Deck 10: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 10: Stockholders Equity

1

A corporation is not an entity that is separate from its owners.

False

2

The arbitrary amount assigned by a company to a share of its stock is the:

A)stated value per share.

B)par value per share.

C)book value per share.

D)A and B

A)stated value per share.

B)par value per share.

C)book value per share.

D)A and B

D

3

Which one of the following is NOT a stockholder's right of ownership in a corporation?

A)the right to participate in management by voting on matters that come before the stockholders

B)the right to receive a proportionate share of the assets remaining after all liabilities are paid upon liquidation

C)the right to maintain one's proportionate share of ownership in the corporation

D)the right to decide if a dividend should be distributed

A)the right to participate in management by voting on matters that come before the stockholders

B)the right to receive a proportionate share of the assets remaining after all liabilities are paid upon liquidation

C)the right to maintain one's proportionate share of ownership in the corporation

D)the right to decide if a dividend should be distributed

D

4

Which statement is FALSE?

A)Preferred stockholders receive dividends before the common stockholders only if the preferred stock is cumulative.

B)Preferred stockholders receive dividends before the common stockholders.

C)Preferred stockholders receive assets before the common stockholders if the corporation liquidates.

D)Preferred stockholders have the same basic four rights as common stockholders,unless a right is taken away.

A)Preferred stockholders receive dividends before the common stockholders only if the preferred stock is cumulative.

B)Preferred stockholders receive dividends before the common stockholders.

C)Preferred stockholders receive assets before the common stockholders if the corporation liquidates.

D)Preferred stockholders have the same basic four rights as common stockholders,unless a right is taken away.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

Stockholders' equity is divided into:

A)retained earnings and paid-in capital.

B)retained earnings and common stock.

C)assets and liabilities.

D)common stock and preferred stock.

A)retained earnings and paid-in capital.

B)retained earnings and common stock.

C)assets and liabilities.

D)common stock and preferred stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

Double taxation means that the:

A)corporation's income tax is allocated to the shareholders based on ownership percentage.

B)corporate earnings are subject to state and federal income tax.

C)corporation pays taxes on its earnings and the shareholders pay taxes on the dividends received from the corporation.

D)shareholders' dividends are taxed at the corporate tax rate.

A)corporation's income tax is allocated to the shareholders based on ownership percentage.

B)corporate earnings are subject to state and federal income tax.

C)corporation pays taxes on its earnings and the shareholders pay taxes on the dividends received from the corporation.

D)shareholders' dividends are taxed at the corporate tax rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

A stockholder has the right to vote in the election of the board of directors.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

A corporation acts under its own name and not the name of its stockholders.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

Dividends are declared by the:

A)Chief Accounting Officer.

B)Chief Financial Officer.

C)President.

D)Board of directors.

A)Chief Accounting Officer.

B)Chief Financial Officer.

C)President.

D)Board of directors.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

Stockholders have limited liability for a corporation's debts.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

If a corporation pays taxes on its income,then the stockholders will not have to pay taxes on the dividends received from that corporation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

The chairperson of the board of directors often has the title of:

A)Chief Financial Officer (CFO).

B)President.

C)Chief Executive Officer (CEO).

D)Chief Operating Officer (COO).

A)Chief Financial Officer (CFO).

B)President.

C)Chief Executive Officer (CEO).

D)Chief Operating Officer (COO).

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

A new corporation forms every time there is a change in ownership in the shares of common stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

The charter reveals the number of shares of common stock a corporation can sell.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

What statement about corporations is FALSE?

A)An advantage of a corporation is ease of transfer of ownership.

B)An advantage of a corporation is a greater ability to raise capital than other forms of organization.

C)An advantage of a corporation is limited life.

D)An advantage of a corporation is stockholders have limited liability for a corporation's debts and acts.

A)An advantage of a corporation is ease of transfer of ownership.

B)An advantage of a corporation is a greater ability to raise capital than other forms of organization.

C)An advantage of a corporation is limited life.

D)An advantage of a corporation is stockholders have limited liability for a corporation's debts and acts.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

If a corporation has only one class of stock,it is understood to be:

A)preferred stock.

B)common stock.

C)participating stock.

D)redeemable stock.

A)preferred stock.

B)common stock.

C)participating stock.

D)redeemable stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is NOT considered to be an advantage of forming a corporation?

A)Continuous life

B)Government regulations

C)Ability to raise more money

D)Limited liability of owners for corporation's debts

A)Continuous life

B)Government regulations

C)Ability to raise more money

D)Limited liability of owners for corporation's debts

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

Stockholders of a corporation directly elect the:

A)Board of directors.

B)President of the corporation.

C)Chief Financial Officer of the corporation.

D)Chairperson of the Board.

A)Board of directors.

B)President of the corporation.

C)Chief Financial Officer of the corporation.

D)Chairperson of the Board.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

Preferred stock that must be paid back or redeemed by a corporation is reported as a(n)________ on the balance sheet.

A)component of stockholders' equity

B)contra account in stockholders' equity

C)liability

D)asset

A)component of stockholders' equity

B)contra account in stockholders' equity

C)liability

D)asset

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

The basic unit of ownership for a corporation is:

A)a share of preferred stock.

B)a share of common stock.

C)a cash dividend.

D)a stock dividend.

A)a share of preferred stock.

B)a share of common stock.

C)a cash dividend.

D)a stock dividend.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

Apple Inc.issued 1 million shares of no-par common stock for $10 million.What journal entry is prepared?

A)debit Cash $10 million and credit Paid-in Capital in Excess of Par $10 million

B)debit Cash $10 million and credit Retained Earnings $10 million

C)debit Cash $10 million and credit Paid-in Capital in Excess of Stated Value $10 million

D)debit Cash $10 million and credit Common Stock $10 million

A)debit Cash $10 million and credit Paid-in Capital in Excess of Par $10 million

B)debit Cash $10 million and credit Retained Earnings $10 million

C)debit Cash $10 million and credit Paid-in Capital in Excess of Stated Value $10 million

D)debit Cash $10 million and credit Common Stock $10 million

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

Paltrowski Company issued 1 million shares of $10 stated value common stock.The selling price was $40 per share.What journal entry is prepared?

A)debit Cash $40 million and credit Common Stock $40 million

B)debit Cash $40 million,credit Common Stock $10 million and credit Paid-in Capital in Excess of Par-Common $30 million

C)debit Cash $40 million,credit Common Stock $10 million and credit Paid-in Capital in Excess of Stated Value-Common $30 million

D)debit Cash $40 million and credit Retained Earnings $40 million

A)debit Cash $40 million and credit Common Stock $40 million

B)debit Cash $40 million,credit Common Stock $10 million and credit Paid-in Capital in Excess of Par-Common $30 million

C)debit Cash $40 million,credit Common Stock $10 million and credit Paid-in Capital in Excess of Stated Value-Common $30 million

D)debit Cash $40 million and credit Retained Earnings $40 million

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

A company can sell common stock in exchange for assets other than cash.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

If stock is issued for an asset other than cash,the asset should be recorded on the books of the corporation at:

A)fair market value of the asset.

B)book value of the asset.

C)par value of the stock.

D)fair value of the stock minus the par value of the stock.

A)fair market value of the asset.

B)book value of the asset.

C)par value of the stock.

D)fair value of the stock minus the par value of the stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

The journal entry to record common stock issued at its par value includes a:

A)debit to Retained Earnings.

B)debit to Common Stock.

C)credit to Retained Earnings.

D)credit to Common Stock.

A)debit to Retained Earnings.

B)debit to Common Stock.

C)credit to Retained Earnings.

D)credit to Common Stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

Convertible preferred stock is usually convertible into the issuer's common stock at the discretion of the preferred stockholder.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

Miller Corporation issued 5,000 shares of its $5 par value common stock in payment for attorney services billed at $40,000.Miller Corporation's stock has been actively trading at $8 per share.The journal entry for this transaction would include a:

A)credit to Paid-in Capital in Excess of Par-Common for $40,000.

B)credit to Paid-in Capital in Excess of Par-Common for $15,000.

C)credit to Cash for $40,000.

D)credit to Common Stock for $40,000.

A)credit to Paid-in Capital in Excess of Par-Common for $40,000.

B)credit to Paid-in Capital in Excess of Par-Common for $15,000.

C)credit to Cash for $40,000.

D)credit to Common Stock for $40,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

Another name for Paid-in Capital in Excess of Par is Additional Paid-in Capital.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

If a corporation issues 4,000 shares of $1 par value common stock for $8,000,the journal entry would include a credit to:

A)Common Stock for $8,000.

B)Paid-in Capital in Excess of Par-Common for $8,000.

C)Common Stock for $4,000.

D)Retained Earnings for $4,000.

A)Common Stock for $8,000.

B)Paid-in Capital in Excess of Par-Common for $8,000.

C)Common Stock for $4,000.

D)Retained Earnings for $4,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

Badger Corporation issued 5,000 shares of its $5 par value common stock in payment for attorney services billed at $40,000.Badger Corporation's stock has been actively trading at $8 per share.The journal entry for this transaction would include a:

A)debit to Legal Expense $25,000.

B)debit to Legal Expense $40,000.

C)credit to Common Stock $15,000.

D)credit to Common Stock $40,000.

A)debit to Legal Expense $25,000.

B)debit to Legal Expense $40,000.

C)credit to Common Stock $15,000.

D)credit to Common Stock $40,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

Legal capital for a corporation equals:

A)the selling price of stock that has been issued.

B)the par value of stock that has been authorized.

C)the par value of stock that has been issued.

D)the par value of stock that is outstanding.

A)the selling price of stock that has been issued.

B)the par value of stock that has been authorized.

C)the par value of stock that has been issued.

D)the par value of stock that is outstanding.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

The number of shares of authorized stock of a corporation:

A)changes every time stock is sold.

B)is stated in the charter.

C)has no limit.

D)must be recorded as a journal entry.

A)changes every time stock is sold.

B)is stated in the charter.

C)has no limit.

D)must be recorded as a journal entry.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

If a corporation issues 5,000 shares of $5 par value common stock for $95,000,the journal entry would include a credit to:

A)Common Stock for $95,000.

B)Paid-in Capital in Excess of Par-Common for $95,000.

C)Common Stock for $70,000.

D)Paid-in Capital in Excess of Par-Common for $70,000.

A)Common Stock for $95,000.

B)Paid-in Capital in Excess of Par-Common for $95,000.

C)Common Stock for $70,000.

D)Paid-in Capital in Excess of Par-Common for $70,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

Corporations may sell stock directly to the stockholders.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

When 100 shares of $1 par value Common Stock are issued at $25 per share,Paid-in Capital in Excess of Par-Common will:

A)increase $100.

B)increase $2,500.

C)increase $2,400.

D)stay the same.

A)increase $100.

B)increase $2,500.

C)increase $2,400.

D)stay the same.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

When common stock is issued for services provided to the corporation,the corporation usually recognizes an expense for the fair market value of the services provided.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

Preferred stock is NOT similar to debt because:

A)preferred dividends are not tax-deductible whereas interest expense is tax-deductible.

B)preferred dividends do not have to be paid whereas interest expense must be paid.

C)preferred stock does not have a maturity date whereas debt usually has a maturity date.

D)all of the above.

A)preferred dividends are not tax-deductible whereas interest expense is tax-deductible.

B)preferred dividends do not have to be paid whereas interest expense must be paid.

C)preferred stock does not have a maturity date whereas debt usually has a maturity date.

D)all of the above.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

When a company issues common stock at a price per share greater than its par value per share,the excess should be credited to:

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Excess Capital.

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Excess Capital.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

When reporting stockholders' equity on the balance sheet,a corporation lists the accounts in the following order:

A)Retained Earnings,Preferred Stock,Common Stock.

