Deck 8: Taxation of Individuals

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/163

Play

Full screen (f)

Deck 8: Taxation of Individuals

1

Carlos had $3,950 of state taxes withheld from his salary this year.If he deducts the full amount as an itemized deduction and receives a refund in the following year,he must file an amended return and reduce the deduction he received by the amount of the refund.

False

2

To be a qualifying relative,an individual must meet certain tests.These tests include,

I)the citizen or residency test.

II)the gross income test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)the citizen or residency test.

II)the gross income test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

C

3

Any charitable contributions made in excess of the individual's limitation on charitable contributions can be carried forward seven years.

False

4

To qualify as a qualifying child,an individual must meet five tests.These are the age test;the non-support test;the principal residence test;relationship test;and the citizen or residency test.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

5

Philip has been working in Spain for the last three years.He and his wife Barbara adopted Juan who will not qualify as a dependent since he is not a U.S citizen.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

6

To qualify as a qualifying relative,an individual must meet three of five tests.These are the gross income test;the support test;the relationship or member of the household test;the citizen or residency test;and the joint return test.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

7

To qualify as a head of household,an unmarried taxpayer must pay more than half of the cost of maintaining a home that is the principal residence for more than half the year of a qualified dependent or an unmarried child who qualifies as a dependent.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

8

To recognize such basic personal living costs as food and clothing,each individual taxpayer is allowed a personal exemption of $4,050 in 2017.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

9

In addition to the regular standard deduction taxpayers who are blind qualify for a second standard deduction of the same amount.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

10

Unreimbursed meals and entertainment paid by employees are subject to the 2-percent of adjusted gross income annual limitation on miscellaneous deductions

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

11

Under the legislative grace concept,Congress allows certain personal expenses to be deducted when they exceed the standard deduction.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

12

Eric,who is 18 years old,sells magazine subscriptions door-to-door for commissions.He earned $2,900 this year and he will have to pay tax on this income at his parent's tax rate.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

13

To qualify for the child- and dependent-care credit,the taxpayer must have earned income and must incur qualified expenses for the care of qualified individuals.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

14

Ariel has two children,Christopher and Pat.Christopher is 25 years old and Pat is 22.Both are full time students at Southern College,have full tuition scholarships,and live at school during the year.Christopher graduated in June.Which test will prevent Ariel from claiming both Pat and Christopher as dependents?

A)Age test.

B)Gross income test.

C)Principal residence test.

D)Non-support test.

E)Full time student test.

A)Age test.

B)Gross income test.

C)Principal residence test.

D)Non-support test.

E)Full time student test.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

15

Alan is a 23-year old student at Upper State College.He earned $4,400 at a summer job.

I)Because he earns over $4,050 his parents cannot claim him as a dependent on their return.

II)Alan cannot claim a personal exemption for himself if his parents can claim him as a dependent.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Because he earns over $4,050 his parents cannot claim him as a dependent on their return.

II)Alan cannot claim a personal exemption for himself if his parents can claim him as a dependent.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

16

Mary Lou is a 22-year old student at Wilson College.She earned $4,300 at a summer job,which is less than half of her support.

I)Mary Lou can claim a personal exemption for herself even if her parents claim her as a dependent.

II)Because Mary Lou is a full-time college student,and she provides less than half of her own support,her parents can claim her as a dependent on their return.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Mary Lou can claim a personal exemption for herself even if her parents claim her as a dependent.

II)Because Mary Lou is a full-time college student,and she provides less than half of her own support,her parents can claim her as a dependent on their return.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

17

To be a qualifying relative,an individual must meet certain tests.These tests include,

I)the gross income test.

II)the age test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)the gross income test.

II)the age test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

18

Unreimbursed medical costs are deductible only to the extent that they exceed 3.0% of the taxpayer's adjusted gross income.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

19

The American Opportunity Scholarship Tax Credit provides for a 100% tax credit on the first $2,000 of qualifying expenses and a 50% tax credit for the next $2,000 of qualifying expenses paid during the year for each qualifying student.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

20

Morris and Marianne have a $310,000 mortgage on their personal residence and a $90,000 mortgage on their mountain retreat.The interest on both of them qualifies as deductible qualified home mortgage interest.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

21

For purposes of the relationship test for dependents,which of the following does not qualify as a relative?

A)Mother.

B)Nephew.

C)Cousin.

D)Grandfather.

E)Stepbrother.

A)Mother.

B)Nephew.

C)Cousin.

D)Grandfather.

E)Stepbrother.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

22

Simone and Fillmore were divorced last year.Fillmore has custody of their two children.Simone pays $9,600 in child support payments during the current year.The total cost of supporting the children is $12,500.Fillmore and Simone do not have any special agreement about dependency exemptions.How many total exemptions may Simone claim for the current year?

A)0

B)1

C)2

D)3

E)4

A)0

B)1

C)2

D)3

E)4

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

23

Frank's wife died in 2015.He has not remarried and maintains a home for himself and his dependent daughter.What is Frank's filing status for 2017?

A)Single.

B)Head of household.

C)Married,filing separately.

D)Surviving spouse.

A)Single.

B)Head of household.

C)Married,filing separately.

D)Surviving spouse.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

24

Thomas has adjusted gross income of $228,000,total itemized deductions of $39,000 and claims 2 personal and 2 dependency exemptions.Which is his filing status?

A)Single.

B)Head of household.

C)Married filing a joint return.

D)Married filing separately.

A)Single.

B)Head of household.

C)Married filing a joint return.

D)Married filing separately.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

25

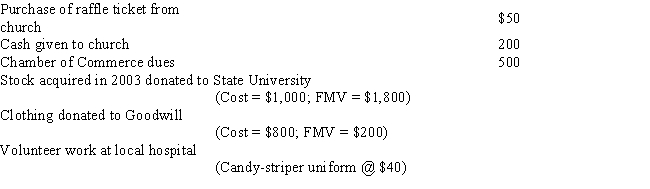

Kevin wants to know if he can claim his brother,Richard,as a qualifying relative for income tax purposes.Richard is 18 and is a part-time student at City Community College.He lives with Kevin in his home for the entire tax year.Kevin provides the majority of Richard's support.During the year Richard has the following items of income:

Can Kevin claim his brother Richard as a dependent for income tax purposes?

A)Yes.

B)No,Richard fails the relationship test.

C)No,Richard fails the gross income test.

D)No,Richard fails the student test.

E)No,Richard fails the residency test.

Can Kevin claim his brother Richard as a dependent for income tax purposes?

A)Yes.

B)No,Richard fails the relationship test.

C)No,Richard fails the gross income test.

D)No,Richard fails the student test.

E)No,Richard fails the residency test.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following will prevent a couple from filing as married filing joint in 2017?

I)One spouse dies on June 6,2017.

II)The couple is legally married,but is living apart throughout the year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)One spouse dies on June 6,2017.

II)The couple is legally married,but is living apart throughout the year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

27

Will and Brenda of New York City are both age 66 and always file a joint tax return.During the current year they provide all the support for their son who is 20,has no income,and is a part-time college student.Their daughter,age 22 and a full-time student at Columbia University,has $4,800 of income.What is the total number of personal and dependency exemptions Will and Brenda can claim?

A)1

B)2

C)3

D)4

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

28

Lillian and Michael were divorced last year.Michael has custody of their two children.Lillian pays $8,600 in child support payments during the current year.The total cost of supporting the children is $12,500.Michael and Lillian do not have any special agreement about dependency exemptions.How many total exemptions may Michael claim for the current year?

A)0

B)1

C)2

D)3

E)4

A)0

B)1

C)2

D)3

E)4

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following individuals can be claimed as a dependent in the current year? (Assume any test not mentioned has been satisfied).

I)Kelly's mother,Dana,lives with her for 10 of 12 months during the year.Kelly provides all the support for Dana during that time.The other two months were spent with Dana's other daughter,Alice.Dana's annual income consists of $12,750 in Social Security and $1,850 of savings account interest.Kelly may claim Dana as a dependent.

II)Bart is a 22-year-old college student.His tuition of $7,000 is paid by a scholarship he received for his good high school record.He lives with his parents,who also provide him with $450 monthly support.Bart earns $1,950 mowing lawns in the neighborhood for other support.He may be claimed as a dependent of his parents.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Kelly's mother,Dana,lives with her for 10 of 12 months during the year.Kelly provides all the support for Dana during that time.The other two months were spent with Dana's other daughter,Alice.Dana's annual income consists of $12,750 in Social Security and $1,850 of savings account interest.Kelly may claim Dana as a dependent.

II)Bart is a 22-year-old college student.His tuition of $7,000 is paid by a scholarship he received for his good high school record.He lives with his parents,who also provide him with $450 monthly support.Bart earns $1,950 mowing lawns in the neighborhood for other support.He may be claimed as a dependent of his parents.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

30

During the current year,his three children,Simon,Alvin,and Theodore and his life-long friend,Arlo,with whom he lives,provide Durbin's support.Durbin's support distribution follows:

If the children file a multiple support agreement,which of the following are eligible to claim Durban as a dependent?

A)Only Theodore.

B)Only Theodore or Arlo.

C)Only Arlo.

D)Theodore,Simon,or Alvin.

E)Theodore,Simon,Arlo,or Alvin

If the children file a multiple support agreement,which of the following are eligible to claim Durban as a dependent?

A)Only Theodore.

B)Only Theodore or Arlo.

C)Only Arlo.

D)Theodore,Simon,or Alvin.

E)Theodore,Simon,Arlo,or Alvin

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

31

To be a qualifying relative,an individual must meet certain tests.These tests include,

I)the citizen or residency test.

II)the non-support test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)the citizen or residency test.

II)the non-support test.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

32

Sergio wants to know if he can claim his daughter,Sarah,as a dependent on his income tax return.Sarah lives at home with her parents all year.Sergio provides $11,500 for her support (i.e. ,food,shelter,and transportation).Sarah,age 18,made $13,250 last year by acting and working as a cashier at a restaurant.Sarah saved $9,000 of her income and spent $4,250 on clothes and entertainment.Can Sergio claim his daughter,Sarah,as a dependent for income tax purposes?

A)Yes.

B)No,Sarah fails the relationship test.

C)No,Sarah fails the gross income test.

D)No,Sarah fails the student test.

E)No,Sarah fails the support test.

A)Yes.

B)No,Sarah fails the relationship test.

C)No,Sarah fails the gross income test.

D)No,Sarah fails the student test.

E)No,Sarah fails the support test.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following individuals can be claimed as a dependent in the current year? (Assume any test not mentioned has been satisfied).

I)Carl and Diane are divorced.Carl has custody of their 6-year-old son.Diane pays Carl $500 per month in child support.Carl pays the other $400 per month it costs to support their son.The divorce decree does not stipulate who gets custody of the son.Carl claims his son as a dependent.

II)Lorraine is a 25-year-old college student.She lives with her parents,who also provide her with $500 monthly support.Lorraine earns $4,600 working part-time for other support.She may be claimed as a dependent of her parents.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Carl and Diane are divorced.Carl has custody of their 6-year-old son.Diane pays Carl $500 per month in child support.Carl pays the other $400 per month it costs to support their son.The divorce decree does not stipulate who gets custody of the son.Carl claims his son as a dependent.

II)Lorraine is a 25-year-old college student.She lives with her parents,who also provide her with $500 monthly support.Lorraine earns $4,600 working part-time for other support.She may be claimed as a dependent of her parents.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

34

Art is supported entirely by his 3 children who provide for his support as follows:

If the children file a multiple support agreement,which of the children will be eligible to claim Kenneth as a dependent?

A)None.

B)Only Allie.

C)Only Barney.

D)Only Allie or Barney.

E)Either Allie,Barney,or Carrie.

If the children file a multiple support agreement,which of the children will be eligible to claim Kenneth as a dependent?

A)None.

B)Only Allie.

C)Only Barney.

D)Only Allie or Barney.

E)Either Allie,Barney,or Carrie.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

35

Norton's spouse died in 2017.Norton has one child,age 7,living at home.Norton provides all of the support for the child.The child lives with Norton during 2017,2018,2019,and 2020.Norton's most advantageous filing status is

A)Married filing jointly in 2017,single in 2018,2019,and 2020.

B)Head of household for all four years.

C)Head of household in 2017,surviving spouse in 2018,2019,and 2020.

D)Married filing jointly in 2017,surviving spouse in 2018 and 2019,head of household in 2020.

A)Married filing jointly in 2017,single in 2018,2019,and 2020.

B)Head of household for all four years.

C)Head of household in 2017,surviving spouse in 2018,2019,and 2020.

D)Married filing jointly in 2017,surviving spouse in 2018 and 2019,head of household in 2020.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

36

Larry and Louise are both 49 years of age and file a joint return.They provide all of the support for their son,Dylan,who is 20 years old and is at home until he gets called into the army.His income at part-time jobs is $4,500.Their daughter,Phyllis,is a 23-year-old full-time student at State University.She lived at school 9 months and provided two thirds of her own support with a summer job.How many personal and dependency exemptions can Larry and Louise claim on their income tax return?

A)1

B)2

C)3

D)4

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

37

Lilly and her husband Ben have a serious argument.In fact,Lilly moved out in August,left town,and has not been heard from since.Ben supports their two children after the split up and maintains their household.What is Ben's filing status for the current year?

A)Single.

B)Head of household.

C)Surviving spouse.

D)Married,filing separately.

A)Single.

