Deck 16: Multistate Corporate Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/160

Play

Full screen (f)

Deck 16: Multistate Corporate Taxation

1

Roughly forty percent of all taxes paid by businesses in the U.S. are to state, local, and municipal jurisdictions.

True

2

A typical state taxable income addition modification is the interest income from U.S. Treasury bonds.

False

3

States collect the most tax dollars from the corporate income tax.

False

4

Usually a business chooses a location where it will build a new plant based chiefly on tax considerations.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

5

Nonbusiness income includes dividends received from investment securities.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

6

Most states begin the computation of taxable income with an amount from the Federal income tax return.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

7

If a state follows Federal income tax rules, the state's tax compliance and enforcement become easier to accomplish.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

8

State and local politicians tend to apply new and increased taxes to taxpayers who are visitors to the jurisdiction and cannot vote to reelect the lawmaker.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

9

A state cannot levy a tax on a business unless the business was incorporated in the state.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

10

In most states, a taxpayer's income is apportioned on the basis of a formula measuring the extent of business contact, and allocated according to the location of property owned or used.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

11

A typical state taxable income addition modification is the Federal net operating loss (NOL) deduction.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

12

Most of the U.S. states have adopted an alternative minimum tax, similar to the Federal system.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

13

A state or local tax on a corporation's income might be called a franchise tax or a business privilege tax.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

14

Double weighting the sales factor effectively increases the tax burden on taxpayers based in the state, such as corporations with in-state headquarters.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

15

All of the U.S. states have adopted a tax based on net taxable income.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

16

The corporate income tax provides about 5 percent of the annual tax revenues for the typical U.S. state.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

17

Politicians use tax devices to create economic development incentives.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

18

Under P.L. 86-272, the taxpayer is exempt from state taxes on income resulting from the mere solicitation of orders for the sale of in-state realty.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

19

All of the U.S. states use the same apportionment formula and factors.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

20

Typical indicators of nexus include the presence of employees based in the state, and the ownership or lease of realty there.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

21

The property factor includes land and buildings used for business purposes.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

22

The property factor includes business assets that the taxpayer owns, but also those merely used under a lease agreement.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

23

Most states waive the collection of sales tax on groceries.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

24

A service engineer spends 60% of her time maintaining the employer's productive business property and 40% maintaining the employer's nonbusiness rental properties. This year, her compensation totaled $90,000. The payroll factor assigns $54,000 to the state in which the employer is based.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

25

A taxpayer has nexus with a state for sales and use tax purposes if it has a physical presence in the state.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

26

In most states, Federal S corporations must make a separate state-level election of the flow-through status.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

27

Typically exempt from the sales/use tax base is the purchase of tools by a manufacturer to make the widgets that it sells.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

28

Most states' consumer sales taxes apply directly to the final purchaser of the taxable asset, but the seller remits the tax to the state treasury.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

29

Almost all of the states assess some form of consumer-level sales/use tax.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

30

A unitary business is treated as a single entity for state tax purposes, with a combined apportionment formula including data from all of the operations of the business.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

31

Typically exempt from the sales/use tax base is the purchase of prescription medicines by an individual.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

32

Typically included in the sales/use tax base is the purchase of computer and cell phone equipment by a large consulting firm that is incorporated in the state.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

33

Typically exempt from the sales/use tax base is the purchase by a symphony orchestra of printed music for its players.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

34

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

35

Typically exempt from the sales/use tax base is the purchase of lumber by a do-it-yourself homeowner, when she builds a deck onto her patio.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

36

The use tax is designed to complement the sales tax. A use tax typically covers purchases made out of state and brought into the jurisdiction.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

37

A few states recognize an entity's S corporation status, such that taxable income flows through directly to shareholders, but they also assess a state-level tax on the entity.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

38

S corporations must withhold taxes on the portions of the entity's income allocated to its out-of-state shareholders.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

39

An assembly worker earns a $30,000 salary and receives a fringe benefit package worth $15,000. The payroll factor assigns $30,000 for this employee.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

40

By making a water's edge election, the multinational taxpayer can limit the reach of the unitary theory to U.S.-based factors and income.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

41

A city might assess a recording tax when a business takes out a mortgage on its real estate.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

42

Under P.L. 86-272, which of the following transactions by itself would create nexus with a state?

A) Inspection by a sales employee of the customer's inventory for specific product lines.

B) Using an independent contractor who acts as a manufacturer's representative for the taxpayer through a sales office in the state.

C) Executing a sales campaign, using an advertising agency acting as an independent contractor for the taxpayer.

D) Maintenance of inventory in the state by an independent contractor under a consignment plan.

A) Inspection by a sales employee of the customer's inventory for specific product lines.

B) Using an independent contractor who acts as a manufacturer's representative for the taxpayer through a sales office in the state.

C) Executing a sales campaign, using an advertising agency acting as an independent contractor for the taxpayer.

D) Maintenance of inventory in the state by an independent contractor under a consignment plan.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

43

The model law relating to the assignment of income among the states for corporations is:

A) The Multistate Tax Treaty.

B) The Uniform Division of Income for Tax Purposes Act (UDITPA).

C) Public Law 86-272.

D) The Multistate Tax Commission (MTC).

A) The Multistate Tax Treaty.

B) The Uniform Division of Income for Tax Purposes Act (UDITPA).

C) Public Law 86-272.

D) The Multistate Tax Commission (MTC).

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

44

Wailes Corporation is subject to a corporate income tax only in State X. The starting point in computing X taxable income is Federal taxable income. Wailes' Federal taxable income is $750,000, which includes a $75,000 deduction for state income taxes. During the year, Wailes received $20,000 interest on Federal obligations. X tax law does not allow a deduction for state income tax payments. Wailes' taxable income for X purposes is:

A) $825,000.

B) $805,000.

C) $750,000.

D) $680,000.

A) $825,000.

B) $805,000.

C) $750,000.

D) $680,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

45

Norman Corporation owns and operates two manufacturing facilities, one in State X and the other in State Y. Due to a temporary decline in the corporation's sales, Norman has rented 20% of its Y facility to an unaffiliated corporation. Norman generated $1,000,000 net rental income and $2,000,000 income from manufacturing. Norman is incorporated in Y. For X and Y purposes, rental income is classified as allocable nonbusiness income. By applying the statutes of each state, Norman determined that its apportionment factors are .65 for X and .35 for Y.

Norman's income attributed to X is:

A) $0.

B) $1,000,000.

C) $1,300,000.

D) $2,000,000.

E) $3,000,000.

Norman's income attributed to X is:

A) $0.

B) $1,000,000.

C) $1,300,000.

D) $2,000,000.

E) $3,000,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

46

The typical local property tax falls on both an investor's real estate and her stock portfolio.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

47

Federal taxable income is used as the starting point in computing the state's income tax base, but numerous state adjustments or modifications generally are required to:

A) Reflect differences between state and Federal tax statutes.

B) Remove income that a state is constitutionally prohibited from taxing.

C) Allow for all of the states to use the same definition of taxable income.

D) a. and b.

A) Reflect differences between state and Federal tax statutes.

B) Remove income that a state is constitutionally prohibited from taxing.

C) Allow for all of the states to use the same definition of taxable income.

D) a. and b.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

48

Use tax would be due if an individual purchased an auto in State A and used it at his home in State

B.

B.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

49

A capital stock tax usually is structured as an excise tax imposed on a corporation's "net worth," using financial statement data to compute the tax.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

50

In determining a corporation's taxable income for state income tax purposes, which of the following does not constitute a subtraction from Federal income?

A) Interest on U.S. obligations.

B) Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C) The amount by which the Federal deduction for depreciation exceeds the depreciation deduction permitted for state tax purposes.

D) The amount by which the state loss from the disposal of assets exceeds the Federal loss from such disposal.

A) Interest on U.S. obligations.

B) Expenses that are directly or indirectly related to state and municipal interest that is taxable for state purposes.

C) The amount by which the Federal deduction for depreciation exceeds the depreciation deduction permitted for state tax purposes.

D) The amount by which the state loss from the disposal of assets exceeds the Federal loss from such disposal.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

51

Typically exempt from the sales/use tax base is the purchase of clothing from a neighbor's "garage sale."

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

52

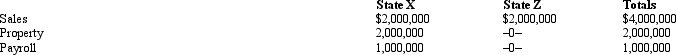

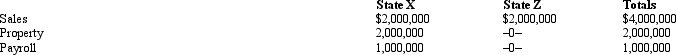

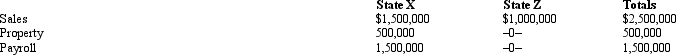

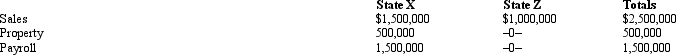

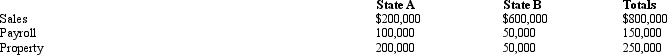

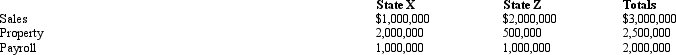

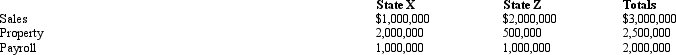

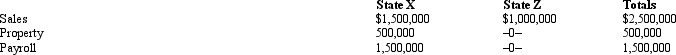

Kurt Corporation realized $900,000 taxable income from the sales of its products in States X and Z. Kurt's activities establish nexus for income tax purposes in both states. Kurt's sales, payroll, and property among the states include the following.  Z utilizes an equally weighted three-factor apportionment formula. Kurt is incorporated in X. How much of Kurt's taxable income is apportioned to Z?

Z utilizes an equally weighted three-factor apportionment formula. Kurt is incorporated in X. How much of Kurt's taxable income is apportioned to Z?

A) $0.

B) $150,000.

C) $900,000.

D) $2,000,000.

Z utilizes an equally weighted three-factor apportionment formula. Kurt is incorporated in X. How much of Kurt's taxable income is apportioned to Z?

Z utilizes an equally weighted three-factor apportionment formula. Kurt is incorporated in X. How much of Kurt's taxable income is apportioned to Z?A) $0.

B) $150,000.

C) $900,000.

D) $2,000,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

53

In most states, medical services are exempt from the sales/use tax base.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is not immune from state income taxation, even if P.L. 86-272 is in effect?

A) Sale of the rights associated with a patent used in the taxpayer's business.

B) Sale of office equipment that constitutes inventory to the purchaser.

C) Sale of office equipment to be used in the taxpayer's business.

D) All of the above are protected by P.L. 86-272 immunity provisions.

A) Sale of the rights associated with a patent used in the taxpayer's business.

B) Sale of office equipment that constitutes inventory to the purchaser.

C) Sale of office equipment to be used in the taxpayer's business.

D) All of the above are protected by P.L. 86-272 immunity provisions.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

55

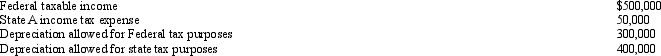

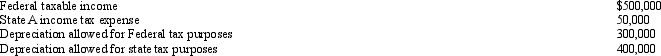

Perez Corporation is subject to tax only in State

A) $400,000.

A) Perez generated the following income and deductions. Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:

B) $450,000.

C) $600,000.

D) $650,000.

A) $400,000.

A) Perez generated the following income and deductions.

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:

Federal taxable income is the starting point in computing A taxable income. State income taxes are not deductible for A tax purposes. Perez's A taxable income is:B) $450,000.

C) $600,000.

D) $650,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

56

Sales/use tax nexus is established for the taxpayer by the sales-solicitation activities of an independent contractor acting on the taxpayer's behalf.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

57

In determining state taxable income, all of the following are adjustments to Federal income except:

A) A Federal net operating loss.

B) Federal income tax expense.

C) Dividends received from other U.S. corporations.

D) Wages paid to officers and executives.

A) A Federal net operating loss.

B) Federal income tax expense.

C) Dividends received from other U.S. corporations.

D) Wages paid to officers and executives.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

58

The typical state sales/use tax falls on sales of both real and personal property.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

59

Under P.L. 86-272, which of the following transactions by itself would create nexus with a state?

A) Order solicitation for a computer, approved and filled from another state.

B) Order solicitation for a marketable security, approved, and filled from another state.

C) Order solicitation for a machine, with credit approval from another state.

D) The conduct of a training seminar for customers as to how to install and operate a new software product.

A) Order solicitation for a computer, approved and filled from another state.

B) Order solicitation for a marketable security, approved, and filled from another state.

C) Order solicitation for a machine, with credit approval from another state.

D) The conduct of a training seminar for customers as to how to install and operate a new software product.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

60

Bulky Company sold an asset on the first day of the tax year for $500,000. Bulky's Federal tax basis for the asset was $300,000. Because of differences in cost recovery schedules, the state regular-tax basis in the asset was $375,000. What adjustment, if any, should be made to Bulky's Federal taxable income in determining the correct taxable income for the typical state?

A) $75,000.

B) $25,000.

C) ($75,000).

D) $0.

A) $75,000.

B) $25,000.

C) ($75,000).

D) $0.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

61

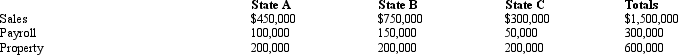

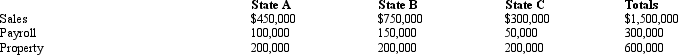

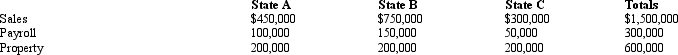

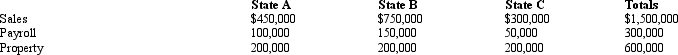

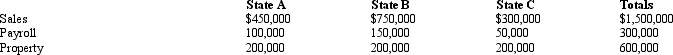

Simpkin Corporation owns manufacturing facilities in States A, B, andC. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Simpkin's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Simpkin's apportionable income assigned to B is:

Simpkin's apportionable income assigned to B is:

A) $611,100. B. $600,000.

C) $500,000.

D) $458,300.

E) $444,400.

Simpkin's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Simpkin's apportionable income assigned to B is:

Simpkin's apportionable income assigned to B is:A) $611,100. B. $600,000.

C) $500,000.

D) $458,300.

E) $444,400.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

62

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a customer in B. This activity is not sufficient for General to create nexus with B. State A applies a throwback rule, but State B does not. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

63

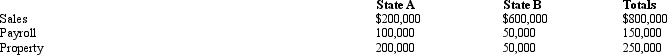

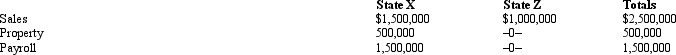

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z. José's activities in both states establish nexus for income tax purposes. José's sales, payroll, and property among the states include the following.  Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?

Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?

A) $600,000.

B) $120,000.

C) $80,000.

D) $0.

Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?

Z utilizes a double-weighted sales factor in its three-factor apportionment formula. How much of José's taxable income is apportioned to Z?A) $600,000.

B) $120,000.

C) $80,000.

D) $0.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

64

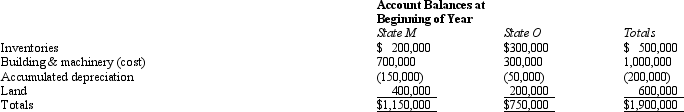

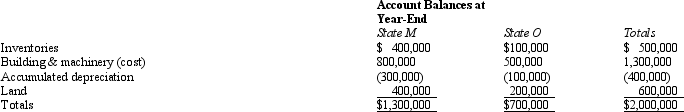

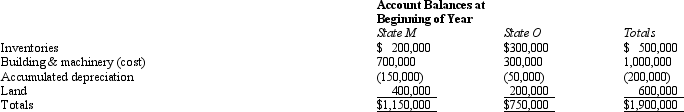

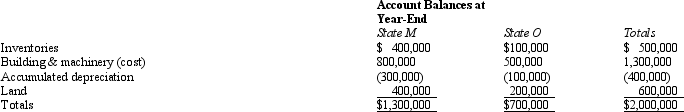

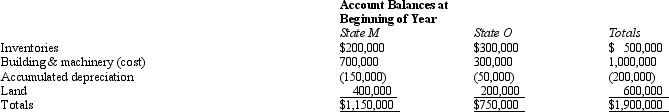

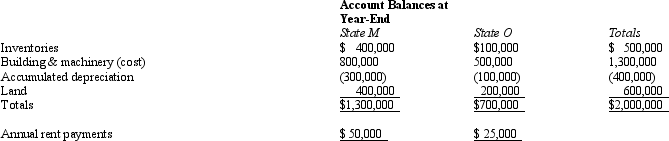

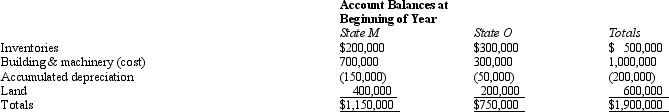

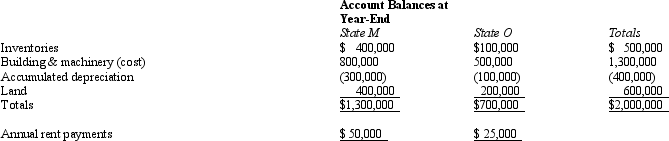

Valdez Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's O property factor is:

Valdez's O property factor is:

A) 35.0%.

B) 37.2%.

C) 39.5%.

D) 53.8%.

Valdez's O property factor is:

Valdez's O property factor is:A) 35.0%.

B) 37.2%.

C) 39.5%.

D) 53.8%.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

65

In the broadest application of the unitary theory, the U.S. unitary business files a combined tax return using factors and income amounts for all affiliates:

A) Organized in the U.S.

B) Organized in NAFTA countries.

C) Organized anywhere in the world.

D) As dictated by the tax treaties between the U.S. and the other countries.

A) Organized in the U.S.

B) Organized in NAFTA countries.

C) Organized anywhere in the world.

D) As dictated by the tax treaties between the U.S. and the other countries.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

66

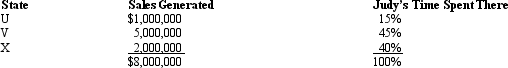

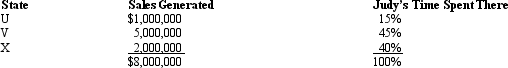

Judy, a regional sales manager, has her office in State X. Her region includes several states, as indicated in the sales report below. Determine how much of Judy's $200,000 compensation is assigned to the payroll factor of State X.

A) $0.

B) $66,667.

C) $80,000.

D) $200,000.

A) $0.

B) $66,667.

C) $80,000.

D) $200,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

67

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a customer in B. This activity is not sufficient for General to create nexus with B. State B applies a throwback rule, but State A does not. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

A) $0 in both A and B.

B) $100,000 in A.

C) $100,000 in B.

D) In both A and B, according to the apportionment formulas of each.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

68

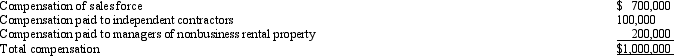

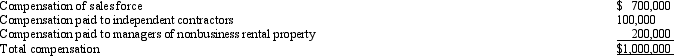

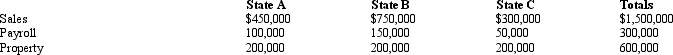

Given the following transactions for the year, determine Comp Corporation's D payroll factor denominator. State D has adopted the principles of UDITPA.

A) $700,000.

B) $800,000.

C) $900,000.

D) $1,000,000.

A) $700,000.

B) $800,000.

C) $900,000.

D) $1,000,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

69

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a State B office of an agency of the U.S. government. General has not established nexus with B. State A does not apply a throwback rule. In which state(s) will the sale be included in the sales factor numerator?

A) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

B) $100,000 in A.

C) $100,000 in B.

D) $0 in both A and B.

A) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

B) $100,000 in A.

C) $100,000 in B.

D) $0 in both A and B.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

70

The throwback rule requires that:

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) Sales of tangible personal property are attributed to the seller's state, even if the taxpayer is not taxable in the state of destination.

C) Sales of services are attributed to the state of commercial domicile.

D) Capital gain/loss is attributed to the state of commercial domicile.

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) Sales of tangible personal property are attributed to the seller's state, even if the taxpayer is not taxable in the state of destination.

C) Sales of services are attributed to the state of commercial domicile.

D) Capital gain/loss is attributed to the state of commercial domicile.

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) Sales of tangible personal property are attributed to the seller's state, even if the taxpayer is not taxable in the state of destination.

C) Sales of services are attributed to the state of commercial domicile.

D) Capital gain/loss is attributed to the state of commercial domicile.

A) Sales of tangible personal property are attributed to the state where they originated, if the taxpayer is not taxable in the state of destination.

B) Sales of tangible personal property are attributed to the seller's state, even if the taxpayer is not taxable in the state of destination.

C) Sales of services are attributed to the state of commercial domicile.

D) Capital gain/loss is attributed to the state of commercial domicile.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

71

Boot Corporation is subject to income tax in States A andB. Boot's operations generated $200,000 of apportionable income, and its sales and payroll activity and average property owned in each of the states is as follows.  How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?

How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?

A) ($50,000). B. $50,000.

C) $16,100.

D) ($16,100).

How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?

How much more (less) of Boot's income is subject to A income tax if, instead of using an equally-weighted three-factor apportionment formula, A uses a formula with a double-weighted sales factor?A) ($50,000). B. $50,000.

C) $16,100.

D) ($16,100).

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

72

Cruz Corporation owns manufacturing facilities in States A, B, andC. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales.

Cruz's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Cruz's apportionable income assigned to C is:

Cruz's apportionable income assigned to C is:

A) $1,000,000. B. $430,542.

C) $333,333.

D) $200,000.

E) $0.

Cruz's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Cruz's apportionable income assigned to C is:

Cruz's apportionable income assigned to C is:A) $1,000,000. B. $430,542.

C) $333,333.

D) $200,000.

E) $0.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

73

Bert Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

Bert's M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Bert's M property factor is:

Bert's M property factor is:A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

74

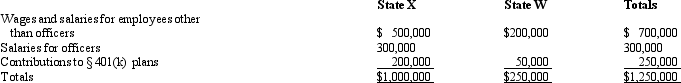

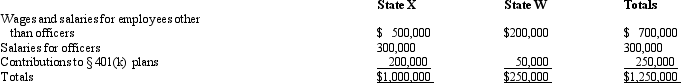

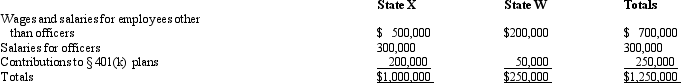

Net Corporation's sales office and manufacturing plant are located in State X. Net also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Net incurred the following personnel costs.  Net's payroll factor for State W is:

Net's payroll factor for State W is:

A) 50.00%.

B) 28.57%.

C) 26.32%.

D) 20.00%.

E) 0%.

Net's payroll factor for State W is:

Net's payroll factor for State W is:A) 50.00%.

B) 28.57%.

C) 26.32%.

D) 20.00%.

E) 0%.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

75

Helene Corporation owns manufacturing facilities in States A, B, andC. A uses a three-factor apportionment formula under which the sales, property and payroll factors are equally weighted. B uses a three-factor apportionment formula under which sales are double-weighted. C employs a single-factor apportionment factor, based solely on sales. Helene's operations generated $1,000,000 of apportionable income, and its sales and payroll activity and average property owned in each of the three states is as follows.

Helene's apportionable income assigned to A is:

Helene's apportionable income assigned to A is:

A) $422,200.

B) $333,333.

C) $322,200.

D) $316,500.

Helene's apportionable income assigned to A is:

Helene's apportionable income assigned to A is:A) $422,200.

B) $333,333.

C) $322,200.

D) $316,500.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

76

Mandy Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z. Mandy's activities establish nexus for income tax purposes only in Z. Mandy's sales, payroll, and property among the states include the following.  X utilizes a sales-only factor in its three-factor apportionment formula. How much of Mandy's taxable income is apportioned to X?

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Mandy's taxable income is apportioned to X?

A) $0.

B) $333,333.

C) $543,333.

D) $1,000,000.

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Mandy's taxable income is apportioned to X?

X utilizes a sales-only factor in its three-factor apportionment formula. How much of Mandy's taxable income is apportioned to X?A) $0.

B) $333,333.

C) $543,333.

D) $1,000,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

77

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to an agency of the U.S. government. State A applies a throwback rule. In which state(s) will the sale be included in the sales factor numerator?

A) $100,000 in A.

B) $50,000 in A, with the balance exempted from other states' sales factors under the Colgate doctrine.

C) $0 in A.

D) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states

A) $100,000 in A.

B) $50,000 in A, with the balance exempted from other states' sales factors under the Colgate doctrine.

C) $0 in A.

D) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

78

Britta Corporation's entire operations are located in State A. Eighty percent ($800,000) of Britta's sales are made in A and the remaining sales ($200,000) are made in State B. B has not adopted a corporate income tax. If A has adopted a throwback rule, the numerator of Britta's A sales factor is:

A) $0.

B) $200,000.

C) $800,000.

D) $1,000,000.

A) $0.

B) $200,000.

C) $800,000.

D) $1,000,000.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

79

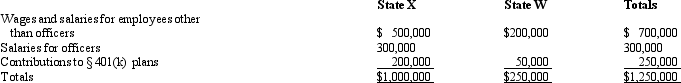

Trayne Corporation's sales office and manufacturing plant are located in State X. Trayne also maintains a manufacturing plant and sales office in State W. For purposes of apportionment, X defines payroll as all compensation paid to employees, including elective contributions to § 401(k) deferred compensation plans. Under the statutes of W, neither compensation paid to officers nor contributions to § 401(k) plans are included in the payroll factor. Trayne incurred the following personnel costs.  Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:

A) 100.00%.

B) 80.00%.

C) 73.68%.

D) 71.43%.

E) 50.00%.

Trayne's payroll factor for State X is:

Trayne's payroll factor for State X is:A) 100.00%.

B) 80.00%.

C) 73.68%.

D) 71.43%.

E) 50.00%.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck

80

José Corporation realized $600,000 taxable income from the sales of its products in States X and Z. José's activities in both states establish nexus for income tax purposes. José's sales, payroll, and property among the states include the following.  X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

A) $600,000.

B) $520,200.

C) $200,000.

D) $79,800.

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?

X utilizes an equally weighted three-factor apportionment formula. How much of José's taxable income is apportioned to X?A) $600,000.

B) $520,200.

C) $200,000.

D) $79,800.

Unlock Deck

Unlock for access to all 160 flashcards in this deck.

Unlock Deck

k this deck