Deck 8: Accounting for Fiduciary Activities Agency and Trust Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 8: Accounting for Fiduciary Activities Agency and Trust Funds

1

Public employee retirement systems should label the difference between assets and liabilities on the statement of plan net assets as "fund balance available for member benefits."

False

Explanation: The GASB requires a statement of plan net assets in which the difference between assets and liabilities is labeled "net assets held in trust for pension benefits." This form is shown in the text as Illustration 8-9.

Explanation: The GASB requires a statement of plan net assets in which the difference between assets and liabilities is labeled "net assets held in trust for pension benefits." This form is shown in the text as Illustration 8-9.

2

Pension plans are required to report two schedules,a schedule of funding progress and a schedule of employer contributions as required supplementary information (RSI)in their stand-alone financial reports and in pension plan financial information reported in the CAFR of sponsoring government.

True

Explanation: Reporting these two schedules as RSI, along with two basic financial statements, a statement of plan net assets and a statement of changes in plan net assets, are the requirements discussed

Explanation: Reporting these two schedules as RSI, along with two basic financial statements, a statement of plan net assets and a statement of changes in plan net assets, are the requirements discussed

3

Public Employee Retirement Systems should utilize the modified accrual basis of accounting.

False

Explanation: GASB standards provide that public employee retirement systems (PERS) use the accrual basis of accounting.

Explanation: GASB standards provide that public employee retirement systems (PERS) use the accrual basis of accounting.

4

Public employee retirement systems should utilize budgetary accounts in the same manner that General Funds and special revenue funds should.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

An agency fund accounts for assets held by a government for the long-term in the capacity of a trustee for an individual,organization,other fund,or other government.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is the most reliable means of distinguishing a trust relationship from an agency relationship for purposes of deciding which type of fiduciary fund should be used?

A)Examine the amount of money involved; agency relationships generally involve smaller amounts.

B)Examine the aggregate of factors,such as the enactment that brought the relationship into existence,statutes,regulations,etc,that help define the nature of the relationship.

C)Examine the length of time assets will be held; trust relationships are generally in existence longer than agency relationships.

D)Examine the wording of any agreements to determine if the word "trust" or "agency" is used.

A)Examine the amount of money involved; agency relationships generally involve smaller amounts.

B)Examine the aggregate of factors,such as the enactment that brought the relationship into existence,statutes,regulations,etc,that help define the nature of the relationship.

C)Examine the length of time assets will be held; trust relationships are generally in existence longer than agency relationships.

D)Examine the wording of any agreements to determine if the word "trust" or "agency" is used.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

If a state or local government is a party to an agency relationship,it must automatically create an agency fund in order to be in conformity with generally accepted accounting principles.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

An agency fund should be used to account for special assessment billing and collection,and related debt service of special assessment debt,if the government has no responsibility for the debt.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

If a state or local government acts as an intermediary between the federal government and beneficiary recipients in processing grant or entitlement resources,those resources should be accounted for in an agency fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

It is common for an agency fund to have relatively small net asset balances.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

Fiduciary funds are sometimes identified in the annual reports of state and local governments as "Trust and Agency Funds."

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Employer (and employee,if applicable)contributions to public employee retirement systems should be based on actuarial computations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following activities would most appropriately be recorded by an agency fund?

A)Assets held for employees' federal and state withholding taxes.

B)Deposits held for customers of a city-owned electric utility.

C)Assets held for special assessment bondholders when the city is secondarily liable for the bonds.

D)Assets held for investment,the earnings from which are used for maintenance of the City Cemetery.

A)Assets held for employees' federal and state withholding taxes.

B)Deposits held for customers of a city-owned electric utility.

C)Assets held for special assessment bondholders when the city is secondarily liable for the bonds.

D)Assets held for investment,the earnings from which are used for maintenance of the City Cemetery.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

All fiduciary funds report transactions between the fund and both internal and external parties.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

Effective management of cash and investments of individual funds may be enhanced by placing the cash and investments in a pool under the control of the treasurer of the government or other official.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

If the fair value of stock received by a private-purpose trust fund differs from the par value of the stock,the premium or discount should be amortized over the remaining life of the stock.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

When a cash and investments pool is created,the assets of each fund entering the pool should be transferred to the pool at their fair value at the date of the transfer.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

Tax agency funds assume liability for gross levies,not for the amounts the levying funds or units expect to collect.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

An agency relationship that usually necessitates the creation of an agency fund is the collection of revenues by one government for several of its funds and/or for other governments and their funds.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

Investment trust funds and pension trust funds should be accounted for in the same manner as permanent funds.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the statements concerning agency funds is true?

A)Agency funds use the same basis of accounting as permanent funds.

B)Agency funds are reported only on the statement of fiduciary net assets.

C)Agency funds use the temporary accounts Additions and Deductions.

D)Agency funds never receive cash.

A)Agency funds use the same basis of accounting as permanent funds.

B)Agency funds are reported only on the statement of fiduciary net assets.

C)Agency funds use the temporary accounts Additions and Deductions.

D)Agency funds never receive cash.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

A statement of cash flows should be prepared for which of the following fiduciary fund types?

A)Fiduciary funds do not provide a statement of cash flows.

B)Agency.

C)Pension trust.

D)Private-purpose trust.

A)Fiduciary funds do not provide a statement of cash flows.

B)Agency.

C)Pension trust.

D)Private-purpose trust.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

A local golfer contributed $100,000 to the city stipulating that the money be invested and that the earnings thereon be used for maintenance of the city golf course.The $100,000 would most appropriately be recorded in a(an)

A)Agency fund.

B)A permanent fund.

C)Private-purpose trust fund.

D)Investment trust fund.

A)Agency fund.

B)A permanent fund.

C)Private-purpose trust fund.

D)Investment trust fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is the appropriate basis of accounting for an agency fund?

A)Cash basis.

B)Modified cash basis.

C)Accrual basis.

D)Modified accrual basis.

A)Cash basis.

B)Modified cash basis.

C)Accrual basis.

D)Modified accrual basis.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

Which of these fiduciary fund types always has zero net assets?

A)Agency funds.

B)Pension trust funds.

C)Investment trust funds.

D)Private-purpose trust funds.

A)Agency funds.

B)Pension trust funds.

C)Investment trust funds.

D)Private-purpose trust funds.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following grants received by a city would most appropriately be recorded in a "pass-through" agency fund?

A)A federal grant for various purposes,for which the ultimate allocation and use of the money will be decided by the state government.The city will serve as a conduit for the money between the state government and various not-for-profit organizations who will use the money.

B)A state grant to a local not-for-profit organization for summer employment of juveniles.

C)A federal grant made directly to a county for repairing and overhauling bridges.

D)A federal grant via the state government for which the city will be responsible for upgrading low-rent housing.

A)A federal grant for various purposes,for which the ultimate allocation and use of the money will be decided by the state government.The city will serve as a conduit for the money between the state government and various not-for-profit organizations who will use the money.

B)A state grant to a local not-for-profit organization for summer employment of juveniles.

C)A federal grant made directly to a county for repairing and overhauling bridges.

D)A federal grant via the state government for which the city will be responsible for upgrading low-rent housing.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

Employer contributions to a public employees retirement system (PERS)should be reported as

A)An expense of the General Fund for employees paid by the General Fund.

B)An other financing use of a proprietary fund for employees paid by a proprietary fund.

C)A revenue of the PERS.

D)An addition to net assets of the PERS.

A)An expense of the General Fund for employees paid by the General Fund.

B)An other financing use of a proprietary fund for employees paid by a proprietary fund.

C)A revenue of the PERS.

D)An addition to net assets of the PERS.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

If special assessment receivables are recorded in the accounts of an agency fund,the appropriate account(s)to credit is (are):

A)Contributions to Net Assets.

B)Revenues and Deferred Revenues.

C)Due to Special Assessment Bondholders.

D)Interfund Transfers In.

A)Contributions to Net Assets.

B)Revenues and Deferred Revenues.

C)Due to Special Assessment Bondholders.

D)Interfund Transfers In.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following accounts is least likely to be used by a tax agency fund?

A)Cash.

B)Revenues.

C)Taxes receivable for other funds and units.

D)Due to other funds and units.

A)Cash.

B)Revenues.

C)Taxes receivable for other funds and units.

D)Due to other funds and units.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

When a cash and investment pool of a certain city was established,the debt service fund transferred investments to the pool having a cost of $3,000,000 but a current fair market value of $3,100,000.To record this transaction,the journal entry made by the debt service fund will include:

A)A debit to Equity in Pooled Cash and Investments in the amount of $3,000,000.

B)A credit to Revenues-Change in Fair Value of Investments in the amount of $100,000.

C)A debit to Investments in the amount of $3,000,000.

D)A credit to Investments in the amount of $3,100,000.

A)A debit to Equity in Pooled Cash and Investments in the amount of $3,000,000.

B)A credit to Revenues-Change in Fair Value of Investments in the amount of $100,000.

C)A debit to Investments in the amount of $3,000,000.

D)A credit to Investments in the amount of $3,100,000.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Which basis of accounting best maintains the original principal of a trust?

A)Accrual basis.

B)Cash basis.

C)Modified accrual basis.

D)Legal basis.

A)Accrual basis.

B)Cash basis.

C)Modified accrual basis.

D)Legal basis.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

In which of the following circumstances would it be inappropriate to report the assets in the fiduciary fund financial statements?

A)When assets are held for the families of the government's police officers killed in the line of duty.

B)When assets are held for other funds of the same government.

C)When assets are held for other governments in an investment pool.

D)When assets are held for Internal Revenue Code

A)When assets are held for the families of the government's police officers killed in the line of duty.

B)When assets are held for other funds of the same government.

C)When assets are held for other governments in an investment pool.

D)When assets are held for Internal Revenue Code

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a valid reason for establishing a tax agency fund and charging a collection fee to other governments?

A)To help eliminate a General Fund deficit.

B)To increase the total amount of taxes levied.

C)To avoid overlapping taxes.

D)To realize administrative efficiencies from centralizing tax billing and collection activities.

A)To help eliminate a General Fund deficit.

B)To increase the total amount of taxes levied.

C)To avoid overlapping taxes.

D)To realize administrative efficiencies from centralizing tax billing and collection activities.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Billing and collection of special assessments and payment of debt principal and interest on special assessment debt for which the city is not obligated in any manner should be recorded in a(an):

A)Debt service fund.

B)Special assessment fund.

C)Agency fund and private-purpose trust fund.

D)Agency fund.

A)Debt service fund.

B)Special assessment fund.

C)Agency fund and private-purpose trust fund.

D)Agency fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

A local civic organization gave the city government $15,000 cash to be used to pay the utility bills of persons whose incomes were below the poverty level.The city should account for the $15,000 gift in

A)An investment trust fund.

B)The General Fund.

C)A permanent fund.

D)Private-purpose trust fund.

A)An investment trust fund.

B)The General Fund.

C)A permanent fund.

D)Private-purpose trust fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

A private-purpose trust fund sold investments in securities having a carrying value of $23,000 for $26,000,resulting in a $3,000 gain on the change in value.If there are no trust provisions to the contrary,the gain is generally

A)Transferred to an operating fund or the General Fund.

B)Reported as income of the trust.

C)Used to maintain the principal of the trust.

D)Transferred to a permanent fund.

A)Transferred to an operating fund or the General Fund.

B)Reported as income of the trust.

C)Used to maintain the principal of the trust.

D)Transferred to a permanent fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Fiduciary funds are accounted for in a manner similar to which of the following funds?

A)Permanent funds.

B)Special revenue funds.

C)Enterprise funds.

D)Debt service funds.

A)Permanent funds.

B)Special revenue funds.

C)Enterprise funds.

D)Debt service funds.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

A donor contributed $100,000 to the city stipulating that the money be invested and that the earnings thereon be used for maintenance of the city municipal swimming pool.The $100,000 would most appropriately be recorded in a(an)

A)Agency fund.

B)Private-purpose trust fund.

C)Endowment fund.

D)Permanent fund.

A)Agency fund.

B)Private-purpose trust fund.

C)Endowment fund.

D)Permanent fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

The cash and investment pool of Lake City allocates dividends,interest,and capital gains and losses on a periodic basis.When the cash and investment pool accrues interest earned on investments in debt securities,pending allocation to participating funds,it would credit which of the following accounts?

A)Interfund Loans.

B)Revenues.

C)Undistributed Earnings on Pooled Investments.

D)Interfund Receivables.

A)Interfund Loans.

B)Revenues.

C)Undistributed Earnings on Pooled Investments.

D)Interfund Receivables.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

The financial position of the Policemen's Pension Fund administered by a city should be reported in the city's basic financial statements as a column in the

A)Statement of assets,liabilities,and fund balances.

B)Statement of fiduciary net assets.

C)Balance sheet-governmental funds.

D)Government-wide statement of net assets.

A)Statement of assets,liabilities,and fund balances.

B)Statement of fiduciary net assets.

C)Balance sheet-governmental funds.

D)Government-wide statement of net assets.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

As of January 1,2011,the Town of Bartonville notified the Barton County Investment Pool that it needed to withdraw $1,000,000 cash from the pool,so the manager sells investments on January 2 to obtain the required $1,000,000 cash.The investments sold had been carried in the Investment Trust Fund accounts at a fair value of $970,000.

Required

1)Show the entry for the sale of investments by the pool on January 2,2011.

2)Show the entry for the distribution of the gain on investments sold,assuming the Town of Bartonville's equitable share of the pool before the withdrawal of cash was 50 percent.

3)Show the entry for the Pool's payment of $1,000,000 to the Town of Bartonville.

Required

1)Show the entry for the sale of investments by the pool on January 2,2011.

2)Show the entry for the distribution of the gain on investments sold,assuming the Town of Bartonville's equitable share of the pool before the withdrawal of cash was 50 percent.

3)Show the entry for the Pool's payment of $1,000,000 to the Town of Bartonville.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

"Because investment trust funds are intended to generate income on an ongoing basis to be used to support the purposes for which the trust was created,they should use modified accrual accounting." Discuss.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

Grant City has held investments over a period of time for Grant Township in an investment pool,accounted for as an investment trust fund.The investments carried at fair value on July 1,2011 were $500,000 (cost totaled $460,000).On July 1,2011,the Grant School District received the proceeds of a general obligation bond sale at par in the amount of $9,500,000.It is expected that about 20 percent of this amount will need to be disbursed within the last six months of the current year,about 50 percent during the year after that,and the remainder in the third year of the project.The interest received on investment of the bond proceeds belongs to the Grant schools.This money was invested in the Grant Investment Pool.No other governmental entities have significant amounts of cash or investments as of July 1,2011.

Required

1)What percentage interest in the pool is held by the school district and the township? Explain your answers; show computations in good form.

2)Assuming that the cash received by the pool from Grant schools was invested promptly and that those investments were managed in the same manner as the township's investments in the pool,and that the earnings on pooled investments in the six months ended December 31,2011,were $300,000 (all received in cash; no accrued interest receivable):

(a)Show the entry in the Investment Trust Fund to summarize the collection of interest for the six-month period.

(b)Show the entry in the Investment Trust Fund to record the liability to the funds for interest earned on pooled investments.

Required

1)What percentage interest in the pool is held by the school district and the township? Explain your answers; show computations in good form.

2)Assuming that the cash received by the pool from Grant schools was invested promptly and that those investments were managed in the same manner as the township's investments in the pool,and that the earnings on pooled investments in the six months ended December 31,2011,were $300,000 (all received in cash; no accrued interest receivable):

(a)Show the entry in the Investment Trust Fund to summarize the collection of interest for the six-month period.

(b)Show the entry in the Investment Trust Fund to record the liability to the funds for interest earned on pooled investments.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

Explain the difference between an internal cash and investments pool and an external cash and investment pool and describe some of the differences in accounting treatment between the two.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

Under current GASB standards,how are other postemployment retirement benefits (OPEB)reported?

A)By disclosing information about OPEB in the notes to the financial statements,but without display of OPEB expenses or liabilities on the face of the financial statements.

B)In a manner that is quite similar to the reporting requirements for pension plans.

C)Using two different methods,one for health care plans and a second for other types of OPEB.

D)By using a modified accrual basis,which requires only expenditures of the current period be reported.

A)By disclosing information about OPEB in the notes to the financial statements,but without display of OPEB expenses or liabilities on the face of the financial statements.

B)In a manner that is quite similar to the reporting requirements for pension plans.

C)Using two different methods,one for health care plans and a second for other types of OPEB.

D)By using a modified accrual basis,which requires only expenditures of the current period be reported.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

In financial reporting for proprietary funds and at the government-wide level,the employer's pension expense for the period is equal to:

A)The employer's contribution.

B)Annual required contribution.

C)Annual pension cost.

D)The change in net pension obligation.

A)The employer's contribution.

B)Annual required contribution.

C)Annual pension cost.

D)The change in net pension obligation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is true regarding termination benefits?

A)Voluntary termination benefits occur when employers provide an incentive to hasten an employee's voluntary termination of employment,such as a one-time payout.

B)Voluntary terminations relate to layoffs or reductions in workforce.

C)Employers incur expenses related to voluntary terminations but not to involuntary terminations.

D)Expenses related to voluntary terminations may be avoided by hiring replacement employees within 60 days of the terminations.

A)Voluntary termination benefits occur when employers provide an incentive to hasten an employee's voluntary termination of employment,such as a one-time payout.

B)Voluntary terminations relate to layoffs or reductions in workforce.

C)Employers incur expenses related to voluntary terminations but not to involuntary terminations.

D)Expenses related to voluntary terminations may be avoided by hiring replacement employees within 60 days of the terminations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

If a city has a fiduciary responsibility for assets entrusted to it,describe the factors that the city would consider in deciding whether to account for the assets in an agency fund or a trust fund.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Explain the purpose of an investment trust fund and describe its accounting treatment.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is the appropriate measurement focus for agency funds?

A)Economic resources.

B)Current financial resources.

C)Cash and cash equivalents.

D)Accrual basis.

A)Economic resources.

B)Current financial resources.

C)Cash and cash equivalents.

D)Accrual basis.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Describe the types of pension plans most often found in governmental entities and the differences between them.Do you expect that most governmental employers sponsor a "single-employer plan" or participate in a public employee retirement system (PERS)?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

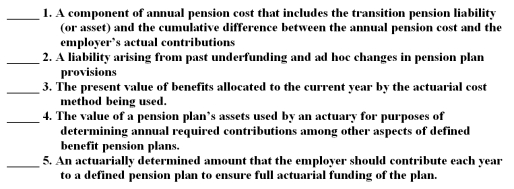

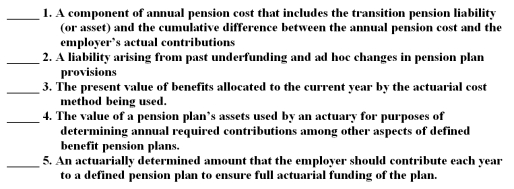

The following are key terms in Chapter 8 that relate to accounting for pension plans.

A.Actuarial accrued liability

B.Actuarial present value of total projected benefits

C.Actuarial value of assets

D.Annual required contributions

E.Net pension obligation

F.Normal cost

G.Unfunded actuarial liability

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition

A.Actuarial accrued liability

B.Actuarial present value of total projected benefits

C.Actuarial value of assets

D.Annual required contributions

E.Net pension obligation

F.Normal cost

G.Unfunded actuarial liability

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

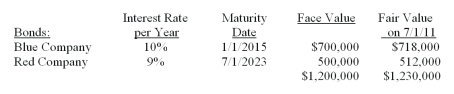

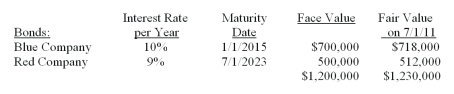

On July 1,2011,Kent County received the following securities to be held as the principal of a trust; the income from the securities is to be transferred to the Kent Heritage Museum,a private not-for-profit museum.  Required

Required

1)In what type of fiduciary fund should the receipt of the bonds described above be recorded?

2)Show in general journal form the entry that should be made to record the receipt of the bonds.

3)On January 1,2012,interest received in cash amounted to $57,500 ($35,000 on Blue Company bonds and $22,500 on Red Company bonds).Assuming that income from the bonds is to be computed on the accrual basis,what is the amount of income for the period 7/1/11 - 12/31/11 that should be transferred to the Kent County Museum early in 2012? Show computations.

Required

Required1)In what type of fiduciary fund should the receipt of the bonds described above be recorded?

2)Show in general journal form the entry that should be made to record the receipt of the bonds.

3)On January 1,2012,interest received in cash amounted to $57,500 ($35,000 on Blue Company bonds and $22,500 on Red Company bonds).Assuming that income from the bonds is to be computed on the accrual basis,what is the amount of income for the period 7/1/11 - 12/31/11 that should be transferred to the Kent County Museum early in 2012? Show computations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Explain the purpose of the account "undistributed change in fair value of investments" used in a cash and investment pool and describe how it should be reported in the government's financial statements.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following activities would be accounted for by a trust fund?

A)Deposits held for customers of a city-owned electric utility.

B)Assets passed-through the state government to the local government.

C)Assets held for special assessment bondholders for which the city has no liability.

D)Assets which are used to assist in the preservation of a private residence that is of historical significance to the city.

A)Deposits held for customers of a city-owned electric utility.

B)Assets passed-through the state government to the local government.

C)Assets held for special assessment bondholders for which the city has no liability.

D)Assets which are used to assist in the preservation of a private residence that is of historical significance to the city.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

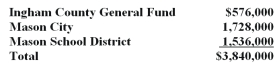

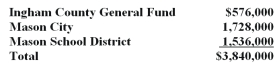

Ingham County collects,in addition to its own taxes,taxes for other units.Tax levied for 2011 were as follows:  Collections from the 2011 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Collections from the 2011 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Required

1)Record the tax levies in the Ingham County Tax Agency Fund.

2)Record the collection from the 2011 tax levies in the Ingham County Tax Agency Fund and the specific liabilities owed each fund and unit (Round all amounts to the nearest whole dollar.)

3)Record in the Ingham County Tax Agency Fund the transfer of collected taxes to each fund and unit.

Collections from the 2011 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Collections from the 2011 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.Required

1)Record the tax levies in the Ingham County Tax Agency Fund.

2)Record the collection from the 2011 tax levies in the Ingham County Tax Agency Fund and the specific liabilities owed each fund and unit (Round all amounts to the nearest whole dollar.)

3)Record in the Ingham County Tax Agency Fund the transfer of collected taxes to each fund and unit.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck