Deck 4: Income Exclusions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/161

Play

Full screen (f)

Deck 4: Income Exclusions

1

Systech offered its stockholders a choice between stock and cash for their annual dividend.Since Carol has chosen stock,she does not have to include the dividend in income.

False

2

To keep the employees on the premises in case an emergency arises,the Riverview Hotel provides meals to its employees in a room adjacent to their restaurant.Since the meals are provided as a convenience to the employer and on their premises,the value of the meals is excluded in the income of the employees.

True

3

Robert's employer provides all of its employees a $40,000 group term life insurance policy.The cost of this policy must be included in Robert's income.

False

4

Melvin was in an accident which was the other driver's fault.Melvin received $15,000 for pain and suffering,emotional distress,and lost wages.Melvin may exclude the entire $15,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

5

Health Savings Accounts are available only to self-employed individuals or small businesses.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

6

On her 18th birthday,Anna's grandfather gave her stock worth $100,000.During the current year,Anna receives $5,000 of dividends on the stock,which she uses to pay college expenses.The cost of Anna's tuition,fees,and books is $4,000.Anna's income from this event is:

A)$- 0 -

B)$1,000

C)$4,000

D)$5,000

E)$75,000

A)$- 0 -

B)$1,000

C)$4,000

D)$5,000

E)$75,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

7

The interest from Guam Water Authority bonds is excluded from income as "Municipal Bond Interest."

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

8

On her 18th birthday,Patti's grandfather gave her $8,000 of dividends on stock he owned,which she uses to pay college expenses.The cost of Patti's tuition,fees,and books is $6,000.Patti's gross income from this event is:

A)$- 0 -

B)$2,000

C)$6,000

D)$8,000

A)$- 0 -

B)$2,000

C)$6,000

D)$8,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

9

Any income earned subsequent to the death of the decedent from inherited property is excludable from the heir's taxable income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

10

Connie received a $1,000 scholarship to attend State University from a local civic group based on her grades and community activities.The $1,000 is included in income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

11

Patrick ran up a large credit card debt.Since the bank wanted to keep Patrick's account they forgave $5,000 of his balance.Patrick was solvent before and after the forgiveness.He has to include the $5,000 in his income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

12

When Rick found out that Ryan's liabilities exceeded his assets by $15,000,he forgave Ryan the $1,000 he owed Rick in hoping that Ryan might get back on his feet.Ryan is allowed to exclude the $1,000 from income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

13

Gifts received are not subject to income taxation;however the donor is subject to the gift tax rules on the making of a gift.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

14

On April 1,Sally is given $20,000 worth of General Motors bonds for her 18th birthday.On June 30,Sally receives the $800 annual interest payment on the bonds.How much income should Sally recognize due to these two events?

A)$- 0 -

B)$200

C)$800

D)$20,000

E)$20,800

A)$- 0 -

B)$200

C)$800

D)$20,000

E)$20,800

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

15

Myra's employer paid her health and accident insurance premium of $5,600.Since she had the option to take the cash and purchase her own insurance,the $5,600 must be included in income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

16

On April 1,Sally is given $20,000 worth of City of Boise bonds for her 18th birthday.On June 30,Sally receives the $800 annual interest payment on the bonds.How much income should Sally recognize due to these two events?

A)$- 0 -

B)$200

C)$800

D)$20,000

E)$20,800

A)$- 0 -

B)$200

C)$800

D)$20,000

E)$20,800

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

17

Clarance rented office space to an attorney who left town before the lease was completed.The attorney left several bookcases and other improvements to cover the remaining rent.Clarance must include in income the value of the leasehold improvements to the extent of the remaining rent that was due.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

18

No-additional-cost services and employee discounts must be made available to employees on a nondiscriminatory basis and must also be in the same line of business in which the employee works to be excluded from the employee's income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

19

Cornell is a building contractor who builds 25-30 homes a year.Charlotte is a real estate broker who sells all of Cornell's homes.Charlotte has recently referred a couple to Cornell who wanted him to build a $400,000 home for them.Knowing that Charlotte and her husband enjoy skiing,he bought her a nice pair of skis and boots.

I)The "gift" appears to be a form of compensation.

II)The skis are considered a gift for income tax purposes.

III)Substance-over-form applies to this situation.

IV)Charlotte recognizes gross income from the receipt of the skis.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I,III,and IV are correct.

D)Statements II and IV are correct.

E)Statements II,III,and IV are correct.

I)The "gift" appears to be a form of compensation.

II)The skis are considered a gift for income tax purposes.

III)Substance-over-form applies to this situation.

IV)Charlotte recognizes gross income from the receipt of the skis.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I,III,and IV are correct.

D)Statements II and IV are correct.

E)Statements II,III,and IV are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

20

Matt,a U.S.citizen,can exclude all of his $120,000 salary he earned as a bullfighter in Spain where he lived all year,from his U.S.tax return.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

21

Ward and June are in the 28% tax bracket.Included in their assets is a Dell Corporation bond with a face value of $10,000.The bond pays $1,000 a year in interest.Ward and June make a gift to their son,Wally (age 19)of the $1,000 in interest income.Wally is in the 10% tax bracket.What is Ward and June's tax liability related to the bond and the bond interest for the current year?

A)$-0-

B)$100

C)$280

D)$1,000

E)$2,800

A)$-0-

B)$100

C)$280

D)$1,000

E)$2,800

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

22

Ward and June are in the 28% tax bracket.Included in their assets is a Dell Corporation bond with a face value of $10,000.The bond pays $1,000 per year in interest.Ward and June gift the bond to their son,Wally (age 19),on January 1,2017.Wally is in the 10% tax bracket.Wally's taxable income from the receipt of the bond and the bond interest in 2017 is

A)$-0-

B)$1,000

C)$1,500

D)$10,000

E)$11,000

A)$-0-

B)$1,000

C)$1,500

D)$10,000

E)$11,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

23

In May,Josefina receives stock worth $10,000 from the estate of her Uncle.The following November she receives a $500 cash dividend on the stock.Josefina must

I)include the $500 dividend in her gross income.

II)include the $10,000 value of the stock received in her gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)include the $500 dividend in her gross income.

II)include the $10,000 value of the stock received in her gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

24

Terri is driving down a road when she sees that Sonny is having trouble changing a tire.Terri stops and helps Sonny.As Sonny is leaving,he gives Terri $50 and thanks her.What are the effects of the $50 receipt?

I)The $50 is a gift because it is from detached and disinterested generosity.

II)The $50 is compensation received for services rendered.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The $50 is a gift because it is from detached and disinterested generosity.

II)The $50 is compensation received for services rendered.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

25

Maria is on a "full ride" tennis scholarship at Western University.Her $12,500 scholarship covers tuition and books ($7,000)and room and board ($5,500).Maria's gross income is

A)$- 0 -

B)$2,000

C)$5,500

D)$7,000

E)$12,500

A)$- 0 -

B)$2,000

C)$5,500

D)$7,000

E)$12,500

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

26

Gary receives $40,000 worth of Quantro,Inc. ,common stock from the estate of his late grandmother.He receives a $100 cash dividend six months later.Before the end of the year,Gary sells the stock for $42,000.Due to these events,how much must Gary include in his gross income for the year?

A)$-0-

B)$100

C)$2,000

D)$2,100

E)$42,100

A)$-0-

B)$100

C)$2,000

D)$2,100

E)$42,100

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

27

A college student who is a candidate for a degree may exclude the value of a scholarship received for

I)Meals.

II)Books.

III)Computer.

IV)Tuition.

V)Housing.

A)Statements I and V are correct.

B)Statements II,III,and IV are correct.

C)Only statement IV is correct.

D)Statements II and IV is correct.

E)Statements I,II,III,IV,and V are correct.

I)Meals.

II)Books.

III)Computer.

IV)Tuition.

V)Housing.

A)Statements I and V are correct.

B)Statements II,III,and IV are correct.

C)Only statement IV is correct.

D)Statements II and IV is correct.

E)Statements I,II,III,IV,and V are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

28

During the current year,Eleanor receives land valued at $30,000 from the estate of her grandfather.Her grandfather's basis in the land was $8,000.Eleanor sells the land for $34,000 late in the year.Eleanor's gross income is:

A)$- 0 -

B)$4,000

C)$8,000

D)$16,000

E)$26,000

A)$- 0 -

B)$4,000

C)$8,000

D)$16,000

E)$26,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

29

Bart's spouse,Carla,dies during the current year.Carla's life insurance policy names Bart the sole beneficiary of the $2 million proceeds.Bart invests the $2 million in a bank certificate of deposit (CD).For the current year,Bart earns $98,000 interest from the CD.What are the tax effects of these events for Bart?

I)The $2 million is excluded from gross income.

II)Bart has no taxable income from these transactions.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The $2 million is excluded from gross income.

II)Bart has no taxable income from these transactions.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

30

Ally served as chairperson of the local school board.Upon completion of her term in office,the organization awards her a silver-serving tray in recognition of her outstanding service to the organization.The value of the tray is $200.What are the tax effects of the award?

I)The value of the tray is included in gross income because of services rendered.

II)The tray is a gift because it is from a detached and disinterested generosity.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The value of the tray is included in gross income because of services rendered.

II)The tray is a gift because it is from a detached and disinterested generosity.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

31

Ally served as chairperson of the local school board.Upon completion of her term in office,the employees in the school district offices take up a collection and purchase her a silver sterling tray in recognition of her outstanding service to the organization.The value of the tray is $200.What are the tax effects of the award?

I)The value of the tray is included in gross income because of services rendered.

II)The tray is a gift because it is from a detached and disinterested generosity.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both are correct.

D)Neither is correct.

I)The value of the tray is included in gross income because of services rendered.

II)The tray is a gift because it is from a detached and disinterested generosity.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both are correct.

D)Neither is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

32

Bart's spouse,Carla,dies during the current year.Carla's life insurance policy names Bart the sole beneficiary of the $2 million proceeds.Bart invests the $2 million in a bank certificate of deposit (CD).For the current year,Bart earns $98,000 interest from the CD.What are the tax effects of these events for Bart?

I)The $98,000 is included in gross income.

II)The $2 million is included in gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The $98,000 is included in gross income.

II)The $2 million is included in gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

33

Fran dies on January 14,2017.Her spouse,Carl,is the beneficiary of a $100,000 life insurance policy.Carl elects to receive the proceeds in 10 equal installments of $11,000.In 2017,Carl receives $11,000.The amount included in Carl's 2017 gross income is

A)$- 0 -

B)$1,000

C)$10,000

D)$11,000

E)$111,000

A)$- 0 -

B)$1,000

C)$10,000

D)$11,000

E)$111,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

34

Bernice is the beneficiary of a $50,000 insurance policy on her father's life.If she receives the proceeds in installments from the insurance company that carries the policy,she will earn only five-percent interest per year,receiving $10,500 per year for five years.Bernice decides to take the $50,000 in a lump-sum payment and invest the funds herself.Of the $50,000 received:

A)All $50,000 is tax-free.

B)All $50,000 is taxable income.

C)$500 is interest income for each year.

D)The first $25,000 is taxable.

A)All $50,000 is tax-free.

B)All $50,000 is taxable income.

C)$500 is interest income for each year.

D)The first $25,000 is taxable.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

35

For the past seven years Karen,an attorney,has directed litigation clients to Rebecca,a CPA,for accounting investigatory work.Because of the amount of litigation work Karen directed to Rebecca,Rebecca's business is now comprised solely of litigation support work.Karen began taking tennis lessons this year.Rebecca gives Karen a new tennis racquet so they could share afternoons by playing tennis together.

I)The "gift" appears to be a form of compensation.

II)Substance-over-form applies to this situation.

III)The tennis racquet meets the income tax definition of a gift.

IV)Karen recognizes no gross income from the receipt of the tennis racquet.

A)Only statement I is correct.

B)Only statement IV is correct.

C)Statements I and II are correct.

D)Statements III and IV are correct.

E)Statements I,II,and IV are correct.

I)The "gift" appears to be a form of compensation.

II)Substance-over-form applies to this situation.

III)The tennis racquet meets the income tax definition of a gift.

IV)Karen recognizes no gross income from the receipt of the tennis racquet.

A)Only statement I is correct.

B)Only statement IV is correct.

C)Statements I and II are correct.

D)Statements III and IV are correct.

E)Statements I,II,and IV are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

36

Drew graduated from business school in December 2017.To honor Drew,on January 3,2018,his uncle gives him two tickets to the Super Bowl.The uncle paid $1,200 for each ticket.Because he had to report to work at a brokerage firm in Indianapolis on January 15,2017,he could not use the tickets.Therefore,he sells them for $2,500 each.How much income must Drew recognize in 2018 because of these events?

A)$- 0 -

B)$2,000

C)$2,400

D)$2,600

E)$5,000

A)$- 0 -

B)$2,000

C)$2,400

D)$2,600

E)$5,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

37

Barbara was the legal owner of a $100,000 life insurance policy on herself.Glenna is the stated beneficiary.Shortly before her death,Barbara transfers ownership of the policy to Glenna for $15,000.Glenna makes one premium payment in the amount of $1,000 before Barbara dies.Glenna subsequently receives the $100,000 life insurance proceeds.How much of the $100,000 is taxable to Glenna?

A)$- 0 -

B)$15,000

C)$84,000

D)$85,000

E)$100,000

A)$- 0 -

B)$15,000

C)$84,000

D)$85,000

E)$100,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

38

Jerry's wife dies in September.His wife had paid $20,000 of premiums on a $150,000 face value whole life insurance policy.Jerry elects to receive the life insurance policy proceeds in 20 annual installments of $10,000.Jerry receives his first $10,000 payment this year.How much of the payment should Jerry report as gross income?

A)$- 0 -

B)$2,500

C)$5,000

D)$7,500

E)$10,000

A)$- 0 -

B)$2,500

C)$5,000

D)$7,500

E)$10,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

39

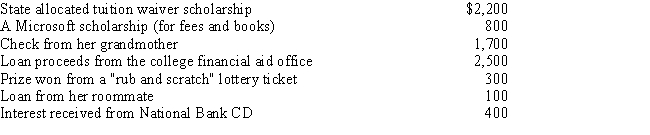

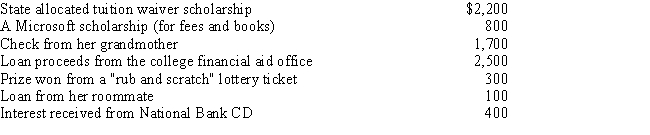

Mei-Ling is a candidate for a master's degree in taxation from Western State University.During the current year she receives the following cash payments:

How much must be included in Mei-Ling's gross income?

A)$- 0-

B)$700

C)$1,500

D)$3,700

E)$8,000

How much must be included in Mei-Ling's gross income?

A)$- 0-

B)$700

C)$1,500

D)$3,700

E)$8,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

40

Ward and June are in the 28% tax bracket.Included in their assets is a Dell Computer Corporation bond with a face value of $10,000.The bond pays $1,000 a year in interest.Ward and June gift the bond to their son,Wally (age 19),on January 1,2017.Wally is in the 15% tax bracket.The 2017 net tax savings for the family unit of Ward,June and Wally related to the transfer of the bond is

A)$-0-

B)$130

C)$150

D)$280

A)$-0-

B)$130

C)$150

D)$280

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

41

Sylvia is a United States citizen who has established legal residency in Japan.She has been teaching school there for several years.Her annual salary is $60,000.Anne's tax situation is

A)She is not subject to U.S.tax law.

B)She can elect to exclude her foreign income from U.S.taxation and take a tax credit for foreign taxes paid.

C)She can elect to exclude her foreign income from U.S.taxation,or take a tax credit for foreign taxes paid.

D)She is not eligible to take a tax credit for foreign taxes paid or exclude her foreign income from her U.S.gross income.

E)Only one jurisdiction,either the U.S.or Japan,not both,can tax Sylvia on her income while in Japan.

A)She is not subject to U.S.tax law.

B)She can elect to exclude her foreign income from U.S.taxation and take a tax credit for foreign taxes paid.

C)She can elect to exclude her foreign income from U.S.taxation,or take a tax credit for foreign taxes paid.

D)She is not eligible to take a tax credit for foreign taxes paid or exclude her foreign income from her U.S.gross income.

E)Only one jurisdiction,either the U.S.or Japan,not both,can tax Sylvia on her income while in Japan.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

42

Rex is a programmer with Monon Electronics Corporation.His annual salary is $50,000.As part of his compensation package,he receives a term-life insurance policy equal to his annual salary.All members of the programming staff receive this benefit.Members of the sales staff have a cafeteria plan from which to select various benefits including life and health insurance coverage.

I)Rex has an excludable amount of income because of the nature of his employment benefit.

II)Rex must include $50,000 in his gross income because that is the value of the insurance benefit.

III)Rex must include the cost of the insurance policy in his gross income.

IV)If the benefit is only available to "key" employees and Rex is a "key" employee,he may exclude the cost of the premiums paid from his gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

I)Rex has an excludable amount of income because of the nature of his employment benefit.

II)Rex must include $50,000 in his gross income because that is the value of the insurance benefit.

III)Rex must include the cost of the insurance policy in his gross income.

IV)If the benefit is only available to "key" employees and Rex is a "key" employee,he may exclude the cost of the premiums paid from his gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

43

Donna is a student at Eastern State University.She receives a $4,000 academic scholarship from the Silverman Foundation.She also has a $2,000 assistantship to grade and tutor for the Department of Economics.Tuition,books,fees,and supplies are $5,000.How much gross income must Donna recognize from the scholarship and assistantship?

A)$- 0 -

B)$1,000

C)$2,000

D)$5,000

E)$6,000

A)$- 0 -

B)$1,000

C)$2,000

D)$5,000

E)$6,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

44

Nancy teaches school in a Chinese university.She is a U.S.citizen and has been teaching in China for 5 years.In the current year she will earn $100,000.What are some of Nancy's options for reporting U.S.gross income?

I)She may include the foreign earned income in her gross income,calculate her U.S.income tax,and take a tax credit for foreign taxes paid.

II)She may exclude up to $102,100 in foreign earned income for the current year.

III)She may exclude all of her income because it is earned outside of the U.S.

A)Only I is correct.

B)Only II is correct.

C)Only III is correct.

D)I and II are correct.

E)II and III are correct.

I)She may include the foreign earned income in her gross income,calculate her U.S.income tax,and take a tax credit for foreign taxes paid.

II)She may exclude up to $102,100 in foreign earned income for the current year.

III)She may exclude all of her income because it is earned outside of the U.S.

A)Only I is correct.

B)Only II is correct.

C)Only III is correct.

D)I and II are correct.

E)II and III are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

45

Sigma Company provides its employees with $25,000 of group-term life insurance.How much is included in gross income because of the life insurance?

A)$- 0 -

B)$25,000

C)$50,000

D)The cost of the premium to purchase $25,000 of group term life insurance.

E)The value of the premium to acquire $25,000 of group term life insurance from IRS tables.

A)$- 0 -

B)$25,000

C)$50,000

D)The cost of the premium to purchase $25,000 of group term life insurance.

E)The value of the premium to acquire $25,000 of group term life insurance from IRS tables.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

46

Sanford's employer has a qualified pension plan that allows employees to contribute up to 10% of their gross salaries to the plan.The employer matches the contribution at the rate of 50% of the employee's contribution.Sanford's current annual salary is $80,000.This is his only source of income.If he contributes the maximum amount to the pension plan,what is Sanford's gross income for the current year?

A)$72,000

B)$76,000

C)$80,000

D)$84,000

E)$88,000

A)$72,000

B)$76,000

C)$80,000

D)$84,000

E)$88,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

47

Sundown,Inc. ,purchases a term life insurance plan only for its corporate officers.Harold receives $250,000 of insurance at a cost to the company of $3,500.The IRS Table of Premium value indicates that premiums are $1.08 annually per $1,000 of protection.How much gross income does Harold have from the purchase of the life insurance by Sundown,Inc.?

A)$216

B)$270

C)$2,800

D)$3,500

E)$5,000

A)$216

B)$270

C)$2,800

D)$3,500

E)$5,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

48

Kristine is the controller of Evans Company.Evans provides all management level employees with medical insurance through a self-insured plan.During the current year,Kristine has $2,650 in medical expenses reimbursed by the plan.The income tax effect of the reimbursements Kristine receives is:

I)Kristine excludes the value of the reimbursement.

II)Kristine includes $2,650 in her gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Kristine excludes the value of the reimbursement.

II)Kristine includes $2,650 in her gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

49

Julia spends her summers away from college as a forest ranger in a remote area near Mt.McKinley,Alaska.She lives in a remote dormitory where she also receives free meals.The dormitory's location permits rangers to be on call in case of an emergency.

I)The value of the lodging is excluded from Julia's gross income.

II)The value of the meals is excluded from Julia's gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The value of the lodging is excluded from Julia's gross income.

II)The value of the meals is excluded from Julia's gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

50

Moonglow,Inc. ,purchases a group-term life insurance plan for all its employees.Harold receives $250,000 of insurance for the current year at a cost to the company of $2,500.The IRS Table of Premium values indicates that premiums are $1.08 annually per $1,000 of protection.How much gross income does Harold have from the purchase of the life insurance by Moonglow,Inc.?

A)$216

B)$270

C)$2,000

D)$2,270

E)$2,500

A)$216

B)$270

C)$2,000

D)$2,270

E)$2,500

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

51

Steve is an employee of Giant Valley Auto City.The company allows all employees to receive a 35% discount on service to their personal vehicles.Steve paid $975 for work done on his truck that normally costs $1,500.How much gross income must Steve recognize because of the discount?

A)$- 0 -

B)$225

C)$300

D)$525

E)$975

A)$- 0 -

B)$225

C)$300

D)$525

E)$975

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

52

Hector's employer has a qualified pension plan to which it contributes 6% of his gross salary.Hector's current annual salary is $50,000.The pension plan also earns $2,500 during the current year on contributions made to the plan on behalf of Hector.What is Hector's gross income from these transactions for the current year?

A)$50,000

B)$52,500

C)$53,000

D)$55,500

A)$50,000

B)$52,500

C)$53,000

D)$55,500

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

53

David,an employee of Lima Corporation,is a U.S.citizen and the regional sales manager for South America.His office is in Miami and he spends nine months each year on business in South America.Which of the following statements about the treatment of his income from Lima Corporation is correct?

A)He must include his Lima income in his gross income and is not allowed a tax credit for any South American taxes paid.

B)He has the option of either excluding $102,100 of his Lima income or taking a tax credit for the South American taxes paid.

C)Because he is in South America only nine months of the year,he is only allowed to exclude $75,975 of Lima income.

D)Because he is in South America only nine months of the year,he is not allowed to exclude any of his Lima income,but he can take a tax credit for any South American taxes paid.

A)He must include his Lima income in his gross income and is not allowed a tax credit for any South American taxes paid.

B)He has the option of either excluding $102,100 of his Lima income or taking a tax credit for the South American taxes paid.

C)Because he is in South America only nine months of the year,he is only allowed to exclude $75,975 of Lima income.

D)Because he is in South America only nine months of the year,he is not allowed to exclude any of his Lima income,but he can take a tax credit for any South American taxes paid.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

54

Victor receives a $4,000 per year scholarship from Southern College.The college specifies that $2,500 is for tuition,books,supplies,and equipment for classes.The other $1,500 is for room and board.As part of the conditions of the scholarship,Victor must also work ten hours per week as a grader,for which he is paid $1,700 for the year.Of the total amount received,Victor will include in income:

A)$1,500

B)$1,700

C)$2,500

D)$3,200

E)$5,700

A)$1,500

B)$1,700

C)$2,500

D)$3,200

E)$5,700

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

55

Angie's employer has a qualified pension plan.The employer makes all payments into the plan;employees do not contribute to the plan.During the current year,the employer pays $5,000 into the plan on Angie's behalf.Which of the following statements is true?

I)Angie is not taxed on the $5,000 in the current year.

II)The $5,000 payment is excluded from her income in the current year,but she will pay tax on the $5,000 as she receives it.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Angie is not taxed on the $5,000 in the current year.

II)The $5,000 payment is excluded from her income in the current year,but she will pay tax on the $5,000 as she receives it.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

56

Denise receives an academic scholarship to Pollytech College.Under the scholarship agreement,she receives tuition ($1,500),books ($400),and room and board ($5,000).How much of the scholarship is included in Denise's gross income?

A)$- 0 -

B)$400

C)$1,500

D)$5,000

E)$6,900

A)$- 0 -

B)$400

C)$1,500

D)$5,000

E)$6,900

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

57

Ramon is a waiter at Trucker's Delight Restaurant.He eats two meals each day at the restaurant at no charge.One is eaten just before he begins work;the other is eaten during working hours.The value of meals consumed by Ramon during the current year is $2,500,evenly distributed between the two meals.What are the tax effects of this situation?

I)Ramon will have to recognize $1,250 of income.

II)None are taxable because the meals are for the convenience of the employer.

III)If Ramon has the option of receiving his choice of either a cash payment or the two meals,the $2,500 is taxable.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and II are correct.

E)Statements I and III are correct.

I)Ramon will have to recognize $1,250 of income.

II)None are taxable because the meals are for the convenience of the employer.

III)If Ramon has the option of receiving his choice of either a cash payment or the two meals,the $2,500 is taxable.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and II are correct.

E)Statements I and III are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

58

Ramona's employer pays 100% of the cost of all employees' group-term life insurance.The life insurance plan is not discriminatory.Ramona's annual salary is $100,000.What is the maximum amount of coverage that can be provided tax-free?

A)$- 0 -

B)$5,000

C)$10,000

D)$50,000

E)$100,000

A)$- 0 -

B)$5,000

C)$10,000

D)$50,000

E)$100,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

59

Harry is a CPA employed as a manager by a regional accounting firm.The firm pays Harry's dues to professional organizations and $175 monthly for his personal parking place at the office.Only managers and partners receive these benefits.

I)Both payments are working condition fringe benefits.

II)These benefits are excludable for Harry even though they discriminate in favor of higher-paid employees.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Both payments are working condition fringe benefits.

II)These benefits are excludable for Harry even though they discriminate in favor of higher-paid employees.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

60

Fanny's employer has a qualified pension plan.The employer makes all payments into the plan;employees do not contribute to the plan.During the current year,the employer pays $4,000 into the plan on Fanny's behalf.The plan also earns $3,000 during the year on the balance in Fanny's retirement account.Which of the following statements is true?

I)Fanny is not taxed on the $4,000 in the current year.

II)Fanny is not taxed on the $3,000 in the current year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Fanny is not taxed on the $4,000 in the current year.

II)Fanny is not taxed on the $3,000 in the current year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

61

Conzo is injured in an accident while working at his job.He received $1,500 in worker's compensation benefits for 5 weeks of lost work.How much should Conzo report as gross income from the receipt of these benefits?

A)$- 0 -

B)$300

C)$750

D)$900

E)$1,500

A)$- 0 -

B)$300

C)$750

D)$900

E)$1,500

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

62

During the Chili Company Christmas party,Alex is given a goose after her name was drawn from Santa's hat.The goose only cost Chili Company $40 because it was purchased from a wholesale grocer client.The price of a goose at a local supermarket is $55.Alex's gross income is

A)$- 0 -

B)$15

C)$40

D)$55

E)$95

A)$- 0 -

B)$15

C)$40

D)$55

E)$95

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

63

Cindy is an employee of Silvertone Corporation.Silvertone pays the medical insurance premiums of all of its employees.Because of large deductible levels and limitations on the payment of certain medical expenses,the basic health insurance policy does not cover all medical costs.During the current year,Silvertone adopted a Cafeteria Plan funded entirely by Silvertone.The plan provides for $3,000 per employee,and Cindy elects $2,500 for her medical costs not covered by the basic policy.She takes the remaining $500 in cash.Actual payments for Cindy's medical care of $1,500 are made from the Cafeteria Plan.

I)Cindy's gross income is increased by the $1,000 of the $2,500 allocation not used for additional medical expenses.

II)Cindy's gross income is increased by the $1,500 paid out of the Cafeteria Plan.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Cindy's gross income is increased by the $1,000 of the $2,500 allocation not used for additional medical expenses.

II)Cindy's gross income is increased by the $1,500 paid out of the Cafeteria Plan.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

64

Linc's annual salary is $80,000.His employer,Riddle Corporation,has a qualified pension plan that allows employees to contribute up to 10% of their salaries,which is matched by the employer.Linc and Riddle Corporation each pay $7,500 into the plan.Riddle provides all employees with health and accident insurance by paying 75% of the cost of the policy.Linc's policy cost $3,200.Riddle also offers a flexible benefits plan that employees can use to pay their share of the cost of the medical insurance,other medical costs,and child-care costs.Linc elects to have $2,500 paid into the plan.He uses $800 to pay his share of the medical insurance costs and was reimbursed for $1,700 of medical and childcare costs from the plan.As an officer,Riddle Corporation pays Linc's $3,240 parking cost.Riddle Corporation has a workout room in its office building that is used exclusively by employees and their families.Dues to a comparable facility would be $100 per month.What is Linc's 2017 taxable income from Riddle Corporation?

A)$70,000

B)$70,180

C)$71,500

D)$71,620

E)$73,240

A)$70,000

B)$70,180

C)$71,500

D)$71,620

E)$73,240

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

65

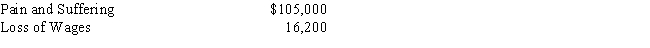

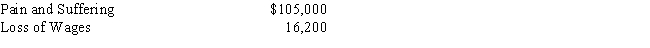

While staying at Vail Heights Resort,Jared falls over a pool cleaning vacuum hose left near the edge of the swimming pool,and suffers severe internal injuries.As part of the settlement,Jared receives the following amounts:

How much of the settlement must be included in Jared's Gross Income?

A)$- 0 -

B)$16,200

C)$60,600

D)$105,000

E)$121,200

How much of the settlement must be included in Jared's Gross Income?

A)$- 0 -

B)$16,200

C)$60,600

D)$105,000

E)$121,200

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

66

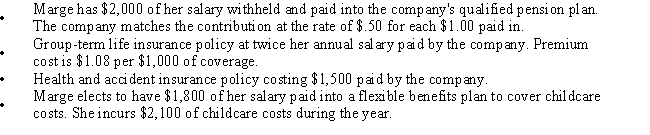

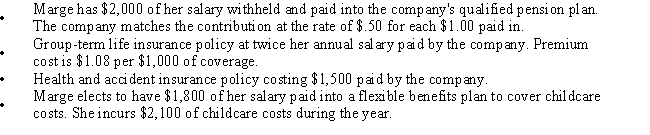

Marge,age 35,is an employee of Troy,Inc.Her annual salary is $50,000.After considering the following list of benefits provided Marge,determine her gross income for the year.

A)$44,700

B)$44,754

C)$46,254

D)$48,054

E)$50,000

A)$44,700

B)$44,754

C)$46,254

D)$48,054

E)$50,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

67

Francisco's employer establishes Health Savings Accounts (HSA's)for its employees.The plan provides for his employer to pay $1,000 into Francisco's HSA,and Francisco to also contribute $1,000 to his HSA.During the year,the plan pays for $1,500 of Francisco's medical expenses not covered by the employer's regular medical insurance plan.

I)Francisco must include the $1,000 contribution by his employer in his adjusted gross income.

II)The $500 still in the account at the end of the year carries forward to the following year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Francisco must include the $1,000 contribution by his employer in his adjusted gross income.

II)The $500 still in the account at the end of the year carries forward to the following year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

68

Dawn's employer,Rourke Enterprises,pays $260 monthly for her covered parking space while at work.Rourke pays $160 monthly for uncovered parking space for Art,and does not pay anything toward Dan's parking.

A)Dawn is allowed to exclude the cost of the parking from her income because if Rourke did not pay for the space,Dawn could deduct her cost.

B)Dawn is allowed to exclude all of the cost of the parking from her income even though not all employees receive free parking.

C)Dawn must include the $260 cost of the parking in her gross income.

D)Dawn must include the $100 difference between the cost for Art's space and her space.

E)Dawn must include $5 monthly in her gross income.

A)Dawn is allowed to exclude the cost of the parking from her income because if Rourke did not pay for the space,Dawn could deduct her cost.

B)Dawn is allowed to exclude all of the cost of the parking from her income even though not all employees receive free parking.

C)Dawn must include the $260 cost of the parking in her gross income.

D)Dawn must include the $100 difference between the cost for Art's space and her space.

E)Dawn must include $5 monthly in her gross income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

69

Gordon's family health insurance costs $6,000 annually.Gordon and his wife are in the 28% marginal tax rate bracket.His employer offers a cafeteria plan that would allow him to cover the insurance premium.How much would the insurance coverage effectively cost if he took advantage of his employer's cafeteria plan?

A)$1,680

B)$3,000

C)$4,320

D)$5,000

A)$1,680

B)$3,000

C)$4,320

D)$5,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

70

Hannah is an employee of Bolero Corporation.Bolero pays the medical insurance premiums of all of its employees.Because of large deductible levels and limitations on the payment of certain medical expenses,the basic health insurance policy does not cover all medical costs.During the current year,Bolero adopted a Flexible Benefits Plan that employees can contribute into to pay for any medical expenses not covered by insurance.Hannah pays $2,500 into the plan during the current year.Premiums paid by Bolero for Hannah's medical insurance were $5,000.

I)Hannah's gross income from her Bolero salary is reduced by the $2,500 payment into the Flexible Benefits Plan.

II)Amounts paid for medical costs by the medical insurance policy are excluded from Hannah's gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Hannah's gross income from her Bolero salary is reduced by the $2,500 payment into the Flexible Benefits Plan.

II)Amounts paid for medical costs by the medical insurance policy are excluded from Hannah's gross income.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

71

Returns of human capital

I)are excluded from gross income.

II)include unemployment compensation benefits.

III)include workers' compensation payments received for personal injury.

IV)are treated the same for tax purposes as all other forms of capital recovery.

A)Statements I and III are correct.

B)Statements II,III,and IV are correct.

C)Statements I,III,and IV are correct.

D)Only statement II is correct.

E)Statements I,II,III,and IV are correct.

I)are excluded from gross income.

II)include unemployment compensation benefits.

III)include workers' compensation payments received for personal injury.

IV)are treated the same for tax purposes as all other forms of capital recovery.

A)Statements I and III are correct.

B)Statements II,III,and IV are correct.

C)Statements I,III,and IV are correct.

D)Only statement II is correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

72

Arthur's employer establishes Health Savings Accounts (HSAs)for its employees.Arthur pays $2,100 into his HSA.During the year,the HSA earns $90 interest and Arthur receives $1,850 from the HSA for reimbursement of medical expenses.

I)Arthur must include $90 in gross income from the HSA arrangement.

II)Arthur loses the $250 in contributions that are not spent on medical expenses in the current year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Arthur must include $90 in gross income from the HSA arrangement.

II)Arthur loses the $250 in contributions that are not spent on medical expenses in the current year.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

73

Chad is a senior manager with Gusto,Inc.Chad's secretary,Loretta,takes care of several of Chad's personal tasks when time permits.Loretta arranges for the weekly pickup and delivery of Chad's laundry and dry cleaning.Loretta also books reservations to the theater and arranges for tickets to basketball games for Chad.Chad hopes that Loretta's services are classified as

A)No additional cost services.

B)An employee discount.

C)A de minimis fringe benefit.

D)Dependent care services.

E)Bonus pay.

A)No additional cost services.

B)An employee discount.

C)A de minimis fringe benefit.

D)Dependent care services.

E)Bonus pay.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

74

Lorraine is an employee of National Corporation.National pays the medical insurance premiums of all of its employees.Because of large deductible levels and limitations on the payment of certain medical expenses,the basic health insurance policy does not cover all medical costs.During the current year,National adopted a Flexible Benefits Plan into which employees can contribute to pay for any medical expenses not covered by insurance.Lorraine pays $2,500 into the plan during the current year.Premiums paid by National for Lorraine's medical insurance were $2,400.

I)There is no tax effect from the $2,500 payment into the Flexible Benefits Plan.

II)Lorraine's gross income from her National salary is reduced by the $2,500 payment into the Flexible Benefits Plan.

III)If Lorraine does not use the entire $2,500 paid into the Flexible Benefits Plan during the current year,she may obtain a refund of any amounts not spent from National.

IV)Amounts paid for medical costs by the medical insurance policy are excluded from Lorraine's gross income.

A)Statements II and IV are correct.

B)Statements I and IV are correct.

C)Statements III and IV are correct.

D)Only statement II is correct.

E)Only statement IV is correct.

I)There is no tax effect from the $2,500 payment into the Flexible Benefits Plan.

II)Lorraine's gross income from her National salary is reduced by the $2,500 payment into the Flexible Benefits Plan.

III)If Lorraine does not use the entire $2,500 paid into the Flexible Benefits Plan during the current year,she may obtain a refund of any amounts not spent from National.

IV)Amounts paid for medical costs by the medical insurance policy are excluded from Lorraine's gross income.

A)Statements II and IV are correct.

B)Statements I and IV are correct.

C)Statements III and IV are correct.

D)Only statement II is correct.

E)Only statement IV is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following non-cash employee benefits would be excluded from the taxable income of the employee? Unless indicated otherwise all benefits are provided on a non-discriminatory basis.

A)Executives of Handyware receive a free automobile every 2 years.

B)The top salesman for Genesis in each sales district receives a free two-week vacation in Hawaii.

C)Carter,a flight attendant for Western Airlines,flew roundtrip from Houston to Dallas 45 times during the tax year to visit her boyfriend at no cost.Airline employees fly free on a space available basis.

D)Mike receives a free apartment from his employer who owns hundreds of apartment complexes all over the country.Mike is the internal auditor for the apartment company.He has the option to live in a free apartment or receive additional compensation.

E)All of the above non-cash benefits can be provided to employees on a tax-free basis.

A)Executives of Handyware receive a free automobile every 2 years.

B)The top salesman for Genesis in each sales district receives a free two-week vacation in Hawaii.

C)Carter,a flight attendant for Western Airlines,flew roundtrip from Houston to Dallas 45 times during the tax year to visit her boyfriend at no cost.Airline employees fly free on a space available basis.

D)Mike receives a free apartment from his employer who owns hundreds of apartment complexes all over the country.Mike is the internal auditor for the apartment company.He has the option to live in a free apartment or receive additional compensation.

E)All of the above non-cash benefits can be provided to employees on a tax-free basis.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

76

Punitive damage awards received because of a personal injury

A)Are the same as loss-of-income damages.

B)Are included in gross income regardless of the cause.

C)Will be excluded from gross income if the award resulted from a physical personal injury.

D)Will be excluded from gross income because punitive awards are meant to punish the offender for gross negligence.

E)Are never taxable.

A)Are the same as loss-of-income damages.

B)Are included in gross income regardless of the cause.

C)Will be excluded from gross income if the award resulted from a physical personal injury.

D)Will be excluded from gross income because punitive awards are meant to punish the offender for gross negligence.

E)Are never taxable.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

77

The tax law allows the exclusion of general types of employment-related fringe benefits provided they are made available to employees on a nondiscriminatory basis.Which of the following must be provided on a nondiscriminatory basis to be excluded from income?

I)De minimis fringe benefits.

II)Employee discounts.

III)No additional cost services.

IV)Working-condition fringes.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements II and III are correct.

D)Statements III and IV are correct.

E)Statements I,II,III,and IV are correct.

I)De minimis fringe benefits.

II)Employee discounts.

III)No additional cost services.

IV)Working-condition fringes.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements II and III are correct.

D)Statements III and IV are correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

78

The income tax treatment of damages received from personal physical injuries is an application of the:

A)Ability-to-Pay Concept.

B)Administrative Convenience Concept.

C)All-inclusive Income Concept.

D)Capital Recovery Concept.

E)Wherewithal-to-Pay Concept.

A)Ability-to-Pay Concept.

B)Administrative Convenience Concept.

C)All-inclusive Income Concept.

D)Capital Recovery Concept.

E)Wherewithal-to-Pay Concept.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

79

Maureen is injured on the job and has to retire.Before her retirement,Maureen earned $20,000 in wages.After her retirement,her employer pays her $5,000 for vacation time that accrued before she was injured.In addition,she receives $10,000 to compensate her for sick pay from an accident and health insurance plan that was paid for by her employer.How much of the above payments should Maureen include in her gross income?

A)$10,000

B)$20,000

C)$25,000

D)$30,000

E)$35,000

A)$10,000

B)$20,000

C)$25,000

D)$30,000

E)$35,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

80

Bonita's employer has a nondiscriminatory childcare reimbursement plan (a type of flexible benefits plan).Bonita expects that her childcare expenses will total $2,000 for the current year.If she does not participate in the reimbursement plan,she will be allowed a $400 tax credit for childcare.Bonita's marginal tax rate is 25%.What are the tax effects of Bonita's alternatives?

I)Bonita will save $2,000 by using the reimbursement plan.

II)The reimbursement plan is $100 more favorable than the tax credit for Bonita.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Bonita will save $2,000 by using the reimbursement plan.

II)The reimbursement plan is $100 more favorable than the tax credit for Bonita.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck