Deck 6: Business Organizations and the Tax Environment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 6: Business Organizations and the Tax Environment

1

Which of the following is a reason why companies move into international operations?

A) To take advantage of lower production costs in regions of inexpensive labor.

B) To develop new markets for their finished products.

C) To better serve their primary customers.

D) Because important raw materials are located abroad.

E) All of the above.

A) To take advantage of lower production costs in regions of inexpensive labor.

B) To develop new markets for their finished products.

C) To better serve their primary customers.

D) Because important raw materials are located abroad.

E) All of the above.

All of the above.

2

Which of the following statements is correct?

A) Given the multi-owner nature of most large corporations, agency costs associated with perquisite consumption are not really a problem.

B) Managers may operate in the stockholders' best interests, but they may also operate in their own personal best interests.As long as managers stay within the law, there simply are not any effective controls that stockholders can implement to control managerial decision making.

C) Shareholder agency costs include the opportunity costs associated with constraining managerial freedom but do not include managerial salaries.

D) An agency relationship exists when one or more persons hire another person to perform some service but withhold decision-making authority from that person.

E) All of the above statements are false.

A) Given the multi-owner nature of most large corporations, agency costs associated with perquisite consumption are not really a problem.

B) Managers may operate in the stockholders' best interests, but they may also operate in their own personal best interests.As long as managers stay within the law, there simply are not any effective controls that stockholders can implement to control managerial decision making.

C) Shareholder agency costs include the opportunity costs associated with constraining managerial freedom but do not include managerial salaries.

D) An agency relationship exists when one or more persons hire another person to perform some service but withhold decision-making authority from that person.

E) All of the above statements are false.

Shareholder agency costs include the opportunity costs associated with constraining managerial freedom but do not include managerial salaries.

3

Which of the following statements is correct?

A) A hostile takeover is a primary method of transferring ownership interest in a corporation.

B) The corporation is a legal entity created by the state and is a direct extension of the legal status of its owners and managers, that is, the owners and managers are the corporation.

C) Unlimited liability and limited life are two key advantages of the corporate form over other forms of business organization.

D) In part due to limited liability and ease of ownership transfer, corporations have less trouble raising money in financial markets than other organizational forms.

E) Although stockholders of the corporation are insulated by limited legal liability, the legal status of the corporation does not protect the firm's managers in the same way.

A) A hostile takeover is a primary method of transferring ownership interest in a corporation.

B) The corporation is a legal entity created by the state and is a direct extension of the legal status of its owners and managers, that is, the owners and managers are the corporation.

C) Unlimited liability and limited life are two key advantages of the corporate form over other forms of business organization.

D) In part due to limited liability and ease of ownership transfer, corporations have less trouble raising money in financial markets than other organizational forms.

E) Although stockholders of the corporation are insulated by limited legal liability, the legal status of the corporation does not protect the firm's managers in the same way.

In part due to limited liability and ease of ownership transfer, corporations have less trouble raising money in financial markets than other organizational forms.

4

Which of the following is an example of an area of business where use of "questionable" ethics is considered a necessity?

A) Attracting and sustaining new customers.

B) Hiring and keeping skilled employees.

C) Keeping up with competition.

D) Dealing with firms who use "questionable" ethics.

E) None of the above.

A) Attracting and sustaining new customers.

B) Hiring and keeping skilled employees.

C) Keeping up with competition.

D) Dealing with firms who use "questionable" ethics.

E) None of the above.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is correct?

A) A good goal for a corporate manager is maximization of expected EPS.

B) Most business in the U.S.is conducted by corporations; corporations' popularity results primarily from their favorable tax treatment.

C) A good example of an agency relationship is the one between stockholders and managers.

D) Corporations and partnerships have an advantage over proprietorships because a sole proprietor is subject to unlimited liability, but investors in the other types of businesses are not.

E) Firms in highly competitive industries find it easier to exercise "social responsibility" than do firms in oligopolistic industries.

A) A good goal for a corporate manager is maximization of expected EPS.

B) Most business in the U.S.is conducted by corporations; corporations' popularity results primarily from their favorable tax treatment.

C) A good example of an agency relationship is the one between stockholders and managers.

D) Corporations and partnerships have an advantage over proprietorships because a sole proprietor is subject to unlimited liability, but investors in the other types of businesses are not.

E) Firms in highly competitive industries find it easier to exercise "social responsibility" than do firms in oligopolistic industries.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is correct?

A) For the most part, our federal tax rates are progressive, because higher incomes are taxed at higher average rates.

B) Bonds issued by a municipality such as the city of Miami would carry a lower interest rate than bonds with the same risk and maturity issued by a private corporation such as Florida Power & Light.

C) Our federal tax laws tend to encourage corporations to finance with debt rather than with equity securities.

D) Our federal tax laws encourage the managers of corporations with surplus cash to invest it in stocks rather than in bonds.However, other factors may offset tax considerations.

E) All of the above statements are true.

A) For the most part, our federal tax rates are progressive, because higher incomes are taxed at higher average rates.

B) Bonds issued by a municipality such as the city of Miami would carry a lower interest rate than bonds with the same risk and maturity issued by a private corporation such as Florida Power & Light.

C) Our federal tax laws tend to encourage corporations to finance with debt rather than with equity securities.

D) Our federal tax laws encourage the managers of corporations with surplus cash to invest it in stocks rather than in bonds.However, other factors may offset tax considerations.

E) All of the above statements are true.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

A loss incurred by a corporation

A) Must be carried forward unless the company has had 2 loss years in a row.

B) Can be carried back 2 years, then carried forward up to 20 years following the loss.

C) Can be carried back 5 years and forward 3 years.

D) Cannot be used to reduce taxes in other years except with special permission from the IRS.

E) Can be carried back 3 years or forward 15 years, whichever is more advantageous to the firm.

A) Must be carried forward unless the company has had 2 loss years in a row.

B) Can be carried back 2 years, then carried forward up to 20 years following the loss.

C) Can be carried back 5 years and forward 3 years.

D) Cannot be used to reduce taxes in other years except with special permission from the IRS.

E) Can be carried back 3 years or forward 15 years, whichever is more advantageous to the firm.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is correct?

A) Other things held constant, it generally is safer to invest money in a proprietorship than in a partnership or a corporation.

B) According to the text, law firms and accounting firms must be organized as proprietorships or partnerships; these businesses do not have the option of incorporating.

C) If you are planning to start a business, which you will run as the sole employee, and if you expect the business to earn $1,000,000 per year before taxes, you can minimize federal income taxes by setting up the business as a corporation.

D) According to the text, "agency problems" tend to increase as the percentage of a corporation's stock owned by its managers increases.

E) Maximizing the income statement item "net income" is not the best goal for a corporation whose managers are interested in maximizing the economic welfare of the firm's stockholders.

A) Other things held constant, it generally is safer to invest money in a proprietorship than in a partnership or a corporation.

B) According to the text, law firms and accounting firms must be organized as proprietorships or partnerships; these businesses do not have the option of incorporating.

C) If you are planning to start a business, which you will run as the sole employee, and if you expect the business to earn $1,000,000 per year before taxes, you can minimize federal income taxes by setting up the business as a corporation.

D) According to the text, "agency problems" tend to increase as the percentage of a corporation's stock owned by its managers increases.

E) Maximizing the income statement item "net income" is not the best goal for a corporation whose managers are interested in maximizing the economic welfare of the firm's stockholders.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

The primary goal of a publicly-owned firm interested in serving its stockholders should be to

A) Minimize the debt used by a firm.

B) Maximize expected EPS.

C) Minimize the chances of losses.

D) Maximize the stock price per share.

E) Maximize expected net income.

A) Minimize the debt used by a firm.

B) Maximize expected EPS.

C) Minimize the chances of losses.

D) Maximize the stock price per share.

E) Maximize expected net income.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

Current tax laws have which of the following effects?

A) Favor dividends because there are no capital gains taxes on dividends.

B) Do not favor capital gains because the tax must be paid as the value of the stock increases, whether or not the stock is sold.

C) Favor capital gains because the tax does not have to be paid until the stock is sold.

D) Do not favor dividends or capital gains for most people because different people are in different tax brackets.

E) Favor dividends since dividends are tax-deductible for the paying corporation whereas retained earnings, which produce capital gains, are not tax-deductible.

A) Favor dividends because there are no capital gains taxes on dividends.

B) Do not favor capital gains because the tax must be paid as the value of the stock increases, whether or not the stock is sold.

C) Favor capital gains because the tax does not have to be paid until the stock is sold.

D) Do not favor dividends or capital gains for most people because different people are in different tax brackets.

E) Favor dividends since dividends are tax-deductible for the paying corporation whereas retained earnings, which produce capital gains, are not tax-deductible.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

Multinational managerial finance requires that

A) The effects of changing currency values be included in financial analyses.

B) Legal and economic differences be considered in financial decisions.

C) Political risk be excluded from multinational corporate financial analyses.

D) All of the above.

E) Only a and b above.

A) The effects of changing currency values be included in financial analyses.

B) Legal and economic differences be considered in financial decisions.

C) Political risk be excluded from multinational corporate financial analyses.

D) All of the above.

E) Only a and b above.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

Taking poison pills and offering greenmail are

A) Ways stockholders protect themselves and their interest from management's conflicting interests.

B) Tactics used by creditors to make their position more favorable when resolving agency problems between stockholders and creditors.

C) Two actions managers might take to ward off hostile takeovers.

D) Both commonly practiced methods used by firms' managers to increase stockholders' wealth.

A) Ways stockholders protect themselves and their interest from management's conflicting interests.

B) Tactics used by creditors to make their position more favorable when resolving agency problems between stockholders and creditors.

C) Two actions managers might take to ward off hostile takeovers.

D) Both commonly practiced methods used by firms' managers to increase stockholders' wealth.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is correct?

A) In a partnership, liability for other partners' misdeeds includes but is limited to the amount a particular partner has invested in the business.

B) Partnerships must be formed according to specific rules which include the filing of a formal written agreement with state authorities where the partnership does business.

C) A fast growth company would be more likely to set up a partnership for its business organization than would a slow-growth company.

D) Partnerships have difficulties attracting capital in part because of the other disadvantages of the partnership form of business, including impermanence of the organization.

E) A major disadvantage of a partnership as a form of business organization is the high cost and practical difficulties of its formation.

A) In a partnership, liability for other partners' misdeeds includes but is limited to the amount a particular partner has invested in the business.

B) Partnerships must be formed according to specific rules which include the filing of a formal written agreement with state authorities where the partnership does business.

C) A fast growth company would be more likely to set up a partnership for its business organization than would a slow-growth company.

D) Partnerships have difficulties attracting capital in part because of the other disadvantages of the partnership form of business, including impermanence of the organization.

E) A major disadvantage of a partnership as a form of business organization is the high cost and practical difficulties of its formation.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following actions is consistent with social responsibility but is necessarily inconsistent with stockholder wealth maximization?

A) Investing in a smokestack "scrubber" to reduce the firm's air pollution as mandated by law.

B) Voluntarily installing expensive machinery to treat effluent discharge which currently is being dumped into a river where it is ruining the drinking water of the community where the plant is located.

C) Investing in a smokestack filter to reduce sulphur-dioxide emissions in order to reduce the current tax being levied on the firm by the state for its pollution.

D) Making a large corporate donation to the local community in order to fund a recreation complex that will be used by the community and the firm's employees.

E) Each of the above actions is consistent with social responsibility and none is necessarily inconsistent with stockholder wealth maximization.

A) Investing in a smokestack "scrubber" to reduce the firm's air pollution as mandated by law.

B) Voluntarily installing expensive machinery to treat effluent discharge which currently is being dumped into a river where it is ruining the drinking water of the community where the plant is located.

C) Investing in a smokestack filter to reduce sulphur-dioxide emissions in order to reduce the current tax being levied on the firm by the state for its pollution.

D) Making a large corporate donation to the local community in order to fund a recreation complex that will be used by the community and the firm's employees.

E) Each of the above actions is consistent with social responsibility and none is necessarily inconsistent with stockholder wealth maximization.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not one of the things that causes a corporation to have a significant advantage over a partnership or a proprietorship?

A) Limited liability.

B) Ease of transfer of ownership interest.

C) Unlimited life.

D) Elimination of double taxation.

E) Ability to retain earnings and thus convert income from personal income to capital gains.

A) Limited liability.

B) Ease of transfer of ownership interest.

C) Unlimited life.

D) Elimination of double taxation.

E) Ability to retain earnings and thus convert income from personal income to capital gains.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is correct?

A) The ability of firms to engage in socially beneficial projects that involve voluntary costs is constrained by competition and the need of firms to attract capital at low cost.

B) The actions that maximize a firm's stock price are inconsistent with maximizing social welfare.

C) The concepts of social responsibility and ethical responsibility on the part of corporations are completely different and neither is relevant in maximizing stock price.

D) In a competitive market, if a group of firms do not spend resources making social welfare improvements, but another group does, in general, this will not affect the second group's ability to attract capital.

E) If government did not mandate socially responsible corporate actions, such as those relating to product safety and fair hiring practices, most firms in competitive markets would still pursue such policies voluntarily.

A) The ability of firms to engage in socially beneficial projects that involve voluntary costs is constrained by competition and the need of firms to attract capital at low cost.

B) The actions that maximize a firm's stock price are inconsistent with maximizing social welfare.

C) The concepts of social responsibility and ethical responsibility on the part of corporations are completely different and neither is relevant in maximizing stock price.

D) In a competitive market, if a group of firms do not spend resources making social welfare improvements, but another group does, in general, this will not affect the second group's ability to attract capital.

E) If government did not mandate socially responsible corporate actions, such as those relating to product safety and fair hiring practices, most firms in competitive markets would still pursue such policies voluntarily.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following mechanisms is not used by shareholders to get managers to act in shareholders' best interests?

A) Threat of firing.

B) Managerial compensation.

C) Performance shares.

D) Threat of takeover.

E) Answers b and c above.

A) Threat of firing.

B) Managerial compensation.

C) Performance shares.

D) Threat of takeover.

E) Answers b and c above.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following does not need to be considered when assessing the impact of financial decisions?

A) Projected earnings.

B) Financial market conditions.

C) Timing of the earnings flow.

D) Riskiness of the firm.

E) All of the above must be considered.

A) Projected earnings.

B) Financial market conditions.

C) Timing of the earnings flow.

D) Riskiness of the firm.

E) All of the above must be considered.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is correct?

A) The corporate bylaws are the set of rules drawn up by the state to enable managers to run the firm in accordance with state laws.

B) Procedures for electing corporate directors are contained in bylaws while the declaration of the activities that the firm will pursue and the number of directors are included in the corporate charter.

C) Procedures which govern changes in the bylaws of the corporation are contained in the corporate charter.

D) Although most companies design a charter, only the bylaws are legally required to be filed with the secretary of state in order for a corporation to be in official existence.

A) The corporate bylaws are the set of rules drawn up by the state to enable managers to run the firm in accordance with state laws.

B) Procedures for electing corporate directors are contained in bylaws while the declaration of the activities that the firm will pursue and the number of directors are included in the corporate charter.

C) Procedures which govern changes in the bylaws of the corporation are contained in the corporate charter.

D) Although most companies design a charter, only the bylaws are legally required to be filed with the secretary of state in order for a corporation to be in official existence.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is correct?

A) The major disadvantage of organizing as a corporation is that it does not provide its owners with limited liability.

B) Bond covenants, or restrictions on debt, are an important device to reduce agency conflicts between stockholders and bondholders.

C) The threat of a hostile takeover serves to reduce agency conflicts between stockholders and bondholders.

D) Compensation packages are designed, in part, to reduce agency conflicts between shareholders and managers.

E) Both answers b and d are correct.

A) The major disadvantage of organizing as a corporation is that it does not provide its owners with limited liability.

B) Bond covenants, or restrictions on debt, are an important device to reduce agency conflicts between stockholders and bondholders.

C) The threat of a hostile takeover serves to reduce agency conflicts between stockholders and bondholders.

D) Compensation packages are designed, in part, to reduce agency conflicts between shareholders and managers.

E) Both answers b and d are correct.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is correct?

A) Due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of U.S.businesses (in terms of number of businesses) are organized as corporations.

B) Most businesses (by number and total dollar sales) are organized as proprietorships or partnerships because it is easier to set up and operate in one of these forms rather than as a corporation.However, if the business gets very large, it becomes advantageous to convert to a corporation, primarily because corporations have important tax advantages over proprietorships and partnerships.

C) For a large company (taxable income over $1 million), the tax situation would, generally, favor organization as a partnership or proprietorship, or possibly as an S corporation, rather than as a regular corporation.However, legal considerations related to ownership transfers and liability offset the tax situation, with the result that most business (measured by dollar sales) is conducted by corporations.

D) In the typical situation, a taxpayer's average tax rate is below his or her marginal rate.However, there is an income range within which the average rate exceeds the marginal rate.

E) Statements c and d are both correct.

A) Due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of U.S.businesses (in terms of number of businesses) are organized as corporations.

B) Most businesses (by number and total dollar sales) are organized as proprietorships or partnerships because it is easier to set up and operate in one of these forms rather than as a corporation.However, if the business gets very large, it becomes advantageous to convert to a corporation, primarily because corporations have important tax advantages over proprietorships and partnerships.

C) For a large company (taxable income over $1 million), the tax situation would, generally, favor organization as a partnership or proprietorship, or possibly as an S corporation, rather than as a regular corporation.However, legal considerations related to ownership transfers and liability offset the tax situation, with the result that most business (measured by dollar sales) is conducted by corporations.

D) In the typical situation, a taxpayer's average tax rate is below his or her marginal rate.However, there is an income range within which the average rate exceeds the marginal rate.

E) Statements c and d are both correct.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

A 9 percent coupon bond issued by the State of Pennsylvania sells for $1,000 and thus provides a 9 percent yield to maturity.What yield on a Synthetic Chemical Company bond would cause the two bonds to provide the same after-tax rate of return to an investor in the 28 percent tax bracket?

A) 12.50%

B) 17.50%

C) 7.00%

D) 14.00%

E) 9.00%

A) 12.50%

B) 17.50%

C) 7.00%

D) 14.00%

E) 9.00%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

In 2014, Craig and Kathy Koehler owned a small business which was held as a proprietorship in Kathy's name.They were thinking of incorporating if that would lower their total tax liability.The Koehlers expected the company to earn $100,000 before taxes next year.They planned to take out salaries of $45,000, and to reinvest the rest in the business.Their personal deductions total $8,150 and they will file a joint return for their personal income.(1) What is their expected total tax liability as a proprietorship? (2) As a corporation? (3) Based on current taxes, should they incorporate?

A) $23,304.50; $14,675.00; Yes

B) $14,675.00; $13,427.50; Yes

C) $23,304.50; $13,427.50; Yes

D) $15,212.50; $23,450.00; No

E) $20,778.00; $23,450.00; No

A) $23,304.50; $14,675.00; Yes

B) $14,675.00; $13,427.50; Yes

C) $23,304.50; $13,427.50; Yes

D) $15,212.50; $23,450.00; No

E) $20,778.00; $23,450.00; No

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not a disadvantage of forming a business as a partnership?

A) Unlimited liability for the owners.

B) Limited life of the organization.

C) Difficulty of transferring ownership.

D) Difficulty in raising capital.

E) Business is taxed like an individual.

A) Unlimited liability for the owners.

B) Limited life of the organization.

C) Difficulty of transferring ownership.

D) Difficulty in raising capital.

E) Business is taxed like an individual.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

Carter Corporation has some money to invest, and its treasurer is choosing between City of Chicago municipal bonds and U.S.Treasury bonds.Both have the same maturity, and they are equally risky and liquid.If Treasury bonds yield 6 percent, and Carter's marginal income tax rate is 40 percent, what yield on the Chicago municipal bonds would make Carter's treasurer indifferent between the two?

A) 2.40%

B) 3.60%

C) 4.50%

D) 5.25%

E) 6.00%

A) 2.40%

B) 3.60%

C) 4.50%

D) 5.25%

E) 6.00%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

As a corporate investor paying a marginal tax rate of 34 percent, if 70 percent of dividends are excludable, what would be your after-tax dividend yield on preferred stock with a 16 percent before-tax dividend yield?

A) 6.36%

B) 7.36%

C) 12.19%

D) 13.01%

E) 14.37%

A) 6.36%

B) 7.36%

C) 12.19%

D) 13.01%

E) 14.37%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a limitation of the proprietorship form of business?

A) Unlimited personal liability

B) Difficulty raising capital

C) Double taxation

D) Difficulty in transferring ownership

E) Limited life

A) Unlimited personal liability

B) Difficulty raising capital

C) Double taxation

D) Difficulty in transferring ownership

E) Limited life

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

A corporation with a marginal tax rate of 34 percent would receive what after-tax dividend yield on a 12 percent coupon rate preferred stock bought at par, assuming a 70 percent dividend exclusion?

A) 11.03%

B) 10.78%

C) 6.48%

D) 7.31%

E) 5.52%

A) 11.03%

B) 10.78%

C) 6.48%

D) 7.31%

E) 5.52%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

____ decisions are decisions about how much and what types of debt and equity should be used to finance the firm.

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Risk tolerance

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Risk tolerance

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

The corporate charter of a firm includes all of the following information except

A) the initial price of the stock to be issued.

B) the types of activities it will pursue.

C) the name of the proposed corporation.

D) the amount of capital stock.

E) the number of directors.

A) the initial price of the stock to be issued.

B) the types of activities it will pursue.

C) the name of the proposed corporation.

D) the amount of capital stock.

E) the number of directors.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

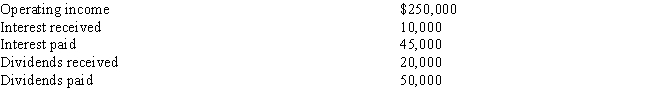

Your corporation has the following cash flows:  If the applicable income tax rate is 40 percent, and if 70 percent of dividends received are exempt from taxes, what is the corporation's tax liability?

If the applicable income tax rate is 40 percent, and if 70 percent of dividends received are exempt from taxes, what is the corporation's tax liability?

A) $74,000

B) $88,400

C) $91,600

D) $100,000

E) $106,500

If the applicable income tax rate is 40 percent, and if 70 percent of dividends received are exempt from taxes, what is the corporation's tax liability?

If the applicable income tax rate is 40 percent, and if 70 percent of dividends received are exempt from taxes, what is the corporation's tax liability?A) $74,000

B) $88,400

C) $91,600

D) $100,000

E) $106,500

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

____ decisions are decisions as to what types of assets should be purchased to help generate cash flows.

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Repurchase

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Repurchase

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Solarcell Corporation has $20,000 which it plans to invest in marketable securities.It is choosing between AT&T bonds which yield 11%, State of Florida municipal bonds which yield 8%, and AT&T preferred stock with a dividend yield of 9%.Solarcell's corporate tax rate is 40%, and 70% of the preferred stock dividends it receives are tax exempt.Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns, which security should be selected? Answer by giving the after-tax rate of return on the highest yielding security.

A) 8.46%

B) 8.00%

C) 7.92%

D) 9.00%

E) 9.16%

A) 8.46%

B) 8.00%

C) 7.92%

D) 9.00%

E) 9.16%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

Weston Corporation has some money to invest, and its treasurer is choosing between General Motors bonds and State of Illinois bonds.Both have the same maturity, and they are equally risky and liquid.If the Illinois bonds, which are tax-exempt, yield 6 percent, and Weston's marginal income tax rate is 40 percent, what yield on GM bonds would make Weston's treasurer indifferent between the two?

A) 6.0%

B) 7.5%

C) 10.0%

D) 12.5%

E) 15.0%

A) 6.0%

B) 7.5%

C) 10.0%

D) 12.5%

E) 15.0%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

Allen Corporation can (1) build a new plant which should generate a before-tax return of 11 percent, or (2) invest the same funds in the preferred stock of FPL, which should provide Allen with a before-tax return of 9%, all in the form of dividends.Assume that Allen's marginal tax rate is 25 percent, and that 70 percent of dividends received are excluded from taxable income.If the plant project is divisible into small increments, and if the two investments are equally risky, what combination of these two possibilities will maximize Allen's effective return on the money invested?

A) All in the plant project.

B) All in FPL preferred stock.

C) 60% in the project; 40% in FPL.

D) 60% in FPL; 40% in the project.

E) 50% in each.

A) All in the plant project.

B) All in FPL preferred stock.

C) 60% in the project; 40% in FPL.

D) 60% in FPL; 40% in the project.

E) 50% in each.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is correct?

A) The proper goal of the financial manager should be to maximize the firm's expected cash flow, because this will add the most wealth to each of the individual shareholders (owners) of the firm.

B) One way to state the decision framework most useful for carrying out the firm's objective is as follows: "The financial manager should seek that combination of assets, liabilities, and capital which will generate the largest expected projected after-tax income over the relevant time horizon."

C) The riskiness inherent in a firm's earnings per share (EPS) depends on the characteristics of the projects the firm selects, which means it depends upon the firm's assets, but EPS does not depend on the manner in which those assets are financed.

D) Because large, publicly-owned firms are controlled by their management teams, and typically, ownership is widely dispersed, managers have great freedom in managing the firm.Managers may operate in the stockholders' best interest, but they may also operate in their own personal best interests.As long as managers stay within the law, there simply aren't any effective controls over managerial decisions in such situations.

E) Agency problems exist between stockholders and managers, and between stockholders and creditors.

A) The proper goal of the financial manager should be to maximize the firm's expected cash flow, because this will add the most wealth to each of the individual shareholders (owners) of the firm.

B) One way to state the decision framework most useful for carrying out the firm's objective is as follows: "The financial manager should seek that combination of assets, liabilities, and capital which will generate the largest expected projected after-tax income over the relevant time horizon."

C) The riskiness inherent in a firm's earnings per share (EPS) depends on the characteristics of the projects the firm selects, which means it depends upon the firm's assets, but EPS does not depend on the manner in which those assets are financed.

D) Because large, publicly-owned firms are controlled by their management teams, and typically, ownership is widely dispersed, managers have great freedom in managing the firm.Managers may operate in the stockholders' best interest, but they may also operate in their own personal best interests.As long as managers stay within the law, there simply aren't any effective controls over managerial decisions in such situations.

E) Agency problems exist between stockholders and managers, and between stockholders and creditors.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

Jane Doe, who has substantial personal wealth and income, is considering the possibility of opening a new business in the chemical waste management field.She will be the sole owner.The business will have a relatively high degree of risk, and it is expected that the firm will incur losses for the first few years.However, the prospects for growth and positive future income look good, and Jane expects to realize substantial cash flows from dividends the firm will eventually pay out.Which of the legal forms of business organization would probably best suit her needs?

A) Proprietorship, because of ease of entry.

B) Regular corporation, because of the limited liability.

C) Partnership, if she needs additional capital.

D) S corporation, to enjoy tax advantages and gain limited liability.

E) In this situation, the various forms of organization seem equally desirable.

A) Proprietorship, because of ease of entry.

B) Regular corporation, because of the limited liability.

C) Partnership, if she needs additional capital.

D) S corporation, to enjoy tax advantages and gain limited liability.

E) In this situation, the various forms of organization seem equally desirable.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is correct?

A) A major disadvantage of a regular partnership or a corporation as a form of business is the fact that they do not offer their owners limited liability, whereas proprietorships do.

B) An advantage of the corporate form for many businesses is the fact that the corporate tax rate always exceeds the personal tax rate, which is the rate at which proprietorships and partnerships are taxed.

C) There are more partnerships and sole proprietorships than corporations in the U.S., but corporations produce more goods and services than do other forms of business.

D) Because corporations enjoy the benefits of limited liability, easy transferability of ownership interest, unlimited life, and favorable tax status relative to the situation for partnerships and proprietorships, most large businesses choose to incorporate.

E) Because lawyers have the incorporation process so automated (e.g., word processors for drawing up the necessary papers), it is less expensive to form a corporation than to form a proprietorship or partnership.

A) A major disadvantage of a regular partnership or a corporation as a form of business is the fact that they do not offer their owners limited liability, whereas proprietorships do.

B) An advantage of the corporate form for many businesses is the fact that the corporate tax rate always exceeds the personal tax rate, which is the rate at which proprietorships and partnerships are taxed.

C) There are more partnerships and sole proprietorships than corporations in the U.S., but corporations produce more goods and services than do other forms of business.

D) Because corporations enjoy the benefits of limited liability, easy transferability of ownership interest, unlimited life, and favorable tax status relative to the situation for partnerships and proprietorships, most large businesses choose to incorporate.

E) Because lawyers have the incorporation process so automated (e.g., word processors for drawing up the necessary papers), it is less expensive to form a corporation than to form a proprietorship or partnership.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is correct?

A) The optimal dividend policy is the one that satisfies the shareholders because they supply the firm's capital.

B) The use of debt financing has no effect on earnings per share (EPS) or stock price.

C) The riskiness of projected EPS depends upon how the firm is financed.

D) Stock price is dependent on the projected EPS and the use of debt but not on the timing of the earnings stream.

E) Dividend policy is one aspect of the firm's financial policy that is determined directly by the shareholders.

A) The optimal dividend policy is the one that satisfies the shareholders because they supply the firm's capital.

B) The use of debt financing has no effect on earnings per share (EPS) or stock price.

C) The riskiness of projected EPS depends upon how the firm is financed.

D) Stock price is dependent on the projected EPS and the use of debt but not on the timing of the earnings stream.

E) Dividend policy is one aspect of the firm's financial policy that is determined directly by the shareholders.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

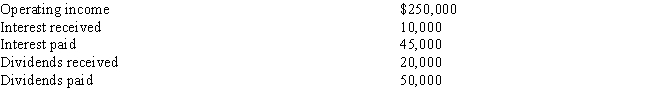

Your corporation has the following cash flows:  If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,

If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,  What is the corporation's tax liability?

What is the corporation's tax liability?

A) $57,530

B) $65,350

C) $69,440

D) $88,350

E) $100,280

If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,

If 70 percent of dividends received are excludable, and if the applicable tax table is as follows,  What is the corporation's tax liability?

What is the corporation's tax liability?A) $57,530

B) $65,350

C) $69,440

D) $88,350

E) $100,280

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

Managers of a firm can increase the value of a firm by

A) increasing the size of the cash inflows.

B) reducing the riskiness of the cash flows.

C) speeding up the timing of the cash flows.

D) all of the above will increase the value of the firm.

A) increasing the size of the cash inflows.

B) reducing the riskiness of the cash flows.

C) speeding up the timing of the cash flows.

D) all of the above will increase the value of the firm.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

A hostile takeover involves an attempt by one group of stockholders to solicit votes from other stockholders in order to put a new management team into place and is usually motivated by low stock price.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

The major advantage of a regular partnership or a corporation as a form of business is the fact that both offer their owners limited liability, whereas proprietorships do not.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

Four of the disadvantages of a partnership are (1) unlimited liability, (2) limited life of the organization, (3) difficulty of transferring ownership, and (4) difficulty in attracting large amounts of capital.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

No firm can take cost-increasing, socially responsible actions in a competitive marketplace and expect to continue to compete, even if those cost-increasing actions yield significant benefits to the firm.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

Managers can increase the value of a firm by making decisions that

A) increase the future cash flows of the firm.

B) increase the amount of time required to generate future cash flows.

C) increase the riskiness of future cash flows.

D) decrease the liquidity of the firm's securities.

A) increase the future cash flows of the firm.

B) increase the amount of time required to generate future cash flows.

C) increase the riskiness of future cash flows.

D) decrease the liquidity of the firm's securities.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

One way to state the decision framework most useful for carrying out the firm's objective is that the financial managers should seek that combination of assets, liabilities, and capital which will generate the largest expected projected income over the relevant time horizon.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

Two key limitations of the proprietorship form of business involve potential difficulty in raising needed capital and the presence of unlimited personal liability for business debts.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

A financial decision which results in an increase in net income is necessarily consistent with the firm's objective of maximizing its stock price.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Deciding upon the form of organization for a business is an important financial decision with potentially significant consequences for the future wealth of the owners.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

____ decisions are decisions as to how much of current earnings to pay out as dividends rather than to retain for reinvestment in the firm.

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Investment

A) Capital structure

B) Capital budgeting

C) Dividend policy

D) Investment

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

Most executives believe that there is a positive correlation between ethics and long-run profitability because ethical behavior does all of the following except

A) avoids fines and legal expenses.

B) reduces corporate taxes

C) attracts business from customers who appreciate and support ethical policies.

D) attracts and keeps employees of the highest caliber.

A) avoids fines and legal expenses.

B) reduces corporate taxes

C) attracts business from customers who appreciate and support ethical policies.

D) attracts and keeps employees of the highest caliber.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

The text makes the point that due to competitive pressures and the continuing need of firms to attract capital, most socially beneficial but cost increasing actions will have to be made mandatory by government.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

All of the following are advantages of a corporation except

A) unlimited life

B) limited liability

C) easy transfer of ownership

D) All of the above are advantages

A) unlimited life

B) limited liability

C) easy transfer of ownership

D) All of the above are advantages

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following are important in determining the value of the firm?

A) Expected future cash flows.

B) Timing of future cash flows.

C) Riskiness of future cash flows.

D) All of the above.

A) Expected future cash flows.

B) Timing of future cash flows.

C) Riskiness of future cash flows.

D) All of the above.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

The proper goal of the financial manager should be to maximize the firm's expected profit, because this will add the most wealth to each of the individual shareholders (owners) of the firm.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

If a firm has a single owner, we can say that the proper goal of a financial manager would be to maximize the firm's earnings per share.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

The key value of limited liability is that it lowers the firm's risk thereby enhancing its value.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

Profit maximization does not always lead to wealth maximization because

A) it does not consider the riskiness of the cash flows.

B) it does not consider the timing of the cash flows.

C) it does not consider the size of the cash flows.

D) two of the above are correct.

E) all of the above are correct

A) it does not consider the riskiness of the cash flows.

B) it does not consider the timing of the cash flows.

C) it does not consider the size of the cash flows.

D) two of the above are correct.

E) all of the above are correct

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is not an advantage of a proprietorship?

A) Inexpensive to form

B) Not regulated heavily

C) Unlimited liability

D) Taxed like an individual

A) Inexpensive to form

B) Not regulated heavily

C) Unlimited liability

D) Taxed like an individual

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

Normal profits are those that result in rates of return that are just sufficient to attract new capital in financial markets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

An agency problem exists between stockholders and managers.A second agency problem arises between stockholders and creditors.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

The fact that a percentage of the interest income received by one corporation is excluded from taxable income has encouraged firms to use more debt financing relative to equity financing.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

Under our current tax laws, when investors pay taxes on their corporate dividend income, they are being subjected to a form of double taxation.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

Multinational managerial finance requires that financial analyses consider the effects of changing currency values.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

Most firms today use executive stock options, as opposed to other incentive methods, to induce management to act in the best interests of stockholders.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

The goal of maximizing stock price is a detriment to society in that few of the actions that result in maximization of stock price also benefit society.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

Interest and dividends paid by a corporation are considered to be deductible operating expenses, hence they decrease the firm's tax liability.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

If the tax laws stated that $0.50 out of every $1.00 of interest paid by a corporation was allowed as a tax-deductible expense, it would probably encourage companies to use more debt financing than they presently do, other things held constant.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

Performance shares are dollar bonuses awarded to managers on the basis of corporate performance.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

The riskiness inherent in a firm's earnings per share (EPS) depends on both the types of projects the firm takes on and the manner in which the projects are financed.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

If a firm's stock price falls during the year, this indicates that the firm's managers are not acting in the shareholders' best interest.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

Because political risk is seldom negotiable, it cannot be explicitly addressed in multinational corporate financial analysis.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

In a competitive marketplace, if managers deviate too far from making decisions that are consistent with stockholder wealth maximization, they risk being disciplined by the market.Part of this discipline involves the threat of being taken over by groups who are more aligned with stockholder interests.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

By maximizing the earnings of the firm we will ensure that the price per share of common stock is maximized, hence shareholders' wealth also will be maximized.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

When considering the risk of foreign investment, higher risk could arise from exchange rate risk and political risk while lower risk might result from international diversification.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

The fact that a proprietorship, as a business, pays no corporate income tax and that it is easily and inexpensively formed are often cited as key advantages to that form of business.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

Legal and economic differences among countries, although important, do not pose significant problems for most multinational corporations when they coordinate and control worldwide operations of subsidiaries.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

If management is maximizing the firm's net income, this is necessarily identical to maximizing earnings per share and stock price.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

If a firm's managers want to maximize stock price it is in their best interests to operate efficient, low-cost plants, develop new and safe products that consumers want, and maintain good relationships with customers, suppliers, creditors, and the communities in which they operate.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck