Deck 7: Managed Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 7: Managed Funds

1

The four main types of listed managed fund structures operating through the ASX are:

A) LICs, LITs, REITs and ETFs.

B) LIRs, LITs, RDITs and ETFs.

C) LICs, LITs, RDITs and ETAs.

D) none of the above.

A) LICs, LITs, REITs and ETFs.

B) LIRs, LITs, RDITs and ETFs.

C) LICs, LITs, RDITs and ETAs.

D) none of the above.

A

2

The indirect cost ratio (ICR):

A) measures management costs not deducted directly from investors' account balances to the average net assets of the fund.

B) measures the average net assets of the fund divided by the management costs deducted directly from investors' account balances.

C) approximates current performance bonuses.

D) all of the above.

A) measures management costs not deducted directly from investors' account balances to the average net assets of the fund.

B) measures the average net assets of the fund divided by the management costs deducted directly from investors' account balances.

C) approximates current performance bonuses.

D) all of the above.

A

3

According to the Australian Securities and Investments Commission (ASIC), a managed investment scheme (MIS), commonly known as a managed fund, exists where:

A) people are brought together to contribute money to obtain an interest in the scheme.

B) money is pooled together with other investors or used in a common enterprise.

C) a responsible entity operates the scheme and hence investors do not have day-to-day control over the operation of the scheme.

D) all of the above.

A) people are brought together to contribute money to obtain an interest in the scheme.

B) money is pooled together with other investors or used in a common enterprise.

C) a responsible entity operates the scheme and hence investors do not have day-to-day control over the operation of the scheme.

D) all of the above.

D

4

Nominate the incorrect statement in relation to standard deviation:

A) Standard deviation is the statistical measurement of dispersion of outcomes around a mean.

B) A higher measure of standard deviation infers higher risk.

C) In approximately 99% of the time, the returns will vary plus or minus two standard deviations from the average.

D) All of the above.

A) Standard deviation is the statistical measurement of dispersion of outcomes around a mean.

B) A higher measure of standard deviation infers higher risk.

C) In approximately 99% of the time, the returns will vary plus or minus two standard deviations from the average.

D) All of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

A diversified managed fund adopting a conservative investor risk profile:

A) is designed for investors seeking short-term growth returns.

B) would include mainly longer-term growth-type investments.

C) would likely seek out investment in small companies, private equity funds and emerging markets.

D) none of the above.

A) is designed for investors seeking short-term growth returns.

B) would include mainly longer-term growth-type investments.

C) would likely seek out investment in small companies, private equity funds and emerging markets.

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

The main contributors to the overall growth in funds under management has/have been the:

A) deregulation of financial markets in the 1980s.

B) increase in superannuation contributions made by employers since 1990.

C) both a and b

D) an increase in the savings ratio in the domestic economy.

A) deregulation of financial markets in the 1980s.

B) increase in superannuation contributions made by employers since 1990.

C) both a and b

D) an increase in the savings ratio in the domestic economy.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

Investing in asset classes directly or indirectly via managed funds results in:

A) different risk outcomes but the same return relationships.

B) the same risk outcomes but different return relationships.

C) the same risk and return relationships.

D) all of the above.

A) different risk outcomes but the same return relationships.

B) the same risk outcomes but different return relationships.

C) the same risk and return relationships.

D) all of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

The relationship that exists between unsystematic risk and the number of securities held in an investment portfolio is:

A) non applicable as no relationship exists.

B) inverse until unsystematic risk is removed.

C) positive until unsystematic risk is removed.

D) inverse up to a maximum of 10 securities and then positive.

A) non applicable as no relationship exists.

B) inverse until unsystematic risk is removed.

C) positive until unsystematic risk is removed.

D) inverse up to a maximum of 10 securities and then positive.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

The information ratio:

A) ignores market movements from returns but instead adjusts for the risk undertaken.

B) is used as a risk-adjusted measure of the relative performance of a portfolio.

C) helps to answer the question, 'Was the manager sufficiently rewarded for the risk incurred by deviating from the benchmark?'.

D) all of the above.

A) ignores market movements from returns but instead adjusts for the risk undertaken.

B) is used as a risk-adjusted measure of the relative performance of a portfolio.

C) helps to answer the question, 'Was the manager sufficiently rewarded for the risk incurred by deviating from the benchmark?'.

D) all of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

The management expense ratio (MER) is a ratio of fees charged to the:

A) book value of assets under management.

B) market value of assets under management.

C) unit price of the fund.

D) none of the above.

A) book value of assets under management.

B) market value of assets under management.

C) unit price of the fund.

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

Unlisted managed funds that have a bid-offer spread to allow for transaction costs:

A) provide a selling price higher than the buying price.

B) provide a buying price higher than the selling price.

C) provide a buying price equal to the selling price.

D) none of the above.

A) provide a selling price higher than the buying price.

B) provide a buying price higher than the selling price.

C) provide a buying price equal to the selling price.

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

The calculation of an absolute return arising from the recent sale of a managed fund requires which of the following information?

A) Purchase price, inflation rate and risk-adjusted sale price.

B) Purchase price and inflation rate.

C) Purchase price and risk-adjusted sale price.

D) Purchase price and actual sale price.

A) Purchase price, inflation rate and risk-adjusted sale price.

B) Purchase price and inflation rate.

C) Purchase price and risk-adjusted sale price.

D) Purchase price and actual sale price.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

The underlying value of units in an unlisted managed fund is based on the:

A) net prevailing market value of the fund's investment portfolio divided by the number of units issued.

B) supply and demand for those units.

C) inflation- adjusted value of the fund's net assets.

D) none of the above.

A) net prevailing market value of the fund's investment portfolio divided by the number of units issued.

B) supply and demand for those units.

C) inflation- adjusted value of the fund's net assets.

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

Passive fund managers attempt to:

A) outperform the market.

B) time the market.

C) replicate the performance of the benchmark.

D) all of the above.

A) outperform the market.

B) time the market.

C) replicate the performance of the benchmark.

D) all of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

Managed funds are popular because they allow investors to gain:

A) access to a wide range of different asset classes.

B) exposure to different industry segments.

C) diversification across a range of different investment types.

D) all of the above.

A) access to a wide range of different asset classes.

B) exposure to different industry segments.

C) diversification across a range of different investment types.

D) all of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

The constitution of a managed investment scheme (MIS) includes matters such as:

A) the cost of buying interests in the scheme.

B) the name of the auditor of the MIS.

C) both a and b

D) none of the above.

A) the cost of buying interests in the scheme.

B) the name of the auditor of the MIS.

C) both a and b

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

Cash management funds would be unlikely to invest in which of the following assets?

A) Overnight deposits.

B) Mix of short and medium-term government securities.

C) Mix of international short-term government securities.

D) Mortgage loans.

A) Overnight deposits.

B) Mix of short and medium-term government securities.

C) Mix of international short-term government securities.

D) Mortgage loans.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

With managed funds it is NOT possible to diversify across:

A) asset classes.

B) management styles.

C) investment sectors.

D) none of the above.

A) asset classes.

B) management styles.

C) investment sectors.

D) none of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Unlisted managed funds:

A) are closed ended structures.

B) are structured so that a prospective unitholder will purchase units from other unitholders.

C) operate as a trust structure and issues units to investors.

D) all of the above.

A) are closed ended structures.

B) are structured so that a prospective unitholder will purchase units from other unitholders.

C) operate as a trust structure and issues units to investors.

D) all of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

Beta risk is particularly relevant for fund managers adopting which investment approach?

A) Passive investing.

B) Active investing.

C) Contrarian investing.

D) None of the above.

A) Passive investing.

B) Active investing.

C) Contrarian investing.

D) None of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

Calculate the unit price of the Masterproc Balanced Fund ("Masterproc ") using the following information extracted from its latest financial statements including the detail that it had 63 million units on issue at the end of the latest financial year:

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Briefly explain the reasons why the unit price of an unlisted managed fund is likely to change on a regular basis.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Ricky Ocasek acquired 3,000 units in the XLNT Sharemarket Fund ("XLNT") at the start of the year for $7.10 per unit. After holding the investment in XLNT for 6 months, Ricky has decided that he wants to go on an around-the-world holiday and will need to sell all of his units in order to pay for the holiday. The current unit price of XLNT is now $8.86 and the fund has also recently made an income distribution to unit holders of 40 cents per unit. In the constitution for XLNT it states that sales of units within 2 years of acquisition are subject to an exit fee of 5% of the market value at the time of sale. Ricky is subject to a marginal tax rate of 30% on all income and realised capital gains.

(a) What is the total initial investment amount made by Ricky in XLNT?

(b) What will be the exit fee if Ricky sells his total investment after 6 months?

(c) What will be the total pre-tax proceeds that Ricky will realise assuming the investment is sold after 6 months?

(d) What will be the pre-tax annualised absolute return to Ricky assuming the investment is sold after 6 months?

(e) How much tax will Ricky be liable for upon the current sale of his total investment in XLNT?

(f) What will be the total after-tax proceeds that Ricky will realise assuming the investment is sold after 6 months?

(g) What will be the after-tax annualised absolute return to Ricky assuming the investment is sold after 6 months?

(a) What is the total initial investment amount made by Ricky in XLNT?

(b) What will be the exit fee if Ricky sells his total investment after 6 months?

(c) What will be the total pre-tax proceeds that Ricky will realise assuming the investment is sold after 6 months?

(d) What will be the pre-tax annualised absolute return to Ricky assuming the investment is sold after 6 months?

(e) How much tax will Ricky be liable for upon the current sale of his total investment in XLNT?

(f) What will be the total after-tax proceeds that Ricky will realise assuming the investment is sold after 6 months?

(g) What will be the after-tax annualised absolute return to Ricky assuming the investment is sold after 6 months?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Calculate the annual returns on each of the following managed funds (using only the information provided):

(a)

Amoeba Special Situations Fund:

(b)

Broadchurch Trading Fund:

(a)

Amoeba Special Situations Fund:

(b)

Broadchurch Trading Fund:

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

Briefly explain the role of the single responsible entity.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

Briefly discuss the concept of 'pooling' as it relates to managed funds and how it can benefit the investor.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

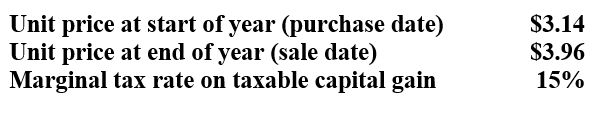

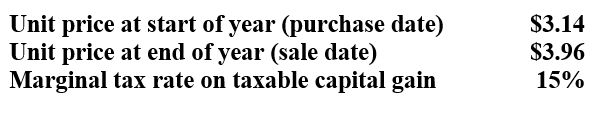

Calculate the absolute return on a pre-tax and after-tax basis for Alicia Mallyon's current investment of 250 units in the Viber Commodities Fund ("Viber ") assuming it was sold after one year based on the information below:

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

You have been able to research the following information on the Alpha Beta Securities Fund ("Alpha Beta"):

(a) Calculate the Sharpe ratio for Alpha Beta.

(b) Interpret your calculation of the Sharpe ratio for Alpha Beta.

(a) Calculate the Sharpe ratio for Alpha Beta.

(b) Interpret your calculation of the Sharpe ratio for Alpha Beta.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

Briefly differentiate active and passive fund management styles.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

Briefly outline the 'three pillars' institutional framework for managed investments and securities in Australia.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck