Deck 21: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/244

Play

Full screen (f)

Deck 21: Cost-Volume-Profit Analysis

1

The dollar amount of sales needed to achieve a target income is computed by dividing the sum of fixed costs plus the target pretax income by the contribution margin ratio.

True

2

While the total amount of variable cost changes with the level of production, variable cost per unit

remains constant as volume changes.

remains constant as volume changes.

True

3

Curvilinear costs increase as volume of activity increases, but at a nonconstant rate.

True

4

Cost-volume-profit analysis requires management to classify all costs as either fixed or variable with respect to production or sales volume within the relevant range of operations.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

5

As the volume increases, fixed cost per unit of output remains constant.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

6

Total variable costs change in proportion to changes in volume of activity.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

7

Dividing a mixed cost into its separate fixed and variable cost components makes it more difficult to perform cost-volume-profit analysis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

8

A step-wise variable cost can be separated into a fixed component and a variable component.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

9

Total fixed costs change in proportion to changes in volume of activity.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

10

Fixed costs per unit decrease proportionately with increases in volume of activity.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

11

Cost-volume-profit analysis is a predictive tool for determining the profit consequences of future cost changes, price changes, and volume of activity changes.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

12

Variable costs per unit increase proportionately with increases in volume of activity.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

13

Cost-volume-profit analysis is used to predict future costs to be incurred, volumes of activity, sales to be made, and profit to be earned.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

14

While the total amount of fixed cost remains constant with the level of production, fixed cost per

unit changes as volume changes.

unit changes as volume changes.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

15

Cost-volume-profit analysis can be used to compute expected income from predicted sales and cost levels.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

16

The relevant range of operations is a range of volume neither close to zero nor at maximum capacity.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

17

As the level of volume of activity increases, the variable cost per unit remains constant.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

18

The relevant range of operations includes extremely high and low levels of production that are unlikely to occur.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

19

The margin of safety is the amount that sales can drop before the company incurs a loss.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

20

While the total amount of fixed cost changes with the level of production, fixed cost per unit

remains constant as volume changes.

remains constant as volume changes.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

21

Scatter diagrams plot volume (units) on the vertical axis and cost on the horizontal axis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

22

Degree of operating leverage (DOL) is defined as total contribution margin in dollars divided by pretax income.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

23

To determine the slope of the variable cost from a scatter diagram, divide the change in cost by the change in units.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

24

To determine the slope of the variable cost from a scatter diagram, divide the change in units by the change in cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

25

The break-even point is the sales level at which a company neither earns a profit nor incurs a loss.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

26

The method most likely to produce the most precise line of cost behavior and require the least amount of judgment is the scatter diagram.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

27

The high-low method is used to derive the variable cost per unit and total fixed costs using just the highest and lowest volume levels.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

28

The contribution margin ratio is the percent of each sales dollar that remains after deducting the total unit variable cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

29

There are only two methods to derive an estimated line of cost behavior; the high-low method and the scatter diagram.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

30

A visual line fit to points in a scatter diagram may be used to identify the approximate relation between past cost and unit data.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

31

Contribution margin per unit is the amount by which a product's unit selling price exceeds its total variable cost per unit.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

32

Scatter diagrams plot volume (units) on the horizontal axis and cost on the vertical axis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

33

The margin of safety can be expressed in units of product, in dollars, or as a percent of sales.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

34

A break-even point can be calculated either in units or in dollars.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

35

The contribution margin per unit is the price at which a unit must be sold in order for the company to break even.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

36

The high-low method can be used to estimate the cost equation using just two points.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

37

The extent, or relative size, of fixed costs in the total cost structure is known as operating leverage.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

38

The basic form of cost-volume-profit analysis is often called break-even analysis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

39

Least-squares regression is a statistical method for identifying cost behavior.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

40

The high-low method of deriving an estimated cost line uses all the data points available.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

41

A graphic depiction of the break-even point is known as a cost-volume-profit (CVP) chart.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

42

A cost-volume-profit (CVP) chart is a graph that plots number of units produced on the horizontal axis and dollars of costs and sales on the vertical axis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

43

A cost that changes as volume changes, but at a nonconstant rate, is called a:

A) Step-wise variable cost.

B) Curvilinear cost.

C) Variable cost.

D) Differential cost.

E) Fixed cost.

A) Step-wise variable cost.

B) Curvilinear cost.

C) Variable cost.

D) Differential cost.

E) Fixed cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

44

An important assumption in multiproduct CVP analysis is a changing sales mix.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

45

The proportion of sales volumes for various products in a multiproduct company is known as the composite mix.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

46

Under variable costing, only costs that change in total with changes in production levels are included in product costs.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

47

On a typical cost-volume-profit graph, unit sales are shown on the horizontal axis and both dollars of sales and dollars of costs are represented on the vertical axis.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

48

A cost with a flat cost line within a relevant range that shifts to another level when volume significantly changes is a(n):

A) Flat line cost.

B) Step-wise cost.

C) Curvilinear cost.

D) Incremental cost.

E) Fixed cost.

A) Flat line cost.

B) Step-wise cost.

C) Curvilinear cost.

D) Incremental cost.

E) Fixed cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

49

An important assumption in multiproduct CVP analysis is a constant sales mix.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

50

The contribution margin ratio is the percent by which the margin of safety exceeds the break-even point.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

51

The absorption costing method is required for external financial reporting.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

52

A cost that remains unchanged in total despite variations in volume of activity within a relevant range is a:

A) Curvilinear cost.

B) Standard cost.

C) Variable cost.

D) Step-wise variable cost.

E) Fixed cost.

A) Curvilinear cost.

B) Standard cost.

C) Variable cost.

D) Step-wise variable cost.

E) Fixed cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

53

Managers can use variable costing information for internal decision making, but they must use absorption costing for external reporting purposes.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

54

Under absorption costing, fixed overhead costs are excluded from product costs.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

55

The variable costing method is required for external financial reporting.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

56

Cost-volume-profit analysis cannot be used when a firm produces and sells more than one product.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

57

The proportion of sales volumes for various products in a multiproduct company is known as the sales mix.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

58

To calculate the break-even point in units, one must know unit fixed cost, unit variable cost, and sales price.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

59

A cost that changes in proportion to changes in volume of activity is a(n):

A) Incremental cost.

B) Product cost.

C) Fixed cost.

D) Variable cost.

E) Differential cost.

A) Incremental cost.

B) Product cost.

C) Fixed cost.

D) Variable cost.

E) Differential cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

60

Under variable costing, fixed overhead costs are excluded from product costs.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

61

A company's normal operating range, which excludes extremely high or low operating levels that are not likely to occur, is called the:

A) Relevant range.

B) High-low point.

C) Margin of safety.

D) Break-even point.

E) Contribution range.

A) Relevant range.

B) High-low point.

C) Margin of safety.

D) Break-even point.

E) Contribution range.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

62

Watson Company has monthly fixed costs of $83,000 and a 40% contribution margin ratio. If the company has set a target monthly income of $15,000, what dollar amount of sales must be made to produce the target income?

A) $207,500

B) $245,000

C) $37,300

D) $170,000

E) $39,200

A) $207,500

B) $245,000

C) $37,300

D) $170,000

E) $39,200

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

63

A firm expects to sell 25,000 units of its product at $11 per unit and to incur variable costs per unit of $6. Total fixed costs are $70,000. The pretax net income is:

A) $90,000.

B) $55,000.

C) $380,000.

D) $125,000.

E) $150,000.

A) $90,000.

B) $55,000.

C) $380,000.

D) $125,000.

E) $150,000.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following costs are most likely to be classified as fixed?

A) Property taxes

B) Shipping costs

C) Sales commissions

D) Direct labor

E) Direct materials

A) Property taxes

B) Shipping costs

C) Sales commissions

D) Direct labor

E) Direct materials

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

65

The margin of safety is the excess of:

A) Break-even sales over expected sales.

B) Expected sales over variable costs.

C) Fixed costs over expected sales.

D) Expected sales over break-even sales.

E) Expected sales over fixed costs.

A) Break-even sales over expected sales.

B) Expected sales over variable costs.

C) Fixed costs over expected sales.

D) Expected sales over break-even sales.

E) Expected sales over fixed costs.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following costs are most likely to be classified as variable?

A) Insurance

B) Straight-line depreciation

C) Manager salaries

D) Factory rent

E) Direct materials

A) Insurance

B) Straight-line depreciation

C) Manager salaries

D) Factory rent

E) Direct materials

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

67

During March, a firm expects its total sales to be $160,000, its total variable costs to be $95,000, and its total fixed costs to be $25,000. The contribution margin for March is:

A) $25,000.

B) $120,000.

C) $65,000.

D) $40,000.

E) $90,000.

A) $25,000.

B) $120,000.

C) $65,000.

D) $40,000.

E) $90,000.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

68

A term describing a firm's normal range of operating activities is:

A) Relevant operating analysis.

B) Break-even level of operations.

C) Margin of safety of operations.

D) Relevant range of operations.

E) High-low level of operations.

A) Relevant operating analysis.

B) Break-even level of operations.

C) Margin of safety of operations.

D) Relevant range of operations.

E) High-low level of operations.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

69

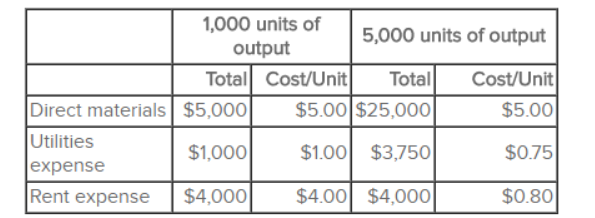

Select cost information for Seacrest Enterprises is as follows:

Based on this information:

A) Direct materials is a fixed cost and utilities expense is a mixed cost.

B) Utilities expense is a mixed cost and rent expense is a fixed cost.

C) Both direct materials and utilities expense are mixed costs.

D) Both direct materials and rent expense are variable costs.

E) Utilities expense is a mixed cost and rent expense is a variable cost.

Based on this information:

A) Direct materials is a fixed cost and utilities expense is a mixed cost.

B) Utilities expense is a mixed cost and rent expense is a fixed cost.

C) Both direct materials and utilities expense are mixed costs.

D) Both direct materials and rent expense are variable costs.

E) Utilities expense is a mixed cost and rent expense is a variable cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

70

A firm expects to sell 25,000 units of its product at $11 per unit and to incur variable costs per unit of $6. Total fixed costs are $70,000. The total contribution margin is:

A) $380,000.

B) $125,000.

C) $150,000.

D) $55,000.

E) $90,000.

A) $380,000.

B) $125,000.

C) $150,000.

D) $55,000.

E) $90,000.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

71

A cost that includes both fixed and variable cost components is called a:

A) Step-variable cost.

B) Mixed cost.

C) Curvilinear cost.

D) Differential cost.

E) Composite cost.

A) Step-variable cost.

B) Mixed cost.

C) Curvilinear cost.

D) Differential cost.

E) Composite cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

72

Curvilinear costs always increase:

A) On a per unit basis when volume of activity goes down.

B) With decreases in volume.

C) When volume increases, but at a nonconstant rate.

D) When management performs break-even analysis.

E) In constant proportion to changes in production levels.

A) On a per unit basis when volume of activity goes down.

B) With decreases in volume.

C) When volume increases, but at a nonconstant rate.

D) When management performs break-even analysis.

E) In constant proportion to changes in production levels.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

73

Cost-volume-profit analysis is based on necessary assumptions. Which of the following is not one of these assumptions?

A) Total fixed costs are held constant.

B) Costs can be classified as variable or fixed.

C) Relevant range includes all possible levels of activity that a company might experience.

D) A constant sales mix in a multiproduct company.

E) Sales price and variable costs per unit of output remain constant as volume changes.

A) Total fixed costs are held constant.

B) Costs can be classified as variable or fixed.

C) Relevant range includes all possible levels of activity that a company might experience.

D) A constant sales mix in a multiproduct company.

E) Sales price and variable costs per unit of output remain constant as volume changes.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

74

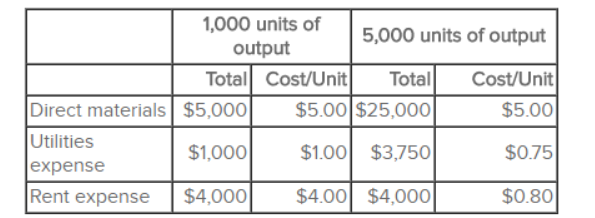

Select cost information for Klondike Corporation is as follows:

Based on this information:

A) Both direct materials and rent expense are fixed costs.

B) Direct materials is a fixed cost and rent expense is a variable cost.

C) Both direct materials and rent expense are mixed costs.

D) Both direct materials and rent expense are variable costs.

E) Direct materials is a variable cost and rent expense is a fixed cost.

Based on this information:

A) Both direct materials and rent expense are fixed costs.

B) Direct materials is a fixed cost and rent expense is a variable cost.

C) Both direct materials and rent expense are mixed costs.

D) Both direct materials and rent expense are variable costs.

E) Direct materials is a variable cost and rent expense is a fixed cost.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

75

A firm expects to sell 25,000 units of its product at $11 per unit. Pretax income is predicted to be $60,000. If the variable costs per unit are $5, total fixed costs must be:

A) $215,000.

B) $275,000.

C) $90,000.

D) $125,000.

E) $65,000.

A) $215,000.

B) $275,000.

C) $90,000.

D) $125,000.

E) $65,000.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

76

An important tool in predicting the volume of activity, the costs to be incurred, the sales to be made, and the profit to be earned is:

A) Cost-volume-profit analysis.

B) Variance analysis.

C) Target income analysis.

D) Least-squares regression analysis.

E) Process costing.

A) Cost-volume-profit analysis.

B) Variance analysis.

C) Target income analysis.

D) Least-squares regression analysis.

E) Process costing.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

77

Which one of the following statements is not true?

A) Total fixed costs remain the same regardless of volume within the relevant range.

B) Total variable costs change with volume.

C) Variable costs per unit remain the same regardless of the volume.

D) Total variable costs decrease as the volume increases.

E) Fixed costs per unit increase as the volume decreases.

A) Total fixed costs remain the same regardless of volume within the relevant range.

B) Total variable costs change with volume.

C) Variable costs per unit remain the same regardless of the volume.

D) Total variable costs decrease as the volume increases.

E) Fixed costs per unit increase as the volume decreases.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

78

If a firm's forecasted sales are $250,000 and its break-even sales are $190,000, the margin of safety in dollars is:

A) $60,000.

B) $250,000.

C) $440,000.

D) $24,000.

E) $190,000.

A) $60,000.

B) $250,000.

C) $440,000.

D) $24,000.

E) $190,000.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

79

The excess of expected sales over the sales level at the break-even point is known as the:

A) Contribution margin.

B) Margin of safety.

C) Profit margin.

D) Relevant range.

E) Sales turnover.

A) Contribution margin.

B) Margin of safety.

C) Profit margin.

D) Relevant range.

E) Sales turnover.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck

80

A target income refers to:

A) Income planned for a future period.

B) Income at the break-even point.

C) Income only in a multiproduct environment.

D) Income at the minimum contribution margin.

E) Income from the most recent period.

A) Income planned for a future period.

B) Income at the break-even point.

C) Income only in a multiproduct environment.

D) Income at the minimum contribution margin.

E) Income from the most recent period.

Unlock Deck

Unlock for access to all 244 flashcards in this deck.

Unlock Deck

k this deck