Deck 20: Macroeconomics in an Open Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/276

Play

Full screen (f)

Deck 20: Macroeconomics in an Open Economy

1

The current account balance equals _________.

A) exports of goods − imports of goods + net primary income + net secondary income

B) exports of services − imports of services + net primary income + net secondary income

C) balance of trade on goods and services + net primary income + net secondary income

D) exports of services − imports of services + balance of trade on goods and services + net secondary income

A) exports of goods − imports of goods + net primary income + net secondary income

B) exports of services − imports of services + net primary income + net secondary income

C) balance of trade on goods and services + net primary income + net secondary income

D) exports of services − imports of services + balance of trade on goods and services + net secondary income

C

2

Since the 1970s in Australia,net primary income has been

A) positive due to export earnings.

B) mostly negative, but occasionally positive due to dividends on shares going overseas.

C) negative as imports have usually exceeded exports.

D) negative due to interest repayments on foreign debt.

A) positive due to export earnings.

B) mostly negative, but occasionally positive due to dividends on shares going overseas.

C) negative as imports have usually exceeded exports.

D) negative due to interest repayments on foreign debt.

D

3

Which of the following is not a non-produced,non-financial asset?

A) A copyright

B) A patent

C) A share in a company

D) A right to a natural resource

A) A copyright

B) A patent

C) A share in a company

D) A right to a natural resource

C

4

A country's balance of payments is best described as a system that records

A) the physical flow of goods and services between countries.

B) international trading, borrowing, and lending flows.

C) only official transactions between the government and governments of other countries.

D) the flow of investment between countries.

A) the physical flow of goods and services between countries.

B) international trading, borrowing, and lending flows.

C) only official transactions between the government and governments of other countries.

D) the flow of investment between countries.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

5

A goods trade deficit indicates that a

A) country imports more than it exports.

B) country imports less than it exports.

C) country's imports equal its exports.

D) country's trade has decreased on average.

A) country imports more than it exports.

B) country imports less than it exports.

C) country's imports equal its exports.

D) country's trade has decreased on average.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

6

If an Australian company sells insurance to a foreign company,how does this affect Australia's balance of payments?

A) It increases exports of services.

B) It increases capital inflows.

C) It increases imports of goods.

D) It lowers the balance on the current account.

A) It increases exports of services.

B) It increases capital inflows.

C) It increases imports of goods.

D) It lowers the balance on the current account.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following transactions would be included in Germany's current account?

A) A German citizen purchases 100 shares in Qantas.

B) An Australian citizen purchases 100 shares in Germany's BMW company.

C) A German citizen purchases a new Volkswagen made in Germany.

D) An Australian citizen purchases a new Mercedes-Benz car made in Germany.

A) A German citizen purchases 100 shares in Qantas.

B) An Australian citizen purchases 100 shares in Germany's BMW company.

C) A German citizen purchases a new Volkswagen made in Germany.

D) An Australian citizen purchases a new Mercedes-Benz car made in Germany.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

8

When Australia sends money to the Philippines to help typhoon survivors,the transaction is recorded in the _________.

A) capital account

B) current account

C) financial account

D) foreign exchange account

A) capital account

B) current account

C) financial account

D) foreign exchange account

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

9

The record of a country's transactions in goods,services,and assets with the rest of the world is its _________.

A) current account

B) financial account

C) balance of payments

D) balance of trade

A) current account

B) financial account

C) balance of payments

D) balance of trade

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

10

Since the 1980s in Australia,the balance on goods and services has

A) usually been positive.

B) usually been negative.

C) led to a current account surplus.

D) led to capital flows out of the financial account.

A) usually been positive.

B) usually been negative.

C) led to a current account surplus.

D) led to capital flows out of the financial account.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a 'capital outflow' from Australia?

A) A Chinese investor buys an Australian government bond.

B) An Indian firm buys and builds a factory in Australia.

C) An Australian investor buys a Japanese bond.

D) An Australian firm buys an Australian government bond.

A) A Chinese investor buys an Australian government bond.

B) An Indian firm buys and builds a factory in Australia.

C) An Australian investor buys a Japanese bond.

D) An Australian firm buys an Australian government bond.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

12

The 'current account' includes records of a country's

A) net exports.

B) net primary income.

C) net secondary income.

D) All of the above are included in an economy's current account.

A) net exports.

B) net primary income.

C) net secondary income.

D) All of the above are included in an economy's current account.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

13

The 'balance of payments' includes all of the following accounts except the _________.

A) current account

B) financial account

C) capital account

D) national debt account

A) current account

B) financial account

C) capital account

D) national debt account

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

14

Any ________ by Australian residents from overseas are ________ additions to the current account.

A) payments received; negative

B) payments made; positive

C) payments made; negative

D) payments received; neutral

A) payments received; negative

B) payments made; positive

C) payments made; negative

D) payments received; neutral

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not included in the 'current account'?

A) Exports of goods

B) Income received on investments

C) Transfer of migrants' income

D) Overseas debt relief by the Australian government

A) Exports of goods

B) Income received on investments

C) Transfer of migrants' income

D) Overseas debt relief by the Australian government

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

16

The 'balance of payments' is a

A) measure of the value of merchandise goods bought and sold on international trade markets.

B) summary record of a country's financial transactions with other countries.

C) record of the value of goods and services bought and sold between countries.

D) summary record of a country's purchases and sales of goods and services on international trade markets.

A) measure of the value of merchandise goods bought and sold on international trade markets.

B) summary record of a country's financial transactions with other countries.

C) record of the value of goods and services bought and sold between countries.

D) summary record of a country's purchases and sales of goods and services on international trade markets.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

17

The major difference between an open economy and a closed economy is that

A) an open economy interacts with the rest of the world, a closed economy does not.

B) a closed economy uses rules rather than discretionary policy, an open economy uses discretionary policy.

C) an open economy is a market economy while a closed economy relies on central planning.

D) a closed economy balances budgets, an open economy does not.

A) an open economy interacts with the rest of the world, a closed economy does not.

B) a closed economy uses rules rather than discretionary policy, an open economy uses discretionary policy.

C) an open economy is a market economy while a closed economy relies on central planning.

D) a closed economy balances budgets, an open economy does not.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

18

An economy that does not have interactions in trade or finance with other economies is referred to as _________.

A) an open economy

B) a closed economy

C) a trade-balanced economy

D) a zero foreign investment economy

A) an open economy

B) a closed economy

C) a trade-balanced economy

D) a zero foreign investment economy

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

19

In 2015/2016,Australia

A) had a trade surplus due to the booming mining sector.

B) had less income flowing overseas than was coming into Australia.

C) had a trade deficit due to a fall in commodity prices.

D) imported more services than it exported.

A) had a trade surplus due to the booming mining sector.

B) had less income flowing overseas than was coming into Australia.

C) had a trade deficit due to a fall in commodity prices.

D) imported more services than it exported.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following would decrease the size of the deficit in the current account of Australia?

A) An increase in imports

B) A decrease in exports

C) A decrease in the amount of income Australian companies pay to foreigners who own investments in Australia

D) An increase in the amount of money the Australian government sends in foreign aid to other countries

A) An increase in imports

B) A decrease in exports

C) A decrease in the amount of income Australian companies pay to foreigners who own investments in Australia

D) An increase in the amount of money the Australian government sends in foreign aid to other countries

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

21

The ________ account records flows of funds into and out of a country.

A) financial

B) capital

C) current

D) net errors and omissions

A) financial

B) capital

C) current

D) net errors and omissions

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

22

If the value of goods and services exported from Australia is smaller than the value of goods and services imported,then

A) Australia's balance of payments will be in deficit.

B) Australia's balance of trade on goods and services will be in deficit.

C) Australia will have a current account surplus.

D) Australia will have a financial account deficit.

A) Australia's balance of payments will be in deficit.

B) Australia's balance of trade on goods and services will be in deficit.

C) Australia will have a current account surplus.

D) Australia will have a financial account deficit.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

23

If the balance on the current account is $8.42 billion and the balance on the financial account is $7.53 billion,what is the balance on the capital account,assuming no statistical discrepancy?

A) $0 billion

B) $0.89 billion

C) −$0.89 billion

D) −$15.95 billion

A) $0 billion

B) $0.89 billion

C) −$0.89 billion

D) −$15.95 billion

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not included in the financial account?

A) An increase in private Australian asset holdings in foreign countries

B) An increase in foreign government asset holdings in foreign countries

C) An increase in foreign private asset holdings in Australia

D) Income received from investments made overseas

A) An increase in private Australian asset holdings in foreign countries

B) An increase in foreign government asset holdings in foreign countries

C) An increase in foreign private asset holdings in Australia

D) Income received from investments made overseas

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

25

A current account deficit must be exactly offset by a capital and financial account surplus.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

26

When imports are greater than exports,there will be a net capital outflow.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

27

Net foreign investment is a measure of net capital outflows,equal to capital outflows minus capital inflows in a given period of accounting.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

28

If foreign holdings of Australian dollars decrease,holding all else constant,the

A) balance on Australia's financial account will decrease.

B) balance on Australia's current account will decrease.

C) balance on Australia's capital account will decrease.

D) Australian balance of trade on goods and services will decrease.

A) balance on Australia's financial account will decrease.

B) balance on Australia's current account will decrease.

C) balance on Australia's capital account will decrease.

D) Australian balance of trade on goods and services will decrease.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

29

When an Australian investor buys a bond issued in a foreign country,ceteris paribus,the

A) balance on the capital account decreases.

B) balance on the current account decreases.

C) balance on the financial account decreases.

D) balance of trade on goods and services decreases.

A) balance on the capital account decreases.

B) balance on the current account decreases.

C) balance on the financial account decreases.

D) balance of trade on goods and services decreases.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

30

What is the difference between 'net exports' and the 'current account balance'?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is an item in Australia's financial account?

A) Net secondary income

B) Net primary income

C) Net exports of goods and services

D) The change in private Australian assets abroad

A) Net secondary income

B) Net primary income

C) Net exports of goods and services

D) The change in private Australian assets abroad

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

32

In recent decades,Australia has incurred overall balance of payments deficits.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

33

Net exports in Australia are negative so Australia must be a net lender abroad.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

34

The purchase of foreign shares and bonds by an Australian brokerage firm is an example of capital inflows to Australia.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

35

If the Australian government sells a bond to the Bank of China,how is this recorded in Australia's balance of payments?

A) A positive entry on the trade account

B) Capital inflow into Australia's financial account

C) A negative entry on the financial account

D) An increase in foreign direct investment into Australia

A) A positive entry on the trade account

B) Capital inflow into Australia's financial account

C) A negative entry on the financial account

D) An increase in foreign direct investment into Australia

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

36

If Australia exports more than it imports,then

A) Australia's balance of payments will be in deficit.

B) Australia's balance of trade on goods and services will be positive.

C) Australia will have a current account surplus.

D) Australia will have a financial account deficit.

A) Australia's balance of payments will be in deficit.

B) Australia's balance of trade on goods and services will be positive.

C) Australia will have a current account surplus.

D) Australia will have a financial account deficit.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

37

If the capital account is in surplus and the current account is zero,then the

A) financial account must be in deficit.

B) balance of trade must be in deficit.

C) balance of payments must be in surplus.

D) balance of services must be in deficit.

A) financial account must be in deficit.

B) balance of trade must be in deficit.

C) balance of payments must be in surplus.

D) balance of services must be in deficit.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

38

Outline the three main components of the current account.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

39

An example of 'foreign direct investment' is:

A) Holden building a factory in India.

B) A British investor buying shares in an Australian firm.

C) An Australian investor buying a Canadian bond.

D) A British bank buying an Australian government bond.

A) Holden building a factory in India.

B) A British investor buying shares in an Australian firm.

C) An Australian investor buying a Canadian bond.

D) A British bank buying an Australian government bond.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

40

A decrease in capital outflows from Australia will

A) decrease the balance on the financial account.

B) increase the balance on the financial account.

C) increase the balance on the capital account.

D) decrease the balance on the current account.

A) decrease the balance on the financial account.

B) increase the balance on the financial account.

C) increase the balance on the capital account.

D) decrease the balance on the current account.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

41

An excess demand for dollars in exchange for yen will cause

A) no change in the exchange rate of the yen to the dollar.

B) the dollar to appreciate relative to the yen.

C) the yen to appreciate against all major currencies.

D) the dollar to decline in value relative to the yen.

A) no change in the exchange rate of the yen to the dollar.

B) the dollar to appreciate relative to the yen.

C) the yen to appreciate against all major currencies.

D) the dollar to decline in value relative to the yen.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

42

Why is the net primary income component in Australia's current account always negative?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

43

Explain what the 'financial account' measures.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not a source of demand for Japanese yen?

A) A Japanese firm that wants to purchase Australian beef.

B) A Chinese person who wants to buy Japanese financial securities.

C) A currency trader who thinks the value of the yen will be greater in the future relative to its value today.

D) An Australian bank that wants to buy a Japanese bond.

A) A Japanese firm that wants to purchase Australian beef.

B) A Chinese person who wants to buy Japanese financial securities.

C) A currency trader who thinks the value of the yen will be greater in the future relative to its value today.

D) An Australian bank that wants to buy a Japanese bond.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

45

An excess demand of the dollar in exchange for yen will cause

A) no change in the exchange rate of the yen to the dollar.

B) the dollar to depreciate relative to the yen.

C) the yen to depreciate against all major currencies.

D) the dollar to appreciate relative to the yen.

A) no change in the exchange rate of the yen to the dollar.

B) the dollar to depreciate relative to the yen.

C) the yen to depreciate against all major currencies.

D) the dollar to appreciate relative to the yen.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

46

Explain where,in Australia's balance of payments,an entry would be made for each of the following:

a.a financier from Singapore buys some Australian shares

b.an Australian buys some Italian shoes in Milan,Italy

_____________________________________________________________________________________________

_____________________________________________________________________________________________

a.a financier from Singapore buys some Australian shares

b.an Australian buys some Italian shoes in Milan,Italy

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

47

The following are hypothetical data for a country's balance of payments.You can assume the balance on the capital account is zero.Use the data to calculate the following:

a.the balance on the current account

b.the balance of trade on goods and services

c.the balance on the financial account

d.net errors and omissions

_____________________________________________________________________________________________

_____________________________________________________________________________________________

a.the balance on the current account

b.the balance of trade on goods and services

c.the balance on the financial account

d.net errors and omissions

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose that the exchange rate between the Japanese yen and the Australia dollar is currently ¥60 = $1,then an individual could trade ________.

A) ¥10 for $0.60

B) ¥10 for $6.00

C) ¥10 for $0.17

D) ¥10 for $0.01

A) ¥10 for $0.60

B) ¥10 for $6.00

C) ¥10 for $0.17

D) ¥10 for $0.01

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

49

The exchange rate of the dollar in exchange for yen will rise if,ceteris paribus,

A) Australian interest rates fall relative to the yen.

B) income in Japan rises.

C) speculators think the value of the dollar will fall.

D) the desirability of investing in Australia declines.

A) Australian interest rates fall relative to the yen.

B) income in Japan rises.

C) speculators think the value of the dollar will fall.

D) the desirability of investing in Australia declines.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

50

The demand for yen in exchange for dollars will increase if,ceteris paribus,

A) Japanese interest rates increase relative to interest rates in other countries.

B) income in Australia falls.

C) speculators think the value of the yen relative to the dollar will fall.

D) the desirability of investing in Japan falls.

A) Japanese interest rates increase relative to interest rates in other countries.

B) income in Australia falls.

C) speculators think the value of the yen relative to the dollar will fall.

D) the desirability of investing in Japan falls.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

51

The dollar will appreciate relative to the yen if,ceteris paribus,

A) Australian interest rates decrease relative to interest rates in other countries.

B) income in Japan falls.

C) speculators think the value of the dollar relative to the yen will rise.

D) there is a recession in Japan.

A) Australian interest rates decrease relative to interest rates in other countries.

B) income in Japan falls.

C) speculators think the value of the dollar relative to the yen will rise.

D) there is a recession in Japan.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is a source of supply for the Australian dollar?

A) A German firm that wants to purchase agricultural products from Australia.

B) An Indian financier who wants to buy an Australian bond.

C) A currency trader who thinks the value of the dollar will be greater in the future relative to the value today.

D) An Australian bank that wants to buy a Japanese bond.

A) A German firm that wants to purchase agricultural products from Australia.

B) An Indian financier who wants to buy an Australian bond.

C) A currency trader who thinks the value of the dollar will be greater in the future relative to the value today.

D) An Australian bank that wants to buy a Japanese bond.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

53

The quantity supplied of dollars is likely to ________ when the exchange rate of yen per dollar ________.

A) not change; rises

B) rise; rises

C) not change; falls

D) rise; falls

A) not change; rises

B) rise; rises

C) not change; falls

D) rise; falls

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

54

In international exchange markets,a rise in interest rates in Australia,ceteris paribus,will cause the demand for dollars to ________ and the supply of dollars to ________.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

55

The supply of dollars in exchange for yen will increase,if,ceteris paribus,

A) Japanese interest rates fall relative to interest rates in other countries.

B) speculators think the value of the dollar will fall relative to the yen.

C) there is a recession in Australia.

D) the desirability of investing in Japan falls.

A) Japanese interest rates fall relative to interest rates in other countries.

B) speculators think the value of the dollar will fall relative to the yen.

C) there is a recession in Australia.

D) the desirability of investing in Japan falls.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

56

The 'nominal exchange rate' is the

A) value of one country's currency over time.

B) average value of one country's currency over one quarter.

C) value of one country's currency in terms of another country's currency.

D) value of one country's currency in terms of another country's currency adjusted for the price level.

A) value of one country's currency over time.

B) average value of one country's currency over one quarter.

C) value of one country's currency in terms of another country's currency.

D) value of one country's currency in terms of another country's currency adjusted for the price level.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

57

If currency traders expect the value of the dollar to rise,what effect will this have on the demand for dollars and the supply of dollars in the foreign exchange market?

A) Demand for dollars will increase and supply of dollars will decrease.

B) Demand for dollars will increase and supply of dollars will increase.

C) Demand for dollars will decrease and supply of dollars will increase.

D) Demand for dollars will decrease and supply of dollars will decrease.

A) Demand for dollars will increase and supply of dollars will decrease.

B) Demand for dollars will increase and supply of dollars will increase.

C) Demand for dollars will decrease and supply of dollars will increase.

D) Demand for dollars will decrease and supply of dollars will decrease.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

58

If the _______________ for dollars __________,the market value of the dollar will ________ relative to other currencies around the world.

A) demand; increases; depreciate

B) supply; increases; depreciate

C) demand; decreases; appreciate

D) supply; decreases; depreciate

A) demand; increases; depreciate

B) supply; increases; depreciate

C) demand; decreases; appreciate

D) supply; decreases; depreciate

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

59

What is the relationship across the current account,the capital account,the financial account,and the balance of payments?

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

60

Speculators who anticipate that the future value of the dollar relative to the yen will ________,will cause a(n)______________.

A) increase; increase in the demand for yen

B) increase; increase in the demand for dollars

C) decrease; decrease in the demand for yen

D) decrease; increase in the demand for dollars

A) increase; increase in the demand for yen

B) increase; increase in the demand for dollars

C) decrease; decrease in the demand for yen

D) decrease; increase in the demand for dollars

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

61

The real exchange rate of British pounds to Australian dollars will increase if the British price level ________ and the nominal exchange rate of pounds to the dollar ________.

A) increases; rises

B) decreases; rises

C) increases; falls

D) decreases; falls

A) increases; rises

B) decreases; rises

C) increases; falls

D) decreases; falls

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

62

Assume that the exchange rate between the dollar and the yen is ¥100 = $1.Suppose the exchange rate changes to ¥150 = $1.What is the price in yen of a $200 iPod before and after the exchange rate change?

A) ¥20 000 before; ¥15 000 after

B) ¥20 000 before; ¥30 000 after

C) ¥300 before; ¥150 after

D) ¥300 before; ¥200 after

A) ¥20 000 before; ¥15 000 after

B) ¥20 000 before; ¥30 000 after

C) ¥300 before; ¥150 after

D) ¥300 before; ¥200 after

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

63

If the dollar appreciates against the yen,ceteris paribus,this will cause:

A) net exports to decline, the rate of increase in aggregate demand to fall, and real GDP to increase at a lower rate.

B) net exports to decline, the rate of increase in aggregate demand to rise, and real GDP to increase at a higher rate.

C) net exports to increase, the rate of increase in aggregate demand to rise, and real GDP to increase at a higher rate.

D) net exports to increase, the rate of increase in aggregate demand to fall, and real GDP to increase at a lower rate.

A) net exports to decline, the rate of increase in aggregate demand to fall, and real GDP to increase at a lower rate.

B) net exports to decline, the rate of increase in aggregate demand to rise, and real GDP to increase at a higher rate.

C) net exports to increase, the rate of increase in aggregate demand to rise, and real GDP to increase at a higher rate.

D) net exports to increase, the rate of increase in aggregate demand to fall, and real GDP to increase at a lower rate.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

64

Assume the exchange rate between the dollar and yen is ¥80= $1.Suppose that the exchange rate changes to ¥75 = $1.As a result of the change,there will be

A) more Japanese goods sold in Australia and less Australian goods sold in Japan.

B) less Japanese goods sold in Australia and more Australian goods sold in Japan.

C) more Japanese goods sold in Australia and the same amount of Australian goods sold in Japan.

D) the same number of Japanese goods sold in Australia and less Australian goods sold in Japan.

A) more Japanese goods sold in Australia and less Australian goods sold in Japan.

B) less Japanese goods sold in Australia and more Australian goods sold in Japan.

C) more Japanese goods sold in Australia and the same amount of Australian goods sold in Japan.

D) the same number of Japanese goods sold in Australia and less Australian goods sold in Japan.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

65

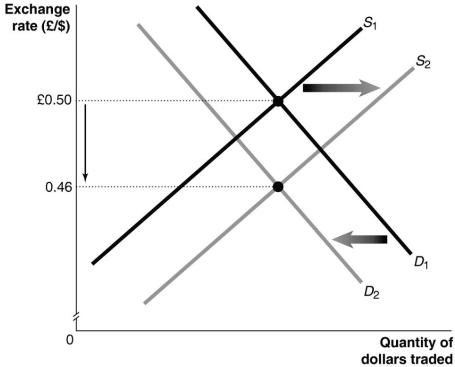

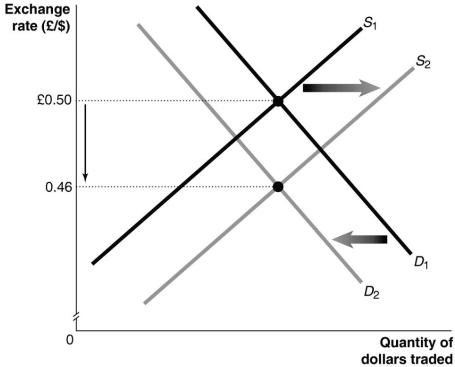

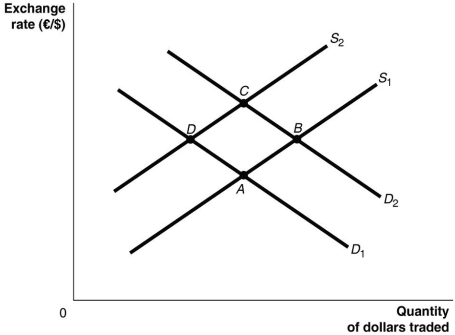

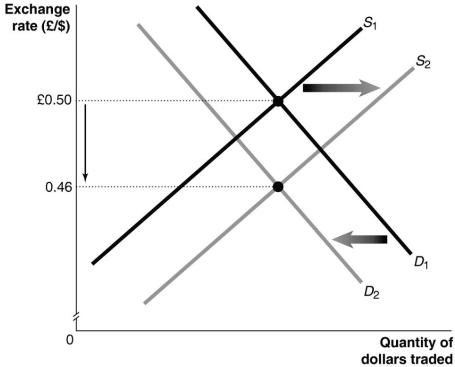

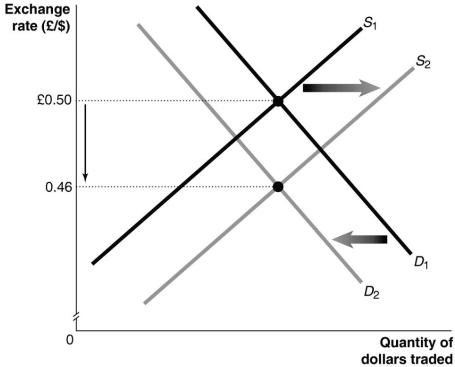

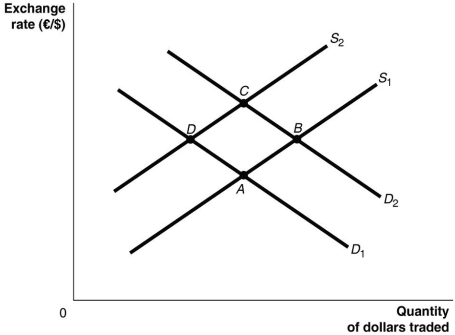

Refer to Figure 20.1 for the following questions.

Figure 20.1

Refer to Figure 20.1.Which of the following events cause the shifts in the supply and demand curves in the market for dollars against the British pound shown in the graph above?

A) Interest rates rise in England

B) Interest rates rise in Australia

C) Real income rises in Australia

D) Real income falls in England

Figure 20.1

Refer to Figure 20.1.Which of the following events cause the shifts in the supply and demand curves in the market for dollars against the British pound shown in the graph above?

A) Interest rates rise in England

B) Interest rates rise in Australia

C) Real income rises in Australia

D) Real income falls in England

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

66

Assume that the exchange rate between the dollar and the euro is €0.6 = $1.Suppose the exchange rate changes to €0.50 = $1.Because of the change

A) Australian exports should increase and Australian imports should increase.

B) Australian exports should decrease and Australian imports should increase.

C) Australian exports should increase and Australian imports should decrease.

D) Australian exports should decrease and Australian imports should decrease.

A) Australian exports should increase and Australian imports should increase.

B) Australian exports should decrease and Australian imports should increase.

C) Australian exports should increase and Australian imports should decrease.

D) Australian exports should decrease and Australian imports should decrease.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

67

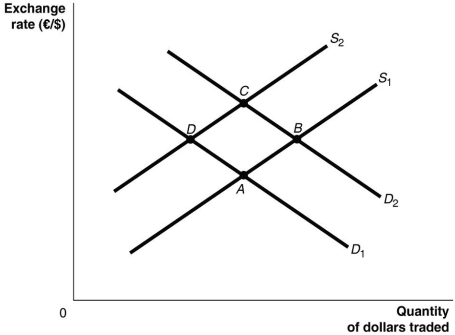

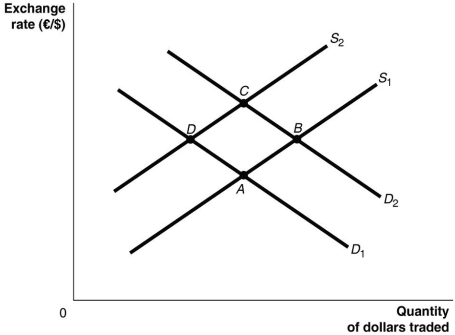

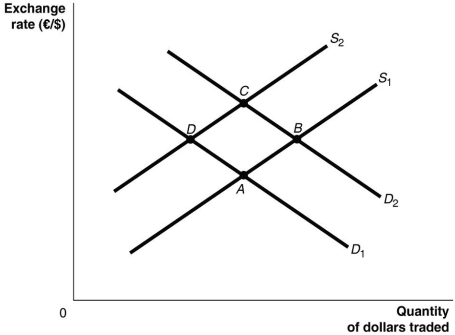

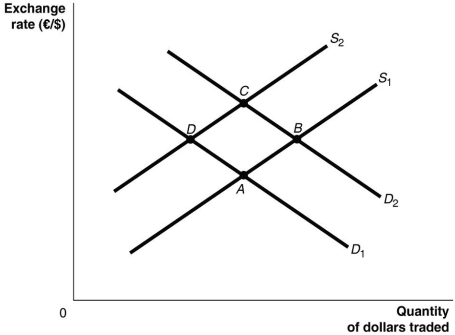

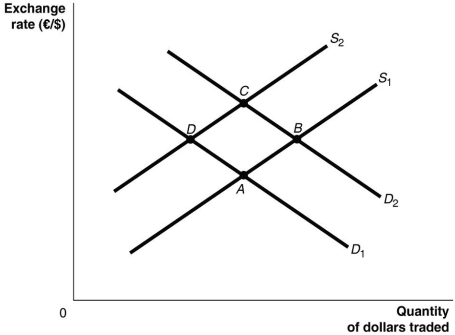

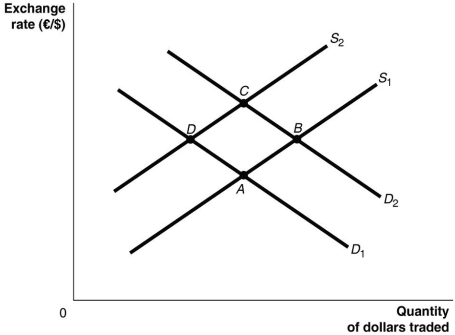

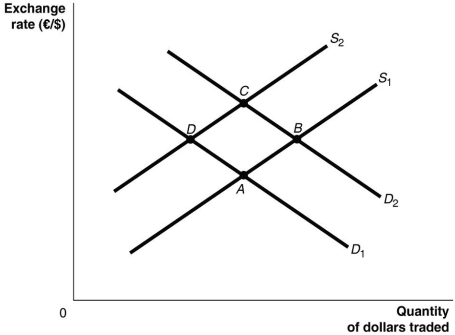

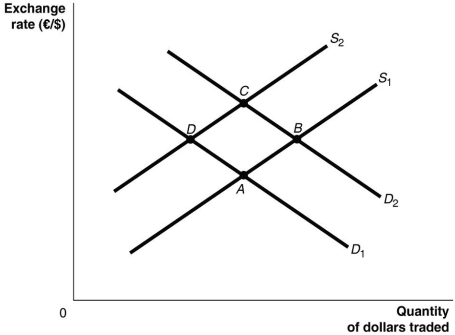

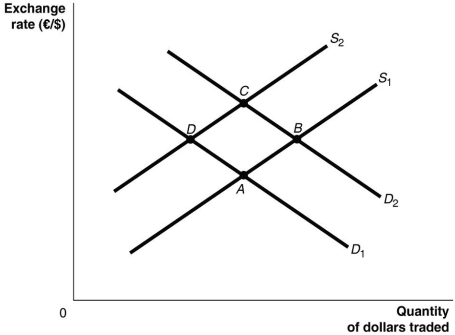

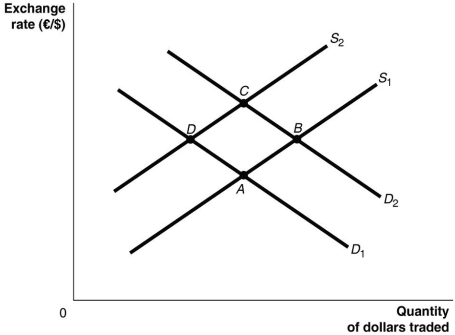

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.Suppose that Italians reduce their demand for Australian steel by half.Assuming all else remains constant,this would be represented as a movement from ________.

A) D2 to D1

B) D1 to D2

C) S2 to S1

D) S1 to S2

Figure 20.2

Refer to Figure 20.2.Suppose that Italians reduce their demand for Australian steel by half.Assuming all else remains constant,this would be represented as a movement from ________.

A) D2 to D1

B) D1 to D2

C) S2 to S1

D) S1 to S2

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

68

Suppose that the European Union experiences a recession and this causes a decline in income in the European Union relative to Australia.Because of this,the dollar will,ceteris paribus,

A) appreciate and Australian net exports will fall.

B) depreciate and Australian net exports will rise.

C) appreciate and Australian net exports will rise.

D) depreciate and Australian net exports will fall.

A) appreciate and Australian net exports will fall.

B) depreciate and Australian net exports will rise.

C) appreciate and Australian net exports will rise.

D) depreciate and Australian net exports will fall.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

69

The real exchange rate of Japanese yen to Australian dollars will increase if Australia's price level ________ and the nominal exchange rate of yen to the dollar ________.

A) increases; rises

B) decreases; rises

C) increases; falls

D) decreases; falls

A) increases; rises

B) decreases; rises

C) increases; falls

D) decreases; falls

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

70

A depreciation of a country's currency is likely to

A) decrease the rate of growth in GDP.

B) increase the rate of growth in GDP.

C) increase imports.

D) decrease exports.

A) decrease the rate of growth in GDP.

B) increase the rate of growth in GDP.

C) increase imports.

D) decrease exports.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

71

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.An appreciation of the dollar is represented as a movement from ________.

A) B to A

B) D to C

C) C to B

D) C to A

Figure 20.2

Refer to Figure 20.2.An appreciation of the dollar is represented as a movement from ________.

A) B to A

B) D to C

C) C to B

D) C to A

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

72

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.Assume that Europe experiences an economic boom.Assuming all else remains constant,this would be represented as a movement from ________.

A) D2 to D1

B) D1 to D2

C) S2 to S1

D) S1 to S2

Figure 20.2

Refer to Figure 20.2.Assume that Europe experiences an economic boom.Assuming all else remains constant,this would be represented as a movement from ________.

A) D2 to D1

B) D1 to D2

C) S2 to S1

D) S1 to S2

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

73

A decrease in value of a country's currency relative to other currencies affects its balance of trade on goods and services by

A) raising imports, reducing exports, and reducing the balance of trade on goods and services.

B) reducing imports, raising exports, and reducing the balance of trade on goods and services.

C) reducing imports, raising exports, and increasing the balance of trade on goods and services.

D) raising imports, reducing exports, and increasing the balance of trade on goods and services.

A) raising imports, reducing exports, and reducing the balance of trade on goods and services.

B) reducing imports, raising exports, and reducing the balance of trade on goods and services.

C) reducing imports, raising exports, and increasing the balance of trade on goods and services.

D) raising imports, reducing exports, and increasing the balance of trade on goods and services.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

74

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.Suppose that interest rates in Australia fall relative to those in the European Union.Assuming all else remains constant,how would this be represented?

A) Supply would decrease, demand would decrease, and the economy moves from B to C to D.

B) Supply would increase, demand would decrease, and the economy moves from C to B to A.

C) Supply would decrease, demand would increase, and the economy moves from A to D to C.

D) Supply would increase, demand would increase, and the economy moves from D to A to B.

Figure 20.2

Refer to Figure 20.2.Suppose that interest rates in Australia fall relative to those in the European Union.Assuming all else remains constant,how would this be represented?

A) Supply would decrease, demand would decrease, and the economy moves from B to C to D.

B) Supply would increase, demand would decrease, and the economy moves from C to B to A.

C) Supply would decrease, demand would increase, and the economy moves from A to D to C.

D) Supply would increase, demand would increase, and the economy moves from D to A to B.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

75

Refer to Figure 20.1 for the following questions.

Figure 20.1

Consider the market for dollars against the British pound shown in Figure 20.1.From this graph,we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound.

A) decreased; 0.46

B) increased; 2.17

C) decreased; 2.00

D) increased; 0.50

Figure 20.1

Consider the market for dollars against the British pound shown in Figure 20.1.From this graph,we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound.

A) decreased; 0.46

B) increased; 2.17

C) decreased; 2.00

D) increased; 0.50

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

76

Suppose that interest rates decrease in Japan and at the same time the Japanese economy is experiencing a recession.What will happen to the value of the dollar relative to the yen?

A) The dollar will appreciate relative to the yen.

B) The dollar will depreciate relative to the yen.

C) One would have to know the size of the demand shift relative to the supply shift to answer correctly.

D) There will be no change in the relative exchange rate.

A) The dollar will appreciate relative to the yen.

B) The dollar will depreciate relative to the yen.

C) One would have to know the size of the demand shift relative to the supply shift to answer correctly.

D) There will be no change in the relative exchange rate.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

77

Assume that the exchange rate between the dollar and the euro is €1 = $1.Suppose the exchange rate changes to €1.25 = $1.What is the price in dollars of a €200 pair of Italian shoes before and after the exchange rate change?

A) $200 before; $160 after

B) $200 before; $250 after

C) $160 before; $125 after

D) $125 before; $160 after

A) $200 before; $160 after

B) $200 before; $250 after

C) $160 before; $125 after

D) $125 before; $160 after

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

78

Assume that the exchange rate between the dollar and the yen is ¥60 = $1.Suppose the exchange rate changes to ¥100 = $1.Because of the change

A) Australian exports should increase and Australian imports should increase.

B) Australian exports should decrease and Australian imports should increase.

C) Australian exports should increase and Australian imports should decrease.

D) Australian exports should decrease and Australian imports should decrease.

A) Australian exports should increase and Australian imports should increase.

B) Australian exports should decrease and Australian imports should increase.

C) Australian exports should increase and Australian imports should decrease.

D) Australian exports should decrease and Australian imports should decrease.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

79

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.Currency speculators believe that the value of the euro will decrease relative to the dollar.Assuming ceteris paribus,how would this be represented?

A) Supply would decrease, demand would decrease, and the economy moves from B to C to D.

B) Supply would increase, demand would decrease, and the economy moves from C to B to A.

C) Supply would decrease, demand would increase, and the economy moves from A to D to C.

D) Supply would increase, demand would increase, and the economy moves from D to A to B.

Figure 20.2

Refer to Figure 20.2.Currency speculators believe that the value of the euro will decrease relative to the dollar.Assuming ceteris paribus,how would this be represented?

A) Supply would decrease, demand would decrease, and the economy moves from B to C to D.

B) Supply would increase, demand would decrease, and the economy moves from C to B to A.

C) Supply would decrease, demand would increase, and the economy moves from A to D to C.

D) Supply would increase, demand would increase, and the economy moves from D to A to B.

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck

80

Refer to Figure 20.2 for the following questions.

Figure 20.2

Refer to Figure 20.2.A depreciation of the euro is represented as a movement from ________.

A) D to A

B) C to D

C) B to C

D) B to A

Figure 20.2

Refer to Figure 20.2.A depreciation of the euro is represented as a movement from ________.

A) D to A

B) C to D

C) B to C

D) B to A

Unlock Deck

Unlock for access to all 276 flashcards in this deck.

Unlock Deck

k this deck