B)Common Stock,Preferred Stock,Additional Paid-in Capital,Retained Earnings.

C)Preferred Stock,Common Stock,Additional Paid-in Capital,Retained Earnings.

D)Retained Earnings,Common Stock,Paid-in Capital in Excess of Par-Common.

A)Retained Earnings,Preferred Stock,Common Stock.

B)Common Stock,Preferred Stock,Additional Paid-in Capital,Retained Earnings.

C)Preferred Stock,Common Stock,Additional Paid-in Capital,Retained Earnings.

D)Retained Earnings,Common Stock,Paid-in Capital in Excess of Par-Common.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

The difference between the issue price per share of the stock and the par value per share of the stock is credited to:

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par.

D)Income Summary.

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par.

D)Income Summary.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

Johnson Corporation had the following transactions:

1.Issued 7,000 shares of common stock with a stated value of $15 per share for $155,000.

2.Issued 3,000 shares of $100 par value preferred stock at $117 per share for cash.

Required:

Prepare the journal entries for the above transactions.Omit explanations.

1.Issued 7,000 shares of common stock with a stated value of $15 per share for $155,000.

2.Issued 3,000 shares of $100 par value preferred stock at $117 per share for cash.

Required:

Prepare the journal entries for the above transactions.Omit explanations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

What is the calculation to determine the number of outstanding shares of stock?

A)number of treasury stock shares plus number of issued shares

B)number of authorized shares minus number of issued shares

C)number of issued shares minus number of treasury shares

D)number of authorized shares minus treasury shares

A)number of treasury stock shares plus number of issued shares

B)number of authorized shares minus number of issued shares

C)number of issued shares minus number of treasury shares

D)number of authorized shares minus treasury shares

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

The purchase of treasury stock decreases the number of shares outstanding.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

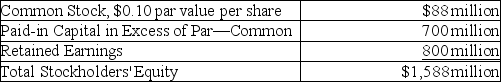

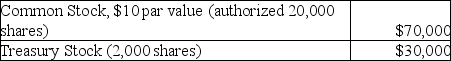

Lisa Laskowski Company reports the following information at the fiscal year end of December 31,2015:  What was the average selling price for the common stock sold?

What was the average selling price for the common stock sold?

A)$0.088 per share

B)$0.10 per share

C)$0.895 per share

D)$1.805 per share

What was the average selling price for the common stock sold?

What was the average selling price for the common stock sold?A)$0.088 per share

B)$0.10 per share

C)$0.895 per share

D)$1.805 per share

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

The purchase of treasury stock has the same effect on stockholders' equity as issuing stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

Amber Corporation purchases 40,000 shares of its own $10 par value common stock for $30 per share.What will be the effect on stockholders' equity?

A)Increase $400,000

B)Increase $1,200,000

C)Decrease $400,000

D)Decrease $1,200,000

A)Increase $400,000

B)Increase $1,200,000

C)Decrease $400,000

D)Decrease $1,200,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

Smith Corporation purchases 40,000 shares of its own $10 par value common stock for $50 per share.What will be the effect on stockholders' equity?

A)Increase $400,000

B)Decrease $400,000

C)Increase $2,000,000

D)Decrease $2,000,000

A)Increase $400,000

B)Decrease $400,000

C)Increase $2,000,000

D)Decrease $2,000,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

Previously issued stock that a corporation purchases from shareholders is called:

A)outstanding stock.

B)authorized stock.

C)issued stock.

D)treasury stock.

A)outstanding stock.

B)authorized stock.

C)issued stock.

D)treasury stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

Treasury stock accounts for the difference between the number of:

A)issued shares and authorized shares.

B)issued shares and preferred shares.

C)outstanding shares and issued shares.

D)authorized shares and outstanding shares.

A)issued shares and authorized shares.

B)issued shares and preferred shares.

C)outstanding shares and issued shares.

D)authorized shares and outstanding shares.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

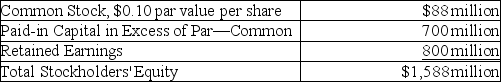

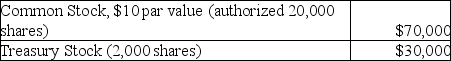

Lewandowski Company reports the following information at the fiscal year end of December 31,2015:  What is the total paid-in capital for this company at December 31,2015?

What is the total paid-in capital for this company at December 31,2015?

A)$88 million

B)$788 million

C)$888 million

D)$1,588 million

What is the total paid-in capital for this company at December 31,2015?

What is the total paid-in capital for this company at December 31,2015?A)$88 million

B)$788 million

C)$888 million

D)$1,588 million

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

Treasury stock belongs in the stockholders' equity section of the balance sheet.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

During the month of February,B & B Builders,Inc.completed the following transactions related to its stock:

• February 2: Issued 3,000 shares of no-par,Class A common stock with a stated value of $1 for $15 cash per share.

• February 3: Issued 9,000 shares of no-par,Class B common stock with no stated value for $20 per share

• February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required:

Prepare journal entries for the above transactions.Omit explanations.

• February 2: Issued 3,000 shares of no-par,Class A common stock with a stated value of $1 for $15 cash per share.

• February 3: Issued 9,000 shares of no-par,Class B common stock with no stated value for $20 per share

• February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required:

Prepare journal entries for the above transactions.Omit explanations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

The purchase of treasury stock by a corporation increases total assets and stockholders' equity.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

A company sells 1,000,000 shares of $0.50 par value preferred stock.The selling price for the stock was $3,000,000.The stated dividend is $1 per share and the stock is cumulative.What journal entry is needed for the sale?

A)debit Cash $3 million and credit Preferred Stock $3,000,000

B)debit Cash $3 million,credit Preferred Stock $500,000 and credit Paid-in Capital in Excess of Par-Preferred $2.5 million

C)debit Cash $3 million and credit Paid-in Capital in Excess of Par-Preferred $3 million

D)debit Cash $3 million and credit Retained Earnings $3 million

A)debit Cash $3 million and credit Preferred Stock $3,000,000

B)debit Cash $3 million,credit Preferred Stock $500,000 and credit Paid-in Capital in Excess of Par-Preferred $2.5 million

C)debit Cash $3 million and credit Paid-in Capital in Excess of Par-Preferred $3 million

D)debit Cash $3 million and credit Retained Earnings $3 million

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

Reasons that a company would purchase treasury stock include all of the following EXCEPT:

A)management wants to avoid a takeover by an outside party.

B)it needs the stock for distribution to employees under stock purchase plans.

C)it wants to increase net assets by buying its stock low and reselling it at a higher price.

D)management wants to decrease earnings per share of common stock.

A)management wants to avoid a takeover by an outside party.

B)it needs the stock for distribution to employees under stock purchase plans.

C)it wants to increase net assets by buying its stock low and reselling it at a higher price.

D)management wants to decrease earnings per share of common stock.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

Gruber Law Offices paid $54,000 to buy back 9,000 shares of its $1 par value common stock.The stock was sold later at a selling price of $10 per share.The journal entry to record the sale would include a:

A)credit to Paid-in Capital from Treasury Stock Transactions $54,000.

B)debit to Common Stock $54,000.

C)credit to Paid-in Capital from Treasury Stock Transactions $36,000.

D)credit to Common Stock $36,000.

A)credit to Paid-in Capital from Treasury Stock Transactions $54,000.

B)debit to Common Stock $54,000.

C)credit to Paid-in Capital from Treasury Stock Transactions $36,000.

D)credit to Common Stock $36,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

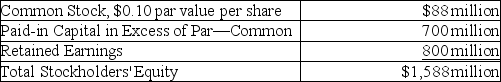

Buetters Company reports the following information at the fiscal year end of December 31,2015:  How many shares of common stock were sold?

How many shares of common stock were sold?

A)8.8 million

B)88 million

C)788 million

D)880 million

How many shares of common stock were sold?

How many shares of common stock were sold?A)8.8 million

B)88 million

C)788 million

D)880 million

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

Treasury stock is a contra-stockholders' equity account.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

Peter's Computers purchased 4,000 shares of its own $10 par value common stock for $92,000.As a result of this transaction:

A)Peter's stockholders' equity increased $52,000.

B)Peter's stockholders' equity increased $40,000.

C)Peter's stockholders' equity decreased $92,000.

D)Peter's stockholders' equity increased $92,000.

A)Peter's stockholders' equity increased $52,000.

B)Peter's stockholders' equity increased $40,000.

C)Peter's stockholders' equity decreased $92,000.

D)Peter's stockholders' equity increased $92,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

If treasury stock is sold at a price greater than its reacquisition cost,the difference is:

A)debited to Paid-in Capital from Treasury Stock Transactions.

B)credited to Paid-in Capital from Treasury Stock Transactions.

C)debited to Retained Earnings.

D)credited to Retained Earnings.

A)debited to Paid-in Capital from Treasury Stock Transactions.

B)credited to Paid-in Capital from Treasury Stock Transactions.

C)debited to Retained Earnings.

D)credited to Retained Earnings.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

There is no journal entry for cash dividends on the date of record.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

On February 3,2015 Bombard Corporation acquired 4,000 shares of its own $1 par value common stock for $30 per share.On May 24,2015,1,500 shares of the treasury stock were sold for $35 per share.

Required:

Prepare the journal entries to record the purchase and sale of the treasury stock.Omit explanations.

Required:

Prepare the journal entries to record the purchase and sale of the treasury stock.Omit explanations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

Orlando Corporation incorporated on January 2,2015.During 2015,Orlando had the following transactions: • issued 30,000 shares of common stock at $25 per share.The par value per share is $1.

• purchased 5,000 shares of treasury stock at $28 per share

• had net income of $400,000.

What is the total amount of stockholders' equity as of December 31,2015?

A)$610,000

B)$750,000

C)$1,010,000

D)$1,150,000

• purchased 5,000 shares of treasury stock at $28 per share

• had net income of $400,000.

What is the total amount of stockholders' equity as of December 31,2015?

A)$610,000

B)$750,000

C)$1,010,000

D)$1,150,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

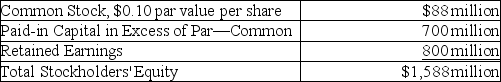

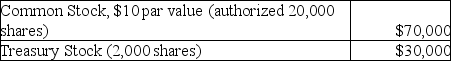

Mews Corporation has the following information reported on the balance sheet as of December 31,2014:  Based on the information above,how many shares of common stock have been issued?

Based on the information above,how many shares of common stock have been issued?

A)20,000

B)7,000

C)5,000

D)2,000

Based on the information above,how many shares of common stock have been issued?

Based on the information above,how many shares of common stock have been issued?A)20,000

B)7,000

C)5,000

D)2,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

On February 1,2015,United Delivery Services reports Common Stock of $1 million,Paid-in Capital in Excess of Par--Common of $9 million and Retained Earnings of $10 million.On February 2,2015,United Delivery Services reacquired 10,000 shares of its $10 par value common stock at $50 per share.On February 23,United Delivery Services sold 1,000 of the reacquired shares at $65 per share.On February 27,the remaining 9,000 shares were sold at $40 per share.

Required:

1.Prepare the journal entries necessary to record these transactions.Omit explanations.

Required:

1.Prepare the journal entries necessary to record these transactions.Omit explanations.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

Passed dividends on cumulative preferred stock are considered to be a liability.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

The Retained Earnings account contains cash for paying dividends to the stockholders.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

A company buys treasury stock for $10 per share.The company later sells the treasury stock for $11 per share.What is the difference between the resale price and the cost of the treasury stock called?

A)Gain on Sale of Treasury Stock

B)Loss on Sale of Treasury Stock

C)Paid-in Capital in Excess of Par

D)Paid-in Capital from Treasury Stock Transactions

A)Gain on Sale of Treasury Stock

B)Loss on Sale of Treasury Stock

C)Paid-in Capital in Excess of Par

D)Paid-in Capital from Treasury Stock Transactions

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

Only stockholders holding stock on the record date will receive a dividend.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

Dividends may be declared and paid in cash only.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

Small stock dividends are recorded at market value per share and large stock dividends are recorded at par value per share.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

A credit balance in Retained Earnings indicates that a company's lifetime earnings exceeded its lifetime losses and dividends declared.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

Bloom Corporation issued 20,000 shares of common stock.Bloom purchased 2,000 shares and later reissued 1,000 shares.How many shares are issued and outstanding?

A)18,000 issued and 18,000 outstanding

B)20,000 issued and 18,000 outstanding

C)19,000 issued and 19,000 outstanding

D)20,000 issued and 19,000 outstanding

A)18,000 issued and 18,000 outstanding

B)20,000 issued and 18,000 outstanding

C)19,000 issued and 19,000 outstanding

D)20,000 issued and 19,000 outstanding

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

A debit balance in the Retained Earnings account indicates a deficit in Retained Earnings.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

The purchase of treasury stock returns ________ to the stockholders but also ________.

A)stock; increases their ownership of the company

B)stock; decreases their ownership of the company

C)cash; increases their ownership of the company

D)cash; decreases their ownership of the company

A)stock; increases their ownership of the company

B)stock; decreases their ownership of the company

C)cash; increases their ownership of the company

D)cash; decreases their ownership of the company

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

Kunze Corporation has $1 par value Common Stock with 100,000 shares authorized and 25,000 shares issued.The journal entry to record Kunze's purchase of 5,000 shares of common stock at $5 per share would be:

A)debit Common Stock for $5,000,debit Paid-in Capital in Excess of Par-Common for $20,000 and credit Cash for $25,000.

B)debit Common Stock for $25,000 and credit Cash for $25,000.

C)debit Cash for $25,000,credit Common Stock for $5,000 and credit Paid-in Capital in Excess of Par-Common for $20,000.

D)debit Treasury Stock for $25,000 and credit Cash for $25,000.

A)debit Common Stock for $5,000,debit Paid-in Capital in Excess of Par-Common for $20,000 and credit Cash for $25,000.

B)debit Common Stock for $25,000 and credit Cash for $25,000.

C)debit Cash for $25,000,credit Common Stock for $5,000 and credit Paid-in Capital in Excess of Par-Common for $20,000.

D)debit Treasury Stock for $25,000 and credit Cash for $25,000.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

Common stockholders receive dividends even if the total dividend is not large enough to pay the preferred stockholders first.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

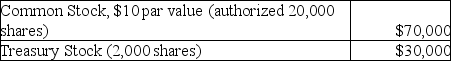

78

Marvin Corporation has the following information reported on the balance sheet as of December 31,2014:  Based on the information above,how many shares of common stock are outstanding?

Based on the information above,how many shares of common stock are outstanding?

A)20,000

B)7,000

C)5,000

D)2,000

Based on the information above,how many shares of common stock are outstanding?

Based on the information above,how many shares of common stock are outstanding?A)20,000

B)7,000

C)5,000

D)2,000

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

Treasury stock has a:

A)debit balance,the opposite of other stockholders' equity accounts.

B)credit balance,the same as other stockholders' equity accounts.

C)credit balance,the opposite of other stockholders' equity accounts.

D)debit balance,the same as other stockholders' equity accounts.

A)debit balance,the opposite of other stockholders' equity accounts.

B)credit balance,the same as other stockholders' equity accounts.

C)credit balance,the opposite of other stockholders' equity accounts.

D)debit balance,the same as other stockholders' equity accounts.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

When treasury stock is purchased,accountants record treasury stock at:

A)the stock's par value.

B)the stock's original selling price.

C)the stock's current market value.

D)the difference between the original selling price and the par value.

A)the stock's par value.

B)the stock's original selling price.

C)the stock's current market value.

D)the difference between the original selling price and the par value.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck