Deck 17: Tax Practice and Ethics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 17: Tax Practice and Ethics

1

A negligence penalty is 20% of the underpayment attributable to negligence.

True

2

Maria and Miguel Blanco are in the midst of negotiating a divorce. Because both parties are unwilling to share any current financial information, their joint Form 1040 for 2011 is not filed until October 31, 2012, when the respective divorce attorneys forced them to cooperate. The Blancos should not be subject to any Federal late-filing penalties, because of the reasonable cause exception.

False

3

Recently, the overall Federal income tax audit rate for individual returns has been about 3%.

False

4

The IRS can require that the taxpayer produce its financial accounting records, to determine if taxable income is computed correctly.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

During any month in which both the failure-to-file and failure-to-pay penalties apply, both penalties must be paid in full.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

The tax professional can do more than just tax compliance work. He or she can work with the client in consultation over the strategy and tactics of dealing with a Federal tax audit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

The IRS targets high-income individuals for an audit rate that is about double that of the general populace.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

A letter ruling is issued by the IRS at no charge.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

One of the four operating divisions of the IRS deals exclusively with manufacturing and exporting businesses.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

Neither the taxpayer nor the government can appeal a decision of the Tax Court Small Cases Division.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

The "IRS' attorney" is known as the Chief Counsel.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

When the IRS issues a notice of tax due, the taxpayer has 30 days to either pay the tax or file a petition with the Tax Court. This is conveyed in the "thirty-day letter."

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

IRS computers use document matching programs for both individuals and business taxpayers to keep the audit rate low.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

When a tax issue is taken to court, the burden of proof is on the taxpayer to show that the items reported on the return are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

The IRS employs almost 90,000 personnel, making it one of the largest Federal agencies.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

After a tax audit, the taxpayer receives the Revenue Agent's Report as part of the "90-day letter."

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

An "office audit" takes place at the headquarters office of the corporate taxpayer.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

Babs filed an amended return in 2011, claiming a refund relative to her 2009 tax computation. When the IRS approves the amended return, it will pay Babs interest with respect to the overpayment.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

In a letter ruling, the IRS responds to a taxpayer request concerning the tax treatment of a proposed transaction.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

An IRS letter ruling might determine that an employee's compensation is unreasonable in amount.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

In the context of civil tax fraud, the burden of proof is on the IRS to show by a "preponderance of the evidence" that the taxpayer had a specific intent to evade a tax.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

The AICPA's Statements on Standards for Tax Services must be followed its members; they are more than merely advisory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

Yang, a calendar year taxpayer, did not file a tax return for 2005 because she honestly believed that no additional tax was due. In 2011, Yang is audited by the IRS and the agent assesses a deficiency of $17,000 for tax year 2005. Yang need not pay this deficiency, since the statute of limitations expired on April 15, 2009.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

A VITA volunteer is exempted from the Code's tax preparer penalties.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

In a criminal fraud case, the burden is on the taxpayer to show that he or she was innocent "beyond the shadow of any reasonable doubt."

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

Circular 230 requires that a tax preparer be aware of changes in the tax law. Furthermore, office practices of the preparer must be up to industry standards.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

Latrelle prepares the tax return for Whitehall Corporation. Latrelle includes a $5,000 deduction on the return. This type of deduction previously has been disallowed by the Tax Court, although there is a 15% chance that the holding will be reversed on an appeal. The return does not make any special disclosure that the deduction is being claimed. Whitehall paid Latrelle a fee of $3,000 for preparing the Form 1120. Latrelle will be assessed a preparer penalty of $1,000 for taking an unreasonable position on the Whitehall return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

In the case of bad debts and worthless securities, the statute of limitations on claims for refund is seven years.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

A tax preparer cannot disclose to a mortgage banker the client's income level, or other information acquired by preparing the return, without the client's permission.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

Circular 230 prohibits a tax preparer from charging an unconscionable fee for his/her services.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

Because he undervalued property that he transferred by gift, Dan owes additional gift taxes of $8,000. The penalty for undervaluation does not apply in this situation, because the tax understatement was too small.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

A CPA and his/her client hold a privilege of confidentiality from the IRS, as to their discussions about completing a tax return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

Jenny prepared Steve's income tax returns for no compensation for 2008 and 2009. Jenny is Steve's mother. In 2011, the IRS notifies Steve that it will audit his returns for 2007-2009. If Steve so desires, Jenny may represent him during the audit of all three returns.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

A CPA can take a tax return position for a client that is contrary to current IRS interpretations of the law.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

Keepert uses "two sets of books." She only reports one-half of her cash sales on the records that she uses to complete her Federal income tax return. The statute of limitations for Keepert's return is six years.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

Under Circular 230, Burke cannot complete a client's original Form 1040 and charge a fee equal to one-third of the resulting refund.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

Jaime's negligence penalty will be waived, under the reasonable cause exception. He told the court, "My taxes were wrong because I couldn't understand the tax law."

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

Circular 230 applies to all tax practitioners. This includes attorneys, CPAs, and enrolled agents, even though each of the groups has its own code of conduct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

The Statements on Standards for Tax Services apply to members of the AICPA.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

As part of a tax return engagement for XYZ Partnership, Enrolled Agent Wang can draft an amendment to the XYZ partnership agreement.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

The Chief Counsel of the IRS is appointed by the:

A) Secretary of the Treasury Department.

B) U. S. Senate.

C) U. S. House of Representatives.

D) U. S. President.

E) American Bar Association President.

A) Secretary of the Treasury Department.

B) U. S. Senate.

C) U. S. House of Representatives.

D) U. S. President.

E) American Bar Association President.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

Ming (a calendar year taxpayer) donates a painting to a local art museum (a qualified charity). The painting cost Ming $2,000 ten years ago and, according to one of Ming's friends (an amateur artist), is worth $40,000. On his income tax return, Ming deducts $40,000 as a Form 1040 charitable contribution. Upon later audit by the IRS, it is determined that the true value of the painting was $30,000. Assuming that Ming is subject to a 30% marginal Federal income tax rate, his penalty for overvaluation is:

A) $5,000.

B) $2,000.

C) $1,000.

D) $0.

E) $10,000 (minimum penalty).

A) $5,000.

B) $2,000.

C) $1,000.

D) $0.

E) $10,000 (minimum penalty).

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

When a "prompt assessment" of the tax liability is requested, the taxpayer essentially is volunteering for an IRS audit of the tax return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements does not reflect the rules governing the accuracy-related penalty for negligence?

A) The penalty rate is 20%.

B) The penalty is imposed only on the part of the deficiency attributable to negligence.

C) The penalty applies only to intentional tax understatements by the taxpayer.

D) The penalty is waived if the taxpayer uses Form 8275 to disclose a return position that is reasonable though contrary to the IRS position.

A) The penalty rate is 20%.

B) The penalty is imposed only on the part of the deficiency attributable to negligence.

C) The penalty applies only to intentional tax understatements by the taxpayer.

D) The penalty is waived if the taxpayer uses Form 8275 to disclose a return position that is reasonable though contrary to the IRS position.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

Maureen, a calendar year taxpayer subject to a 35% marginal tax rate, claimed a Form 1040 charitable contribution deduction of $250,000 for a sculpture that the IRS later valued at $200,000. The applicable overvaluation penalty is:

A) $17,500.

B) $14,000.

C) $3,500.

D) $0.

A) $17,500.

B) $14,000.

C) $3,500.

D) $0.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

Faye, a CPA, is preparing Judith's tax return. Before computing Judith's deduction for business supplies, Faye must examine Judith's records in support of the deducted amount.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

With respect to the Small Cases Division of the Tax Court,

A) The taxpayer (but not the IRS) can appeal a contrary judgment.

B) The IRS (but not the taxpayer) can appeal a contrary judgment.

C) Either the IRS or the taxpayer can appeal a contrary judgment.

D) Neither the IRS nor the taxpayer can appeal a contrary judgment.

A) The taxpayer (but not the IRS) can appeal a contrary judgment.

B) The IRS (but not the taxpayer) can appeal a contrary judgment.

C) Either the IRS or the taxpayer can appeal a contrary judgment.

D) Neither the IRS nor the taxpayer can appeal a contrary judgment.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements is incorrect as to the conduct of IRS income tax audits?

A) Only the Appeals Division of the IRS has the authority to settle tax disputes based on the hazards of litigation.

B) The IRS publishes the factors its computers use for audit selection purposes annually in the Commissioner's Report.

C) For a Form 1040 that is filed on April 11, 2012, if the taxpayer has not received an audit notification from the IRS by the end of 2012, the return may still be audited.

D) Most IRS examinations of Forms 1040 are conducted solely through the mail.

A) Only the Appeals Division of the IRS has the authority to settle tax disputes based on the hazards of litigation.

B) The IRS publishes the factors its computers use for audit selection purposes annually in the Commissioner's Report.

C) For a Form 1040 that is filed on April 11, 2012, if the taxpayer has not received an audit notification from the IRS by the end of 2012, the return may still be audited.

D) Most IRS examinations of Forms 1040 are conducted solely through the mail.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

Henrietta has hired Gracie, a CPA, to complete this year's Form 1040. Henrietta uses software to keep the books for her business. She tells Gracie that a $5,000 amount for business supplies is "close enough" to constitute the deduction. Gracie can use this estimate in completing the Form 1040.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

In preparing a tax return, a CPA should verify "to the penny" every item of information submitted by a client.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

Which statement appearing below does not correctly describe the IRS letter ruling process?

A) They are issued by the Secretary of the Treasury Department.

B) Some letter rulings are of such importance and general interest that they are later published (in anonymous form) as Revenue Rulings.

C) Letter rulings are private and can be seen only by the taxpayer who requested the ruling.

D) Letter rulings can benefit both taxpayers and the IRS.

A) They are issued by the Secretary of the Treasury Department.

B) Some letter rulings are of such importance and general interest that they are later published (in anonymous form) as Revenue Rulings.

C) Letter rulings are private and can be seen only by the taxpayer who requested the ruling.

D) Letter rulings can benefit both taxpayers and the IRS.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

When a practitioner discovers an error in a client's prior return, AICPA tax ethics rules require that an amended return immediately be filed.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

Ron, a calendar year taxpayer subject to a 35% marginal tax rate, claimed a Form 1040 charitable contribution deduction of $250,000 for a sculpture that the IRS later valued at $150,000. The applicable overvaluation penalty is:

A) $0.

B) $7,000.

C) $10,000 (maximum penalty).

D) $14,000.

A) $0.

B) $7,000.

C) $10,000 (maximum penalty).

D) $14,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

The penalty for substantial understatement of tax liability does not apply if:

A) The taxpayer has substantial authority for the treatment taken on the tax return.

B) The relevant facts affecting the treatment are adequately disclosed in the return or on Form 8275.

C) The IRS failed to meet its burden of proof in showing the taxpayer's error.

D) All of the above statements are correct.

E) None of the above statements are correct.

A) The taxpayer has substantial authority for the treatment taken on the tax return.

B) The relevant facts affecting the treatment are adequately disclosed in the return or on Form 8275.

C) The IRS failed to meet its burden of proof in showing the taxpayer's error.

D) All of the above statements are correct.

E) None of the above statements are correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is correct as to the conduct of IRS income tax audits?

A) Office audits are conducted at the office of the IRS.

B) The most common type of Federal income tax audit is the field audit.

C) An office audit typically is used for a business taxpayer.

D) A correspondence audit usually is concluded after a meeting with the taxpayer at the IRS auditor's office.

A) Office audits are conducted at the office of the IRS.

B) The most common type of Federal income tax audit is the field audit.

C) An office audit typically is used for a business taxpayer.

D) A correspondence audit usually is concluded after a meeting with the taxpayer at the IRS auditor's office.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Harold, a calendar year taxpayer subject to a 35% marginal tax rate, claimed a Form 1040 charitable contribution deduction of $20,000 for a sculpture that the IRS later valued at $10,000. The applicable overvaluation penalty is:

A) $10,000.

B) $7,000.

C) $3,500.

D) $0.

A) $10,000.

B) $7,000.

C) $3,500.

D) $0.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

Gloria, a calendar year taxpayer subject to a 35% marginal income tax rate, claimed a Form 1040 charitable contribution deduction of $800,000 for a sculpture that the IRS later valued at $100,000. The applicable overvaluation penalty is:

A) $245,000.

B) $98,000.

C) $49,000.

D) $10,000 (maximum penalty).

A) $245,000.

B) $98,000.

C) $49,000.

D) $10,000 (maximum penalty).

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

It is advisable that an IRS audit be conducted at the office of the tax advisor, and not of the client.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

Last year, Ned's property tax deduction on his residence was $22,500. Although he lives in the same house, he tells his CPA that this year's taxes will be only $7,500. The CPA can use this estimate in computing Ned's itemized deductions, under the Statements of Standards for Tax Services.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements correctly reflects the rules governing interest to be paid on an individual's Federal tax deficiency or claim for refund?

A) The IRS has full discretion in determining the rate that will apply.

B) The simple interest method for calculating interest is used.

C) The rate of interest for assessments is one percentage point lower than the rate of interest for refunds.

D) The IRS adjusts the rate of interest quarterly.

A) The IRS has full discretion in determining the rate that will apply.

B) The simple interest method for calculating interest is used.

C) The rate of interest for assessments is one percentage point lower than the rate of interest for refunds.

D) The IRS adjusts the rate of interest quarterly.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

Freddie has been assessed a preparer penalty for willful and reckless conduct. When he completed Peggy's Federal income tax return (who is in the 35% tax bracket), Freddie purposely omitted $100,000 of cash receipts that should have been reported as gross income. Freddie charged Peggy $6,000 to prepare the return. What is Freddie's preparer penalty?

A) $0, because Peggy incurred her own understatement penalty for the return.

B) $3,000.

C) $5,000.

D) $17,500.

A) $0, because Peggy incurred her own understatement penalty for the return.

B) $3,000.

C) $5,000.

D) $17,500.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

Juanita, who is subject to a 45% marginal gift tax rate, made a gift of a sculpture to Bianca, valuing the property at $150,000. The IRS later valued the gift at $300,000. The applicable undervaluation penalty is:

A) $27,000.

B) $13,500.

C) $10,000 (maximum penalty).

D) $0.

A) $27,000.

B) $13,500.

C) $10,000 (maximum penalty).

D) $0.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

Concerning a taxpayer's requirement to make quarterly estimated tax payments:

A) An individual must make estimated payments if his or her balance due for the Federal income tax for the year will exceed $1,000.

B) The due dates of the payments for a calendar-year C corporation are March, June, September, and December 15.

C) A C corporation must make estimated payments if its Federal income tax liability for the year will exceed $250.

D) A trust is not required to make estimated payments.

A) An individual must make estimated payments if his or her balance due for the Federal income tax for the year will exceed $1,000.

B) The due dates of the payments for a calendar-year C corporation are March, June, September, and December 15.

C) A C corporation must make estimated payments if its Federal income tax liability for the year will exceed $250.

D) A trust is not required to make estimated payments.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

The Statements on Standards for Tax Services are issued by the:

A) IRS.

B) AICPA.

C) ABA.

D) SEC.

A) IRS.

B) AICPA.

C) ABA.

D) SEC.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

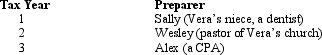

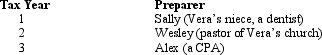

Vera is audited by the IRS for several tax years. Her returns were prepared by the following parties.  Which of the following statements is correct?

Which of the following statements is correct?

A) Sally may represent Vera for tax year 1. Such representation may extend through the Appeals Division of the IRS.

B) Wesley may represent Vera for all tax years under audit.

C) Alex can only represent Vera for tax year 3.

D) Vera may represent herself for all tax years involved.

Which of the following statements is correct?

Which of the following statements is correct?A) Sally may represent Vera for tax year 1. Such representation may extend through the Appeals Division of the IRS.

B) Wesley may represent Vera for all tax years under audit.

C) Alex can only represent Vera for tax year 3.

D) Vera may represent herself for all tax years involved.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

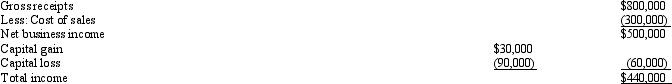

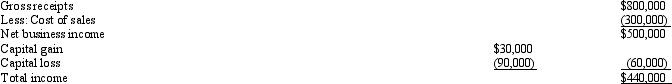

Jake, an individual calendar year taxpayer, incurred the following transactions.  Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?

Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?

A) More than $110,000.

B) More than $132,500.

C) More than $207,500.

D) The six-year rule does not apply here.

Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?

Assuming that any error in timely reporting these amounts was inadvertent, how much omission from gross income would be required before the six-year statute of limitations would apply?A) More than $110,000.

B) More than $132,500.

C) More than $207,500.

D) The six-year rule does not apply here.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

A tax preparer is in violation of Circular 230 if he or she:

A) Files a tax return that includes a math error.

B) Charges a fee to prepare an original Form 1120 equal to one-third of the taxpayer's refund due.

C) Fails to inform the IRS of an error on the client's prior-year return.

D) All of the above are Circular 230 violations.

A) Files a tax return that includes a math error.

B) Charges a fee to prepare an original Form 1120 equal to one-third of the taxpayer's refund due.

C) Fails to inform the IRS of an error on the client's prior-year return.

D) All of the above are Circular 230 violations.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

Mickey, a calendar year taxpayer, was not required to file a 2010 Federal income tax return. During 2011, his AGI is $120,000 and his tax liability is $20,000. To avoid a penalty for tax underpayments for 2011, Mickey must make aggregate estimated tax payments of at least:

A) $0.

B) $1,000 (minimum amount).

C) $18,000.

D) $20,000.

A) $0.

B) $1,000 (minimum amount).

C) $18,000.

D) $20,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

Mickey, a calendar year taxpayer, filed a return correctly showing no Federal income tax liability for 2010. During 2011, his AGI is $120,000 and his tax liability is $20,000. To avoid a penalty for 2011, Mickey must make aggregate estimated tax payments of at least:

A) $0.

B) $1,000 (minimum amount).

C) $18,000.

D) $20,000.

A) $0.

B) $1,000 (minimum amount).

C) $18,000.

D) $20,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

Concerning the penalty for civil tax fraud:

A) Fraudulent behavior is more than mere negligence on the part of the taxpayer.

B) The burden of proof to establish the penalty is on the government.

C) The penalty is 100% of the underpayment.

D) Fraud is defined in Code §§ 6663(b) and (f).

A) Fraudulent behavior is more than mere negligence on the part of the taxpayer.

B) The burden of proof to establish the penalty is on the government.

C) The penalty is 100% of the underpayment.

D) Fraud is defined in Code §§ 6663(b) and (f).

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

Circular 230 allows a tax preparer to:

A) Take a position on a tax return that is contrary to a decision of the U.S. Supreme Court.

B) Operate the "Tax Nerd's Blog" on the Internet.

C) Charge a $5,000 fee to prepare a Form 1040EZ.

D) Avoid signing a tax return that is likely to be audited.

A) Take a position on a tax return that is contrary to a decision of the U.S. Supreme Court.

B) Operate the "Tax Nerd's Blog" on the Internet.

C) Charge a $5,000 fee to prepare a Form 1040EZ.

D) Avoid signing a tax return that is likely to be audited.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

Leroy, who is subject to a 45% marginal gift tax rate, made a gift of a sculpture to Marvin, valuing the property at $150,000. The IRS later valued the gift at $400,000. The applicable undervaluation penalty is:

A) $0.

B) $22,500.

C) $25,000 (maximum penalty).

D) $45,000.

A) $0.

B) $22,500.

C) $25,000 (maximum penalty).

D) $45,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

73

Megan prepared for compensation a Federal income tax return for Joan. Joan's return included an aggressive interpretation of the rules concerning overnight business travel. Megan is not liable for a preparer penalty for taking an unreasonable tax return position if:

A) The tax reduction attributable to the disputed deduction did not exceed $5,000.

B) There was a reasonable basis for Joan's interpretation of the travel deduction rules.

C) There was substantial authority for Joan's interpretation of the travel deduction rules.

D) The IRS found that the travel deduction was frivolous, but Joan disclosed the position in an attachment to the return.

A) The tax reduction attributable to the disputed deduction did not exceed $5,000.

B) There was a reasonable basis for Joan's interpretation of the travel deduction rules.

C) There was substantial authority for Joan's interpretation of the travel deduction rules.

D) The IRS found that the travel deduction was frivolous, but Joan disclosed the position in an attachment to the return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

George, a calendar year taxpayer subject to a 45% marginal gift tax rate, made a gift of a sculpture to Redd, valuing the property at $100,000. The IRS later valued the gift at $140,000. The applicable undervaluation penalty is:

A) $7,200.

B) $3,600.

C) $1,000 (minimum penalty).

D) $0.

A) $7,200.

B) $3,600.

C) $1,000 (minimum penalty).

D) $0.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

Roger prepared for compensation a Federal income tax return for Mona. Mona's return included an aggressive interpretation of the rules concerning overnight business travel. Roger is not liable for a preparer penalty for taking an unreasonable tax return position if:

A) The tax reduction attributable to the disputed deduction did not exceed $5,000.

B) Mona is assessed her own penalty for an understatement of tax due to disregard of IRS rules.

C) There was a reasonable basis for Mona's interpretation of the travel deduction rules, and Mona disclosed the position in an attachment to the return.

D) The IRS found that the travel deduction was frivolous, but Mona disclosed the position in an attachment to the return.

A) The tax reduction attributable to the disputed deduction did not exceed $5,000.

B) Mona is assessed her own penalty for an understatement of tax due to disregard of IRS rules.

C) There was a reasonable basis for Mona's interpretation of the travel deduction rules, and Mona disclosed the position in an attachment to the return.

D) The IRS found that the travel deduction was frivolous, but Mona disclosed the position in an attachment to the return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

The rules of Circular 230 need not be followed by which of the following paid tax preparers?

A) A CPA.

B) A Wal-Mart cashier who e-files 15 tax returns for her paying clients per filing season.

C) An enrolled agent.

D) All of the above are subject to the Circular 230 rules.

A) A CPA.

B) A Wal-Mart cashier who e-files 15 tax returns for her paying clients per filing season.

C) An enrolled agent.

D) All of the above are subject to the Circular 230 rules.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is subject to tax return preparer penalties?

A) Lizzie, the firm's administrative assistant, makes copies of returns and assembles the mailings that the client must make to the taxing agencies.

B) Meredith is the director of Federal taxes for a C corporation.

C) Sammy is a volunteer who prepares returns at the retirement home under the IRS Tax Counseling for the Elderly program.

D) Abbie prepares her mother's tax returns for $50 a year. A CPA, Abbie would charge a client $750 for completing a similar return.

A) Lizzie, the firm's administrative assistant, makes copies of returns and assembles the mailings that the client must make to the taxing agencies.

B) Meredith is the director of Federal taxes for a C corporation.

C) Sammy is a volunteer who prepares returns at the retirement home under the IRS Tax Counseling for the Elderly program.

D) Abbie prepares her mother's tax returns for $50 a year. A CPA, Abbie would charge a client $750 for completing a similar return.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

The privilege of confidentiality applies to a CPA tax preparer concerning the client's information relative to:

A) Financial accounting tax accrual workpapers.

B) A tax research memo used to determine an amount reported on the tax return.

C) Building a defense against a penalty assessed for the use of a tax shelter.

D) Building a defense against a charge brought by the SEC.

A) Financial accounting tax accrual workpapers.

B) A tax research memo used to determine an amount reported on the tax return.

C) Building a defense against a penalty assessed for the use of a tax shelter.

D) Building a defense against a charge brought by the SEC.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

The special tax penalty imposed on appraisers:

A) Is waived if the taxpayer also was charged with his/her own valuation penalty.

B) Applies if the appraiser knew that the appraisal would be used in preparing a Federal income tax return.

C) Equals 10% of the appraised value of the property, with a $5,000 minimum penalty.

D) Can be as much as 200% of the appraisal fee that was charged.

A) Is waived if the taxpayer also was charged with his/her own valuation penalty.

B) Applies if the appraiser knew that the appraisal would be used in preparing a Federal income tax return.

C) Equals 10% of the appraised value of the property, with a $5,000 minimum penalty.

D) Can be as much as 200% of the appraisal fee that was charged.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

The usual three-year statute of limitations on additional tax assessments applies in the following situation(s).

A) No return at all is filed.

B) An investment in a marketable security is worthless.

C) Taxpayer inadvertently omits an amount of gross income equal to 30% of the gross income stated on the return.

D) Taxpayer discovers an inadvertent overstatement of deductions equal to 30% of gross income.

A) No return at all is filed.

B) An investment in a marketable security is worthless.

C) Taxpayer inadvertently omits an amount of gross income equal to 30% of the gross income stated on the return.

D) Taxpayer discovers an inadvertent overstatement of deductions equal to 30% of gross income.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck