Deck 18: Accounting for Private Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 18: Accounting for Private Not-For-Profit Organizations

1

Which of the following is not a required characteristic of a private not-for-profit organization per the definition given by the AICPA?

A)no owners or shareholders

B)an operating purpose other than making a profit

C)an organization dedicated to service of the public good

D)Significant contributions from providers who do not expect reciprocal goods or services in return

A)no owners or shareholders

B)an operating purpose other than making a profit

C)an organization dedicated to service of the public good

D)Significant contributions from providers who do not expect reciprocal goods or services in return

C

2

Gains and losses are allocated to each participating fund in a pooled investment fund based on its share of the total fair value at the previous valuation date.

True

3

Investment revenue includes realized and unrealized gains and losses on investments, but not interest or dividends.

False

4

Contribution of a work of art to a museum for public exhibit would

A)be recognized as a contribution at fair market value.

B)be recognized as operating revenue based upon admission fees.

C)be recognized as an asset subject to depreciation.

D)not be recognized as a contribution.

A)be recognized as a contribution at fair market value.

B)be recognized as operating revenue based upon admission fees.

C)be recognized as an asset subject to depreciation.

D)not be recognized as a contribution.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

Donated services are recognized as a contribution if:

A)they create or enhance nonfinancial assets.

B)they require specialized skills and the individuals performing the donated service possess those skills.

C)the organization would otherwise purchase the service.

D)All of the above are correct.

A)they create or enhance nonfinancial assets.

B)they require specialized skills and the individuals performing the donated service possess those skills.

C)the organization would otherwise purchase the service.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

A major corporation makes a donation of $10,000,000 to the local art museum foundation for the construction of a new art museum provided the community can match the $10,000,000 with other donations.This is an example of a(n):

A)Unconditional Pledge

B)Unrestricted Contribution

C)Conditional Pledge

D)Endowment

A)Unconditional Pledge

B)Unrestricted Contribution

C)Conditional Pledge

D)Endowment

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

Investment revenue includes interest and dividends, and realized and unrealized gains and losses on investments.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

A not-for-profit organization issues a Statement of Financial Position.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

Alice makes a cash gift which has no strings attached to a political party.It is recorded as:

A)An Endowment.

B)Revenue-Unrestricted Contribution.

C)Revenue-Temporarily Restricted Contribution.

D)An increase in the fund balance of the General Fund.

A)An Endowment.

B)Revenue-Unrestricted Contribution.

C)Revenue-Temporarily Restricted Contribution.

D)An increase in the fund balance of the General Fund.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

A major corporation makes a donation of $10,000,000 to the local art museum foundation for the construction of a new art museum provided the community can match the $10,000,000 with other donations.At the time the donation is received, it should be recorded as:

A)Contribution Revenue - Temporarily Restricted

B)Contribution Revenue - Unrestricted with a corresponding entry to Provision for Uncollectible Contributions

C)Plant Fund Assets

D)Refundable Advance

A)Contribution Revenue - Temporarily Restricted

B)Contribution Revenue - Unrestricted with a corresponding entry to Provision for Uncollectible Contributions

C)Plant Fund Assets

D)Refundable Advance

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

Currently, which of the following has jurisdiction over accounting and financial reporting standards for voluntary health and welfare organizations?

A)The Governmental Accounting Standards Board

B)The Financial Accounting Standards Board

C)American Institute of Certified Public Accountants

D)The Not-for-Profit Accounting Board

A)The Governmental Accounting Standards Board

B)The Financial Accounting Standards Board

C)American Institute of Certified Public Accountants

D)The Not-for-Profit Accounting Board

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

Government grants that require performance by the not-for-profit organization are recorded on a cash basis.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would fall under the jurisdiction of the GASB rather than the FASB?

A)The American Cancer Society.

B)The Ohio State University.

C)The Metropolitan Museum of Art.

D)St.Jude's Children's Hospital.

A)The American Cancer Society.

B)The Ohio State University.

C)The Metropolitan Museum of Art.

D)St.Jude's Children's Hospital.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

For Agency Funds, assets are recorded as liabilities when received, and only recorded as income in the appropriate fund when release by the contributor.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

In a not-for-profit organization, depreciation on capital assets is recognized on equipment.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

The statement of functional expenses provides a comparison of actual expenses to budgeted amounts.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

The Statement of Activities is a required disclosure for a not-for-profit organization.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

A not-for-profit organization does not issue an income statement.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

On the financial statements of a not-for-profit organization, the term that refers to the accumulated excess of revenues over expenses is:

A)Retained surplus.

B)Fund balance.

C)Net assets.

D)Net equity.

A)Retained surplus.

B)Fund balance.

C)Net assets.

D)Net equity.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

The Brown Museum of Art would need to recognize a contributed work of art as contribution revenue if it was:

A)displayed with its Impressionism Collection.

B)to be auctioned to raise funds to expand the gift shop.

C)used for its educational outreach program that teaches children to paint.

D)sold to purchase an item for its Modern Collection.

A)displayed with its Impressionism Collection.

B)to be auctioned to raise funds to expand the gift shop.

C)used for its educational outreach program that teaches children to paint.

D)sold to purchase an item for its Modern Collection.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not true about accounting for investments that are included in permanently restricted net assets?

A)They should be reported at amortized cost or lower of cost or market.

B)Earnings are reported as unrestricted if the donors have not specified otherwise.

C)They are referred to as endowment investments.

D)There is no requirement to classify investments into trading, available for sale and held to maturity categories.

A)They should be reported at amortized cost or lower of cost or market.

B)Earnings are reported as unrestricted if the donors have not specified otherwise.

C)They are referred to as endowment investments.

D)There is no requirement to classify investments into trading, available for sale and held to maturity categories.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

Reclassifying net assets from temporarily restricted to unrestricted:

A)is done when the unrestricted net assets fall below a predetermined threshold.

B)matches the net assets to the expenses they support.

C)does not require a formal journal entry.

D)may be done at the organization's discretion when an expense is incurred for a purpose for which both restricted and unrestricted net assets are available.

A)is done when the unrestricted net assets fall below a predetermined threshold.

B)matches the net assets to the expenses they support.

C)does not require a formal journal entry.

D)may be done at the organization's discretion when an expense is incurred for a purpose for which both restricted and unrestricted net assets are available.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

A donation was received by a voluntary health and welfare organization of materials to be used in providing services.How would these donated materials be recorded?

A)As inventory

B)As restricted contributions

C)As assets held for resale

D)As contributed services

A)As inventory

B)As restricted contributions

C)As assets held for resale

D)As contributed services

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

Atlee makes a cash gift to a not-for-profit local ballet company which is designated by the donor to buy costumes for a new ballet staging.It should be accounted for with the following journal entry:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following organizations would be classified as a voluntary health and welfare organization?

A)the local ballet company

B)the Sierra Foundation, an environmental organization

C)a private elementary school

D)a synagogue

A)the local ballet company

B)the Sierra Foundation, an environmental organization

C)a private elementary school

D)a synagogue

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Not-for-profit organizations recognize expenses:

A)when the expenditures are made.

B)by their natural classifications.

C)as decreases in unrestricted net assets.

D)None of the above.

A)when the expenditures are made.

B)by their natural classifications.

C)as decreases in unrestricted net assets.

D)None of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

A donation was received by a voluntary health and welfare organization specifically to care for indigent patients.Which of the following should be used to record the gift?

A)Unrestricted Net Assets

B)Public Support--Unrestricted Contribution

C)Public Support--Temporarily Restricted Contributions

D)Revenues--Unrestricted

A)Unrestricted Net Assets

B)Public Support--Unrestricted Contribution

C)Public Support--Temporarily Restricted Contributions

D)Revenues--Unrestricted

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

Recently revised accounting standards for mergers and acquisitions of not-for-profit organizations:

A)require the recognition of goodwill for all acquisitions.

B)allows for a different methods of accounting for mergers than for acquisitions.

C)stipulate a new not-for-profit entity is created whenever there is a combination of two organizations.

D)allow the purchase method of accounting in certain situations.

A)require the recognition of goodwill for all acquisitions.

B)allows for a different methods of accounting for mergers than for acquisitions.

C)stipulate a new not-for-profit entity is created whenever there is a combination of two organizations.

D)allow the purchase method of accounting in certain situations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

The local chapter of a CPA association, a not-for-profit organization, separate their expenses between program functions and support functions.Which of the following denote a proper classification of expenses? ?

A)I.

B)II.

C)III.

D)IV.

A)I.

B)II.

C)III.

D)IV.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

What is the proper method of carrying investments by a voluntary health and welfare organization?

A)cost

B)lower of cost or market

C)either cost or market if applied consistently

D)market value measured as of the financial statement date

A)cost

B)lower of cost or market

C)either cost or market if applied consistently

D)market value measured as of the financial statement date

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not true about multi-year pledges or pledges payable in the future?

A)The pledges are recorded as unrestricted if the donor has not stipulated any restrictions.

B)The pledges are recorded at their present value.

C)The pledges are treated as temporarily restricted revenue.

D)An allowance for doubtful contributions should be established based on historical expenses.

A)The pledges are recorded as unrestricted if the donor has not stipulated any restrictions.

B)The pledges are recorded at their present value.

C)The pledges are treated as temporarily restricted revenue.

D)An allowance for doubtful contributions should be established based on historical expenses.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

Public support for a voluntary health and welfare organization includes:

A)news articles about the organization.

B)banners and promotional materials.

C)legacies and bequests.

D)celebrity endorsements.

A)news articles about the organization.

B)banners and promotional materials.

C)legacies and bequests.

D)celebrity endorsements.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

A contribution made in 2013 to a not-for-profit organization, which is restricted to usage to in the organization's 50th anniversary year in 2015, is recorded as a credit to:

A)Contributions.

B)Revenue--unrestricted.

C)Revenue--temporarily restricted.

D)Revenue--permanently restricted.

A)Contributions.

B)Revenue--unrestricted.

C)Revenue--temporarily restricted.

D)Revenue--permanently restricted.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

A voluntary welfare organization is permitted to use building facilities rent free.This should be recorded as:

A)a footnote in the financial statements disclosing the rent-free arrangement.

B)a contribution.

C)rent expense at the fair market value.

D)both b and c are correct.

A)a footnote in the financial statements disclosing the rent-free arrangement.

B)a contribution.

C)rent expense at the fair market value.

D)both b and c are correct.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

The American Heart Association is having its annual Heart Ball.The ball is an on-going event and a major annual event for the association.Any promotional costs of the ball are considered:

A)Cost of Special Events

B)Operating Expenses

C)Fund Raising Expenses

D)None of the above

A)Cost of Special Events

B)Operating Expenses

C)Fund Raising Expenses

D)None of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

A temporary restriction expires when:

A)the stipulated time has elapsed.

B)the stipulated purpose has been fulfilled.

C)the useful life of donated assets has ended.

D)All of the above.

A)the stipulated time has elapsed.

B)the stipulated purpose has been fulfilled.

C)the useful life of donated assets has ended.

D)All of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

Hargett Heart Association has received donated services from several members of the community.The controller must determine which should be recorded as contribution revenue.The services and their values follow: 1) A retired biology professor conducted two small research projects, which resulted in the organization receiving a major grant, but did not accept a stipend for either.The stipend is usually $2,000 per project.

2) Local high school students participated in "Clean Up the Neighborhood" Day and provided 100 hours of labor trimming hedges and raking leaves on the property.The controller estimates the going rate for such work is $8 per hour.

3) An architect donated plans for a renovation to one of the research labs.The association paid $5,000 for plans for a similar renovation two years ago.

How much contribution revenue should be recognized from donated services?

A)$9,800

B)$9,000

C)$5,800

D)$5,000

2) Local high school students participated in "Clean Up the Neighborhood" Day and provided 100 hours of labor trimming hedges and raking leaves on the property.The controller estimates the going rate for such work is $8 per hour.

3) An architect donated plans for a renovation to one of the research labs.The association paid $5,000 for plans for a similar renovation two years ago.

How much contribution revenue should be recognized from donated services?

A)$9,800

B)$9,000

C)$5,800

D)$5,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

A CPA donates her services to prepare the annual financial report for a voluntary health and welfare organization.The services should be recorded as:

A)revenues-unrestricted.

B)accounting expenses.

C)a footnote disclosure in the financial report.

D)both a and b are correct.

A)revenues-unrestricted.

B)accounting expenses.

C)a footnote disclosure in the financial report.

D)both a and b are correct.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following items are considered special events support for a voluntary health and welfare organization?

A)bingo games and bake sales

B)a donated painting

C)donated stock in a publicly traded company

D)bequest of a building

A)bingo games and bake sales

B)a donated painting

C)donated stock in a publicly traded company

D)bequest of a building

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

Rho Pi Phi Fraternity received a $2,000 donation from an alumnus who stipulated the funds be spent to provide a scholarship for a current member.The funds were spent as stipulated.The entry or entries to record the expense are:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

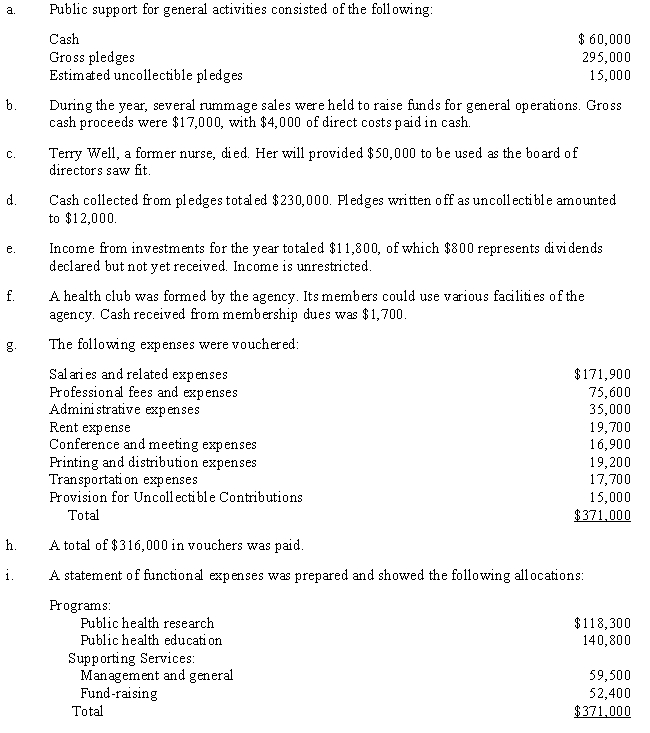

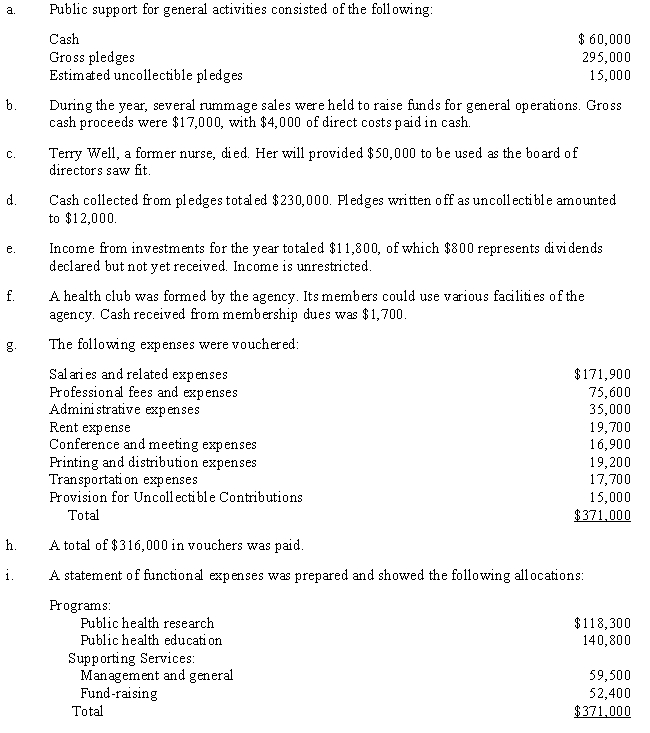

The following events are for the Public Health Agency, a voluntary health and welfare organization that conducts two programs: public health research and public health education:

Required:

Required:

Prepare journal entries for the year ended December 31, 2017:

Required:

Required:

Prepare journal entries for the year ended December 31, 2017:

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

The following events are for the Public Health Agency, a voluntary health and welfare organization that conducts two programs: public health research and public health education:

a.The agency received a donation of capital stock with a market value of $200,000, with the stipulation that the income and principal may be used only for additions to plant.

b.An adjoining building and land were purchased at a cost of $600,000.A 10% cash down payment was made.A mortgage note for the remainder was signed.

c.Unused sterilizers with a cost of $15,000 and a book value of $5,000 were sold for $3,000 cash.

d.New sterilizers costing $28,000 were purchased.

e.A payment of $90,000 was made to cover semiannual mortgage interest of $20,000 and reduction of principal of $70,000.

f.Annual depreciation of $180,000 was recorded.g.The directors approved the following percentages for allocating all expenses (but not losses):

Public health research program 30%

Public health education program 40%

Management and general services 10%

Fund-raising services 20%

Total 100%

Required:

Prepare the journal entries for the events.

a.The agency received a donation of capital stock with a market value of $200,000, with the stipulation that the income and principal may be used only for additions to plant.

b.An adjoining building and land were purchased at a cost of $600,000.A 10% cash down payment was made.A mortgage note for the remainder was signed.

c.Unused sterilizers with a cost of $15,000 and a book value of $5,000 were sold for $3,000 cash.

d.New sterilizers costing $28,000 were purchased.

e.A payment of $90,000 was made to cover semiannual mortgage interest of $20,000 and reduction of principal of $70,000.

f.Annual depreciation of $180,000 was recorded.g.The directors approved the following percentages for allocating all expenses (but not losses):

Public health research program 30%

Public health education program 40%

Management and general services 10%

Fund-raising services 20%

Total 100%

Required:

Prepare the journal entries for the events.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

a.Describe the basic accounting for private not-for-profit groups promoted by the FASB including a brief description of the three net asset classes.

b.Indicate in which of the net asset classes the following transactions belong:

1.Donor makes a cash gift to not-for profit which must be invested and maintained in perpetuity

2.Income Earned on donation noted in item #1 is restricted to certain program expenditures

3.Gains/Losses, both realized and unrealized, on donation noted in item #1.Not stipulated in donor agreement or by the law

4.Expenses paid out for programs stipulated in donor agreement relating to donation made in item #1.

b.Indicate in which of the net asset classes the following transactions belong:

1.Donor makes a cash gift to not-for profit which must be invested and maintained in perpetuity

2.Income Earned on donation noted in item #1 is restricted to certain program expenditures

3.Gains/Losses, both realized and unrealized, on donation noted in item #1.Not stipulated in donor agreement or by the law

4.Expenses paid out for programs stipulated in donor agreement relating to donation made in item #1.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

The Elder Citizens Agency is a voluntary health and welfare organization.The following events occur:

Required:

Required:

Prepare journal entries to record the events.

Required:

Required:

Prepare journal entries to record the events.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following financial statements is not required when reporting for a voluntary health and welfare organization?

A)Statement of Financial Position

B)Statement of Support, Revenue, Expenses and Changes in Fund Balances

C)Statement of Functional Expenses

D)Statement of Cash Flows

A)Statement of Financial Position

B)Statement of Support, Revenue, Expenses and Changes in Fund Balances

C)Statement of Functional Expenses

D)Statement of Cash Flows

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

In the year 2015, a group of merchants in the community of Gunning organized a merchant group, The Gunning Group, in an effort to work together to increase business to Gunning area merchants.Each of the 100 members pays dues of $200 per year for operations and fund raising.All dues were collected in 2015.Other group activities for 2015 were as follows:

?

?

Make the necessary entries to account for the above listed transactions.

?

?

?

Make the necessary entries to account for the above listed transactions.

?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

The Community Drug Clinic is a voluntary health and welfare organization that conducts two programs: drug abuse research and drug abuse education.An inexperienced accountant recorded the following entries:

?

a.Pledges Receivable

200,000

?

?

Income

?

200,000

?

To record signed pledges received.Of the total,

?

?

?

20% must be used for a special local college

?

?

?

program.It is estimated that 5% of the

?

?

?

unrestricted pledges will prove uncollectible.?

?

?

b.Cash

100,000

?

?

Income

?

100,000

?

Received money from a successful business

?

?

?

person, formerly a drug addict.Amount must

?

?

?

be used to acquire a building for the clinic's

?

?

?

program

?

?

?

c.Building, etc

100,000

?

?

Cash

?

100,000

?

To record down payment on land,

?

?

?

building, and equipment with funds

?

?

?

received in step (b).A mortgage note

?

?

?

was signed for an additional $150,000.?

?

?

?

d.

?

e.

?

f.

?

g.

?

h.

Required:

?

?

Omitting explanations, prepare the correct entries, including the entry to assign expenses to programs and services.Assume that the incorrect entries of the previous accountant are reversed prior to your entries.

?

a.Pledges Receivable

200,000

?

?

Income

?

200,000

?

To record signed pledges received.Of the total,

?

?

?

20% must be used for a special local college

?

?

?

program.It is estimated that 5% of the

?

?

?

unrestricted pledges will prove uncollectible.?

?

?

b.Cash

100,000

?

?

Income

?

100,000

?

Received money from a successful business

?

?

?

person, formerly a drug addict.Amount must

?

?

?

be used to acquire a building for the clinic's

?

?

?

program

?

?

?

c.Building, etc

100,000

?

?

Cash

?

100,000

?

To record down payment on land,

?

?

?

building, and equipment with funds

?

?

?

received in step (b).A mortgage note

?

?

?

was signed for an additional $150,000.?

?

?

?

d.

?

e.

?

f.

?

g.

?

h.

Required:

?

?Omitting explanations, prepare the correct entries, including the entry to assign expenses to programs and services.Assume that the incorrect entries of the previous accountant are reversed prior to your entries.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

South City Shelter is a voluntary health and welfare organization that provides emergency shelter and health care for the homeless, as well as educational programs.South City Shelter incurred the following transactions:

?

a.A computer with a book value of $500 (original cost, $2,800) was sold for $650.?

?

b.Kitchen equipment with a book value of $1,100 (original cost, $3,500) was damaged in a fire and taken to the dump.?

?

c.Total depreciation for the year was $60,000.?

?

d.To close the depreciation expense, it was determined that 70% should be allocated to the Shelter Program, 15% to the Education Program, and 15% to the Health Care Program.?

Required:

?

Make the necessary journal entries to reflect the events.

?

a.A computer with a book value of $500 (original cost, $2,800) was sold for $650.?

?

b.Kitchen equipment with a book value of $1,100 (original cost, $3,500) was damaged in a fire and taken to the dump.?

?

c.Total depreciation for the year was $60,000.?

?

d.To close the depreciation expense, it was determined that 70% should be allocated to the Shelter Program, 15% to the Education Program, and 15% to the Health Care Program.?

Required:

?

Make the necessary journal entries to reflect the events.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

The Good Health Agency is a voluntary health and welfare organization that conducts two programs: public health research and public health education.Activities for the year ended December 31, 2015 were as follows:

?

* including materials meeting conditions of the endowment gift in

d. ?

?

?

j. Trish Dyer, CPA, performed the agency's audit on a pro bono basis. The value of the audit was estimated to be , and was acculed after the end of the year. ?

?

k. The net assets at December 31,2014 were:

Required:

?

Prepare a statement of activities for Good Health Agency for the year ended December 31, 2015.?

?

* including materials meeting conditions of the endowment gift in

d.

?

??

j. Trish Dyer, CPA, performed the agency's audit on a pro bono basis. The value of the audit was estimated to be , and was acculed after the end of the year. ?

?

k. The net assets at December 31,2014 were:

Required:

?

Prepare a statement of activities for Good Health Agency for the year ended December 31, 2015.?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

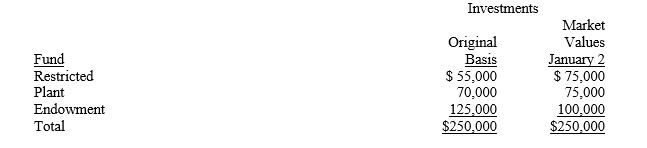

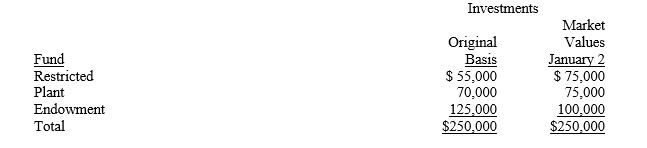

Senior Wellness Center is a voluntary health and welfare organization devoted to health education for the elderly.It has investments in its Restricted Fund, its Plant Fund, and its Endowment Fund.There are no restrictions on investment income or gains and losses in the endowment fund.On January 2, the organization decided to pool the investments of the three funds, and thereafter to maintain all investment account balances at market value.

?

a.On January 2, when investments were pooled, the following data applied:

?

?

?

?

b.On March 31, the end of the first quarter, the pool reports sales of investments carried at $70,000 for $90,000.Realized gains and other realized income are allocated to funds upon realization.Percentages of equity may be rounded to the nearest tenth of one percent.Total cash and market value of pooled investments on March 31 is $275,000.?

?

c.The second-quarter report as of June 30 shows sales of investments for $90,000 which were carried at $100,000.Total cash and market value of pooled investments on June 30 is $260,000.?

Required:

?

Prepare a schedule of equities in pooled investments for the three funds at the end of the first two quarters.?

?

a.On January 2, when investments were pooled, the following data applied:

?

?

?

?

b.On March 31, the end of the first quarter, the pool reports sales of investments carried at $70,000 for $90,000.Realized gains and other realized income are allocated to funds upon realization.Percentages of equity may be rounded to the nearest tenth of one percent.Total cash and market value of pooled investments on March 31 is $275,000.?

?

c.The second-quarter report as of June 30 shows sales of investments for $90,000 which were carried at $100,000.Total cash and market value of pooled investments on June 30 is $260,000.?

Required:

?

Prepare a schedule of equities in pooled investments for the three funds at the end of the first two quarters.?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

Describe the circumstances that must be true in order for donated, personal services to be recorded as revenue (contributions) in a not-for-profit organization.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

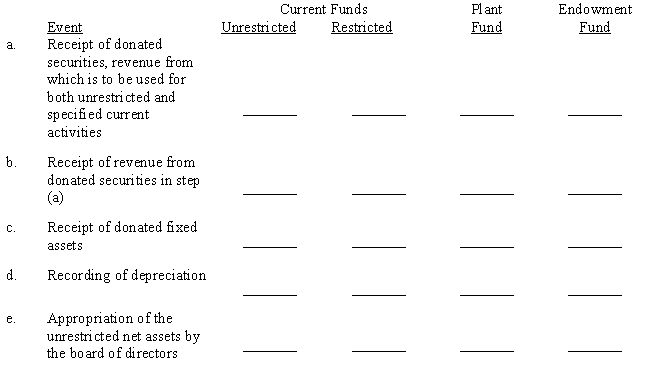

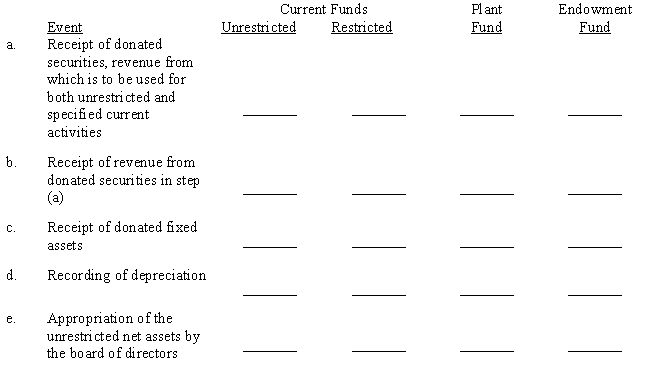

By placing a check mark in the appropriate column, indicate in which fund of a voluntary health and welfare organization the following events normally would be recorded.(Note: An event may require entries in more than one fund.)

?

?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

Rapitown Arts Council provides financial support to a number of independent fine-art projects in the city.Data concerning several events follow:

?

a.During 2015, a fund-raising drive yielded $100,000 in cash and $25,000 in pledges.?

?

b.Based on past experience, 10% of the pledges are estimated to be uncollectible.?

?

c.A July 4 art fair yielded $20,000 in gross revenue.The proceeds of the fair are considered unrestricted.The cost of the program was $8,000, paid in cash.?

?

d.$22,000 of the pledges mentioned in part (a) are collected during the year.?

?

e.The following expenses were paid:

?

?

Required:

?

Make the necessary entries to record the transactions.?

?

a.During 2015, a fund-raising drive yielded $100,000 in cash and $25,000 in pledges.?

?

b.Based on past experience, 10% of the pledges are estimated to be uncollectible.?

?

c.A July 4 art fair yielded $20,000 in gross revenue.The proceeds of the fair are considered unrestricted.The cost of the program was $8,000, paid in cash.?

?

d.$22,000 of the pledges mentioned in part (a) are collected during the year.?

?

e.The following expenses were paid:

?

?

Required:

?

Make the necessary entries to record the transactions.?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

The following events are for South City Shelter, a voluntary health and welfare organization that provides emergency shelter and health care for the homeless, as well as educational programs:

a.A fund-raising program for a portable medical clinic yielded cash contributions of $50,000 and pledges of $100,000.In the past, 5% of pledges have been shown to be uncollectible.

b.A note for $100,000 was signed to finance the remaining cost of the clinic.

c.The mobile clinic and support materials were purchased for $240,000.

d.A note payment of $5,000 and $1,500 in interest was paid for the note in part (c).

Required:

Record the necessary journal entries.

a.A fund-raising program for a portable medical clinic yielded cash contributions of $50,000 and pledges of $100,000.In the past, 5% of pledges have been shown to be uncollectible.

b.A note for $100,000 was signed to finance the remaining cost of the clinic.

c.The mobile clinic and support materials were purchased for $240,000.

d.A note payment of $5,000 and $1,500 in interest was paid for the note in part (c).

Required:

Record the necessary journal entries.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

Voluntary health and welfare organizations prepare a Statement of Activities which displays program and supporting services costs.Program expenses for a cancer society would include:

A)fund-raising costs

B)chief executive officer salary

C)program costs of cancer research

D)brochures for prospective members

A)fund-raising costs

B)chief executive officer salary

C)program costs of cancer research

D)brochures for prospective members

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

Depreciation Expense is recorded in which of the following funds for a voluntary health and welfare organization electing to use fund accounting?

A)Current Unrestricted Fund

B)Plant Fund

C)Depreciation is recorded in both the Current Unrestricted and Plant funds.

D)Depreciation is not normally recorded by health and welfare organizations.

A)Current Unrestricted Fund

B)Plant Fund

C)Depreciation is recorded in both the Current Unrestricted and Plant funds.

D)Depreciation is not normally recorded by health and welfare organizations.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

How do you differentiate between a voluntary health and welfare organization and another not-for-profit organization?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

The following events affected the Rapitown Arts Council:

?

a.Contributions of $20,000, restricted for use in the children's art program, are received.?

?

b.Stocks with a book value of $10,000 and a fair market value of $11,000 were donated.The proceeds from the sale of the stocks are to be used by the local drama group.?

?

c.A famous author lectured to high school students in the children's art program.The cost was $3,000 and was paid by the contributions from part (a).?

?

d.The stock donated in part (b) is sold for $11,500.?

Required:

?

Make the necessary journal entries.

?

a.Contributions of $20,000, restricted for use in the children's art program, are received.?

?

b.Stocks with a book value of $10,000 and a fair market value of $11,000 were donated.The proceeds from the sale of the stocks are to be used by the local drama group.?

?

c.A famous author lectured to high school students in the children's art program.The cost was $3,000 and was paid by the contributions from part (a).?

?

d.The stock donated in part (b) is sold for $11,500.?

Required:

?

Make the necessary journal entries.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following expenses would be considered a program service expense for the local cancer society?

A)salary of a home care nurse

B)salary of the local director

C)rent for the local office

D)printing costs for a fund-raising brochure

A)salary of a home care nurse

B)salary of the local director

C)rent for the local office

D)printing costs for a fund-raising brochure

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

The Good Health Agency is a voluntary health and welfare organization that conducts two programs: public health research and public health education.

?

?

Required:

Required:

?

Prepare journal entries for these events.Charge the respective services for their share of expenses.

?

?

Required:

Required:?

Prepare journal entries for these events.Charge the respective services for their share of expenses.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

What are the two major categories of resources obtained by voluntary health and welfare organizations, and how do they differ?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck