Deck 22: Accounting for Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 22: Accounting for Not-For-Profit Organizations

1

A gift-in-kind, for which the not-for-profit entity has no discretion on disposition, should be accounted for by the not-for-profit, nongovernmental entity as

A) a special purpose contribution.

B) an exchange transaction.

C) an agency transaction.

D) a conditional promise to give.

A) a special purpose contribution.

B) an exchange transaction.

C) an agency transaction.

D) a conditional promise to give.

C

2

Voluntary health and welfare organizations

A) may not have paid executives or staff.

B) are governed by separate GASB statements.

C) use fund accounting, following the rules for proprietary fund reporting.

D) are supported by, and provide voluntary services to, the public.

A) may not have paid executives or staff.

B) are governed by separate GASB statements.

C) use fund accounting, following the rules for proprietary fund reporting.

D) are supported by, and provide voluntary services to, the public.

D

3

An alumnus made a donation of adjoining land to a not-for-profit, nongovernmental university. The donor made no specifications regarding the time period or use of the land. The university would record the gift as

A) an endowment asset.

B) temporarily restricted revenue.

C) unrestricted revenue.

D) permanently restricted support.

A) an endowment asset.

B) temporarily restricted revenue.

C) unrestricted revenue.

D) permanently restricted support.

C

4

Not-for-profit, private colleges classify student unions, dining halls, and residence halls as

A) educational and general services.

B) auxiliary enterprises.

C) independent operations.

D) restricted enterprises.

A) educational and general services.

B) auxiliary enterprises.

C) independent operations.

D) restricted enterprises.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

Voluntary health and welfare organizations classify fund-raising costs as

A) costs of services sold.

B) program services.

C) auxiliary expenses.

D) supporting services.

A) costs of services sold.

B) program services.

C) auxiliary expenses.

D) supporting services.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

In a nonprofit, nongovernmental hospital, courtesy allowances are

A) charity care services.

B) revenue deductions.

C) expenses.

D) revenues earned even if the standard charge is above or below the allowance.

A) charity care services.

B) revenue deductions.

C) expenses.

D) revenues earned even if the standard charge is above or below the allowance.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following statements is not required for voluntary health and welfare organizations?

A) A statement of financial position

B) A statement of activities

C) A statement of functional expenses

D) A statement of changes in net assets

A) A statement of financial position

B) A statement of activities

C) A statement of functional expenses

D) A statement of changes in net assets

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not true?

A) A not-for-profit entity operates for purposes other than to provide goods or services at a profit.

B) A not-for-profit entity may be governmental or non-governmental.

C) A not-for-profit entity may possess ownership interests like a corporation.

D) A not-for-profit entity receives resources from resource providers who do not expect commensurate or proportionate pecuniary return.

A) A not-for-profit entity operates for purposes other than to provide goods or services at a profit.

B) A not-for-profit entity may be governmental or non-governmental.

C) A not-for-profit entity may possess ownership interests like a corporation.

D) A not-for-profit entity receives resources from resource providers who do not expect commensurate or proportionate pecuniary return.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Under GAAP, for nonprofit, nongovernmental entities, an unconditional transfer of cash or other assets to an entity, or a settlement or cancellation of its liabilities in a voluntary, non-reciprocal transfer, is called a(n)

A) unconditional promise to give.

B) contribution.

C) conditional promise to give.

D) residual equity transfer.

A) unconditional promise to give.

B) contribution.

C) conditional promise to give.

D) residual equity transfer.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

For a Voluntary Health and Welfare Organization, what entry is prepared when the restriction on a cash donation is met?

A) Debit Unrestricted Net Assets, Credit Restricted Net Assets

B) Debit Unrestricted Fund Balance, Credit Restricted Fund Balance

C) Debit Restricted Fund Balance, Credit Unrestricted Fund Balance

D) Debit Temporarily Restricted Net Assets - Reclassifications out, Credit Unrestricted Net Assets - Reclassifications in

A) Debit Unrestricted Net Assets, Credit Restricted Net Assets

B) Debit Unrestricted Fund Balance, Credit Restricted Fund Balance

C) Debit Restricted Fund Balance, Credit Unrestricted Fund Balance

D) Debit Temporarily Restricted Net Assets - Reclassifications out, Credit Unrestricted Net Assets - Reclassifications in

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

The gift shop of a nonprofit, private hospital has cash revenue of $24,000. What account will the hospital credit?

A) Unrestricted support

B) Unrestricted revenue

C) Temporarily restricted revenue

D) Other operating revenue - unrestricted

A) Unrestricted support

B) Unrestricted revenue

C) Temporarily restricted revenue

D) Other operating revenue - unrestricted

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

For nonprofit, nongovernmental organizations, unconditional promises to give that include promises of payments due in future periods (next year or later) are reported as

A) unrestricted revenues.

B) unrestricted support.

C) deferred revenues until payment is received.

D) restricted support.

A) unrestricted revenues.

B) unrestricted support.

C) deferred revenues until payment is received.

D) restricted support.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1, 2011, a Voluntary Health and Welfare Organization (VHWO) receives an unconditional promise to give $6,000. The money is not collectible until 2012. The VHWO estimates that 10% of pledges are uncollectible. On January 1, 2011, the VHWO will credit

A) Unrestricted Support - Contribution, $6,000.

B) Allowance for Uncollectible Contributions $600, and Unrestricted Support - Contribution, $5,400.

C) Allowance for Uncollectible Contributions $600, Temporarily Restricted Support - Contribution, $5,400.

D) Allowance for Uncollectible Contributions $600, Contribution Revenue $5,400.

A) Unrestricted Support - Contribution, $6,000.

B) Allowance for Uncollectible Contributions $600, and Unrestricted Support - Contribution, $5,400.

C) Allowance for Uncollectible Contributions $600, Temporarily Restricted Support - Contribution, $5,400.

D) Allowance for Uncollectible Contributions $600, Contribution Revenue $5,400.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

Voluntary health and welfare organizations (VHWO) measure contributions at fair value unless

A) fair value is less than the original cost of the item.

B) the contributed item is not intended to be re-sold by the VHWO.

C) fair value cannot be reasonably determined.

D) the contributions are not in cash or cash equivalents.

A) fair value is less than the original cost of the item.

B) the contributed item is not intended to be re-sold by the VHWO.

C) fair value cannot be reasonably determined.

D) the contributions are not in cash or cash equivalents.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Voluntary health and welfare organizations must report expenses classified by

A) restriction.

B) function and natural classification.

C) restriction and natural classification.

D) restriction, function and natural classification.

A) restriction.

B) function and natural classification.

C) restriction and natural classification.

D) restriction, function and natural classification.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

In a not-for-profit, private university, the federal grant funds given directly to students for financial aid are an example of

A) a bequest.

B) an agency transaction.

C) unrestricted revenue.

D) a restricted contribution.

A) a bequest.

B) an agency transaction.

C) unrestricted revenue.

D) a restricted contribution.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

A nongovernmental, not-for-profit entity is subject to: I. GASB

II) FASB

A) I only

B) II only

C) a combination of I and II depending on the entity's purpose

D) neither I or II

II) FASB

A) I only

B) II only

C) a combination of I and II depending on the entity's purpose

D) neither I or II

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

In a nongovernmental, nonprofit hospital, contractual adjustments are

A) the discounted rate given to hospital employees.

B) discounts arranged with third-party payors.

C) recorded as a deduction from revenue or as an expense.

D) additional amounts paid by select group participants.

A) the discounted rate given to hospital employees.

B) discounts arranged with third-party payors.

C) recorded as a deduction from revenue or as an expense.

D) additional amounts paid by select group participants.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

A donor gives a Voluntary Health and Welfare Organization(VHWO) $1,000 cash that is restricted for a research project. What account does the VHWO credit when the VHWO receives the money?

A) Nonoperating Revenue

B) Permanently Restricted Revenue

C) Unrestricted Support

D) Temporarily Restricted Support

A) Nonoperating Revenue

B) Permanently Restricted Revenue

C) Unrestricted Support

D) Temporarily Restricted Support

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

An alumnus of a nonprofit, nongovernmental university establishes an endowment of $50,000. When the university receives the endowment from the donor, what account will the university credit?

A) Temporarily restricted revenues

B) Temporarily restricted support

C) Permanently restricted revenues

D) Permanently restricted support

A) Temporarily restricted revenues

B) Temporarily restricted support

C) Permanently restricted revenues

D) Permanently restricted support

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

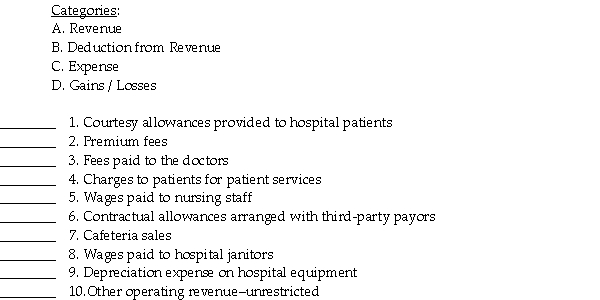

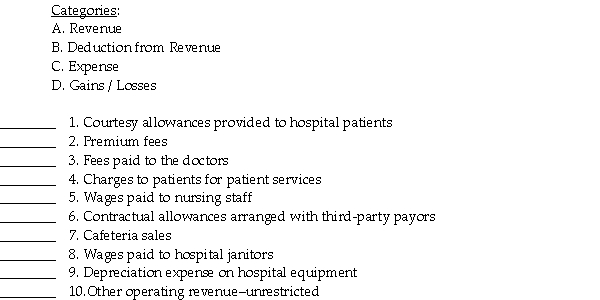

Match each of the following descriptions with the correct category for a private, not-for-profit hospital. Each term may be used more than once.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

Will Wealth made three charitable donations in 2014. Each was for $500,000, however they were made to three different organizations as follows:

1. Will donated to a local voluntary health and welfare organization (VHWO), and indicated that the funds could be used as the VHO wanted.

2. Will donated to a local private, not-for-profit university, designating the funds to be used for scholarships and student aid.

3. Will donated to the local not-for-profit, nongovernmental hospital, designating the funds to be used for purchase of diagnostic equipment.

Required:

For each of the above three situations:

A. Prepare the journal entry that each organization would prepare at the time of the contribution.

B. Prepare the journal entry that each organization would prepare at the time of the subsequent spending of the funds. Assume that the spending is in accordance with any restrictions that Will placed on the donation.

1. Will donated to a local voluntary health and welfare organization (VHWO), and indicated that the funds could be used as the VHO wanted.

2. Will donated to a local private, not-for-profit university, designating the funds to be used for scholarships and student aid.

3. Will donated to the local not-for-profit, nongovernmental hospital, designating the funds to be used for purchase of diagnostic equipment.

Required:

For each of the above three situations:

A. Prepare the journal entry that each organization would prepare at the time of the contribution.

B. Prepare the journal entry that each organization would prepare at the time of the subsequent spending of the funds. Assume that the spending is in accordance with any restrictions that Will placed on the donation.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

Carousel Clothes is a voluntary health and welfare organization that provides gently-used second-hand clothes to those in need. They had the following transactions in 2014.

1. Cash gifts were received in the amount of $60,000, of which $13,000 had been pledged in the prior year.

2. Pledges made in the current year but not yet fulfilled amounted to $39,000. Ten percent of the pledges typically prove to be uncollectible. Pledges are made for 2014.

3. An office supply company donates office furniture to the VHWO. The fair value of the furniture is $40,000. No restrictions were placed on the donation.

4. The following expenses were incurred and paid: director's salary, $15,000; facility rental, $18,000; cleaning and repair costs for clothes, $29,000; and purchase of supplies consumed in tagging and distribution of clothes, $5,000. The director's salary is categorized as Support Services and the rest of the costs are Program Services.

5. Restricted pledges were received during the year for $450,000. The pledges are restricted for the construction of a new facility.

Required:

Prepare the journal entries for Carousel for 2014.

1. Cash gifts were received in the amount of $60,000, of which $13,000 had been pledged in the prior year.

2. Pledges made in the current year but not yet fulfilled amounted to $39,000. Ten percent of the pledges typically prove to be uncollectible. Pledges are made for 2014.

3. An office supply company donates office furniture to the VHWO. The fair value of the furniture is $40,000. No restrictions were placed on the donation.

4. The following expenses were incurred and paid: director's salary, $15,000; facility rental, $18,000; cleaning and repair costs for clothes, $29,000; and purchase of supplies consumed in tagging and distribution of clothes, $5,000. The director's salary is categorized as Support Services and the rest of the costs are Program Services.

5. Restricted pledges were received during the year for $450,000. The pledges are restricted for the construction of a new facility.

Required:

Prepare the journal entries for Carousel for 2014.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

Record the following transactions for Porter Hospital, a private, nonprofit hospital:

1. Gross patient services revenues: $25,000,000. Billed to patients.

2. Included in the above revenues are: charity services, $500,000; contractual adjustments, $11,000,000; and estimated uncollectible amounts, $250,000.

3. Purchased equipment by issuing a 5-year note for $200,000.

4. Received cash donations restricted for a capital building addition program, $5,100,000.

5. Incurred and paid $1,700,000 of contractor billings for the capital building program.

1. Gross patient services revenues: $25,000,000. Billed to patients.

2. Included in the above revenues are: charity services, $500,000; contractual adjustments, $11,000,000; and estimated uncollectible amounts, $250,000.

3. Purchased equipment by issuing a 5-year note for $200,000.

4. Received cash donations restricted for a capital building addition program, $5,100,000.

5. Incurred and paid $1,700,000 of contractor billings for the capital building program.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

Wilhelman University, a not-for-profit, nongovernmental university, had the following transactions in 2014.

1. Tuition bills were sent amounting to $4,000,000, with tuition waivers granted on that amount of $200,000.

2. State funding was received in the amount of $2,000,000.

3. The bookstore and cafeteria sales amounted to $1,600,000, and their cost of sales was $1,500,000. Assume cash sales and cash purchases for these auxiliary operations.

4. Endowment income amounted to $100,000 that was restricted to chair the accounting department, and $200,000 of unrestricted income.

5. Expenses were incurred and paid as follows: faculty, $3,800,000 (including faculty chair, paid in part by endowment income); Student services, $250,000; Facilities operations, $350,000; and scholarships (excluding tuition waived), $400,000.

Required:

Prepare the journal entries for 2014 for Wilhelman University.

1. Tuition bills were sent amounting to $4,000,000, with tuition waivers granted on that amount of $200,000.

2. State funding was received in the amount of $2,000,000.

3. The bookstore and cafeteria sales amounted to $1,600,000, and their cost of sales was $1,500,000. Assume cash sales and cash purchases for these auxiliary operations.

4. Endowment income amounted to $100,000 that was restricted to chair the accounting department, and $200,000 of unrestricted income.

5. Expenses were incurred and paid as follows: faculty, $3,800,000 (including faculty chair, paid in part by endowment income); Student services, $250,000; Facilities operations, $350,000; and scholarships (excluding tuition waived), $400,000.

Required:

Prepare the journal entries for 2014 for Wilhelman University.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

Childrens Hospital is a private, not-for-profit hospital. The following information is available about the operations.

1. Gross patient services charges totaled $6,400,000.

2. Included in the above revenues are: charity services, $210,000; contractual adjustments, $2,400,000; and courtesy allowances, $37,000.

3. Received a donation of marketable securities with a fair value of $165,000 for the purchase of new diagnostic equipment.

4. The marketable securities were sold for $182,000 and diagnostic equipment was purchased at a cost of $210,000.

5. Revenue from the hospital gift shop was $58,000 and from the cafeteria revenues were $227,000. Received cash from both enterprises.

6. Incurred and paid nursing service costs of $1,700,000 and general service costs of $400,000.

Required:

Prepare journal entries for the aforementioned transactions.

1. Gross patient services charges totaled $6,400,000.

2. Included in the above revenues are: charity services, $210,000; contractual adjustments, $2,400,000; and courtesy allowances, $37,000.

3. Received a donation of marketable securities with a fair value of $165,000 for the purchase of new diagnostic equipment.

4. The marketable securities were sold for $182,000 and diagnostic equipment was purchased at a cost of $210,000.

5. Revenue from the hospital gift shop was $58,000 and from the cafeteria revenues were $227,000. Received cash from both enterprises.

6. Incurred and paid nursing service costs of $1,700,000 and general service costs of $400,000.

Required:

Prepare journal entries for the aforementioned transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

A small town in a rural area has an organization that serves the local community when there is a financial need. Among the services they provide is free groceries, clothes and furniture, along with transportation to doctors' appointments when the doctor is out of town. This voluntary health and welfare organization (VHWO) accepts most donations of goods, all donations of cash, and has developed a relationship with the local grocer who helps them obtain needed food items. The VHO has one paid administrator who tracks and coordinates the donations, performs application reviews to determine eligibility, and schedules transportation for those in need. Volunteers unload and pack grocery items, sort clothes and furniture, and drive those who need transportation. Gasoline costs are reimbursed to the driver based on mileage. The local CPA provides bookkeeping and tax services for free, and designates 90% of expenses incurred to community services and 10% to management and general.

The VHWO had the following transactions in 2014:

1. The administrator is paid $11,000 salary.

2. The accountant services are valued at $6,000 based on their normal billable rate.

3. The landlord of the building they use for their operations has waived their rent and provided the bill of $6,000 for their records. The VHWO paid utilities and property taxes of $3,000.

4. Office furniture was donated with an estimated fair value of $9,400.

5. The VHWO received cash donations of $20,000, $5,000 of which was an unpaid pledge from the prior year. The beginning pledges receivable balance was $6,000, and no amount had previously been estimated to be uncollectible. The prior year balance will now be written off. In addition, $12,000 was pledged to be donated in 2015. Based on recent history, the VHWO knows that 10% of the new pledges will not be collected.

Required:

Prepare the journal entries for the transactions noted above.

The VHWO had the following transactions in 2014:

1. The administrator is paid $11,000 salary.

2. The accountant services are valued at $6,000 based on their normal billable rate.

3. The landlord of the building they use for their operations has waived their rent and provided the bill of $6,000 for their records. The VHWO paid utilities and property taxes of $3,000.

4. Office furniture was donated with an estimated fair value of $9,400.

5. The VHWO received cash donations of $20,000, $5,000 of which was an unpaid pledge from the prior year. The beginning pledges receivable balance was $6,000, and no amount had previously been estimated to be uncollectible. The prior year balance will now be written off. In addition, $12,000 was pledged to be donated in 2015. Based on recent history, the VHWO knows that 10% of the new pledges will not be collected.

Required:

Prepare the journal entries for the transactions noted above.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Albatross University, a not-for-profit, nongovernmental university, had the following transactions in 2014.

1. Tuition bills were sent amounting to $8,000,000, with 70% collected before the end of the fiscal year; tuition waivers were granted on the total amount of $400,000, and $220,000 was expected to be uncollectible.

2. Cafeteria sales, all cash, were $1,400,000.

3. Salaries and wages were paid amounting to $5,500,000, of which $370,000 was for cafeteria staff.

4. Long-term debt payments were made from general funds amounting to $800,000, of which $130,000 was for interest.

5. Equipment was purchased for the engineering department with funds previously set aside for that purpose, amounting to $180,000.

Required:

Prepare the journal entries for 2014 for Albatross University.

1. Tuition bills were sent amounting to $8,000,000, with 70% collected before the end of the fiscal year; tuition waivers were granted on the total amount of $400,000, and $220,000 was expected to be uncollectible.

2. Cafeteria sales, all cash, were $1,400,000.

3. Salaries and wages were paid amounting to $5,500,000, of which $370,000 was for cafeteria staff.

4. Long-term debt payments were made from general funds amounting to $800,000, of which $130,000 was for interest.

5. Equipment was purchased for the engineering department with funds previously set aside for that purpose, amounting to $180,000.

Required:

Prepare the journal entries for 2014 for Albatross University.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

General Hospital is a private, not-for-profit hospital. The following information is available about the operations.

1. Gross patient services charges totaled $3,700,000.

2. Included in the above revenues are: charity services, $360,000; contractual adjustments, $1,200,000; courtesy allowances, $20,000; and estimated uncollectible amounts, $250,000.

3. Premium fees receipts were $110,000.

4. Purchased $75,000 of hospital supplies on account, with payments on that account, $36,000.

5. Received cash donations for a new hospital wing of $2,500,000.

6. Paid contractor $275,000 for billed costs toward the new hospital wing.

Required:

Prepare journal entries for the aforementioned transactions.

1. Gross patient services charges totaled $3,700,000.

2. Included in the above revenues are: charity services, $360,000; contractual adjustments, $1,200,000; courtesy allowances, $20,000; and estimated uncollectible amounts, $250,000.

3. Premium fees receipts were $110,000.

4. Purchased $75,000 of hospital supplies on account, with payments on that account, $36,000.

5. Received cash donations for a new hospital wing of $2,500,000.

6. Paid contractor $275,000 for billed costs toward the new hospital wing.

Required:

Prepare journal entries for the aforementioned transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

A private, not-for-profit university received donations of $1,000,000 cash in 2014 that were restricted to certain research projects on sustainability, with an emphasis on reducing the campus waste. The university incurred and paid $450,000 of expenses on this research in 2014.

In 2014, an alumnus contributed a $700,000 endowment for energy research with all endowment income restricted for that purpose. Income totaled $35,000 for the year. Energy research expenses incurred and paid were $22,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

In 2014, an alumnus contributed a $700,000 endowment for energy research with all endowment income restricted for that purpose. Income totaled $35,000 for the year. Energy research expenses incurred and paid were $22,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

The following information is available about the operations for a private, not-for-profit university.

1. The university sold $20,000,000 of 5% bonds to finance the construction of a new building for the business school. The bonds were sold on January 1 and pay interest on December 31 of each year. The bonds were sold at par and mature in 20 years.

2. The university received $7,500,000 cash in alumni and corporate donations for the new business school building.

3. The building was constructed at a total cost of $22,000,000 and the contractor was paid in full.

4. Interest was paid on the bonds.

5. Depreciation on the new building the first year was $275,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

1. The university sold $20,000,000 of 5% bonds to finance the construction of a new building for the business school. The bonds were sold on January 1 and pay interest on December 31 of each year. The bonds were sold at par and mature in 20 years.

2. The university received $7,500,000 cash in alumni and corporate donations for the new business school building.

3. The building was constructed at a total cost of $22,000,000 and the contractor was paid in full.

4. Interest was paid on the bonds.

5. Depreciation on the new building the first year was $275,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

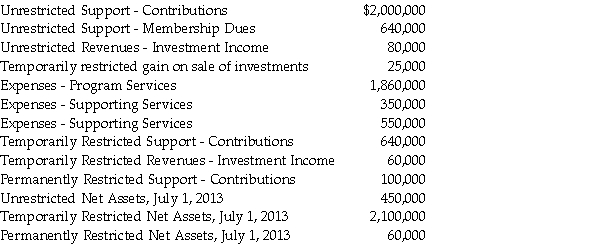

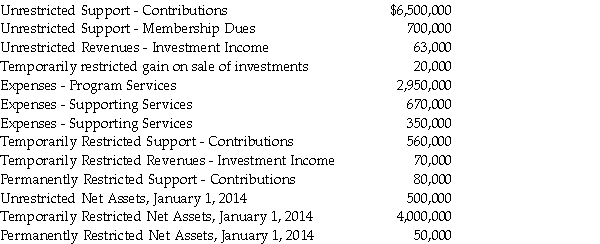

The following information was taken from the accounts and records of the Helping Hands Foundation, a private, not-for-profit organization classified as a VHWO. All balances are as of June 30, 2014, unless otherwise noted.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.

Required:

Prepare Helping Hands' Statement of Activities for the fiscal year ended June 30, 2014.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.Required:

Prepare Helping Hands' Statement of Activities for the fiscal year ended June 30, 2014.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

The Trasque Hospital is a nongovernmental, not-for-profit hospital. During 2014, they had the following transactions.

1. Trasque's standard charges for services rendered amounted to $550,000. Contractual adjustments on those amounts with third-party payors amounted to $230,000. Bad debts on the remaining balance are estimated to be 10%.

2. The hospital received a cash donation of $20,000 to be used for medical equipment.

3. The hospital also received rent from a local shelter that uses the basement of their facility for overflow housing, amounting to $6,000 per year.

4. The hospital paid the following costs: Professional fees (doctors and physician assistants), $80,000; Nursing services, $70,000; and administrative services, $40,000.

5. The hospital paid for pharmaceuticals and medical supplies amounting to $110,000. The hospital had an agreement with the pharmaceutical and medical supply vendors to carry all inventory on consignment, due to their not-for-profit status. As a result, items are only paid for as consumed, and all inventory belongs to the vendors.

Required:

Prepare the journal entries for Trasque for 2014.

1. Trasque's standard charges for services rendered amounted to $550,000. Contractual adjustments on those amounts with third-party payors amounted to $230,000. Bad debts on the remaining balance are estimated to be 10%.

2. The hospital received a cash donation of $20,000 to be used for medical equipment.

3. The hospital also received rent from a local shelter that uses the basement of their facility for overflow housing, amounting to $6,000 per year.

4. The hospital paid the following costs: Professional fees (doctors and physician assistants), $80,000; Nursing services, $70,000; and administrative services, $40,000.

5. The hospital paid for pharmaceuticals and medical supplies amounting to $110,000. The hospital had an agreement with the pharmaceutical and medical supply vendors to carry all inventory on consignment, due to their not-for-profit status. As a result, items are only paid for as consumed, and all inventory belongs to the vendors.

Required:

Prepare the journal entries for Trasque for 2014.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

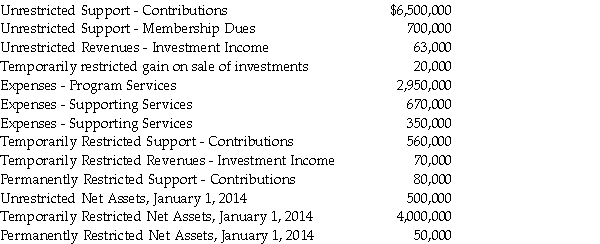

34

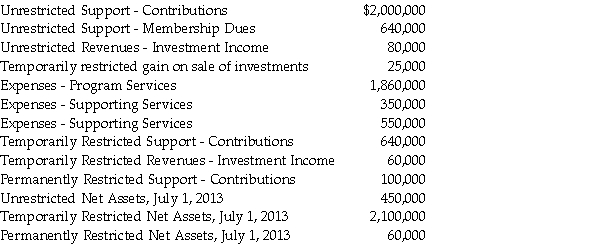

The following information was taken from the accounts and records of the Community Chest Foundation, a private, not-for-profit VHWO organization. All balances are as of December 31, 2014, unless otherwise noted.

The unrestricted support from contributions was received in cash during the year. The expenses included $980,000 paid from temporarily-restricted cash donations.

The unrestricted support from contributions was received in cash during the year. The expenses included $980,000 paid from temporarily-restricted cash donations.

Required:

Prepare Community Chest's Statement of Activities for the year ended December 31, 2014.

The unrestricted support from contributions was received in cash during the year. The expenses included $980,000 paid from temporarily-restricted cash donations.

The unrestricted support from contributions was received in cash during the year. The expenses included $980,000 paid from temporarily-restricted cash donations.Required:

Prepare Community Chest's Statement of Activities for the year ended December 31, 2014.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

Marshfield Hospital is a private, not-for-profit hospital. The following transactions occurred:

1. Unrestricted cash gifts that were received last year, but designated for use in the current year, totaled $180,000. The cash gifts were used in the current year in accordance with restrictions.

2. Unrestricted pledges of $800,000 were received. Ten percent of the pledges typically prove uncollectible. Additional cash contributions during the year totaled $300,000.

3. Gifts in kind were received that were sold at a silent auction for $23,000. The fair value of the donated gifts in kind could not be reasonably determined.

4. Expenses were incurred and paid as follows: Salary of doctor, $190,000; facility rental, $36,000; purchases of supplies, $8,000; and utility costs, $10,000.

5. Marketable securities with a fair value of $650,000 were received as a donation with a stipulation that the hospital use the funds to purchase suitable land for the hospital.

Required:

Prepare journal entries for the aforementioned transactions.

1. Unrestricted cash gifts that were received last year, but designated for use in the current year, totaled $180,000. The cash gifts were used in the current year in accordance with restrictions.

2. Unrestricted pledges of $800,000 were received. Ten percent of the pledges typically prove uncollectible. Additional cash contributions during the year totaled $300,000.

3. Gifts in kind were received that were sold at a silent auction for $23,000. The fair value of the donated gifts in kind could not be reasonably determined.

4. Expenses were incurred and paid as follows: Salary of doctor, $190,000; facility rental, $36,000; purchases of supplies, $8,000; and utility costs, $10,000.

5. Marketable securities with a fair value of $650,000 were received as a donation with a stipulation that the hospital use the funds to purchase suitable land for the hospital.

Required:

Prepare journal entries for the aforementioned transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

A private, not-for-profit university received donations of $800,000 in 2014 that were restricted to capital improvements of the football stadium. The university spent $670,000 on capital improvements for the stadium in 2014 and recorded depreciation of $130,000.

In 2014, an alumnus contributed a $1,500,000 endowment for football scholarships with all endowment income restricted for that purpose. Endowment income totaled $75,000 for the year and scholarship awards were $68,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

In 2014, an alumnus contributed a $1,500,000 endowment for football scholarships with all endowment income restricted for that purpose. Endowment income totaled $75,000 for the year and scholarship awards were $68,000.

Required:

Prepare the appropriate journal entries for the university for these transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

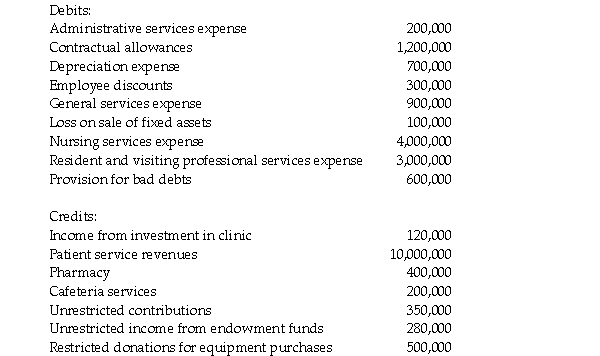

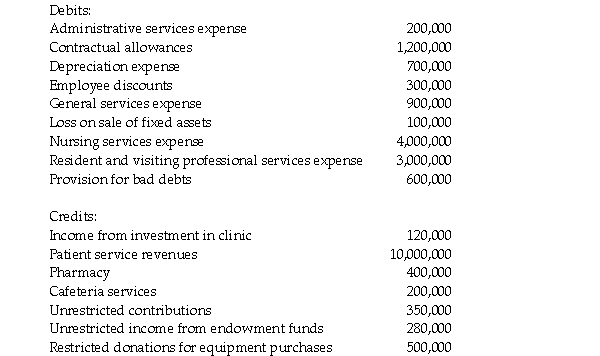

37

Southtown Community Hospital (SCH) shows the following balances on its trial balance at June 30, 2014, their fiscal year end. SCH is a not-for-profit, nongovernmental hospital. $260,000 cash was spent on equipment from donations restricted for that purpose.

Required:

Required:

Prepare a statement of operations for Southtown Community Hospital at June 30, 2014.

Required:

Required:Prepare a statement of operations for Southtown Community Hospital at June 30, 2014.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

Prepare journal entries to record the following transactions for a private, not-for-profit university.

1. Tuition and fees assessed total $10,000,000, 80% of which was collected by year-end; tuition scholarships were granted for $1,300,000, and $650,000 was expected to be uncollectible.

2. Revenues collected from sales and services by the university bookstore were $1,450,000.

3. Salaries and wages paid were $5,600,000, $300,000 of which was for employees of the university bookstore.

4. Financial aid funds of $700,000 were received from the Pell Grant program; the funds were then disbursed to the appropriate students.

5. Contributions of $600,000 were received; $30,000 was restricted for the athletic department and the balance was unrestricted. An additional $70,000 was pledged to the athletic department by the alumni.

6. Athletic equipment was purchased with $42,000 previously set aside for that purpose.

1. Tuition and fees assessed total $10,000,000, 80% of which was collected by year-end; tuition scholarships were granted for $1,300,000, and $650,000 was expected to be uncollectible.

2. Revenues collected from sales and services by the university bookstore were $1,450,000.

3. Salaries and wages paid were $5,600,000, $300,000 of which was for employees of the university bookstore.

4. Financial aid funds of $700,000 were received from the Pell Grant program; the funds were then disbursed to the appropriate students.

5. Contributions of $600,000 were received; $30,000 was restricted for the athletic department and the balance was unrestricted. An additional $70,000 was pledged to the athletic department by the alumni.

6. Athletic equipment was purchased with $42,000 previously set aside for that purpose.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

Coats for Kids is a private, not-for-profit organization that provides free coats for children in the suburbs of a large city. Coats for Kids had the following transactions in 2014.

1. Unrestricted cash gifts that were received last year, but designated for use in the current year, totaled $50,000. The cash gifts were used in 2014.

2. Unrestricted pledges of $40,000 were received. They are expected to be collected in 2014. Ten percent of the pledges typically prove uncollectible. Additional cash contributions during the year totaled $65,000.

3. A donor donated investments with a fair value of $10,000. The investments can be sold and used only for the purchase of coats for children.

4. The following expenses were incurred and paid: Salary of director, $15,000, classified as supporting services. The remaining expenses of $47,500 were classified as program services.

5. Pledges of $250,000 were received during the year. The pledges were restricted for use in purchasing new delivery vans. All of these pledges are expected to be collected in the next fiscal year. Ten percent are estimated to be uncollectible.

Required:

Prepare the journal entries for the aforementioned transactions.

1. Unrestricted cash gifts that were received last year, but designated for use in the current year, totaled $50,000. The cash gifts were used in 2014.

2. Unrestricted pledges of $40,000 were received. They are expected to be collected in 2014. Ten percent of the pledges typically prove uncollectible. Additional cash contributions during the year totaled $65,000.

3. A donor donated investments with a fair value of $10,000. The investments can be sold and used only for the purchase of coats for children.

4. The following expenses were incurred and paid: Salary of director, $15,000, classified as supporting services. The remaining expenses of $47,500 were classified as program services.

5. Pledges of $250,000 were received during the year. The pledges were restricted for use in purchasing new delivery vans. All of these pledges are expected to be collected in the next fiscal year. Ten percent are estimated to be uncollectible.

Required:

Prepare the journal entries for the aforementioned transactions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck