Deck 5: Nontariff Trade Barriers

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

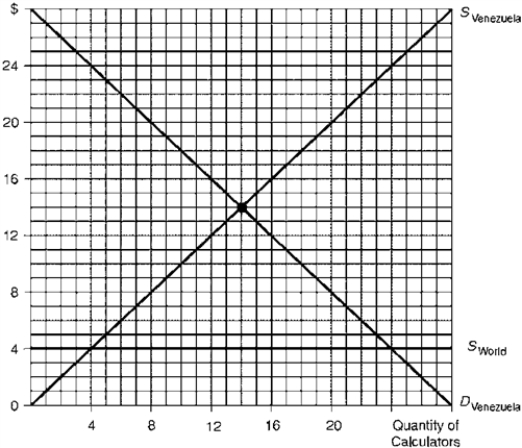

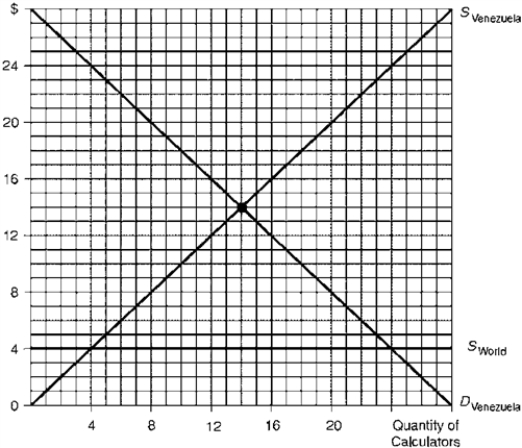

Question

Question

Question

Question

Question

Question

Question

Question

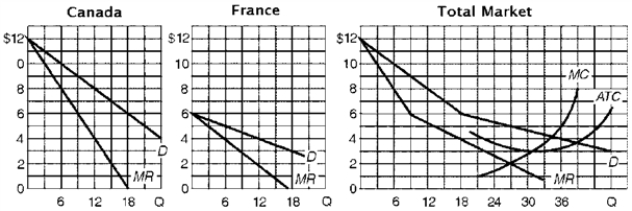

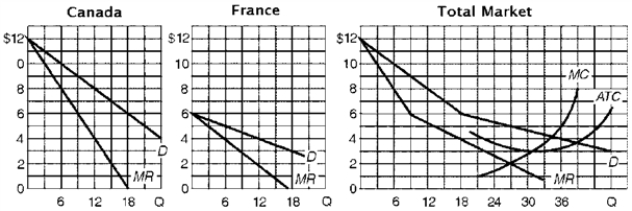

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/134

Play

Full screen (f)

Deck 5: Nontariff Trade Barriers

1

Suppose the United States and Japan enter into a voluntary export agreement in which Japan imposes an export quota on its automakers.The largest share of the export quota's "revenue effect" would tend to be captured by:

A) The U.S.government

B) Japanese automakers

C) American auto consumers

D) American autoworkers

A) The U.S.government

B) Japanese automakers

C) American auto consumers

D) American autoworkers

B

2

Because export subsidies tend to result in domestic exporters charging lower prices on their goods sold overseas,the home country's:

A) Export revenues will decrease

B) Export revenues will rise

C) Terms of trade will worsen

D) Terms of trade will improve

A) Export revenues will decrease

B) Export revenues will rise

C) Terms of trade will worsen

D) Terms of trade will improve

C

3

Suppose the government grants a subsidy to its export firms that permits them to charge lower prices on goods sold abroad.The export revenue of these firms would rise if the foreign demand is:

A) Elastic in response to the price reduction

B) Inelastic in response to the price reduction

C) Unit elastic in response to the price reduction

D) None of the above

A) Elastic in response to the price reduction

B) Inelastic in response to the price reduction

C) Unit elastic in response to the price reduction

D) None of the above

A

4

If a tariff and an import quota lead to equivalent increases in the domestic price of steel,then:

A) The quota results in efficiency reductions but the tariff does not

B) The tariff results in efficiency reductions but the quota does not

C) They have different impacts on how much is produced and consumed

D) They have different impacts on how income is distributed

A) The quota results in efficiency reductions but the tariff does not

B) The tariff results in efficiency reductions but the quota does not

C) They have different impacts on how much is produced and consumed

D) They have different impacts on how income is distributed

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

5

Anti-dumping law has been called unfair for all of the following reasons EXCEPT:

A) they do not reflect currency fluctuations

B) they are based on average variable cost

C) they are based on average total cost

D) all of these are reasons to call these laws unfair

A) they do not reflect currency fluctuations

B) they are based on average variable cost

C) they are based on average total cost

D) all of these are reasons to call these laws unfair

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

6

Assume the U.S.has a competitive advantage in producing calculators,while the rest of the world has a competitive advantage in steel.Suppose the U.S.and the rest of the world enter into an agreement to lower import quotas below existing levels on calculators and steel.Which of the following would least likely occur for the U.S.? Rising levels of:

A) Consumer surplus for American buyers of steel

B) Producer surplus for American steelmakers

C) Production in the American calculator industry

D) Producer surplus for American calculator producers

A) Consumer surplus for American buyers of steel

B) Producer surplus for American steelmakers

C) Production in the American calculator industry

D) Producer surplus for American calculator producers

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

7

Tariffs and quotas on imports tend to involve larger sacrifices in national welfare than would occur under domestic subsidies.This is because,unlike domestic subsidies,import tariffs and quotas:

A) Permit less efficient home production

B) Distort choices for domestic consumers

C) Result in higher tax rates for domestic residents

D) Redistribute revenue from domestic producers to consumers

A) Permit less efficient home production

B) Distort choices for domestic consumers

C) Result in higher tax rates for domestic residents

D) Redistribute revenue from domestic producers to consumers

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

8

Which trade restriction stipulates the percentage of a product's total value that must be produced domestically in order for that product to be sold domestically?

A) Import quota

B) Orderly marketing agreement

C) Local content requirement

D) Government procurement policy

A) Import quota

B) Orderly marketing agreement

C) Local content requirement

D) Government procurement policy

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

9

The imposition of a domestic content requirement by the United States would cause consumer surplus for Americans to:

A) Rise

B) Fall

C) Remain unchanged

D) None of the above

A) Rise

B) Fall

C) Remain unchanged

D) None of the above

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

10

Domestic content legislation applied to autos would tend to:

A) Support wage levels of American autoworkers

B) Lower auto prices for American autoworkers

C) Encourage American automakers to locate production overseas

D) Increase profits of American auto companies

A) Support wage levels of American autoworkers

B) Lower auto prices for American autoworkers

C) Encourage American automakers to locate production overseas

D) Increase profits of American auto companies

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

11

The imposition of a tariff on imported steel for the home country results in:

A) Improving terms of trade and rising volume of trade

B) Higher steel prices and falling steel consumption

C) Lower profits for domestic steel companies

D) Higher unemployment for domestic steel workers

A) Improving terms of trade and rising volume of trade

B) Higher steel prices and falling steel consumption

C) Lower profits for domestic steel companies

D) Higher unemployment for domestic steel workers

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

12

Empirical studies show that because voluntary export quotas are typically administered by exporting countries,foreign exporters tend to:

A) Raise their export prices,thus capturing much of the quota's revenue effect

B) Lower their export prices,thus losing much of the quota's revenue effect

C) Raise their export prices,thus selling more goods overseas

D) Lower their export prices,thus selling fewer goods overseas

A) Raise their export prices,thus capturing much of the quota's revenue effect

B) Lower their export prices,thus losing much of the quota's revenue effect

C) Raise their export prices,thus selling more goods overseas

D) Lower their export prices,thus selling fewer goods overseas

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following refers to a market-sharing pact negotiated by trading partners to moderate the intensity of international competition?

A) Orderly marketing agreement

B) Local content requirements

C) Import quota

D) Trigger price mechanism

A) Orderly marketing agreement

B) Local content requirements

C) Import quota

D) Trigger price mechanism

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

14

A producer successfully practicing international dumping would charge:

A) A relatively higher price in the more inelastic market

B) A relatively higher price in the more elastic market

C) The same price in all markets,regardless of their elasticities

D) Different prices in all markets,regardless of their elasticities

A) A relatively higher price in the more inelastic market

B) A relatively higher price in the more elastic market

C) The same price in all markets,regardless of their elasticities

D) Different prices in all markets,regardless of their elasticities

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

15

The United Auto Workers union attempted to win the approval of legislation that would moderate the practice of foreign sourcing on the part of American auto manufacturers.Which of the following best represents this legislation?

A) Voluntary export quotas

B) Trigger price mechanism

C) Tariff quotas

D) Local content laws

A) Voluntary export quotas

B) Trigger price mechanism

C) Tariff quotas

D) Local content laws

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

16

Suppose the government grants a subsidy to domestic producers of an import-competing good.The subsidy tends to result in deadweight losses for the domestic economy in the form of the:

A) Consumption effect

B) Redistribution effect

C) Revenue effect

D) Protective effect

A) Consumption effect

B) Redistribution effect

C) Revenue effect

D) Protective effect

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

17

A firm that faces problems of falling sales and excess productive capacity might resort to international dumping if it:

A) Can charge higher prices in markets that are elastic to price changes

B) Earns revenues on foreign sales that at least cover variable costs

C) Can sell at that price where domestic and foreign demand elasticities equate

D) Is able to force foreign prices below marginal production costs

A) Can charge higher prices in markets that are elastic to price changes

B) Earns revenues on foreign sales that at least cover variable costs

C) Can sell at that price where domestic and foreign demand elasticities equate

D) Is able to force foreign prices below marginal production costs

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

18

Concerning the restrictive impact of an import quota,assume there occurs an increase in the domestic demand for the import product.As long as the quota falls short of what would be imported under free market conditions,the economy's adjustment to the increase in demand would take the form of:

A) A decrease in domestic production of the import good

B) An increase in the amount of the good being imported

C) An increase in the domestic price of the import good

D) A decrease in domestic consumption of the import good

A) A decrease in domestic production of the import good

B) An increase in the amount of the good being imported

C) An increase in the domestic price of the import good

D) A decrease in domestic consumption of the import good

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

19

Compared to an import quota,an equivalent tariff may provide a less certain amount of protection for home producers since:

A) A tariff has no deadweight loss in terms of production and consumption

B) Foreign firms may absorb the tariff by offering exports at lower prices

C) Tariffs are effective only if home demand is perfectly elastic

D) Quotas do not result in increases in the price of the imported good

A) A tariff has no deadweight loss in terms of production and consumption

B) Foreign firms may absorb the tariff by offering exports at lower prices

C) Tariffs are effective only if home demand is perfectly elastic

D) Quotas do not result in increases in the price of the imported good

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

20

The U.S.-Japaneses agreement in 1981 to limit imports of small Japanese cars to the U.S.

A) affected Japanese automakers uniformly

B) resulted in losses to the Japanese auto industry

C) cost the U.S.consumer an extra $660 or so per Japanese import purchased

D) did not save any U.S.jobs

A) affected Japanese automakers uniformly

B) resulted in losses to the Japanese auto industry

C) cost the U.S.consumer an extra $660 or so per Japanese import purchased

D) did not save any U.S.jobs

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

21

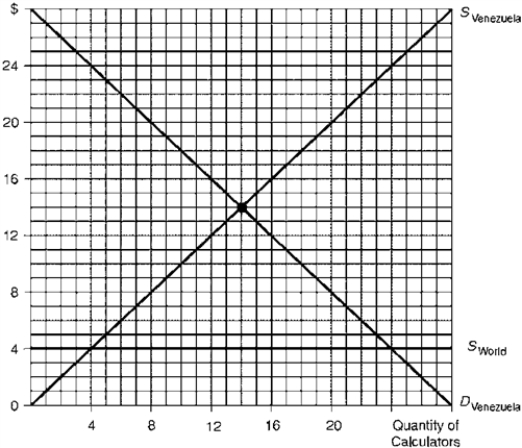

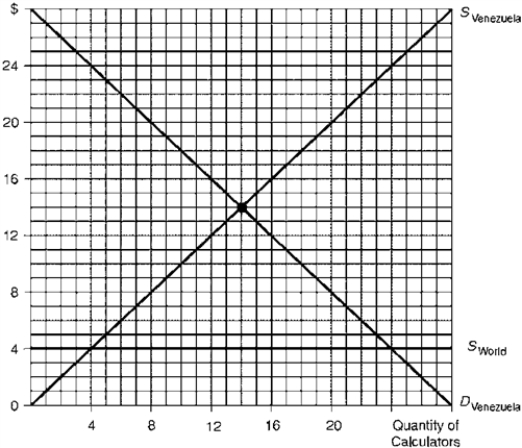

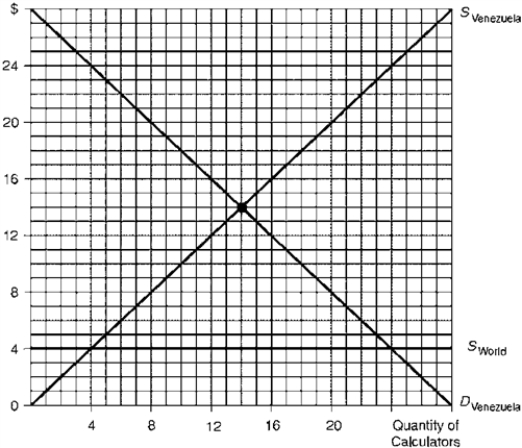

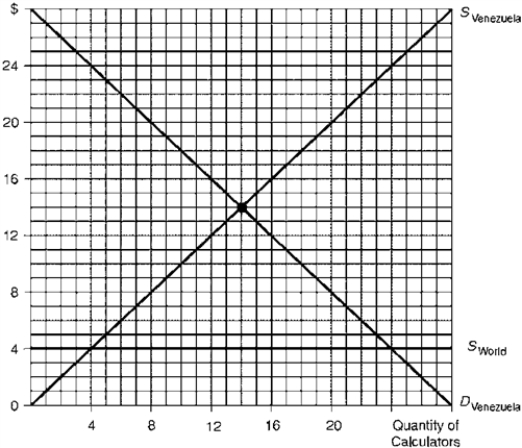

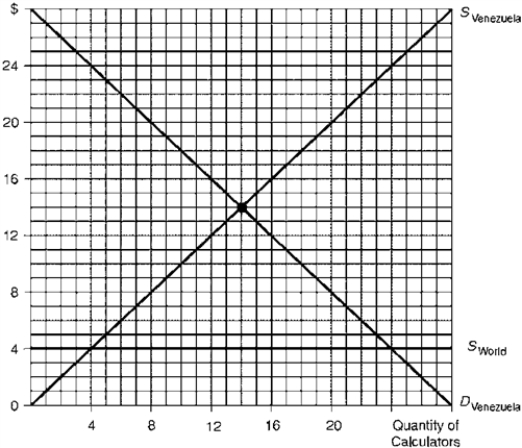

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If Mexican steel importers behave as monopoly buyers and foreign exporters behave as competitive sellers,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If Mexican steel importers behave as monopoly buyers and foreign exporters behave as competitive sellers,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

22

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.With free trade,Mexico's consumer surplus and producer surplus respectively equal:

A) $2000 and $1200

B) $3200 and $200

C) $3600 and $800

D) $4000 and $600

Consider Figure 5.1.With free trade,Mexico's consumer surplus and producer surplus respectively equal:

A) $2000 and $1200

B) $3200 and $200

C) $3600 and $800

D) $4000 and $600

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

23

Import quotas tend to lead to all of the following except:

A) Domestic producers of the imported good being harmed

B) Domestic consumers of the imported good being harmed

C) Prices increasing in the importing country

D) Prices falling in the exporting country

A) Domestic producers of the imported good being harmed

B) Domestic consumers of the imported good being harmed

C) Prices increasing in the importing country

D) Prices falling in the exporting country

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

24

Government subsidies may take the form of all of these EXCEPT:

A) cash disbursements

B) tax breaks

C) bank credits

D) insurance arrangements

A) cash disbursements

B) tax breaks

C) bank credits

D) insurance arrangements

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

25

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). As a result of the subsidy Mexican steel producers gain ____ of producer surplus.

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). As a result of the subsidy Mexican steel producers gain ____ of producer surplus.

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

26

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If foreign exporters behave as monopoly sellers,and Mexican importers behave as competitive buyers,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If foreign exporters behave as monopoly sellers,and Mexican importers behave as competitive buyers,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

27

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The total cost of the subsidy to the Mexican government equals:

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The total cost of the subsidy to the Mexican government equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

28

If the home country's government grants a subsidy on a domestically produced good,domestic producers tend to:

A) Capture the entire subsidy in the form of higher profits

B) Increase their level of production

C) Reduce wages paid to domestic workers

D) Consider the subsidy as an increase in production cost

A) Capture the entire subsidy in the form of higher profits

B) Increase their level of production

C) Reduce wages paid to domestic workers

D) Consider the subsidy as an increase in production cost

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

29

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The quantity of imports equals:

A) 1 ton

B) 2 tons

C) 3 tons

D) 4 tons

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The quantity of imports equals:

A) 1 ton

B) 2 tons

C) 3 tons

D) 4 tons

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

30

If import licenses are auctioned off to domestic importers in a competitive market,their scarcity value (revenue effect)accrues to:

A) Foreign corporations

B) Foreign workers

C) Domestic corporations

D) The domestic government

A) Foreign corporations

B) Foreign workers

C) Domestic corporations

D) The domestic government

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

31

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The overall deadweight welfare loss to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). The overall deadweight welfare loss to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

32

To maintain that South Koreans are dumping their VCRs in the United States is to maintain that:

A) Koreans are selling VCRs in the United States below their production cost

B) Koreans are selling VCRs in the United States above their production cost

C) The cost of manufacturing VCRs in Korea is lower in Korea than in the United States since wages are lower in Korea

D) The cost of manufacturing VCRs in Korea is higher in Korea than in the United States since wages are higher in Korea

A) Koreans are selling VCRs in the United States below their production cost

B) Koreans are selling VCRs in the United States above their production cost

C) The cost of manufacturing VCRs in Korea is lower in Korea than in the United States since wages are lower in Korea

D) The cost of manufacturing VCRs in Korea is higher in Korea than in the United States since wages are higher in Korea

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

33

From the perspective of the American public as a whole,export subsidies levied by overseas governments on goods sold to the United States:

A) Help more than they hurt

B) Hurt more than they help

C) Are equivalent to an import quota

D) Are equivalent to an export quota

A) Help more than they hurt

B) Hurt more than they help

C) Are equivalent to an import quota

D) Are equivalent to an export quota

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

34

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If the Mexican government auctions import licenses to the highest foreign bidder,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Referring to Figure 5.1,suppose the Mexican government imposes an import quota equal to 2 tons of steel. If the Mexican government auctions import licenses to the highest foreign bidder,the overall welfare loss of the quota to Mexico equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

35

If a tariff and an import quota lead to equivalent increases in the domestic price of steel,then:

A) The quota results in efficiency reductions but the tariff does not

B) The tariff results in efficiency reductions but the quota does not

C) They have identical impacts on how much is produced and consumed

D) They have identical impacts on how income is distributed

A) The quota results in efficiency reductions but the tariff does not

B) The tariff results in efficiency reductions but the quota does not

C) They have identical impacts on how much is produced and consumed

D) They have identical impacts on how income is distributed

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

36

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.With free trade,the quantity of steel imported by Mexico equals:

A) 2 tons

B) 4 tons

C) 6 tons

D) 8 tons

Consider Figure 5.1.With free trade,the quantity of steel imported by Mexico equals:

A) 2 tons

B) 4 tons

C) 6 tons

D) 8 tons

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

37

A specification of a maximum amount of a foreign produced good that will be allowed to enter the country over a given time period is referred to as:

A) A domestic subsidy

B) An export subsidy

C) An import quota

D) An export quota

A) A domestic subsidy

B) An export subsidy

C) An import quota

D) An export quota

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

38

In certain industries,Japanese employers do not lay off workers.Therefore,they sometimes have excess supplies of goods that they cannot sell on the home market without lowering prices.To hold down losses,they sell goods in overseas markets at prices well beneath those in Japan.This practice is best referred to as:

A) Orderly marketing

B) Trigger pricing

C) Domestic content pricing

D) Dumping

A) Orderly marketing

B) Trigger pricing

C) Domestic content pricing

D) Dumping

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

39

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose instead that the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). As a result of the subsidy,the welfare loss to Mexico due to inefficient domestic production equals:

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose instead that the Mexican government provides a subsidy of $200 per ton to its steel producers,as indicated by the supply schedule SM (with subsidy). As a result of the subsidy,the welfare loss to Mexico due to inefficient domestic production equals:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

40

Export subsidies levied by foreign governments on products in which the United States has a comparative disadvantage:

A) Lower the welfare of all Americans

B) Lead to increases in U.S.consumer surplus

C) Encourage U.S.production of competing goods

D) Encourage U.S.workers to demand higher wages

A) Lower the welfare of all Americans

B) Lead to increases in U.S.consumer surplus

C) Encourage U.S.production of competing goods

D) Encourage U.S.workers to demand higher wages

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

41

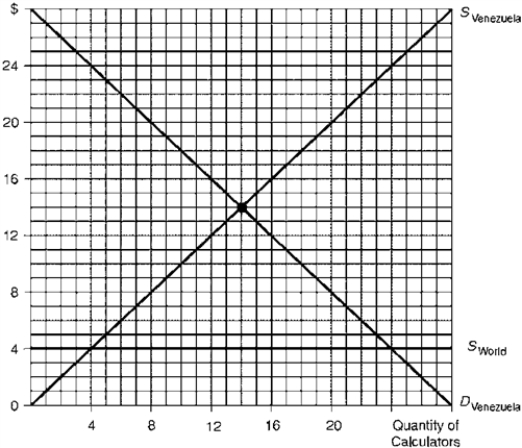

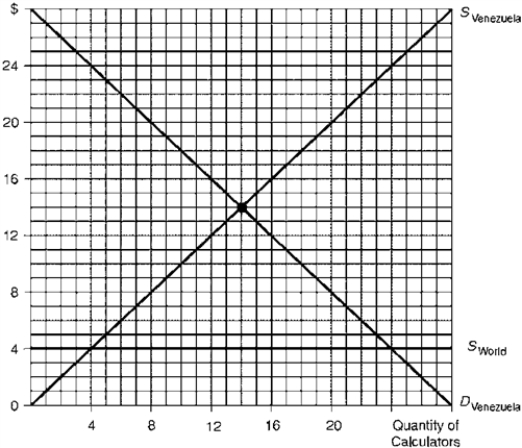

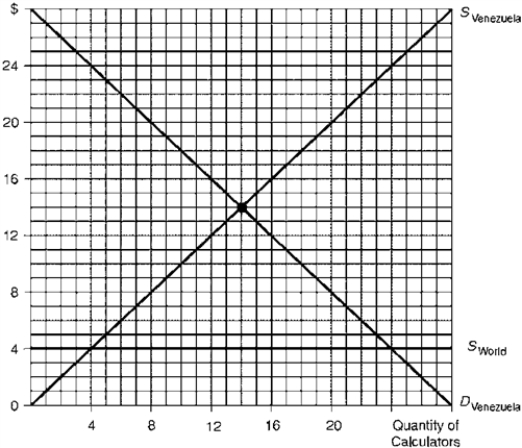

Figure 5.4.Venezuelan Calculator Market

Consider Figure 5.4.Assume the Venezuelan government grants its manufacturers a production subsidy of $4 per calculator.After the subsidy is granted,Venezuelan imports total:

A) 8 calculators

B) 12 calculators

C) 16 calculators

D) 20 calculators

Consider Figure 5.4.Assume the Venezuelan government grants its manufacturers a production subsidy of $4 per calculator.After the subsidy is granted,Venezuelan imports total:

A) 8 calculators

B) 12 calculators

C) 16 calculators

D) 20 calculators

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

42

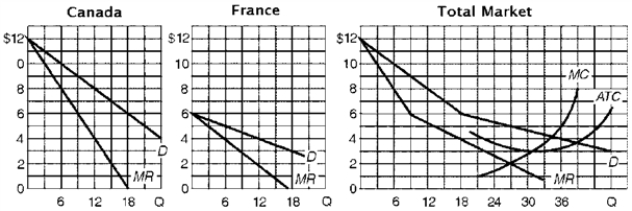

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.If the Swedish government auctions import licenses to the highest bidder in a competitive market,it could realize revenues of up to:

A) $3.20

B) $4.00

C) $4.80

D) $5.60

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.If the Swedish government auctions import licenses to the highest bidder in a competitive market,it could realize revenues of up to:

A) $3.20

B) $4.00

C) $4.80

D) $5.60

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

43

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons. Assuming Mexican importers behave as monopoly buyers while foreign exporters behave as competitive sellers,the overall welfare loss of the quota to Mexico is:

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons. Assuming Mexican importers behave as monopoly buyers while foreign exporters behave as competitive sellers,the overall welfare loss of the quota to Mexico is:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

44

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.After the quota is levied,the price of apples in Sweden will equal:

A) $0.60 per pound

B) $1.00 per pound

C) $1.40 per pound

D) $1.80 per pound

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.After the quota is levied,the price of apples in Sweden will equal:

A) $0.60 per pound

B) $1.00 per pound

C) $1.40 per pound

D) $1.80 per pound

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

45

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.At the free-trade price of $0.60 per pound,Sweden's consumer surplus totals $____ and producer surplus totals $____.

A) $10.80,$2.40

B) $14.60,$3.90

C) $24.20,$1.80

D) $32.40,$2.30

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.At the free-trade price of $0.60 per pound,Sweden's consumer surplus totals $____ and producer surplus totals $____.

A) $10.80,$2.40

B) $14.60,$3.90

C) $24.20,$1.80

D) $32.40,$2.30

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

46

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.The quota's revenue effect equals:

A) $1.60

B) $2.40

C) $3.20

D) $4.00

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.The quota's revenue effect equals:

A) $1.60

B) $2.40

C) $3.20

D) $4.00

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

47

Figure 5.1.Alternative Nontariff Trade Barriers Levied by a "Small" Country

Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons. Assuming Mexican importers behave as competitive buyers while foreign exporters behave as monopoly sellers,the overall welfare loss of the quota to Mexico is:

A) $200

B) $400

C) $600

D) $800

Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons. Assuming Mexican importers behave as competitive buyers while foreign exporters behave as monopoly sellers,the overall welfare loss of the quota to Mexico is:

A) $200

B) $400

C) $600

D) $800

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

48

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.If SSweden+Quota represents the supply schedule after a quota is levied,Sweden's imports will equal:

A) 6 apples

B) 8 apples

C) 10 apples

D) 12 apples

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.If SSweden+Quota represents the supply schedule after a quota is levied,Sweden's imports will equal:

A) 6 apples

B) 8 apples

C) 10 apples

D) 12 apples

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

49

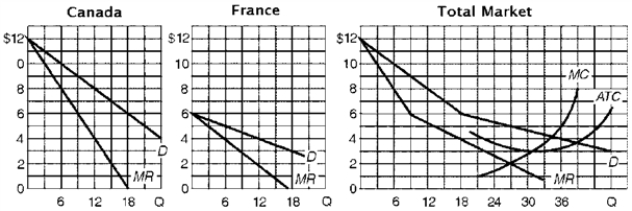

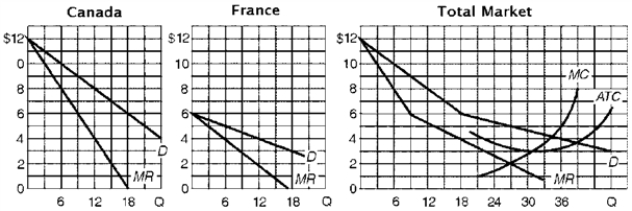

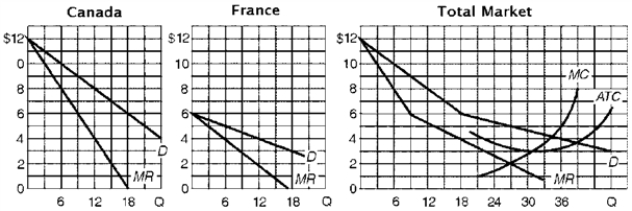

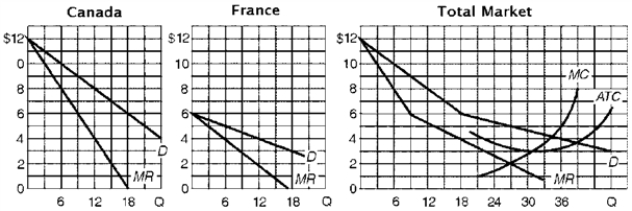

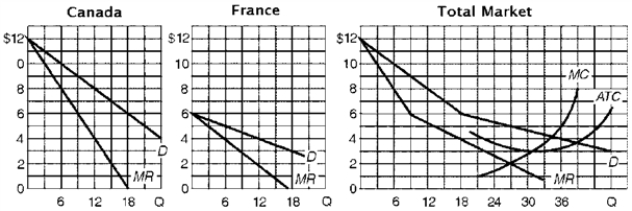

Figure 5.2 illustrates the revenue and cost conditions of ABC Inc.which sells calculators in Canada and France.

Figure 5.2.International Dumping

Referring to Figure 5.2,consider if ABC Inc.sells 27 calculators at a price of $5 each,realizing profits totaling $54.Of this quantity,ABC Inc.sells ____ calculators in Canada and realizes revenues totaling $____; the firm sells ____ calculators in France and realizes revenues totaling $____.

A) 15,$35,9,$45

B) 15,$45,9,$35

C) 21,$105,6,$30

D) 21,$30,6,$105

Figure 5.2.International Dumping

Referring to Figure 5.2,consider if ABC Inc.sells 27 calculators at a price of $5 each,realizing profits totaling $54.Of this quantity,ABC Inc.sells ____ calculators in Canada and realizes revenues totaling $____; the firm sells ____ calculators in France and realizes revenues totaling $____.

A) 15,$35,9,$45

B) 15,$45,9,$35

C) 21,$105,6,$30

D) 21,$30,6,$105

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

50

Figure 5.4.Venezuelan Calculator Market

Consider Figure 5.4.Suppose the rest of the world supplies calculators to Venezuela at a price of $4 each.With free trade,Venezuelan imports total:

A) 8 calculators

B) 16 calculators

C) 20 calculators

D) 24 calculators

Consider Figure 5.4.Suppose the rest of the world supplies calculators to Venezuela at a price of $4 each.With free trade,Venezuelan imports total:

A) 8 calculators

B) 16 calculators

C) 20 calculators

D) 24 calculators

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

51

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Suppose the rest of the world can supply apples to Sweden at a price of $0.60 per pound.With free trade,Sweden produces ____ pounds of apples and imports ____ pounds of apples.

A) 10,8

B) 10,18

C) 6,22

D) 6,16

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Suppose the rest of the world can supply apples to Sweden at a price of $0.60 per pound.With free trade,Sweden produces ____ pounds of apples and imports ____ pounds of apples.

A) 10,8

B) 10,18

C) 6,22

D) 6,16

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

52

Figure 5.2 illustrates the revenue and cost conditions of ABC Inc.which sells calculators in Canada and France.

Figure 5.2.International Dumping

Consider Figure 5.2.Compared with the total revenue and total profit that ABC Inc.realizes in the absence of dumping,with dumping the firm attains a:

A) Fall in revenue of $18; fall in profits of $15

B) Fall in revenue of $18,fall in profits of $18

C) Rise in revenue of $18,rise in profits of $15

D) Rise in revenue of $18,rise in profits of $18

Figure 5.2.International Dumping

Consider Figure 5.2.Compared with the total revenue and total profit that ABC Inc.realizes in the absence of dumping,with dumping the firm attains a:

A) Fall in revenue of $18; fall in profits of $15

B) Fall in revenue of $18,fall in profits of $18

C) Rise in revenue of $18,rise in profits of $15

D) Rise in revenue of $18,rise in profits of $18

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

53

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Assume that Swedish import companies behave as competitive buyers while foreign export companies behave as a monopoly seller.Compared to free trade,Sweden's import quota results in domestic welfare:

A) Gains totaling $3.20

B) Gains totaling $4.80

C) Losses totaling $3.20

D) Losses totaling $4.80

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Assume that Swedish import companies behave as competitive buyers while foreign export companies behave as a monopoly seller.Compared to free trade,Sweden's import quota results in domestic welfare:

A) Gains totaling $3.20

B) Gains totaling $4.80

C) Losses totaling $3.20

D) Losses totaling $4.80

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

54

Figure 5.4.Venezuelan Calculator Market

Consider Figure 5.4.The cost of the production subsidy to the Venezuelan government totals:

A) $32

B) $40

C) $48

D) $54

Consider Figure 5.4.The cost of the production subsidy to the Venezuelan government totals:

A) $32

B) $40

C) $48

D) $54

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

55

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.In the absence of trade,Sweden's equilibrium price and quantity of apples would be:

A) $0.60 and 22 pounds

B) $0.60 and 14 pounds

C) $1.00 and 18 pounds

D) $1.40 and 14 pounds

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.In the absence of trade,Sweden's equilibrium price and quantity of apples would be:

A) $0.60 and 22 pounds

B) $0.60 and 14 pounds

C) $1.00 and 18 pounds

D) $1.40 and 14 pounds

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

56

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.As a result of the quota,Sweden's consumer surplus:

A) Increases by $6

B) Increases by $8

C) Decreases by $6

D) Decreases by $8

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.As a result of the quota,Sweden's consumer surplus:

A) Increases by $6

B) Increases by $8

C) Decreases by $6

D) Decreases by $8

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

57

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Assume that Swedish import companies behave as a monopoly buyer while foreign export companies behave as competitive sellers.Compared to free trade,Sweden's import quota results in domestic welfare:

A) Gains totaling $1.60

B) Gains totaling $3.20

C) Losses totaling $1.60

D) Losses totaling $3.20

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.Assume that Swedish import companies behave as a monopoly buyer while foreign export companies behave as competitive sellers.Compared to free trade,Sweden's import quota results in domestic welfare:

A) Gains totaling $1.60

B) Gains totaling $3.20

C) Losses totaling $1.60

D) Losses totaling $3.20

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

58

Figure 5.2 illustrates the revenue and cost conditions of ABC Inc.which sells calculators in Canada and France.

Figure 5.2.International Dumping

Consider Figure 5.2.With international dumping,ABC Inc.sells ____ calculators to Canadian buyers at a price of $____ and ____ calculators to French buyers at a price of $____.

A) 15,$4,12,$7

B) 15,$7,12,$4

C) 9,$5,15,$6

D) 9,$6,15,$5

Figure 5.2.International Dumping

Consider Figure 5.2.With international dumping,ABC Inc.sells ____ calculators to Canadian buyers at a price of $____ and ____ calculators to French buyers at a price of $____.

A) 15,$4,12,$7

B) 15,$7,12,$4

C) 9,$5,15,$6

D) 9,$6,15,$5

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

59

Figure 5.2 illustrates the revenue and cost conditions of ABC Inc.which sells calculators in Canada and France.

Figure 5.2.International Dumping

Consider Figure 5.2.In the absence of international dumping,ABC Inc.maximizes profits by selling ____ calculators at a price of $____; the firm realizes profits totaling $____.

A) 27,$5,$54

B) 27,$5,$36

C) 24,$4,$46

D) 24,$4,$28

Figure 5.2.International Dumping

Consider Figure 5.2.In the absence of international dumping,ABC Inc.maximizes profits by selling ____ calculators at a price of $____; the firm realizes profits totaling $____.

A) 27,$5,$54

B) 27,$5,$36

C) 24,$4,$46

D) 24,$4,$28

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

60

Figure 5.3 illustrates the apple market for Sweden,assumed to be a "small" country that is unable to affect the world price.SSweden is the domestic supply and DSweden is the domestic demand.SSweden+Quota is Sweden's supply schedule with an import quota.

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.The quota leads to a deadweight welfare loss for Sweden of an amount equaling:

A) $0.80

B) $1.60

C) $2.40

D) $3.20

Figure 5.3.Sweden's Apple Market

Consider Figure 5.3.The quota leads to a deadweight welfare loss for Sweden of an amount equaling:

A) $0.80

B) $1.60

C) $2.40

D) $3.20

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

61

To the extent that domestic importing companies organize as a monopoly buyer,and foreign exporting companies behave as competitive sellers,the importing companies capture the revenue effect of a quota.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

62

Figure 5.6 Domestice Supply and demand for Wine - US

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.If the US imposes a quota of 15 bottles of wine ,how much revenue will the US government collect?

A) 0

B) $35

C) $70

D) $105

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.If the US imposes a quota of 15 bottles of wine ,how much revenue will the US government collect?

A) 0

B) $35

C) $70

D) $105

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

63

Figure 5.4.Venezuelan Calculator Market

Consider Figure 5.4.The increase in Venezuelan producer surplus under the production subsidy totals:

A) $16

B) $20

C) $24

D) $32

Consider Figure 5.4.The increase in Venezuelan producer surplus under the production subsidy totals:

A) $16

B) $20

C) $24

D) $32

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

64

An import quota is a physical restriction on the quantity of goods that may be imported during a specified time period.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

65

Concerning international dumping,many economists argue that "fair value" should be based on

A) Average variable cost

B) Average fixed cost

C) Marginal cost

D) Total cost

A) Average variable cost

B) Average fixed cost

C) Marginal cost

D) Total cost

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

66

Figure 5.4.Venezuelan Calculator Market

Consider Figure 5.4.The production subsidy results in an overall welfare loss for Venezuela totaling:

A) $8

B) $12

C) $16

D) $20

Consider Figure 5.4.The production subsidy results in an overall welfare loss for Venezuela totaling:

A) $8

B) $12

C) $16

D) $20

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

67

Figure 5.6 Domestice Supply and demand for Wine - US

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.IF the US imposes a quota of 15 bottles of wine what will happen to consumer surplus?

A) decreases by $210

B) decreases by $245

C) stays the same

D) increases by $70

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.IF the US imposes a quota of 15 bottles of wine what will happen to consumer surplus?

A) decreases by $210

B) decreases by $245

C) stays the same

D) increases by $70

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

68

The sugar import quotas of the U.S.government have tended to increase the market price of sugar,thus reducing the costs to the government of maintaining sugar price supports for domestic growers.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

69

Subsidies to domestic firms may lead to

A) An increase in prices

B) Higher volume of exports

C) Higher volume of imports

D) Increase in welfare of the trading partner

A) An increase in prices

B) Higher volume of exports

C) Higher volume of imports

D) Increase in welfare of the trading partner

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

70

Import tariffs and import quotas yield identical protection effects,consumption effects,redistribution effects,and revenue effects.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

71

Figure 5.6 Domestice Supply and demand for Wine - US

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.What will happen to the price of a bottle of wine in the US if a quota of 15 bottles of wine is imposed?

A) increase to $15

B) increase to $10

C) stay the same at $8

D) decrease to $5

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.What will happen to the price of a bottle of wine in the US if a quota of 15 bottles of wine is imposed?

A) increase to $15

B) increase to $10

C) stay the same at $8

D) decrease to $5

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

72

A global import quota permits a specified number of goods to be imported each year,but does not specify where the product is shipped from and who is permitted to import.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

73

An import quota tends to reduce the overall welfare of the importing nation by an amount equal to the protective effect,consumption effect,and the portion of the revenue effect that is captured by the domestic government.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

74

A voluntary export agreement

A) Typically applies only to the world's most important exporting nation(s)

B) Typically applies only to the world's least important exporting nation (s)

C) Is always more restrictive on trade than a tariff or import quota

D) All of the above

A) Typically applies only to the world's most important exporting nation(s)

B) Typically applies only to the world's least important exporting nation (s)

C) Is always more restrictive on trade than a tariff or import quota

D) All of the above

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

75

Import quotas can yield revenue for the domestic government if it auctions import licenses to the highest bidder in a competitive market.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

76

Figure 5.6 Domestice Supply and demand for Wine - US

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.IF the US imposes a quota of 15 bottles of wine,how much wine will US consumers demand,how much wine will US producers produce and how much wine will be imported?

A) 30 bottles,20 bottles,10 bottles

B) 40 bottles,25 bottles,15 bottles

C) 30 bottles,30 bottles,0 bottles

D) 30 bottles,15 bottles,15 bottles

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.IF the US imposes a quota of 15 bottles of wine,how much wine will US consumers demand,how much wine will US producers produce and how much wine will be imported?

A) 30 bottles,20 bottles,10 bottles

B) 40 bottles,25 bottles,15 bottles

C) 30 bottles,30 bottles,0 bottles

D) 30 bottles,15 bottles,15 bottles

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

77

In the post-World War II era,Nontariff trade barriers have decreased in importance relative to tariff barriers.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

78

Figure 5.6 Domestice Supply and demand for Wine - US

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.How much will the US produce and import in these circumstances?

A) 5 bottles,40 bottles

B) 40 bottles,0 bottles

C) 5 bottles,35 bottles

D) 5 bottles,0 bottles

Consider Figure 5.6.In the global market for wine,the EU is willing to supply as much wine as the US demands at $8 per bottle.How much will the US produce and import in these circumstances?

A) 5 bottles,40 bottles

B) 40 bottles,0 bottles

C) 5 bottles,35 bottles

D) 5 bottles,0 bottles

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

79

Today most industrial countries protect their industries via global import quotas rather than selective import quotas.

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck

80

When voluntary export limits are imposed on the world's chief exporter

A) The exports of the non-restrained suppliers may be stimulated

B) A trade diversion effect may occur

C) Both a and b

D) None of the above

A) The exports of the non-restrained suppliers may be stimulated

B) A trade diversion effect may occur

C) Both a and b

D) None of the above

Unlock Deck

Unlock for access to all 134 flashcards in this deck.

Unlock Deck

k this deck