B)Head of household.

C)Surviving spouse.

D)Married,filing separately.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

38

Rosa is a single parent who maintains a home in Durham in which she and her 16-year-old daughter reside.She also provides most of the support for her son,Carmelo,age 25,who is a full-time student at Duke Law School,lives at home,and earns $3,500 as a part-time waiter at a local diner.How many personal and dependency exemptions can Rosa claim?

A)0

B)1

C)2

D)3

A)0

B)1

C)2

D)3

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

39

Brandon is retired and lives with his son,Charles.Charles and his sister and brother,Heloise and Barney,provide Brandon's total support:

If the children file a multiple support agreement,which of the children are eligible to claim Brandon as a dependent?

A)None.

B)Only Charles.

C)Only Heloise.

D)Only Charles and Heloise.

E)Charles,Heloise,or Barney.

If the children file a multiple support agreement,which of the children are eligible to claim Brandon as a dependent?

A)None.

B)Only Charles.

C)Only Heloise.

D)Only Charles and Heloise.

E)Charles,Heloise,or Barney.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

40

In October of the current year,Brandy and her husband Ben split up and do not speak to each other.Neither individual will cooperate with the other on finalizing the divorce.Ben supports their two children after the split up and maintains their household.What is Ben's filing status for the current year?

A)Single.

B)Head of household.

C)Surviving spouse.

D)Married,filing separately.

A)Single.

B)Head of household.

C)Surviving spouse.

D)Married,filing separately.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

41

Randy is a single individual who receives a salary of $30,000.During 2017,he has $7,000 withheld for payment of his federal income taxes and $2,500 for his state income taxes.In 2076,he receives a $400 refund after filing his 2017 federal tax return and a $50 refund after filing his state tax return.

I)Randy is allowed a deduction for the $2,500 of state taxes withheld from his salary on his 2017 federal tax return.

II)If Randy has total itemized deductions of $6,400 on his 2016 federal tax return,he must include the $50 state tax refund in his 2017 gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Randy is allowed a deduction for the $2,500 of state taxes withheld from his salary on his 2017 federal tax return.

II)If Randy has total itemized deductions of $6,400 on his 2016 federal tax return,he must include the $50 state tax refund in his 2017 gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

42

Samantha incurs the following medical expenses for the current year:

How much may Samantha include as qualified medical expenses on her current tax return before any limitation?

A)$400

B)$500

C)$900

D)$1,300

E)$1,700

How much may Samantha include as qualified medical expenses on her current tax return before any limitation?

A)$400

B)$500

C)$900

D)$1,300

E)$1,700

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

43

Julian and Judy divorced and Julian received custody of their child.Judy must pay child support of $24,000 annually.Therefore,Julian agreed in writing to allow Judy to claim the dependency exemption for the child.Julian maintains a home for himself and the child.For the current year,Julian's filing status and total exemptions claimed are

A)Single and one exemption.

B)Single and two exemptions.

C)Head of household and two exemptions.

D)Head of household and one exemption.

A)Single and one exemption.

B)Single and two exemptions.

C)Head of household and two exemptions.

D)Head of household and one exemption.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

44

Paul,age 40 and single,has an 8-year-old son,Larry.Larry resides with his mother,Susan,in her home.Pursuant to the terms of their divorce,Paul properly claims Larry as a dependent on his income tax return.Paul pays child support payments to his ex-wife for support of his child.Susan does not claim Larry as her dependent but she does bear the economic burden of supporting the household in which they reside.What is the maximum amount of the 2017 standard deduction that Susan qualifies for?

A)$6,350

B)$9,350

C)$9,600

D)$12,700

E)Susan does not qualify to claim a standard deduction.

A)$6,350

B)$9,350

C)$9,600

D)$12,700

E)Susan does not qualify to claim a standard deduction.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

45

Cory is a 32 years old,unmarried,and has no children.Cory's father lives in a nursing home.

I)Because Cory's father does not live in the same household,Cory cannot file as a head of household.

II)If his father's taxable income is less than $4,050 and the other dependency tests are met,Cory will file as head of household.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Because Cory's father does not live in the same household,Cory cannot file as a head of household.

II)If his father's taxable income is less than $4,050 and the other dependency tests are met,Cory will file as head of household.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following qualify for the medical expense deduction?

I)Over-the-counter cough medicine.

II)Chiropractic treatments.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Over-the-counter cough medicine.

II)Chiropractic treatments.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

47

Bruce,65,supports his mother who lives with him.What is the maximum amount of the 2017 standard deduction that Bruce qualifies for?

A)$6,350

B)$8,700

C)$9,300

D)$10,500

E)$10,900

A)$6,350

B)$8,700

C)$9,300

D)$10,500

E)$10,900

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

48

Georgia is unmarried and maintains a home in which she and her unmarried daughter Karla age 34,live.Karla is an engineer and earns $52,000 annually.Karla had some severe financial difficulties two years ago and Georgia has been helping her out ever since.Georgia's spouse died in 2016.What is Georgia's filing status for 2017?

A)Head of household

B)Surviving spouse

C)Married,filing jointly

D)Single

E)Married,filing separately

A)Head of household

B)Surviving spouse

C)Married,filing jointly

D)Single

E)Married,filing separately

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

49

Marci is single and her adjusted gross income is $30,000.In addition,she pays the following expenses during the year:

Marci pays $600 for medical insurance premiums and receives a reimbursement of $1,000 from the insurance company for her medical expenses.Compute her medical deduction.

A)$- 0 -

B)$550

C)$750

D)$1,250

E)$1,450

Marci pays $600 for medical insurance premiums and receives a reimbursement of $1,000 from the insurance company for her medical expenses.Compute her medical deduction.

A)$- 0 -

B)$550

C)$750

D)$1,250

E)$1,450

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

50

Irene is 47 years old,unmarried,and has no children.Irene's mother lives in a nursing home.

I)Irene can file as head of household because her mother lives in a nursing home.

II)Because Irene's mother is a lineal descendent,Irene automatically qualifies for head of household status.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Irene can file as head of household because her mother lives in a nursing home.

II)Because Irene's mother is a lineal descendent,Irene automatically qualifies for head of household status.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

51

Michael,age 42 and single,has a 13-year-old son,Tony.Tony resides with his mother,Jennifer,in her home.Pursuant to the terms of their divorce,Michael properly claims Tony as a dependent on his income tax return.Michael pays child support payments to his ex-wife for support of his child.Jennifer does not claim Tony as her dependent but she does bear the economic burden of supporting the household in which they reside.What is the maximum amount of the 2017 standard deduction that Michael qualifies for?

A)$6,350

B)$12,700

C)$9,350

D)$5,000

A)$6,350

B)$12,700

C)$9,350

D)$5,000

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

52

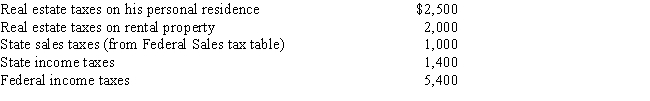

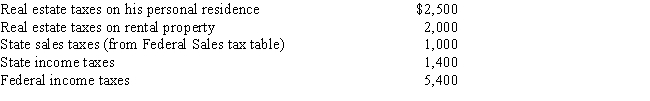

During the current year,Robbie and Anne pay the following taxes:

What amount can Robbie and Anne claim as an itemized deduction for taxes on their federal income tax return for the year?

A)$5,850

B)$6,950

C)$7,550

D)$8,050

E)$11,300

What amount can Robbie and Anne claim as an itemized deduction for taxes on their federal income tax return for the year?

A)$5,850

B)$6,950

C)$7,550

D)$8,050

E)$11,300

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

53

Richard pays his license plate fee for his car in July of the current year.Of the $400 he paid $10 represented a registration fee,$140 represented a charge based on the weight of the car,and a $200 charge based on the value of the car.How much of the $400 can Richard deduct on his current-year tax return?

A)$- 0 -

B)$60

C)$140

D)$200

E)$400

A)$- 0 -

B)$60

C)$140

D)$200

E)$400

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

54

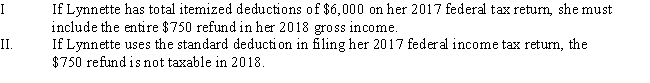

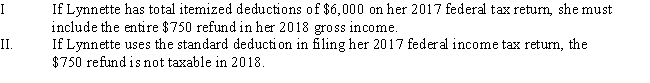

Lynnette is a single individual who receives a salary of $36,000.During 2017,she has $6,800 withheld for payment of her federal income taxes and $2,900 for her 2017 state income taxes.In 2018,she receives a $450 refund after filing her 2017 federal tax return and a $750 refund after filing her 2017 state tax return.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

55

Carlos incurs the following medical expenses during the current tax year:

Carlos's adjusted gross income for the year is $32,000.He receives a $500 reimbursement from his insurance company.Determine the amount of his medical expense deduction for the current year.

A)$- 0 -

B)$210

C)$2,360

D)$2,400

E)$2,610

Carlos's adjusted gross income for the year is $32,000.He receives a $500 reimbursement from his insurance company.Determine the amount of his medical expense deduction for the current year.

A)$- 0 -

B)$210

C)$2,360

D)$2,400

E)$2,610

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following qualify for the medical expense deduction?

I)Insulin.

II)Medicare insurance premiums.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Insulin.

II)Medicare insurance premiums.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

57

Tisha's husband died in 2014.She has not remarried and maintains a home for herself and her dependent son.What is Tisha's filing status for 2017?

A)Single.

B)Head of household.

C)Married,filing separately.

D)Surviving spouse.

A)Single.

B)Head of household.

C)Married,filing separately.

D)Surviving spouse.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

58

Ricardo pays the following taxes during the year:

What is the amount Ricardo can deduct for taxes as an itemized deduction for the year?

A)$7,500

B)$8,100

C)$9,500

D)$12,900

E)$15,500

What is the amount Ricardo can deduct for taxes as an itemized deduction for the year?

A)$7,500

B)$8,100

C)$9,500

D)$12,900

E)$15,500

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

59

Anita receives a state income tax refund of $550 in May 2017.When she filed her 2016 federal income tax return,she used the standard deduction amount.Although the all-inclusive income concept would require Anita to report the $550 in her federal gross income for 2017,she may exclude it.What tax concept explains why the exclusion is permitted in this case?

A)Wherewithal to pay.

B)Tax benefit rule.

C)Ability to pay.

D)Assignment of income.

E)Administrative convenience.

A)Wherewithal to pay.

B)Tax benefit rule.

C)Ability to pay.

D)Assignment of income.

E)Administrative convenience.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

60

Morris is a single individual who has total itemized deductions in 2017 of $6,500.His itemized deductions include $2,000 for state income taxes.After filing his 2017 state income tax return he receives a refund of $275.

A)Morris must include $275 as income on his 2017 federal income tax return.

B)Morris must amend his 2017 federal tax return to reflect state income taxes of $1,725 ($2,000 - $275).

C)If Morris itemizes his tax return in 2018 he must reduce his state tax deduction by $275.

D)Morris must include $200 as income on his 2018 federal income tax return.

E)Morris does not have to report any of the state income tax refund on his 2018 tax return.

A)Morris must include $275 as income on his 2017 federal income tax return.

B)Morris must amend his 2017 federal tax return to reflect state income taxes of $1,725 ($2,000 - $275).

C)If Morris itemizes his tax return in 2018 he must reduce his state tax deduction by $275.

D)Morris must include $200 as income on his 2018 federal income tax return.

E)Morris does not have to report any of the state income tax refund on his 2018 tax return.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following taxes is deductible from adjusted gross income when paid by an individual taxpayer?

I)State income tax.

II)Property tax on property owned in Alberta,Canada.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)State income tax.

II)Property tax on property owned in Alberta,Canada.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

62

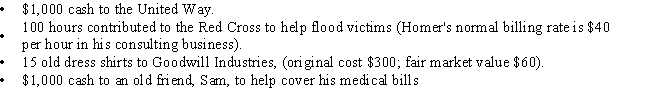

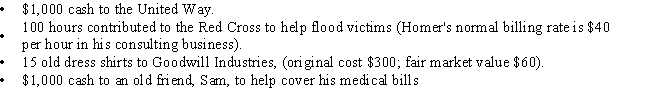

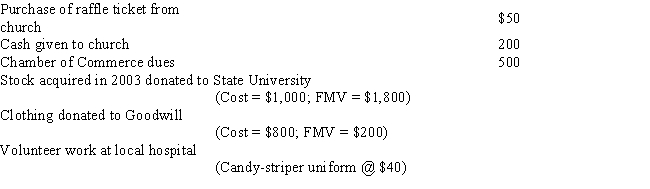

Homer has AGI of $41,500,and makes the following donations in the current year:

What is Homer's charitable contribution deduction for the current year?

A)$1,000-

B)$1,060

C)$1,300

D)$2,060

E)$6,300

What is Homer's charitable contribution deduction for the current year?

A)$1,000-

B)$1,060

C)$1,300

D)$2,060

E)$6,300

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

63

Wayne purchases a new home during the year,borrowing $725,000 from Century National Bank to finance the purchase.He also pays $7,250 in points and $4,500 in loan origination fees.During the year he pays interest of $71,000 on the loan.What is Wayne's allowable interest deduction?

A)$- 0 -

B)$7,250

C)$71,000

D)$78,250

E)$82,750

A)$- 0 -

B)$7,250

C)$71,000

D)$78,250

E)$82,750

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following properties from an income tax standpoint will be the best one for Juan to contribute to his favorite charity?

A)Stock acquired in 1992,basis = $13,000,FMV = $10,000.

B)Stock acquired in 1996,basis = $7,000,FMV = $10,000.

C)Inventory items acquired in 2004,basis = $8,000,FMV = $10,000.

D)Inventory items acquired in 2010,basis = $18,000,FMV = $10,000.

E)Juan should be indifferent between giving any of the above properties from an income tax standpoint because they each have the same fair market value.

A)Stock acquired in 1992,basis = $13,000,FMV = $10,000.

B)Stock acquired in 1996,basis = $7,000,FMV = $10,000.

C)Inventory items acquired in 2004,basis = $8,000,FMV = $10,000.

D)Inventory items acquired in 2010,basis = $18,000,FMV = $10,000.

E)Juan should be indifferent between giving any of the above properties from an income tax standpoint because they each have the same fair market value.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

65

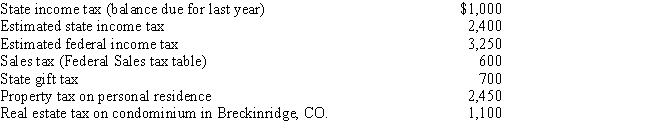

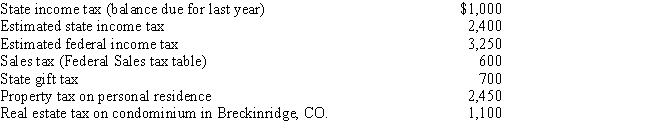

Ronald pays the following taxes during the year:

What is the amount Ronald can deduct for taxes as an itemized deduction for the year?

A)$3,500

B)$3,900

C)$4,900

D)$6,900

E)$12,300

What is the amount Ronald can deduct for taxes as an itemized deduction for the year?

A)$3,500

B)$3,900

C)$4,900

D)$6,900

E)$12,300

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

66

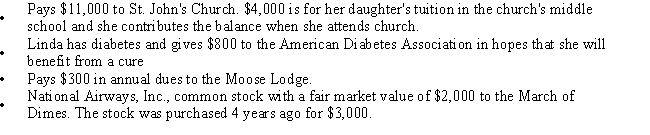

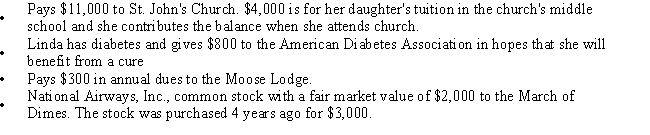

Linda's personal records for the current year show the following facts:

Linda's AGI for the current year is $32,000.What is her charitable contribution deduction?

A)$7,000

B)$9,000

C)$9,800

D)$10,800

E)$13,800

Linda's AGI for the current year is $32,000.What is her charitable contribution deduction?

A)$7,000

B)$9,000

C)$9,800

D)$10,800

E)$13,800

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

67

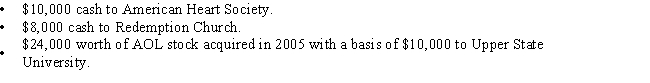

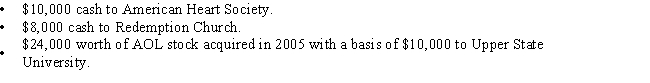

Armando has AGI of $80,000 and makes the following charitable contributions:

What is Armando's maximum charitable deduction in the current year?

A)$18,000

B)$24,000

C)$28,000

D)$40,000

E)$42,000

What is Armando's maximum charitable deduction in the current year?

A)$18,000

B)$24,000

C)$28,000

D)$40,000

E)$42,000

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

68

Certain interest expense can be carried forward if not deductible in the current year.Which of the following types of interest can be carried forward and deducted in a future year?

A)Credit card interest.

B)Personal car loan interest.

C)Interest on a loan to buy common stock.

D)Home equity loan interest.

A)Credit card interest.

B)Personal car loan interest.

C)Interest on a loan to buy common stock.

D)Home equity loan interest.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

69

Baylen,whose adjusted gross income is $60,000,purchases a new home during the year,borrowing $300,000 from Century National Bank to finance the purchase.He also pays $3,000 in points and $4,500 in loan origination fees.During the year he pays interest of $14,000 on the loan.What is Baylen's allowable interest deduction?

A)$14,000

B)$15,800

C)$17,000

D)$18,800

E)$23,300

A)$14,000

B)$15,800

C)$17,000

D)$18,800

E)$23,300

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

70

Linc,age 25,is single and makes an annual contribution to his church of $2,000.Linc always uses the standard deduction when filing his income tax return.Determine the amount of Linc's deduction for charitable contributions.

A)$- 0 -

B)$200

C)$560

D)$1,000

E)$2,000

A)$- 0 -

B)$200

C)$560

D)$1,000

E)$2,000

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

71

Kristin has AGI of $120,000 in 2016 and 2017.She makes cash contributions to the American Cancer Society of $63,000 in 2016 and $65,000 in 2017.Kristin's charitable contribution carryover from 2017 is:

A)$- 0 -

B)$3,000

C)$5,000

D)$8,000

E)$34,000

A)$- 0 -

B)$3,000

C)$5,000

D)$8,000

E)$34,000

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

72

Brock incurs $950 interest on his GMAC auto loan,$150 interest on a loan with Computer Express to buy a multi-media equipped computer (personal use),$500 interest on his credit cards,and $1,000 investment interest.Brock's net investment income is $650.Brock's deductible interest amount is

A)$- 0 -

B)$350

C)$650

D)$1,000

E)$1,600

A)$- 0 -

B)$350

C)$650

D)$1,000

E)$1,600

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

73

Louise makes the following contributions during the current year:

If Louise's gross income is $35,000,what is her allowable charitable contribution?

A)$1,440

B)$2,240

C)$2,290

D)$2,790

E)$2,840

If Louise's gross income is $35,000,what is her allowable charitable contribution?

A)$1,440

B)$2,240

C)$2,290

D)$2,790

E)$2,840

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

74

Gerald purchases a new home on June 30,2017.During January 2018,he receives his real estate tax statement for calendar year 2017 showing $1,800 payable.Gerald pays the $1,800 on March 1,2018.The seller of the residence had credited Gerald with $900 of the 2017 taxes on the closing statement.What is the amount of real estate taxes that Gerald may claim as an itemized deduction in 2018?

A)$- 0 -

B)$450

C)$900

D)$1,800

E)$2,700

A)$- 0 -

B)$450

C)$900

D)$1,800

E)$2,700

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

75

Randolph borrows $100,000 from his uncle's bank and invests the proceeds in various corporate bonds.He pays $9,000 in interest on the loan during the current year.The bonds produce $7,200 of interest income.Randolph reports adjusted gross income of $100,000 in the current year.If the interest income is his only investment income,how much of the interest expense is deductible by Randolph?

A)$7,000

B)$7,200

C)$9,000

D)None of this interest is deductible.

A)$7,000

B)$7,200

C)$9,000

D)None of this interest is deductible.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

76

Hank,whose adjusted gross income is $100,000,purchases a new principal residence in the current year for $250,000.He borrows $220,000 from a local mortgage company and pays loan origination fees of $1,600.During the year,Hank pays $7,000 of interest on the loan.What is Hank's allowable interest deduction for the year?

A)$7,000

B)$7,750

C)$8,500

D)$8,600

E)$10,100

A)$7,000

B)$7,750

C)$8,500

D)$8,600

E)$10,100

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

77

Carlyle purchases a new personal residence for $230,000.He makes a down payment of $30,000 and finances the balance at a very favorable interest rate.To obtain the favorable rate,points equal to 3% of the loan balance are paid at the closing.What amount of the points can Carlyle deduct in the current year?

A)$- 0 -

B)$3,000

C)$4,000

D)$6,000

E)$6,600

A)$- 0 -

B)$3,000

C)$4,000

D)$6,000

E)$6,600

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

78

Bender borrows $200,000 from his uncle's bank and invests the proceeds in various common stocks.He pays $9,000 in interest on the loan during the current year.The stocks produce $7,200 of dividend income,all taxed at the rate of 15%.Bender reports adjusted gross income of $100,000 in the current year.If the dividend income is his only investment income,how much of the interest expense is deductible by Bender?

A)$7,000

B)$7,200

C)$9,000

D)None of this interest is deductible.

A)$7,000

B)$7,200

C)$9,000

D)None of this interest is deductible.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following taxes is deductible from adjusted gross income when paid by an individual taxpayer?

I)State income tax.

II)State excise tax on gasoline.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)State income tax.

II)State excise tax on gasoline.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

80

Debra and Ken refinance their personal residence on July 1,2017.They borrow $96,000 over a 20-year period and paid points of $1,920.For 2017,what amount of the points is deductible?

A)$- 0 -

B)$48

C)$96

D)$480

E)$960

A)$- 0 -

B)$48

C)$96

D)$480

E)$960

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck