Deck 15: Capital Structure Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 15: Capital Structure Policy

1

A firm's capital structure consists of which of the following?

A)The amount of debt that a firm utilizes

B)The amount of debt and preferred stock that a firm utilizes

C)The amount of debt,preferred stock,and common stock that a firm utilizes

D)None of the above

A)The amount of debt that a firm utilizes

B)The amount of debt and preferred stock that a firm utilizes

C)The amount of debt,preferred stock,and common stock that a firm utilizes

D)None of the above

C

2

A company whose rate of return on investments is higher than the interest rate on its debt is said to have:

A)unfavorable financial leverage.

B)a sub-optimal capital structure.

C)favorable financial leverage.

D)negative financial leverage.

A)unfavorable financial leverage.

B)a sub-optimal capital structure.

C)favorable financial leverage.

D)negative financial leverage.

C

3

Which of the following should be excluded from a firm's capital structure?

A)Common equity

B)Non-interest bearing debt

C)Long-term debt

D)Short-term bank notes

A)Common equity

B)Non-interest bearing debt

C)Long-term debt

D)Short-term bank notes

B

4

The primary objective of capital structure management is to find the combination of funding sources that will minimize the

A)interest rate.

B)WACC.

C)probability of financial distress.

D)cost of equity.

A)interest rate.

B)WACC.

C)probability of financial distress.

D)cost of equity.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

How does the text distinguish between firm's financial structure and its capital structure?

A)Financial structure includes only interest bearing debt

B)Capital structure includes only non-interest bearing debt

C)Financial structure uses market values of equity

D)Capital structure includes only interest bearing debt

A)Financial structure includes only interest bearing debt

B)Capital structure includes only non-interest bearing debt

C)Financial structure uses market values of equity

D)Capital structure includes only interest bearing debt

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is NOT a component of a firm's capital structure?

A)Preferred stock

B)Bonds

C)Common stock

D)Accounts payable

E)Retained earnings

A)Preferred stock

B)Bonds

C)Common stock

D)Accounts payable

E)Retained earnings

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

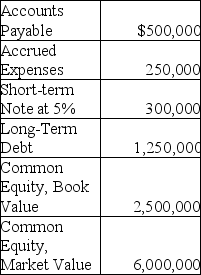

Cornucopia's liabilities and equity are shown below:

Cornucopia's debt ratio is ________.

A).48

B).32

C).21

D).30

Cornucopia's debt ratio is ________.

A).48

B).32

C).21

D).30

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

What is meant by the terms "favorable" and "unfavorable" leverage?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

The Times Interest Earned Ratio measures a firm's ability to meet both interest payments and scheduled principal repayments.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

The firm's optimal capital structure is the mix of financing sources that:

A)minimizes the risk of financial distress.

B)maximizes after-tax earnings.

C)maximizes the total value of the firm's debt and equity.

D)all of the above.

A)minimizes the risk of financial distress.

B)maximizes after-tax earnings.

C)maximizes the total value of the firm's debt and equity.

D)all of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

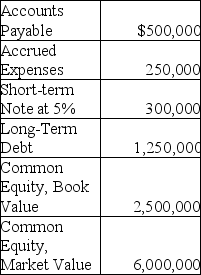

Cornucopia's liabilities and equity are shown below:

Cornucopia's debt to value ratio is ________.

A).48

B).32

C).21

D).30

Cornucopia's debt to value ratio is ________.

A).48

B).32

C).21

D).30

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

Financial structure includes long-term and short-term sources of funds.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

A company that earns a rate of return on its investments lower than the interest rate on its debt is said to have:

A)unfavorable financial leverage.

B)a sub-optimal capital structure.

C)favorable financial leverage.

D)negative financial leverage.

A)unfavorable financial leverage.

B)a sub-optimal capital structure.

C)favorable financial leverage.

D)negative financial leverage.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

Merrimac Brewing company's total assets equal $18 million.The book value of Merrimac's equity is $6 million.The market value of Merrimac's equity is $10 million.It's Debt to Value ratio is .5.What is the book value of Merrimac's interest- bearing debt?

A)$5 million

B)$10 million

C)$15 million

D)$20 million

A)$5 million

B)$10 million

C)$15 million

D)$20 million

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

A firm's financial structure is defined by the Debt Ratio,while it's capital structure is defined by the Debt to Value ratio.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

Fibonacci Property Management's balance sheet shows total liabilities of $5 million and total assets of $13 million.Interest bearing liabilities total $3 million (book value).The market value of Fibonnacci's equity is $21 million.Fibonacci's Debt to Value ratio is ________.

A).38

B).23

C).125

D).24

A).38

B).23

C).125

D).24

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Fibonacci Property Management's balance sheet shows total liabilities of $5 million and total assets of $13 million.Interest bearing liabilities total $3 million (book value).The market value of Fibonnacci's equity is $21 million.Fibonacci's debt ratio is ________.

A).38

B).23

C).125

D).24

A).38

B).23

C).125

D).24

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose we calculate a times interest earned ratio of 29 for Colgate-Palmolive.We can conclude:

A)Colgate-Palmolive may experience some difficulty meeting it's interest payments.

B)Colgate-Palmolive is very unlikely to have difficulty meeting it's interest payments.

C)Colgate-Palmolive has $29 of operating cash flow for every dollar of interest expense.

D)Colgate-Palmolive's EBITDA is 29 times larger than its interest expense.

A)Colgate-Palmolive may experience some difficulty meeting it's interest payments.

B)Colgate-Palmolive is very unlikely to have difficulty meeting it's interest payments.

C)Colgate-Palmolive has $29 of operating cash flow for every dollar of interest expense.

D)Colgate-Palmolive's EBITDA is 29 times larger than its interest expense.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

Merrimac Brewing company's total assets equal $18 million.The book value of Merrimac's equity is $6 million.The market value of Merrimac's equity is $10 million.It's Debt to Value ratio is .5.What is Merrimac's Debt Ratio?

A).75

B).67

C).33

D).25

A).75

B).67

C).33

D).25

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

Tremont Inc.'s Total Assets =$25 million.The balance sheet shows Accounts payable and accruals totaling $7 million,common stock and retained earnings total $10 million.There is no preferred stock.What is the book value of interest bearing debt?

A)$15 million

B)$7 million

C)$18 million

D)$8 million

A)$15 million

B)$7 million

C)$18 million

D)$8 million

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

When the impact of taxes is considered,as the firm takes on more debt

A)there will be no change in total cash flows.

B)both taxes and total cash flow to stockholders and bondholders will decrease.

C)cash flows will increase because taxes will decrease.

D)the weighted average cost of capital will increase.

A)there will be no change in total cash flows.

B)both taxes and total cash flow to stockholders and bondholders will decrease.

C)cash flows will increase because taxes will decrease.

D)the weighted average cost of capital will increase.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a reasonable conclusion from the Tradeoff theory of capital structure?

A)A high debt ratio will result in a maximum price of a firm's common stock.

B)A firm's common stock price will not be affected by the amount of debt a firm uses.

C)A low debt ratio will result in a maximum price for a firm's common stock.

D)Modest levels of debt have a more favorable impact on a firm's average cost of capital and stock price than no debt.

A)A high debt ratio will result in a maximum price of a firm's common stock.

B)A firm's common stock price will not be affected by the amount of debt a firm uses.

C)A low debt ratio will result in a maximum price for a firm's common stock.

D)Modest levels of debt have a more favorable impact on a firm's average cost of capital and stock price than no debt.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is consistent with the original formulation of the Modigliani and Miller Capital Structure Theorem?

A)A firm's composite cost of capital decreases as financial leverage is used.

B)A firm's common stock price falls as financial leverage is used.

C)A firm's composite cost of capital and common stock price are unaffected by the amount of financial leverage used by the firm.

D)A firm's composite cost of capital increases as operating leverage is used.

E)A firm's common stock price rises as operating leverage is used.

A)A firm's composite cost of capital decreases as financial leverage is used.

B)A firm's common stock price falls as financial leverage is used.

C)A firm's composite cost of capital and common stock price are unaffected by the amount of financial leverage used by the firm.

D)A firm's composite cost of capital increases as operating leverage is used.

E)A firm's common stock price rises as operating leverage is used.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

The Tradeoff theory of capital structure suggests that if a firm moves from zero debt in its capital structure to moderate usage of debt,the result is an increase in a firm's:

A)stock price.

B)cost of equity.

C)dividend payout.

D)both A and C.

A)stock price.

B)cost of equity.

C)dividend payout.

D)both A and C.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

An optimal capital structure is achieved:

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's expected stock price is maximized.

D)when a firm's break-even point is achieved.

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's expected stock price is maximized.

D)when a firm's break-even point is achieved.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

Bipolar Beverages total assets equal $360 million.The book value of Bipolar's equity is $180 million.The market value of Bipolar's equity is $ 250 million.The book value of the company's interest bearing debt is $120 million.Compute Bipolar's Debt Ratio and Debt to Value Ratio.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

An optimal capital structure is achieved:

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's expected stock price is maximized.

D)when a firm's break-even point is achieved.

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's expected stock price is maximized.

D)when a firm's break-even point is achieved.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

The inclusion of bankruptcy risk in firm valuation:

A)acknowledges that a firm has an upper limit to debt financing.

B)causes cost of capital curve to be linear.

C)causes the cost of capital curve to be downward sloping regardless of capital structure.

D)has no consequences for practical management of capital structure policy.

A)acknowledges that a firm has an upper limit to debt financing.

B)causes cost of capital curve to be linear.

C)causes the cost of capital curve to be downward sloping regardless of capital structure.

D)has no consequences for practical management of capital structure policy.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

Optimal capital structure is:

A)the funding mix that will maximize the company's common stock price.

B)the mix of all items that appear on the right-hand side of the company's balance sheet.

C)the mix of funds that will minimize the firm's beta.

D)the mix of securities that will maximize EPS.

A)the funding mix that will maximize the company's common stock price.

B)the mix of all items that appear on the right-hand side of the company's balance sheet.

C)the mix of funds that will minimize the firm's beta.

D)the mix of securities that will maximize EPS.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is the most important factor that affects a firm's financing mix?

A)The amount of EPS

B)The amount of operating income

C)The number of shares that are outstanding

D)The predictability of cash flows

A)The amount of EPS

B)The amount of operating income

C)The number of shares that are outstanding

D)The predictability of cash flows

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

The tradeoff theory of capital structure management assumes:

A)no corporate income taxes.

B)cost of equity remains constant with an increase in financial leverage.

C)firms might fail.

D)none of the above.

A)no corporate income taxes.

B)cost of equity remains constant with an increase in financial leverage.

C)firms might fail.

D)none of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

Why is the Debt to Assets Ratio always higher than the Debt to Value ratio?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

If interest expense lowers taxes,why does the WACC not decrease indefinitely with the addition of more debt?

A)The tax shield effect of debt will result in a lower cost of equity.

B)Increasing debt too much can result in a greater likelihood of firm failure (financial distress).

C)A firm's common stock price will not be affected by the amount of debt a firm uses.

D)Too much common equity increases the probability of bankruptcy.

A)The tax shield effect of debt will result in a lower cost of equity.

B)Increasing debt too much can result in a greater likelihood of firm failure (financial distress).

C)A firm's common stock price will not be affected by the amount of debt a firm uses.

D)Too much common equity increases the probability of bankruptcy.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

From the information below,select the optimal capital structure for Mountain High Corp.

A)Debt = 40%;Equity = 60%;EPS = $2.95;Stock price = $26.50

B)Debt = 50%;Equity = 50%;EPS = $3.05;Stock price = $28.90

C)Debt = 60%;Equity = 40%;EPS = $3.18;Stock price = $31.20

D)Debt = 80%;Equity = 20%;EPS = $3.42;Stock price = $30.40

E)Debt = 70%;Equity = 30%;EPS = $3.31;Stock price = $30.00

A)Debt = 40%;Equity = 60%;EPS = $2.95;Stock price = $26.50

B)Debt = 50%;Equity = 50%;EPS = $3.05;Stock price = $28.90

C)Debt = 60%;Equity = 40%;EPS = $3.18;Stock price = $31.20

D)Debt = 80%;Equity = 20%;EPS = $3.42;Stock price = $30.40

E)Debt = 70%;Equity = 30%;EPS = $3.31;Stock price = $30.00

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is consistent with the Tradeoff theory of capital structure?

A)The cost of capital continuously decreases as the firm's debt ratio increases.

B)The cost of capital remains constant as the firm's debt ratio increases.

C)The cost of capital continuously increases as the firm's debt ratio increases.

D)There is an optimal level of debt financing.

E)Capital structure does not affect a firm's cost of capital.

A)The cost of capital continuously decreases as the firm's debt ratio increases.

B)The cost of capital remains constant as the firm's debt ratio increases.

C)The cost of capital continuously increases as the firm's debt ratio increases.

D)There is an optimal level of debt financing.

E)Capital structure does not affect a firm's cost of capital.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following will happen if the original Modigliani and Miller Theorem is relaxed to include taxes,but not bankruptcy costs?

A)Increased usage of financial leverage will increase a firm's composite cost of capital indefinitely.

B)Increased usage of financial leverage will lower a firm's composite cost of capital indefinitely.

C)Increased usage of financial leverage will not affect a firm's composite cost of capital.

D)Increased usage of operating leverage will increase a firm's composite cost of capital indefinitely.

A)Increased usage of financial leverage will increase a firm's composite cost of capital indefinitely.

B)Increased usage of financial leverage will lower a firm's composite cost of capital indefinitely.

C)Increased usage of financial leverage will not affect a firm's composite cost of capital.

D)Increased usage of operating leverage will increase a firm's composite cost of capital indefinitely.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

The original form of the Modigliani and Miller Capital Structure Theorem

A)ignores the effect of taxes.

B)ignores the relationship between firm value and cost of capital.

C)ignores transaction costs.

D)both A and C are true.

A)ignores the effect of taxes.

B)ignores the relationship between firm value and cost of capital.

C)ignores transaction costs.

D)both A and C are true.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

An optimal capital structure is achieved:

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's break-even point is achieved.

D)when a firm's weighted average cost of capital is minimized.

A)when a firm's expected profits are maximized.

B)when a firm's expected EPS are maximized.

C)when a firm's break-even point is achieved.

D)when a firm's weighted average cost of capital is minimized.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

Capital structure theory suggests that companies may put the interests of ________ ahead of the interests of ________.

A)Potential stockholders,existing stockholders

B)Stockholders,bondholders

C)There are no potential conflicts t arising from the way a firm manages its capital structure.

D)Existing shareholders,IRS

A)Potential stockholders,existing stockholders

B)Stockholders,bondholders

C)There are no potential conflicts t arising from the way a firm manages its capital structure.

D)Existing shareholders,IRS

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

The Modigliani and Miller Capital Structure Theorem,in its original form:

A)uses unrealistic assumptions.

B)provided important insights into capital structure policy.

C)concludes that how a firm is financed is not important.

D)all of the above.

A)uses unrealistic assumptions.

B)provided important insights into capital structure policy.

C)concludes that how a firm is financed is not important.

D)all of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

Chelsea Corporation's cost of equity is 16% and it is 100% equity financed.If it can borrow enough money at 10% to buy back half of its stock,what would would happen to the cost of equity be under the original assumptions of the Modigliani and Miller Capital Structure Theorem.

A)It would remain at 16%.

B)t would rise to 22%.

C)It would fall to 11%.

D)It would fall to 13%.

A)It would remain at 16%.

B)t would rise to 22%.

C)It would fall to 11%.

D)It would fall to 13%.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

Agency costs tend to occur in business organizations when ownership and management control are confined to the same individuals.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

The Modigliani and Miller Capital Structure Theorem,in its original form,assumes:

A)there are no transactions costs.

B)there are no taxes.

C)investors can borrow money at the same rate as the firm.

D)all of the above.

A)there are no transactions costs.

B)there are no taxes.

C)investors can borrow money at the same rate as the firm.

D)all of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

With taxes,but in the absence of financial distress costs,the optimal capital structure would be:

A)100% equity.

B)50% debt,50% equity.

C)100% debt.

D)completely insensitive to the mix of debt and equity.

A)100% equity.

B)50% debt,50% equity.

C)100% debt.

D)completely insensitive to the mix of debt and equity.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

Investors require a higher return on common stock investments if a firm uses less leverage.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Capital Structure Theory in general assumes that?

A)A firm's value is determined by capitalizing (discounting)the firm's expected net income by the firm's cost of equity.

B)A firm's cost of capital rises as a firm uses more financial leverage.

C)A firm's value is determined by discounting the firm's expected cash flows by the WACC.

D)A firm's cash flows will grow indefinitely at a constant rate.

A)A firm's value is determined by capitalizing (discounting)the firm's expected net income by the firm's cost of equity.

B)A firm's cost of capital rises as a firm uses more financial leverage.

C)A firm's value is determined by discounting the firm's expected cash flows by the WACC.

D)A firm's cash flows will grow indefinitely at a constant rate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

The independence hypothesis suggests that the cost of equity decreases as financial leverage increases.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

The theory that managers may prefer internal sources of funds to the lowest cost source of funds is known as:

A)the Modigliani and Miller Proposition.

B)tradeoff theory.

C)financial stress avoidance theory.

D)pecking order theory.

A)the Modigliani and Miller Proposition.

B)tradeoff theory.

C)financial stress avoidance theory.

D)pecking order theory.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

The Tradeoff Theory view of capital structure management says that the cost of capital curve is:

A)a straight line.

B)v-shaped.

C)s-shaped.

D)saucer-shaped.

A)a straight line.

B)v-shaped.

C)s-shaped.

D)saucer-shaped.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is part of a firm's financial structure but NOT a component of its capital structure?

A)Retained earnings

B)Mortgage bonds

C)Accounts payable

D)Both A and C

A)Retained earnings

B)Mortgage bonds

C)Accounts payable

D)Both A and C

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

The pecking order theory of capital structure indicates that firms prefer to finance investment opportunities with external financial capital first,then with internally generated funds.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

The most acceptable view of capital structure,according to the text,is that the weighted average cost of capital:

A)first falls with moderate levels of leverage and then increases as a firm's leverage becomes high.

B)does not change with leverage.

C)increases proportionately with increases in leverage.

D)increases with moderate amounts of leverage and then falls.

A)first falls with moderate levels of leverage and then increases as a firm's leverage becomes high.

B)does not change with leverage.

C)increases proportionately with increases in leverage.

D)increases with moderate amounts of leverage and then falls.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

The Modigliani and Miller Capital Structure Theorem suggests that the cost of equity decreases as financial leverage increases.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

The inclusion of financial distress costs in firm valuation:

A)acknowledges that a firm is insulated from the impact of high debt financing.

B)provides a rationale for a saucer-shaped cost of capital curve.

C)eliminates conflicts between bondholders and stockholders.

D)causes the cost of capital to rise in a linear fashion as more debt is added to the capital structure.

A)acknowledges that a firm is insulated from the impact of high debt financing.

B)provides a rationale for a saucer-shaped cost of capital curve.

C)eliminates conflicts between bondholders and stockholders.

D)causes the cost of capital to rise in a linear fashion as more debt is added to the capital structure.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

The trade-off theory of capital structure recognizes the tax-shield benefit of debt financing,but also recognizes that the benefit is offset by costs associated with debt financing.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

The Tradeoff Theory of capital structure theory indicates that:

A)the tax shield on debt positively affects firm value,indicating that there is some benefit to financial leverage as opposed to an all-equity capitalization.

B)the higher the firm's financial leverage,the higher the probability the firm will be unable to meet the financial obligations included in its debt contracts,which could ultimately lead to firm failure.

C)there is a range of capital structures,rather than a single capital structure,that is optimal.

D)all of the above.

A)the tax shield on debt positively affects firm value,indicating that there is some benefit to financial leverage as opposed to an all-equity capitalization.

B)the higher the firm's financial leverage,the higher the probability the firm will be unable to meet the financial obligations included in its debt contracts,which could ultimately lead to firm failure.

C)there is a range of capital structures,rather than a single capital structure,that is optimal.

D)all of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Other things the same,the use of debt financing reduces the firm's total tax bill,resulting in a higher total market value.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

Lowell Corporation and Lawrence Corporation each have EBIT of $4 million.Lowell has no debt and no interest expense;Lawrence has $2 million in debt at a before-tax rate of 8%.The tax rate is 40%.How much cash does each firm return to its investors.

A)Lowell $2,400,000,Lawrence $2,144,000

B)Lowell $2,400,000,Lawrence $2,240,000

C)Lowell $2,400,000,Lawrence $2,464,000

D)Lowell $2,400,000,Lawrence $2,304,000

A)Lowell $2,400,000,Lawrence $2,144,000

B)Lowell $2,400,000,Lawrence $2,240,000

C)Lowell $2,400,000,Lawrence $2,464,000

D)Lowell $2,400,000,Lawrence $2,304,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Newbury Inc.has retained $2 million in earnings this year.It can borrow up $1.5 million at a rate of 8% and sell the same amount of new stock at a cost of 17%.Newbury cost of common equity without selling any new stock is 16%.If Newbury's capital budget is $2.5 million,pecking order theory says management will use:

A)$1.5 million in debt and $1 million in retained earnings.

B)$2 million in retained earnings and $o.5 million in debt.

C)$833,333 each from retained earnings,new debt and new stock.

D)$1.5 million in debt and $1 million in new stock.

A)$1.5 million in debt and $1 million in retained earnings.

B)$2 million in retained earnings and $o.5 million in debt.

C)$833,333 each from retained earnings,new debt and new stock.

D)$1.5 million in debt and $1 million in new stock.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

The objective of capital structure management is to maximize the market value of the firm's equity.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

Cheshire Corporation is now financed 100% with equity.The cost of equity is 15%.Cheshire is considering a proposal to borrow enough money at 7% to buy back half of its common stock.It would then be financed 50% with debt and 50% with equity.Assume that this does not affect the cost of equity.Cheshire's tax rate is 40%.What is Cheshire's cost of capital without and with the stock repurchase?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

For all U.S.companies the Debt to Value ratio is about:

A)12%.

B)90%.

C)33%.

D)42%.

A)12%.

B)90%.

C)33%.

D)42%.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

Under what conditions are shareholders likely to incur agency costs when managers make capital budgeting decisions?

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

Basic tools of capital structure management include:

A)EBIT-EPS analysis.

B)comparative profitability ratios.

C)capital budgeting techniques.

D)none of the above.

A)EBIT-EPS analysis.

B)comparative profitability ratios.

C)capital budgeting techniques.

D)none of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly explain what the empirical evidence suggests about financial managers' actions as they relate to the capital structure theory.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is a good reason for a company to have higher than average debt ratios.

A)The company's cash flows are difficult to predict.

B)The company generates little taxable income.

C)Customer support is an important aspect of the company's business.

D)The company faces high marginal tax rates.

A)The company's cash flows are difficult to predict.

B)The company generates little taxable income.

C)Customer support is an important aspect of the company's business.

D)The company faces high marginal tax rates.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

The tax shield on interest is calculated by multiplying the interest rate paid on debt by the principal amount of the debt and the firm's marginal tax rate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

When using an EPS-EBIT chart to evaluate a pure debt financing and pure equity financing plan,the debt financing plan line will have:

A)a steeper slope than the equity financing plan line.

B)a slower rate of change as EBIT increases.

C)a downward slope.

D)the same slope as the equity plan,but a higher intercept.

A)a steeper slope than the equity financing plan line.

B)a slower rate of change as EBIT increases.

C)a downward slope.

D)the same slope as the equity plan,but a higher intercept.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

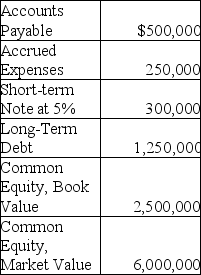

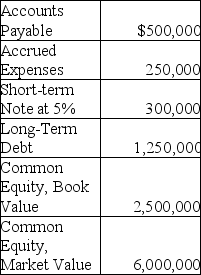

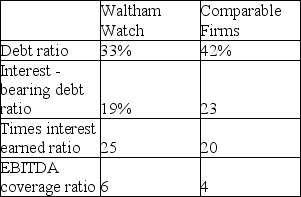

From the table above we can conclude:

A)Waltham has a conservative capital structure policies.

B)Waltham has too much debt.

C)Waltham uses more leverage than the typical firm in its industry.

D)Waltham's EPS would be more sensitive than a typical firm's to changes in EBIT.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Which two ratios would be most helpful in managing a firm's capital structure?

A)Book Debt to Equity,Current Ratio

B)Debt to Value Ratio and Times Interest Earned

C)Debt to Assets,Profit Margin

D)Payables Turnover,Return on Assets

A)Book Debt to Equity,Current Ratio

B)Debt to Value Ratio and Times Interest Earned

C)Debt to Assets,Profit Margin

D)Payables Turnover,Return on Assets

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

List and briefly explain at least two important reasons why capital structures tend to differ between industries and even companies within the same industry.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

According to the pecking order theory of capital structure,when external funding is needed,common stock will be used to raise the funds.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

Companies faced with higher tax burdens are likely to use more debt.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following factors favors the use of more debt in a company's financial structure?

A)High levels of taxable income

B)Low levels of taxable income

C)The business is basically risky with unpredictable cash flows.

D)Risk of bankruptcy would make customers reluctant to buy the company's products.

A)High levels of taxable income

B)Low levels of taxable income

C)The business is basically risky with unpredictable cash flows.

D)Risk of bankruptcy would make customers reluctant to buy the company's products.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

In which countries would you expect companies to have the lowest leverage ratios?

A)Countries with very high tax rates.

B)Countries that tend to subsidize key industries and protect them from failure.

C)Countries where creditors have very strong legal protection.

D)Countries where the market value of companies is high compared to their book values.

A)Countries with very high tax rates.

B)Countries that tend to subsidize key industries and protect them from failure.

C)Countries where creditors have very strong legal protection.

D)Countries where the market value of companies is high compared to their book values.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Which industry would you expect to have the highest Debt to Asset ratios?

A)Business oriented software

B)Electric utilities

C)Communications equipment

D)Retail clothing

A)Business oriented software

B)Electric utilities

C)Communications equipment

D)Retail clothing

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Adams Inc.expects EBIT of $50 million if there is a recession,$100 million if the economy is normal,and $150 million if the economy expands.Bellingham Inc.also expects EBIT of $50 million if there is a recession,$100 million if the economy is normal,and $150 million if the economy expands.Adams is financed entirely with equity while Bellingham is financed 50% with debt at 10%.Adams has $200 million in equity;Bellingham is financed with $100 million of debt and $100 million of equity.The tax rate is 30%.Both firms pay out all available earnings as dividends.If there is a recession,compare dividends and total distributions to investors for each company.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

If a firm chose to increase its debt ratio from 20% to 40%,what is the potential risk?

A)The average cost of capital would most likely rise.

B)The price of the firm's common stock would definitely decline.

C)If economic forces cause a reduction of sales,the firm's EPS might decline.

D)The firm's WACC might decline.

A)The average cost of capital would most likely rise.

B)The price of the firm's common stock would definitely decline.

C)If economic forces cause a reduction of sales,the firm's EPS might decline.

D)The firm's WACC might decline.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

When benchmarking a firm's capital structure,management should compare it:

A)firms in S&P 500.

B)firms in the same geographic region.

C)firms recognized for the quality of their management.

D)firms in similar lines of business.

A)firms in S&P 500.

B)firms in the same geographic region.

C)firms recognized for the quality of their management.

D)firms in similar lines of business.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

U.S.companies differ very little in their capital structures.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck