Deck 20: Estates and Trusts: Their Nature and the Accountants Role

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 20: Estates and Trusts: Their Nature and the Accountants Role

1

Which of the following items is not included in the estate principal subsequent to the date of death?

A)Assets discovered after the date of death

B)Gains on the sale of principal assets

C)Losses on the sale of principal

D)All affect the estate principal.

A)Assets discovered after the date of death

B)Gains on the sale of principal assets

C)Losses on the sale of principal

D)All affect the estate principal.

D

2

In the initial journal entry recording the inventory of the estate, liabilities incurred by the decedent are

A)not recorded.

B)credited to specific liability accounts.

C)credited to the account Claims Against Estate Principal.

D)credited to the account Claims Against Estate Income.

A)not recorded.

B)credited to specific liability accounts.

C)credited to the account Claims Against Estate Principal.

D)credited to the account Claims Against Estate Income.

A

3

Which of the following is not an example of income in an estate?

A)Business profits.

B)Gain or loss on disposition or transfer of estate principal.

C)Rents collected or accrued.

D)Interest on monies lent.

A)Business profits.

B)Gain or loss on disposition or transfer of estate principal.

C)Rents collected or accrued.

D)Interest on monies lent.

B

4

The beneficiary is taxed on a portion of taxable income that he or she received, and the estate, as a separate entity, is taxed on a pro rata income share that it accumulates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

A charitable remainder trust splits assets between a surviving spouse and a trust.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

The party ultimately receiving the principal of an estate may be referred to as the

A)income beneficiary.

B)remainderman.

C)devisee.

D)b and c

A)income beneficiary.

B)remainderman.

C)devisee.

D)b and c

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

A charitable remainder trust distributes the income from trust assets to individual beneficiaries over a period of time, at which time the assets go to the remainderman, which must be a charitable organization.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

An investment would be included in the estate at its fair value on the date of the owner's death.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

A trust created through a will is called a testamentary trust.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

An administrator of an estate differs from an executor of a will in that an administrator

A)has fiduciary responsibility for real property.

B)has fiduciary responsibility for personal property.

C)has fiduciary responsibility in a testate distribution.

D)is appointed by the court.

A)has fiduciary responsibility for real property.

B)has fiduciary responsibility for personal property.

C)has fiduciary responsibility in a testate distribution.

D)is appointed by the court.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

In an intestate distribution, personal property is distributed

A)under the laws of the state where the property is located.

B)under the laws of the state in which the decedent was domiciled.

C)directly to the devisee.

D)directly to the legatee.

A)under the laws of the state where the property is located.

B)under the laws of the state in which the decedent was domiciled.

C)directly to the devisee.

D)directly to the legatee.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Property that is titled as "joint tenants" allows for:

A)the property to pass outside of the probate process to a surviving joint owner.

B)tenants to remain in a leased property if the lessor dies.

C)the decedent's interest in the property to avoid inclusion in his or her estate for estate tax purposes.

D)a distribution to the joint survivor that is recognized as taxable income.

A)the property to pass outside of the probate process to a surviving joint owner.

B)tenants to remain in a leased property if the lessor dies.

C)the decedent's interest in the property to avoid inclusion in his or her estate for estate tax purposes.

D)a distribution to the joint survivor that is recognized as taxable income.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

A trust created through a will is called a testamentary trust.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

The primary purpose of accounting for estates is to facilitate reporting to the court during the fiduciary's term.Therefore, which of the following concepts is least important?

A)GAAP for revenue recognition

B)Inflows and outflows of assets

C)Distinction between principal and income

D)All are important in accounting for estates.

A)GAAP for revenue recognition

B)Inflows and outflows of assets

C)Distinction between principal and income

D)All are important in accounting for estates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

The gross estate reflects the original purchase value of all property in which the decedent had an interest at the date of death, regardless of the nature of the property or to whom it passes.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

Assets are included in the estate at their fair value on the date of death or on an alternate valuation date, if elected.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following would not be included in the corpus or principal of an estate?

A)accrued interest and declared dividends on investments held by decedent

B)personal valuables

C)life insurance proceeds where designated beneficiary is the estate

D)all of the above are included

A)accrued interest and declared dividends on investments held by decedent

B)personal valuables

C)life insurance proceeds where designated beneficiary is the estate

D)all of the above are included

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

When assets are discovered after the initial accounting for estate principal, the fiduciary will credit:

A)Investments found.

B)Estate Principal: Assets Subsequently Discovered

C)Estate Income: Assets Subsequently Discovered

D)Gain on Realization of Principal Asset

A)Investments found.

B)Estate Principal: Assets Subsequently Discovered

C)Estate Income: Assets Subsequently Discovered

D)Gain on Realization of Principal Asset

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

The party to which legal title and management responsibilities are initially given in a trust agreement is referred to as the trustee.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

The marital deduction is allowed for the value of qualifying property passing to a surviving spouse, but it may defer estate taxes only until the death of the surviving spouse.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following items are chargeable against the income of an estate?

A)Costs incurred in probating the will

B)A loss on the sale of estate assets

C)Legal fees incurred to protect income flow

D)All of the above

A)Costs incurred in probating the will

B)A loss on the sale of estate assets

C)Legal fees incurred to protect income flow

D)All of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is true concerning the maximum gift that can be given within a year without incurring any gift tax or using any of the unified credit?

A)A single individual is limited to gifts of $13,000 in cash or property with a fair market value of $26,000 to an individual.

B)Consenting spouses can give each other a maximum of $26,000.

C)Consenting spouses together can give an individual $26,000.

D)A single individual is limited to a gift of $13,000 to a qualified charity.

A)A single individual is limited to gifts of $13,000 in cash or property with a fair market value of $26,000 to an individual.

B)Consenting spouses can give each other a maximum of $26,000.

C)Consenting spouses together can give an individual $26,000.

D)A single individual is limited to a gift of $13,000 to a qualified charity.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

The Charge and Discharge Statement accounting indicates the need to segregate

A)real property from personal property.

B)devices from legacies.

C)principal items from income items.

D)assets of the estate from claims against the estate.

A)real property from personal property.

B)devices from legacies.

C)principal items from income items.

D)assets of the estate from claims against the estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

In a testate distribution, a gift of property left after all other legacies have been assigned is referred to as a

A)general legacy.

B)demonstrative legacy.

C)residuary legacy.

D)specific legacy.

A)general legacy.

B)demonstrative legacy.

C)residuary legacy.

D)specific legacy.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

The primary purpose of an estate's charge and discharge statement is to detail

A)cash flow as to principal and as to income.

B)income and expenses of the estate.

C)transactions affecting principal and income.

D)the profit or loss during the period of stewardship.

A)cash flow as to principal and as to income.

B)income and expenses of the estate.

C)transactions affecting principal and income.

D)the profit or loss during the period of stewardship.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following items is not charged against the income of an estate?

A)Ordinary repairs to income-producing property

B)Expenses incurred to protect income flow

C)Loss on the sale of an estate asset

D)All of the above are charged against the income

A)Ordinary repairs to income-producing property

B)Expenses incurred to protect income flow

C)Loss on the sale of an estate asset

D)All of the above are charged against the income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not true about the unified credit that accompanies the unified transfer tax?

A)It is a lifetime credit.

B)If a portion is used to reduce gift taxes, less credit is available to reduce potential estate taxes.

C)Gives the spouses make to each other reduces the amount of available credit.

D)The current lifetime credit is $345,800.

A)It is a lifetime credit.

B)If a portion is used to reduce gift taxes, less credit is available to reduce potential estate taxes.

C)Gives the spouses make to each other reduces the amount of available credit.

D)The current lifetime credit is $345,800.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following best describes the accounting for discounts and premiums for bonds purchased by a fiduciary for an estate?

A)Premiums are amortized, but discounts are not.

B)Discounts are amortized, but premiums are not.

C)GAAP guidelines for amortization are followed, i.e., both are amortized.

D)Like bonds purchased prior to the death, neither discounts nor premiums are amortized.

A)Premiums are amortized, but discounts are not.

B)Discounts are amortized, but premiums are not.

C)GAAP guidelines for amortization are followed, i.e., both are amortized.

D)Like bonds purchased prior to the death, neither discounts nor premiums are amortized.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

If after paying debts and expenses, the estate principal is not adequate to satisfy the various legacies, the legacies are satisfied to whatever extent possible through the:

A)probate process.

B)a property devise.

C)abatement process.

D)legacy process.

A)probate process.

B)a property devise.

C)abatement process.

D)legacy process.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

The starting point for the computation of federal estate tax is the gross estate.Which of the following statements is not true regarding the computation of the gross estate?

A)The gross estate for tax purposes is often greater than the estate for probate purposes

B)The taxable estate does not include transfers of property made during decedent's lifetime.

C)The gross estate for tax purposes also includes certain transfers by the deceased during life in which certain rights are retained by the decedent

D)The taxable estate can be reduced by certain allowable deductions

A)The gross estate for tax purposes is often greater than the estate for probate purposes

B)The taxable estate does not include transfers of property made during decedent's lifetime.

C)The gross estate for tax purposes also includes certain transfers by the deceased during life in which certain rights are retained by the decedent

D)The taxable estate can be reduced by certain allowable deductions

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not a legacy?

A)a tract of land bequeathed to the local humane society

B)a diamond and pearl necklace to a family member

C)$20,000 left to a nephew

D)a Ford Explorer left to a niece

A)a tract of land bequeathed to the local humane society

B)a diamond and pearl necklace to a family member

C)$20,000 left to a nephew

D)a Ford Explorer left to a niece

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

When determining a decedent's gross estate for federal tax purposes, which of the following items would not be included?

A)fair market value of real property

B)fair market value of intangible property

C)fair market value of property left to a surviving spouse

D)all of the above items would be included in the gross estate

A)fair market value of real property

B)fair market value of intangible property

C)fair market value of property left to a surviving spouse

D)all of the above items would be included in the gross estate

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

A gift from a specific source, with the will stipulating that if the amount cannot be satisfied from that source, it should be satisfied from the general estate is a __________ legacy.

A)specific

B)residuary

C)general

D)demonstrative

A)specific

B)residuary

C)general

D)demonstrative

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is not true?

A)Medical payments made on someone else's behalf are considered taxable gifts.

B)Gifts between spouses are not subject to gift tax.

C)Making gifts throughout one's lifetime may reduce estate taxes.

D)The annual maximum allowable exclusion for gifts is adjusted for inflation.

A)Medical payments made on someone else's behalf are considered taxable gifts.

B)Gifts between spouses are not subject to gift tax.

C)Making gifts throughout one's lifetime may reduce estate taxes.

D)The annual maximum allowable exclusion for gifts is adjusted for inflation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

All of the following would be charged to principal in an estate except:

A)Property taxes incurred after death to protect income flow.

B)Final income taxes of decedent.

C)Medical expenses.

D)Funeral expenses.

A)Property taxes incurred after death to protect income flow.

B)Final income taxes of decedent.

C)Medical expenses.

D)Funeral expenses.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

The alternate valuation date is how many months after the decedent's death?

A)3

B)6

C)9

D)12

A)3

B)6

C)9

D)12

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Planning for estate taxes should address:

A)Taking actions to benefit from a loss in property values.

B)Making gifts during one's lifetime.

C)Utilization of charitable contributions.

D)All of the above.

A)Taking actions to benefit from a loss in property values.

B)Making gifts during one's lifetime.

C)Utilization of charitable contributions.

D)All of the above.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements concerning accounting for depreciation and depletion in an estate is not true?

A)For any depreciation taken, an equal amount of income maybe transferred to principal.

B)Depreciation is a calculated on a basis other than GAAP.

C)Depletion is generally taken for wasting assets.

D)All of the above.

A)For any depreciation taken, an equal amount of income maybe transferred to principal.

B)Depreciation is a calculated on a basis other than GAAP.

C)Depletion is generally taken for wasting assets.

D)All of the above.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

The unified tax base used to compute federal estate tax is calculated as follows:

A)Gross estate - deductions allowed - tax credits

B)Gross estate - deductions allowed + post-1976 taxable gifts

C)Probate estate - deductions allowed + post-1976 taxable gifts

D)Gross estate - deductions allowed - post-1976 taxable gifts

A)Gross estate - deductions allowed - tax credits

B)Gross estate - deductions allowed + post-1976 taxable gifts

C)Probate estate - deductions allowed + post-1976 taxable gifts

D)Gross estate - deductions allowed - post-1976 taxable gifts

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is true concerning the handling of discounts and premiums for bonds that are part of an estate at the time of death?

A)Straight-line amortization is normally used to amortize discounts and premiums.

B)Effective amortization is the preferred method.

C)Either straight-line or effective amortization can be used.

D)Discounts and premiums are not amortized.

A)Straight-line amortization is normally used to amortize discounts and premiums.

B)Effective amortization is the preferred method.

C)Either straight-line or effective amortization can be used.

D)Discounts and premiums are not amortized.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

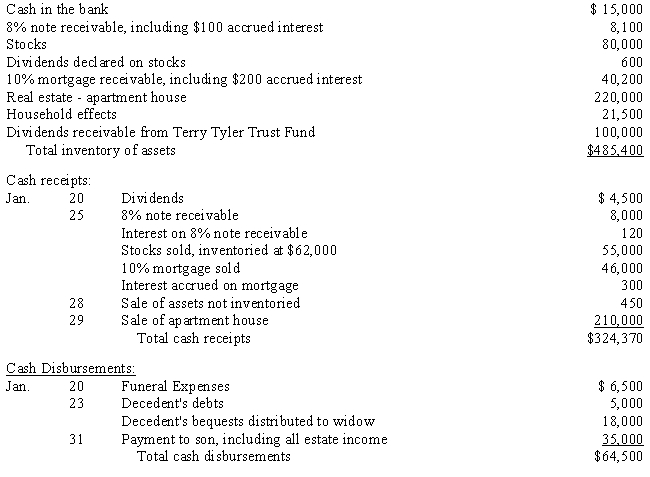

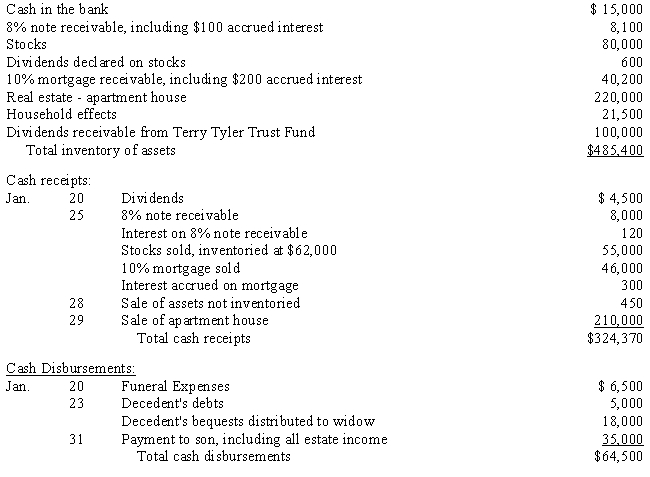

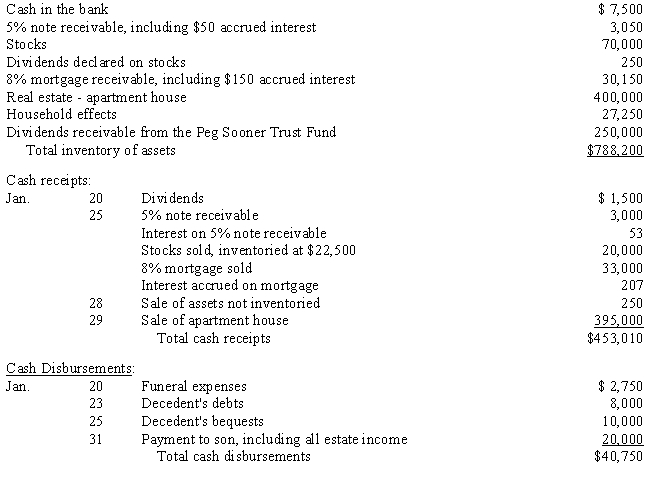

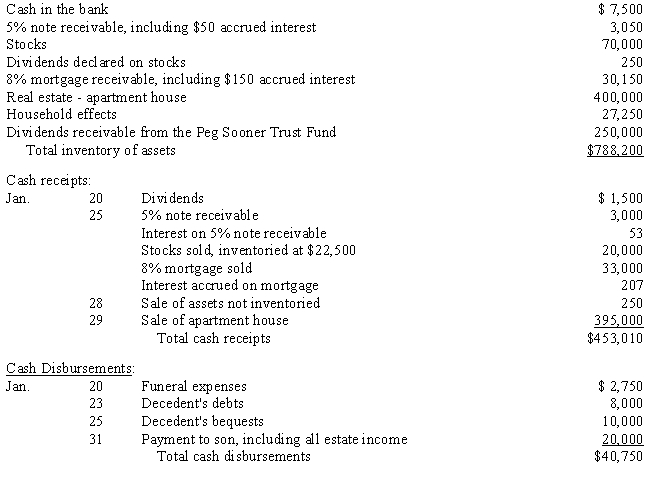

Trent Tyler died on January 15, 2012.Records disclose the following estate:

Required:

Required:

Prepare a charge and discharge statement for the period January 15 through January 31, 2012.

Required:

Required:

Prepare a charge and discharge statement for the period January 15 through January 31, 2012.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

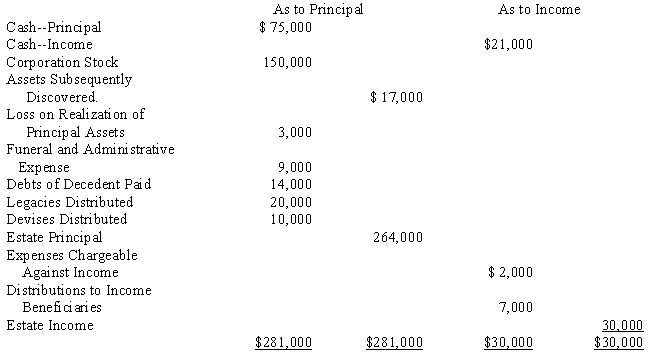

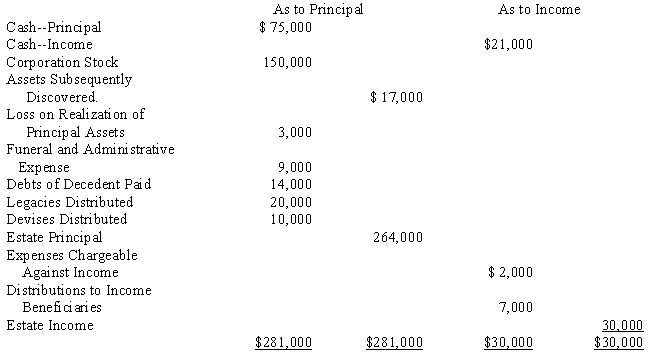

42

Betty Bloome died on February 28, 2015.The following trial balance was prepared by the executor of Betty's estate as of October 31, 2015:

Required:

Required:

Prepare a charge and discharge statement as of December 31, 2015.

Required:

Required:

Prepare a charge and discharge statement as of December 31, 2015.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

Al Sooner died on January 15, 2015.Records disclose the following estate:

Required:

Required:

Prepare journal entries to record the events in his estate for the period January 15 through January 31, 2015.

Required:

Required:

Prepare journal entries to record the events in his estate for the period January 15 through January 31, 2015.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

Mr.Riekoff died and left the following stocks to his two sons:

?

?

Required:

?

a.If both sons sold their stocks ten months after their father's death for $50,000 and the alternate valuation was not used, what would their respective capital gains/losses be?

b.Assuming that the price of the stock remained constant in the year prior to Mr.Riekoff's death, what might have been a better method of handling the stocks from a tax planning perspective? Explain why.

?

?

Required:

?

a.If both sons sold their stocks ten months after their father's death for $50,000 and the alternate valuation was not used, what would their respective capital gains/losses be?

b.Assuming that the price of the stock remained constant in the year prior to Mr.Riekoff's death, what might have been a better method of handling the stocks from a tax planning perspective? Explain why.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

In his will, Andrew Baker provided for the establishment of a trust that will include the bulk of his estate assets.At the time of his death, his net assets had a market value of $430,000 consisting of $75,000 in cash, $125,000 of U.S.Treasury bonds including accrued interest, and the remainder in various securities.Income beneficiaries of the trust will be the same as the income beneficiaries of the estate.Fiduciary Bank will act as trustee.

?

Required:

?

a.Identify the term that describes this kind of trust.?

?

b.Prepare journal entries on the bank's books for the following transactions:

?

?

?

(1)

The assets are accepted by the bank as trustee.?

?

?

?

(2)

Bond interest of $35,000 is received, of which $10,000 was accrued to the date of transfer to the trustee.Dividends of $20,000 are also received.?

?

?

?

(3)

The following cash distributions were made by the trustee:

?

?

Required:

?

a.Identify the term that describes this kind of trust.?

?

b.Prepare journal entries on the bank's books for the following transactions:

?

?

?

(1)

The assets are accepted by the bank as trustee.?

?

?

?

(2)

Bond interest of $35,000 is received, of which $10,000 was accrued to the date of transfer to the trustee.Dividends of $20,000 are also received.?

?

?

?

(3)

The following cash distributions were made by the trustee:

?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Complete the following statements by filling in the blanks:

?

a. Real property disposed of under a valid will is called a(n)

b. A person who dies without a valid will is said to die

c. The personal representative of the decedent under a valid will is called the

d. For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the

e. Since estate rates increase as the tax base increases, the rates are said to be

f. With spousal consent, nontaxable gifts per individual per year amount to

g. Under appropriate conditions, the fiduciary of an estate may value assets at a date six months after death. The date is called the

h. A valid will says, "My nephew shall receive the gold Canadian maple leaf coins in my Greenwood Trust safety deposit box." This is an example of legacy.

i. Income from an asset may be assigned to one party called the After a stipulated period of time, the asset itsel may be distributed to another party called the

?

a. Real property disposed of under a valid will is called a(n)

b. A person who dies without a valid will is said to die

c. The personal representative of the decedent under a valid will is called the

d. For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the

e. Since estate rates increase as the tax base increases, the rates are said to be

f. With spousal consent, nontaxable gifts per individual per year amount to

g. Under appropriate conditions, the fiduciary of an estate may value assets at a date six months after death. The date is called the

h. A valid will says, "My nephew shall receive the gold Canadian maple leaf coins in my Greenwood Trust safety deposit box." This is an example of legacy.

i. Income from an asset may be assigned to one party called the After a stipulated period of time, the asset itsel may be distributed to another party called the

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

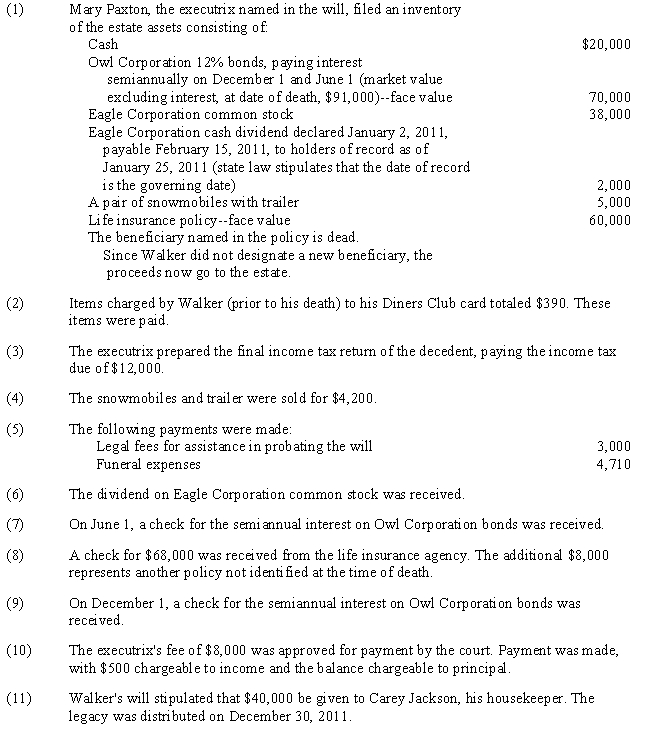

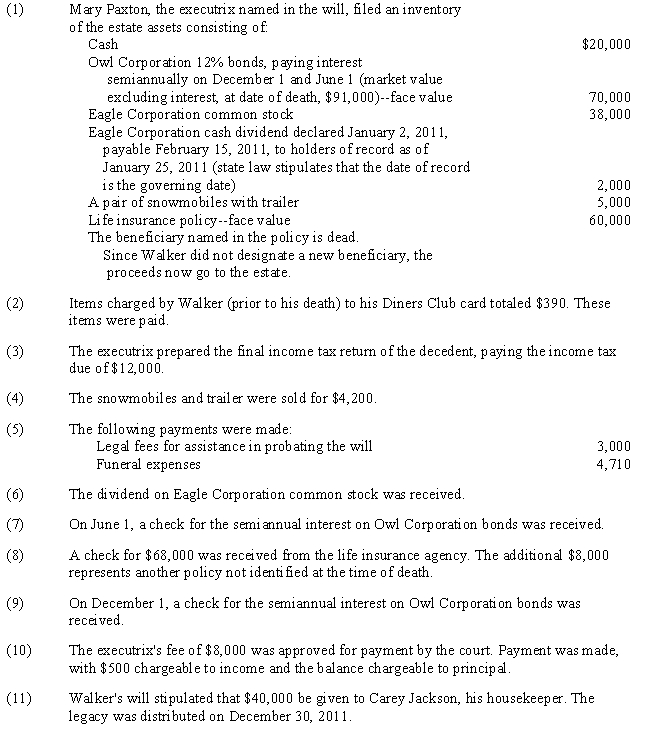

Willie Walker, a widower, died on February 1, 2013.He had no living relatives.The following selected events occurred after Walker's death:

Required:

Required:

Prepare journal entries to record the above events.Upon completion of the journal entries, prepare a double trial balance for the estate of Willie Walker as of December 31, 2014.

Required:

Required:

Prepare journal entries to record the above events.Upon completion of the journal entries, prepare a double trial balance for the estate of Willie Walker as of December 31, 2014.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

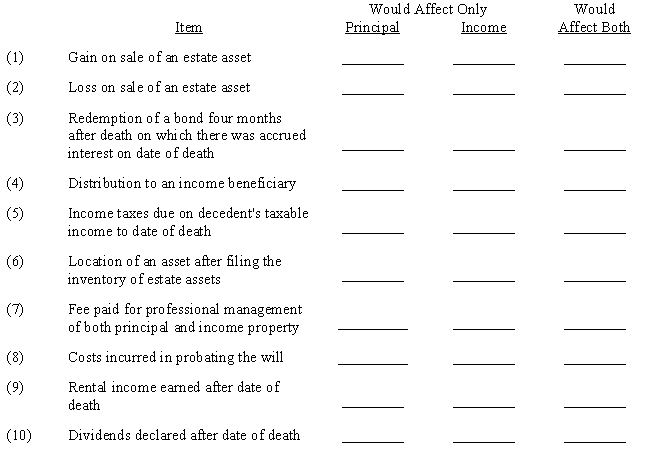

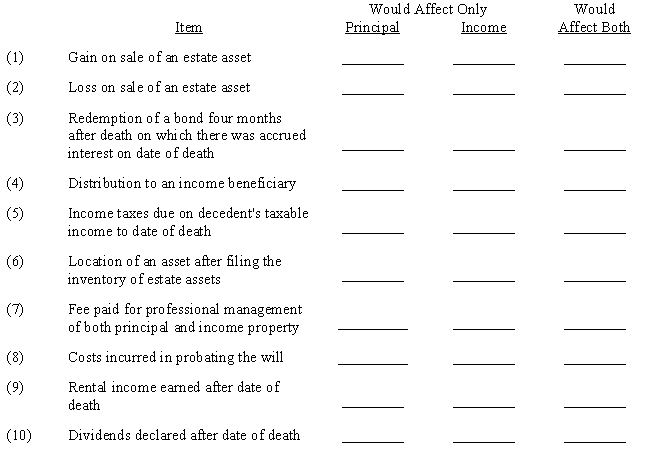

Assuming that no stipulation is made in the will, indicate by placing a check mark in the appropriate column whether the typical accounting treatment of each of the following items would affect principal only, income only, or both principal and income accounts of an estate.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Angela Burke died in 2014 leaving a gross estate that consists of the following assets: (values given are market values on date of death or valuation):

?

Since 1980 , Angela has made taxable gifts of to her children, to whom she al so leaves her estate. Required:

?

Determine, in good form, the tax base for the estate.

?

?

Since 1980 , Angela has made taxable gifts of to her children, to whom she al so leaves her estate. Required:

?

Determine, in good form, the tax base for the estate.

?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

What are some of the tax planning strategies which may be employed to reduce the tax on the decedent's gross estate?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Mr.Arnold Schwartz died on January 23, 2015.He owned the following items on the date of his death:

?

He also had the following liabilities:

?

His funeral and administrative expenses were $10,000.

?

Arnold's will specified the following:

?

(1) Mercy Hospice was to receive in cash.

(2) His son was to receive the rental property and one-fourth of the stocks.

(3) His wife was to receive the remainder of the assets. Required:

?

Assuming Arnold made $100,000 in taxable gifts since 1976, compute his tax base for estate tax purposes.

?

He also had the following liabilities:

?

His funeral and administrative expenses were $10,000.

?

Arnold's will specified the following:

?

(1) Mercy Hospice was to receive in cash.

(2) His son was to receive the rental property and one-fourth of the stocks.

(3) His wife was to receive the remainder of the assets. Required:

?

Assuming Arnold made $100,000 in taxable gifts since 1976, compute his tax base for estate tax purposes.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

If the funds in an estate are insufficient to satisfy all valid claims against it, state laws provide a priority for settlement.

?

Required:

?

a.Reorder the list of claims below in the most common order of priority:

?

?

?

?

(1)

Wages due domestic servants for a period of not more than one year prior to date of death and medical claims for the same period.?

(2)

Taxes: income, estate, and inheritance.?

(3)

Claims having a special lien against property, but not to exceed the value of the property.?

(4)

Debts due the United States and various states.?

(5)

All other claims.?

(6)

Funeral and administrative expenses.?

(7)

Judgments of any court of competent jurisdiction.?

?

?

b.If funds are insufficient to satisfy all of the claims within a class, explain how claims are paid.

?

Required:

?

a.Reorder the list of claims below in the most common order of priority:

?

?

?

?

(1)

Wages due domestic servants for a period of not more than one year prior to date of death and medical claims for the same period.?

(2)

Taxes: income, estate, and inheritance.?

(3)

Claims having a special lien against property, but not to exceed the value of the property.?

(4)

Debts due the United States and various states.?

(5)

All other claims.?

(6)

Funeral and administrative expenses.?

(7)

Judgments of any court of competent jurisdiction.?

?

?

b.If funds are insufficient to satisfy all of the claims within a class, explain how claims are paid.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

Define what makes up the corpus or principal of an estate and list several examples.Also, list the potential claims or deductions from the principal.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

For estate planning purposes, Albert began distributing gifts in 2012.Already, in 2012, Albert has given his daughter stocks costing $5,000, with a current market value of $10,000.

?

Required:

?

What is the maximum additional gift Albert can give in 2012 to his daughter in cash without incurring any gift tax liability assuming that:

?

a.Albert is single.

b.Albert is married and his wife is willing to give the maximum amount the couple is allowed.

?

Required:

?

What is the maximum additional gift Albert can give in 2012 to his daughter in cash without incurring any gift tax liability assuming that:

?

a.Albert is single.

b.Albert is married and his wife is willing to give the maximum amount the couple is allowed.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

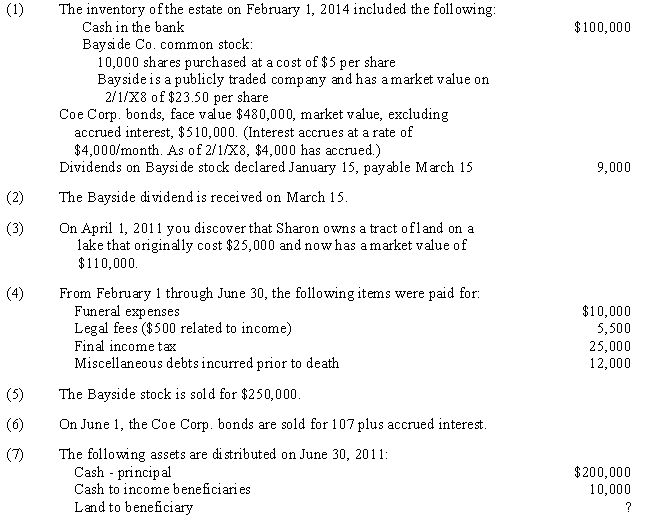

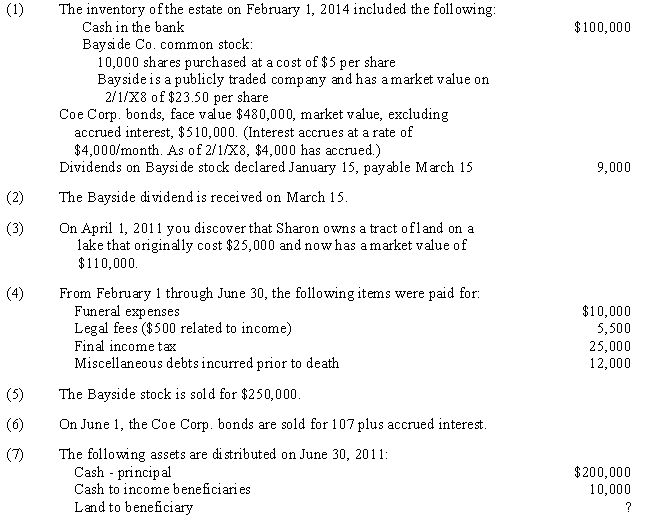

On February 1, 2014, Sharon Kane died.Sharon left a valid will.Events in 2014 related to the estate are as follows:

?

?

Required:

Required:

?

a.As the executor of the estate, record the 2011 events in general journal form.?

?

b.Prepare a Charge and Discharge Statement for the period February 1, 2011 to June 30, 2011.?

?

?

Required:

Required:?

a.As the executor of the estate, record the 2011 events in general journal form.?

?

b.Prepare a Charge and Discharge Statement for the period February 1, 2011 to June 30, 2011.?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Adequate estate planning is critical for an individual or family with a sizable net worth.List the goals of estate planning for large, more complex estates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck