Deck 2: Financial Assets Instruments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 2: Financial Assets Instruments

1

All of the following may serve to reduce the coupon rate that would otherwise be required on a bond issued at par, except a

A) Sinking fund.

B) Restrictive covenant.

C) Call provision.

D) Change in rating from Aa to Aaa.

E) None of the above (all may reduce the required coupon rate).

A) Sinking fund.

B) Restrictive covenant.

C) Call provision.

D) Change in rating from Aa to Aaa.

E) None of the above (all may reduce the required coupon rate).

Call provision.

2

Pure options are instruments that are

A) Created by investors outside the firm.

B) Bought and sold primarily by investors and speculators.

C) Of greater importance to investors than to financial managers.

D) All of the above.

E) None of the above.

A) Created by investors outside the firm.

B) Bought and sold primarily by investors and speculators.

C) Of greater importance to investors than to financial managers.

D) All of the above.

E) None of the above.

All of the above.

3

Your Aunt Agatha purchased a call option a few months ago.Today is the expiration date, so she must decide whether to exercise the option.Which of the following statements is correct? Do not consider brokers' commissions in your answer.

A) Aunt Agatha doesn't need to make a decision about exercising the option today; in fact, it would be better if she waited until after the option expires.

B) Aunt Agatha should exercise the option if the price of the stock is less than the exercise, or strike, price.

C) Aunt Agatha should exercise the option if the price of the stock is greater than the exercise, or strike, price.

D) Aunt Agatha should exercise the option, regardless of the current stock price.

E) None of the above.

A) Aunt Agatha doesn't need to make a decision about exercising the option today; in fact, it would be better if she waited until after the option expires.

B) Aunt Agatha should exercise the option if the price of the stock is less than the exercise, or strike, price.

C) Aunt Agatha should exercise the option if the price of the stock is greater than the exercise, or strike, price.

D) Aunt Agatha should exercise the option, regardless of the current stock price.

E) None of the above.

Aunt Agatha should exercise the option if the price of the stock is greater than the exercise, or strike, price.

4

An option which gives the holder the right to sell a stock at a specified price at some time in the future is called a(n)

A) Call option.

B) Put option.

C) Out-of-the-money option.

D) Naked option.

E) Covered option.

A) Call option.

B) Put option.

C) Out-of-the-money option.

D) Naked option.

E) Covered option.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following types of debt protect a bondholder against an increase in interest rates?

A) Floating rate debt.

B) Bonds that are redeemable ("putable") at par at the bondholders' option.

C) Bonds with call provisions.

D) All of the above.

E) Only answers a and b above.

A) Floating rate debt.

B) Bonds that are redeemable ("putable") at par at the bondholders' option.

C) Bonds with call provisions.

D) All of the above.

E) Only answers a and b above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

Assume the securities are all issued by the same firm.From the investor's standpoint, rank the following securities in order of increasing risk (the number of the least risky security is placed first, or to the left, in the answer set).

A) 1, 2, 3, 4

B) 4, 1, 2, 3

C) 4, 1, 3, 2

D) 4, 2, 1, 3

E) 4, 2, 3, 1

A) 1, 2, 3, 4

B) 4, 1, 2, 3

C) 4, 1, 3, 2

D) 4, 2, 1, 3

E) 4, 2, 3, 1

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is correct?

A) One danger a family-owned business faces when it goes public is the loss of absolute voting control of the company, because there is no way to keep new stockholders from voting.

B) The market is less active for small companies' shares, so these stocks must be included on the SEC's list in order to inform investors of their existence.Therefore, "listed shares" as the term is generally used refers to shares of smaller as opposed to larger companies.

C) Before a company can offer a new issue of common stock to the public, it must get approval from the SEC for the price at which the stock can be sold.If the SEC thinks the proposed price is too high, then the company's prospectus is rejected and the stock cannot be sold.

D) The preemptive right refers to stockholders' right to elect a company's board of directors.

E) Each of the above statements is false.

A) One danger a family-owned business faces when it goes public is the loss of absolute voting control of the company, because there is no way to keep new stockholders from voting.

B) The market is less active for small companies' shares, so these stocks must be included on the SEC's list in order to inform investors of their existence.Therefore, "listed shares" as the term is generally used refers to shares of smaller as opposed to larger companies.

C) Before a company can offer a new issue of common stock to the public, it must get approval from the SEC for the price at which the stock can be sold.If the SEC thinks the proposed price is too high, then the company's prospectus is rejected and the stock cannot be sold.

D) The preemptive right refers to stockholders' right to elect a company's board of directors.

E) Each of the above statements is false.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

Companies A and B recently established a new jointly owned subsidiary, ABBA Corporation.ABBA now requires $100 million of capital.A and B will supply $40 million of common equity, $20 million each.The remaining $60 million will be raised by using some combination of debt and preferred stock.Which of the following statements is most correct?

A) The interest rate on the debt would be higher if ABBA uses $60 million of debt and $0 preferred than it would be if ABBA uses $30 million of debt and $30 million of preferred.

B) Because 70 percent of preferred stock dividends received are excluded from a corporation's taxable income, (1) most preferred stock is owned by corporations, and (2) frequently a company's bond interest rate is higher than its preferred stock dividend yield.

C) If ABBA's preferred stock were made convertible into its common, the preferred would have a lower dividend yield than if the preferred were nonconvertible.

D) All of the above statements are true.

E) Only answers a and b above are true.

A) The interest rate on the debt would be higher if ABBA uses $60 million of debt and $0 preferred than it would be if ABBA uses $30 million of debt and $30 million of preferred.

B) Because 70 percent of preferred stock dividends received are excluded from a corporation's taxable income, (1) most preferred stock is owned by corporations, and (2) frequently a company's bond interest rate is higher than its preferred stock dividend yield.

C) If ABBA's preferred stock were made convertible into its common, the preferred would have a lower dividend yield than if the preferred were nonconvertible.

D) All of the above statements are true.

E) Only answers a and b above are true.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following factors does not influence a firm's long-term financing decisions?

A) Its target capital structure.

B) Maturity matching considerations.

C) Comparative costs of financing alternatives.

D) Availability of collateral.

E) All of the above factors may influence a firm's long-term financing decisions.

A) Its target capital structure.

B) Maturity matching considerations.

C) Comparative costs of financing alternatives.

D) Availability of collateral.

E) All of the above factors may influence a firm's long-term financing decisions.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

Other things held constant, if a bond indenture contains a call provision, the yield to maturity that would exist without such a call provision will generally be ____ the YTM with it.

A) Higher than

B) Lower than

C) The same as

D) Either higher or lower, depending on the level of call premium, than

E) Unrelated to

A) Higher than

B) Lower than

C) The same as

D) Either higher or lower, depending on the level of call premium, than

E) Unrelated to

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

Of the following provisions that might be found in a bond indenture, which would tend to reduce the coupon interest rate on the bond in question?

A) A subordination clause in a debenture.

B) A call provision.

C) A convertible feature.

D) Having relatively few restrictive covenants.

E) All of the above.

A) A subordination clause in a debenture.

B) A call provision.

C) A convertible feature.

D) Having relatively few restrictive covenants.

E) All of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following events would make it more likely that a company would choose to call its outstanding callable bonds?

A) A reduction in market interest rates.

B) The company's bonds are downgraded.

C) An increase in the call premium.

D) Answers a and b are both correct.

E) Answers a, b, and c are all correct.

A) A reduction in market interest rates.

B) The company's bonds are downgraded.

C) An increase in the call premium.

D) Answers a and b are both correct.

E) Answers a, b, and c are all correct.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

The terms and conditions to which a bond is subject are set forth in its

A) Debenture.

B) Underwriting agreement.

C) Indenture.

D) Restrictive covenants.

E) Call provision.

A) Debenture.

B) Underwriting agreement.

C) Indenture.

D) Restrictive covenants.

E) Call provision.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

Common equity refers to the sum of which of the following balance sheet accounts?

A) Common stock and retained earnings

B) Book value, retained earnings, and common stock

C) Common stock, additional paid-in capital, retained earnings

D) Either answer a or c above could be correct depending on whether the firm has "par" or "no par" stock.

E) Both b and c are correct since additional paid-in capital is equivalent to book value.

A) Common stock and retained earnings

B) Book value, retained earnings, and common stock

C) Common stock, additional paid-in capital, retained earnings

D) Either answer a or c above could be correct depending on whether the firm has "par" or "no par" stock.

E) Both b and c are correct since additional paid-in capital is equivalent to book value.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

An American Depository Receipt (ADR) represents

A) Debt sold by a foreign borrower that is denominated in the currency of the country where it is sold.

B) Stock of foreign companies that is sold directly to investors in the United States.

C) Equity instruments of one country that are sold in another country.

D) The certificates that represent ownership in foreign companies that are sold in the United States.

E) Certificates representing ownership in stocks of foreign companies that are held in trust by a bank located in the country the stock is traded.

A) Debt sold by a foreign borrower that is denominated in the currency of the country where it is sold.

B) Stock of foreign companies that is sold directly to investors in the United States.

C) Equity instruments of one country that are sold in another country.

D) The certificates that represent ownership in foreign companies that are sold in the United States.

E) Certificates representing ownership in stocks of foreign companies that are held in trust by a bank located in the country the stock is traded.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

Companies can issue different classes of common stock.Which of the following statements concerning stock classes is correct?

A) All common stocks fall into one of three classes: A, B, and C.

B) Most firms have several classes of common stock outstanding.

C) All common stock, regardless of class, must have voting rights.

D) All common stock, regardless of class, must have the same dividend privileges.

E) None of the above statements is necessarily true.

A) All common stocks fall into one of three classes: A, B, and C.

B) Most firms have several classes of common stock outstanding.

C) All common stock, regardless of class, must have voting rights.

D) All common stock, regardless of class, must have the same dividend privileges.

E) None of the above statements is necessarily true.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following are generally considered advantages of term loans over publicly issued bonds?

A) Lower flotation costs.

B) Speed, or how long it takes to bring the issue to market.

C) Flexibility, or the ability to adjust the bond's terms after it has been issued.

D) All of the above.

E) Only answers b and c above.

A) Lower flotation costs.

B) Speed, or how long it takes to bring the issue to market.

C) Flexibility, or the ability to adjust the bond's terms after it has been issued.

D) All of the above.

E) Only answers b and c above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

The preemptive right is important to shareholders because it

A) Allows management to sell additional shares below the current market price.

B) Protects the current shareholders against dilution of ownership interests.

C) Is included in every corporate charter.

D) Will result in higher dividends per share.

E) The preemptive right is not important to shareholders.

A) Allows management to sell additional shares below the current market price.

B) Protects the current shareholders against dilution of ownership interests.

C) Is included in every corporate charter.

D) Will result in higher dividends per share.

E) The preemptive right is not important to shareholders.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is correct?

A) All common stock must have full voting rights.

B) While firms are allowed to issue different classes of common stock, the Securities and Exchange Commission (SEC) requires that each class have the same dividend privileges.

C) The New York Stock Exchange (NYSE) allows firms with dual class stock to be listed on the exchange.

D) In order to increase a stock's liquidity, investment bankers generally require that insiders sell some percentage of their shares after a firm has undergone an initial public offering (IPO).

E) When a firm raises capital, investment bankers enter into a "best efforts" arrangement which guarantees that the securities will be sold.

A) All common stock must have full voting rights.

B) While firms are allowed to issue different classes of common stock, the Securities and Exchange Commission (SEC) requires that each class have the same dividend privileges.

C) The New York Stock Exchange (NYSE) allows firms with dual class stock to be listed on the exchange.

D) In order to increase a stock's liquidity, investment bankers generally require that insiders sell some percentage of their shares after a firm has undergone an initial public offering (IPO).

E) When a firm raises capital, investment bankers enter into a "best efforts" arrangement which guarantees that the securities will be sold.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

Eurodebt is the term used to designate

A) Debt sold by a foreign borrower that is denominated in the currency of the country where it is sold.

B) European bank loans that are denominated in the new Euro currency.

C) Debt that is denominated in a currency that is different than the currency of the country in which it is sold.

D) Equity instruments of one country that are sold in another country.

E) The certificates that represent ownership in foreign companies that are sold in the United States.

A) Debt sold by a foreign borrower that is denominated in the currency of the country where it is sold.

B) European bank loans that are denominated in the new Euro currency.

C) Debt that is denominated in a currency that is different than the currency of the country in which it is sold.

D) Equity instruments of one country that are sold in another country.

E) The certificates that represent ownership in foreign companies that are sold in the United States.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements concerning common stock and the investment banking process is false?

A) The preemptive right gives each existing common stockholder the right to purchase his or her proportionate share of a new stock issue.

B) If a firm sells 1,000,000 new shares of Class B stock, the transaction occurs in the primary market.

C) Listing a large firm's stock is often considered to be beneficial to stockholders because the increases in liquidity and status probably outweigh the additional costs to the firm.

D) Stockholders have the right to elect the firm's directors, who in turn select the officers who manage the business.If stockholders are dissatisfied with management's performance, an outside group may ask the stockholders to vote for it in an effort to take control of the business.This action is called a margin call.

E) A large issue of new stock could cause the stock price to fall.This loss is called "market pressure," and it is treated as a flotation cost because it is a cost associated with the new issue.

A) The preemptive right gives each existing common stockholder the right to purchase his or her proportionate share of a new stock issue.

B) If a firm sells 1,000,000 new shares of Class B stock, the transaction occurs in the primary market.

C) Listing a large firm's stock is often considered to be beneficial to stockholders because the increases in liquidity and status probably outweigh the additional costs to the firm.

D) Stockholders have the right to elect the firm's directors, who in turn select the officers who manage the business.If stockholders are dissatisfied with management's performance, an outside group may ask the stockholders to vote for it in an effort to take control of the business.This action is called a margin call.

E) A large issue of new stock could cause the stock price to fall.This loss is called "market pressure," and it is treated as a flotation cost because it is a cost associated with the new issue.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

An investor purchased a call option that allows her to purchase 100 shares of Dell Computer common stock for $45 per share any time during the next six months.The current market price of Dell's stock is $42.50.If the price of Dell increases to $50 and the investor decides to exercise it, what will be the gain or loss that results from the exercise? Ignore taxes and commissions.

A) $500 gain

B) $250 loss

C) $750 gain

D) $250 gain

E) None of the above.

A) $500 gain

B) $250 loss

C) $750 gain

D) $250 gain

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Rollincoast Incorporated issued BBB bonds two years ago that provided a yield to maturity of 11.5 percent.Long-term risk-free government bonds were yielding 8.7 percent at that time.The current risk premium on BBB bonds versus government bonds is half what it was two years ago.If the risk-free long-term governments are currently yielding 7.8 percent, then at what rate should Rollincoast expect to issue new bonds?

A) 7.8%

B) 8.7%

C) 9.2%

D) 10.2%

E) 12.9%

A) 7.8%

B) 8.7%

C) 9.2%

D) 10.2%

E) 12.9%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is false?

A) When a corporation's shares are owned by a few individuals who are associated with or are the firm's management, we say that the firm is "closely held."

B) A publicly owned corporation is simply a company whose shares are held by the investing public, which may include other corporations and institutions as well as individuals.

C) Going public establishes a true market value for the firm and ensures that a liquid market will always exist for the firm's shares.

D) When stock in a closely held corporation is offered to the public for the first time the transaction is called "going public" and the market for such stock is called the new issue market.

A) When a corporation's shares are owned by a few individuals who are associated with or are the firm's management, we say that the firm is "closely held."

B) A publicly owned corporation is simply a company whose shares are held by the investing public, which may include other corporations and institutions as well as individuals.

C) Going public establishes a true market value for the firm and ensures that a liquid market will always exist for the firm's shares.

D) When stock in a closely held corporation is offered to the public for the first time the transaction is called "going public" and the market for such stock is called the new issue market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

The sale of new common stock at a price greater than par value will affect which balance sheet accounts? (Choose the most complete answer.)

A) Common stock, paid-in capital, retained earnings.

B) Assets, common stock, paid-in capital.

C) Liabilities, common equity.

D) Common stock, retained earnings.

E) Common stock, paid-in capital.

A) Common stock, paid-in capital, retained earnings.

B) Assets, common stock, paid-in capital.

C) Liabilities, common equity.

D) Common stock, retained earnings.

E) Common stock, paid-in capital.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

A firm plans to sell $100 million of 20-year bonds to raise capital for expansion.Which of the following provisions, if it were included in the bond's indenture, would tend to raise the coupon interest rate over what it would be if the provision were not included?

A) A call provision under which the firm may call the bonds for redemption after 5 years.

B) Provision for a sinking fund, where a set percentage of the bonds must be called for redemption at par each year.

C) A restrictive covenant which states that the firm's current ratio must always exceed 2.0.

D) A pledge of real property as security for the bonds.

E) A provision under which the bondholders may, at their option, turn the bond in to the company and receive the bond's face value; that is, the bond is redeemable at par at the holder's option.

A) A call provision under which the firm may call the bonds for redemption after 5 years.

B) Provision for a sinking fund, where a set percentage of the bonds must be called for redemption at par each year.

C) A restrictive covenant which states that the firm's current ratio must always exceed 2.0.

D) A pledge of real property as security for the bonds.

E) A provision under which the bondholders may, at their option, turn the bond in to the company and receive the bond's face value; that is, the bond is redeemable at par at the holder's option.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is correct?

A) A warrant is basically a long-term option that enables the holder to sell common stock back to the firm at an agreed upon price, at a specified time in the future.

B) Generally, warrants are distributed along with preferred stock in order to make the preferred stock less risky.

C) If a company issuing coupon paying debt wanted to reduce the cash outflows associated with the coupon payments, it could issue warrants with the debt to accomplish this.

D) One of the disadvantages of warrants to the issuing firm is that they can be detachable and can be traded separately from the debt with which they are issued.

E) Warrants are attractive to investors because when they are issued with stock, investors receive dividends on the warrants they own as well as on the underlying stock.

A) A warrant is basically a long-term option that enables the holder to sell common stock back to the firm at an agreed upon price, at a specified time in the future.

B) Generally, warrants are distributed along with preferred stock in order to make the preferred stock less risky.

C) If a company issuing coupon paying debt wanted to reduce the cash outflows associated with the coupon payments, it could issue warrants with the debt to accomplish this.

D) One of the disadvantages of warrants to the issuing firm is that they can be detachable and can be traded separately from the debt with which they are issued.

E) Warrants are attractive to investors because when they are issued with stock, investors receive dividends on the warrants they own as well as on the underlying stock.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

A company is planning to raise $1,000,000 to finance a new plant.Which of the following statements is correct?

A) If debt is used to raise the million dollars, the cost of the debt would be lower if the debt is in the form of a fixed rate bond rather than a floating rate bond.

B) If debt is used to raise the million dollars, the cost of the debt would be lower if the debt is in the form of a bond rather than a term loan.

C) If debt is used to raise the million dollars, but $500,000 is raised as a first mortgage bond on the new plant and $500,000 as debentures, the interest rate on the first mortgage bond would be lower than it would be if the entire $1 million were raised by selling first mortgage bonds.

D) The company would be especially anxious to have a call provision included in the indenture if its management thinks that interest rates are almost certain to rise in the foreseeable future.

E) All of the above statements are false.

A) If debt is used to raise the million dollars, the cost of the debt would be lower if the debt is in the form of a fixed rate bond rather than a floating rate bond.

B) If debt is used to raise the million dollars, the cost of the debt would be lower if the debt is in the form of a bond rather than a term loan.

C) If debt is used to raise the million dollars, but $500,000 is raised as a first mortgage bond on the new plant and $500,000 as debentures, the interest rate on the first mortgage bond would be lower than it would be if the entire $1 million were raised by selling first mortgage bonds.

D) The company would be especially anxious to have a call provision included in the indenture if its management thinks that interest rates are almost certain to rise in the foreseeable future.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

An investor purchased a call option that allows her to purchase 100 shares of Dell Computer common stock for $45 per share any time during the next six months.The price she paid for the option was $2.50 per share, or $250 total, and the current market price of Dell's stock is $42.50.If the price of Dell increases to $44.50 and the investor decides to exercise it, what will be the gain or loss that results from the option position that was held? Ignore taxes and commissions.

A) $200 gain

B) $300 loss

C) $50 loss

D) $450 loss

E) None of the above.

A) $200 gain

B) $300 loss

C) $50 loss

D) $450 loss

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements is correct?

A) A floating rate bond has an advantage over a fixed rate bond because its price is more stable and this makes a floating rate preferred bond more suitable as a liquid asset.

B) Convertible preferred stock would likely appeal more to income-oriented investors because they can convert their capital gains into bond income simply by converting their preferred stock into bonds.

C) One advantage of preferred stock from an issuer's perspective is that it has a lower after-tax cost than that of debt.

D) One principal advantage of preferred stock is that preferred stockholders have a legal enforceable right to their stock dividend, thus, preferred stock is generally less risky than unsecured debt.

E) Because of the 70% dividend exclusion rule for preferred stock dividends, the higher a company's tax bracket, the more likely it is to issue preferred stock.

A) A floating rate bond has an advantage over a fixed rate bond because its price is more stable and this makes a floating rate preferred bond more suitable as a liquid asset.

B) Convertible preferred stock would likely appeal more to income-oriented investors because they can convert their capital gains into bond income simply by converting their preferred stock into bonds.

C) One advantage of preferred stock from an issuer's perspective is that it has a lower after-tax cost than that of debt.

D) One principal advantage of preferred stock is that preferred stockholders have a legal enforceable right to their stock dividend, thus, preferred stock is generally less risky than unsecured debt.

E) Because of the 70% dividend exclusion rule for preferred stock dividends, the higher a company's tax bracket, the more likely it is to issue preferred stock.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is correct?

A) If the demand curve for a firm's stock is relatively flat, the firm will have a more difficult time raising a large amount of new equity funds for expansion than would be true if the demand curve were steeper.

B) Flotation costs to raise a given amount of funds would, typically, be smaller under a best-efforts arrangement than with an underwritten offering, and the corporation is also more certain of getting the needed funds under a best-efforts offering.This is why best-efforts deals are most common.

C) Par value is not necessarily the actual price at which stock is issued by the firm, but it does constitute the maximum legal liability per share in the event of bankruptcy.Thus, if a firm sold $5 par stock to investors at $30 per share, in the event of bankruptcy the firm would have to pay the stockholders no more than $5 per share.

D) The preemptive right gives current stockholders the right to purchase, on a pro rata basis, any additional shares sold by the firm.This right protects current stockholders against both dilution of control and dilution of value.

E) One of the legal rights that often goes with common stock is the preemptive right.This is the right of present stockholders to purchase their "proportional share" of all new securities that might be issued by the firm, including common and preferred stock, and all types of debt.

A) If the demand curve for a firm's stock is relatively flat, the firm will have a more difficult time raising a large amount of new equity funds for expansion than would be true if the demand curve were steeper.

B) Flotation costs to raise a given amount of funds would, typically, be smaller under a best-efforts arrangement than with an underwritten offering, and the corporation is also more certain of getting the needed funds under a best-efforts offering.This is why best-efforts deals are most common.

C) Par value is not necessarily the actual price at which stock is issued by the firm, but it does constitute the maximum legal liability per share in the event of bankruptcy.Thus, if a firm sold $5 par stock to investors at $30 per share, in the event of bankruptcy the firm would have to pay the stockholders no more than $5 per share.

D) The preemptive right gives current stockholders the right to purchase, on a pro rata basis, any additional shares sold by the firm.This right protects current stockholders against both dilution of control and dilution of value.

E) One of the legal rights that often goes with common stock is the preemptive right.This is the right of present stockholders to purchase their "proportional share" of all new securities that might be issued by the firm, including common and preferred stock, and all types of debt.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is correct?

A) One of the advantages of common stock financing is that there is no dilution of owners' equity, as there is with debt.

B) If the market price of a stock falls below its book value, the firm can be liquidated, with the book value proceeds then distributed to the shareholders.Thus, a stock's book value per share sets a floor below which the stock's market price is unlikely to fall.

C) The preemptive right gives a firm's preferred stockholders preference to assets over common stockholders in the event the firm is liquidated.

D) The steeper the demand curve for a firm's stock, the higher will be its flotation costs when it sells a new issue of common stock, other things held constant.

E) All of the above statements are false.

A) One of the advantages of common stock financing is that there is no dilution of owners' equity, as there is with debt.

B) If the market price of a stock falls below its book value, the firm can be liquidated, with the book value proceeds then distributed to the shareholders.Thus, a stock's book value per share sets a floor below which the stock's market price is unlikely to fall.

C) The preemptive right gives a firm's preferred stockholders preference to assets over common stockholders in the event the firm is liquidated.

D) The steeper the demand curve for a firm's stock, the higher will be its flotation costs when it sells a new issue of common stock, other things held constant.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is correct?

A) Because bonds can generally be called only at a premium, meaning that the bondholder will enjoy a capital gain, including a call provision (other than a sinking fund call) in the indenture increases the value of the bond and lowers the bond's required rate of return.

B) You are considering two bonds.Both are rated double A (AA), both mature in 20 years, both have a 10 percent coupon, and both are offered to you at their $1,000 par value.However, Bond X has a sinking fund while Bond Y does not.This probably is not an equilibrium situation, as Bond X, which has the sinking fund, generally would be expected to have a higher yield than Bond Y.

C) A sinking fund provides for the orderly retirement of a debt (or preferred stock) issue.Sinking funds generally force the firm to call a percentage of the issue each year.However, the call price for sinking fund purposes is generally higher than the call price for refunding purposes.

D) Zero coupon bonds are bought primarily by pension funds and other tax exempt investors because they avoid the tax that non-tax exempt investors must pay on the accrued value each year.

E) All of the above statements are false.

A) Because bonds can generally be called only at a premium, meaning that the bondholder will enjoy a capital gain, including a call provision (other than a sinking fund call) in the indenture increases the value of the bond and lowers the bond's required rate of return.

B) You are considering two bonds.Both are rated double A (AA), both mature in 20 years, both have a 10 percent coupon, and both are offered to you at their $1,000 par value.However, Bond X has a sinking fund while Bond Y does not.This probably is not an equilibrium situation, as Bond X, which has the sinking fund, generally would be expected to have a higher yield than Bond Y.

C) A sinking fund provides for the orderly retirement of a debt (or preferred stock) issue.Sinking funds generally force the firm to call a percentage of the issue each year.However, the call price for sinking fund purposes is generally higher than the call price for refunding purposes.

D) Zero coupon bonds are bought primarily by pension funds and other tax exempt investors because they avoid the tax that non-tax exempt investors must pay on the accrued value each year.

E) All of the above statements are false.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

NOPREM Inc.is a firm whose shareholders don't possess the preemptive right.The firm currently has 1,000 shares of stock outstanding, the price is $100 per share.The firm plans to issue an additional 1,000 shares at $90.00 per share.Since the shares will be offered to the public at large, what is the amount per share that old shareholders will lose if they are excluded from purchasing new shares?

A) $90.00

B) $5.00

C) $10.00

D) $0

E) $2.50

A) $90.00

B) $5.00

C) $10.00

D) $0

E) $2.50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

B & O Railroad's convertible debentures were issued at their $1,000 par value in 2008.At any time prior to maturity on February 1, 2028, a debenture holder can exchange a bond for 25 shares of common stock.What is the conversion price, Pc?

A) $25

B) $1,000

C) $40

D) $1,025

E) $50

A) $25

B) $1,000

C) $40

D) $1,025

E) $50

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is false?

A) Any bond sold outside the country of the borrower is called an international bond.

B) Foreign bonds and Eurobonds are two important types of international bonds.

C) Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold.

D) The term Eurobond specifically applies to any foreign bonds denominated in U.S.currency.

E) None of the above.

A) Any bond sold outside the country of the borrower is called an international bond.

B) Foreign bonds and Eurobonds are two important types of international bonds.

C) Foreign bonds are bonds sold by a foreign borrower but denominated in the currency of the country in which the issue is sold.

D) The term Eurobond specifically applies to any foreign bonds denominated in U.S.currency.

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

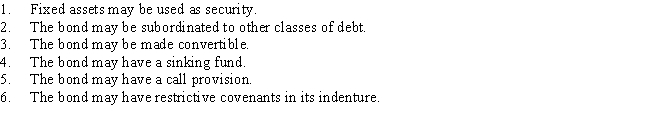

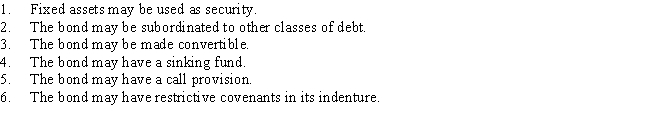

Listed below are some provisions that are often contained in bond indentures:  Which of the above provisions, each viewed alone, would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

Which of the above provisions, each viewed alone, would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

A) 1, 2, 3, 4, 5, 6

B) 1, 2, 3, 4, 6

C) 1, 3, 4, 5, 6

D) 1, 3, 4, 6

E) 1, 4, 6

Which of the above provisions, each viewed alone, would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?

Which of the above provisions, each viewed alone, would tend to reduce the yield to maturity investors would otherwise require on a newly issued bond?A) 1, 2, 3, 4, 5, 6

B) 1, 2, 3, 4, 6

C) 1, 3, 4, 5, 6

D) 1, 3, 4, 6

E) 1, 4, 6

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements concerning preferred stock is correct?

A) Preferred stock generally has a higher component cost to the firm than does common stock.

B) By law in most states, all preferred stock issues must be cumulative, meaning that the cumulative, compounded total of all unpaid preferred dividends must be paid before dividends can be paid on the firm's common stock.

C) From the issuer's point of view, preferred stock is less risky than bonds.

D) Preferred stock, because of the current tax treatment of dividends, is bought mostly by individuals in high tax brackets.

E) Unlike bonds, preferred stock cannot have a convertible feature.

A) Preferred stock generally has a higher component cost to the firm than does common stock.

B) By law in most states, all preferred stock issues must be cumulative, meaning that the cumulative, compounded total of all unpaid preferred dividends must be paid before dividends can be paid on the firm's common stock.

C) From the issuer's point of view, preferred stock is less risky than bonds.

D) Preferred stock, because of the current tax treatment of dividends, is bought mostly by individuals in high tax brackets.

E) Unlike bonds, preferred stock cannot have a convertible feature.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is correct?

A) Once a firm declares bankruptcy, it is liquidated by the trustee, who uses the proceeds to pay bondholders, unpaid wages, taxes, and lawyer fees.

B) A firm with a sinking fund payment coming due would generally choose to buy back bonds in the open market, if the price of the bond exceeds the sinking fund call price.

C) Income bonds pay interest only when the amount of the interest is actually earned by the company.Thus, these securities cannot bankrupt a company and this makes them riskier to investors than regular bonds.

D) One disadvantage of zero-coupon bonds is that issuing firms cannot realize the tax savings from issuing debt until the bonds mature.

E) Other things held constant, callable bonds should have a lower yield to maturity than noncallable bonds.

A) Once a firm declares bankruptcy, it is liquidated by the trustee, who uses the proceeds to pay bondholders, unpaid wages, taxes, and lawyer fees.

B) A firm with a sinking fund payment coming due would generally choose to buy back bonds in the open market, if the price of the bond exceeds the sinking fund call price.

C) Income bonds pay interest only when the amount of the interest is actually earned by the company.Thus, these securities cannot bankrupt a company and this makes them riskier to investors than regular bonds.

D) One disadvantage of zero-coupon bonds is that issuing firms cannot realize the tax savings from issuing debt until the bonds mature.

E) Other things held constant, callable bonds should have a lower yield to maturity than noncallable bonds.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

An investor purchased a call option that allows her to purchase 100 shares of Dell Computer common stock for $45 per share any time during the next six months.The price she paid for the option was $2.50 per share, or $250 total, and the current market price of Dell's stock is $42.50.If the price of Dell increases to $50 and the investor decides to exercise it, what will be the gain or loss that results from the option position that was held? Ignore taxes and commissions.

A) $500 gain

B) $250 loss

C) $750 gain

D) $250 gain

E) None of the above.

A) $500 gain

B) $250 loss

C) $750 gain

D) $250 gain

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

A call provision gives bondholders the right to demand, or "call for," repayment of a bond.Typically, calls are exercised if interest rates rise, because when rates rise the bondholder can get the principal amount back and reinvest it elsewhere at higher rates.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

Corporations issue and purchase a variety of financial securities for all of the following reasons EXCEPT

A) raise capital

B) hedge against risk

C) alter the capital structure of the firm

D) all of the above are reasons to issue or purchase financial securities

A) raise capital

B) hedge against risk

C) alter the capital structure of the firm

D) all of the above are reasons to issue or purchase financial securities

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is NOT a type of debt?

A) commercial paper

B) certificate of deposit

C) term loan

D) preferred stock

A) commercial paper

B) certificate of deposit

C) term loan

D) preferred stock

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

Many bond indentures allow the company to acquire bonds for a sinking fund either by purchasing bonds in the market or by a lottery administered by the trustee for the purchase of a percentage of the issue through a call at face value.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

Typically, debentures have higher interest rates than mortgage bonds primarily because the mortgage bonds are backed by assets while debentures are unsecured.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is NOT a source of equity on a firm's balance sheet?

A) additional paid-in capital

B) retained earnings

C) common stock

D) property, plant, and equipment

A) additional paid-in capital

B) retained earnings

C) common stock

D) property, plant, and equipment

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

A(n) ____ is generally obtained from a bank or insurance company and the borrower agrees to make a series of payments consisting of interest and principal.

A) putable bond

B) bankers acceptance

C) income bond

D) term loan

E) certificate of deposit

A) putable bond

B) bankers acceptance

C) income bond

D) term loan

E) certificate of deposit

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

A ____ is an agreement to between two firms where one firm agrees to sell some of its financial assets to another and then buy the financial assets back from that firm at a later time

A) buy back

B) call option

C) repurchase agreement

D) put option

A) buy back

B) call option

C) repurchase agreement

D) put option

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

Stock repurchases might be undertaken when

A) the firm has excess cash but no "good" investment opportunities

B) the price of the firm's stock is undervalued

C) the firm wants to increase the proportion of its assets that are financed with debt

D) management wants to gain more ownership control of the firm-by repurchasing the stock of other investors

E) All of the above are reasons stock repurchases might be undertaken

A) the firm has excess cash but no "good" investment opportunities

B) the price of the firm's stock is undervalued

C) the firm wants to increase the proportion of its assets that are financed with debt

D) management wants to gain more ownership control of the firm-by repurchasing the stock of other investors

E) All of the above are reasons stock repurchases might be undertaken

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

The income that an investor earns from municipal bonds is

A) exempt from federal, state, and local taxes.

B) generally exempt from federal taxes, but most states impose local taxes.

C) generally exempt from state and local taxes, but taxed federally.

D) fully taxed by federal, state, and local authorities.

A) exempt from federal, state, and local taxes.

B) generally exempt from federal taxes, but most states impose local taxes.

C) generally exempt from state and local taxes, but taxed federally.

D) fully taxed by federal, state, and local authorities.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not an advantage of a term loan over public debt offerings?

A) speed

B) low issuance costs

C) significantly lower interest rates

D) flexibility

A) speed

B) low issuance costs

C) significantly lower interest rates

D) flexibility

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

A ____ is a financial instrument which gives the owner the right but not the obligation to sell shares of stock at a specified price during a particular time period.

A) convertible security

B) call option

C) warrant

D) put option

E) callable security

A) convertible security

B) call option

C) warrant

D) put option

E) callable security

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

A(n) ____ is a bond that pays no annual interest but is sold at a discount below par, thus providing compensation to investors in the form of capital appreciation.

A) coupon bond

B) income bond

C) convertible bond

D) zero coupon bond

E) callable bond

A) coupon bond

B) income bond

C) convertible bond

D) zero coupon bond

E) callable bond

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

Preferred stockholders generally are given the right to vote for directors if

A) the preferred stock is participating preferred stock.

B) the directors are elected under the cumulative method.

C) the common stockholders do not vote in new directors with a clear majority.

D) the company cannot pay its interest payments.

E) the company has not paid the preferred dividend for a specified period.

A) the preferred stock is participating preferred stock.

B) the directors are elected under the cumulative method.

C) the common stockholders do not vote in new directors with a clear majority.

D) the company cannot pay its interest payments.

E) the company has not paid the preferred dividend for a specified period.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

A protective feature on preferred stock that requires preferred dividends previously not paid to be disbursed before any common stock dividends can be paid is called what?

A) cumulative dividends

B) callable dividends

C) putable dividends

D) historical dividends

E) paid dividends

A) cumulative dividends

B) callable dividends

C) putable dividends

D) historical dividends

E) paid dividends

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

Under a term loan the borrower agrees to make a series of amortized payments on specific dates.Although speed and flexibility are two advantages of term loans, such loans typically have high issuance costs.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

Bond ratings of ____ and higher are considered investment grade.

A) AAA

B) AA

C) A

D) BBB

A) AAA

B) AA

C) A

D) BBB

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

Sharon has a convertible bond with a face value of $1,000 that can be converted into 40 shares of common stock of Mountain Ice Corporation.If the current price of the stock is $20, what is the conversion price of the bond?

A) $20

B) $50

C) $800

D) $500

E) None of the above.

A) $20

B) $50

C) $800

D) $500

E) None of the above.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is NOT an example of a financial asset?

A) convertible bond

B) certificate of deposit

C) preferred stock

D) inventory

E) mutual fund

A) convertible bond

B) certificate of deposit

C) preferred stock

D) inventory

E) mutual fund

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

A French firm is buying $1,000,000 of optical cable from a firm in the United States.The French firm will pay for the cable in thirty days.To protect itself from changes in the exchange rate between the Euro and dollar, the French firm enters into a futures contract to purchase $1,000,000 at a price of $1.25/€.How many Euros will it cost the French firm to purchase $1,000,000 using the futures contract?

A) €125,000,000

B) €2,500,000

C) €1,250,000

D) €1,000,000

E) €800,000

A) €125,000,000

B) €2,500,000

C) €1,250,000

D) €1,000,000

E) €800,000

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

When a corporation's shares are owned by a few individuals who are associated with the firm's management, we say that the firm is "closely held."

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

Several types of futures contracts are available to hedge against price changes in such items as gold, agricultural products, and so forth.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

A proxy is a document giving one party the authority to act for another party, typically the power to vote shares of common stock.A proxy can be an important tool relating to control of the firm.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

Classified stock is one can be used to meet special needs of a firm, such as when owners of a start-up firm need capital but don't want to relinquish control of the firm.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

If a firm's stockholders are given the preemptive right, this means that a group of stockholders can call for a meeting to replace the management.Without the preemptive right, dissident stockholders would have to seek to oust management through a proxy fight.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

Because junk bonds are such high-risk instruments, the returns on such bonds aren't very high and the existence of this market detracts from social welfare.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

The "preferred" feature of preferred stock means that it normally will generate a higher total return for the stockholder than common stock.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

The owner of a convertible bond owns, in effect, both a bond and a call option.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

The exercise price is the price that must be paid for a share of common stock when it is bought by exercising a warrant.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

Companies can have different types of preferred stock, such as Class A or Class B, with each type having different rights and privileges, but by law there can be only one class of common stock.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

The striking price is different from the exercise price and deals with convertibles rather than with warrants.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

An option is a contract which gives its holder the right to buy (sell) an asset at a predetermined price within a specified period of time.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

Par value is not necessarily the actual price at which common stock is issued by the firm, but it does constitute the maximum legal liability per share in the event of bankruptcy.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

There is an inverse relationship between bond ratings and the required return on a bond.The required return is lowest for AAA rated bonds, and required returns increase as the ratings get lower (worse).

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

Issuing zero coupon bonds might appeal to a company that is considering investing in a long-term project that will not generate positive cash flows for several years.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

Founders' shares is a type of classified stock where the shares are owned by the firm's founders and they retain the sole voting rights to those shares but have restricted dividends for a specified time period.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

In the event of bankruptcy, debtholders have a prior or first claim to a firm's income and assets over the claims of both common and preferred stockholders.However, in bankruptcy all debtholders are treated equally as a single class of claimants.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

The additional paid-in capital account represents the difference between a stock's par value and the funds actually received from the sale of new common stock.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

A publicly owned corporation is simply a company whose shares are held by the investing public, which may include other corporations and institutions.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

A junk bond is a high risk, high yield debt instrument typically used to finance a leveraged buyout or a merger, or to provide financing to a company of questionable financial strength.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck