Deck 4: Investment Choices

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 4: Investment Choices

1

Cash investments aim to provide:

A) a capital guarantee.

B) returns that fully offset the investor from the impacts of inflation.

C) income, liquidity and stable returns.

D) both b and c

A) a capital guarantee.

B) returns that fully offset the investor from the impacts of inflation.

C) income, liquidity and stable returns.

D) both b and c

C

2

With regard to shares as an asset class, nominate the correct statement below:

A) Shares are generally considered a relatively high-risk and high-return investment and are suit able for longer-term investors.

B) Shares have similar risks to listed property trusts.

C) By investing in companies providing unfranked dividends, Australian investors can derive tax-effective returns by means of the dividend imputation system under which, given companies have already paid tax at the company tax rate, investors can use franking credits to offset the amount of tax they pay on dividends.

D) Both a and b

A) Shares are generally considered a relatively high-risk and high-return investment and are suit able for longer-term investors.

B) Shares have similar risks to listed property trusts.

C) By investing in companies providing unfranked dividends, Australian investors can derive tax-effective returns by means of the dividend imputation system under which, given companies have already paid tax at the company tax rate, investors can use franking credits to offset the amount of tax they pay on dividends.

D) Both a and b

D

3

In finance, risk may be defined as:

A) the chance of a loss of capital.

B) the chance of loss of purchasing power.

C) the variability of returns.

D) all of the above.

A) the chance of a loss of capital.

B) the chance of loss of purchasing power.

C) the variability of returns.

D) all of the above.

D

4

Given the information provided below, which of the following share investments is clearly preferred to the others?

A) Tee Enterprises

B) Scamanda Trading

C) Bouble Holdings

D) Insufficient information to make an informed decision.

A) Tee Enterprises

B) Scamanda Trading

C) Bouble Holdings

D) Insufficient information to make an informed decision.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

The relative investment performance of the major asset classes in the last 10 and 20 years as included in the text shows:

A) Australian shares to have underperformed listed property.

B) Australian bonds to have underperformed listed property.

C) hedged international shares to have outperformed unhedged international shares.

D) all of the above.

A) Australian shares to have underperformed listed property.

B) Australian bonds to have underperformed listed property.

C) hedged international shares to have outperformed unhedged international shares.

D) all of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

The importance of the efficient frontier lies in the fact that it:

A) identifies where the most efficient portfolios are.

B) is a curve and shows how diversification lets investors improve their efficient risk / return ratio.

C) represents the optimal mix of return and risk for a portfolio of investments given a required level of risk.

D) all of the above.

A) identifies where the most efficient portfolios are.

B) is a curve and shows how diversification lets investors improve their efficient risk / return ratio.

C) represents the optimal mix of return and risk for a portfolio of investments given a required level of risk.

D) all of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

Gibson (2000) studied the effects of using multiple asset classes (2, 3 or 4 asset classes) for portfolio investing. He concluded that:

A) by using a combination of all 4 asset classes over a period of time an investor would achieve the highest long-term average return but it would have a higher level of risk than other asset class combinations.

B) by using a combination of 3 asset classes over a period of time an investor would achieve the highest long-term average return with a lower level of risk than other asset class combinations.

C) by using a combination of 2 asset classes over a period of time an investor would achieve the highest long-term average return with the lowest level of risk.

D) by using a combination of all 4 asset classes over a period of time an investor would achieve the highest long-term average return with a lower level of risk than other asset class combinations.

A) by using a combination of all 4 asset classes over a period of time an investor would achieve the highest long-term average return but it would have a higher level of risk than other asset class combinations.

B) by using a combination of 3 asset classes over a period of time an investor would achieve the highest long-term average return with a lower level of risk than other asset class combinations.

C) by using a combination of 2 asset classes over a period of time an investor would achieve the highest long-term average return with the lowest level of risk.

D) by using a combination of all 4 asset classes over a period of time an investor would achieve the highest long-term average return with a lower level of risk than other asset class combinations.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

With regard to the benefits of diversification, nominate the incorrect statement:

A) The expected (mean) return for the portfolio lies between the highest return for all assets in the portfolio and the lowest return for all assets in the portfolio.

B) The riskiness of a portfolio is simply a weighted average of the standard deviations of the individual shares in the portfolio.

C) Portfolio risk can be reduced to close to zero when the returns of the shares contained in the portfolio are perfectly negatively correlated, that is they have a correlation coefficient of -1.0.

D) A correlation coefficient of -1 would indicate that the two companies move counter-cyclically to each other.

A) The expected (mean) return for the portfolio lies between the highest return for all assets in the portfolio and the lowest return for all assets in the portfolio.

B) The riskiness of a portfolio is simply a weighted average of the standard deviations of the individual shares in the portfolio.

C) Portfolio risk can be reduced to close to zero when the returns of the shares contained in the portfolio are perfectly negatively correlated, that is they have a correlation coefficient of -1.0.

D) A correlation coefficient of -1 would indicate that the two companies move counter-cyclically to each other.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Markowitz's modern portfolio theory assumes that there are two asset types being:

A) low risk and high risk assets.

B) low risk and moderate risk assets.

C) risky and risk-free assets.

D) none of the above.

A) low risk and high risk assets.

B) low risk and moderate risk assets.

C) risky and risk-free assets.

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

In terms of behavioural theory, overconfidence can result in:

A) individual investors being mistakenly convinced that they can regularly beat the market.

B) sharemarket investors less likely to speculate by regularly trading in stocks.

C) people deviating from rational thinking in making judgements where there is an element of uncertainty.

D) both a and c

A) individual investors being mistakenly convinced that they can regularly beat the market.

B) sharemarket investors less likely to speculate by regularly trading in stocks.

C) people deviating from rational thinking in making judgements where there is an element of uncertainty.

D) both a and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

When selecting suitable products for investment, personal investors often are attracted to property as an asset class because:

A) returns are expected to keep pace with inflation.

B) it is a tangible investment unlike the other asset classes.

C) both a and b

D) none of the above.

A) returns are expected to keep pace with inflation.

B) it is a tangible investment unlike the other asset classes.

C) both a and b

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

With regard to listed property as an asset class, nominate the correct statement below:

A) Both listed property trusts known as real estate investment trusts (A-REITs) and unlisted property trusts are pooled investments which hold a basket of properties in one or more of the property sectors and offer units to be purchased by investors.

B) Listed property trusts do not have similar risks to shares.

C) Property is a long-term investment with higher risk than fixed-interest investments but slightly lower risk, historically, than shares.

D) Both a and c

A) Both listed property trusts known as real estate investment trusts (A-REITs) and unlisted property trusts are pooled investments which hold a basket of properties in one or more of the property sectors and offer units to be purchased by investors.

B) Listed property trusts do not have similar risks to shares.

C) Property is a long-term investment with higher risk than fixed-interest investments but slightly lower risk, historically, than shares.

D) Both a and c

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Fixed-interest investments have the following characteristics:

A) They cannot be traded on the secondary market before their maturity if an investor needs to convert their investment to cash.

B) Interest is usually paid on a regular basis, but with some investments, the interest amount is factored into the final payment and offered as a discount security or with accumulated interest paid on maturity.

C) They are not subject to credit risk.

D) Both a and b

A) They cannot be traded on the secondary market before their maturity if an investor needs to convert their investment to cash.

B) Interest is usually paid on a regular basis, but with some investments, the interest amount is factored into the final payment and offered as a discount security or with accumulated interest paid on maturity.

C) They are not subject to credit risk.

D) Both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

The enterprising or aggressive investor is characterised by:

A) speculation.

B) their willingness to devote time and care to the selection of sound and attractive investments even though they may not be fully trained experts in the field.

C) the conservation of capital.

D) both a and b

A) speculation.

B) their willingness to devote time and care to the selection of sound and attractive investments even though they may not be fully trained experts in the field.

C) the conservation of capital.

D) both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

To be _ _% confident that the actual returns will lie in a given range, we simply determine the values of the expected return plus two standard deviations and the expected return minus two standard deviations, assuming the returns are normally distributed.

A) 42

B) 68

C) 95

D) 99

A) 42

B) 68

C) 95

D) 99

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

In terms of loss aversion theory it is generally accepted that investors:

A) consider losses far more undesirable than equivalent gains.

B) have an a degree of aversion to losses which is counter to efficient market theory.

C) are more likely to sell losing stocks than winning stocks.

D) both a and b

A) consider losses far more undesirable than equivalent gains.

B) have an a degree of aversion to losses which is counter to efficient market theory.

C) are more likely to sell losing stocks than winning stocks.

D) both a and b

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Facts common to most investment scams include:

A) investors being provided with a product disclosure statement.

B) the promise of returns equivalent to bank deposits.

C) both a and b

D) none of the above.

A) investors being provided with a product disclosure statement.

B) the promise of returns equivalent to bank deposits.

C) both a and b

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Standard deviation:

A) is equal to the variance squared.

B) measures the variability of returns around the expected return.

C) is found by taking the square root of expected return.

D) all of the above.

A) is equal to the variance squared.

B) measures the variability of returns around the expected return.

C) is found by taking the square root of expected return.

D) all of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

The expected return on a portfolio is calculated as the:

A) average return of individual shares in the portfolio, as a fraction of the number of individual shares in the total portfolio.

B) weighted average return of individual shares in the portfolio, weighted by the risk of each share forming part of the total portfolio.

C) weighted average return of individual shares in the portfolio, weighted by the fraction of the total portfolio invested in each share.

D) none of the above.

A) average return of individual shares in the portfolio, as a fraction of the number of individual shares in the total portfolio.

B) weighted average return of individual shares in the portfolio, weighted by the risk of each share forming part of the total portfolio.

C) weighted average return of individual shares in the portfolio, weighted by the fraction of the total portfolio invested in each share.

D) none of the above.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

The mean and expected returns on an investment have the following relationship:

A) they are equivalent as they represent the same outcome.

B) the mean return is always greater than the expected return.

C) the mean return is always less than the expected return.

D) there is no relationship between the mean and expected returns.

A) they are equivalent as they represent the same outcome.

B) the mean return is always greater than the expected return.

C) the mean return is always less than the expected return.

D) there is no relationship between the mean and expected returns.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Steve Howell is seeking to select between 2 fixed-interest securities where all income and capital will be returned at maturity that he has assessed as having the same amount of risk exposure for a 3-year term. He has $10,000 available for immediate investment. Ignore the effects of taxation in any calculations.

The details for each security are as follows:

Security A:

Issuer: Wakpac Bank

Annual nominal compound interest rate: Year 1: 4%, Year 2: 6%, Year 3: 8%

Security B:

Issuer: Fortune Finance

Annual real interest rate: 2.75% compounded for 3 years

It expected that inflation for each of the next 3 years will be as follows:

Year 1: 2.5%, Year 2: 3%, Year 3: 5%,

Perform relevant calculations and make an informed investment recommendation to Steve including an assessment of the annualised real rate of return provided by the Wakpac Bank.

The details for each security are as follows:

Security A:

Issuer: Wakpac Bank

Annual nominal compound interest rate: Year 1: 4%, Year 2: 6%, Year 3: 8%

Security B:

Issuer: Fortune Finance

Annual real interest rate: 2.75% compounded for 3 years

It expected that inflation for each of the next 3 years will be as follows:

Year 1: 2.5%, Year 2: 3%, Year 3: 5%,

Perform relevant calculations and make an informed investment recommendation to Steve including an assessment of the annualised real rate of return provided by the Wakpac Bank.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

Briefly explain the effect of a multiple asset class portfolio as reported by Gibson (2000).

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

Describe how investor behaviour can challenge the assumption that investors are rational.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

Explain the general range of classifications used by financial planners.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

How does diversification reduce risk?

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

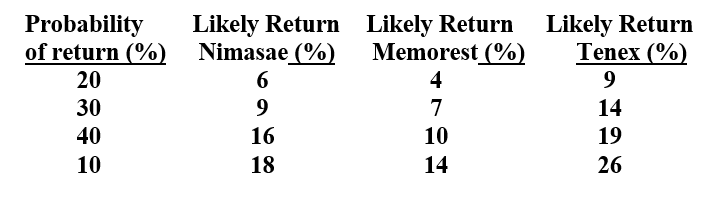

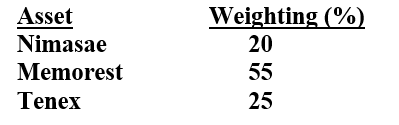

From the previous question Sally has now asked you to calculate the risk attached to each of the investments proposed in Nimasae, Memorest and Tenex. She has also sought comments on the return / risk relationship for each of the individual investments by ranking each of the return and risk of the investments from lowest to highest. Further demonstrate your discussion of the return / risk relationship by showing Sally the likely range of returns that could eventuate for each asset with a 95% level of accuracy.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

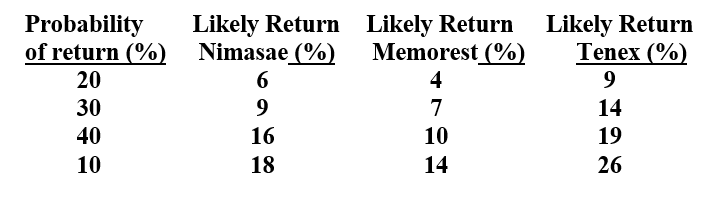

Sally Stricke recently commenced an investment portfolio which includes assets Nimasae, Memorest and Tenex about which Sally acquired the following financial information as to the likely returns at various probabilities:

a) Calculate the expected return for each asset.

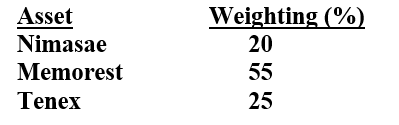

b) Calculate the expected return on a portfolio comprising each asset weighted as follows:

c) Briefly explain to Sally benefit of combining the assets into a portfolio instead of undertaking individual investments in Nimasae, Memorest and Tenex.

a) Calculate the expected return for each asset.

b) Calculate the expected return on a portfolio comprising each asset weighted as follows:

c) Briefly explain to Sally benefit of combining the assets into a portfolio instead of undertaking individual investments in Nimasae, Memorest and Tenex.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Briefly explain some of the investment choices available to investors.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

Explain the concept of risk in the field of finance.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck