Deck 6: Direct Investment - Property

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 6: Direct Investment - Property

1

The Net Present Value (NPV) approach:

A) is a suitable form of analysis for property investments.

B) would include net rental income as cash outflows as part of NPV analysis.

C) results in a greater positive NPV / lower negative NPV when a relatively higher discount rate is used.

D) both b and c

A) is a suitable form of analysis for property investments.

B) would include net rental income as cash outflows as part of NPV analysis.

C) results in a greater positive NPV / lower negative NPV when a relatively higher discount rate is used.

D) both b and c

A

2

Alice sells a property in 2014 for $300,000 that she has held for five years. She bought the property for $200,000 and during the period of ownership she claimed a building depreciation allowance of $8,000 each year. Given a marginal tax rate of 46.5% (including the Medicare levy) the relevant tax to be paid relating to the sale will be:

A) $32,550

B) $65,100

C) $27,900

D) $46,500

A) $32,550

B) $65,100

C) $27,900

D) $46,500

A

3

A tax-free component and a tax-deferred component are two taxation benefits associated with the income derived by a property. The tax-deferred component:

A) derives from building depreciation allowances and provides for tax relief for a period of five years.

B) derives from depreciation of furniture and fittings and provides tax relief for a period of seven years.

C) derives from building depreciation allowances and the accumulated sum reduces the cost base of the property when it is sold.

D) derives from depreciation of furniture and fittings and the accumulated sum adds to the cost base of the property when it is sold.

A) derives from building depreciation allowances and provides for tax relief for a period of five years.

B) derives from depreciation of furniture and fittings and provides tax relief for a period of seven years.

C) derives from building depreciation allowances and the accumulated sum reduces the cost base of the property when it is sold.

D) derives from depreciation of furniture and fittings and the accumulated sum adds to the cost base of the property when it is sold.

C

4

Mortgage funds:

A) provide opportunities for capital growth returns for investors.

B) will increase their loan-to-value ratio the relatively higher the risk of the borrower.

C) are a relatively illiquid investment at least in the early periods after issue.

D) both a and c

A) provide opportunities for capital growth returns for investors.

B) will increase their loan-to-value ratio the relatively higher the risk of the borrower.

C) are a relatively illiquid investment at least in the early periods after issue.

D) both a and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

Tax-deferred distributions from property trusts:

A) are declared by the unitholder recipient as income in the tax return in the year of receipt.

B) are used by the unitholder recipient to decrease the cost base of the investment in the property trust.

C) are used by the unitholder recipient to increase the cost base of the investment in the property trust.

D) are only available to unitholder recipients where they have held their investment in the property trust for at least 12 months.

A) are declared by the unitholder recipient as income in the tax return in the year of receipt.

B) are used by the unitholder recipient to decrease the cost base of the investment in the property trust.

C) are used by the unitholder recipient to increase the cost base of the investment in the property trust.

D) are only available to unitholder recipients where they have held their investment in the property trust for at least 12 months.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

An example of direct property investment is:

A) John is a registered investor in a listed real estate investment trust.

B) Jill holds units in an unlisted property trust.

C) James is the registered owner of a commercial property.

D) Jenny is a member of a private property syndicate.

A) John is a registered investor in a listed real estate investment trust.

B) Jill holds units in an unlisted property trust.

C) James is the registered owner of a commercial property.

D) Jenny is a member of a private property syndicate.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

The income to be declared in the income tax return which relates to property investment consists of the gross rental income from the tenant. The deductions that can offset the income include:

A) interest on the loan taken out to purchase the property.

B) a portion of the set-up costs of borrowing the funds which are allowed to be deducted over a 3-year period.

C) a capital depreciation allowance of 4.0% of the cost of the building is allowable for 40 years.

D) a capital expense such as the addition of an air conditioner to the property.

A) interest on the loan taken out to purchase the property.

B) a portion of the set-up costs of borrowing the funds which are allowed to be deducted over a 3-year period.

C) a capital depreciation allowance of 4.0% of the cost of the building is allowable for 40 years.

D) a capital expense such as the addition of an air conditioner to the property.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

A person's equity in their own home valued 10-years after initial purchase:

A) is the difference between the current market value of the home and their initial purchase price.

B) is the difference between the current market value of the home and the amount initially borrowed on a principal and interest home loan.

C) will rise with principal loan repayments on borrowings assuming housing prices at least remain constant.

D) will decrease with principal loan repayments on borrowings assuming housing prices at least remain constant.

A) is the difference between the current market value of the home and their initial purchase price.

B) is the difference between the current market value of the home and the amount initially borrowed on a principal and interest home loan.

C) will rise with principal loan repayments on borrowings assuming housing prices at least remain constant.

D) will decrease with principal loan repayments on borrowings assuming housing prices at least remain constant.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Increases in capital city house prices may be the result of:

A) the policy of state governments to limit the supply of land by means of zoning.

B) lower levels of immigration.

C) the threat of a higher taxation policy on property investment.

D) a decrease in office jobs in city areas.

A) the policy of state governments to limit the supply of land by means of zoning.

B) lower levels of immigration.

C) the threat of a higher taxation policy on property investment.

D) a decrease in office jobs in city areas.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

The NTA of an unlisted property trust assuming all other items are held constant:

A) will increase in situations where the fund manager decides to repay principal on outstanding debt from surplus cash holdings.

B) will increase in situations where the fund manager decides to revalue upwards the amount included in the balance sheet for goodwill attached to a prominent property held by the fund.

C) is used by fund managers to determine the current value of units in the trust before adjusting for any management fees.

D) both a and c

A) will increase in situations where the fund manager decides to repay principal on outstanding debt from surplus cash holdings.

B) will increase in situations where the fund manager decides to revalue upwards the amount included in the balance sheet for goodwill attached to a prominent property held by the fund.

C) is used by fund managers to determine the current value of units in the trust before adjusting for any management fees.

D) both a and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

What is the valuation approach which is described as follows: "An estimated market value made by comparing recent sales figures to provide a return required by investors based on the income stream paid to investors less normal operating expenses"?

A) The cost approach.

B) The direct comparison approach.

C) The securitisation approach.

D) The capitalisation approach.

A) The cost approach.

B) The direct comparison approach.

C) The securitisation approach.

D) The capitalisation approach.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements regarding loan types is incorrect?

A) Capped loans provide some certainty to the borrower regarding interest rates for a specified period before they revert to standard variable loans.

B) Equity loans require the borrower to undergo an approval process each time they wish to borrow from this facility.

C) 100% offset loans benefit from potentially decreasing interest expenses for the borrower if used wisely.

D) None of the above.

A) Capped loans provide some certainty to the borrower regarding interest rates for a specified period before they revert to standard variable loans.

B) Equity loans require the borrower to undergo an approval process each time they wish to borrow from this facility.

C) 100% offset loans benefit from potentially decreasing interest expenses for the borrower if used wisely.

D) None of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

When providing advice to a client on whether it is best for them to rent or buy a family home based only on financial grounds, the advice:

A) will favour the buying option in times of relatively low interest rates and current flat housing prices.

B) will favour the buying option in times of relatively tight rental markets.

C) both a and

D) none of the above.

A) will favour the buying option in times of relatively low interest rates and current flat housing prices.

B) will favour the buying option in times of relatively tight rental markets.

C) both a and

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Where a single homeowner dies in 2014 and bequests their family home which was originally purchased in 2001 to a beneficiary:

A) the home will be subject to a potential capital gains tax liability if sold by the beneficiary within 1 year following the death of the homeowner using the original purchase price as the cost base.

B) the home will be exempted from a potential capital gains tax liability if sold by the beneficiary within 2 years following the death of the homeowner.

C) the home will be valued at its market value at the date of death of the homeowner and subject to sale on any subsequent disposal by the beneficiary.

D) none of the above.

A) the home will be subject to a potential capital gains tax liability if sold by the beneficiary within 1 year following the death of the homeowner using the original purchase price as the cost base.

B) the home will be exempted from a potential capital gains tax liability if sold by the beneficiary within 2 years following the death of the homeowner.

C) the home will be valued at its market value at the date of death of the homeowner and subject to sale on any subsequent disposal by the beneficiary.

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

Property trusts:

A) are taxpaying entities.

B) can make tax-deferred distributions to individual unitholders who benefit differentially on an after-tax basis depending on their personal marginal tax rate.

C) can withhold income distributions to unitholders in any year depending on the trusts expected cash flow requirements for the following period.

D) both b and c

A) are taxpaying entities.

B) can make tax-deferred distributions to individual unitholders who benefit differentially on an after-tax basis depending on their personal marginal tax rate.

C) can withhold income distributions to unitholders in any year depending on the trusts expected cash flow requirements for the following period.

D) both b and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

As compared to an A-REIT, an unlisted property trust is likely to:

A) be smaller in size holding less properties.

B) have relatively more debt as a proportion of the total trust assets.

C) both a and

D) both a and b

A) be smaller in size holding less properties.

B) have relatively more debt as a proportion of the total trust assets.

C) both a and

D) both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

A characteristic of property is:

A) it is generally regarded as an intangible form of investment.

B) it is generally regarded as an illiquid form of investment.

C) returns may comprise income but not capital.

D) entry costs and exit costs can be relatively low.

A) it is generally regarded as an intangible form of investment.

B) it is generally regarded as an illiquid form of investment.

C) returns may comprise income but not capital.

D) entry costs and exit costs can be relatively low.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Establishing a market value for older buildings is more problematic using the:

A) cost approach.

B) direct comparison approach.

C) capitalisation approach.

D) both a and b

A) cost approach.

B) direct comparison approach.

C) capitalisation approach.

D) both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

The capitalisation approach results in:

A) a higher market value the greater the capitalisation rate used for a given net rental income stream.

B) a lower market value the greater the capitalisation rate used for a given net rental income stream.

C) a lower market value the lower the capitalisation rate used for an increasing net rental income stream.

D) both a and c

A) a higher market value the greater the capitalisation rate used for a given net rental income stream.

B) a lower market value the greater the capitalisation rate used for a given net rental income stream.

C) a lower market value the lower the capitalisation rate used for an increasing net rental income stream.

D) both a and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Characteristics of an A-REIT include:

A) units being issued to investors on establishment.

B) prices fluctuating in accordance with general market sentiment on the ASX.

C) investors receiving distributions in the form of fully-franked dividends.

D) both a and b

A) units being issued to investors on establishment.

B) prices fluctuating in accordance with general market sentiment on the ASX.

C) investors receiving distributions in the form of fully-franked dividends.

D) both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

At the start of the current financial year Paul decided to purchase a newly constructed apartment in the city for $400,000 which he hopes will increase his long-term wealth and create some tax deductions given that he is on a 46.5% marginal tax rate. He used $80,000 of his own money as a deposit and borrowed the remaining $320,000 from Fast Finance on an interest-only loan for 5 years at a fixed interest rate of 7% p.a.. Some additional details regarding the property purchase are listed below:

Purchase price of $400,000 consisting of $375,000 for the building costs and $25,000 for depreciable plant and equipment. A building allowance of 2.5% p.a. and plant and equipment depreciation of 20% p.a. is available for the purchase on a straight-line basis. Property rental of 6% p.a. gross (of the total purchase cost) with annual cash-based operating expenses (excluding financing) of $10,000.

a) Paul asks you to prepare a table to show how the income from the apartment would be taxed and how it would affect his after-tax cash flow. Use the information provided to complete the pro-forma table below for the first year after the property purchase.

Cash flow Details $

Gross rent

Less property expenses paid in cash

Less interest payments

Net cash outflow before tax (A)

Less depreciation of building

Less depreciation of furniture, fittings, etc.

Taxable income

Tax loss (i.e. tax savings) (B)

After-tax cash flow (B-A)

b) Paul decides to sell the property after 5 years when the sale price is $600,000 and selling costs are $20,000. Note that the value of plant and equipment originally purchased for $25,000 at the time of sale is expected to be $nil. Your task is to produce for Paul a schedule showing the taxation liability and the after-tax proceeds on the sale of the property at this time. Use the table below for this task.

Net sale proceeds before tax $

Sale proceeds

Less selling costs

Net sale proceeds

Less repayment of interest-only loan

Net proceeds before tax (A)

Tax liability:

Net sale proceeds

Less purchase price

Less accumulated building depreciation

Reduced cost base

Capital gain

(net sale proceeds less reduced cost base)

Taxable gain

Tax on capital gain (B)

After-tax proceeds on sale of property (A - B)

Purchase price of $400,000 consisting of $375,000 for the building costs and $25,000 for depreciable plant and equipment. A building allowance of 2.5% p.a. and plant and equipment depreciation of 20% p.a. is available for the purchase on a straight-line basis. Property rental of 6% p.a. gross (of the total purchase cost) with annual cash-based operating expenses (excluding financing) of $10,000.

a) Paul asks you to prepare a table to show how the income from the apartment would be taxed and how it would affect his after-tax cash flow. Use the information provided to complete the pro-forma table below for the first year after the property purchase.

Cash flow Details $

Gross rent

Less property expenses paid in cash

Less interest payments

Net cash outflow before tax (A)

Less depreciation of building

Less depreciation of furniture, fittings, etc.

Taxable income

Tax loss (i.e. tax savings) (B)

After-tax cash flow (B-A)

b) Paul decides to sell the property after 5 years when the sale price is $600,000 and selling costs are $20,000. Note that the value of plant and equipment originally purchased for $25,000 at the time of sale is expected to be $nil. Your task is to produce for Paul a schedule showing the taxation liability and the after-tax proceeds on the sale of the property at this time. Use the table below for this task.

Net sale proceeds before tax $

Sale proceeds

Less selling costs

Net sale proceeds

Less repayment of interest-only loan

Net proceeds before tax (A)

Tax liability:

Net sale proceeds

Less purchase price

Less accumulated building depreciation

Reduced cost base

Capital gain

(net sale proceeds less reduced cost base)

Taxable gain

Tax on capital gain (B)

After-tax proceeds on sale of property (A - B)

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

Outline six of the positive characteristics that are associated with an investment in the property market.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

Speculate on the reasons why, although the percentage of Australians occupying their own home is very high by world standards, the proportion of the younger population in Australia (those under 35 years of age) has been decreasing in more recent times.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

a) Given the following information, calculate the net tangible asset (NTA) price per unit of the "Futuristic Office Property Fund" which is an A-REIT.

Market value of property held by the fund is $80,000,000; the mortgage owed to lenders is $50,000,000; and the number of units issued to the public is 20,000,000.

b) The market price of the fund is currently trading at a discount of 10% to the answer derived in part a) of this question. Calculate this market price and discuss why a price different to the NTA may occur for an A-REIT.

Market value of property held by the fund is $80,000,000; the mortgage owed to lenders is $50,000,000; and the number of units issued to the public is 20,000,000.

b) The market price of the fund is currently trading at a discount of 10% to the answer derived in part a) of this question. Calculate this market price and discuss why a price different to the NTA may occur for an A-REIT.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

a) Use the capitalisation approach for the following situation to determine a market value for a residential investment property that is planned to be rented for a net amount of $20,000 p.a..

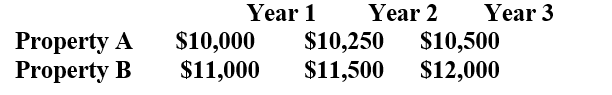

There have been three recent sales of rental properties recorded in a similar location, as follows:

b) The capitalisation method can also be used to determine the net rent income that can be demanded from a tenant. Suppose a person paid $290,000 for a rental property in a similar area and required a net rental return (after annual operating expenses of $11,000) of 9.0% p.a. from the investment. What would be the gross rental income that could be expected?

There have been three recent sales of rental properties recorded in a similar location, as follows:

b) The capitalisation method can also be used to determine the net rent income that can be demanded from a tenant. Suppose a person paid $290,000 for a rental property in a similar area and required a net rental return (after annual operating expenses of $11,000) of 9.0% p.a. from the investment. What would be the gross rental income that could be expected?

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

Discuss the range of factors that you would consider when considering the purchase of a commercial property.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Imagine you are having a discussion with a friend about investment in property. Your friend favours a direct form of investment because of the costs involved with a property fund but would like to know the benefits of investing in a property fund. Provide an outline of these benefits.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Outline the taxation advantages of investing in a property trust.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

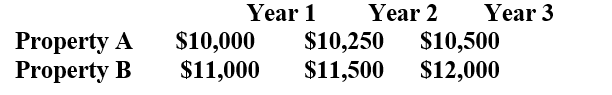

Debra is assessing an investment in one of two residential rental properties under consideration for a 3-year time frame.

Each property requires an initial outlay of $200,000 and would be sold at the end of 3 years. Debra expects that at this time she could sell property A for $300,000 and property B for $280,000. She also anticipates an increase in net rental income each year for each property. Property B is older but because of its excellent location she expects to achieve a higher net rental even though its expected sales price is likely to be a bit lower than property B.

If Debra did not want to invest in either of the two properties then she would invest the $200,000 in a managed fund of equivalent risk which is expected to pay a rate of return of 7% p.a.

The expected net income flows for both properties is shown below:

a) Calculate the Net Present Value (NPV) of each of the two properties to assist Debra with her decision.

b) Based on the NPV analysis which property, if any, should Debra buy?

c) Indicate the assumptions on which NPV is based that may, in fact, even lead Debra to an investment decision that may be incorrect.

Each property requires an initial outlay of $200,000 and would be sold at the end of 3 years. Debra expects that at this time she could sell property A for $300,000 and property B for $280,000. She also anticipates an increase in net rental income each year for each property. Property B is older but because of its excellent location she expects to achieve a higher net rental even though its expected sales price is likely to be a bit lower than property B.

If Debra did not want to invest in either of the two properties then she would invest the $200,000 in a managed fund of equivalent risk which is expected to pay a rate of return of 7% p.a.

The expected net income flows for both properties is shown below:

a) Calculate the Net Present Value (NPV) of each of the two properties to assist Debra with her decision.

b) Based on the NPV analysis which property, if any, should Debra buy?

c) Indicate the assumptions on which NPV is based that may, in fact, even lead Debra to an investment decision that may be incorrect.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck