returns from that investment.

D) The higher the income yield, the lower the overall returns from that investment.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

Joanna Robertson bought a share of XYZ Corp. at $200 last year. She was paid a dividend of $30 during the same year. However, the same share is trading at $280 this year. Calculate the investment percent yield if Joanna sells the share at $280.

A) 70%

B) 110%

C) 15%

D) 55%

A) 70%

B) 110%

C) 15%

D) 55%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

The ________ rate is the percentage rate of change of a price index over time.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

Joanna Robertson bought a share of XYZ Corp. at $200 last year. She was paid a dividend of $30 during the same year. However, the same share is trading at $280 this year. Calculate Joanna's income percent yield from holding the share for a year.

A) 15%

B) 40%

C) 55%

D) 30%

A) 15%

B) 40%

C) 55%

D) 30%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Allen Gibbs purchased 50 shares of ABC Corp., each worth $110. If the price of the share increases to $135 after a year, which of the following will be the capital gain if Allen sells all his shares?

A) $1,250

B) $25

C) $6,750

D) $5,500

A) $1,250

B) $25

C) $6,750

D) $5,500

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

Donna Warne purchased a share of company X at $700 one year ago. The share is now trading at $850. Calculate the percent capital gain if Donna sells her share at the current price.

A) 17.6%

B) 150%

C) 6.7%

D) 21.4%

A) 17.6%

B) 150%

C) 6.7%

D) 21.4%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following correctly identifies the Fisher equation?

A) r = (1 + R) / (1 + i)

B) r = R / (1 + i)

C) 1 + r = R / (1 + i)

D) 1 + r = (1 + R) / (1 + i)

A) r = (1 + R) / (1 + i)

B) r = R / (1 + i)

C) 1 + r = R / (1 + i)

D) 1 + r = (1 + R) / (1 + i)

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

Calculate the nominal percent return from an investment of $300 in a share whose price increases to $375 after a year.

A) 75%

B) 20%

C) 25%

D) 16.67%

A) 75%

B) 20%

C) 25%

D) 16.67%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

The ________ price index is used to represent relative price movements for a group of items.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

The Paasche index uses the ________ period quantities in deriving the weights.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

Joanna Robertson bought a share of XYZ Corp. at $200 last year. She was paid a dividend of $30 during the same year. However, the same share is trading at $280 this year. Calculate Joanna's capital gains percent yield if she sells the shares at $280.

A) 80%

B) 15%

C) 40%

D) 28.57%

A) 80%

B) 15%

C) 40%

D) 28.57%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

The ________ price index uses quantities evaluated in the base period to compute the weighted aggregate price index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

Jack Simmons is expecting to earn a 0.34% return on his investment in a government bond that matures next year. If the inflation rate during the time of maturity is expected to be 7%, what will be the real rate of return from his investment?

A) 6.64%

B) - 3.36%

C) - 6.22%

D) 25%

A) 6.64%

B) - 3.36%

C) - 6.22%

D) 25%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following investment options is the most profitable in percentage terms?

A) A government bond with a coupon payment of $10, purchased at $100 and sold at $90 after a year.

B) A government bond with a coupon payment of $15, purchased at $175 and sold at $155 after a year.

C) A share with a dividend payment of $5, purchased at $50 and sold at $60 after a year.

D) A Treasury bill purchased at $160 and sold at $175 after a year.

A) A government bond with a coupon payment of $10, purchased at $100 and sold at $90 after a year.

B) A government bond with a coupon payment of $15, purchased at $175 and sold at $155 after a year.

C) A share with a dividend payment of $5, purchased at $50 and sold at $60 after a year.

D) A Treasury bill purchased at $160 and sold at $175 after a year.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

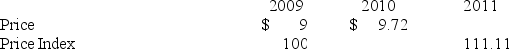

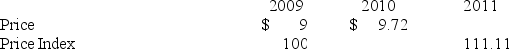

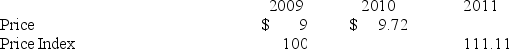

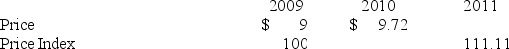

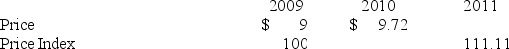

Consider the following information about the price and the price index of a popular book over three years.  What was the approximate price of the book in 2011?

What was the approximate price of the book in 2011?

A) $10

B) $10.80

C) $8.10

D) $10.69

What was the approximate price of the book in 2011?

What was the approximate price of the book in 2011?A) $10

B) $10.80

C) $8.10

D) $10.69

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

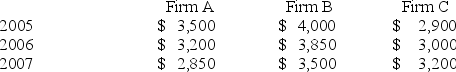

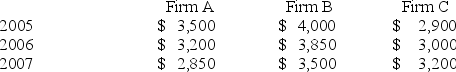

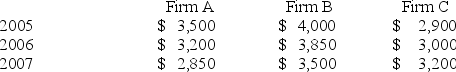

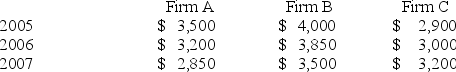

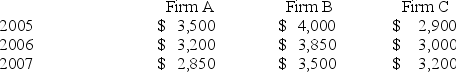

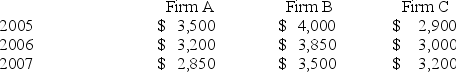

Firms A, B, and C operate in the market for computers. Each firm's product is popular in the market and is distinct from what the other firms offer. The following table shows the prices of laptops from 2005 through 2007.  Which of the following is the unweighted price index for the total price of three types of laptops in 2006, using 2005 as the base year?

Which of the following is the unweighted price index for the total price of three types of laptops in 2006, using 2005 as the base year?

A) 96.63

B) 103.48

C) 91.83

D) 100.96

Which of the following is the unweighted price index for the total price of three types of laptops in 2006, using 2005 as the base year?

Which of the following is the unweighted price index for the total price of three types of laptops in 2006, using 2005 as the base year?A) 96.63

B) 103.48

C) 91.83

D) 100.96

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

The price of a basket of goods in 2000 was $500. If the same basket cost $600 in 2002, identify the correct statement from the following.

A) The price index in 2002 must have been 100 points higher than in 2000.

B) The price increase between 2000 and 2002 was 10%.

C) If 2000 is considered the base year, then the price index in 2002 must have been 120.

D) If 2002 is considered the base year, then the price index in 2000 must have been 70.

A) The price index in 2002 must have been 100 points higher than in 2000.

B) The price increase between 2000 and 2002 was 10%.

C) If 2000 is considered the base year, then the price index in 2002 must have been 120.

D) If 2002 is considered the base year, then the price index in 2000 must have been 70.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Firms A, B, and C operate in the market for computers. Each firm's product is popular in the market and distinct from what the other firms offer. The following table shows the prices of laptops from 2005 through 2007.  If 2005 is used as the base year, which of the following statements about the prices of these laptops is true?

If 2005 is used as the base year, which of the following statements about the prices of these laptops is true?

A) The prices increased by about 4.8% between 2006 and 2007.

B) The prices were about 8.17% lower in 2007 than in 2005.

C) The prices increased by about 3.36% from 2005 to 2006.

D) The increase in the price of firm C's laptop outweighed the fall in the prices of the others so that the overall index for 2006 was greater than 100.

If 2005 is used as the base year, which of the following statements about the prices of these laptops is true?

If 2005 is used as the base year, which of the following statements about the prices of these laptops is true?A) The prices increased by about 4.8% between 2006 and 2007.

B) The prices were about 8.17% lower in 2007 than in 2005.

C) The prices increased by about 3.36% from 2005 to 2006.

D) The increase in the price of firm C's laptop outweighed the fall in the prices of the others so that the overall index for 2006 was greater than 100.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

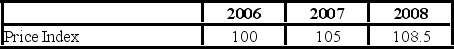

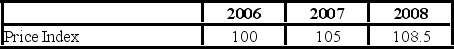

The following table provides the values of the simple price index for watches in a country.  If the base year is revised from 2006 to 2007, which of the following is the updated index for 2008?

If the base year is revised from 2006 to 2007, which of the following is the updated index for 2008?

A) 113.5

B) 96.77

C) 95.24

D) 103.33

If the base year is revised from 2006 to 2007, which of the following is the updated index for 2008?

If the base year is revised from 2006 to 2007, which of the following is the updated index for 2008?A) 113.5

B) 96.77

C) 95.24

D) 103.33

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

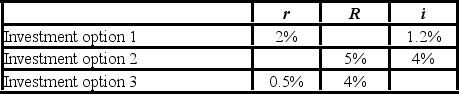

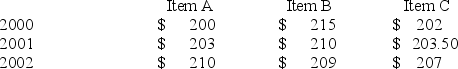

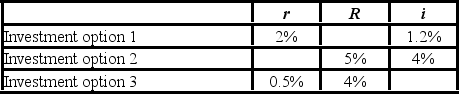

Hugh Wallace has the following information regarding three investment options. Each investment option involves the same one-year period.  What nominal rate of return will Hugh earn if he invested in option 1?

What nominal rate of return will Hugh earn if he invested in option 1?

A) 0.79%

B) 3.22%

C) 0.32%

D) 6.67%

What nominal rate of return will Hugh earn if he invested in option 1?

What nominal rate of return will Hugh earn if he invested in option 1?A) 0.79%

B) 3.22%

C) 0.32%

D) 6.67%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

If the price index for a particular year is 75, it implies that ________.

A) prices have increased by 7.5% over the base year

B) prices have increased by 0.75% over the base year

C) prices have decreased by 0.25% compared to the base year

D) prices have decreased by 25% compared to the base year

A) prices have increased by 7.5% over the base year

B) prices have increased by 0.75% over the base year

C) prices have decreased by 0.25% compared to the base year

D) prices have decreased by 25% compared to the base year

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

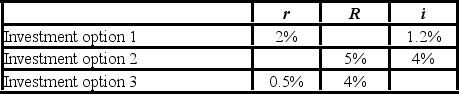

Hugh Wallace has the following information regarding three investment options. Each investment option involves the same one-year period.  Which of the following statements regarding these investment options is true?

Which of the following statements regarding these investment options is true?

A) Investment option 1 has the highest nominal rate of return.

B) The expected percent rate of interest during the time of maturity of investment option 3 is 1.48%.

C) Investment option 3 has the highest expected inflation rate and the lowest real rate of return.

D) Adjusted for inflation, investment option 1 is the best choice for Hugh.

Which of the following statements regarding these investment options is true?

Which of the following statements regarding these investment options is true?A) Investment option 1 has the highest nominal rate of return.

B) The expected percent rate of interest during the time of maturity of investment option 3 is 1.48%.

C) Investment option 3 has the highest expected inflation rate and the lowest real rate of return.

D) Adjusted for inflation, investment option 1 is the best choice for Hugh.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Consider the following information about the price and the price index of a popular book over three years.  What was the price index for this book in 2010?

What was the price index for this book in 2010?

A) 72

B) 92.59

C) 107.2

D) 108

What was the price index for this book in 2010?

What was the price index for this book in 2010?A) 72

B) 92.59

C) 107.2

D) 108

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

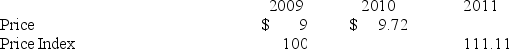

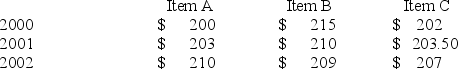

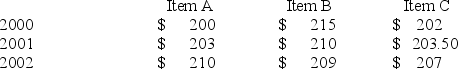

Consider the following data on the prices of three items, A, B, and C, from 2000 through 2002.  If the price of item C in 2002 was 210 instead of 207, which of the following is the unweighted aggregate price index for 2002 for the three items, using 2000 as the base year?

If the price of item C in 2002 was 210 instead of 207, which of the following is the unweighted aggregate price index for 2002 for the three items, using 2000 as the base year?

A) 98.09

B) 100.45

C) 102.03

D) 101.94

If the price of item C in 2002 was 210 instead of 207, which of the following is the unweighted aggregate price index for 2002 for the three items, using 2000 as the base year?

If the price of item C in 2002 was 210 instead of 207, which of the following is the unweighted aggregate price index for 2002 for the three items, using 2000 as the base year?A) 98.09

B) 100.45

C) 102.03

D) 101.94

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

Timothy Keating invested $120 in buying a share of company X in June last year. Although the company had announced that it will not pay any dividend, the price of this share has increased over the last few months and is expected to go up to $140 by June this year. If the expected annual inflation rate in June this year is 5%, calculate Timothy's real rate of return from this investment if he sells the share at $140.

A) 11.11%

B) 14.29%

C) −22.22%

D) −10%

A) 11.11%

B) 14.29%

C) −22.22%

D) −10%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Consider the following data on the prices of three items, A, B, and C, from 2000 through 2002.  Compute the unweighted price index for the three items for 2002, using 2000 as the base year.

Compute the unweighted price index for the three items for 2002, using 2000 as the base year.

A) 98.26

B) 98.48

C) 109

D) 101.46

Compute the unweighted price index for the three items for 2002, using 2000 as the base year.

Compute the unweighted price index for the three items for 2002, using 2000 as the base year.A) 98.26

B) 98.48

C) 109

D) 101.46

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

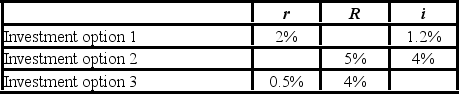

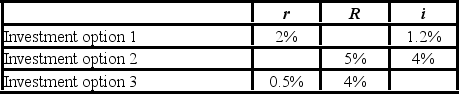

Hugh Wallace has the following information regarding three investment options. Each investment option involves the same one-year period.  What real percent rate of return will Hugh earn if he invests in option 2?

What real percent rate of return will Hugh earn if he invests in option 2?

A) −2.5%

B) 4.58%

C) 0.96%

D) −3.37%

What real percent rate of return will Hugh earn if he invests in option 2?

What real percent rate of return will Hugh earn if he invests in option 2?A) −2.5%

B) 4.58%

C) 0.96%

D) −3.37%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

Consider the following information about the price and the price index of a popular book over three years.  If the price index in 2011 was 95, which of the following is the percent change in the price of the book between 2010 and 2011?

If the price index in 2011 was 95, which of the following is the percent change in the price of the book between 2010 and 2011?

A) -12.04%

B) -5%

C) -2.53%

D) -13%

If the price index in 2011 was 95, which of the following is the percent change in the price of the book between 2010 and 2011?

If the price index in 2011 was 95, which of the following is the percent change in the price of the book between 2010 and 2011?A) -12.04%

B) -5%

C) -2.53%

D) -13%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

If the price index for a particular year is 110, it implies that ________.

A) prices have increased by 11% over the base year

B) prices have increased by 10% over the base year

C) prices have increased by 1.1% over the base year

D) prices have increased by 0.10% over the base year

A) prices have increased by 11% over the base year

B) prices have increased by 10% over the base year

C) prices have increased by 1.1% over the base year

D) prices have increased by 0.10% over the base year

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the following data on the prices of three items, A, B, and C, from 2000 through 2002.  Which of the following is the unweighted aggregate price index for the three items for 2002, using 2001 as the base year?

Which of the following is the unweighted aggregate price index for the three items for 2002, using 2001 as the base year?

A) 98.48

B) 101.54

C) 109.5

D) 102.58

Which of the following is the unweighted aggregate price index for the three items for 2002, using 2001 as the base year?

Which of the following is the unweighted aggregate price index for the three items for 2002, using 2001 as the base year?A) 98.48

B) 101.54

C) 109.5

D) 102.58

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

If pt is the price of good X in period t, and p0 is the base period price, which of the following is the equation for a simple price index for good X?

A) × 100

× 100

B) × 100.

× 100.

C) × 100.

× 100.

D) pt - p0 × 100.

A)

× 100

× 100B)

× 100.

× 100.C)

× 100.

× 100.D) pt - p0 × 100.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Consider the following information about the price and the price index of a popular book over three years.  Which of the following is the correct statement?

Which of the following is the correct statement?

A) The price of the book increased by 3.11% between 2010 and 2011.

B) If 2011 was the base year, the price index for the book in 2009 would have been 90.

C) Between 2009 and 2011, the price of the book went up by 11.11%.

D) If 2010 was the base year, the price index in 2009 would have been 99.28.

Which of the following is the correct statement?

Which of the following is the correct statement?A) The price of the book increased by 3.11% between 2010 and 2011.

B) If 2011 was the base year, the price index for the book in 2009 would have been 90.

C) Between 2009 and 2011, the price of the book went up by 11.11%.

D) If 2010 was the base year, the price index in 2009 would have been 99.28.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Consider the following data on the prices of three items, A, B, and C, from 2000 through 2002.  Compute the unweighted price index for the three items for 2000, using 2001 as the base year.

Compute the unweighted price index for the three items for 2000, using 2001 as the base year.

A) 100.08

B) 98.56

C) 100.85

D) 99.92

Compute the unweighted price index for the three items for 2000, using 2001 as the base year.

Compute the unweighted price index for the three items for 2000, using 2001 as the base year.A) 100.08

B) 98.56

C) 100.85

D) 99.92

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

Consider the following information about the price and the price index of a popular book over three years.  If the price index in 2011 was 95 instead of 111.11, it would imply that ________.

If the price index in 2011 was 95 instead of 111.11, it would imply that ________.

A) the price of the book in 2011 was 16.11% lower than its price in 2009

B) 2011 would be considered as the base year

C) the price of the book in 2011 was 5% lower than its price in 2009

D) the price of the book in 2011 would be $4

If the price index in 2011 was 95 instead of 111.11, it would imply that ________.

If the price index in 2011 was 95 instead of 111.11, it would imply that ________.A) the price of the book in 2011 was 16.11% lower than its price in 2009

B) 2011 would be considered as the base year

C) the price of the book in 2011 was 5% lower than its price in 2009

D) the price of the book in 2011 would be $4

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

Katie Jones started her career with an annual salary of $30,000 in 2006. Five years later, in 2011, her salary had increased to $55,000 a year. If the values of the CPI (with a base of 1982−1984) for 2006 and 2011 are 201.6 and 224.9, respectively, compute the increase in Katie's real income.

A) 64.34%

B) 83.33%

C) 105.31%

D) 164.34%

A) 64.34%

B) 83.33%

C) 105.31%

D) 164.34%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000 to 2002.  Which of the following is the Paasche price index for 2002 if the base period is 2000 and the current period is 2002?

Which of the following is the Paasche price index for 2002 if the base period is 2000 and the current period is 2002?

A) 94.11

B) 106.26

C) 130

D) 106.07

Which of the following is the Paasche price index for 2002 if the base period is 2000 and the current period is 2002?

Which of the following is the Paasche price index for 2002 if the base period is 2000 and the current period is 2002?A) 94.11

B) 106.26

C) 130

D) 106.07

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is true about the comparison between the CPI and the PPI?

A) Both indices are based on the same basket of goods and services.

B) Sales and excise taxes are included in the PPI, but they are not included in the CPI.

C) The PPI is more commonly used to adjust wages for changes in the cost of living than the CPI.

D) Unlike the CPI that uses prices people pay, the PPI uses the prices measured at the wholesale level.

A) Both indices are based on the same basket of goods and services.

B) Sales and excise taxes are included in the PPI, but they are not included in the CPI.

C) The PPI is more commonly used to adjust wages for changes in the cost of living than the CPI.

D) Unlike the CPI that uses prices people pay, the PPI uses the prices measured at the wholesale level.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is the correct expression for the Laspeyres price index?

A) × 100

× 100

B) × 100

× 100

C) × 100

× 100

D) × 100

× 100

A)

× 100

× 100B)

× 100

× 100C)

× 100

× 100D)

× 100

× 100

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

Jones Inc., a company manufacturing drills, earned a revenue of $5 million in 2011. This was 6% more than their revenue in 2009. The CPI for 2009 and 2011 was 115 and 122 respectively, while the PPI for 2009 and 2011 was 110 and 114 respectively. Which of the following accurately reflects the real growth in revenues between 2009 and 2011?

A) 6%

B) 2.65%

C) 0.28%

D) 10.25%

A) 6%

B) 2.65%

C) 0.28%

D) 10.25%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

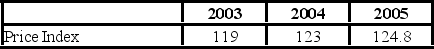

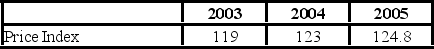

The following table shows the value of CPI for three years in a country.  Which of the following is the annual inflation rate for 2005?

Which of the following is the annual inflation rate for 2005?

A) 1.46%

B) 3.36%

C) 4.87%

D) 1.8%

Which of the following is the annual inflation rate for 2005?

Which of the following is the annual inflation rate for 2005?A) 1.46%

B) 3.36%

C) 4.87%

D) 1.8%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is true of the CPI?

A) It uses the same basket of goods and services as the PPI.

B) The quantities of items in the current year are used for computing the weights for the index.

C) It is an unweighted price index used to measure inflation.

D) It is based on the prices paid by urban consumers for a representative basket of goods and services.

A) It uses the same basket of goods and services as the PPI.

B) The quantities of items in the current year are used for computing the weights for the index.

C) It is an unweighted price index used to measure inflation.

D) It is based on the prices paid by urban consumers for a representative basket of goods and services.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

When Dana Roberts started her job as a librarian two years ago, her annual salary was $40,000. Although she is very good at her job and is now earning 10% more than what she started with, she notices that new hires in the same field are being offered $43,000 as an annual salary this year. Which of the following statements is most likely to be true?

A) Dana is earning less than $43,000 this year.

B) Real income for librarians in this country has increased, on an average, by $3,000 during the last two years.

C) If inflation in the current year is very high, then it is possible that Dana was better off with $40,000 two years back than the new hires are with a salary of $43,000 today.

D) Adjusted for inflation in the current year, it is likely that Dana's income this year is lower than the income of the new hires.

A) Dana is earning less than $43,000 this year.

B) Real income for librarians in this country has increased, on an average, by $3,000 during the last two years.

C) If inflation in the current year is very high, then it is possible that Dana was better off with $40,000 two years back than the new hires are with a salary of $43,000 today.

D) Adjusted for inflation in the current year, it is likely that Dana's income this year is lower than the income of the new hires.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following correctly identifies the expression for calculating the inflation rate for period t, based on the CPI?

A) it =

B) it = × 100

× 100

C) it =

D) it = × 100

× 100

A) it =

B) it =

× 100

× 100C) it =

D) it =

× 100

× 100

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

The following table shows the value of CPI for three years in a country.  Which of the following is the annual inflation rate for 2004?

Which of the following is the annual inflation rate for 2004?

A) 4%

B) 1.46%

C) 3.36%

D) 4.87%

Which of the following is the annual inflation rate for 2004?

Which of the following is the annual inflation rate for 2004?A) 4%

B) 1.46%

C) 3.36%

D) 4.87%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

Firms A, B, and C operate in the market for computers. Each firm's product is popular in the market and distinct from what the other firms offer. The following table shows the prices of laptops from 2005 through 2007.  Suppose this data was collected from a particular town, where people have a preference for firm C's laptops. If 2005 is used as the base year, which of the following statements will be true?

Suppose this data was collected from a particular town, where people have a preference for firm C's laptops. If 2005 is used as the base year, which of the following statements will be true?

A) The unweighted price index for 2007 understates the fall in the prices of laptops.

B) The unweighted price index for 2006 overstates the fall in the prices of laptops.

C) The unweighted price index should only use the data for laptops produced by firms A and B to provide an accurate picture of the change in prices.

D) The unweighted price index will better reflect the change in prices over these years than a weighted price index.

Suppose this data was collected from a particular town, where people have a preference for firm C's laptops. If 2005 is used as the base year, which of the following statements will be true?

Suppose this data was collected from a particular town, where people have a preference for firm C's laptops. If 2005 is used as the base year, which of the following statements will be true?A) The unweighted price index for 2007 understates the fall in the prices of laptops.

B) The unweighted price index for 2006 overstates the fall in the prices of laptops.

C) The unweighted price index should only use the data for laptops produced by firms A and B to provide an accurate picture of the change in prices.

D) The unweighted price index will better reflect the change in prices over these years than a weighted price index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000 to 2002.  Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.

Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.

A) 105.12

B) 94.11

C) 92.85

D) 98.92

Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.

Compute the Paasche price index for 2001 if the base period is 2000 and the current period is 2002.A) 105.12

B) 94.11

C) 92.85

D) 98.92

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true about the comparison between the Laspeyres and Paasche indices?

A) The Laspeyres index is more expensive to compute than the Paasche index.

B) The data requirements are more stringent for the Laspeyres index than for the Paasche index.

C) Unlike the Laspeyres index, the Paasche index incorporates current expenditure patterns of consumers.

D) Unlike the Paasche index, the Laspeyres index requires that the weights be updated each year and the index numbers be recomputed for all of the previous years.

A) The Laspeyres index is more expensive to compute than the Paasche index.

B) The data requirements are more stringent for the Laspeyres index than for the Paasche index.

C) Unlike the Laspeyres index, the Paasche index incorporates current expenditure patterns of consumers.

D) Unlike the Paasche index, the Laspeyres index requires that the weights be updated each year and the index numbers be recomputed for all of the previous years.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000-2002.  Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?

Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?

A) 106.07

B) 106.3

C) 94.28

D) 94.08

Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?

Which of the following is the Laspeyres price index for 2002, using 2000 as the base year?A) 106.07

B) 106.3

C) 94.28

D) 94.08

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is true about the Laspeyres and Paasche indices?

A) As long as the evaluation period is the same, the two indices usually yield the same value.

B) The difference in the values of the two indices, if any, can usually account for the varying price levels across periods.

C) The Laspeyres price index uses the current period quantities as weights, as opposed to the base period quantities used by the Paasche price index.

D) The greater the length of time between periods, the higher the chances of variation between the values of the two indices.

A) As long as the evaluation period is the same, the two indices usually yield the same value.

B) The difference in the values of the two indices, if any, can usually account for the varying price levels across periods.

C) The Laspeyres price index uses the current period quantities as weights, as opposed to the base period quantities used by the Paasche price index.

D) The greater the length of time between periods, the higher the chances of variation between the values of the two indices.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

Gulten started her career with an annual salary of $82,000 in 2006. Five years later, in 2011, her salary had increased to $85,000 a year. If the values of the CPI (with a base of 1982−1984) for 2006 and 2011 are 201.6 and 224.9, respectively, compute the increase in Gulten's real income.

A) −7.08%

B) 3.66%

C) 15.68%

D) 92.92%

A) −7.08%

B) 3.66%

C) 15.68%

D) 92.92%

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

Three firms, X, Y, and Z, operate in the same industry, although their products have different features and are priced differently. The following table provides the prices and the quantities sold (in units) during the period 2000 to 2002.  Which of the following is the Laspeyres price index for 2001, using 2000 as the base year?

Which of the following is the Laspeyres price index for 2001, using 2000 as the base year?

A) 95.64

B) 113.60

C) 104.56

D) 105.19

Which of the following is the Laspeyres price index for 2001, using 2000 as the base year?

Which of the following is the Laspeyres price index for 2001, using 2000 as the base year?A) 95.64

B) 113.60

C) 104.56

D) 105.19

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

A Paasche index with updated weights ________.

A) is likely to produce a lower estimate than a Laspeyres index when prices are increasing

B) uses the current period quantities as weights as opposed to the base period quantities used in the Paasche index, which does not use updated weights

C) is likely to produce a lower estimate than a Laspeyres index when prices are decreasing

D) accounts for inflation but fails to account for changing consumption patterns over time

A) is likely to produce a lower estimate than a Laspeyres index when prices are increasing

B) uses the current period quantities as weights as opposed to the base period quantities used in the Paasche index, which does not use updated weights

C) is likely to produce a lower estimate than a Laspeyres index when prices are decreasing

D) accounts for inflation but fails to account for changing consumption patterns over time

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

Firms A, B, and C operate in the market for computers. Each firm's product is popular in the market and distinct from what the other firms offer. The following table shows the prices of laptops from 2005 through 2007.  If 2006 is used as the base year, which of the following statements is true?

If 2006 is used as the base year, which of the following statements is true?

A) The prices in 2007 were 5.02% lower than the prices in 2005.

B) The price index for 2005 will be 100, as per the unweighted price index.

C) The unweighted price index for 2007 suggests that laptop prices were 8.17% lower than the prices in 2006, as per the unweighted price index.

D) The laptop prices in 2005 were 3.48% higher than the prices in 2006, as per the unweighted price index.

If 2006 is used as the base year, which of the following statements is true?

If 2006 is used as the base year, which of the following statements is true?A) The prices in 2007 were 5.02% lower than the prices in 2005.

B) The price index for 2005 will be 100, as per the unweighted price index.

C) The unweighted price index for 2007 suggests that laptop prices were 8.17% lower than the prices in 2006, as per the unweighted price index.

D) The laptop prices in 2005 were 3.48% higher than the prices in 2006, as per the unweighted price index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

When a given time series is adjusted for changes in prices, it is called a(n) ________.

A) deflated series

B) unweighted series

C) nominal series

D) cyclical series

A) deflated series

B) unweighted series

C) nominal series

D) cyclical series

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck