Deck 8: Leveraged Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 8: Leveraged Investments

1

The buyer of a contract for difference (CFD):

A) is going short and expects the price to fall

B) is going long and expects the price to rise

C) has the right but not the obligation to buy the underlying asset in the future at a fixed price.

D) none of the above

A) is going short and expects the price to fall

B) is going long and expects the price to rise

C) has the right but not the obligation to buy the underlying asset in the future at a fixed price.

D) none of the above

B

2

An option:

A) is an agreement to trade something in the future, either to buy or to sell a specific amount of a specific asset

B) is an agreement that gives the buyer (holder) of the option the right but not the obligation to buy or sell something in the future at a fixed price

C) is an agreement that gives the holder the right to buy or sell the underlying asset, so, as with all investment assets, the investor wishes to be long if they expect prices to rise and wishes to be short if they expect them to fall

D) none of the above

A) is an agreement to trade something in the future, either to buy or to sell a specific amount of a specific asset

B) is an agreement that gives the buyer (holder) of the option the right but not the obligation to buy or sell something in the future at a fixed price

C) is an agreement that gives the holder the right to buy or sell the underlying asset, so, as with all investment assets, the investor wishes to be long if they expect prices to rise and wishes to be short if they expect them to fall

D) none of the above

B

3

Negative gearing arises where:

A) borrowings are not undertaken

B) annual income from an investment is greater than the deductible expenses

C) borrowings are on an interest-only basis

D) none of the above

A) borrowings are not undertaken

B) annual income from an investment is greater than the deductible expenses

C) borrowings are on an interest-only basis

D) none of the above

D

4

The buyer of a futures contract will prefer prices of the underlying asset in the future to:

A) remain constant

B) fall

C) rise

D) either a or c

A) remain constant

B) fall

C) rise

D) either a or c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

The general risk/reward trade-off associated with warrants shows that:

A) capital protected warrants are more risky than self funding instalment warrants

B) self funding instalment warrants are more risky than hot instalment warrants

C) instalment warrants are more risky than hot instalment warrants

D) none of the above

A) capital protected warrants are more risky than self funding instalment warrants

B) self funding instalment warrants are more risky than hot instalment warrants

C) instalment warrants are more risky than hot instalment warrants

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Futures contracts:

A) rarely end in the physical delivery of the underlying asset

B) require a deposit or initial margin

C) are typically reversed out prior to expiry

D) all of the above

A) rarely end in the physical delivery of the underlying asset

B) require a deposit or initial margin

C) are typically reversed out prior to expiry

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

A margin loan exposes the borrower to which source(s) of risk for interest repayments?

A) timing issues arising from the receipt of investment income and the repayment of loan interest

B) the ability of the borrower to replace or add to security provided in the event of a margin call

C) the loan servicing ability of the borrower to meet repayments from existing income

D) both a and c

A) timing issues arising from the receipt of investment income and the repayment of loan interest

B) the ability of the borrower to replace or add to security provided in the event of a margin call

C) the loan servicing ability of the borrower to meet repayments from existing income

D) both a and c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

If an investor believes that the price of an asset is going to decrease in the future they would:

A) prefer to currently own the asset and hold

B) prefer not to currently own the asset if they are long-term investor

C) prefer to sell the asset if currently held

D) both b and c

A) prefer to currently own the asset and hold

B) prefer not to currently own the asset if they are long-term investor

C) prefer to sell the asset if currently held

D) both b and c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

Over time, an investor making principal and interest loan repayments on an investment using borrowed funds which is increasing in value would expect their gearing ratio to:

A) increase

B) decrease

C) remain unchanged

D) either a or c

A) increase

B) decrease

C) remain unchanged

D) either a or c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

The benefits arising from margin lending over traditional principal and interest mortgage loans typically include:

A) a lower interest rate than a mortgage loan

B) liquidity

C) investment diversification opportunities

D) both b and c

A) a lower interest rate than a mortgage loan

B) liquidity

C) investment diversification opportunities

D) both b and c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

The presence of rising asset prices and concessional tax rates on capital gains in a stable interest rate environment is more preferable for a negatively geared share investment than which of the following economic conditions?

A) stable asset prices and rising interest rates

B) rising asset prices and rising interest rates

C) decreasing asset prices and relatively high tax rates on capital gains

D) all of the above

A) stable asset prices and rising interest rates

B) rising asset prices and rising interest rates

C) decreasing asset prices and relatively high tax rates on capital gains

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

The estimated percentage of options exercised on the ASX Options Market is:

A) less than 5%

B) less than 15%

C) less than 30%

D) less than 55%

A) less than 5%

B) less than 15%

C) less than 30%

D) less than 55%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

Some variations of standard interest and principal mortgages available to investors include:

A) equity release loans, where surplus equity above agreed levels may be withdrawn

B) interest-only loans with the entire principal payable at the end of the loan

C) reverse mortgages

D) all of the above

A) equity release loans, where surplus equity above agreed levels may be withdrawn

B) interest-only loans with the entire principal payable at the end of the loan

C) reverse mortgages

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

Loan-to-valuation ratios (LVRs) are set by:

A) lenders

B) borrowers

C) the Reserve Bank of Australia (RBA)

D) none of the above

A) lenders

B) borrowers

C) the Reserve Bank of Australia (RBA)

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

When an investor invests in an income producing asset:

A) interest on any loans associated with the income producing asset are tax deductible

B) interest is not a tax deductible expense

C) interest may be deducted from the income derived from an income producing to the extent of the level of income less any other associated expenses

D) none of the above

A) interest on any loans associated with the income producing asset are tax deductible

B) interest is not a tax deductible expense

C) interest may be deducted from the income derived from an income producing to the extent of the level of income less any other associated expenses

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

In Australia, index options can be exercised:

A) only on specified dates not including the expiry date

B) only after one month following acquisition

C) at any time up to and including the expiry date

D) none of the above

A) only on specified dates not including the expiry date

B) only after one month following acquisition

C) at any time up to and including the expiry date

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

Investment products or instruments that derive their value from underlying assets include:

A) contracts for difference (CFDs)

B) options

C) warrants

D) all of the above

A) contracts for difference (CFDs)

B) options

C) warrants

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

The strike price of an option is:

A) the price paid for the option premium

B) the trading price of the option at the inception of the option contract

C) the price at which an option contract will be transacted if the option is exercised

D) none of the above

A) the price paid for the option premium

B) the trading price of the option at the inception of the option contract

C) the price at which an option contract will be transacted if the option is exercised

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Where the value of secured assets falls below an agreed debt-to-asset ratio for a margin loan, what action will be required to be taken?

A) the lender must meet a margin call on the loan

B) the borrower must meet a margin call on the loan

C) the lender will require the loan to be discharged in full

D) none of the above

A) the lender must meet a margin call on the loan

B) the borrower must meet a margin call on the loan

C) the lender will require the loan to be discharged in full

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

The lender in a mortgage contract is referred to as the:

A) mortgagee

B) pledger

C) both a and b

D) mortgagor

A) mortgagee

B) pledger

C) both a and b

D) mortgagor

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

Briefly discuss the principal benefits of undertaking gearing as an investment strategy.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Briefly discuss the value of the tax shield for a negatively geared property investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

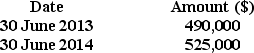

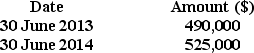

Nick Lanay purchased a residential investment property on 1 July 2012 for $430,000. No other acquisition costs were incurred on obtaining the property although the purchase price of the property includes $20,000 of fixtures and fittings that are subject to an annual depreciation deduction of 20% p.a. calculated on a straight-line basis for taxation purposes. The property purchase was subject to existing property related agreements whereby both the rental income payable by the tenant and the management fee payable to the property agent were fixed for a further period of 2 years following its acquisition. The terms of these agreements were as follows:

Rental Income - 4% of the market value of the property calculated at the commencement of the financial year and payable monthly in arrears.

Management fee - 9% of the rental income plus an administration fee of $5 per month payable monthly in arrears.

For a fee of $250 for each valuation undertaken, the following amounts were assessed as the market value of the property by a local Property Services firm:

In order to acquire the property, Nick borrowed 80% of the property purchase price from the Now Bank on an interest-only basis over a 10 year period. The interest rate charged on the loan for the first year was fixed at 6% and for the second year was fixed at 7%.

In order to acquire the property, Nick borrowed 80% of the property purchase price from the Now Bank on an interest-only basis over a 10 year period. The interest rate charged on the loan for the first year was fixed at 6% and for the second year was fixed at 7%.

Over the following 2 years Nick incurred the following additional property expenses:

Nick also works full-time as a stuntman for a local film studio where his salary for the 2013 financial year is $66,000 and $70,000 for the 2014 financial year. He also receives a fixed payment of $1,000 each year as interest on a term deposit he made a number of years ago.

Nick also works full-time as a stuntman for a local film studio where his salary for the 2013 financial year is $66,000 and $70,000 for the 2014 financial year. He also receives a fixed payment of $1,000 each year as interest on a term deposit he made a number of years ago.

a) Using the individual marginal tax rates included in chapter 3 of the text assuming that these rates remain constant as well as ignoring the medicare levy and any tax offsets, what are the taxation consequences for each of the 2013 and 2014 financial years of the property purchase by Nick?

b) Following from your calculations in part a) of this question, what are the after-tax cash flow consequences for each of the 2013 and 2014 financial years of the property purchase by Nick?

Rental Income - 4% of the market value of the property calculated at the commencement of the financial year and payable monthly in arrears.

Management fee - 9% of the rental income plus an administration fee of $5 per month payable monthly in arrears.

For a fee of $250 for each valuation undertaken, the following amounts were assessed as the market value of the property by a local Property Services firm:

In order to acquire the property, Nick borrowed 80% of the property purchase price from the Now Bank on an interest-only basis over a 10 year period. The interest rate charged on the loan for the first year was fixed at 6% and for the second year was fixed at 7%.

In order to acquire the property, Nick borrowed 80% of the property purchase price from the Now Bank on an interest-only basis over a 10 year period. The interest rate charged on the loan for the first year was fixed at 6% and for the second year was fixed at 7%.Over the following 2 years Nick incurred the following additional property expenses:

Nick also works full-time as a stuntman for a local film studio where his salary for the 2013 financial year is $66,000 and $70,000 for the 2014 financial year. He also receives a fixed payment of $1,000 each year as interest on a term deposit he made a number of years ago.

Nick also works full-time as a stuntman for a local film studio where his salary for the 2013 financial year is $66,000 and $70,000 for the 2014 financial year. He also receives a fixed payment of $1,000 each year as interest on a term deposit he made a number of years ago.a) Using the individual marginal tax rates included in chapter 3 of the text assuming that these rates remain constant as well as ignoring the medicare levy and any tax offsets, what are the taxation consequences for each of the 2013 and 2014 financial years of the property purchase by Nick?

b) Following from your calculations in part a) of this question, what are the after-tax cash flow consequences for each of the 2013 and 2014 financial years of the property purchase by Nick?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Given the information in Question 23 in relation to the property purchase by Nick Lanay on 1 July 2012, respond to the following questions:

(a) What is the gearing ratio in relation to the investment property as at;

(i) 1 July 2012,

(ii) 30 June 2013, and

(iii) 30 June 2014?

(b) Assume that the investment property was sold at the market valuations as shown in Question 23 on each of 30 June 2013 and 30 June 2014 respectively. Ignoring the Medicare levy and any tax offsets as well as assuming that any capital gain is taxed in full at marginal tax rates in the 2013 financial year and is subject to the 50% capital gains tax discount in the 2014 financial year:

(i) What would have been Nick's after-tax return on the property following the sale based on the property purchase price for the 2013 and 2014 financial years? Include all financial information from Question 23 in your calculations.

(ii) What would have been Nick's after-tax return on the property following the sale based on the capital initially contributed by Nick for the 2013 and 2014 financial years? Include all financial information from Question 23 in your calculations.

(a) What is the gearing ratio in relation to the investment property as at;

(i) 1 July 2012,

(ii) 30 June 2013, and

(iii) 30 June 2014?

(b) Assume that the investment property was sold at the market valuations as shown in Question 23 on each of 30 June 2013 and 30 June 2014 respectively. Ignoring the Medicare levy and any tax offsets as well as assuming that any capital gain is taxed in full at marginal tax rates in the 2013 financial year and is subject to the 50% capital gains tax discount in the 2014 financial year:

(i) What would have been Nick's after-tax return on the property following the sale based on the property purchase price for the 2013 and 2014 financial years? Include all financial information from Question 23 in your calculations.

(ii) What would have been Nick's after-tax return on the property following the sale based on the capital initially contributed by Nick for the 2013 and 2014 financial years? Include all financial information from Question 23 in your calculations.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

What are the main considerations to be assessed when selecting a suitable investment asset to negatively gear?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

Stan Dover is a coffee exporter who is concerned about recent news reports of a record coffee harvest in the current year from South America and its potential effects on future coffee prices. After seeking your advice, Stan has decided to undertake the following strategy to protect his current coffee holdings against an expected decrease in prices:

1 Sell 4 coffee futures contracts today (3 October 2014).

2 Buy back 4 coffee futures contracts on 30 December 2014 just prior to the expiry of the contract.

The relevant price information for coffee futures contracts are as follows:

Determine whether Stan was successful in protecting against an expected decrease the coffee price as evidenced by his approximate realised return calculated on:

a) - a 3 monthly basis, and

b) - an annualised basis.

1 Sell 4 coffee futures contracts today (3 October 2014).

2 Buy back 4 coffee futures contracts on 30 December 2014 just prior to the expiry of the contract.

The relevant price information for coffee futures contracts are as follows:

Determine whether Stan was successful in protecting against an expected decrease the coffee price as evidenced by his approximate realised return calculated on:

a) - a 3 monthly basis, and

b) - an annualised basis.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

What is the significance to the borrower of the loan-to-valuation ratio (LVR) adopted for margin lending?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

Manfred Rooney is a librarian who is seeking to invest in a diversified portfolio of shares using a margin loan facility.

He seeks to borrow the maximum available from the margin lender, Come in Spinner Financing, on an interest-only basis based on the following proposed share investment portfolio and loan-to-valuation ratio (LVR) as agreed by the lender:

What is the maximum margin lending loan available to Manfred?

He seeks to borrow the maximum available from the margin lender, Come in Spinner Financing, on an interest-only basis based on the following proposed share investment portfolio and loan-to-valuation ratio (LVR) as agreed by the lender:

What is the maximum margin lending loan available to Manfred?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

Briefly discuss the options available to a futures trader holding an 'open' position on a futures contract.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

Assume that Manfred undertook the share investments as shown in Question 27 using the margin loan facility and that after a period of 12 months the share portfolio was valued as follows:

a) What is the maximum margin lending loan now available to Manfred?

b) Assuming that the current margin loan from Come in Spinner Financing was that previously calculated in Question 27, what are the implications for Manfred of the reassessed maximum margin lending loan? Show all calculations.

c) What options are available to Manfred given your discussion in part (b) of this question?

a) What is the maximum margin lending loan now available to Manfred?

b) Assuming that the current margin loan from Come in Spinner Financing was that previously calculated in Question 27, what are the implications for Manfred of the reassessed maximum margin lending loan? Show all calculations.

c) What options are available to Manfred given your discussion in part (b) of this question?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck