Deck 3: Measurement

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/31

Play

Full screen (f)

Deck 3: Measurement

1

The highest and best use concept values the asset based on the highest value that the market would place on the asset, considering all possible uses that are

A) physically possible.

B) legally permissible.

C) financially feasible.

D) economically intolerable.

A) physically possible.

B) legally permissible.

C) financially feasible.

D) economically intolerable.

financially feasible.

2

In order to measure fair value under IFRS13, an entity must determine

A) the item being measured, and how the item could or would be used.

B) the market the item would be (or is) bought and sold in.

C) which fair value model is being used to value the item.

D) all of the above

A) the item being measured, and how the item could or would be used.

B) the market the item would be (or is) bought and sold in.

C) which fair value model is being used to value the item.

D) all of the above

all of the above

3

Which of the following is an example of an item that would be measured under the current value measurement categorization?

A) inventory using various cost flow assumptions.

B) inventory measured at the lower of cost and net realizable value.

C) biological assets.

D) financial instruments carried at cost.

A) inventory using various cost flow assumptions.

B) inventory measured at the lower of cost and net realizable value.

C) biological assets.

D) financial instruments carried at cost.

biological assets.

4

Which of the following is not a category to measure financial statement elements?

A) cost-based measures.

B) hybrid measures.

C) cash flow measures.

D) current value measures.

A) cost-based measures.

B) hybrid measures.

C) cash flow measures.

D) current value measures.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

5

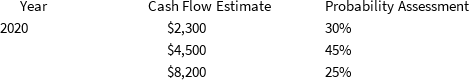

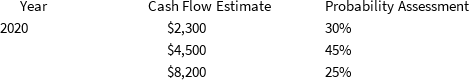

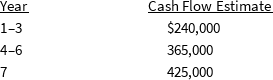

Use the following data to solve the following questions:

-Frontier Landscaping owns some equipment that is used in their operations. Management estimates that the equipment will last another three years and will generate the following future cash flows at the end of each year.

Assuming Frontier Landscaping's equipment has a carrying value of $16,000, how much of an impairment loss must Frontier record?

A) none as there is no impairment.

B) $383

C) $6,606

D) $2,518

-Frontier Landscaping owns some equipment that is used in their operations. Management estimates that the equipment will last another three years and will generate the following future cash flows at the end of each year.

Assuming Frontier Landscaping's equipment has a carrying value of $16,000, how much of an impairment loss must Frontier record?

A) none as there is no impairment.

B) $383

C) $6,606

D) $2,518

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

6

Branson Company deposited $5,800 in an account paying 2.5% annual interest. How much simple interest would Branson earn in 3 years?

A)$5,945

B) $435

C) $145

D) $446

A)$5,945

B) $435

C) $145

D) $446

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is an example of an item that would be measured under the hybrid measurement categorization?

A) investment properties.

B) inventory measured at the lower of cost and net realizable value.

C) biological assets.

D) financial instruments carried at cost.

A) investment properties.

B) inventory measured at the lower of cost and net realizable value.

C) biological assets.

D) financial instruments carried at cost.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

8

Branson Company deposited $5,800 in an account paying 2.5% annual interest. How much interest-on-interest would Branson earn in 3 years?

A) $11

B) $33

C) $5.50

D) $22

A) $11

B) $33

C) $5.50

D) $22

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

9

Level 1 inputs

A) are the lowest-quality inputs but provide the best-quality fair value.

B) are used when level 3 inputs are not available.

C) are generally not observable in various markets.

D) are more objective.

A) are the lowest-quality inputs but provide the best-quality fair value.

B) are used when level 3 inputs are not available.

C) are generally not observable in various markets.

D) are more objective.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

10

Inputs to income models include which of the following?

A) using a risk-free and risk-adjusted interest rate

B) adjusting cash flows and the discount rate in the same calculation

C) actual cash flows

D) time value of money

A) using a risk-free and risk-adjusted interest rate

B) adjusting cash flows and the discount rate in the same calculation

C) actual cash flows

D) time value of money

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

11

Billow Company has issued a 3% bond that is payable in 5 years and has a face value of $100,000. The risk-adjusted market rate is 4%. Calculate the fair value of the bond.

A) $82,193

B) $13,355

C) $68,838

D) $95,548

A) $82,193

B) $13,355

C) $68,838

D) $95,548

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

12

Fiddler Company has a loan balance of $853.02 and must make equal payments of $100 at the end of each of the next 10 months. What is the monthly rate of interest that Fiddler Company is paying?

A) 2%

B) 2.5%

C) 3%

D) 4%

A) 2%

B) 2.5%

C) 3%

D) 4%

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

13

Helvetica Corporation is interested in leasing a piece of machinery that has a fair value of $150,000. The market rate for financing is 8% and Helvetica plans to lease the machinery for the next five years. Calculate the quarterly lease payments.

A)$ 9,174

B) $15,278

C) $31,824

D) $37,569

A)$ 9,174

B) $15,278

C) $31,824

D) $37,569

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following data to solve the following questions:

-Frontier Landscaping owns some equipment that is used in their operations. Management estimates that the equipment will last another three years and will generate the following future cash flows at the end of each year.

Calculate the present value of each of these future cash flows given a 4% discount rate.

A) $15,617

B) $9,394

C) $18,135

D) $35,165

-Frontier Landscaping owns some equipment that is used in their operations. Management estimates that the equipment will last another three years and will generate the following future cash flows at the end of each year.

Calculate the present value of each of these future cash flows given a 4% discount rate.

A) $15,617

B) $9,394

C) $18,135

D) $35,165

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

15

The cost model attempts to reflect the amount that would be required to

A) replace the asset's service capacity.

B) value older financial assets where there is no longer a market for the asset.

C) value the asset.

D) value older non-financial assets where there is a market for the asset.

A) replace the asset's service capacity.

B) value older financial assets where there is no longer a market for the asset.

C) value the asset.

D) value older non-financial assets where there is a market for the asset.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

16

Under the traditional discounted cash flow approach,

A) the model is best used when cash flows are uncertain.

B) the stream of contracted cash flows is discounted.

C) the risk-free discount rate is used.

D) the method is best used when cash flows are variable.

A) the model is best used when cash flows are uncertain.

B) the stream of contracted cash flows is discounted.

C) the risk-free discount rate is used.

D) the method is best used when cash flows are variable.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

17

A fair value measure under IFRS 13 is based on which view of fair value?

A) market participant view

B) shareholder view

C) fair value view

D) unbiased view

A) market participant view

B) shareholder view

C) fair value view

D) unbiased view

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

18

Valuation premise does not refer to

A) the perceived value of the asset/liability.

B) the actual use of the asset/liability.

C) the highest and best use valuation in the market.

D) how the asset/liability is to be used.

A) the perceived value of the asset/liability.

B) the actual use of the asset/liability.

C) the highest and best use valuation in the market.

D) how the asset/liability is to be used.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

19

Branson Company deposited $5,800 in an account paying 2.5% annual interest. How much compound interest would Branson earn in 3 years?

A)$6,235

B) $435

C) $145

D) $446

A)$6,235

B) $435

C) $145

D) $446

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

20

Under the expected cash flow approach,

A) the model is best used where the element being measured does not have variable cash flows.

B) the projected cash flows reflect the certainty in terms of amount and timing.

C) the discount rate is adjusted to accommodate the riskiness of the cash flows.

D) the cash flow uncertainty is dealt with by using probabilities.

A) the model is best used where the element being measured does not have variable cash flows.

B) the projected cash flows reflect the certainty in terms of amount and timing.

C) the discount rate is adjusted to accommodate the riskiness of the cash flows.

D) the cash flow uncertainty is dealt with by using probabilities.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

21

Inputs under IFRS 13

There are three levels of inputs under IFRS 13. What type of inputs are used by Hood Company in exercise 3-85? As a result, what classification would be assigned to the specialized equipment?

There are three levels of inputs under IFRS 13. What type of inputs are used by Hood Company in exercise 3-85? As a result, what classification would be assigned to the specialized equipment?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

22

Pearson Corporation makes an investment today (January 1, 2020). They will receive $9,000 every December 31 for the next six years (2020-2025). If Pearson wants to earn 12% on the investment, what is the most they should invest on January 1, 2020?

A) $37,003

B) $41,443

C) $73,036

D) $81,801

A) $37,003

B) $41,443

C) $73,036

D) $81,801

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

23

Your client, Bench Company, has a few minor lawsuits outstanding. Your main contact, Michael Wood, has heard that, though their amount is unknown, these lawsuits must be recorded on the financial statements. Explain briefly for Mr. Wood, the cash flow approach you would take to determining the amount to record on Bench Company's financial statements.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

24

The main difference in the accounting for measurement issues between IFRS and ASPE is that

A) IFRS has a well-developed framework for measuring fair values (IFRS13), whereas ASPE does not.

B) there is no difference between accounting for measurement issues between these standards.

C) guidance under ASPE is concentrated in a single area of the ASPE body of knowledge.

D) IFRS requires explicit disclosure of fair value amounts, whereas these disclosures under ASPE are optional.

A) IFRS has a well-developed framework for measuring fair values (IFRS13), whereas ASPE does not.

B) there is no difference between accounting for measurement issues between these standards.

C) guidance under ASPE is concentrated in a single area of the ASPE body of knowledge.

D) IFRS requires explicit disclosure of fair value amounts, whereas these disclosures under ASPE are optional.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

25

Barkley Company will receive $400,000 in a future year. If the future receipt is discounted at an interest rate of 8%, its present value is $252,068. In how many years is the $400,000 received?

A) 5 years

B) 6 years

C) 7 years

D) 8 years

A) 5 years

B) 6 years

C) 7 years

D) 8 years

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

26

Present value of an annuity due

How much must be invested now to receive $30,000 for ten years if the first $30,000 is received today and the rate is 8%?

How much must be invested now to receive $30,000 for ten years if the first $30,000 is received today and the rate is 8%?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

27

Raleigh Inc. is considering leasing a piece of equipment with a fair value of $108,000 for three years. The current market interest rate for financing the equipment is 5% compounded semi-annually. Calculate the semi-annual lease payment assuming that the payment is made at the beginning of the period (round to the nearest dollar).

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

28

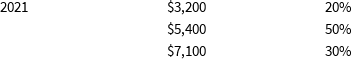

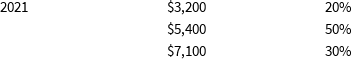

Assume that Picnic Paper Co. has several minor lawsuits outstanding. To determine the amount of liability to recognize on the statement of financial position, Picnic decides to use expected cash flow techniques. Based on discussions with their lawyers, Picnic has developed the following cash flow estimates, and related probabilities:

Instructions

Instructions

Based on these estimates, and assuming a risk-free rate of 5%, what is the present value of expected cash flows that Picnic should record on their statement of financial position for 2020?

Instructions

InstructionsBased on these estimates, and assuming a risk-free rate of 5%, what is the present value of expected cash flows that Picnic should record on their statement of financial position for 2020?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

29

Calculate market price of a bond

On January 1, 2020 Lance Co. issued five-year bonds with a face value of $700,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%.

Calculate the issue price of the bonds.

On January 1, 2020 Lance Co. issued five-year bonds with a face value of $700,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%.

Calculate the issue price of the bonds.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

30

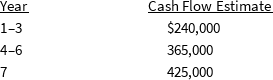

Valuation under IFRS 13

Hood Company owns specialized equipment that was purchased in an acquisition of Riding Company. The equipment has a book value of $1,800,000, but according to IFRS, it is assessed for impairment on an annual basis. To perform this impairment test, Hood must estimate the fair value of the equipment. It has developed the following cash flow estimates related to the equipment based on internal information. Each cash flow estimate reflects Hood's estimate of annual cash flows over the next 7 years. The equipment is assumed to have no residual value after the 7 years. (Assume the cash flows occur at the end of each year.)

Hood determines, using their own assumptions, that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the equipment?

Hood determines, using their own assumptions, that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the equipment?

Hood Company owns specialized equipment that was purchased in an acquisition of Riding Company. The equipment has a book value of $1,800,000, but according to IFRS, it is assessed for impairment on an annual basis. To perform this impairment test, Hood must estimate the fair value of the equipment. It has developed the following cash flow estimates related to the equipment based on internal information. Each cash flow estimate reflects Hood's estimate of annual cash flows over the next 7 years. The equipment is assumed to have no residual value after the 7 years. (Assume the cash flows occur at the end of each year.)

Hood determines, using their own assumptions, that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the equipment?

Hood determines, using their own assumptions, that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the equipment?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

31

Raleigh Inc. is considering leasing a piece of equipment with a fair value of $108,000 for three years. The current market interest rate for financing the equipment is 5% compounded semi-annually. Calculate the semi-annual lease payment assuming that the payment is made at the end of the period (round to the nearest dollar).

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck