Deck 12: Income Redistribution: Conceptual Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/34

Play

Full screen (f)

Deck 12: Income Redistribution: Conceptual Issues

1

The _________ of whites in poverty in the U.S.is greater than that of blacks and Hispanics.

A) percentage

B) total number

C) fraction

D) none of these answer options are correct.

A) percentage

B) total number

C) fraction

D) none of these answer options are correct.

total number

2

A redistribution is Pareto efficient if no one is made worse off afterward.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

True

3

The United States' official measure of poverty is measured by

A) only cash income.

B) cash income and capital gains.

C) only in-kind income.

D) the imputed value of rent payments.

A) only cash income.

B) cash income and capital gains.

C) only in-kind income.

D) the imputed value of rent payments.

only cash income.

4

A notion that supports the idea that some items should be distributed equally to all is known as

A) Pareto efficiency.

B) the Hoover Principle.

C) poverty gap closing.

D) commodity egalitarianism.

A) Pareto efficiency.

B) the Hoover Principle.

C) poverty gap closing.

D) commodity egalitarianism.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

5

An imaginary situation in which people have no knowledge of what their place in society is to be is?

A) first position

B) start position

C) original position

D) pole position

A) first position

B) start position

C) original position

D) pole position

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

6

The poverty rate in the United States has __________ over the last 30 years.

A) remained the same

B) increased

C) decreased

D) not been accurately measured

A) remained the same

B) increased

C) decreased

D) not been accurately measured

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

7

Giving in-kind transfers will ensure that people get proper amounts of nutrition.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

8

An in-kind transfer is a

A) transfer made by people to be kind to others.

B) transfer of wealth.

C) transfer of goods and services instead of cash.

D) system of clearing checks by local banks.

A) transfer made by people to be kind to others.

B) transfer of wealth.

C) transfer of goods and services instead of cash.

D) system of clearing checks by local banks.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

9

Changing the price of good Y will

A) only affect the demand for that good.

B) have effects across some markets.

C) keep prices down in all markets.

D) have no effect.

A) only affect the demand for that good.

B) have effects across some markets.

C) keep prices down in all markets.

D) have no effect.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

10

The group comprising the highest percentage of the poor is

A) the disabled.

B) elderly.

C) male heads of households.

D) children.

A) the disabled.

B) elderly.

C) male heads of households.

D) children.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

11

In a public goods context,it is difficult to measure its impact on real income because

A) public goods are generally free to the public.

B) they make up a small percentage of total GDP.

C) people do not reveal how they value public goods.

D) inflation decreases the value of the good.

A) public goods are generally free to the public.

B) they make up a small percentage of total GDP.

C) people do not reveal how they value public goods.

D) inflation decreases the value of the good.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

12

Giving poor people food instead of cash for food

A) is an in-kind transfer.

B) will benefit some more than others,depending on their utility function.

C) is politically popular.

D) all of these answer options are correct.

A) is an in-kind transfer.

B) will benefit some more than others,depending on their utility function.

C) is politically popular.

D) all of these answer options are correct.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

13

Maximizing the utility of the person with the minimum utility is known as

A) the minimax criterion.

B) the maximin criterion.

C) the Hicks-Kaldor criterion.

D) the Corlett-Hague Rule.

A) the minimax criterion.

B) the maximin criterion.

C) the Hicks-Kaldor criterion.

D) the Corlett-Hague Rule.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

14

Ignoring taxes when making redistributive decisions has no impact on equity.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

15

For the additive social welfare function to yield results,we must assume

A) individuals have identical utility functions.

B) individuals' utility functions have diminishing marginal utility of income.

C) the total amount of income available is fixed.

D) all of these answer options are correct.

A) individuals have identical utility functions.

B) individuals' utility functions have diminishing marginal utility of income.

C) the total amount of income available is fixed.

D) all of these answer options are correct.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

16

An additive social welfare function would

A) add the incomes of the lowest ten percent of income earners.

B) subtract out the utility functions of all people who are unemployed.

C) sum all individual utilities.

D) maximize the utility of the person with the minimum utility.

A) add the incomes of the lowest ten percent of income earners.

B) subtract out the utility functions of all people who are unemployed.

C) sum all individual utilities.

D) maximize the utility of the person with the minimum utility.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

17

The poverty line in the United States

A) last changed in 1980.

B) never changes.

C) changes with the level of inflation and family size.

D) changes with the minimum wage.

A) last changed in 1980.

B) never changes.

C) changes with the level of inflation and family size.

D) changes with the minimum wage.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

18

Taking into account the utility of all persons in society is referred to as

A) an utilitarian social welfare function.

B) equalizing social welfare function.

C) an in-kind transfer.

D) a Pareto equilibrium.

A) an utilitarian social welfare function.

B) equalizing social welfare function.

C) an in-kind transfer.

D) a Pareto equilibrium.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

19

The middle class in the United States has _______ since the late 1960s.

A) stayed the same

B) decreased

C) increased a great deal but then declined

D) increased slightly

A) stayed the same

B) decreased

C) increased a great deal but then declined

D) increased slightly

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

20

Generally,official poverty measures ignore

A) the impact of taxes.

B) the value of in-kind transfers.

C) the value of medical expenses that are paid by the government.

D) all of these answer options are correct.

A) the impact of taxes.

B) the value of in-kind transfers.

C) the value of medical expenses that are paid by the government.

D) all of these answer options are correct.

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

21

Income is the only factor used to measure a person's wealth.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

22

Social welfare functions require that a society has at least three people living in it.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

23

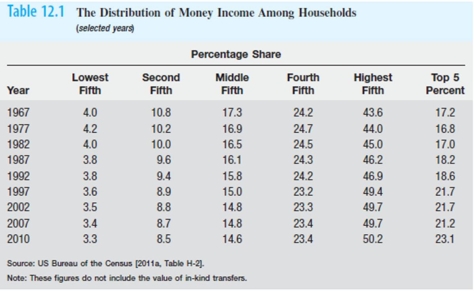

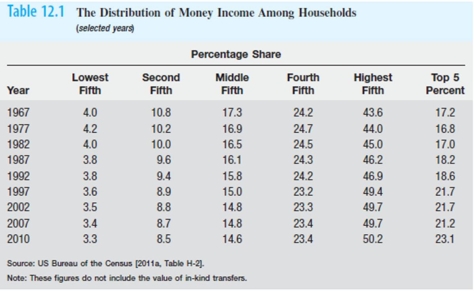

Refer to the table below.Relative to their starting position,people in the fourth-fifth of the income distribution have seen the greatest decrease in their share of income.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

24

Poverty is relative and not absolute.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

25

If the least wealthy person in a society has millions of dollars,should we still consider that person poor?

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

26

State whether you agree with the following statement and why: "It doesn't make sense to give poor people cash since they'll spend it on cigarettes and lottery tickets instead of needed items."

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

27

The poverty rate in the United States has decreased by more than 50% over the last 40 years.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

28

Measures of income before intervention are calculated on an annual rather than a lifetime basis.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose there are only two people,Mr.Mullinax and Ms.Fleming,who must split a fixed income of $500.For Mr.Mullinax,the marginal utility of income is MUm = 600 - 2Im,while for Ms.Fleming,marginal utility is MUf = 600 - 3If,where Im and If are the amounts of income to Mr.Mullinax and Ms.Fleming,respectively.

(A)What is the optimal distribution of income if the social welfare function is additive?

(B)What is the optimal distribution if society values only the utility of Ms.Fleming? What if the reverse is true? Comment on your answer.

(C)Finally,comment on how your answers change if the marginal utility of income for both Mr.Mullinax and Ms.Fleming is constant such that Mum = 250 = MUf.(This one is subtle.)

(A)What is the optimal distribution of income if the social welfare function is additive?

(B)What is the optimal distribution if society values only the utility of Ms.Fleming? What if the reverse is true? Comment on your answer.

(C)Finally,comment on how your answers change if the marginal utility of income for both Mr.Mullinax and Ms.Fleming is constant such that Mum = 250 = MUf.(This one is subtle.)

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

30

Ethics play a key role in income redistribution.

A) True

B) False

C) Uncertain

A) True

B) False

C) Uncertain

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

31

How would poverty be affected in the United States if the measure were changed to a more comprehensive one that included the value of in-kind transfers,medical services,and taxes?

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that in a certain society $10,000 is the official cut-off of income for the poor.This means that any person making less than $10,000 is considered poor.Suppose further that there are three people in this society: Randy,Marlon,and Tito,with incomes of $9,900,$9,900,and $5,000,respectively.

A)How many people are in poverty?

B)How much income would it take,on average,to lift every poor person out of poverty?

C)What if some policy caused $200 to be taken from Tito and given to Randy.How many people are in poverty now? How much income would it take,on average,to lift every poor person out of poverty?

A)How many people are in poverty?

B)How much income would it take,on average,to lift every poor person out of poverty?

C)What if some policy caused $200 to be taken from Tito and given to Randy.How many people are in poverty now? How much income would it take,on average,to lift every poor person out of poverty?

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

33

How would you feel about a policy that would raise someone else's income without lowering yours? Are you any worse off?

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose Lefty has utility characterized by the equation: Ul = 3I1/2,where I is income.In addition,Righty has utility characterized by the equation: Ur = 4I1/2,where I is income.

(A)If each had $100,000,which one would have the higher level of utility?

(B)Illustrate Lefty's and Right's utility functions.

(C)What equal amount of income could we give to both that would also give them the same level of utility?

(A)If each had $100,000,which one would have the higher level of utility?

(B)Illustrate Lefty's and Right's utility functions.

(C)What equal amount of income could we give to both that would also give them the same level of utility?

Unlock Deck

Unlock for access to all 34 flashcards in this deck.

Unlock Deck

k this deck