Deck 25: Taxation of International Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 25: Taxation of International Transactions

1

The IRS can use § 482 reallocations to assure that transactions between related parties are properly reflected in a tax return.

True

2

The "residence of seller" rule is used in determining the sourcing of all gross income and deductions of a U.S.multinational business.

False

3

Twenty unrelated U.S.persons equally own all of the stock of Quigley, a foreign corporation.Quigley is a CFC.

False

4

In allocating interest expense between U.S.and foreign sources, a taxpayer must use the tax basis of the income-producing assets.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

A U.S.business conducts international communications activities between the U.S.and Spain. The resulting income is sourced 100% to the U.S., the residence of the taxpayer.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

Losses and deductions, similar to income items, can be U.S.- or foreign-source.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

Income tax treaties may provide for either higher or lower withholding tax rates on interest income than the rate provided under U.S.statutory law.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

Dividends received from Leprechaun, Ltd., an Irish corporation that earns 40% of its income from U.S.business activities, are 40% U.S.-source income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

The transfer of the assets of a U.S.corporation's foreign branch to a newly formed foreign corporation is always tax deferred under § 351.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

Hendricks Corporation, a domestic corporation, owns 40 percent of Shane Corporation and 55 percent of Ferrell Corporation, both foreign corporations.Ferrell owns the other 60 percent of Shane Corporation.Both Shane and Ferrell are CFCs.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

The United States has in force income tax treaties with about 70 countries.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

A Qualified Business Unit of a U.S.corporation that operates in Germany generally uses the Euro as its functional currency.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

LocalCo merges into HeirCo, a non-U.S.entity, in a transaction that would qualify as a "Type A" reorganization. The resulting realized gain is tax-deferred under U.S.income tax law, using §§ 351 and 368.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

Serena, a nonresident alien, is employed by GlobalCo, a foreign corporation.Serena works in the United States for 3 days during the year, receiving a gross salary of $2,500 for this period.GlobalCo is not engaged in a U.S.trade or business.Under the "commercial traveler" exception, the $2,500 is not classified as U.S.-source income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

Julio, a nonresident alien, realizes a gain on the sale of commercial real estate located in Omaha.The real estate was sold to Mariana, Julio's cousin who is also a nonresident alien.Julio recognizes foreign-source income from the sale because his home country is not the U.S.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

Interest paid to an unrelated party by a domestic corporation that historically earns more than 50% of its gross income each year from the conduct of an active trade or business outside the United States is foreign-source income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

The source of income received for the use of intangible property is the home country of the owner of the property producing the income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

When a business taxpayer "goes international," the first step usually is to create an overseas branch sales office.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

A "U.S.shareholder" for purposes of CFC classification is any U.S.person who owns directly, indirectly, and constructively at least 50% of the voting power of a foreign corporation.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

"Inbound" and "offshore" asset transfers by a U.S.business can be subject to immediate Federal income taxation under § 367.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

An appropriate transfer price is one that considers the risks, assets, and functions of the persons to whom income is assigned.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

A domestic corporation is one whose assets are primarily (> 50%) located in the U.S.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

In 2013, George renounces his U.S.citizenship and moves to Fredonia, where income tax rates are very low. George is a multimillionaire and says he "has had it" with high Federal income taxes on wealthy individuals like himself. In 2016, George's U.S.-source income is $1.5 million. That income escapes Federal income taxes.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

Subpart F income includes portfolio income like dividends and interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

A nonresident alien with U.S.-source income effectively connected with a U.S.trade or business claims effectively connected business deductions against that income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

Quest is organized and operates in the U.K. Its U.S.effectively connected earnings for the taxable year are $900,000 and its net U.S.equity has increased by $40,000. Quest's dividend equivalent amount for the tax year is $860,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

Unused foreign tax credits are carried back one year and then forward 10 years.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

ForCo, a foreign corporation, purchases widgets from USCo, Inc., its U.S.parent corporation.The widgets are sold by ForCo to another unrelated foreign corporation in the same country as ForCo.The income from sale of the widgets by ForCo is not Subpart F foreign base company sales income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

Freda was born and continues to live in Uruguay. She exports widgets to U.S.customers. The U.S.does not have in force an income tax treaty with Urugauy. Freda's net U.S.income from the widgets is subject to a flat 30% Federal income tax rate.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

Jokerz, a CFC of a U.S.parent, generated $80,000 of Subpart F foreign base company services income in its first year of operations. The next year, Jokerz distributes $50,000 cash to the parent, from those service profits. The parent is taxed on $80,000 in the first year and $50,000 in the second year.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

Collins, Inc.received gross foreign-source dividend income of $250,000.Foreign taxes withheld on the dividend were $25,000 and no § 902 credit is available.Its worldwide taxable income for the tax year is $500,000.U.S.tax before the FTC is $175,000.Collins' current year FTC is $87,500.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

Nico lives in California. She was born in Peru but holds a green card. Nico is a nonresident alien (NRA).

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

ForCo, a subsidiary of a U.S.corporation incorporated in Belgium, manufactures widgets in Belgium and sells the widgets to its 100%-owned subsidiary in Germany.The income from the sale of widgets is not Subpart F foreign base company sales income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

Waltz, Inc., a U.S.taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S.taxes of $157,500 before FTC. Waltz's FTC is $50,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

A U.S.taxpayer may take a current FTC equal to the greater of the FTC limit or the actual foreign taxes (direct or indirect) paid or accrued.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

U.S.individuals who receive dividends from foreign corporations may claim the deemed-paid foreign tax credit related to such dividends.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

Kipp, a U.S.shareholder under the CFC provisions, owns 40% of a CFC.If the CFC's Subpart F income for the taxable year is $200,000, Kipp is not taxed on receipt of a constructive dividend of $80,000 because he doesn't own more than 50% of the CFC.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

The purpose of the transfer pricing rules is to ensure that taxpayers have ultimate flexibility in shifting profits between related entities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

Scott, Inc., a domestic corporation, receives a dividend of $700,000 from a non-CFC foreign corporation.Deemed-paid foreign taxes attributable to the dividend are $120,000.If Scott elects the FTC, its gross income attributable to this dividend is $700,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

Gains on the sale of U.S.real property held directly or indirectly through U.S.stock ownership by NRAs and foreign corporations are subject to taxation under FIRPTA.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

41

Olaf, a citizen of Norway with no trade or business activities in the United States, sells at a gain 200 shares of MicroShift, Inc., a U.S.company.The sale takes place through Olaf's broker in Oslo.How is this gain treated for U.S.tax purposes?

A)It is foreign-source income subject to U.S.taxation.

B)It is foreign-source income not subject to U.S.taxation.

C)It is U.S.-source income subject to U.S.taxation.

D)It is U.S.-source income exempt from U.S.taxation.

A)It is foreign-source income subject to U.S.taxation.

B)It is foreign-source income not subject to U.S.taxation.

C)It is U.S.-source income subject to U.S.taxation.

D)It is U.S.-source income exempt from U.S.taxation.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

Dividends received from a domestic corporation are totally U.S.source:

A)If the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a U.S.trade or business.

B)If the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a U.S.trade or business.

C)Unless the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

D)Unless the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

E)In all of the above cases.

A)If the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a U.S.trade or business.

B)If the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a U.S.trade or business.

C)Unless the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

D)Unless the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

E)In all of the above cases.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

Liang, an NRA, is sent to the United States by Fuller Corporation, her foreign employer.She spends 50 days in the United States and earns $15,000 for a two-month period.This amount is attributable to 40 U.S.working days and 10 foreign working days.Her employer does not have a U.S.trade or business and Liang spends no other time in the U.S.for the tax year.Liang's U.S.-source taxable income is:

A)$0.

B)$3,000.

C)$12,000.

D)$15,000.

A)$0.

B)$3,000.

C)$12,000.

D)$15,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

The U.S.system for taxing income earned outside its borders by U.S.persons is referred to as the territorial approach, because only income earned within the U.S.border is subject to taxation.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

45

Section 482 is used by the Treasury to:

A)Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B)Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C)Increase information that is reported about U.S.corporations with non-U.S.owners.

D)All of the above.

E)None of the above.

A)Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B)Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C)Increase information that is reported about U.S.corporations with non-U.S.owners.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

46

Chang, an NRA, is employed by Fisher, Inc., a foreign corporation.In November, Chang spends 12 days in the United States performing consulting services for Fisher's U.S.branch.She earns $5,000 per month.A month includes 20 workdays.

A)Chang has no U.S.-source income, under the commercial traveler exception.

B)Chang has $3,000 U.S.-source income, since her foreign employer has a U.S.branch.

C)Chang has $60,000 U.S.-source income which is exempt from U.S.taxation, since she is in the U.S.for 90 days or less.

D)Chang has $60,000 U.S.-source income which is exempt from U.S.taxation, since she is working for a foreign employer.

A)Chang has no U.S.-source income, under the commercial traveler exception.

B)Chang has $3,000 U.S.-source income, since her foreign employer has a U.S.branch.

C)Chang has $60,000 U.S.-source income which is exempt from U.S.taxation, since she is in the U.S.for 90 days or less.

D)Chang has $60,000 U.S.-source income which is exempt from U.S.taxation, since she is working for a foreign employer.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

Wood, a U.S.corporation, owns Holz, a German corporation.Wood receives a dividend (non-Subpart F income) from Holz of 75,000€.The average exchange rate for the year is $1US: 0.6€, and the exchange rate on the date of the dividend distribution is $1US: 0.80€.Wood's exchange gain or loss is:

A)$15,000 loss.

B)$15,000 gain.

C)$75,000 gain.

D)$0. There is no exchange gain or loss on a dividend distribution.

A)$15,000 loss.

B)$15,000 gain.

C)$75,000 gain.

D)$0. There is no exchange gain or loss on a dividend distribution.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

Without the foreign tax credit, double taxation would result when:

A)The United States taxes the U.S.-source income of a U.S.resident.

B)A foreign country taxes the foreign-source income of a nonresident alien.

C)The United States and a foreign country both tax the foreign-source income of a U.S.resident.

D)Terms of a tax treaty assign income taxing rights to the U.S.

A)The United States taxes the U.S.-source income of a U.S.resident.

B)A foreign country taxes the foreign-source income of a nonresident alien.

C)The United States and a foreign country both tax the foreign-source income of a U.S.resident.

D)Terms of a tax treaty assign income taxing rights to the U.S.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

Flapp Corporation, a domestic corporation, conducts all of its transactions in the U.S.dollar.It sells inventory for $1 million to a Canadian company when the exchange rate is $1US: $1.2Can.The Canadian company pays for the inventory when the exchange rate is $1US: $1.25Can.What is Flapp's exchange gain or loss on this sale?

A)Flapp does not have a foreign currency exchange gain or loss, since it conducts all of its transactions in the U.S.dollar.

B)Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.) and it collects on the receivable when the exchange rate is $1US: $1.25Can.Flapp has an exchange gain of $50,000.

C)Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.).It collects on the receivable at $1US: $1.25Can.Flapp has an exchange loss of $5,000.

D)Flapp's foreign currency exchange loss is $50,000.

A)Flapp does not have a foreign currency exchange gain or loss, since it conducts all of its transactions in the U.S.dollar.

B)Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.) and it collects on the receivable when the exchange rate is $1US: $1.25Can.Flapp has an exchange gain of $50,000.

C)Flapp's account receivable for the sale is $1 million (when the exchange rate is $1US: $1.2Can.).It collects on the receivable at $1US: $1.25Can.Flapp has an exchange loss of $5,000.

D)Flapp's foreign currency exchange loss is $50,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

50

GreenCo, a domestic corporation, earns $25 million of taxable income from U.S.sources and $5 million of taxable income from foreign sources.What amount of taxable income does GreenCo report on its U.S.tax return?

A)$30 million.

B)$25 million.

C)$30 million less any tax paid on U.S.income.

D)$25 million less any tax paid on the foreign income.

A)$30 million.

B)$25 million.

C)$30 million less any tax paid on U.S.income.

D)$25 million less any tax paid on the foreign income.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

The U.S.system for taxing income earned inside its borders by non-U.S.persons is referred to as inbound taxation because such foreign persons are earning income by coming into the United States.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is false in regard to the U.S.income tax treaty program?

A)There are about 70 bilateral income tax treaties between the U.S.and other countries.

B)Tax treaties generally provide for primary taxing rights that require the other treaty partner to allow a credit for the taxes paid on the twice-taxed income.

C)Residence of the taxpayer is an important consideration in applying tax treaties, while the presence of a permanent establishment is not.

D)None of the above statements is false.

A)There are about 70 bilateral income tax treaties between the U.S.and other countries.

B)Tax treaties generally provide for primary taxing rights that require the other treaty partner to allow a credit for the taxes paid on the twice-taxed income.

C)Residence of the taxpayer is an important consideration in applying tax treaties, while the presence of a permanent establishment is not.

D)None of the above statements is false.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

53

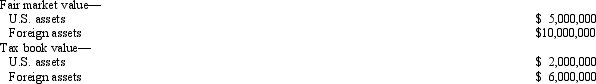

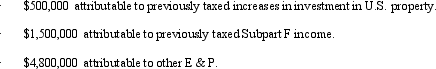

Qwan, a U.S.corporation, reports $250,000 interest expense for the tax year.None of the interest relates to nonrecourse debt or loans from affiliated corporations.Qwan's U.S.and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

A)Using tax book values.

B)Using tax book value for U.S.source and fair market value for foreign source.

C)Using fair market values.

D)Using fair market value for U.S.source and tax book value for foreign source.

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?A)Using tax book values.

B)Using tax book value for U.S.source and fair market value for foreign source.

C)Using fair market values.

D)Using fair market value for U.S.source and tax book value for foreign source.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

An advance pricing agreement (APA) is used between:

A)Two or more governments.

B)Two related taxpayers.

C)The taxpayer and the IRS.

D)The IRS and U.S.taxing authorities.

A)Two or more governments.

B)Two related taxpayers.

C)The taxpayer and the IRS.

D)The IRS and U.S.taxing authorities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

U.S.income tax treaties:

A)Provide rules by which multinational taxpayers avoid double taxation.

B)Provide for taxation exclusively by the source country.

C)Provide that the country with the highest tax rate will be allowed exclusive tax collection.

D)Provide for taxation exclusively by the country of residence.

A)Provide rules by which multinational taxpayers avoid double taxation.

B)Provide for taxation exclusively by the source country.

C)Provide that the country with the highest tax rate will be allowed exclusive tax collection.

D)Provide for taxation exclusively by the country of residence.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

USCo, a domestic corporation, purchases inventory for resale from distributors within the U.S.and resells this inventory to customers outside the U.S., with title passing outside the U.S.What is the source of the USCo's inventory sales income?

A)50% U.S.source and 50% foreign source.

B)50% foreign source and 50% sourced based on location of manufacturing assets.

C)100% U.S.source.

D)100% foreign source.

A)50% U.S.source and 50% foreign source.

B)50% foreign source and 50% sourced based on location of manufacturing assets.

C)100% U.S.source.

D)100% foreign source.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

Wood, a U.S.corporation owns 30% of Hout, a foreign corporation.The remaining 70% of Hout is owned by other foreign corporations not controlled by Wood.Hout's functional currency is the euro.Wood receives a 50,000€ distribution from Hout.If the average exchange rate for the E & P to which the dividend is attributed is 1.2€: $1, the exchange rate at year end is .95€: $1, and on the date of the dividend payment the exchange rate is 1.1€: $1, what is Wood's tax result from the distribution?

A)Wood receives a dividend of $45,455 and realizes an exchange gain of $3,788 [$45,455 minus $41,667 (50,000€/1.2)].

B)Wood receives a dividend of $52,632 (50,000€/.95) with no exchange gain or loss.

C)Wood receives a dividend of $41,667 and realizes an exchange loss of $3,788 ($41,667 minus $45,455).

D)Wood receives a dividend of $45,455 (50,000€/1.1) with no exchange gain or loss.

A)Wood receives a dividend of $45,455 and realizes an exchange gain of $3,788 [$45,455 minus $41,667 (50,000€/1.2)].

B)Wood receives a dividend of $52,632 (50,000€/.95) with no exchange gain or loss.

C)Wood receives a dividend of $41,667 and realizes an exchange loss of $3,788 ($41,667 minus $45,455).

D)Wood receives a dividend of $45,455 (50,000€/1.1) with no exchange gain or loss.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

During the current year, USACo (a domestic corporation) sold equipment to FrenchCo, a foreign corporation, for $350,000, with title passing to the buyer in France.USACo purchased the equipment several years ago for $100,000 and took $80,000 of depreciation deductions on the equipment, all of which were allocated to U.S.-source income.USACo's adjusted basis in the equipment is $20,000 on the date of sale.What is the source of the $330,000 gain on the sale of this equipment?

A)$330,000 foreign source.

B)$330,000 U.S.source.

C)$250,000 foreign source and $80,000 U.S.source.

D)$250,000 U.S.source and $80,000 foreign source.

A)$330,000 foreign source.

B)$330,000 U.S.source.

C)$250,000 foreign source and $80,000 U.S.source.

D)$250,000 U.S.source and $80,000 foreign source.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements best describes the purpose of § 482, under which the Treasury can reallocate income and deductions among related taxpayers?

A)To provide tax benefits to U.S.multinationals that export U.S.produced property.

B)To allow the IRS to select the best method for determining transfer prices for U.S.taxpayers.

C)To alleviate double taxation problems generated by related entities doing business in two or more countries.

D)To place a controlled entity on a tax parity with an uncontrolled entity with regard to prices charged by the entities.

A)To provide tax benefits to U.S.multinationals that export U.S.produced property.

B)To allow the IRS to select the best method for determining transfer prices for U.S.taxpayers.

C)To alleviate double taxation problems generated by related entities doing business in two or more countries.

D)To place a controlled entity on a tax parity with an uncontrolled entity with regard to prices charged by the entities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

ForCo, a foreign corporation, receives interest income of $100,000 from USCo, an unrelated domestic corporation.USCo has historically earned 85% of its income from foreign sources.What amount of ForCo's interest income is U.S.source?

A)$100,000.

B)$28,000.

C)$18,000.

D)$0.

A)$100,000.

B)$28,000.

C)$18,000.

D)$0.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following transactions by a U.S.corporation may result in taxation under § 367?

A)Incorporation of U.S branch as a U.S.corporation when the branch earns foreign-source income.

B)Incorporation of a U.S.branch as a U.S.corporation if the new U.S.corporation also has foreign shareholders.

C)Incorporation of a U.S.branch as a U.S.corporation if the new U.S.corporation has no foreign shareholders.

D)All the above.

E)None of the above.

A)Incorporation of U.S branch as a U.S.corporation when the branch earns foreign-source income.

B)Incorporation of a U.S.branch as a U.S.corporation if the new U.S.corporation also has foreign shareholders.

C)Incorporation of a U.S.branch as a U.S.corporation if the new U.S.corporation has no foreign shareholders.

D)All the above.

E)None of the above.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

In which of the following independent situations would Slane, a foreign corporation, be classified as a controlled foreign corporation? The Slane stock is directly owned 12% by Jen, 10% by Kathy, 12% by Leslie, 10% by David, 8% by Ben, and 48% by Mike.

A)Jen, Kathy, Leslie, David, Ben, and Mike are all U.S.citizens.

B)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.David is married to Kathy.Mike is a foreign resident and citizen.

C)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.Ben is Mike's son.Mike is a foreign resident and citizen.

D)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.Mike is a foreign resident and citizen.

A)Jen, Kathy, Leslie, David, Ben, and Mike are all U.S.citizens.

B)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.David is married to Kathy.Mike is a foreign resident and citizen.

C)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.Ben is Mike's son.Mike is a foreign resident and citizen.

D)Jen, Kathy, Leslie, David, and Ben are all U.S.citizens.Mike is a foreign resident and citizen.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

Abbott, Inc., a domestic corporation, reports worldwide taxable income of $8 million, including a $900,000 dividend from ForCo, a wholly-owned foreign corporation.ForCo's undistributed E & P are $18 million and it has paid $12 million of foreign income taxes attributable to these earnings.What is Abbott's deemed paid foreign tax credit related to the dividend received (before consideration of any limitation)?

A)$0.

B)$600,000.

C)$900,000.

D)$18 million.

A)$0.

B)$600,000.

C)$900,000.

D)$18 million.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

Amber, Inc., a domestic corporation receives a $150,000 cash dividend from Starke, Ltd.Amber owns 15% of Starke.Starke's E & P is $2 million and it has paid foreign taxes of $1 million attributable to that E & P.What is Amber's gross income related to the Starke dividend?

A)$225,000.

B)$150,000.

C)$33,750.

D)$22,500.

A)$225,000.

B)$150,000.

C)$33,750.

D)$22,500.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

OutCo, a controlled foreign corporation in Meena, earns $600,000 in net interest and dividend income from investments in the bonds and stock of unrelated companies.All of the dividend payors are located in Meena.OutCo's Subpart F income for the year is:

A)$0.

B)$0 only if OutCo is engaged in a trade or business in Meena.

C)$600,000.

D)$600,000 only if OutCo is engaged in a trade or business in Meena.

A)$0.

B)$0 only if OutCo is engaged in a trade or business in Meena.

C)$600,000.

D)$600,000 only if OutCo is engaged in a trade or business in Meena.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

Peanut, Inc., a domestic corporation, receives $500,000 of foreign-source interest income, on which foreign taxes of $5,000 are withheld.Peanut's worldwide taxable income is $900,000, and its U.S.Federal income tax liability before FTC is $270,000.What is Peanut's foreign tax credit?

A)$500,000.

B)$275,000.

C)$150,000.

D)$5,000.

A)$500,000.

B)$275,000.

C)$150,000.

D)$5,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

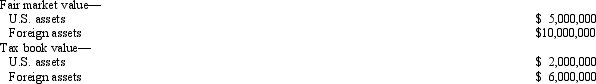

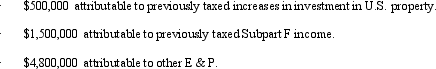

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

A)$3 million.

B)$2.5 million.

C)$1.5 million.

D)$1 million.

E)$0.

Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:A)$3 million.

B)$2.5 million.

C)$1.5 million.

D)$1 million.

E)$0.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

Generally, accrued foreign income taxes are translated at the:

A)Exchange rate when the taxes are paid.

B)Exchange rate on the date when the taxes are accrued.

C)Average exchange rate for the tax year to which the taxes relate.

D)Average exchange rate for the last five tax years.

A)Exchange rate when the taxes are paid.

B)Exchange rate on the date when the taxes are accrued.

C)Average exchange rate for the tax year to which the taxes relate.

D)Average exchange rate for the last five tax years.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

OutCo, a controlled foreign corporation owned 100% by USCo, earned $900,000 in Subpart F income for the current year.OutCo's current year E & P is $250,000 and its accumulated E & P is $18 million.What is the current year Subpart F deemed dividend to USCo?

A)$250,000.

B)$650,000.

C)$900,000.

D)$18 million.

A)$250,000.

B)$650,000.

C)$900,000.

D)$18 million.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

Kilps, a U.S.corporation, receives a $200,000 dividend from a 20% owned foreign corporation.The deemed-paid taxes attributable to this dividend are $40,000 and foreign taxes withheld on remittance of the dividend are $30,000.Kilps's U.S.tax liability before the FTC is $350,000, the gross dividend income is $240,000, and Kilps's worldwide taxable income is $1 million.Kilps's foreign tax credit for the taxable year is:

A)$84,000.

B)$70,000.

C)$40,000.

D)$30,000.

A)$84,000.

B)$70,000.

C)$40,000.

D)$30,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

A tax haven often is:

A)A country with high internal income taxes.

B)A country with no or low internal income taxes.

C)A country without income tax treaties.

D)A country that prohibits "treaty shopping."

A)A country with high internal income taxes.

B)A country with no or low internal income taxes.

C)A country without income tax treaties.

D)A country that prohibits "treaty shopping."

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following income items does not represent Subpart F income if it is earned by a controlled foreign corporation in Fredonia? Purchase of inventory from the U.S.parent, followed by:

A)Sale to anyone outside Fredonia.

B)Sale to anyone inside Fredonia.

C)Sale to a related party outside Fredonia.

D)Sale to a non-related party outside Fredonia.

A)Sale to anyone outside Fredonia.

B)Sale to anyone inside Fredonia.

C)Sale to a related party outside Fredonia.

D)Sale to a non-related party outside Fredonia.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

A controlled foreign corporation (CFC) realizes Subpart F income from:

A)Purchase of inventory from unrelated party and sale outside the CFC country.

B)Purchase of inventory from a related party and sale outside the CFC country.

C)Services performed for the U.S.parent in a country in which the CFC was organized.

D)Services performed on behalf of an unrelated party in a country outside the country in which the CFC was organized.

E)None of the above transactions.

A)Purchase of inventory from unrelated party and sale outside the CFC country.

B)Purchase of inventory from a related party and sale outside the CFC country.

C)Services performed for the U.S.parent in a country in which the CFC was organized.

D)Services performed on behalf of an unrelated party in a country outside the country in which the CFC was organized.

E)None of the above transactions.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

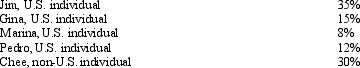

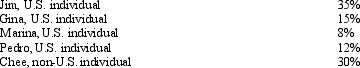

The following persons own Schlecht Corporation, a foreign corporation.  None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

A)Schlecht is not a CFC.

B)Chee includes $90,000 in gross income.

C)Marina is not a U.S.shareholder.

D)Marina includes $24,000 in gross income.

E)None of the above statements is correct.

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?

None of the shareholders are related.Subpart F income for the tax year is $300,000.No distributions are made.Which of the following statements is correct?A)Schlecht is not a CFC.

B)Chee includes $90,000 in gross income.

C)Marina is not a U.S.shareholder.

D)Marina includes $24,000 in gross income.

E)None of the above statements is correct.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

Copp, Inc., a domestic corporation, owns 30% of a CFC that has $50 million of earnings and profits for the current year.Included in that amount is $20 million of Subpart F income.Copp has been a CFC for the entire year and makes no distributions in the current year.Copp must include in gross income (before any § 78 gross-up):

A)$0.

B)$50 million.

C)$20 million.

D)$6 million.

A)$0.

B)$50 million.

C)$20 million.

D)$6 million.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

Amber, Inc., a domestic corporation receives a $150,000 cash dividend from Starke, Ltd.Amber owns 15% of Starke.Starke's E & P is $2 million and it has paid foreign taxes of $1 million attributable to that E & P.What is Amber's foreign tax credit related to the Starke dividend?

A)$200,000.

B)$150,000.

C)$100,000.

D)$75,000.

A)$200,000.

B)$150,000.

C)$100,000.

D)$75,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

BlueCo, a domestic corporation, incorporates its foreign branch in a § 351 exchange, creating GreenCo, a wholly owned foreign corporation.BlueCo transfers $200 in inventory (basis = $50) and $900 in land (basis = $950) to GreenCo.GreenCo uses these assets in carrying on a trade or business outside the United States.What gain or loss, if any, is recognized as a result of this transaction?

A)$0.

B)($50).

C)$100.

D)$150.

A)$0.

B)($50).

C)$100.

D)$150.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

RedCo, a domestic corporation, incorporates its foreign branch in a § 351 exchange, creating GreenCo, a wholly owned foreign corporation.RedCo transfers $200 in Yen (basis = $150) and $900 in land (basis = $925) to GreenCo.GreenCo uses these assets in carrying on a trade or business outside the United States.What gain or loss, if any, is recognized as a result of this transaction?

A)$0.

B)$50.

C)$25.

D)($25).

A)$0.

B)$50.

C)$25.

D)($25).

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

Ridge, Inc., a domestic corporation, reports worldwide taxable income of $800,000, including a $300,000 dividend from Emma, Inc., a foreign corporation.Ridge's U.S.tax liability before FTC is $280,000.Ridge owns 20% of Emma.Emma's E & P after taxes is $8 million and it has paid foreign taxes of $4 million attributable to that E & P.If Ridge elects the FTC, its U.S.gross income with regard to the dividend from Emma is:

A)$450,000.

B)$300,000.

C)$90,000.

D)$60,000.

A)$450,000.

B)$300,000.

C)$90,000.

D)$60,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements regarding the translation of foreign income taxes is true?

A)Translation of foreign taxes into U.S.dollars helps manage the U.S.balance of trade.

B)Foreign taxes are translated into U.S.dollars only when such translation provides a tax benefit to the taxpayer.

C)Foreign taxes typically are paid in a foreign currency and, thus, must be converted to U.S.dollars when used as a FTC on a U.S.return.

D)Translation of foreign taxes into U.S.dollars encourages foreign corporations to set up operations in the United States.

A)Translation of foreign taxes into U.S.dollars helps manage the U.S.balance of trade.

B)Foreign taxes are translated into U.S.dollars only when such translation provides a tax benefit to the taxpayer.

C)Foreign taxes typically are paid in a foreign currency and, thus, must be converted to U.S.dollars when used as a FTC on a U.S.return.

D)Translation of foreign taxes into U.S.dollars encourages foreign corporations to set up operations in the United States.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck