Deck 10: Property, Plant, and Equipment: Accounting Model Basics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/99

Play

Full screen (f)

Deck 10: Property, Plant, and Equipment: Accounting Model Basics

1

A plant site donated by a city to a manufacturer that plans to open a new factory should be recorded on the manufacturer's books at

A) the nominal cost of taking title to it.

B) its market value.

C) one dollar (since the site cost nothing but should be included in the statement of financial position).

D) the value assigned to it by the company's directors.

A) the nominal cost of taking title to it.

B) its market value.

C) one dollar (since the site cost nothing but should be included in the statement of financial position).

D) the value assigned to it by the company's directors.

its market value.

2

Under ASPE, the costs for environmental clean-up at the end of an asset's useful life

A) are always expensed as incurred.

B) are recognized only if they represent a legal obligation.

C) are capitalized once they have become apparent.

D) include only costs related to the acquisition of the asset.

A) are always expensed as incurred.

B) are recognized only if they represent a legal obligation.

C) are capitalized once they have become apparent.

D) include only costs related to the acquisition of the asset.

are recognized only if they represent a legal obligation.

3

Examples of property, plant, and equipment include

A) land, equipment, vehicles.

B) equipment, apple trees, mineral resource property.

C) machinery, livestock, patents.

D) computers, cherry orchards, copyrights.

A) land, equipment, vehicles.

B) equipment, apple trees, mineral resource property.

C) machinery, livestock, patents.

D) computers, cherry orchards, copyrights.

equipment, apple trees, mineral resource property.

4

Which of the following does NOT apply to the capitalization of borrowing costs for the purchase of assets?

A) They can have a significant impact on a company's earnings.

B) This is allowed under both ASPE and IFRS.

C) This is not allowed under IFRS.

D) They must be disclosed in the notes to the financial statements.

A) They can have a significant impact on a company's earnings.

B) This is allowed under both ASPE and IFRS.

C) This is not allowed under IFRS.

D) They must be disclosed in the notes to the financial statements.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

5

Chad Corporation purchased a tract of land for $ 765,000, which included a warehouse and office building. The following data were collected concerning the property:

What are the appropriate amounts that Chad should record for the land, warehouse, and office building, respectively?

A) land, $ 250,000; warehouse, $ 150,000; office building, $ 300,000

B) land, $ 300,000; warehouse, $ 200,000; office building, $ 400,000

C) land, $ 273,214; warehouse, $ 163,929; office building, $ 327,857

D) land, $ 255,000; warehouse, $ 170,000; office building, $ 340,000

What are the appropriate amounts that Chad should record for the land, warehouse, and office building, respectively?

A) land, $ 250,000; warehouse, $ 150,000; office building, $ 300,000

B) land, $ 300,000; warehouse, $ 200,000; office building, $ 400,000

C) land, $ 273,214; warehouse, $ 163,929; office building, $ 327,857

D) land, $ 255,000; warehouse, $ 170,000; office building, $ 340,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

6

When accounting for asset exchanges,

A) if a transaction lacks commercial substance, it is not recorded.

B) an asset cannot be recognized at more than its fair value.

C) if the fair values of either the asset given up or the asset received cannot be ascertained, then the Board of Directors may assign an arbitrary value.

D) when an exchange lacks commercial substance, either a gain or loss may be recognized.

A) if a transaction lacks commercial substance, it is not recorded.

B) an asset cannot be recognized at more than its fair value.

C) if the fair values of either the asset given up or the asset received cannot be ascertained, then the Board of Directors may assign an arbitrary value.

D) when an exchange lacks commercial substance, either a gain or loss may be recognized.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

7

When a plant asset is acquired by the issuance of a public company's common shares, the cost of the plant asset is properly measured by the

A) market value of the plant asset.

B) original cost of the plant asset.

C) book value of the plant asset.

D) book value of the shares.

A) market value of the plant asset.

B) original cost of the plant asset.

C) book value of the plant asset.

D) book value of the shares.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

8

Property, plant, and equipment purchased on long-term credit contracts should be accounted for at the

A) actual cash to be paid in the future.

B) future amount of the future payments.

C) present value of the future payments.

D) future value of the current payments.

A) actual cash to be paid in the future.

B) future amount of the future payments.

C) present value of the future payments.

D) future value of the current payments.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

9

Spock Inc. exchanged merchandise that cost $ 19,000 and normally sold for $ 27,000 for a new delivery truck with a list price of $ 31,000. The delivery truck should be recorded on Spock's books at

A) $ 31,000.

B) $ 27,000.

C) $ 19,000.

D) $ 12,000.

A) $ 31,000.

B) $ 27,000.

C) $ 19,000.

D) $ 12,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

10

When a closely held corporation issues preferred shares for land, the land should be recorded at the

A) total value of the shares issued.

B) total book value of the shares issued.

C) total liquidating value of the shares issued.

D) fair market value of the land.

A) total value of the shares issued.

B) total book value of the shares issued.

C) total liquidating value of the shares issued.

D) fair market value of the land.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

11

Frosty Ltd. exchanged 400 common shares of Grants Corp., which Frosty was holding as an investment, for new equipment from Milliken Sales. The Grants Corp. common shares, which had been purchased by Frosty for $ 80 per share, had a quoted market value of $ 100 per share at the date of exchange. The equipment had a recorded amount on Milliken's books of $ 37,000, but the fair value was not available. The journal entry that Frosty should make to record this exchange is

A)a) Equipment.............................................32,000

Investment in Lesotho Corp Common Shares...................32,000

B)Equipment........................................................37,000

Investment in Lesotho Corp. Common Shares....................32,000

Gain on Disposal of Investment..........................................5,000

C)Equipment.................................................................37,000

Loss on Disposal of Investment................................3,000

Investment in Lesotho Corp. Common Shares...............................40,000

D)Equipment.........................................................40,000

Investment in Lesotho Corp. Common Shares...........................32,000

Gain on Disposal of Investment..................................................8,000

A)a) Equipment.............................................32,000

Investment in Lesotho Corp Common Shares...................32,000

B)Equipment........................................................37,000

Investment in Lesotho Corp. Common Shares....................32,000

Gain on Disposal of Investment..........................................5,000

C)Equipment.................................................................37,000

Loss on Disposal of Investment................................3,000

Investment in Lesotho Corp. Common Shares...............................40,000

D)Equipment.........................................................40,000

Investment in Lesotho Corp. Common Shares...........................32,000

Gain on Disposal of Investment..................................................8,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT included in the IAS16 definition of property, plant, and equipment (PPE)?

A) PPE will be used over more than one accounting period.

B) PPE is held for use in the production of goods and services.

C) PPE can be tangible or intangible.

D) PPE is tangible.

A) PPE will be used over more than one accounting period.

B) PPE is held for use in the production of goods and services.

C) PPE can be tangible or intangible.

D) PPE is tangible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

13

Mozambique Ltd. received a $ 250,000 grant from the federal government to help buy equipment as an incentive for them to establish manufacturing operations in Ottawa. Assuming that Mozambique uses the cost reduction method for such transactions, they should record this transaction as a

A) memo entry only.

B) credit to Equipment for $ 250,000.

C) credit to Deferred Revenue for $ 250,000.

D) credit to Contribution Revenue for $ 250,000.

A) memo entry only.

B) credit to Equipment for $ 250,000.

C) credit to Deferred Revenue for $ 250,000.

D) credit to Contribution Revenue for $ 250,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

14

When an enterprise is the recipient of a donated asset, the account credited would probably be a(n)

A) equity account.

B) revenue account.

C) deferred revenue account.

D) asset account.

A) equity account.

B) revenue account.

C) deferred revenue account.

D) asset account.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements applies to the recognition of property, plant, and equipment acquisitions?

A) It is certain that the item's associated future benefits will flow to the entity.

B) It is probable that the item's associated future benefits will flow to the entity.

C) The cost can be measured reliably.

D) It is probable that the item's associated future benefits will flow to the entity, and the cost can be measured reliably.

A) It is certain that the item's associated future benefits will flow to the entity.

B) It is probable that the item's associated future benefits will flow to the entity.

C) The cost can be measured reliably.

D) It is probable that the item's associated future benefits will flow to the entity, and the cost can be measured reliably.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

16

The debit for non-refundable provincial sales tax correctly calculated and paid on the purchase of machinery should be included in

A) Provincial Sales Tax Expense.

B) Machinery.

C) Accumulated Depreciation-Machinery.

D) Prepaid Provincial Sales Tax.

A) Provincial Sales Tax Expense.

B) Machinery.

C) Accumulated Depreciation-Machinery.

D) Prepaid Provincial Sales Tax.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

17

Upshaw Ltd. bought a lift truck with a list price of $ 30,000. The dealer granted a 10% reduction in the list price, and an additional 2% cash discount on the net price when payment was made in 30 days. Provincial sales tax was $ 1,785 and Upshaw paid an extra $ 350 to have a special horn installed. The recorded cost of the truck should be

A) $ 29,135.

B) $ 31,535.

C) $ 28,595.

D) $ 28,552.

A) $ 29,135.

B) $ 31,535.

C) $ 28,595.

D) $ 28,552.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following would NOT be included in the cost of an item of property, plant, and equipment?

A) the purchase price net of any trade discounts and rebates

B) delivery costs

C) costs of training employees to use the asset

D) costs of obligations associated with the asset's eventual disposal

A) the purchase price net of any trade discounts and rebates

B) delivery costs

C) costs of training employees to use the asset

D) costs of obligations associated with the asset's eventual disposal

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

19

On January 2, 2020, Neeson Delivery Company traded in an old delivery truck for a newer model. Data relative to the old and new trucks follow: Old Truck

Original cost.....................................................................$9,000

Accumulated depreciation at January 2,2020...................6,000

Fairvalue ...........................................................................3,000

New Truck

List price..........................................................

Cash price without trade-in..............................14,000

Cash paid with trade-in.....................................11,000 The cost of the new truck for financial accounting purposes is

A) $ 9,000.

B) $ 11,000.

C) $ 14,000.

D) $ 15,000.

Original cost.....................................................................$9,000

Accumulated depreciation at January 2,2020...................6,000

Fairvalue ...........................................................................3,000

New Truck

List price..........................................................

Cash price without trade-in..............................14,000

Cash paid with trade-in.....................................11,000 The cost of the new truck for financial accounting purposes is

A) $ 9,000.

B) $ 11,000.

C) $ 14,000.

D) $ 15,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

20

How should variable overhead costs incurred to self-construct an asset be recorded?

A) They should be included in the cost of the asset.

B) They should be assigned to the cost of inventory production.

C) They should be written off as a loss for the period.

D) They should be recorded as a one-time special assessment in a separate asset account.

A) They should be included in the cost of the asset.

B) They should be assigned to the cost of inventory production.

C) They should be written off as a loss for the period.

D) They should be recorded as a one-time special assessment in a separate asset account.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

21

Ghana Football Club had a player contract with Mowgli that is recorded in its books at $ 300,000 on July 1, 2020. Ivory Coast Football Club had a player contract with Eeyore that is recorded in its books at $ 375,000 on July 1, 2020. On this date, Ghana traded Mowgli to Ivory Coast for Eeyore and paid a cash difference of $ 37,500. The fair value of the Eeyore contract was $ 450,000 on the exchange date. After the exchange, the Eeyore contract should be recorded in Ghana's books at

A) $ 337,500.

B) $ 375,000.

C) $ 412,500.

D) $ 450,000.

A) $ 337,500.

B) $ 375,000.

C) $ 412,500.

D) $ 450,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

22

Bally Ho Inc. traded one of its used trailers (cost $ 15,000, accumulated depreciation $ 13,500) for another used trailer with a fair value of $ 2,400. Bally Ho also paid $ 300 to complete the transaction. Since the exchange will leave Bally Ho in the same economic position, this transaction lacks commercial substance. What is the gain or loss on the exchange?

A) $ 900 gain

B) $ 675 gain

C) $ 225 loss

D) $ 0 (no gain or loss)

A) $ 900 gain

B) $ 675 gain

C) $ 225 loss

D) $ 0 (no gain or loss)

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

23

Soflo Inc. acquired a new delivery truck in exchange for an old delivery truck that it had acquired several years earlier for $ 50,000. On the date of the exchange, the old truck had a fair value of $ 20,000, and its net book value (carrying value) was $ 19,000. In addition, Soflo paid $ 65,000 cash for the new truck, which had a list price of $ 90,000. At what amount should Soflo record the new truck for financial accounting purposes?

A) $ 65,000

B) $ 84,200

C) $ 85,000

D) $ 90,000

A) $ 65,000

B) $ 84,200

C) $ 85,000

D) $ 90,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

24

Dinga Corp. exchanged similar pieces of equipment with Elongo Corp. No cash was exchanged. Since this exchange will not significantly change the economic position of either company, this transaction lacks commercial substance. At this time, the net book value of Dinga's asset is $ 36,000, while the net book value of Elongo's asset on their books is $ 33,300. However, it has been reliably determined that the fair value of Dinga's asset is $ 36,900, while the fair value of Elongo's asset is $ 34,200. Given these facts, at what amount should Dinga record the asset it receives from Elongo?

A) $ 36,900

B) $ 36,000

C) $ 34,200

D) $ 33,300

A) $ 36,900

B) $ 36,000

C) $ 34,200

D) $ 33,300

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

25

If a corporation purchases a lot and building and subsequently tears down the building and uses the property as a parking lot, the proper accounting treatment of the cost of the building would depend on

A) the significance of the cost allocated to the building in relation to the combined cost of the lot and building.

B) the length of time for which the building was held prior to its demolition.

C) management's plans for the property when the building was acquired.

D) the planned future use of the parking lot.

A) the significance of the cost allocated to the building in relation to the combined cost of the lot and building.

B) the length of time for which the building was held prior to its demolition.

C) management's plans for the property when the building was acquired.

D) the planned future use of the parking lot.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

26

Chiquita Corp. purchased a large area of land with the intention to transform it into a banana plantation. Before the new seedlings can be planted, the site, which is prone to flooding, must be drained. The cost of the draining should be

A) capitalized as part of the cost of the land.

B) expensed only after the first crop of bananas has been harvested.

C) expensed immediately.

D) reported as loss from discontinued operations.

A) capitalized as part of the cost of the land.

B) expensed only after the first crop of bananas has been harvested.

C) expensed immediately.

D) reported as loss from discontinued operations.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

27

On August 1, 2020, Chapelle Corp. purchases a new machine. The company makes a $ 7,200 cash down payment, and agrees to pay four monthly instalments of $ 10,800 each, starting September 1, 2020, signing a non-interest-bearing note to this effect. The cash equivalent price of the machine is $ 43,200. As well, Chapelle pays installation costs of $ 1,200. The recorded cost of the machine should be

A) $ 8,400.

B) $ 44,400.

C) $ 50,400.

D) $ 51,600.

A) $ 8,400.

B) $ 44,400.

C) $ 50,400.

D) $ 51,600.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

28

On February 1, 2020, Sudan Corp. purchased a parcel of land for $ 300,000 as a factory site. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2020. Costs incurred during this period are listed below: Demolition of old building..............................................................$25,000

Architect's feer .................................................................................35,000

Legal fees for title invertigation and purchase contract..............

Construction costs............................................................................990,000

(5alvaged materials resulting from demolition were sold for .) Sudan should record the cost of the land and new building, respectively, at

A) $ 330,000 and $ 1,015,000.

B) $ 315,000 and $ 1,030,000.

C) $ 315,000 and $ 1,025,000.

D) $ 320,000 and $ 1,025,000.

Architect's feer .................................................................................35,000

Legal fees for title invertigation and purchase contract..............

Construction costs............................................................................990,000

(5alvaged materials resulting from demolition were sold for .) Sudan should record the cost of the land and new building, respectively, at

A) $ 330,000 and $ 1,015,000.

B) $ 315,000 and $ 1,030,000.

C) $ 315,000 and $ 1,025,000.

D) $ 320,000 and $ 1,025,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

29

On January 2, 2020, Zimbabwe Corp. purchases a new machine. The company makes a $ 3,000 cash down payment, and agrees to pay eight semi-annual instalments of $ 2,000 each, starting July 1, 2020, signing a non-interest-bearing note to this effect. The cash equivalent price of the machine is not known, but the appropriate interest rate for this type of transaction is 8% p.a. Rounding to the nearest dollar (if necessary), Zimbabwe should record the cost of the machine at

A) $ 15,413.

B) $ 16,465.

C) $ 16,000.

D) $ 19,000.

A) $ 15,413.

B) $ 16,465.

C) $ 16,000.

D) $ 19,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following information for questions.

Morocco Corp. purchased land as a factory site for $ 250,000. They paid $ 10,000 to tear down two buildings on the land, and the salvage from these old buildings was sold for $ 1,350. Legal fees of $ 870 were paid for title investigation and making the purchase. Architect's fees were $ 10,300. Title insurance cost $ 600, and liability insurance during construction cost $ 650. Excavation costs were $ 2,610. A contractor was paid $ 600,000 to construct the new building. An assessment made by the city for pavement was $ 1,600. Interest costs during construction were $ 42,500.

The cost of the land should be recorded at

A) $ 260,120.

B) $ 261,720.

C) $ 262,470.

D) $ 264,070.

Morocco Corp. purchased land as a factory site for $ 250,000. They paid $ 10,000 to tear down two buildings on the land, and the salvage from these old buildings was sold for $ 1,350. Legal fees of $ 870 were paid for title investigation and making the purchase. Architect's fees were $ 10,300. Title insurance cost $ 600, and liability insurance during construction cost $ 650. Excavation costs were $ 2,610. A contractor was paid $ 600,000 to construct the new building. An assessment made by the city for pavement was $ 1,600. Interest costs during construction were $ 42,500.

The cost of the land should be recorded at

A) $ 260,120.

B) $ 261,720.

C) $ 262,470.

D) $ 264,070.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

31

On December 1, 2020, Guinea Corp. purchased a tract of land as a factory site for $ 500,000. The old building on the property was razed, and salvaged materials resulting from demolition were sold. Additional costs incurred and salvage proceeds realized during December 2020 were as follows: Cost to raze old building .......................................$25,000

Legel fees for purchese contrect and to record ownership.............................5,000

Property purchase tax........................................................................8,000

Proceeds from sole of solvaged materials.........................................4,000 On Guinea's December 31, 2020 balance sheet, what amount should be reported for the land?

A) $ 513,000

B) $ 521,000

C) $ 534,000

D) $ 538,000

Legel fees for purchese contrect and to record ownership.............................5,000

Property purchase tax........................................................................8,000

Proceeds from sole of solvaged materials.........................................4,000 On Guinea's December 31, 2020 balance sheet, what amount should be reported for the land?

A) $ 513,000

B) $ 521,000

C) $ 534,000

D) $ 538,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

32

The costs of land improvements with limited lives, such as a parking lot, are

A) added to the land account.

B) recorded in a separate account.

C) depreciated over their useful lives.

D) recorded in a separate account and depreciated over their useful lives.

A) added to the land account.

B) recorded in a separate account.

C) depreciated over their useful lives.

D) recorded in a separate account and depreciated over their useful lives.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

33

Liberia Corporation exchanged 2,000 shares of its common shares for a parcel of land to be held as a future plant site. The book value of the shares is currently $ 90 per share, and their current market value is $ 110 per share. Liberia received $ 30,000 from the sale of scrap when an existing building on the property was removed from the site. Based on these facts, the land should be capitalized at

A) $ 150,000.

B) $ 180,000.

C) $ 190,000.

D) $ 220,000.

A) $ 150,000.

B) $ 180,000.

C) $ 190,000.

D) $ 220,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

34

Ben's Delivery buys a van with a list price of $ 60,000. The dealer grants a 15% reduction in list price and an additional 2% cash discount on the net price if payment is made in 30 days, which Ben's did. Non-refundable sales taxes are $ 800 and Ben's paid an extra $ 600 to have a GPS device installed. What amount should Ben's record as the cost of the van?

A) $ 51,380.

B) $ 49,980.

C) $ 51,290.

D) $ 50,780.

A) $ 51,380.

B) $ 49,980.

C) $ 51,290.

D) $ 50,780.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

35

On January 2, 2020, Holliwell Inc. replaced its boiler with a more efficient one. The following information was available on that date: Purchase price of new boiler.......................................

Carrying amount of old boiler.......................................4,000

Fair value of old boiler.................................................2,400

Installation cost of new boiler......................................3,200

The old boiler was sold for $ 2,400. At what amount should Holliwell capitalize the cost of the new boiler?

A) $ 42,300

B) $ 43,200

C) $ 39,200

D) $ 40,000

Carrying amount of old boiler.......................................4,000

Fair value of old boiler.................................................2,400

Installation cost of new boiler......................................3,200

The old boiler was sold for $ 2,400. At what amount should Holliwell capitalize the cost of the new boiler?

A) $ 42,300

B) $ 43,200

C) $ 39,200

D) $ 40,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following information for questions.

Morocco Corp. purchased land as a factory site for $ 250,000. They paid $ 10,000 to tear down two buildings on the land, and the salvage from these old buildings was sold for $ 1,350. Legal fees of $ 870 were paid for title investigation and making the purchase. Architect's fees were $ 10,300. Title insurance cost $ 600, and liability insurance during construction cost $ 650. Excavation costs were $ 2,610. A contractor was paid $ 600,000 to construct the new building. An assessment made by the city for pavement was $ 1,600. Interest costs during construction were $ 42,500.

The cost of the building should be recorded at

A) $ 656,060.

B) $ 655,800.

C) $ 653,710.

D) $ 653,450.

Morocco Corp. purchased land as a factory site for $ 250,000. They paid $ 10,000 to tear down two buildings on the land, and the salvage from these old buildings was sold for $ 1,350. Legal fees of $ 870 were paid for title investigation and making the purchase. Architect's fees were $ 10,300. Title insurance cost $ 600, and liability insurance during construction cost $ 650. Excavation costs were $ 2,610. A contractor was paid $ 600,000 to construct the new building. An assessment made by the city for pavement was $ 1,600. Interest costs during construction were $ 42,500.

The cost of the building should be recorded at

A) $ 656,060.

B) $ 655,800.

C) $ 653,710.

D) $ 653,450.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

37

On August 1, 2020, Burkina Corp. purchases a new machine. The company makes a $ 2,000 cash down payment, and agrees to pay four annual instalments of $ 3,000 each, starting August 1, 2021, signing a non-interest bearing-note to this effect. The cash equivalent price of the machine is $ 12,500. Due to an employee strike, Burkina could not install the machine immediately, and thus incurred $ 300 of storage costs. As well, Burkina pays installation costs of $ 400. The recorded cost of the machine should be

A) $ 14,000.

B) $ 13,200.

C) $ 12,900.

D) $ 12,500.

A) $ 14,000.

B) $ 13,200.

C) $ 12,900.

D) $ 12,500.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

38

Land is generally included in property, plant, and equipment EXCEPT when

A) it is not yet ready for use.

B) it is held for resale by land developers.

C) it includes a building that must be demolished.

D) special amounts are assessed for local improvements such as sewers.

A) it is not yet ready for use.

B) it is held for resale by land developers.

C) it includes a building that must be demolished.

D) special amounts are assessed for local improvements such as sewers.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

39

On January 2, 2020, Gabon Corp. purchases a new machine. The company makes a $ 2,000 cash down payment, and agrees to pay four annual instalments of $ 4,000 each, starting December 31, 2020, signing a non-interest-bearing note to this effect. The cash equivalent price of the machine is not known, but the appropriate interest rate for this type of transaction is 9% p.a. Rounding to the nearest dollar (if necessary), Gabon should record the cost of the machine at

A) $ 18,000.

B) $ 16,000.

C) $ 14,959.

D) $ 12,959.

A) $ 18,000.

B) $ 16,000.

C) $ 14,959.

D) $ 12,959.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

40

Under IFRS, biological assets should normally be measured at

A) cost.

B) cost less accumulated depreciation.

C) fair value.

D) fair value less costs to sell.

A) cost.

B) cost less accumulated depreciation.

C) fair value.

D) fair value less costs to sell.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

41

Nigeria Ltd. acquires a new machine. It is comprised of two different components (A and B) that are expected to be overhauled at different times. The acquisition costs of the components are as follows:

Component A is expected to have a useful life of 5 years and a residual value of $ 20,000 before the first major overhaul is required. Component B is expected to have a useful life of 7 years and a residual value of $ 15,000 before its first overhaul. Nigeria uses straight-line depreciation for all its equipment. What is the net book value of component A after 5 years?

A) $ 0

B) $ 19,000

C) $ 20,000

D) $ 55,600

Component A is expected to have a useful life of 5 years and a residual value of $ 20,000 before the first major overhaul is required. Component B is expected to have a useful life of 7 years and a residual value of $ 15,000 before its first overhaul. Nigeria uses straight-line depreciation for all its equipment. What is the net book value of component A after 5 years?

A) $ 0

B) $ 19,000

C) $ 20,000

D) $ 55,600

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

42

On September 10, 2020, Angola Printing incurred the following costs for one of its printing presses: Purchase of stapling attachment.............................................................$84,000

Installation of attachment........................................................................10,000

Replacement parts for renovation of presz.........................................

Labour and overhead in connection with renovation of presc ............ Neither the attachment nor the renovation increased the estimated useful life of the press. However, the renovation resulted in significantly increased productivity. What amount of the costs should be capitalized?

A) $ 0

B) $ 108,000

C) $ 130,000

D) $ 144,000

Installation of attachment........................................................................10,000

Replacement parts for renovation of presz.........................................

Labour and overhead in connection with renovation of presc ............ Neither the attachment nor the renovation increased the estimated useful life of the press. However, the renovation resulted in significantly increased productivity. What amount of the costs should be capitalized?

A) $ 0

B) $ 108,000

C) $ 130,000

D) $ 144,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following expenditures after acquisition would NOT be capitalized?

A) adding a new wing to a hospital

B) replacing the air conditioning system in an office building

C) major overhaul of a fleet of trucks

D) replacing all the tires on an 18-wheel semi-trailer

A) adding a new wing to a hospital

B) replacing the air conditioning system in an office building

C) major overhaul of a fleet of trucks

D) replacing all the tires on an 18-wheel semi-trailer

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is correct?

A) IFRS allows the cost, revaluation, or fair value models; ASPE allows only the cost model.

B) ASPE allows the cost, revaluation, or fair value models; IFRS allows only the cost model.

C) Both IFRS and ASPE allow the cost, revaluation, or fair value models.

D) IFRS allows the cost, revaluation, or fair value models; ASPE allows only the cost and revaluation models.

A) IFRS allows the cost, revaluation, or fair value models; ASPE allows only the cost model.

B) ASPE allows the cost, revaluation, or fair value models; IFRS allows only the cost model.

C) Both IFRS and ASPE allow the cost, revaluation, or fair value models.

D) IFRS allows the cost, revaluation, or fair value models; ASPE allows only the cost and revaluation models.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

45

When using the revaluation model of accounting for PP&E assets (asset-adjustment or elimination method),

A) the related Accumulated Depreciation account is closed to OCI.

B) depreciation continues to be charged in the original pattern.

C) the difference between fair value and book value is always debited to Revaluation Surplus (OCI).

D) a new depreciation rate must be calculated.

A) the related Accumulated Depreciation account is closed to OCI.

B) depreciation continues to be charged in the original pattern.

C) the difference between fair value and book value is always debited to Revaluation Surplus (OCI).

D) a new depreciation rate must be calculated.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is correct?

A) IFRS requires that any net revenues or expenses derived from an asset before it is ready for use be included in income; ASPE requires that such revenues and expenses be included in the asset's cost.

B) ASPE requires that any net revenues or expenses derived from an asset before it is ready for use be included in income; IFRS requires that such revenues and expenses be included in the asset's cost.

C) Both IFRS and ASPE require that any net revenues or expenses derived from an asset before it is ready for use be included in income.

D) Both IFRS and ASPE require that any net revenues or expenses derived from an asset before it is ready for use be included in the asset's cost.

A) IFRS requires that any net revenues or expenses derived from an asset before it is ready for use be included in income; ASPE requires that such revenues and expenses be included in the asset's cost.

B) ASPE requires that any net revenues or expenses derived from an asset before it is ready for use be included in income; IFRS requires that such revenues and expenses be included in the asset's cost.

C) Both IFRS and ASPE require that any net revenues or expenses derived from an asset before it is ready for use be included in income.

D) Both IFRS and ASPE require that any net revenues or expenses derived from an asset before it is ready for use be included in the asset's cost.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

47

Assume the same facts as indicated above, except that, between December 31, 2020, and December 31, 2021, the property's fair value had decreased by $ 10,000. As a result, Tunisia's 2021 income statement will include a

A) $ 10,000 loss.

B) $ 8,000 loss.

C) $ 8,000 gain (other comprehensive income).

D) $ 2,000 loss.

A) $ 10,000 loss.

B) $ 8,000 loss.

C) $ 8,000 gain (other comprehensive income).

D) $ 2,000 loss.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

48

Nickel Corporation uses the fair value model of accounting for its investment property. The fair values of its property were: December 31, 2020, $ 180,000 and December 31, 2021, $ 195,000. At December 31, 2021, Nickel should

A) recognize a gain of $ 15,000 in income.

B) report a gain of $ 15,000 in other comprehensive income.

C) defer the gain until the property is sold.

D) do nothing (ignore it).

A) recognize a gain of $ 15,000 in income.

B) report a gain of $ 15,000 in other comprehensive income.

C) defer the gain until the property is sold.

D) do nothing (ignore it).

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

49

Round Up Corporation uses the cost model to account for its property, plant, and equipment, which were acquired on January 1, 2020, for $ 200,000. Round Up uses straight-line depreciation and estimates the assets will have an eight-year life with no residual value. Assuming Round Up did not experience any impairment losses, the December 31, 2021, net book value of the assets is

A) $ 200,000.

B) $ 175,000.

C) $ 150,000.

D) $ 125,000.

A) $ 200,000.

B) $ 175,000.

C) $ 150,000.

D) $ 125,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is correct?

A) IFRS treats major overhauls that allow the continued use of an asset, as replacements; ASPE usually treats them as expenses.

B) ASPE treats major overhauls that allow the continued use of an asset, as replacements; IFRS usually treats them as expenses.

C) Both IFRS and ASPE treat major overhauls that allow the continued use of an asset, as replacements.

D) Both IFRS and ASPE treat major overhauls that allow the continued use of an asset, as expenses.

A) IFRS treats major overhauls that allow the continued use of an asset, as replacements; ASPE usually treats them as expenses.

B) ASPE treats major overhauls that allow the continued use of an asset, as replacements; IFRS usually treats them as expenses.

C) Both IFRS and ASPE treat major overhauls that allow the continued use of an asset, as replacements.

D) Both IFRS and ASPE treat major overhauls that allow the continued use of an asset, as expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information for questions.

Tunisia Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available:

1. Accumulated Depreciation at December 31, 2021, (prior to any fair value adjustments) was $ 12,000.

2. Between December 31, 2020, and December 31, 2021, the property's fair value had increased by $ 30,000.

3. The December 31, 2021, balance in the revaluation surplus account (prior to any fair value adjustments) was $ 2,000.

The adjusted December 31, 2021, in the revaluation surplus account will be

A) $ 0.

B) $ 28,000.

C) $ 30,000.

D) $ 32,000.

Tunisia Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available:

1. Accumulated Depreciation at December 31, 2021, (prior to any fair value adjustments) was $ 12,000.

2. Between December 31, 2020, and December 31, 2021, the property's fair value had increased by $ 30,000.

3. The December 31, 2021, balance in the revaluation surplus account (prior to any fair value adjustments) was $ 2,000.

The adjusted December 31, 2021, in the revaluation surplus account will be

A) $ 0.

B) $ 28,000.

C) $ 30,000.

D) $ 32,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

52

The revaluation model of accounting for PP&E assets

A) uses a revaluation surplus account to hold net increases in the asset's fair value.

B) may be applied to all classes of PP&E including investment property.

C) may be applied to investment property under ASPE.

D) is not allowed under IFRS.

A) uses a revaluation surplus account to hold net increases in the asset's fair value.

B) may be applied to all classes of PP&E including investment property.

C) may be applied to investment property under ASPE.

D) is not allowed under IFRS.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

53

Land was purchased to be used as the site for the construction of a plant. A building on the property was sold and removed by the buyer so that construction on the plant could begin. The proceeds from the sale of the building should be

A) classified as other income.

B) deducted from the cost of the land.

C) netted against the costs to clear the land and expensed as incurred.

D) netted against the costs to clear the land and amortized over the life of the plant.

A) classified as other income.

B) deducted from the cost of the land.

C) netted against the costs to clear the land and expensed as incurred.

D) netted against the costs to clear the land and amortized over the life of the plant.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

54

The fair value model of accounting for PP&E assets

A) recognizes changes in the asset's fair value in other comprehensive income.

B) should be applied to investment property only.

C) once chosen for one investment property does not have to be applied to all investment property.

D) is acceptable under both IFRS and ASPE.

A) recognizes changes in the asset's fair value in other comprehensive income.

B) should be applied to investment property only.

C) once chosen for one investment property does not have to be applied to all investment property.

D) is acceptable under both IFRS and ASPE.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

55

When can the balance in the Revaluation Surplus (OCI) account be transferred to retained earnings?

A) at the end of every year, or when the asset is sold

B) whenever a revaluation is performed

C) only when the revalued asset is sold

D) never

A) at the end of every year, or when the asset is sold

B) whenever a revaluation is performed

C) only when the revalued asset is sold

D) never

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

56

The cost model of accounting for PP&E assets

A) should be applied to investment property only.

B) should be applied to other PP&E assets only.

C) can be applied to all classes of PP&E including investment property.

D) is not appropriate under ASPE.

A) should be applied to investment property only.

B) should be applied to other PP&E assets only.

C) can be applied to all classes of PP&E including investment property.

D) is not appropriate under ASPE.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

57

A major overhaul made to a machine increased its fair value and its production capacity by 25% without extending the machine's useful life. The cost of the improvement should be

A) expensed.

B) debited to accumulated depreciation.

C) capitalized.

D) allocated between accumulated depreciation and the machine account.

A) expensed.

B) debited to accumulated depreciation.

C) capitalized.

D) allocated between accumulated depreciation and the machine account.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

58

An expenditure that maintains an existing asset so that it can function in the manner intended should be

A) fully expensed in the period in which it is made.

B) partially expensed in the period in which it is made.

C) fully capitalized in the period in which it is made.

D) partially capitalized in the period in which it is made.

A) fully expensed in the period in which it is made.

B) partially expensed in the period in which it is made.

C) fully capitalized in the period in which it is made.

D) partially capitalized in the period in which it is made.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

59

Kenya Ltd. acquires a new machine. It is comprised of two different components (A and B) that are expected to be overhauled at different times. The acquisition costs of the components are as follows:

Component A is expected to have a useful life of 5 years and a residual value of $ 20,000 before the first major overhaul is required. Component B is expected to have a useful life of 7 years and a residual value of $ 15,000 before its first overhaul. Kenya uses straight-line depreciation for all its equipment. At the beginning of year 6, component A undergoes a major overhaul at a cost of 100,000. The work is expected to extend its life by 3 years, but the residual value will then be zero. What is the net book value of component A one year after the overhaul?

A) $ 120,000

B) $ 80,000

C) $ 66,667

D) $ 40,000

Component A is expected to have a useful life of 5 years and a residual value of $ 20,000 before the first major overhaul is required. Component B is expected to have a useful life of 7 years and a residual value of $ 15,000 before its first overhaul. Kenya uses straight-line depreciation for all its equipment. At the beginning of year 6, component A undergoes a major overhaul at a cost of 100,000. The work is expected to extend its life by 3 years, but the residual value will then be zero. What is the net book value of component A one year after the overhaul?

A) $ 120,000

B) $ 80,000

C) $ 66,667

D) $ 40,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions.

Tunisia Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available:

1. Accumulated Depreciation at December 31, 2021, (prior to any fair value adjustments) was $ 12,000.

2. Between December 31, 2020, and December 31, 2021, the property's fair value had increased by $ 30,000.

3. The December 31, 2021, balance in the revaluation surplus account (prior to any fair value adjustments) was $ 2,000.

The adjusted December 31, 2021, balance in the related contra-asset account will be

A) $ 0.

B) $ 10,000.

C) $ 12,000.

D) $ 14,000.

Tunisia Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available:

1. Accumulated Depreciation at December 31, 2021, (prior to any fair value adjustments) was $ 12,000.

2. Between December 31, 2020, and December 31, 2021, the property's fair value had increased by $ 30,000.

3. The December 31, 2021, balance in the revaluation surplus account (prior to any fair value adjustments) was $ 2,000.

The adjusted December 31, 2021, balance in the related contra-asset account will be

A) $ 0.

B) $ 10,000.

C) $ 12,000.

D) $ 14,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

61

Non-monetary transaction without commercial substance

Malawi Auto traded one of its used trailers (cost $ 40,000, accumulated depreciation $ 36,000) for another used trailer with a fair value of $ 6,400. Malawi also paid $ 600 to complete the transaction.

Instructions

Assuming the transaction lacks commercial substance, prepare the journal entry to record the exchange.

Malawi Auto traded one of its used trailers (cost $ 40,000, accumulated depreciation $ 36,000) for another used trailer with a fair value of $ 6,400. Malawi also paid $ 600 to complete the transaction.

Instructions

Assuming the transaction lacks commercial substance, prepare the journal entry to record the exchange.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

62

On May 1, 2020, Ethiopia Ltd. began construction of a new building for its own use. Expenditures of $ 75,000 were incurred monthly for five months beginning on May 1. The building was completed and ready for occupancy on September 1, 2020. For the purpose of determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures on the building during 2020 were

A) $ 62,500.

B) $ 75,000.

C) $ 187,500.

D) $ 375,000.

A) $ 62,500.

B) $ 75,000.

C) $ 187,500.

D) $ 375,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

63

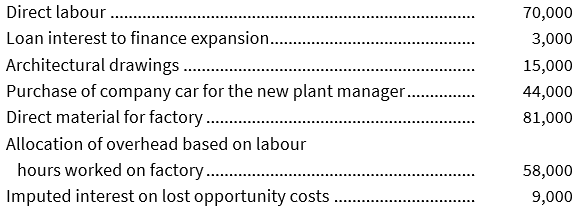

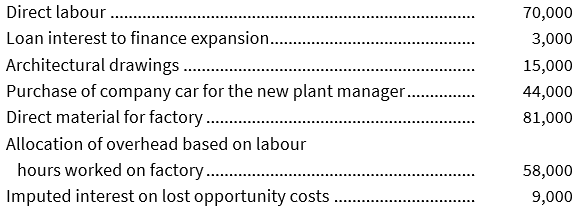

Costs included in assets

Eritrea Ltd. is expanding its operations. Due to the expansion, they incurred the following costs during the fiscal period when they constructed a new factory:

Instructions

Which of these costs should be included in the cost of the new factory?

Eritrea Ltd. is expanding its operations. Due to the expansion, they incurred the following costs during the fiscal period when they constructed a new factory:

Instructions

Which of these costs should be included in the cost of the new factory?

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is correct?

A) ASPE considers investment, mining, and oil and gas properties to be part of property, plant, and equipment; IFRS has different standards for each of these.

B) IFRS considers investment, mining, and oil and gas properties to be part of property, plant, and equipment; ASPE has different standards for each of these.

C) Both ASPE and IFRS consider investment, mining, and oil and gas properties to be part of property, plant, and equipment.

D) Both ASPE and IFRS have different standards for investment, mining, and oil and gas properties; they do not consider them to be part of property, plant, and equipment.

A) ASPE considers investment, mining, and oil and gas properties to be part of property, plant, and equipment; IFRS has different standards for each of these.

B) IFRS considers investment, mining, and oil and gas properties to be part of property, plant, and equipment; ASPE has different standards for each of these.

C) Both ASPE and IFRS consider investment, mining, and oil and gas properties to be part of property, plant, and equipment.

D) Both ASPE and IFRS have different standards for investment, mining, and oil and gas properties; they do not consider them to be part of property, plant, and equipment.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

65

During calendar 2020, Somalia Corp. incurred weighted-average accumulated expenditures of $ 800,000 during construction of assets that qualified for capitalization of interest. The only debt outstanding during 2020 was a $ 900,000, 8%, five-year note payable dated January 1, 2018. The amount of interest that should be capitalized during calendar 2020 is

A) $ 0.

B) $ 32,000.

C) $ 64,000.

D) $ 72,000.

A) $ 0.

B) $ 32,000.

C) $ 64,000.

D) $ 72,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following information to solve the following questions:

On March 1, 2020, Mauritania Ltd. purchased land for $ 270,000 cash, which they intend to use for their new head office. Construction on the office building began on March 1. The following expenditures were incurred for construction:

The office building was completed and ready for occupancy on July 1. To help pay for construction, Mauritania borrowed $ 360,000 on March 1, 2020, on a 9%, three-year note payable. Other than this note, the only other debt outstanding during 2020 was a $ 150,000, 10%, six-year note payable dated January 1, 2019.

-The actual interest cost incurred during 2020 was

A) $ 27,000.

B) $ 39,500.

C) $ 42,000.

D) $ 47,400.

On March 1, 2020, Mauritania Ltd. purchased land for $ 270,000 cash, which they intend to use for their new head office. Construction on the office building began on March 1. The following expenditures were incurred for construction:

The office building was completed and ready for occupancy on July 1. To help pay for construction, Mauritania borrowed $ 360,000 on March 1, 2020, on a 9%, three-year note payable. Other than this note, the only other debt outstanding during 2020 was a $ 150,000, 10%, six-year note payable dated January 1, 2019.

-The actual interest cost incurred during 2020 was

A) $ 27,000.

B) $ 39,500.

C) $ 42,000.

D) $ 47,400.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

67

Use the following information to solve the following questions:

On March 1, 2020, Mauritania Ltd. purchased land for $ 270,000 cash, which they intend to use for their new head office. Construction on the office building began on March 1. The following expenditures were incurred for construction:

The office building was completed and ready for occupancy on July 1. To help pay for construction, Mauritania borrowed $ 360,000 on March 1, 2020, on a 9%, three-year note payable. Other than this note, the only other debt outstanding during 2020 was a $ 150,000, 10%, six-year note payable dated January 1, 2019.

-The weighted-average accumulated expenditures on the construction project during 2020 were

A) $ 1,467,000.

B) $ 348,000.

C) $ 258,000.

D) $ 156,000.

On March 1, 2020, Mauritania Ltd. purchased land for $ 270,000 cash, which they intend to use for their new head office. Construction on the office building began on March 1. The following expenditures were incurred for construction:

The office building was completed and ready for occupancy on July 1. To help pay for construction, Mauritania borrowed $ 360,000 on March 1, 2020, on a 9%, three-year note payable. Other than this note, the only other debt outstanding during 2020 was a $ 150,000, 10%, six-year note payable dated January 1, 2019.

-The weighted-average accumulated expenditures on the construction project during 2020 were

A) $ 1,467,000.

B) $ 348,000.

C) $ 258,000.

D) $ 156,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

68

Acquisition Cost

Rwanda Corporation purchased land at a cost of $ 100,000. Closing costs were $ 3,800, plus Rwanda paid $ 48,000 for site preparation so they could construct a building on the site.

Instructions

Calculate the amount that should be recorded as the cost of the land.

Rwanda Corporation purchased land at a cost of $ 100,000. Closing costs were $ 3,800, plus Rwanda paid $ 48,000 for site preparation so they could construct a building on the site.

Instructions

Calculate the amount that should be recorded as the cost of the land.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

69

Explain the concept of componentization as it applies to the recognition of PP&E assets.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

70

Borrowing costs that are capitalized should

A) be written off over the remaining term of the debt.

B) be accumulated in a separate deferred charge account and written off straight-line over a 40-year period.

C) not be written off until the related asset is fully depreciated or disposed of.

D) be amortized over the related asset's useful life.

A) be written off over the remaining term of the debt.

B) be accumulated in a separate deferred charge account and written off straight-line over a 40-year period.

C) not be written off until the related asset is fully depreciated or disposed of.

D) be amortized over the related asset's useful life.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following information for questions.

Egypt Corp. owns equipment that originally cost $ 100,000. At December 31, 2020, the equipment's book value (after 2020 depreciation was booked) is $ 60,000. It is determined that the fair value of the equipment at this date is $ 90,000. Although Egypt's policy is to apply the revaluation model using the proportionate method, this is the first time the company has done it.

The adjusting entry to record the revaluation will include a

A) debit to Accumulated Depreciation of $ 20,000.

B) credit to Equipment of $ 10,000.

C) credit to Revaluation Surplus (OCI) of $ 30,000.

D) debit to Revaluation Surplus (OCI) of $ 10,000.

Egypt Corp. owns equipment that originally cost $ 100,000. At December 31, 2020, the equipment's book value (after 2020 depreciation was booked) is $ 60,000. It is determined that the fair value of the equipment at this date is $ 90,000. Although Egypt's policy is to apply the revaluation model using the proportionate method, this is the first time the company has done it.

The adjusting entry to record the revaluation will include a

A) debit to Accumulated Depreciation of $ 20,000.

B) credit to Equipment of $ 10,000.

C) credit to Revaluation Surplus (OCI) of $ 30,000.

D) debit to Revaluation Surplus (OCI) of $ 10,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

72

Asset exchange

Arabia Inc. traded its fleet of rental cars for a new fleet. Two-thirds of the old fleet's original cost of $ 375,000 had been depreciated. The new fleet is valued at $ 500,000 and Arabia was required to make a cash payment of $ 400,000.

Instructions

Prepare the required entr(ies) to record the exchange.

Arabia Inc. traded its fleet of rental cars for a new fleet. Two-thirds of the old fleet's original cost of $ 375,000 had been depreciated. The new fleet is valued at $ 500,000 and Arabia was required to make a cash payment of $ 400,000.

Instructions

Prepare the required entr(ies) to record the exchange.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

73

When using the revaluation model of accounting for PP&E assets (proportionate method),

A) a Revaluation Surplus account is not used.

B) depreciation continues to be charged in the original pattern.

C) the asset account and its related contra-asset are both adjusted.

D) over the life of the asset, it is possible that there can be a net increase in net income from revaluations.

A) a Revaluation Surplus account is not used.

B) depreciation continues to be charged in the original pattern.

C) the asset account and its related contra-asset are both adjusted.

D) over the life of the asset, it is possible that there can be a net increase in net income from revaluations.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

74

Construction of a qualifying asset is started on April 1 and finished on December 1. The fraction used to multiply an expenditure made on April 1 to find weighted-average accumulated expenditures is

A) 8 ÷ 8.

B) 8 ÷ 12.

C) 9 ÷ 12.

D) 11 ÷ 12.

A) 8 ÷ 8.

B) 8 ÷ 12.

C) 9 ÷ 12.

D) 11 ÷ 12.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

75

Asset exchange with commercial substance

In 2021, Malawi Inc. exchanged equipment for two delivery trucks. The equipment had been purchased for $ 95,000 ten years ago and has since been fully depreciated. While the equipment was recently appraised at $ 22,000, a reliable valuation for the trucks was not available. This transaction has commercial substance.

Instructions

Prepare the journal entry to record the exchange.

In 2021, Malawi Inc. exchanged equipment for two delivery trucks. The equipment had been purchased for $ 95,000 ten years ago and has since been fully depreciated. While the equipment was recently appraised at $ 22,000, a reliable valuation for the trucks was not available. This transaction has commercial substance.

Instructions

Prepare the journal entry to record the exchange.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following information for questions.

Egypt Corp. owns equipment that originally cost $ 100,000. At December 31, 2020, the equipment's book value (after 2020 depreciation was booked) is $ 60,000. It is determined that the fair value of the equipment at this date is $ 90,000. Although Egypt's policy is to apply the revaluation model using the proportionate method, this is the first time the company has done it.

By how much must the accumulated depreciation account be increased (decreased) at December 31, 2020?

A) $ 20,000

B) $ 40,000

C) $ 60,000

D) $ (60,000)

Egypt Corp. owns equipment that originally cost $ 100,000. At December 31, 2020, the equipment's book value (after 2020 depreciation was booked) is $ 60,000. It is determined that the fair value of the equipment at this date is $ 90,000. Although Egypt's policy is to apply the revaluation model using the proportionate method, this is the first time the company has done it.

By how much must the accumulated depreciation account be increased (decreased) at December 31, 2020?

A) $ 20,000

B) $ 40,000

C) $ 60,000

D) $ (60,000)

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

77

Borrowing costs incurred for the acquisition of assets may be capitalized if certain conditions are met. Which of the following issues is irrelevant in making that determination?

A) the capitalization period

B) the avoidable borrowing costs

C) whether the asset is a "qualifying asset"

D) the depreciation period

A) the capitalization period

B) the avoidable borrowing costs

C) whether the asset is a "qualifying asset"

D) the depreciation period

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

78

On March 1, Senegal Inc. began construction of a small building for its own use. Payments of $ 150,000 were made monthly for three months beginning March 1. The building was completed and ready for occupancy on June 1. In determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures are

A) $ 0.

B) $ 75,000.

C) $ 150,000.

D) $ 450,000.

A) $ 0.

B) $ 75,000.

C) $ 150,000.

D) $ 450,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

79

Non-interest-bearing note

Togo Auto purchased several trucks by issuing a $ 40,000, 4-year, non-interest-bearing note to Rabat Motors. The market interest rate for this type of transaction is 8%.

Instructions

Prepare the journal entry to record the purchase of these trucks.

Togo Auto purchased several trucks by issuing a $ 40,000, 4-year, non-interest-bearing note to Rabat Motors. The market interest rate for this type of transaction is 8%.

Instructions

Prepare the journal entry to record the purchase of these trucks.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

80

A company is constructing an asset for its own use. Construction began in 2020. The asset is being financed entirely with a specific new borrowing. Construction expenditures were made in 2020 and 2021 at the end of each quarter. The total amount of interest cost capitalized in 2021 should be determined by applying the interest rate on the specific new borrowing to the

A) total accumulated expenditures for the asset in 2020 and 2021.

B) weighted-average accumulated expenditures for the asset in 2020 and 2021.

C) weighted-average expenditures for the asset in 2021.

D) total expenditures for the asset in 2021.

A) total accumulated expenditures for the asset in 2020 and 2021.

B) weighted-average accumulated expenditures for the asset in 2020 and 2021.

C) weighted-average expenditures for the asset in 2021.

D) total expenditures for the asset in 2021.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck