Deck 4: Cash and Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

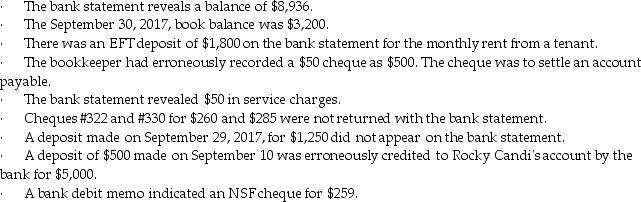

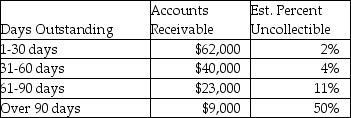

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

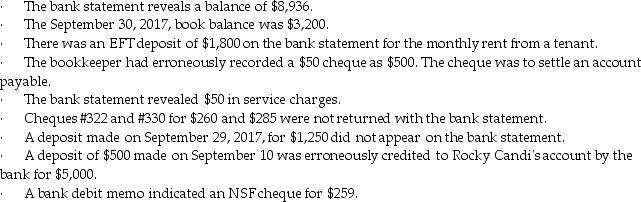

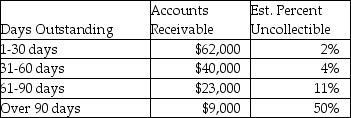

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/155

Play

Full screen (f)

Deck 4: Cash and Receivables

1

Which of the following items will not cause a difference between the book balance and the bank balance?

A) deposits in transit

B) bank collections

C) cancelled cheques

D) outstanding cheques

A) deposits in transit

B) bank collections

C) cancelled cheques

D) outstanding cheques

C

2

The cheques that have been paid by the bank on behalf of the depositor and included with the bank statement are called:

A) cancelled cheques

B) cheques in transit

C) NSF cheques

D) outstanding cheques

A) cancelled cheques

B) cheques in transit

C) NSF cheques

D) outstanding cheques

A

3

As they are less liquid than cash,cash equivalents cannot be reported on the same line as cash.

False

4

In a bank reconciliation,there might be items which have been recorded by the company that have not yet been recorded by the bank.Examples of such items would include:

A) NSF cheques

B) deposits in transit

C) bank collections

D) bank service charges

A) NSF cheques

B) deposits in transit

C) bank collections

D) bank service charges

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

5

The asset requiring the highest level of internal control is:

A) Cash

B) Accounts Receivable

C) Inventory

D) Capital Assets

A) Cash

B) Accounts Receivable

C) Inventory

D) Capital Assets

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

6

In a bank reconciliation,bank service charges are:

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) added to the bank balance in the general ledger

D) deducted from the bank balance in the general ledger

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) added to the bank balance in the general ledger

D) deducted from the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

7

In a bank reconciliation,a deposit in transit is:

A) added to the bank balance in the general ledger

B) added to the bank balance on the bank statement

C) deducted from the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

A) added to the bank balance in the general ledger

B) added to the bank balance on the bank statement

C) deducted from the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following,when prepared correctly,ensures that all cash transactions have been accounted for and that the bank and book records of cash are correct?

A) bank reconciliation

B) bank statement

C) bank remittance

D) setting up a lock-box system

A) bank reconciliation

B) bank statement

C) bank remittance

D) setting up a lock-box system

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

9

When preparing a bank reconciliation,which of the following items would be subtracted from the bank balance on the bank statement?

A) deposits in transit

B) bank service charges

C) EFT cash payments

D) outstanding cheques

A) deposits in transit

B) bank service charges

C) EFT cash payments

D) outstanding cheques

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

10

All cash receipts should be deposited for safekeeping in the bank.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

11

In a bank reconciliation,a bank error:

A) must be added to the bank balance on the bank statement

B) must be deducted from the bank balance on the bank statement

C) may be added or deducted from the bank balance on the bank statement

D) may be added or deducted from the bank balance in the general ledger

A) must be added to the bank balance on the bank statement

B) must be deducted from the bank balance on the bank statement

C) may be added or deducted from the bank balance on the bank statement

D) may be added or deducted from the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

12

In a bank reconciliation,outstanding cheques are:

A) added to the bank balance on the bank statement

B) added to the bank balance in the general ledger

C) deducted from the bank balance on the bank statement

D) deducted from the bank balance in the general ledger

A) added to the bank balance on the bank statement

B) added to the bank balance in the general ledger

C) deducted from the bank balance on the bank statement

D) deducted from the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

13

On the balance sheet numerous bank accounts and time deposits can be combined and identified on one line as cash and cash equivalents.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

14

In a bank reconciliation,a book error:

A) may be added or deducted from the bank balance in the general ledger

B) may be added or deducted from the bank balance on the bank statement

C) must be added to the bank balance in the general ledger

D) must be deducted from the bank balance in the general ledger

A) may be added or deducted from the bank balance in the general ledger

B) may be added or deducted from the bank balance on the bank statement

C) must be added to the bank balance in the general ledger

D) must be deducted from the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

15

To control payments for purchases of invoices,the following would not be presented as supporting documents for approval:

A) purchase order

B) invoice

C) receiving slip

D) cancelled cheque

A) purchase order

B) invoice

C) receiving slip

D) cancelled cheque

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

16

In a bank reconciliation,an NSF cheque is:

A) added to the bank balance on the bank statement

B) deducted from the bank balance in the general ledger

C) added to the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

A) added to the bank balance on the bank statement

B) deducted from the bank balance in the general ledger

C) added to the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

17

If the balance on the bank statement does not equal the balance in the company's Cash account,then you can conclude that:

A) the company accountant made an error in the accounting process

B) the bank made an error

C) both the company accountant and the bank made errors

D) there are some reconciling items that, when identified, will explain the differences between the balances

A) the company accountant made an error in the accounting process

B) the bank made an error

C) both the company accountant and the bank made errors

D) there are some reconciling items that, when identified, will explain the differences between the balances

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

18

When preparing a bank reconciliation,which of the following items would be added to the book balance?

A) EFT payments

B) deposits in transit

C) NSF cheques

D) EFT cash receipts

A) EFT payments

B) deposits in transit

C) NSF cheques

D) EFT cash receipts

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

19

One of the benefits of using cheques is the payment record it provides.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

20

In a bank reconciliation,items recorded by the bank but not yet recorded by the company include:

A) bank collections

B) deposits in transit

C) outstanding cheques

D) deposits in transit and outstanding cheques

A) bank collections

B) deposits in transit

C) outstanding cheques

D) deposits in transit and outstanding cheques

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

21

If a bank statement included an NSF cheque for $450,the journal entry to record this reconciling item would include a:

A) debit to Cash for $450

B) credit to Cash for $450

C) credit to Accounts Receivable for $450

D) debit to Accounts Payable for $450

A) debit to Cash for $450

B) credit to Cash for $450

C) credit to Accounts Receivable for $450

D) debit to Accounts Payable for $450

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

22

In a bank reconciliation,a bank collection is:

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) added to the bank balance in the general ledger

D) deducted from the bank balance in the general ledger

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) added to the bank balance in the general ledger

D) deducted from the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

23

If the bookkeeper mistakenly records a deposit of $530 as $350,the error would be shown on the bank reconciliation statement as a:

A) $180 deduction from the book balance

B) $180 deduction from the bank balance

C) $180 addition to the bank balance

D) $180 addition to the book balance

A) $180 deduction from the book balance

B) $180 deduction from the bank balance

C) $180 addition to the bank balance

D) $180 addition to the book balance

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

24

If the bookkeeper mistakenly records a deposit of $360 as $630,the error would be shown on the bank reconciliation statement as a:

A) $270 deduction from the bank balance

B) $270 deduction from the book balance

C) $270 addition to the book balance

D) $270 addition to the bank balance

A) $270 deduction from the bank balance

B) $270 deduction from the book balance

C) $270 addition to the book balance

D) $270 addition to the bank balance

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

25

All cash receipts should be deposited for safekeeping in the bank.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

26

If a bookkeeper mistakenly recorded a disbursement of $48 instead of the correct amount of $84,the error would be shown on the bank reconciliation as a:

A) $36 addition to the books

B) $36 deduction from the books

C) $48 addition to the books

D) $48 deduction from the books

A) $36 addition to the books

B) $36 deduction from the books

C) $48 addition to the books

D) $48 deduction from the books

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

27

In a bank reconciliation,an EFT cash payment is:

A) deducted from the bank balance in the general ledger

B) added to the bank balance in the general ledger

C) deducted from the bank balance on the bank statement

D) added to the bank balance on the bank statement

A) deducted from the bank balance in the general ledger

B) added to the bank balance in the general ledger

C) deducted from the bank balance on the bank statement

D) added to the bank balance on the bank statement

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

28

If a bank statement included an EFT payment of $670 for insurance,the journal entry to record this reconciling item would include a:

A) debit to Cash for $670

B) debit to Accounts Payable for $670

C) credit to Cash for $670

D) credit to Prepaid Insurance for $670

A) debit to Cash for $670

B) debit to Accounts Payable for $670

C) credit to Cash for $670

D) credit to Prepaid Insurance for $670

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following items below may be made to reconcile a book balance to a bank balance?

A) a deposit in transit

B) an EFT receipt

C) outstanding cheques

D) an addition or subtraction to correct a bank error, as appropriate

A) a deposit in transit

B) an EFT receipt

C) outstanding cheques

D) an addition or subtraction to correct a bank error, as appropriate

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

30

If a bank reconciliation included $600 of outstanding cheques,the journal entry to record this reconciling item would include:

A) a credit to Cash of $600

B) a debit to Cash of $600

C) a credit to Accounts Payable of $600

D) no entry is required

A) a credit to Cash of $600

B) a debit to Cash of $600

C) a credit to Accounts Payable of $600

D) no entry is required

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

31

If a bank statement included a bank collection and related interest revenue,the journal entry to record this reconciling item would include a:

A) debit to Note Receivable

B) credit to Cash

C) debit to Cash

D) debit to Note Payable

A) debit to Note Receivable

B) credit to Cash

C) debit to Cash

D) debit to Note Payable

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

32

If a bookkeeper mistakenly recorded a disbursement of $63 instead of the correct amount of $36,the error would be shown on the bank reconciliation as a:

A) $36 addition to the books

B) $36 deduction from the books

C) $27 addition to the books

D) $27 deduction from the books

A) $36 addition to the books

B) $36 deduction from the books

C) $27 addition to the books

D) $27 deduction from the books

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

33

If the bank records a deposit of $50 as $150,the error would be shown on a bank reconciliation as:

A) a deduction from the book balance of $100

B) an addition to the book balance of $100

C) a deduction from the bank balance of $100

D) an addition to the bank balance of $100

A) a deduction from the book balance of $100

B) an addition to the book balance of $100

C) a deduction from the bank balance of $100

D) an addition to the bank balance of $100

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

34

In a bank reconciliation,an EFT cash receipt is:

A) added to the bank balance on the bank statement

B) added to the bank balance in the general ledger

C) deducted from the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

A) added to the bank balance on the bank statement

B) added to the bank balance in the general ledger

C) deducted from the bank balance in the general ledger

D) deducted from the bank balance on the bank statement

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following does not require a journal entry for a bank reconciliation?

A) outstanding cheques

B) bank service charge

C) collection by the bank of a note receivable

D) NSF cheque returned by the bank

A) outstanding cheques

B) bank service charge

C) collection by the bank of a note receivable

D) NSF cheque returned by the bank

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

36

In a bank reconciliation,interest revenue is:

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) deducted from the bank balance in the general ledger

D) added to the bank balance in the general ledger

A) added to the bank balance on the bank statement

B) deducted from the bank balance on the bank statement

C) deducted from the bank balance in the general ledger

D) added to the bank balance in the general ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

37

If the bank records a deposit of $3,300 as $330,the error would be shown on a bank reconciliation as:

A) a deduction from the book balance of $2,970

B) a deduction from the bank balance of $2,970

C) an addition to the bank balance of $2,970

D) an addition to the book balance of $2,970

A) a deduction from the book balance of $2,970

B) a deduction from the bank balance of $2,970

C) an addition to the bank balance of $2,970

D) an addition to the book balance of $2,970

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

38

When preparing a bank reconciliation,deposits in transit are added to the balance shown on the bank statement.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

39

What is an example of an item recorded by the company but not yet recorded by the bank?

A) an electronic funds transfer

B) a deposit in transit

C) a service charge

D) an NSF cheque

A) an electronic funds transfer

B) a deposit in transit

C) a service charge

D) an NSF cheque

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

40

If a bank reconciliation included deposits in transit amounting to $1,500,the journal entry to record this reconciling item would include:

A) no entry is required

B) a credit to Accounts Receivable for $1,500

C) a debit to Cash for $1,500

D) a credit to Cash for $1,500

A) no entry is required

B) a credit to Accounts Receivable for $1,500

C) a debit to Cash for $1,500

D) a credit to Cash for $1,500

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

41

Outstanding cheques are deposits you have recorded but the bank has not.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

42

The cost of printing cheques should be deducted from the bank side of a bank reconciliation.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

43

In a bank reconciliation,adjustments to the bank balance always require preparation of journal entries.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

44

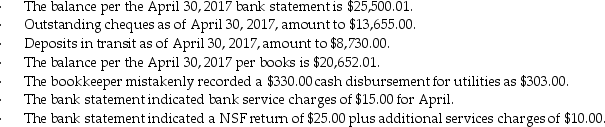

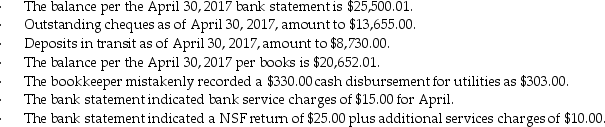

Prepare the bank reconciliation and adjusting entries for Mac Moose Company for April 30 ,2017 using the following information:

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

45

Briefly describe how payment of expenses by cheque is an important internal control.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

46

What is a bank reconciliation? Why is it important to prepare a bank reconciliation every month when the bank statement is received from the bank?

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

47

Prepare any journal entries based on the following data regarding the bank reconciliation prepared by Corruption Company on July 31,2017.

a.A customer's cheque for $260 was returned with the bank statement and stamped NSF.

b.Outstanding cheques amount to $650.

c.Service charges for July per bank statement are $25.

d.Cheque #925 for $3,250 for office equipment was erroneously recorded by the bookkeeper as $2,350.

e.The bank erroneously credited Corruption Company's account for a $575 deposit made by Bribe and Bilk Inc.

f.A deposit ticket correctly prepared for $695 appeared on the bank statement as a deposit for $965.

g.Cheque #930 for $900 for rent expense was erroneously recorded by the bookkeeper as $90.

a.A customer's cheque for $260 was returned with the bank statement and stamped NSF.

b.Outstanding cheques amount to $650.

c.Service charges for July per bank statement are $25.

d.Cheque #925 for $3,250 for office equipment was erroneously recorded by the bookkeeper as $2,350.

e.The bank erroneously credited Corruption Company's account for a $575 deposit made by Bribe and Bilk Inc.

f.A deposit ticket correctly prepared for $695 appeared on the bank statement as a deposit for $965.

g.Cheque #930 for $900 for rent expense was erroneously recorded by the bookkeeper as $90.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

48

Signature cards are one example of a bank account control document.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

49

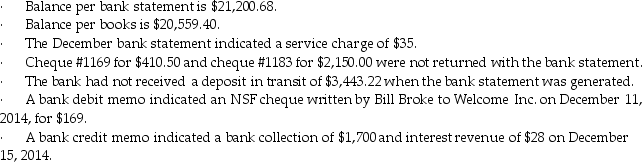

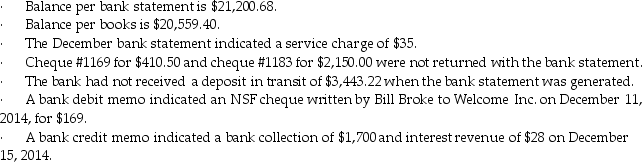

Prepare a bank reconciliation dated December 31,2017,for Welcome Inc.based on the following information.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

50

Outstanding cheques are added to the ending bank balance on the bank statement when preparing the bank reconciliation.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

51

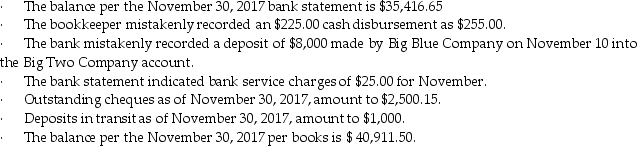

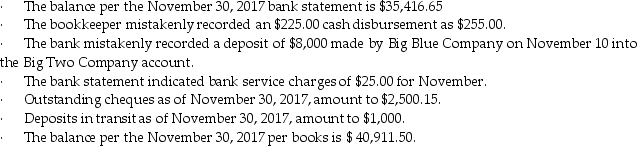

Prepare a bank reconciliation for Big Blue Company for November 30,2017 using the following information:

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

52

Bank charges are deducted from the ending bank balance in the general ledger when preparing the bank reconciliation.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

53

In a bank reconciliation,interest revenue earned on a chequing account would be deducted from the book balance.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

54

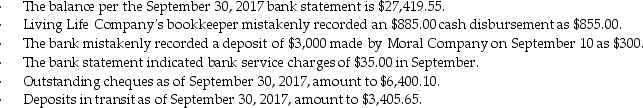

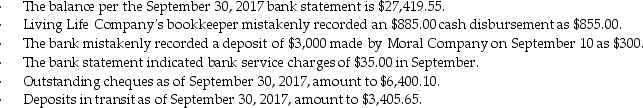

Prepare a bank reconciliation for Living Life Company as of September 30,2017,based on the following information.(Hint: you will need to compute Living Life Company's cash balance per books as of September 30,2017 using the data below.)

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

55

The journal entry for a note collected by the bank with interest requires a debit to Cash and a credit to both Note Receivable and Interest Revenue.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

56

To maintain effective internal control,the majority of all payments in an organization should be made using cash.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

57

One of the benefits of using cheques is the payment record it provides.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

58

Once the bank reconciliation has been completed,journal entries must be made for the book side of the reconciliation.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

59

The following data have been gathered for Rocky Candi Corporation for the month ended September 30,2017.Prepare a bank reconciliation based on the following information:

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

60

The journal entry for an NSF (nonsufficient funds)cheque involves a debit to Accounts Payable.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

61

For good internal control over cash,the handling of cash and the record keeping for receivables should be separated.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

62

An aging-of-accounts-receivable indicates that the amount of uncollectible accounts is $3,410.The Allowance for Uncollectible Accounts prior to adjustment has a credit balance of $500.The Accounts Receivable balance is $44,820.The amount of the adjusting entry for uncollectible accounts should be for:

A) $500

B) $2,910

C) $3,910

D) $3,410

A) $500

B) $2,910

C) $3,910

D) $3,410

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

63

A critical element of internal control over collections of accounts receivables is:

A) depositing the cash from the cash register on a daily basis

B) setting up a petty cash account

C) using a cheque writing machine

D) the separation of cash-handling and cash-accounting duties

A) depositing the cash from the cash register on a daily basis

B) setting up a petty cash account

C) using a cheque writing machine

D) the separation of cash-handling and cash-accounting duties

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

64

Under a lock-box system,customers' payments are initially received by the company's:

A) accounts receivable department

B) treasurer's department

C) purchasing department

D) bank

A) accounts receivable department

B) treasurer's department

C) purchasing department

D) bank

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

65

With regard to notes receivable,which of the following statements is correct?

A) Notes receivable are less formal contracts than accounts receivable.

B) Notes receivable are also called promissory notes because a written promise to pay is not required.

C) All notes receivable require the borrower to pledge collateral.

D) The borrower signs a written promise to pay the lender a definite sum at the maturity date, with interest.

A) Notes receivable are less formal contracts than accounts receivable.

B) Notes receivable are also called promissory notes because a written promise to pay is not required.

C) All notes receivable require the borrower to pledge collateral.

D) The borrower signs a written promise to pay the lender a definite sum at the maturity date, with interest.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

66

The balance in Accounts Receivable was $700,000 at the beginning of the year and $780,000 at the end of the year.Credit sales for the year totaled $4,110,000.During the year,$430,000 in customer accounts were written off.How much cash was collected from customers during the period?

A) $3,600,000

B) $4,030,000

C) $4,460,000

D) $4,620,000

A) $3,600,000

B) $4,030,000

C) $4,460,000

D) $4,620,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

67

Net accounts receivable is equal to accounts receivable less the allowance for uncollectible accounts.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

68

Accounts (trade)receivable are amounts to be collected from customers from the sale of goods or services.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

69

Estimating uncollectible accounts by analyzing receivables from specific customers according to how long each has been outstanding is known as the:

A) direct write-off method

B) percent-of-sales method

C) allowance method

D) aging-of-receivables method

A) direct write-off method

B) percent-of-sales method

C) allowance method

D) aging-of-receivables method

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

70

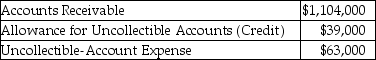

A year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following:  Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $1,000.Under the aging-of-receivables method,the Uncollectible-Account Expense at year-end is:

Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $1,000.Under the aging-of-receivables method,the Uncollectible-Account Expense at year-end is:

A) $1,240

B) $8,870

C) $9,870

D) $10,870

Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $1,000.Under the aging-of-receivables method,the Uncollectible-Account Expense at year-end is:

Before the year-end adjustment,the credit balance in Allowance for Uncollectible Accounts was $1,000.Under the aging-of-receivables method,the Uncollectible-Account Expense at year-end is:A) $1,240

B) $8,870

C) $9,870

D) $10,870

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

71

One of the benefits of extending credit to customers is the possibility of increased sales.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

72

The category "Other Receivables" on the balance sheet includes:

A) Accounts Receivable, Interest Receivable

B) Notes Receivable, Accounts Receivable, Interest Receivable

C) Interest Receivable, Dividend Receivable, Advances to Employees

D) Notes Receivable

A) Accounts Receivable, Interest Receivable

B) Notes Receivable, Accounts Receivable, Interest Receivable

C) Interest Receivable, Dividend Receivable, Advances to Employees

D) Notes Receivable

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

73

Explain how net realizable value for accounts receivable is calculated.On which financial statement is net realizable value shown?

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

74

The aging-of-receivables method of estimating uncollectible accounts is:

A) not an acceptable method of estimating bad debts

B) a balance sheet approach, since it focuses on accounts receivable

C) an income statement approach, since it focuses on the amount of expense to be reported on the income statement

D) is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet

A) not an acceptable method of estimating bad debts

B) a balance sheet approach, since it focuses on accounts receivable

C) an income statement approach, since it focuses on the amount of expense to be reported on the income statement

D) is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

75

Global Alliance Ltd has just established a lock-box account at a local bank.Explain what this is and why it would be used.Identify the specific element of internal control that the use of a lock-box addresses.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

76

Briefly state the main issues in controlling and managing the collection of receivables.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

77

A ledger that contains a separate account for each customer is called an accounts receivable:

A) control ledger

B) current ledger

C) trade ledger

D) subsidiary ledger

A) control ledger

B) current ledger

C) trade ledger

D) subsidiary ledger

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

78

Receivables are monetary claims against others.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

79

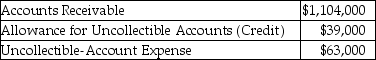

The following account balances were extracted from the accounting records of Thomas Corporation at the end of the year:  What is the net realizable value of the accounts receivable?

What is the net realizable value of the accounts receivable?

A) $1,065,000

B) $1,104,000

C) $1,143,000

D) $1,167,000

What is the net realizable value of the accounts receivable?

What is the net realizable value of the accounts receivable?A) $1,065,000

B) $1,104,000

C) $1,143,000

D) $1,167,000

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck

80

Two major types of receivable include: account receivables and notes payable.

Unlock Deck

Unlock for access to all 155 flashcards in this deck.

Unlock Deck

k this deck