Deck 13: Accounting for Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 13: Accounting for Not-For-Profit Organizations

1

Cash planning and budgeting are important in government because the timing of cash inflows often do not coincide with the timing of cash outflows.

True

Explanation: Cash receipts from tax sources are often concentrated in a few months of the fiscal year whereas expenditures related to services, particularly payrolls, may be relatively level throughout the year. Cash planning and budgeting permit efficient short-term borrowing when needed and repayment of short-term debt and/or temporary investment during periods of excess cash balances.

Explanation: Cash receipts from tax sources are often concentrated in a few months of the fiscal year whereas expenditures related to services, particularly payrolls, may be relatively level throughout the year. Cash planning and budgeting permit efficient short-term borrowing when needed and repayment of short-term debt and/or temporary investment during periods of excess cash balances.

2

Total quality management (TQM)seeks to continuously improve an organization's ability to meet or exceed customers' demands,and,as such,is useful in a government setting as well as a business setting.

True

Explanation: TQM is relevant to any kind of organization since it strives for quality and productivity improvement. Under TQM, goals are oriented toward satisfying customer needs. In government, customers might be defined as service recipients, taxpayers, citizens, business, or other governments.

Explanation: TQM is relevant to any kind of organization since it strives for quality and productivity improvement. Under TQM, goals are oriented toward satisfying customer needs. In government, customers might be defined as service recipients, taxpayers, citizens, business, or other governments.

3

Effective financial management requires information about capital assets,including nonfinancial information such as physical measures of capital assets,their service condition,and estimated replacement schedule.

True

Explanation: Nonfinancial information of the type mentioned in the question is essential for long-range planning of capital asset replacement cycles and future financing needs and more important than ever as governments report on infrastructure assets under GASBS 34.

Explanation: Nonfinancial information of the type mentioned in the question is essential for long-range planning of capital asset replacement cycles and future financing needs and more important than ever as governments report on infrastructure assets under GASBS 34.

4

Every government,regardless of its size,should prepare a cash budget for each month of the fiscal year.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

A fortunate by-product of fund accounting for the governmental funds of state and local governments is that it readily accumulates costs needed for decision-making.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

Governmental budgets must be made available for public scrutiny,and public hearings must be held to provide adequate opportunity for citizens' input,prior to legislative adoption of the budget.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

A generally unallowable cost may be allowable under certain circumstances.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

To determine which costs are unallowable for charging to a federal assistance program,one should refer to the appropriate cost circular published by the Government Accountability Office (GAO).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

Accounting for federal and nonfederal grants and contracts requires an accounting system that can associate line-item expenses with functional programs with funding sources.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

A major disadvantage of activity-based costing in a governmental setting is the very limited number of activities for which it can be used.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

The type of budgeting that relates input of resources to output of services is zero-based budgeting.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

In budgeting for the inflow of financial resources,government officials must concern themselves with revenues and other financing sources.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

Some of the budgeting approaches governments have experimented with as alternatives to line-item,incremental budgeting include performance budgeting,program budgeting,the planning-programming-budgeting system,and zero-based budgeting.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

A major advantage of activity-based costing (ABC)is that it reduces unit cost distortions arising from overhead allocations that often occur using traditional cost accounting systems.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

Entrepreneurial budgeting places responsibility for budgeting on the highest level person in the organization who integrates strategic planning in the budgeting process.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

The sole purpose of preparing a governmental budget is to show compliance with laws and regulations.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

The concepts of total quality management (TQM)are consistent with earlier budget approaches such as performance budgeting and PPBS.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

One of the major advantages of incremental budgeting is that it focuses largely on inputs.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Service efforts and accomplishments measures suffer from the same problem as line-item or object-of-expenditures budgeting; that is,focusing only on resource inputs while ignoring outputs and outcomes of governmental activities.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

Budget appropriations for governmental funds ordinarily cover only one year,however; there is also a need to develop multi-year capital budgets.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

State and local governments and not-for-profit organizations that receive grants or contracts from the federal government should charge costs of these grants or contracts in conformity with

A)Cost Accounting Standards Board standards.

B)Office of Management and Budget cost circulars.

C)Financial Accounting Standards Board standards.

D)Governmental Accounting Standards Board standards.

A)Cost Accounting Standards Board standards.

B)Office of Management and Budget cost circulars.

C)Financial Accounting Standards Board standards.

D)Governmental Accounting Standards Board standards.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

Cash disbursements budgets

A)Need to be prepared because GASB standards specify the use of the accrual basis of accounting for governments.

B)Should usually be prepared for each month of the year,or for shorter intervals,in order to facilitate planning short-term borrowings and investments.

C)Should be prepared only for funds not required to operate under legal appropriation budgets.

D)Should be prepared only for each fiscal year because disbursements for each month are approximately equal.

A)Need to be prepared because GASB standards specify the use of the accrual basis of accounting for governments.

B)Should usually be prepared for each month of the year,or for shorter intervals,in order to facilitate planning short-term borrowings and investments.

C)Should be prepared only for funds not required to operate under legal appropriation budgets.

D)Should be prepared only for each fiscal year because disbursements for each month are approximately equal.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

Cash receipts and cash disbursement budgets for a government

A)Should be prepared for all funds for the entire fiscal year.

B)Should be prepared as needed to enhance cash management,investment management,and short-term debt management.

C)Should be prepared for only those funds for which appropriations budgets are required by law to be prepared on the accrual basis or the modified accrual basis.

D)Should be prepared for only those funds for which appropriations budgets are not required by law.

A)Should be prepared for all funds for the entire fiscal year.

B)Should be prepared as needed to enhance cash management,investment management,and short-term debt management.

C)Should be prepared for only those funds for which appropriations budgets are required by law to be prepared on the accrual basis or the modified accrual basis.

D)Should be prepared for only those funds for which appropriations budgets are not required by law.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not an element of a typical governmental total quality management (TQM)structure?

A)Customer orientation.

B)Support and commitment of top-level officials.

C)Strong central control over personnel classifications,budget allocations,and procurement.

D)Reduction of barriers to productivity and quality improvement.

A)Customer orientation.

B)Support and commitment of top-level officials.

C)Strong central control over personnel classifications,budget allocations,and procurement.

D)Reduction of barriers to productivity and quality improvement.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following kinds of cost accounting would be least useful for governmental budgeting?

A)Process.

B)Job order.

C)Standard.

D)Variable.

A)Process.

B)Job order.

C)Standard.

D)Variable.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

Traditional governmental accounting is better suited to determination of costs than to determination of benefits.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

In budgeting revenues,state and local government administrators should

A)Be careful not to utilize unauthorized sources or exceed authorized ceilings on revenues from specific sources.

B)Ensure that at least the amount of revenues needed to meet spending needs are raised,even if authorized ceilings on some revenue sources must be exceeded.

C)Utilize all authorized revenues sources and at the maximum amount allowed by law.

D)Ignore "other financing sources" since these resource inflows are not available for appropriation.

A)Be careful not to utilize unauthorized sources or exceed authorized ceilings on revenues from specific sources.

B)Ensure that at least the amount of revenues needed to meet spending needs are raised,even if authorized ceilings on some revenue sources must be exceeded.

C)Utilize all authorized revenues sources and at the maximum amount allowed by law.

D)Ignore "other financing sources" since these resource inflows are not available for appropriation.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

The schedule of legally required events in the budgeting process is generally referred to as the

A)Budget docket.

B)Legal timetable.

C)Hearing schedule.

D)Budget calendar.

A)Budget docket.

B)Legal timetable.

C)Hearing schedule.

D)Budget calendar.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following might appropriately be termed an outcome indicator for a police department that reports service efforts and accomplishments (SEA)indicators?

A)Number of crimes investigated.

B)Value of property lost due to crime.

C)Hours of patrol.

D)Number of personnel hours expended.

A)Number of crimes investigated.

B)Value of property lost due to crime.

C)Hours of patrol.

D)Number of personnel hours expended.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following costs would be allowable under OMB Circular A-87?

A)Advertising on the Internet by a defense contractor.

B)Lobbying for continuation of an educational program by the school administrator.

C)Indirect costs of the state legislature.

D)Depreciation expense on the equipment used in a federal research grant.

A)Advertising on the Internet by a defense contractor.

B)Lobbying for continuation of an educational program by the school administrator.

C)Indirect costs of the state legislature.

D)Depreciation expense on the equipment used in a federal research grant.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

The government official typically responsible for providing department heads with such technical support as clerical assistance with budget computation and maintenance of document files relating to the budget is

A)The chief financial officer.

B)The legislative budget analyst.

C)The budget officer.

D)The director of finance.

A)The chief financial officer.

B)The legislative budget analyst.

C)The budget officer.

D)The director of finance.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

The GASB "Budgeting Principle" states that an annual budget should be adopted by (for)every

A)Governmental fund type.

B)Fund of a government.

C)Government.

D)Governmental fund type except capital projects funds.

A)Governmental fund type.

B)Fund of a government.

C)Government.

D)Governmental fund type except capital projects funds.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

Service efforts and accomplishments (SEA)reporting helps citizens,elected officials,appointed officials,investors and creditors,and other interested parties evaluate the government's performance in the absence of a "bottom line" measure such as exists for for-profit entities.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following costs incurred by a city for a federal grant program would likely be considered unallowable under OMB Circular A-87?

A)Depreciation expense on equipment.

B)The salary of the person administering the grant.

C)Salary expense of the mayor.

D)Advertising for a secretary to help the program administrator.

A)Depreciation expense on equipment.

B)The salary of the person administering the grant.

C)Salary expense of the mayor.

D)Advertising for a secretary to help the program administrator.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

Which basis of accounting best contributes to measuring the cost of services for rational budgeting purposes?

A)Accrual.

B)Modified cash.

C)Modified accrual.

D)Cash.

A)Accrual.

B)Modified cash.

C)Modified accrual.

D)Cash.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is not consistent with the GASB's "Budgeting,Budgetary Control,and Budgetary Reporting Principle?"

A)An annual budget must be adopted using generally accepted accounting principles.

B)The accounting system should provide the basis for appropriate budgetary control.

C)Budgetary comparison schedules should be presented as required supplementary information for the General Fund and each major special revenue fund for which an annual budget has been adopted.

D)The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period.

A)An annual budget must be adopted using generally accepted accounting principles.

B)The accounting system should provide the basis for appropriate budgetary control.

C)Budgetary comparison schedules should be presented as required supplementary information for the General Fund and each major special revenue fund for which an annual budget has been adopted.

D)The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a typical step in the budgeting process for a state or local government?

A)Request by management for input on the budget.

B)Review and revisions of the budget by the administrative staff of each unit.

C)Public hearings for citizen input.

D)Approval by a majority vote of the citizenry.

A)Request by management for input on the budget.

B)Review and revisions of the budget by the administrative staff of each unit.

C)Public hearings for citizen input.

D)Approval by a majority vote of the citizenry.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not one of the purposes of a budget considered in the Government Finance Officer Association (GFOA)Distinguished Budget Presentation Award Program?

A)As a policy document.

B)As a legal document.

C)As a financial plan.

D)As a communication device.

A)As a policy document.

B)As a legal document.

C)As a financial plan.

D)As a communication device.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

Effective capital budgeting for general capital assets of a government requires

A)Intermediate and long-range capital improvement plans for general capital assets.

B)Nonfinancial information on physical measures and service condition of capital assets of component units.

C)Consideration of how proprietary fund capital projects will be financed.

D)Information about the capital asset needs of a motor pool accounted for as an internal service fund.

A)Intermediate and long-range capital improvement plans for general capital assets.

B)Nonfinancial information on physical measures and service condition of capital assets of component units.

C)Consideration of how proprietary fund capital projects will be financed.

D)Information about the capital asset needs of a motor pool accounted for as an internal service fund.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following budgetary approaches starts with line-item expenditures and applies a factor approximating the inflation rate to most items,unless specific information is available to suggest a different factor be applied?

A)Performance budgeting.

B)Zero-based budgeting.

C)Program budgeting.

D)Incremental budgeting.

A)Performance budgeting.

B)Zero-based budgeting.

C)Program budgeting.

D)Incremental budgeting.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

Why is a medium- or long-range capital improvement plan essential to sound capital budgeting?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Explain what is required to develop an effective total quality management (TQM)program for a government.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

What is the role of cost drivers in an activity-based cost (ABC)system? Explain how analysis of cost drivers can be useful in identifying inefficient activities and the cause(s)of the inefficiency?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

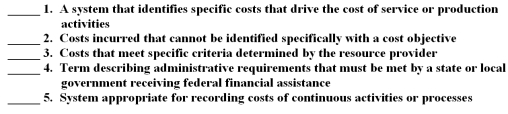

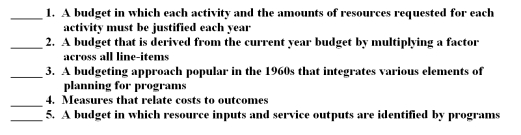

The following are key terms in Chapter 13 that relate to costing of government services:

A.Allowable costs

B.Job order costing

C.Common rule

D.Cost objective

E.Indirect costs

F.Direct costs

G.Process costing

H.Activity-based costing

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Allowable costs

B.Job order costing

C.Common rule

D.Cost objective

E.Indirect costs

F.Direct costs

G.Process costing

H.Activity-based costing

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

"Because a budgetary comparison statement is required for conformity with GAAP (under GASBS 34),resource management purposes are best served by preparation of the budget on the same basis as the accounts." Do you agree? Why or why not?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

Balanced scorecards integrate all of the following into a document that can be shared with employees and stakeholders except

A)GASB financial reporting standards.

B)Internal business processes measures.

C)Nonfinancial measures,such as customer satisfaction.

D)Financial performance measures.

A)GASB financial reporting standards.

B)Internal business processes measures.

C)Nonfinancial measures,such as customer satisfaction.

D)Financial performance measures.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

In order to account properly to federal and nonfederal grantors,an accounting information system must be able to capture information about all of the following except

A)Program or functional expenses.

B)Effectiveness level.

C)Granting agency or sponsor required financial information.

D)Line-item expenses.

A)Program or functional expenses.

B)Effectiveness level.

C)Granting agency or sponsor required financial information.

D)Line-item expenses.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

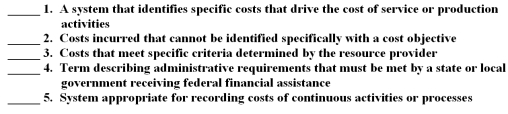

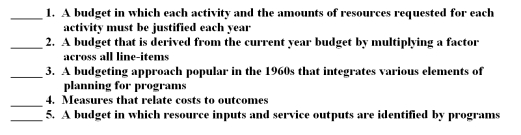

The following are key terms in Chapter 13 that relate to budgeting of government services:

A.Efficiency measures

B.Effectiveness measures

C.Planning-programming-budgeting system

D.Zero-based budgeting

E.Program budgeting

F.Flexible budgeting

G.Incremental budgeting

H.Budget calendar

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Efficiency measures

B.Effectiveness measures

C.Planning-programming-budgeting system

D.Zero-based budgeting

E.Program budgeting

F.Flexible budgeting

G.Incremental budgeting

H.Budget calendar

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

Why should persons who manage,advise,or audit governments and not-for-profit organizations be generally familiar with OMB Circulars A-87,A-21,and A-122? In your answer explain what "OMB" means,and why its circulars should be of concern to those involved with management,advisement,or auditing of state and local governments and not-for-profit organizations.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

What is the name of the type of budgeting in which the very existence of each activity should be justified each year? Elaborate.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

If governments and not-for-profit (NFP)organizations exist in order to provide services needed by the public,or segments of the public,and are not concerned with the generation of net income:

A)Explain concisely why governmental and NFP administrators should be concerned with the determination of costs of services rendered?

B)Explain concisely why governmental and NFP administrators should understand the relationships between cost determination and budgeting.In your answer be sure to identify clearly the relationships you are discussing.

A)Explain concisely why governmental and NFP administrators should be concerned with the determination of costs of services rendered?

B)Explain concisely why governmental and NFP administrators should understand the relationships between cost determination and budgeting.In your answer be sure to identify clearly the relationships you are discussing.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

Name at least three criteria that must be met for costs to be allowable under OMB circulars.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following has contributed most to governments' increased interest in activity-based accounting?

A)GASB standards.

B)Implementation of innovative management approaches (such as TQM and SEA measures)in response to public demand for greater accountability and productivity.

C)Increased demand for high profile management tools to bolster the image of government.

D)The Single Audit Act of 1984 (and 1996 Amendments).

A)GASB standards.

B)Implementation of innovative management approaches (such as TQM and SEA measures)in response to public demand for greater accountability and productivity.

C)Increased demand for high profile management tools to bolster the image of government.

D)The Single Audit Act of 1984 (and 1996 Amendments).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

All of the following are objectives of activity-based cost (ABC)accounting in government except

A)To preserve,at a minimum,the present quality and availability of services.

B)To help find lower cost alternatives to providing services.

C)To link customer (taxpayer)satisfaction to improvements in the operating systems used to provide goods and services.

D)To make increases in the volume of services dependent on reducing costs.

A)To preserve,at a minimum,the present quality and availability of services.

B)To help find lower cost alternatives to providing services.

C)To link customer (taxpayer)satisfaction to improvements in the operating systems used to provide goods and services.

D)To make increases in the volume of services dependent on reducing costs.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

Explain the relevance of process cost accounting to governmental financial management.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

Assuming that the expenditures budget for special revenues funds is required by law to be prepared on the modified accrual basis,explain what additional information you would need in order to be able to convert the expenditures budget into a cash disbursements budget useful for management purposes.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

If the revenues budget of a government is prepared on the modified accrual basis is there any reason why the revenues budget should be converted to a cash receipts budget? Explain.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

How can service efforts and accomplishments (SEA)indicators be useful in improving budgeting?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

Describe what is meant by the direct costs of a program (for example,a fire prevention program)and why it is important to distinguish direct costs from indirect costs.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

In the chapters that discuss governmental fund-types,it is assumed that budgets are prepared on the modified accrual basis.Examples in those chapters also assume that the perspective of the budget is the fund,and that revenue budgets are prepared by source and appropriations budgets are prepared by function.From the standpoint of financial management of a government,state what objectives are served by preparation of budgets on the same basis as financial statements.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

"User charges for services rendered by an activity accounted for by a proprietary fund should cover indirect costs as well as direct costs.Further,user charges must be set before the service is rendered (which means before either direct costs or indirect costs are known)." Assuming that both these statements are true,explain how you would proceed to set user charges for an activity accounted for by a proprietary fund.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

Describe what is meant by the term "entrepreneurial budgeting." Would you expect governments to adopt an entrepreneurial budgeting approach in lieu of a more traditional budgeting approach,such as incremental budgeting?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

Activity-based costing data is available for various activities relating to highway signage in Pinconning City.The activities include: cut brush,hand-letter and silk-screen signs,hang banners,install signs,relocate or remove signs,repair and replace signs,apply sign face,and installation.The specific components of the costs for each activity are personnel costs,direct material costs,overhead costs,and stock costs.Accomplishments are measured in terms of number of hours or signs for each of the activities.How does this method of accumulating costs compare with a typical cost accounting system that allocates indirect costs on a predetermined overhead rate basis? What can you learn from an activity based system that is not provided by a conventional costing system?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

Mountain City government has a payroll department that handles the processing of payroll for all city employees.The responsibilities of the payroll department relate to full-time,part-time and contractual employees and include: obtaining information from new employees so they can be added to the payroll; having new employees complete payroll withholding and deduction forms; collecting time sheets; calculating gross pay,appropriate deductions and employer contributions for each pay period; and completing vouchers for contributions and withholdings.The annual budget of the payroll department is  The city charges the payroll department an indirect overhead cost rate based on the number of square feet of office space utilized.The overhead rate is currently $9 per square foot.The overhead rate is intended to cover maintenance costs,utilities,and equipment depreciation.Recently,Mountain City has begun to wonder if it would be more economical to contract for its payroll services.The city's budget administrator contacted a neighboring city and learned that the neighboring city was paying $1.50/check for its payroll function.

The city charges the payroll department an indirect overhead cost rate based on the number of square feet of office space utilized.The overhead rate is currently $9 per square foot.The overhead rate is intended to cover maintenance costs,utilities,and equipment depreciation.Recently,Mountain City has begun to wonder if it would be more economical to contract for its payroll services.The city's budget administrator contacted a neighboring city and learned that the neighboring city was paying $1.50/check for its payroll function.

Required

1.Calculate Mountain City payroll department's cost per check.

2.Based on costs would it be cheaper to maintain the payroll department or contract out for the payroll services?

3.Discuss what other information you would want before making a decision about retaining or contracting payroll.

The city charges the payroll department an indirect overhead cost rate based on the number of square feet of office space utilized.The overhead rate is currently $9 per square foot.The overhead rate is intended to cover maintenance costs,utilities,and equipment depreciation.Recently,Mountain City has begun to wonder if it would be more economical to contract for its payroll services.The city's budget administrator contacted a neighboring city and learned that the neighboring city was paying $1.50/check for its payroll function.

The city charges the payroll department an indirect overhead cost rate based on the number of square feet of office space utilized.The overhead rate is currently $9 per square foot.The overhead rate is intended to cover maintenance costs,utilities,and equipment depreciation.Recently,Mountain City has begun to wonder if it would be more economical to contract for its payroll services.The city's budget administrator contacted a neighboring city and learned that the neighboring city was paying $1.50/check for its payroll function.Required

1.Calculate Mountain City payroll department's cost per check.

2.Based on costs would it be cheaper to maintain the payroll department or contract out for the payroll services?

3.Discuss what other information you would want before making a decision about retaining or contracting payroll.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

Discuss the implications of GASB governmental fund and government-wide financial reporting on the budgeting process in a city.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck