Deck 6: Inventory and Cost of Goods Sold

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 6: Inventory and Cost of Goods Sold

1

The largest expense category on the income statement of most merchandising companies is:

A) cost of goods sold

B) other expenses

C) selling expenses

D) administrative expenses

A) cost of goods sold

B) other expenses

C) selling expenses

D) administrative expenses

A

2

Technological advances in computers and inventory tracking have:

A) made perpetual inventory records less expensive to maintain

B) completely eliminated the need to physically count inventory

C) made journal entries unnecessary for inventory purchases

D) made perpetual inventory records more expensive to maintain

A) made perpetual inventory records less expensive to maintain

B) completely eliminated the need to physically count inventory

C) made journal entries unnecessary for inventory purchases

D) made perpetual inventory records more expensive to maintain

A

3

Perpetual inventory records provide information helpful in making all the following decisions except:

A) whether immediate delivery of merchandise is possible

B) when to reorder

C) how quickly items of merchandise are selling

D) whether to extend credit to a customer

A) whether immediate delivery of merchandise is possible

B) when to reorder

C) how quickly items of merchandise are selling

D) whether to extend credit to a customer

D

4

In a perpetual inventory system, businesses maintain a continuous record for each inventory item.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

All of the following are deducted from the purchase price of inventory in determining cost of goods sold except:

A) purchase returns

B) purchase allowances

C) freight in

D) purchase discounts

A) purchase returns

B) purchase allowances

C) freight in

D) purchase discounts

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

A purchase allowance is a decrease in the cost of purchases because the purchaser returned goods to the supplier.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

If a company is using a perpetual inventory system, the balance in its inventory account three-quarters of the way through an accounting period would be equal to:

A) the total of the beginning inventory plus goods purchased during the accounting period

B) the inventory on hand at the beginning of the period

C) the amount of inventory on hand at that date

D) the amount of goods purchased during the period

A) the total of the beginning inventory plus goods purchased during the accounting period

B) the inventory on hand at the beginning of the period

C) the amount of inventory on hand at that date

D) the amount of goods purchased during the period

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

If a company uses a periodic inventory system, it will maintain all of the following accounts except:

A) Cost of Goods Sold

B) Purchases

C) Sales

D) Inventory

A) Cost of Goods Sold

B) Purchases

C) Sales

D) Inventory

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

A perpetual inventory system offers all the following advantages except:

A) inventory balances are always current

B) it enhances internal control

C) it is less expensive than a periodic system

D) it helps salespeople determine whether there is a sufficient supply of inventory on hand to fill customer orders

A) inventory balances are always current

B) it enhances internal control

C) it is less expensive than a periodic system

D) it helps salespeople determine whether there is a sufficient supply of inventory on hand to fill customer orders

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

Sales taxes paid by a merchandising company on its sales are normally included in the cost of goods sold account.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

King Size International buys beds from a manufacturer for sale overseas. A shipment of beds to King Size was received slightly damaged. The manufacturer agreed to take an extra 10% off of its invoice price to King Size if it will keep and sell the beds to its customers. In this situation, King Size has received a:

A) purchase return

B) purchase discount

C) purchase allowance

D) sales allowance

A) purchase return

B) purchase discount

C) purchase allowance

D) sales allowance

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

Freight-in is the transportation cost, paid by the buyer, to move goods from the seller to the buyer.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

In a merchandising business, gross margin is equal to sales revenue minus:

A) the sum of cost of goods sold, operating expenses, and prepaid expenses

B) the sum of cost of goods sold and operating expenses

C) cost of goods sold

D) the sum of cost of goods sold and sales commissions

A) the sum of cost of goods sold, operating expenses, and prepaid expenses

B) the sum of cost of goods sold and operating expenses

C) cost of goods sold

D) the sum of cost of goods sold and sales commissions

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

Under a periodic inventory system, which of the following entries would record the purchase of merchandise on credit?

A) Debit Inventory and credit Accounts Payable

B) Credit Purchases and debit Cost of Goods Sold

C) Credit Sales and debit Accounts Receivable

D) Debit Purchases and credit Accounts Payable

A) Debit Inventory and credit Accounts Payable

B) Credit Purchases and debit Cost of Goods Sold

C) Credit Sales and debit Accounts Receivable

D) Debit Purchases and credit Accounts Payable

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following would be included in the Cost of Goods Sold account on a merchandising company's income statement?

A) shipping costs from the manufacturer to the merchandiser

B) sales commissions

C) costs of advertising

D) sales taxes

A) shipping costs from the manufacturer to the merchandiser

B) sales commissions

C) costs of advertising

D) sales taxes

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following would not be included in the Inventory account on a merchandising company's balance sheet?

A) customs duties

B) sales taxes received

C) shipping costs from the manufacturer to the merchandising company

D) insurance on the merchandise while in transit from the manufacturer

A) customs duties

B) sales taxes received

C) shipping costs from the manufacturer to the merchandising company

D) insurance on the merchandise while in transit from the manufacturer

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

Using a perpetual inventory system, which of the following entries would record the cost of merchandise sold on credit?

A) Credit Sales and debit Accounts Receivable

B) Debit Cost of Goods Sold and credit Purchases

C) Debit Cost of Goods Sold and credit Inventory

D) Debit Inventory and credit Cost of Goods Sold

A) Credit Sales and debit Accounts Receivable

B) Debit Cost of Goods Sold and credit Purchases

C) Debit Cost of Goods Sold and credit Inventory

D) Debit Inventory and credit Cost of Goods Sold

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

Historically, perpetual inventory systems have been used to account for inventory items with a low unit cost.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

Sales commissions are not normally included in the cost of goods sold account.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

Under a perpetual inventory system, which of the following entries would record the purchase of merchandise on credit?

A) Debit Inventory and credit Accounts Payable

B) Credit Purchases and Debit Cost of Goods Sold

C) Credit Sales and debit Accounts Receivable

D) Debit Purchases and credit Accounts Payable

A) Debit Inventory and credit Accounts Payable

B) Credit Purchases and Debit Cost of Goods Sold

C) Credit Sales and debit Accounts Receivable

D) Debit Purchases and credit Accounts Payable

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

When using the weighted-average cost method to determine the cost of inventory sold, the weighted-average cost per unit is calculated as the:

A) cost of goods available for sale divided by the number of units available for sale

B) cost of goods sold divided by the average number of units in inventory

C) cost of goods sold divided by the number of units sold

D) cost of goods in ending inventory divided by the number of units in ending inventory

A) cost of goods available for sale divided by the number of units available for sale

B) cost of goods sold divided by the average number of units in inventory

C) cost of goods sold divided by the number of units sold

D) cost of goods in ending inventory divided by the number of units in ending inventory

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

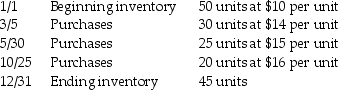

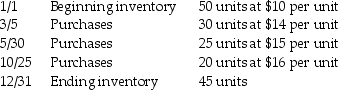

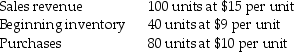

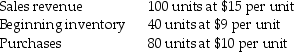

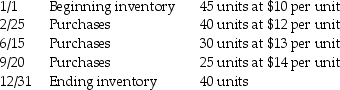

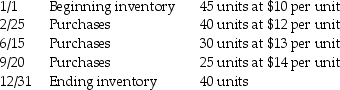

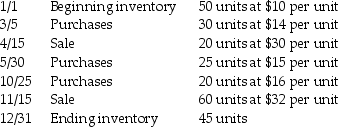

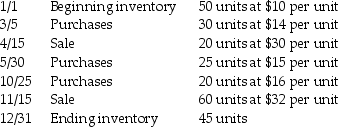

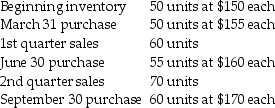

Given the following data, calculate the cost of goods sold for the period using the weighted-average method for a periodic inventory system, rounding to the nearest dollar. (Do not round in the process of your calculations, only round your final answer.)

A) $960

B) $966

C) $980

D) $2,500

A) $960

B) $966

C) $980

D) $2,500

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

In a time of increasing inventory costs, FIFO gives us a higher COGS number compared to the weighted average method.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

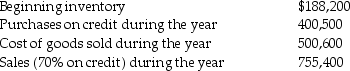

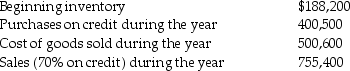

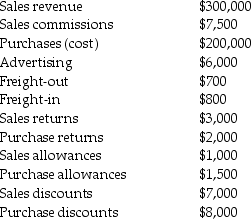

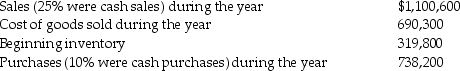

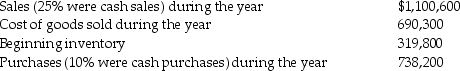

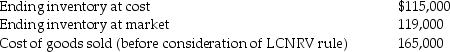

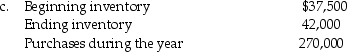

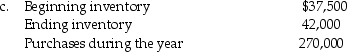

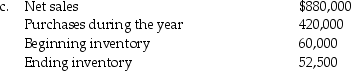

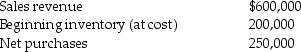

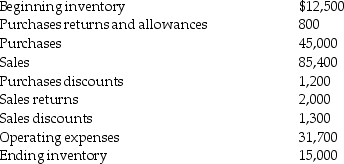

The following data pertain to Stainless Steel Enterprises for the year ended December 31, 2013:

b. Compute the balance in the inventory account on December 31, 2013.

b. Compute the balance in the inventory account on December 31, 2013.

b. Compute the balance in the inventory account on December 31, 2013.

b. Compute the balance in the inventory account on December 31, 2013.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

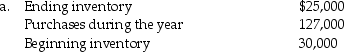

25

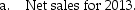

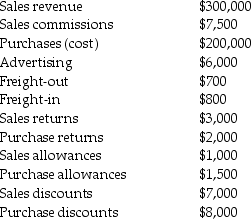

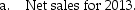

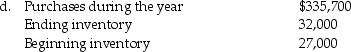

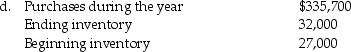

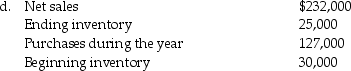

The following information is available for Don't Pay a Cent Corporation for the year ended December 31, 2013:

Calculate the following for Don't Pay a Cent Corporation:

Calculate the following for Don't Pay a Cent Corporation:

b. Net purchases for 2013.

b. Net purchases for 2013.

Calculate the following for Don't Pay a Cent Corporation:

Calculate the following for Don't Pay a Cent Corporation: b. Net purchases for 2013.

b. Net purchases for 2013.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Given the following data, calculate the cost of ending inventory using the weighted-average method for a periodic inventory system, rounding to the nearest dollar. (Do not round in the process of your calculations, only round your final answer.)

A) $720

B) $619

C) $581

D) $450

A) $720

B) $619

C) $581

D) $450

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

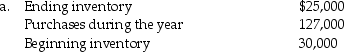

27

The following data pertain to Home Office Company for the year ended December 31, 2014:

b. Compute the balance in the inventory account on December 31, 2014.

b. Compute the balance in the inventory account on December 31, 2014.

b. Compute the balance in the inventory account on December 31, 2014.

b. Compute the balance in the inventory account on December 31, 2014.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

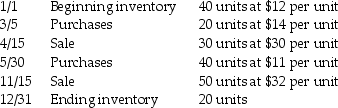

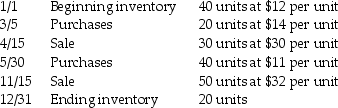

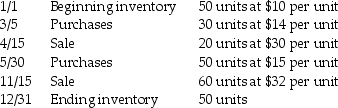

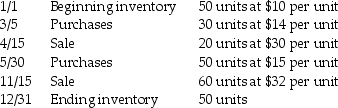

Given the following data, calculate the cost of goods sold for the 11/15 sale using the weighted-average method for a perpetual inventory system, rounding to the nearest dollar. (Do not round in the process of your calculations, only round your final answer.)

A) $720

B) $771

C) $785

D) $1,920

A) $720

B) $771

C) $785

D) $1,920

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

What is the most important asset of a merchandising business?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

FIFO tends to decrease cost of goods sold when:

A) costs are constant

B) costs are decreasing

C) costs are increasing

D) FIFO will always yield the lowest possible taxes

A) costs are constant

B) costs are decreasing

C) costs are increasing

D) FIFO will always yield the lowest possible taxes

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

Given the following data, what is the weighted-average cost of ending inventory rounded to the nearest whole dollar? (Do not round in the process of your calculations, only round your final answer.)

A) $300

B) $200

C) $193

D) $180

A) $300

B) $200

C) $193

D) $180

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

FIFO income typically is less realistic compared to the net income under weighted-average cost.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

When the FIFO method is used, cost of goods sold is assumed to consist of:

A) the most recently purchased units

B) the units with the lowest per unit cost

C) the units with the highest per unit cost

D) the oldest units

A) the most recently purchased units

B) the units with the lowest per unit cost

C) the units with the highest per unit cost

D) the oldest units

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

Given the following data, calculate the cost of ending inventory using the FIFO costing method:

A) $400

B) $545

C) $480

D) $560

A) $400

B) $545

C) $480

D) $560

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

Given the following data, what is cost of goods sold as determined under the FIFO method?

A) $6,400

B) $5,250

C) $4,600

D) $7,000

A) $6,400

B) $5,250

C) $4,600

D) $7,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

A company may use more than one type of inventory method. For example it may use specific identification for one type of inventory and FIFO for another.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Given the following data, calculate the cost of goods sold for the 04/15 sale using the weighted-average method for a perpetual inventory system, rounding to the nearest dollar. (Do not round in the process of your calculations, only round your final answer.)

A) $200

B) $230

C) $280

D) $600

A) $200

B) $230

C) $280

D) $600

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

What is the major expense shown on the income statement for a merchandising business?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

In a merchandising business, gross margin is the difference between sales revenue and the cost of goods sold.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

FIFO tends to increase cost of goods sold when:

A) costs are increasing

B) costs are declining

C) costs are constant

D) FIFO will always yield the lowest possible cost of goods sold

A) costs are increasing

B) costs are declining

C) costs are constant

D) FIFO will always yield the lowest possible cost of goods sold

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

The comparability principle in accounting means that a company must perform strictly proper accounting only for items and transactions that are significant to the financial statements of a business.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

Previously written down inventory does not need to be reassessed as it is at its lowest value.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

The disclosure principle indicates an organization should provide enough information for those outside of the organization to make an informed decision about the organization.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

If year-end inventory is reduced from cost to a lower net realizable value, which of the following accurately depicts the results?

A) Year-end inventory is reduced and cost of goods sold is reduced by the same amount.

B) Cost of goods sold is reduced and beginning inventory of the next period is reduced by the same amount.

C) The capital account balance is increased and beginning inventory of the next period is reduced by the same amount.

D) Cost of goods sold is increased and beginning inventory of the next period is decreased by the same amount.

A) Year-end inventory is reduced and cost of goods sold is reduced by the same amount.

B) Cost of goods sold is reduced and beginning inventory of the next period is reduced by the same amount.

C) The capital account balance is increased and beginning inventory of the next period is reduced by the same amount.

D) Cost of goods sold is increased and beginning inventory of the next period is decreased by the same amount.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

FIFO uses "old" inventory costs against revenue.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

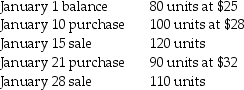

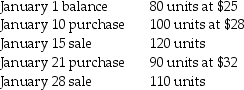

Inventory data for Hot Buys Company for January 2014 are as follows:

Using FIFO, compute ending inventory as of January 31, 2014, and determine cost of goods sold for January.

Using FIFO, compute ending inventory as of January 31, 2014, and determine cost of goods sold for January.

Using FIFO, compute ending inventory as of January 31, 2014, and determine cost of goods sold for January.

Using FIFO, compute ending inventory as of January 31, 2014, and determine cost of goods sold for January.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

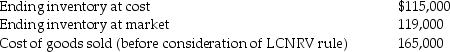

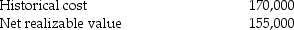

47

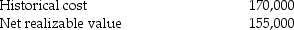

Consider the following data:  Which of the following depicts the proper account balance after the application of the LCNRV rule?

Which of the following depicts the proper account balance after the application of the LCNRV rule?

A) Ending Inventory balance will be $119,000.

B) Ending Inventory balance will be $115,000.

C) Cost of Goods Sold will be $161,000.

D) Cost of Goods Sold will be $169,000.

Which of the following depicts the proper account balance after the application of the LCNRV rule?

Which of the following depicts the proper account balance after the application of the LCNRV rule?A) Ending Inventory balance will be $119,000.

B) Ending Inventory balance will be $115,000.

C) Cost of Goods Sold will be $161,000.

D) Cost of Goods Sold will be $169,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

State some guidelines a company's management could use to determine the most desirable inventory costing method.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

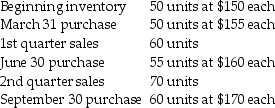

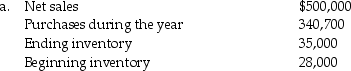

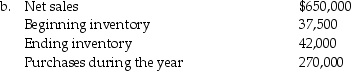

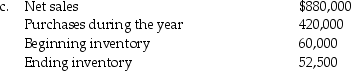

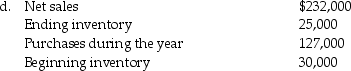

Calculate inventory turnover for the following independent situations.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

The lower-of-cost-or-net-realizable-value rule applies only when a company uses the FIFO inventory valuation method.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Ending inventory under FIFO reflects the cost of goods most recently acquired.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

A firm can change their inventory costing method if it provides more reliable and relevant information.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

When applying the lower-of-cost-or-net-realizable-value rules to ending inventory valuation, net realizable value generally refers to the cost at which the company could sell a unit of inventory.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

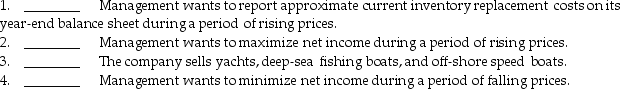

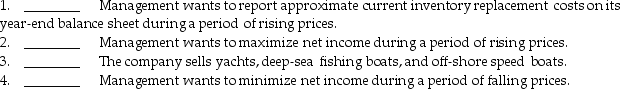

State which of the following inventory methods would best attain the goals of management. Indicate your answer by writing the proper letter in the blank beside each specific goal.

a. FIFO

b. Weighted-averaged.

c. Specific identification

a. FIFO

b. Weighted-averaged.

c. Specific identification

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

The specific unit cost method is frequently used for items with common characteristics, such as gallons of paint.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

When using the weighted-average cost method to determine the cost of inventory sold, the weighted-average cost per unit is calculated as the cost of goods available for sale divided by the number of units available for sale.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Inventory data for Freezer Burn Corporation for the year ended December 31, 2013, are as follows:

Compute the perpetual ending inventory balance on December 31, 2013, using:

Compute the perpetual ending inventory balance on December 31, 2013, using:

a. FIFO

b. Weighted-average

Compute the perpetual ending inventory balance on December 31, 2013, using:

Compute the perpetual ending inventory balance on December 31, 2013, using:a. FIFO

b. Weighted-average

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

The disclosure principle requires that management prepare financial reports that disclose all of the following types of information except:

A) the method of inventory costing used

B) forecasts of expected future earnings to help investors decide whether to invest in the company

C) information that facilitates comparison with other companies' financial reports

D) information that is relevant to decision making

A) the method of inventory costing used

B) forecasts of expected future earnings to help investors decide whether to invest in the company

C) information that facilitates comparison with other companies' financial reports

D) information that is relevant to decision making

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

A change in inventory costing method should be applied prospectively.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

Sales Company Ltd. paid $10 wholesale for one unit of inventory for resale in the retail market. The same inventory can now be purchased for $9. The retail sales price of the inventory is $13, however, it normally costs $2 to sell each unit. Using the lower-of-cost-and-net-realizable-value rule the inventory would be reported on Sales Company Ltd.'s balance sheet at:

A) $9

B) $10

C) $11

D) $13

A) $9

B) $10

C) $11

D) $13

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

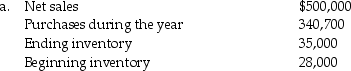

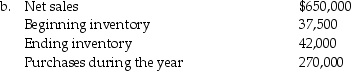

Calculate gross margin percentage for the following independent situations.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

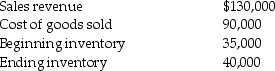

62

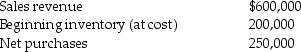

The following information is available for Digital Image Corporation for the year ended December 31, 2013:

Ending inventory:

Ending inventory:

a. Compute gross margin as it would appear on the income statement valuing ending inventory at historical cost.

a. Compute gross margin as it would appear on the income statement valuing ending inventory at historical cost.

b. Compute gross margin as it would appear on the income statement valuing ending inventory at lower-of-cost-or-net-realizable-value.

Ending inventory:

Ending inventory: a. Compute gross margin as it would appear on the income statement valuing ending inventory at historical cost.

a. Compute gross margin as it would appear on the income statement valuing ending inventory at historical cost.b. Compute gross margin as it would appear on the income statement valuing ending inventory at lower-of-cost-or-net-realizable-value.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

The gross margin percentage can be calculated by dividing cost of goods sold by net sales revenue.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Roughrider Ltd. (Roughrider) uses the lower of cost and net realizable value rule to value its football equipment inventory. Roughrider defines market as net realizable value. Roughrider's inventory on January 31, 2014 had a cost of $1,200,000 and an NRV of $1,125,000.

Required:

a. By how much should Roughrider's inventory be written down?

b. Prepare the journal entry that Roughrider should prepare to record the write-down.

c. What amount should be reported for inventory on Roughrider's January 31, 2014 balance sheet?

Required:

a. By how much should Roughrider's inventory be written down?

b. Prepare the journal entry that Roughrider should prepare to record the write-down.

c. What amount should be reported for inventory on Roughrider's January 31, 2014 balance sheet?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

The gross margin percentage is one of the most closely watched profitability measures. It can be calculated by:

A) dividing cost of goods sold by average inventory

B) dividing gross margin by net sales revenue

C) dividing gross margin by net accounts receivable

D) dividing cost of goods sold by net sales revenue

A) dividing cost of goods sold by average inventory

B) dividing gross margin by net sales revenue

C) dividing gross margin by net accounts receivable

D) dividing cost of goods sold by net sales revenue

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

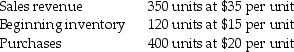

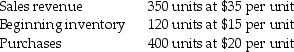

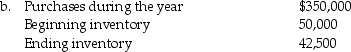

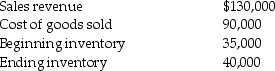

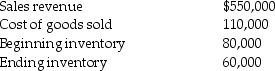

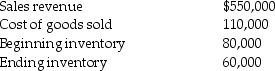

Data for Flat Panel Ltd. for the year ended December 31, 2013, are as follows:  Inventory turnover for 2013 is:

Inventory turnover for 2013 is:

A) 2.40

B) 2.25

C) 1.07

D) 3.47

Inventory turnover for 2013 is:

Inventory turnover for 2013 is:A) 2.40

B) 2.25

C) 1.07

D) 3.47

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

Inventory turnover is calculated by dividing average inventory by cost of goods sold.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

State some methods retailers might use to increase the gross margin on sales.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

Discuss methods companies could use to increase the rate of inventory turnover.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

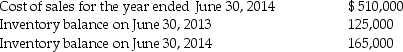

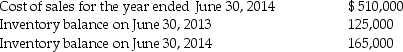

You are provided with the following information about the bookstore at your university:

Required:

Required:

a. Calculate the inventory turnover ratio for the year ended June 30, 2014.

b. What is the average length of time that it took to sell its inventory in 2014?

c. Is the inventory turnover ratio satisfactory? What would you need to know to fully answer this question?

Required:

Required:a. Calculate the inventory turnover ratio for the year ended June 30, 2014.

b. What is the average length of time that it took to sell its inventory in 2014?

c. Is the inventory turnover ratio satisfactory? What would you need to know to fully answer this question?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

Victory Stables Ltd. for the year ended December 31, 2013, are as follows:  The Gross Profit percentage for 2013 is:

The Gross Profit percentage for 2013 is:

A) 0.80

B) 1.57

C) 0.20

D) 1.83

The Gross Profit percentage for 2013 is:

The Gross Profit percentage for 2013 is:A) 0.80

B) 1.57

C) 0.20

D) 1.83

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

Average inventory is equal to:

A) beginning inventory plus cost of goods sold divided by two

B) beginning inventory plus ending inventory divided by two

C) cost of goods sold plus purchases divided by two

D) ending inventory plus cost of goods sold divided by two

A) beginning inventory plus cost of goods sold divided by two

B) beginning inventory plus ending inventory divided by two

C) cost of goods sold plus purchases divided by two

D) ending inventory plus cost of goods sold divided by two

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

The Key West Group uses the lower of cost and net realizable value rule to value its kayak inventory. The Kayaks in inventory were purchased on January 1, 2012 for $12,000. At year end December 31, 2012 the net realizable value of Key West's inventory dropped to $9,000. At the end of 2013 due to a shortage of Kayaks this inventory increased in value to $15,000.

Required:

Prepare the required journal entries (if any) required at the 2012 and 2013 year end.

Required:

Prepare the required journal entries (if any) required at the 2012 and 2013 year end.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

Victory Stables had sales and cost of sales of $600,000 and $450,000 respectively in 2014. The company had shareholders equity of $750,000 and its assets were $1,125,000. Calculate the company's gross margin and gross profit percentage for 2014.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

The gross margin rate is equal to:

A) net sales revenue minus cost of goods sold

B) gross margin divided by net sales revenue

C) net sales revenue minus gross margin on sales

D) cost of goods sold divided by net sales revenue

A) net sales revenue minus cost of goods sold

B) gross margin divided by net sales revenue

C) net sales revenue minus gross margin on sales

D) cost of goods sold divided by net sales revenue

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

A sharp decrease in the gross profit percentage is a potential indicator of trouble.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

Smart-T Incorporated had sales and cost of sales of $1,850,000 and $1,100,000 respectively in 2014. The company had shareholders equity of $925,000, liabilities of $775,000 and assets of $1,700,000. Included in Smart-T's assets was inventory valued at $100,000 which was a $50,000 increase from the previous year's holdings.

Calculate Smart-T's gross profit percentage and inventory turn over for 2014.

Calculate Smart-T's gross profit percentage and inventory turn over for 2014.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Inventory turnover is calculated by:

A) dividing average inventory by cost of goods sold

B) dividing cost of goods sold by average inventory

C) multiplying average inventory by cost of goods sold

D) subtracting ending inventory from cost of goods sold

A) dividing average inventory by cost of goods sold

B) dividing cost of goods sold by average inventory

C) multiplying average inventory by cost of goods sold

D) subtracting ending inventory from cost of goods sold

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

In 2013, Norwood Limited had sales and cost of sales of $250,000 and $62,500 respectively. The company had shareholders equity of $100,000 and its assets were $125,000. The company's gross margin for 2013 was:

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

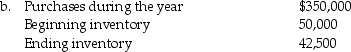

80

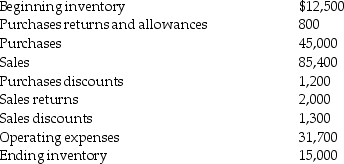

The following data are available for Big Box Corporation:

Compute:

Compute:

a. Net purchases

b. Net sales

c. Cost of goods sold

d. Gross margin

e. Gross margin rate and allowances

f. Net income

Compute:

Compute:a. Net purchases

b. Net sales

c. Cost of goods sold

d. Gross margin

e. Gross margin rate and allowances

f. Net income

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck