Deck 6: Cash Flow, Eps, and Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 6: Cash Flow, Eps, and Taxation

1

Investor has a 40% ownership interest in the common stock of Investee.Investor paid $10,000 more than book value for its 40% interest and regards the excess as attributable to goodwill.If Investee reports income of $200,000 and pays dividends of $50,000, the operating activities of the consolidated statement of cash flows (indirect method) will reflect an adjustment of

A)$80,000

B)$70,000

C)$60,000

D)$20,000

A)$80,000

B)$70,000

C)$60,000

D)$20,000

C

2

The cash purchase of a controlling interest in a firm requires disclosure on the consolidated statement of cash flows as a(n)

A)financing activity only.

B)financing activity and in the schedule of noncash financing and investing activity.

C)investing activity only.

D)investing activity and in the schedule of noncash financing and investing activity.

A)financing activity only.

B)financing activity and in the schedule of noncash financing and investing activity.

C)investing activity only.

D)investing activity and in the schedule of noncash financing and investing activity.

D

3

A parent company owns 80% of the common stock of its subsidiary.During the current year, the parent purchases an additional 10% interest from non-controlling shareholders.This cash transaction will appear in which section of the consolidated statement of cash flows? ?

A)

B)

C)

D)

A)

B)

C)

D)

C

4

For two or more corporations to file a consolidated tax return, the parent must own what percentage of the voting power of all classes of stock and what percentage of the fair value of all the outstanding stock of the corporation?

A)90%

B)80%

C)70%

D)60%

A)90%

B)80%

C)70%

D)60%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

A parent company purchased all the outstanding bonds of its subsidiary.This cash transaction will appear in which section of the consolidated statement of cash flows? ?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

In a noncash purchase of a controlling interest in a firm, disclosure is required on the consolidated statement of cash flows as a(n)

A)financing activity only.

B)financing activity and in the schedule of noncash financing and investing activity.

C)investing activity only.

D)investing activity and in the schedule of noncash financing and investing activity.

A)financing activity only.

B)financing activity and in the schedule of noncash financing and investing activity.

C)investing activity only.

D)investing activity and in the schedule of noncash financing and investing activity.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true about the consolidated statement of cash flows?

A)The purchase of intercompany bonds from parties outside the consolidated group is treated as a retirement of consolidated debt; the payment is reported as a cash outflow from financing activities.

B)The purchase of intercompany bonds from parties outside the consolidated group is treated as a retirement of consolidated debt; the payment is reported as a cash outflow from investing activities.

C)Intercompany interest payments and amortization of premiums and/or discounts on intercompany bonds are reported in the operating activities section of the statement.

D)Intercompany interest payments and amortization of premiums and/or discounts on intercompany bonds are reported in the investing activities section of the statement.

A)The purchase of intercompany bonds from parties outside the consolidated group is treated as a retirement of consolidated debt; the payment is reported as a cash outflow from financing activities.

B)The purchase of intercompany bonds from parties outside the consolidated group is treated as a retirement of consolidated debt; the payment is reported as a cash outflow from investing activities.

C)Intercompany interest payments and amortization of premiums and/or discounts on intercompany bonds are reported in the operating activities section of the statement.

D)Intercompany interest payments and amortization of premiums and/or discounts on intercompany bonds are reported in the investing activities section of the statement.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

Consolidated Basic Earnings Per Share (BEPS) is calculated by dividing

A)consolidated net income by parent company outstanding stock.

B)consolidated net income by parent company outstanding stock and subsidiary outstanding stock.

C)consolidated net income by parent company outstanding stock and subsidiary non-controlling outstanding stock.

D)none of the above

A)consolidated net income by parent company outstanding stock.

B)consolidated net income by parent company outstanding stock and subsidiary outstanding stock.

C)consolidated net income by parent company outstanding stock and subsidiary non-controlling outstanding stock.

D)none of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

Company P purchased an 80% interest in Company S on January 1, 2016, at a price in excess of book value, such that a patent arises in the consolidation process.As a result of amortizing the patent on the consolidated income statement, an adjustment would be required in which section of the consolidated statement of cash flows? ?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

Company P acquired 80% of the outstanding common stock of the Company S by issuing common stock with a market value of $550,000.The balance sheet of Company S was as follows on the acquisition date:

The market values were as follows: Inventory, $130,000; Land, $120,000; Building, $400,000.What is the amount that will appear as Cash Provided (Used) by Investing Activities on the consolidated statement of cash flows, as a result of this purchase?

A)$600,000

B)$500,000

C)$50,000

D)$0

The market values were as follows: Inventory, $130,000; Land, $120,000; Building, $400,000.What is the amount that will appear as Cash Provided (Used) by Investing Activities on the consolidated statement of cash flows, as a result of this purchase?

A)$600,000

B)$500,000

C)$50,000

D)$0

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

The purchase of additional shares from the non-controlling interest of a subsidiary by the parent results in disclosure in which section of a cash flow statement?

A)operating activities

B)financing activities

C)investing activities

D)not reflected on the statement of cash flows

A)operating activities

B)financing activities

C)investing activities

D)not reflected on the statement of cash flows

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

Company P acquired 75% of the outstanding common stock of the Company S by issuing common stock with a market value of $650,000 on January 1, 2016.The balance sheet of Company S was as follows on the acquisition date:

The market values were as follows: Inventory, $180,000; Land, $150,000; Building, $600,000.What is the amount that will appear as Cash Provided (Used) by Financing Activities as a result of this purchase?

A)$560,000

B)$100,000?

C)$75,000

D)$0

The market values were as follows: Inventory, $180,000; Land, $150,000; Building, $600,000.What is the amount that will appear as Cash Provided (Used) by Financing Activities as a result of this purchase?

A)$560,000

B)$100,000?

C)$75,000

D)$0

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not true regarding diluted earnings per share (DEPS) when the subsidiary has outstanding dilutive securities which may require the issuance of subsidiary company shares only?

A)The calculation of consolidated DEPS becomes a two-stage process where the DEPS of the subsidiary must first be calculated.

B)The controlling interest's share of net income is divided by the number of outstanding parent shares.

C)Both the income of the parent and subsidiary would be the income as shown in their respective income distribution schedules, except for the inclusion of the parent's share of subsidiary income.

D)The DEPS of the subsidiary is a component of the calculation of consolidated DEPS.

A)The calculation of consolidated DEPS becomes a two-stage process where the DEPS of the subsidiary must first be calculated.

B)The controlling interest's share of net income is divided by the number of outstanding parent shares.

C)Both the income of the parent and subsidiary would be the income as shown in their respective income distribution schedules, except for the inclusion of the parent's share of subsidiary income.

D)The DEPS of the subsidiary is a component of the calculation of consolidated DEPS.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

Dividends paid by a subsidiary have the following effect on the consolidated cash flow

A)all dividends to the parent and to non-controlling stockholders appear on the statement.

B)only dividends to the parent appear on the statement.

C)only dividends to NCI appear on the statement.

D)neither dividends to the parent or to non-controlling stockholders appear on the statement

A)all dividends to the parent and to non-controlling stockholders appear on the statement.

B)only dividends to the parent appear on the statement.

C)only dividends to NCI appear on the statement.

D)neither dividends to the parent or to non-controlling stockholders appear on the statement

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

Amortization of excesses in periods subsequent to the purchase would affect which sections of a consolidated statement of cash flows?

A)operating activity

B)financing activity

C)investing activity

D)all of the above

A)operating activity

B)financing activity

C)investing activity

D)all of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

Ponti Company purchased the net assets of the Sorri Company for $800,000.The book value of the net assets of Sorri Company were as follows on the acquisition date:

The market values were as follows: Inventory, $160,000; Land, $170,000; Building, $450,000.The excess purchase price is allocated to goodwill.On the consolidated statement of cash flows, what is the amount that will appear as cash applied to investing as a result of this purchase?

A)$800,000

B)$720,000

C)$750,000

D)$670,000

The market values were as follows: Inventory, $160,000; Land, $170,000; Building, $450,000.The excess purchase price is allocated to goodwill.On the consolidated statement of cash flows, what is the amount that will appear as cash applied to investing as a result of this purchase?

A)$800,000

B)$720,000

C)$750,000

D)$670,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

The purchase of additional shares directly from a subsidiary by the parent results in disclosure in which section of a consolidated statement of cash flows?

A)operating activities

B)financing activities

C)investing activities

D)not reflected on the consolidated statement of cash flows

A)operating activities

B)financing activities

C)investing activities

D)not reflected on the consolidated statement of cash flows

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

When the acquisition of a subsidiary occurs during a reporting period, the computation of both Basic earnings per share (BEPS) and Diluted earnings per share (DEPS) includes subsidiary income

A)and subsidiary securities for the entire period.

B)for the entire period and the number of subsidiary shares weighted for the partial period.

C)for the partial period and the number of subsidiary shares weighted for the partial period

D)for the partial period and the number of subsidiary shares entire period

A)and subsidiary securities for the entire period.

B)for the entire period and the number of subsidiary shares weighted for the partial period.

C)for the partial period and the number of subsidiary shares weighted for the partial period

D)for the partial period and the number of subsidiary shares entire period

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

Program Corporation owns 70% of Solution Company.Selected financial data for each for the current year follows: Consolidated basic earnings per share (BEPS) is (round to the nearest cent):

A)$1.25

B)$1.64

C)$1.60

D)$1.59

A)$1.25

B)$1.64

C)$1.60

D)$1.59

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

Company P acquired 60% of the outstanding common stock of Company S by issuing common stock with a market value of $420,000 on January 1, 2016.The balance sheet of Company S was as follows on the acquisition date:

The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000.The inventory was sold during 2016, the building has a 10-year life, and any excess purchase price is attributed to goodwill.What adjustment is needed to consolidated net income to arrive at cash flow-operations for 2017, under the indirect method, as a result of amortization of excesses from the purchase?

A)$1,000

B)$9,000

C)$14,800

D)$15,000

The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000.The inventory was sold during 2016, the building has a 10-year life, and any excess purchase price is attributed to goodwill.What adjustment is needed to consolidated net income to arrive at cash flow-operations for 2017, under the indirect method, as a result of amortization of excesses from the purchase?

A)$1,000

B)$9,000

C)$14,800

D)$15,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

For ownership interest of at least 20% but less than 80%, the parent may exclude how much of the dividends received from its reported income when filing separately?

A)100%

B)80%

C)70%

D)20%

A)100%

B)80%

C)70%

D)20%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

Company P purchased an 80% interest in Company S on January 1, 2016, for $800,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of fair value over book value was attributed to a patent with a 10-year remaining life.In 2016, Company P reported internally generated net income before taxes of $150,000.Company S reported a net income before taxes of $70,000.The firms file a consolidated tax return at a 30% tax rate.The tax on subsidiary earnings is

A)$20,000

B)$16,200

C)$15,000

D)$10,000

A)$20,000

B)$16,200

C)$15,000

D)$10,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

One complication that arises in consolidation when the parent and subsidiary have filed separate tax returns is:

A)timing differences are created in consolidation for items such as intercompany profits in inventory.

B)the parent and subsidiary may both incur taxes on the same items.

C)a special tax reserve must be set up in owners' equity.

D)None of the above.

A)timing differences are created in consolidation for items such as intercompany profits in inventory.

B)the parent and subsidiary may both incur taxes on the same items.

C)a special tax reserve must be set up in owners' equity.

D)None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

Because good will is amortized over 15 years for tax purposes, but is not amortized for financial reporting:

A)impairment of goodwill will result in a deferred tax liability.

B)there are no deferred tax implications.

C)a deferred tax liability results from amortization which will not be utilized until goodwill is impairment adjusted or the company is later sold.

D)a subsidiary will include any goodwill amortization the parent deducts in its taxable income.

A)impairment of goodwill will result in a deferred tax liability.

B)there are no deferred tax implications.

C)a deferred tax liability results from amortization which will not be utilized until goodwill is impairment adjusted or the company is later sold.

D)a subsidiary will include any goodwill amortization the parent deducts in its taxable income.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

The following comparative consolidated trial balances apply to Pembina Company and its subsidiary Scranton Company (80% interest) for the fiscal year ended 12/31/18:

?

?

The following events occurred during the year:

?

a) No trading securities were sold nor were any investments added to the portfolio.

b) Sold land, book value , for .

c) Purchased equipment with a cost of to replace equipment, book value , that was sold for .

d) Dividends declared and paid: Pembina ; Scranton .

e) Consolidated net income: . Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2018, for Pembina and its subsidiary.

?

?

?

The following events occurred during the year:

?

a) No trading securities were sold nor were any investments added to the portfolio.

b) Sold land, book value , for .

c) Purchased equipment with a cost of to replace equipment, book value , that was sold for .

d) Dividends declared and paid: Pembina ; Scranton .

e) Consolidated net income: . Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2018, for Pembina and its subsidiary.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

In calculating the voting power and market value for two or more corporations to file a consolidated tax return, preferred stock is included only if it

A)is entitled to vote.

B)is not limited and not preferred as to dividends.

C)has redemption rights beyond its issue price plus a reasonable redemption or liquidation premium and is convertible into the other class of stock.

D)meets any of the above conditions.

A)is entitled to vote.

B)is not limited and not preferred as to dividends.

C)has redemption rights beyond its issue price plus a reasonable redemption or liquidation premium and is convertible into the other class of stock.

D)meets any of the above conditions.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

When an affiliated group elects to be taxed as a single entity, taxable income is calculated based on

A)consolidated income as determined on the consolidated worksheet.

B)each firms separate income.

C)each firms separate income with adjustments for intercompany transactions.

D)none of the above.

A)consolidated income as determined on the consolidated worksheet.

B)each firms separate income.

C)each firms separate income with adjustments for intercompany transactions.

D)none of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

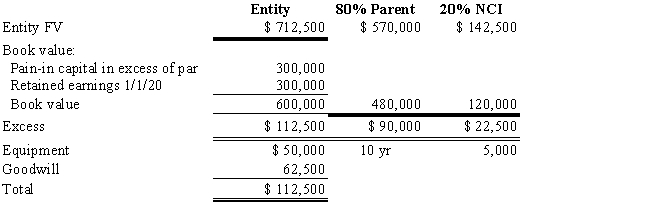

Company S has been an 80%-owned subsidiary of Company P since January 1, 2018.The determination and distribution of excess schedule prepared at the time of purchase was as follows:

?

?

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

?

The only change in plant assets during 2019 was that Company S sold a machine for $10,000.The machine had a cost of $60,000 and accumulated depreciation of $40,000.Depreciation expense recorded during 2019 was as follows:

?

?

The 2019 consolidated income was $180,000, of which the NCI was $10,000.Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

?

Consolidated inventory was $287,000 in 2018 and $223,000 in 2019; consolidated current liabilities were $246,000 in 2018 and $216,700 in 2019.Cash increased by $203,700.

?

Required:

?

Using the indirect method and the information provided, prepare the 2019 consolidated statement of cash flows for Company P.and its subsidiary, Company S.

?

?

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.?

The only change in plant assets during 2019 was that Company S sold a machine for $10,000.The machine had a cost of $60,000 and accumulated depreciation of $40,000.Depreciation expense recorded during 2019 was as follows:

?

?

The 2019 consolidated income was $180,000, of which the NCI was $10,000.Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

?

Consolidated inventory was $287,000 in 2018 and $223,000 in 2019; consolidated current liabilities were $246,000 in 2018 and $216,700 in 2019.Cash increased by $203,700.

?

Required:

?

Using the indirect method and the information provided, prepare the 2019 consolidated statement of cash flows for Company P.and its subsidiary, Company S.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

When there is an excess of fair value over cost relative to an identifiable asset,

A)the recording of a deferred tax liability is required for the excess.

B)the recording of a deferred tax liability is necessary for the amount of the tax rate times the excess.

C)no amortization of a deferred tax liability is necessary

D)this excess does not create a deferred tax liability that needs to be recorded.

A)the recording of a deferred tax liability is required for the excess.

B)the recording of a deferred tax liability is necessary for the amount of the tax rate times the excess.

C)no amortization of a deferred tax liability is necessary

D)this excess does not create a deferred tax liability that needs to be recorded.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

Consolidated firms that meet the tax law requirements to be an affiliated group

A)must file a consolidated return.

B)must receive permission of the Internal Revenue Service to file separately.

C)may elect to file as a single entity or as a consolidated group.

D)cannot change the method of filing in the future.

A)must file a consolidated return.

B)must receive permission of the Internal Revenue Service to file separately.

C)may elect to file as a single entity or as a consolidated group.

D)cannot change the method of filing in the future.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

Company P purchased an 80% interest in Company S on January 1, 2016, for $800,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of fair value over book value was attributed to a patent with a 10-year remaining life.In 2016, Company P reported internally generated net income before taxes of $150,000.Company S reported a net income before taxes of $70,000.The firms file a consolidated tax return at a 30% tax rate.The controlling share of consolidated net income is

A)$14,000

B)$12,000

C)$28,000

D)$36,000

A)$14,000

B)$12,000

C)$28,000

D)$36,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

Company P purchased an 80% interest in Company S on January 1, 2016, for $800,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of fair value over book value was attributed to a patent with a 10-year remaining life.In 2016, Company P reported internally generated net income before taxes of $150,000.Company S reported a net income before taxes of $70,000.The firms file a consolidated tax return at a 30% tax rate.The nondeductible portion of excess amortization is

A)$20,000

B)$15,000

C)$4,000

D)$0 (The amortization is fully deductible)

A)$20,000

B)$15,000

C)$4,000

D)$0 (The amortization is fully deductible)

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

For companies that meet the requirements of an affiliated firm but elect to file separately, the parent may exclude how much of the dividends received from reported income?

A)100%

B)80%

C)70%

D)20%

A)100%

B)80%

C)70%

D)20%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

Plaza Company acquires an 80% interest in Scenic Company for $200,000 cash on January 1, 2020.On that date, Scenic's equipment (remaining economic life of 5 years) is undervalued by $25,000; any excess of cost over book value is attributed to goodwill.Scenic's balance sheet on the date of the purchase is as follows:

?

?

The controlling interest in consolidated net income for 2020 is $97,900; the non-controlling interest is $6,000.On December 31, 2020, Plaza acquired a 15% interest in Adams, Inc.and, in an unrelated transaction, issued additional common stock.Dividends declared and paid during the year by Plaza and Scenic were $30,000 and $15,000, respectively.There are no purchases or sales of property, plant, or equipment during the year.Based on the following information, prepare a statement of cash flows using the indirect method for Plaza Company and its subsidiary for the year ended December 31, 2020.

?

?

Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2020, for Plaza and its subsidiary.

?

?

?

The controlling interest in consolidated net income for 2020 is $97,900; the non-controlling interest is $6,000.On December 31, 2020, Plaza acquired a 15% interest in Adams, Inc.and, in an unrelated transaction, issued additional common stock.Dividends declared and paid during the year by Plaza and Scenic were $30,000 and $15,000, respectively.There are no purchases or sales of property, plant, or equipment during the year.Based on the following information, prepare a statement of cash flows using the indirect method for Plaza Company and its subsidiary for the year ended December 31, 2020.

?

?

Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2020, for Plaza and its subsidiary.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

Company P purchased an 75% interest in Company S on January 1, 2016, for $675,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of cost over book value was attributed to a patent with a 10-year life.In 2016, Company P reported internally generated income before taxes of $80,000.Company S reported internally generated income before taxes of $40,000.The firms file separate tax returns at a 30% tax rate.Assume an 80% exclusion rate on intercompany income.The tax applicable to Company S's income is

A)$15,750

B)$9,750

C)$2,500

D)$4,500

A)$15,750

B)$9,750

C)$2,500

D)$4,500

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

Company P purchased an 80% interest in Company S on January 1, 2016, for $800,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of fair value over book value was attributed to a patent with a 10-year remaining life.In 2016, Company P reported internally generated net income before taxes of $150,000.Company S reported a net income before taxes of $70,000.The firms file a consolidated tax return at a 30% tax rate.The consolidated net income is

A)$142,800

B)$121,800

C)$138,800

D)$152,000

A)$142,800

B)$121,800

C)$138,800

D)$152,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

The following comparative consolidated trial balances apply to Perella Company and its subsidiary Sherwood Company (80% control):

?

?

The following is additional information for 2018:

?

a) No trading securities were sold nor were any investments added to the portfolio.

b) Land was acquired by issuing a note and giving cash for the balance.

c) Equipment (cost ; accumulated depreciation ) was sold for

d) Dividends declared and paid: Perella 50,000 ; Sherwood .

e) Consolidated net income amounted to . Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2018, for Perella and its subsidiary.

?

?

?

The following is additional information for 2018:

?

a) No trading securities were sold nor were any investments added to the portfolio.

b) Land was acquired by issuing a note and giving cash for the balance.

c) Equipment (cost ; accumulated depreciation ) was sold for

d) Dividends declared and paid: Perella 50,000 ; Sherwood .

e) Consolidated net income amounted to . Required:

?

Prepare the consolidated statement of cash flows for the year ended December 31, 2018, for Perella and its subsidiary.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

Assume the parent owns 90% of the subsidiary and has an adjusted internally generated net income of $100,000 and 5,000 shares of common stock outstanding.Also assume the parent has dilutive bonds outstanding that are convertible into 2,000 shares of common stock and the interest paid on these bonds was $4,000.What is the consolidated diluted earnings per share (DEPS) if the subsidiary data include: 3,000 shares of common stock, 150 shares of convertible bonds that are held by parent, 5 shares of common stock that are from convertible bonds outstanding by subsidiary and subsidiary diluted earnings per share of $ 6.88.

A)$ 20.80

B)$ 25.48

C)$ 18.25

D)$ 14.86

A)$ 20.80

B)$ 25.48

C)$ 18.25

D)$ 14.86

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

Company P purchased an 75% interest in Company S on January 1, 2016, for $675,000.On the purchase date, Company S stockholders' equity was $800,000.Any excess of cost over book value was attributed to a patent with a 10-year life.In 2016, Company P reported internally generated income before taxes of $80,000.Company S reported internally generated income before taxes of $40,000.The firms file separate tax returns at a 30% tax rate.Assume an 80% exclusion rate on intercompany income.The nondeductible portion of excess amortization is

A)$0 (The amortization is fully deductible)

B)$9,750

C)$2,500

D)$4,500

A)$0 (The amortization is fully deductible)

B)$9,750

C)$2,500

D)$4,500

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

For ownership interest of less than 20%, the parent may exclude how much of the dividends received from its reported income when filing separately?

A)100%

B)80%

C)70%

D)20%

A)100%

B)80%

C)70%

D)20%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

Dills Company purchased an 80% interest in the common stock of Sarada Company for $140,000 on January 1, 2018.On this date the book value of Sarada's net identifiable assets totaled $100,000.Any excess was attributed to a patent with a 10-year life.

?

During 2019, Dills Company and Sarada Company reported the following internally generated income before taxes:

?

?

Sarada Company routinely sells goods to Dills Company.This year those sales amounted to $60,000.Dills Company inventories included intercompany goods of $30,000 at the beginning of the year and $12,000 at the end of the year.Sarada Company sells goods to Dills Company at a gross profit of 16.67%.

?

On January 1, 2019 Dills Company sold a new machine to Sarada Company, for $40,000.The cost of the machine was $30,000.It has a 5-year life.

?

The affiliated group files a consolidated tax return and is taxed at 30%.

?

Required:

?

Prepare a consolidated income statement for 2019.Include income distribution for both firms.

?

?

During 2019, Dills Company and Sarada Company reported the following internally generated income before taxes:

?

?

Sarada Company routinely sells goods to Dills Company.This year those sales amounted to $60,000.Dills Company inventories included intercompany goods of $30,000 at the beginning of the year and $12,000 at the end of the year.Sarada Company sells goods to Dills Company at a gross profit of 16.67%.

?

On January 1, 2019 Dills Company sold a new machine to Sarada Company, for $40,000.The cost of the machine was $30,000.It has a 5-year life.

?

The affiliated group files a consolidated tax return and is taxed at 30%.

?

Required:

?

Prepare a consolidated income statement for 2019.Include income distribution for both firms.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

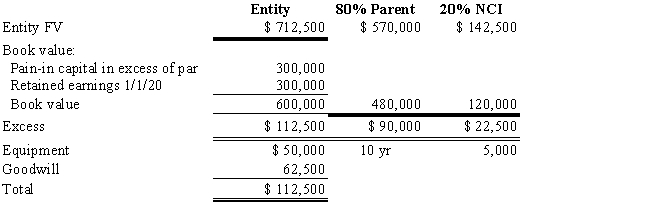

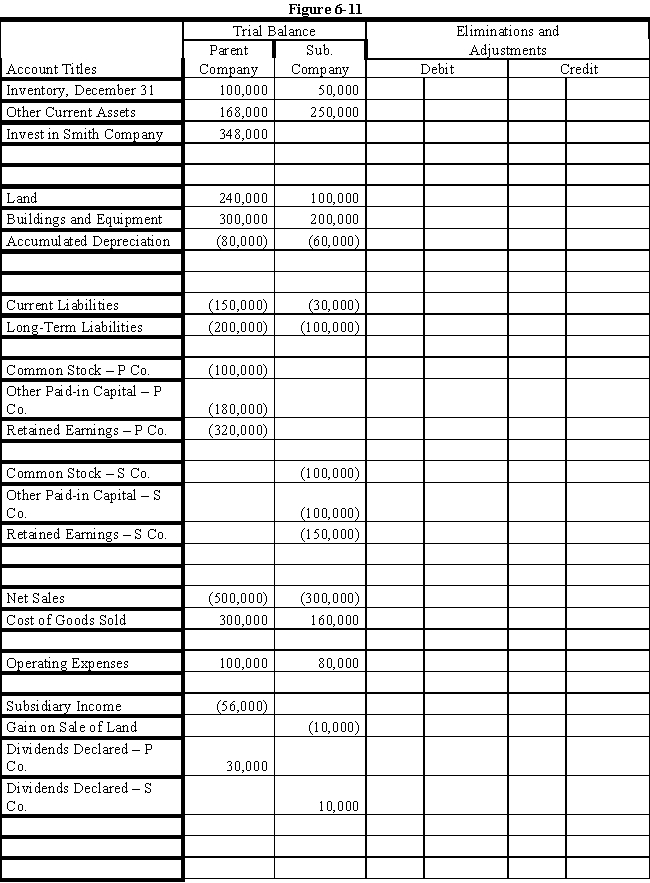

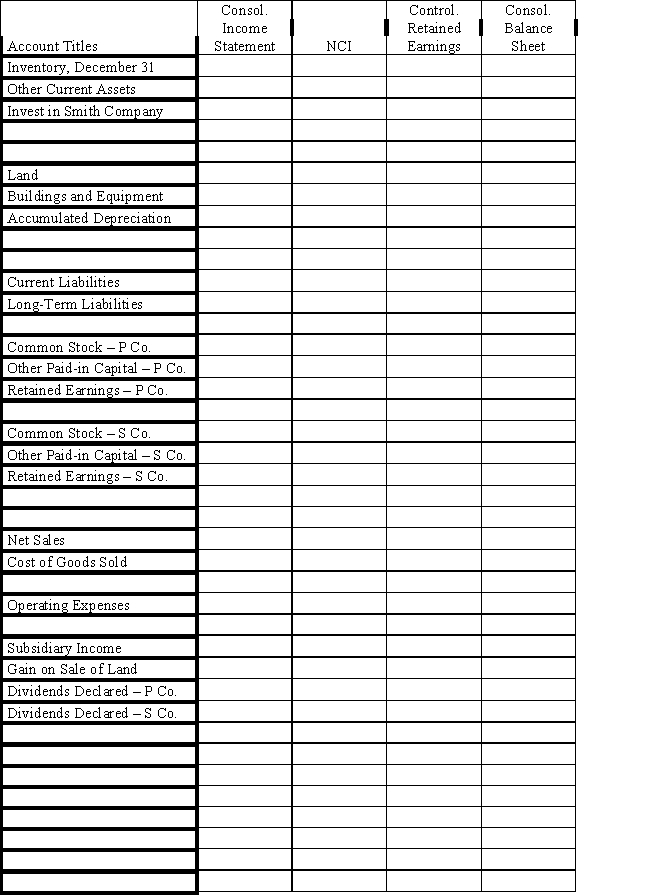

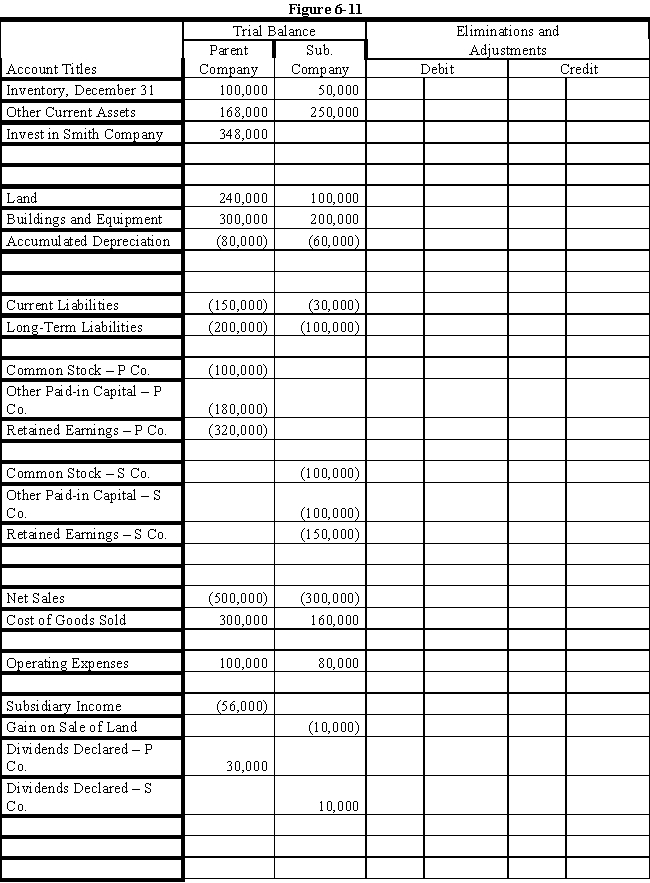

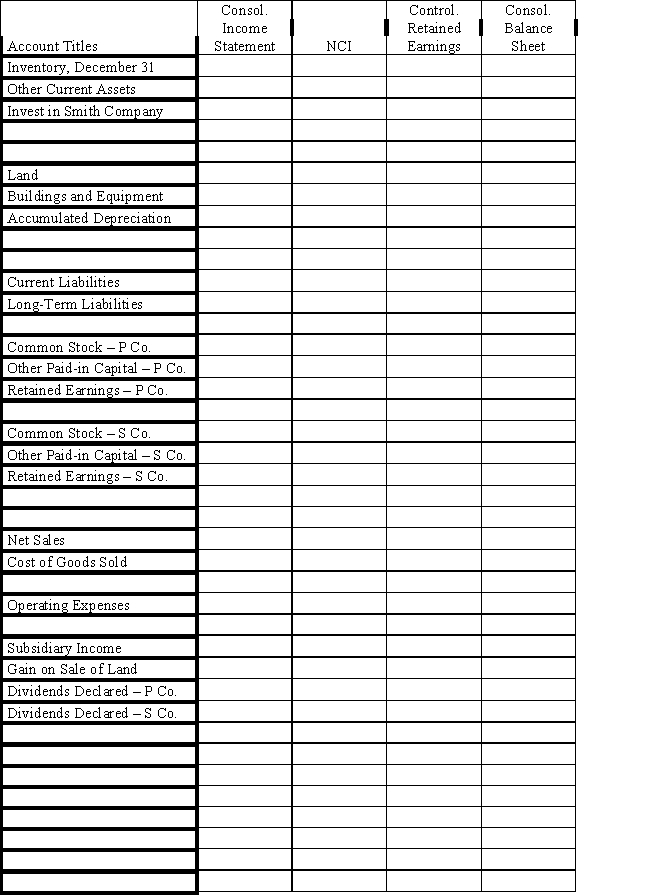

On January 1, 2018, Paul Company purchased 80% of the common stock of Smith Company for $300,000.On this date Smith had total owners' equity of $350,000.Any excess of cost over book value is attributed to a patent, to be amortized over 10 years.

?

During 2018, Paul has accounted for its investment in Smith using the simple equity method.

?

During 2018, Paul sold merchandise to Smith for $50,000, of which $10,000 is held by Smith on December 31, 2018.Paul's gross profit on sales is 40%.

?

During 2018, Smith sold some land to Paul at a gain of $10,000.Paul still holds the land at year end.

?

Paul and Smith qualify as an affiliated group for tax purposes and thus will file a consolidated tax return.Assume a 30% corporate income tax rate.

?

Required:

?

Complete the Figure 6-11 worksheet for consolidated financial statements for the year ended December 31, 2018.

?

?

?

?

?

?

During 2018, Paul has accounted for its investment in Smith using the simple equity method.

?

During 2018, Paul sold merchandise to Smith for $50,000, of which $10,000 is held by Smith on December 31, 2018.Paul's gross profit on sales is 40%.

?

During 2018, Smith sold some land to Paul at a gain of $10,000.Paul still holds the land at year end.

?

Paul and Smith qualify as an affiliated group for tax purposes and thus will file a consolidated tax return.Assume a 30% corporate income tax rate.

?

Required:

?

Complete the Figure 6-11 worksheet for consolidated financial statements for the year ended December 31, 2018.

?

?

?

??

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

Dills Company purchased an 80% interest in the common stock of Sarada Company for $140,000 on January 1, 2018.On this date the book value of Sarada's net identifiable assets totaled $100,000.Any excess was attributed to a patent with a 10-year life.

?

During 2019, Dills Company and Sarada Company reported the following internally generated income before taxes:

?

?

Sarada Company routinely sells goods to Dills Company.This year those sales amounted to $60,000.Dills Company inventories included intercompany goods of $30,000 at the beginning of the year and $12,000 at the end of the year.Sarada Company sells goods to Dills Company at a gross profit of 16.67%.

?

On January 1, 2019 Dills Company sold a new machine to Sarada Company, for $40,000.The cost of the machine was $30,000.It has a 5-year life.

?

The firms file separate tax returns.Both are subject to a 30% tax rate.Dills Company receives an 80% dividend deduction.

?

Required:

?

Prepare a consolidated income statement for 2019.Include income distribution for both firms.

?

During 2019, Dills Company and Sarada Company reported the following internally generated income before taxes:

?

?

Sarada Company routinely sells goods to Dills Company.This year those sales amounted to $60,000.Dills Company inventories included intercompany goods of $30,000 at the beginning of the year and $12,000 at the end of the year.Sarada Company sells goods to Dills Company at a gross profit of 16.67%.

?

On January 1, 2019 Dills Company sold a new machine to Sarada Company, for $40,000.The cost of the machine was $30,000.It has a 5-year life.

?

The firms file separate tax returns.Both are subject to a 30% tax rate.Dills Company receives an 80% dividend deduction.

?

Required:

?

Prepare a consolidated income statement for 2019.Include income distribution for both firms.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

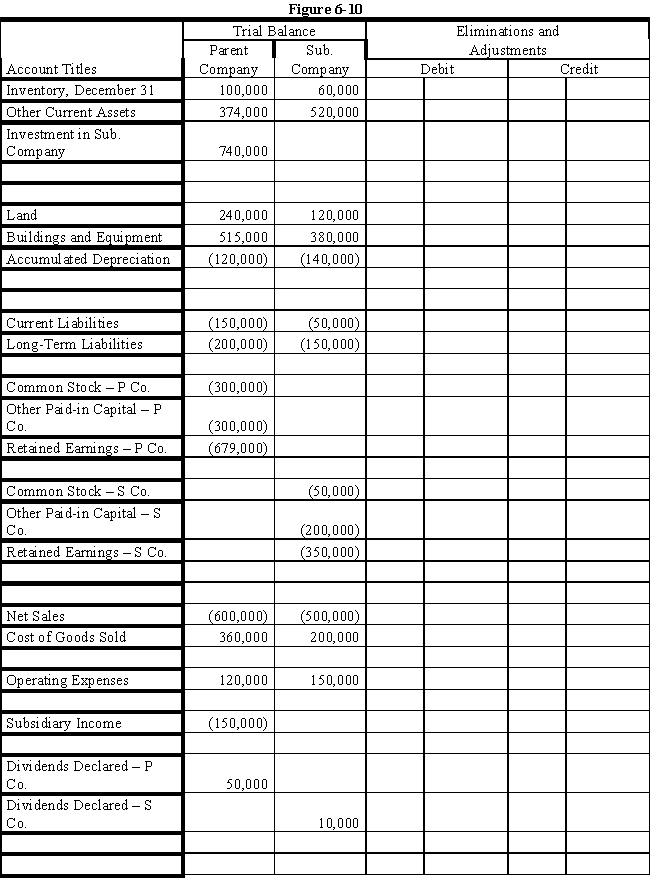

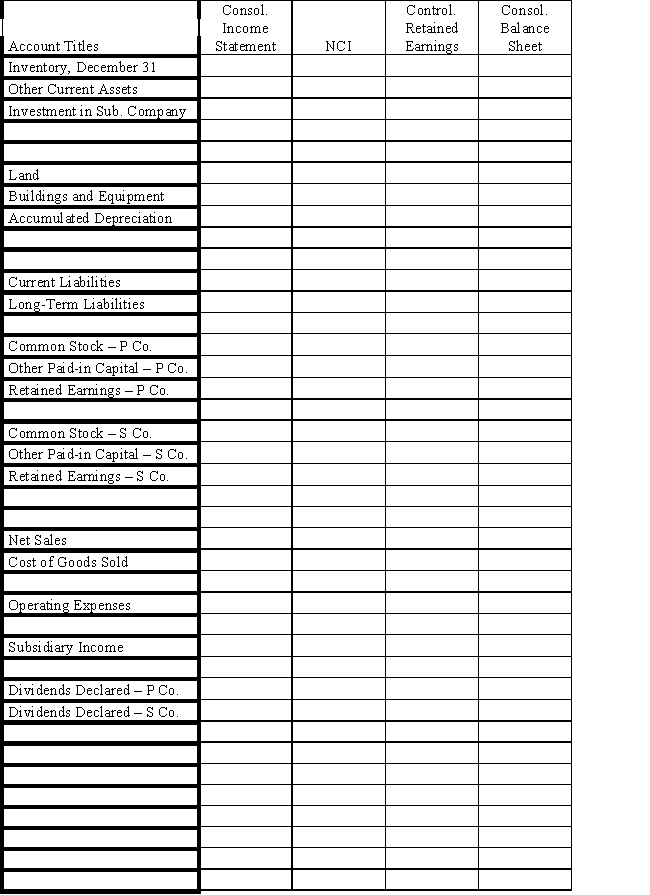

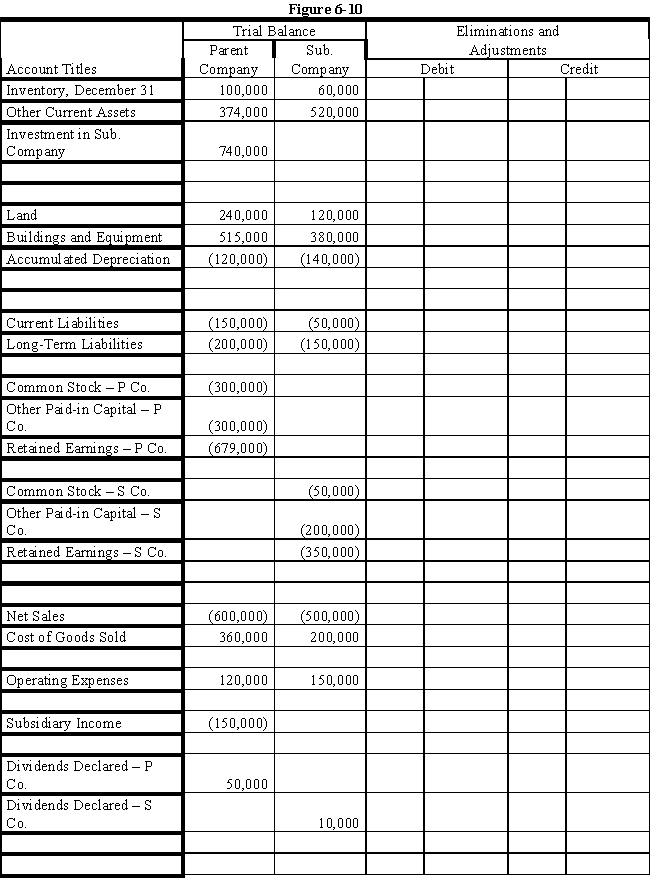

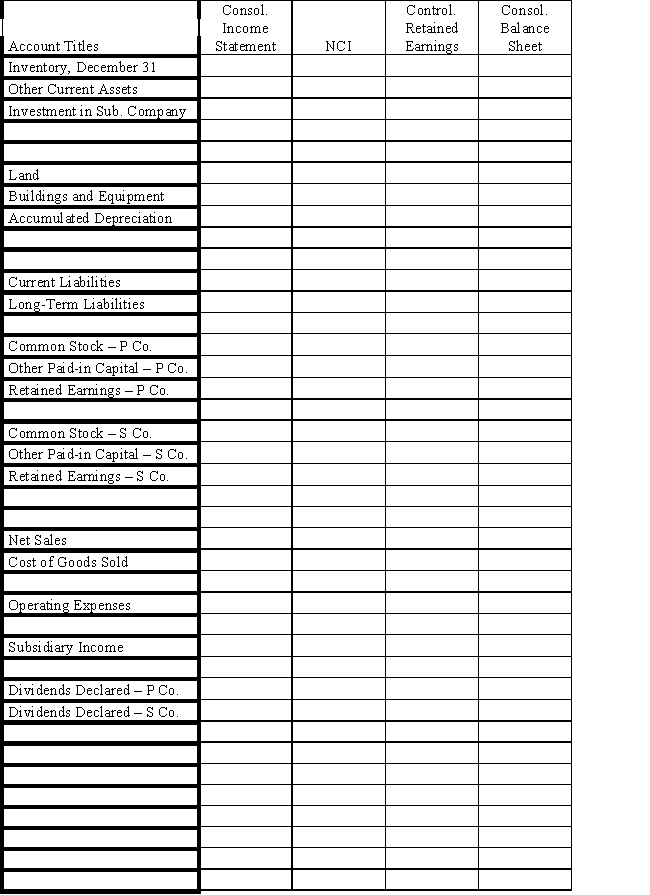

On January 1, 2020, Parent Company acquired 100% of the common stock of Subsidiary Company in a stock exchange.On this date Subsidiary had total owners' equity of $550,000 and book value approximated fair value.

During 2020 and 2021, Parent has accounted for its investment in Subsidiary using the simple equity method.

On January 1, 2021, Parent held merchandise acquired from Subsidiary for $75,000.During 2021, Subsidiary sold merchandise to Parent for $100,000, of which $25,000 is held by Parent on December 31, 2021.Subsidiary's usual gross profit on affiliated sales is 50%.

On December 31, 2020, Parent sold to Subsidiary some equipment with a cost of $75,000 and a book value of $30,000.The sales price was $40,000.Subsidiary is depreciating the equipment over a 5-year life, assuming no salvage value and using the straight-line method.

Parent and Subsidiary qualify as an affiliated group for tax purposes and thus will file a consolidated tax return.Assume a 30% corporate income tax rate.

Required:

Complete the Figure 6-10 worksheet for consolidated financial statements for the year ended December 31, 2021.

During 2020 and 2021, Parent has accounted for its investment in Subsidiary using the simple equity method.

On January 1, 2021, Parent held merchandise acquired from Subsidiary for $75,000.During 2021, Subsidiary sold merchandise to Parent for $100,000, of which $25,000 is held by Parent on December 31, 2021.Subsidiary's usual gross profit on affiliated sales is 50%.

On December 31, 2020, Parent sold to Subsidiary some equipment with a cost of $75,000 and a book value of $30,000.The sales price was $40,000.Subsidiary is depreciating the equipment over a 5-year life, assuming no salvage value and using the straight-line method.

Parent and Subsidiary qualify as an affiliated group for tax purposes and thus will file a consolidated tax return.Assume a 30% corporate income tax rate.

Required:

Complete the Figure 6-10 worksheet for consolidated financial statements for the year ended December 31, 2021.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Plateau Company acquires an 80% interest in Seagull Company for $200,000 cash on January 1, 2020.On that date, Seagull's equipment is undervalued by $25,000; any excess of cost over book value is attributed to goodwill.Seagull's balance sheet on the date of the purchase is as follows:

?

?

The controlling interest in consolidated net income for 2020 is $97,900; the non-controlling interest is $6,000.During the year Plateau retired long-term debt by issuing common stock.Dividends declared and paid during the year by Plateau and Seagull were $30,000 and $15,000, respectively.During the year Seagull sold equipment with a book value of $30,000 for a gain of $3,000; there were no purchases of property, plant, or equipment during the year.

?

?

?

Required:

?

Prepare a statement of cash flows using the indirect method for Plateau Company and its subsidiary for the year ended December 31, 2020.

?

?

The controlling interest in consolidated net income for 2020 is $97,900; the non-controlling interest is $6,000.During the year Plateau retired long-term debt by issuing common stock.Dividends declared and paid during the year by Plateau and Seagull were $30,000 and $15,000, respectively.During the year Seagull sold equipment with a book value of $30,000 for a gain of $3,000; there were no purchases of property, plant, or equipment during the year.

?

?

?

Required:

?

Prepare a statement of cash flows using the indirect method for Plateau Company and its subsidiary for the year ended December 31, 2020.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

Plymouth Company holds a 90% interest in Savannah, Inc., which was acquired in a previous year.As of the end of the current fiscal period, the following information is available:

?

?

Additional information:

?

The warrants to acquire Savannah stock were issued July 1 of the current year. Exercise price is ; stock price is .

The warrants to acquire Plymouth stock were issued in a previous fiscal period. Exercise price is ; stock price is .

Each share of convertible preferred can be converted into 5 shares of Savannah common stock. Plymouth owns of the convertible preferred stock. Required:

?

Compute consolidated basic and diluted earnings per share for the current year.Ignore any tax effects.

?

?

?

Additional information:

?

The warrants to acquire Savannah stock were issued July 1 of the current year. Exercise price is ; stock price is .

The warrants to acquire Plymouth stock were issued in a previous fiscal period. Exercise price is ; stock price is .

Each share of convertible preferred can be converted into 5 shares of Savannah common stock. Plymouth owns of the convertible preferred stock. Required:

?

Compute consolidated basic and diluted earnings per share for the current year.Ignore any tax effects.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Plymouth Company holds a 90% interest in Savannah, Inc., which was acquired in a previous year.As of the end of the current fiscal period, the following information is available:

?

Assume a 50% treasury stock method effect on the stock warrants

?

Required:

Compute consolidated basic and diluted earnings per share for the current year; ignore income taxes.

?

?

Assume a 50% treasury stock method effect on the stock warrants

?

Required:

Compute consolidated basic and diluted earnings per share for the current year; ignore income taxes.

?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

Discuss how the following items affecting shareholder equity are disclosed in a consolidated statement of cash flows:

1) The acquisition of controlling interest by issuing shares of stock

2) The purchase of additional subsidiary shares from the non-controlling interest

3) Subsidiary dividends

1) The acquisition of controlling interest by issuing shares of stock

2) The purchase of additional subsidiary shares from the non-controlling interest

3) Subsidiary dividends

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck