Deck 1: Personal Financial Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 1: Personal Financial Planning

1

Monetary policy, administered by the RBA, is concerned with control over interest rates and the amount of money in circulation and is used to:

A) stimulate the economy by increasing interest rates

B) stimulate the economy by decreasing interest rates

C) slow the economy by increasing interest rates

D) both b and c

A) stimulate the economy by increasing interest rates

B) stimulate the economy by decreasing interest rates

C) slow the economy by increasing interest rates

D) both b and c

D

2

The highest credit rating from those indicated below would be:

A) CCC

B) AAA

C) A

D) BBB

A) CCC

B) AAA

C) A

D) BBB

B

3

The currency risk effects from holding an investment valued in an overseas currency will result in:

A) a rise in the Australian dollar value of the investment if the Australian dollar falls relative to the overseas currency

B) a rise in the Australian dollar value of the investment if the Australian dollar rises relative to the overseas currency

C) a fall in the Australian dollar value of the investment if the Australian dollar rises relative to the overseas currency

D) both a and c

A) a rise in the Australian dollar value of the investment if the Australian dollar falls relative to the overseas currency

B) a rise in the Australian dollar value of the investment if the Australian dollar rises relative to the overseas currency

C) a fall in the Australian dollar value of the investment if the Australian dollar rises relative to the overseas currency

D) both a and c

D

4

The term personal financial planning generally implies:

A) the achievement of a financial outcome within a specified time period

B) successfully gaining a job promotion

C) winning the lottery within a specified time period

D) both a and b

A) the achievement of a financial outcome within a specified time period

B) successfully gaining a job promotion

C) winning the lottery within a specified time period

D) both a and b

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Superannuation guarantee contributions in Australia are levied on:

A) employers and the self-employed

B) employers

C) employees

D) both b and c

A) employers and the self-employed

B) employers

C) employees

D) both b and c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Market volatility as a component of interest-rate risk:

A) affects the amount of interest payments received on a fixed-interest investment

B) affects the value of a fixed-interest investment at its maturity date

C) affects the value of a fixed-interest investment sold before its maturity date

D) both a and b

A) affects the amount of interest payments received on a fixed-interest investment

B) affects the value of a fixed-interest investment at its maturity date

C) affects the value of a fixed-interest investment sold before its maturity date

D) both a and b

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

The lowest level of business activity occurs during which of the following phases in the business cycle?

A) boom or expansion phase

B) recession phase

C) recovery phase

D) contraction phase

A) boom or expansion phase

B) recession phase

C) recovery phase

D) contraction phase

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

The role of ASIC is to:

A) draft legislation governing the financial planning industry

B) monitor competition policy within the financial services sector

C) ensure compliance by practitioners with legal requirements governing the financial planning industry

D) establish and monitor compliance of the prudential regulations that govern the operations of financial institutions within Australia

A) draft legislation governing the financial planning industry

B) monitor competition policy within the financial services sector

C) ensure compliance by practitioners with legal requirements governing the financial planning industry

D) establish and monitor compliance of the prudential regulations that govern the operations of financial institutions within Australia

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

A managed fund investing in subprime mortgages will be holding assets of:

A) low quality with a low possibility of default by borrowers

B) low quality with a high possibility of default by borrowers

C) high quality with a low possibility of default by borrowers

D) high quality with a high possibility of default by borrowers

A) low quality with a low possibility of default by borrowers

B) low quality with a high possibility of default by borrowers

C) high quality with a low possibility of default by borrowers

D) high quality with a high possibility of default by borrowers

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Items which are regarded as financial products include:

A) a security (e.g. a share in a body corporate or a debenture of a body corporate)

B) health insurance, funeral bonds and reinsurance

C) exempt public sector superannuation schemes within the meaning of the Superannuation Industry (Supervision) Act 1993

D) all of the above

A) a security (e.g. a share in a body corporate or a debenture of a body corporate)

B) health insurance, funeral bonds and reinsurance

C) exempt public sector superannuation schemes within the meaning of the Superannuation Industry (Supervision) Act 1993

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

A close reading of chapter 1 provides which of the following lessons for investors:

A) be aware of market cycles

B) do not diversify unless there are no other options available

C) both a and b

D) none of the above

A) be aware of market cycles

B) do not diversify unless there are no other options available

C) both a and b

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

In Australia, it is expected that by about 2050 there will be approximately:

A) 2.7 people in working age groups for each retired person

B) 3.5 people in working age groups for each retired person

C) 5.0 people in working age groups for each retired person

D) 4 males in working age groups and 2.5 females in working age groups for each retired person

A) 2.7 people in working age groups for each retired person

B) 3.5 people in working age groups for each retired person

C) 5.0 people in working age groups for each retired person

D) 4 males in working age groups and 2.5 females in working age groups for each retired person

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

Stimulating or contracting the economy via changes in interest rates is an example of the government's use of:

A) fiscal policy

B) industrial relations policy

C) monetary policy

D) welfare policy

A) fiscal policy

B) industrial relations policy

C) monetary policy

D) welfare policy

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

The 'know your client rule':

A) provides that a licensee must monitor and supervise the activities of representatives to ensure they are complying with the law

B) provides that before a financial planner is able to give specific advice on an investment, the Corporations Act requires the planner to make every effort to understand the client's investment objectives, financial situation and particular needs

C) applies to both wholesale and retail clients

D) is contained within the Financial Services Guide

A) provides that a licensee must monitor and supervise the activities of representatives to ensure they are complying with the law

B) provides that before a financial planner is able to give specific advice on an investment, the Corporations Act requires the planner to make every effort to understand the client's investment objectives, financial situation and particular needs

C) applies to both wholesale and retail clients

D) is contained within the Financial Services Guide

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

To adequately meet required income needs in retirement it is generally accepted that people will need approximately what percentage of their pre-retirement income?

A) more than 90 per cent

B) 60 to 70 per cent

C) 40 to 50 per cent

D) less than 40 per cent

A) more than 90 per cent

B) 60 to 70 per cent

C) 40 to 50 per cent

D) less than 40 per cent

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

The global financial crisis:

A) was brought about by US investment banks disguising the true risk characteristics of the collateralised debt obligations they were selling

B) was made worse by the uncertainty within global markets as to the level of credit risk posed by financial institutions leading to governments having to guarantee bank deposits

C) resulted in Governments offering stimulus packages to attempt to prevent economies from slipping into recession

D) all of the above

A) was brought about by US investment banks disguising the true risk characteristics of the collateralised debt obligations they were selling

B) was made worse by the uncertainty within global markets as to the level of credit risk posed by financial institutions leading to governments having to guarantee bank deposits

C) resulted in Governments offering stimulus packages to attempt to prevent economies from slipping into recession

D) all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

A financial service is defined by the Corporations Act to be provided in the circumstances where people:

A) give financial advice in relation to financial products

B) give legal advice in relation to financial products

C) make a market in a financial product

D) both a and c

A) give financial advice in relation to financial products

B) give legal advice in relation to financial products

C) make a market in a financial product

D) both a and c

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

The value of the expected shortfall the working population will have in building an adequate retirement benefit is termed the:

A) Retirement Standard (RS)

B) Retirement Savings Gap (RSG)

C) Target Retirement Benefit (TRB)

D) none of the above

A) Retirement Standard (RS)

B) Retirement Savings Gap (RSG)

C) Target Retirement Benefit (TRB)

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Generally accepted finance principles would support which of the following statements?

A) 'high return generally equals high risk'

B) 'high return generally equals low risk'

C) 'high risk is generally inversely related to high return'

D) none of the above

A) 'high return generally equals high risk'

B) 'high return generally equals low risk'

C) 'high risk is generally inversely related to high return'

D) none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

Given an understanding of interest-rate risk, an existing fixed-interest investor in bonds would be affected in which of the following way(s) if the market interest rates on bonds were to rise from 8% to 10%?

A) interest receipts from the bonds would rise and the market price of the bond would also rise

B) interest receipts from the bonds would fall and the market price of the bond would also fall

C) interest receipts from the bonds would be unaffected and the market price of the bond would rise

D) interest receipts from the bonds would be unaffected and the market price of the bond would fall

A) interest receipts from the bonds would rise and the market price of the bond would also rise

B) interest receipts from the bonds would fall and the market price of the bond would also fall

C) interest receipts from the bonds would be unaffected and the market price of the bond would rise

D) interest receipts from the bonds would be unaffected and the market price of the bond would fall

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

After reading chapter 1 you have learned of some of the issues that investors need to consider. Many of these lessons are learned by investors but not often applied. Outline five lessons that you have gained from your reading of chapter 1. You may illustrate the lesson by use of an example where appropriate.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Explain in your own words the relationship between personal financial planning and the 'life cycle' theory of consumption and saving.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Explain the role of the ASIC.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

What are some of the principal factors that have contributed towards many developed countries including Australia, facing a rapidly ageing population?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

Briefly outline the ways in which governments seek to constrain or stimulate the domestic economy.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

Comment on whether you consider the current government superannuation contribution requirements to be adequate in order to provide for a suitable retirement income for the Australian population.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

Explain how the global financial crisis started and its impact upon Australia.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

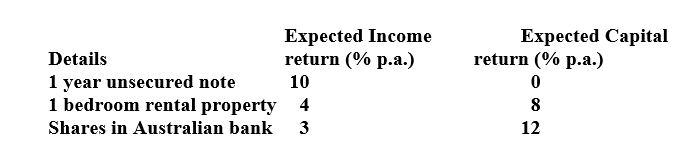

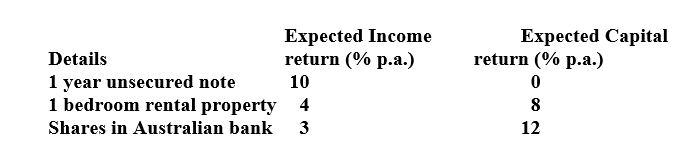

Reno has a goal of purchasing a new speedboat valued at approximately $14,000 financed from the returns generated on his investments over the next 12 months.

He currently has approximately $150,000 available for investment and wishes to select any one of the following alternative investments in order to realise his goal:

Ignore the effects of taxation in your calculations.

(a) Calculate the expected amount of income and capital generated by each investment over the next 12 months.

(b) Rank the investments in the order of their total return (expressed as a dollar amount) from the highest to the lowest.

(c) Briefly outline the main risks attached to each investment from the various types of risk discussed in this chapter.

(d) What issues would be relevant and what specific benefits could Reno achieve if he sought to diversify his investments using the alternative investments provided?

He currently has approximately $150,000 available for investment and wishes to select any one of the following alternative investments in order to realise his goal:

Ignore the effects of taxation in your calculations.

(a) Calculate the expected amount of income and capital generated by each investment over the next 12 months.

(b) Rank the investments in the order of their total return (expressed as a dollar amount) from the highest to the lowest.

(c) Briefly outline the main risks attached to each investment from the various types of risk discussed in this chapter.

(d) What issues would be relevant and what specific benefits could Reno achieve if he sought to diversify his investments using the alternative investments provided?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

List and explain the various types of investment risk.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

Differentiate the roles of the financial counsellor and the financial planner.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck