Deck 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 2: Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No Differential

1

Under the equity method of accounting for a stock investment,the investment initially should be recorded at:

A) cost.

B) cost minus any differential.

C) proportionate share of the fair value of the investee company's net assets.

D) proportionate share of the book value of the investee company's net assets.

A) cost.

B) cost minus any differential.

C) proportionate share of the fair value of the investee company's net assets.

D) proportionate share of the book value of the investee company's net assets.

A

2

A change from the cost method to the equity method of accounting for an investment in common stock resulting from an increase in the number of shares held by the investor requires:

A) only a footnote disclosure.

B) that the cumulative amount of the change be shown as a line item on the income statement, net of tax.

C) that the change be accounted for as an unrealized gain included in other comprehensive income.

D) retroactive restatement as if the investor always had used the equity method.

A) only a footnote disclosure.

B) that the cumulative amount of the change be shown as a line item on the income statement, net of tax.

C) that the change be accounted for as an unrealized gain included in other comprehensive income.

D) retroactive restatement as if the investor always had used the equity method.

D

3

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

Based on the preceding information,what amount will be reported by Yang as balance in investment in Spiel on December 31,20X8,if it used the equity method of accounting?

A) $108,250

B) $118,750

C) $100,000

D) $122,500

Based on the preceding information,what amount will be reported by Yang as balance in investment in Spiel on December 31,20X8,if it used the equity method of accounting?

A) $108,250

B) $118,750

C) $100,000

D) $122,500

D

4

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X8 if it used the fair value option to account for its investment in Spiel?

A) $11,250

B) $2,500

C) $6,250

D) $7,500

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X8 if it used the fair value option to account for its investment in Spiel?

A) $11,250

B) $2,500

C) $6,250

D) $7,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following observations is consistent with the equity method of accounting?

A) Dividends declared by the investee are treated as income by the investor.

B) It is used when the investor lacks the ability to exercise significant influence over the investee.

C) It may be used in place of consolidation.

D) Its primary use is in reporting nonsubsidiary investments.

A) Dividends declared by the investee are treated as income by the investor.

B) It is used when the investor lacks the ability to exercise significant influence over the investee.

C) It may be used in place of consolidation.

D) Its primary use is in reporting nonsubsidiary investments.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

From an investor's point of view,a liquidating dividend from an investee is:

A) A dividend declared by the investee in excess of its earnings in the current year.

B) A dividend declared by the investee in excess of its earnings since acquisition by the investor.

C) Any dividend declared by the investee since acquisition.

D) A dividend declared by the investee in excess of the investee's retained earnings.

A) A dividend declared by the investee in excess of its earnings in the current year.

B) A dividend declared by the investee in excess of its earnings since acquisition by the investor.

C) Any dividend declared by the investee since acquisition.

D) A dividend declared by the investee in excess of the investee's retained earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

On January 1,20X9 Athlon Company acquired 30 percent of the common stock of Opteron Corporation,at underlying book value.For the same year,Opteron reported net income of $55,000,which includes an extraordinary gain of 40,000.It did not pay any dividends during the year.By what amount would Athlon's investment in Opteron Corporation increase for the year,if Athlon used the equity method?

A) $0

B) $16,500

C) $4,500

D) $12,000

A) $0

B) $16,500

C) $4,500

D) $12,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

On January 1, 20X8, William Company acquired 30 percent of eGate Company's common stock, at underlying book value of $100,000. eGate has 100,000 shares of $2 par value, 5 percent cumulative preferred stock outstanding. No dividends are in arrears. eGate reported net income of $150,000 for 20X8 and paid total dividends of $72,000. William uses the equity method to account for this investment.

Based on the preceding information,what amount of investment income will William Company report from its investment in eGate for the year?

A) $45,000

B) $42,000

C) $62,000

D) $35,000

Based on the preceding information,what amount of investment income will William Company report from its investment in eGate for the year?

A) $45,000

B) $42,000

C) $62,000

D) $35,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

On January 1, 20X8, William Company acquired 30 percent of eGate Company's common stock, at underlying book value of $100,000. eGate has 100,000 shares of $2 par value, 5 percent cumulative preferred stock outstanding. No dividends are in arrears. eGate reported net income of $150,000 for 20X8 and paid total dividends of $72,000. William uses the equity method to account for this investment.

Based on the preceding information,what amount would William Company receive as dividends from eGate for the year?

A) $62,000

B) $21,600

C) $18,600

D) $54,000

Based on the preceding information,what amount would William Company receive as dividends from eGate for the year?

A) $62,000

B) $21,600

C) $18,600

D) $54,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X8,if it used the equity method of accounting?

A) $7,500

B) $11,250

C) $18,750

D) $26,250

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X8,if it used the equity method of accounting?

A) $7,500

B) $11,250

C) $18,750

D) $26,250

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X7 if it used the fair value option to account for its investment in Spiel?

A) $17,500

B) $12,500

C) $11,250

D) $7,500

Based on the preceding information,what amount will be reported by Yang as income from its investment in Spiel for 20X7 if it used the fair value option to account for its investment in Spiel?

A) $17,500

B) $12,500

C) $11,250

D) $7,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, 20X7, Yang Corporation acquired 25 percent of the outstanding shares of Spiel Corporation for $100,000 cash. Spiel Company reported net income of $75,000 and paid dividends of $30,000 for both 20X7 and 20X8. The fair value of shares held by Yang was $110,000 and $105,000 on December 31, 20X7 and 20X8 respectively.

Based on the preceding information,what amount will be reported by Yang as balance in investment in Spiel on December 31,20X8,if it used the fair value option to account for its investment in Spiel?

A) $105,000

B) $118,750

C) $100,000

D) $122,500

Based on the preceding information,what amount will be reported by Yang as balance in investment in Spiel on December 31,20X8,if it used the fair value option to account for its investment in Spiel?

A) $105,000

B) $118,750

C) $100,000

D) $122,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1, 20X4, Timber Company acquired 25% of Johnson Company's common stock at underlying book value of $200,000. Johnson has 80,000 shares of $10 par value, 6 percent cumulative preferred stock outstanding. No dividends are in arrears. Johnson reported net income of $270,000 for 20X4 and paid total dividends of $140,000. Timber uses the equity method to account for this investment.

Based on the preceding information,what amount would Timber Company receive as dividends from Johnson for the year?

A) $23,000

B) $35,000

C) $37,500

D) $92,000

Based on the preceding information,what amount would Timber Company receive as dividends from Johnson for the year?

A) $23,000

B) $35,000

C) $37,500

D) $92,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

On January 1, 20X4, Timber Company acquired 25% of Johnson Company's common stock at underlying book value of $200,000. Johnson has 80,000 shares of $10 par value, 6 percent cumulative preferred stock outstanding. No dividends are in arrears. Johnson reported net income of $270,000 for 20X4 and paid total dividends of $140,000. Timber uses the equity method to account for this investment.

Based on the preceding information,what amount would be reported by Timber Company as the balance in its investment account on December 31,20X4?

A) $200,000

B) $220,500

C) $232,500

D) $255,500

Based on the preceding information,what amount would be reported by Timber Company as the balance in its investment account on December 31,20X4?

A) $200,000

B) $220,500

C) $232,500

D) $255,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

On January 1, 20X4, Timber Company acquired 25% of Johnson Company's common stock at underlying book value of $200,000. Johnson has 80,000 shares of $10 par value, 6 percent cumulative preferred stock outstanding. No dividends are in arrears. Johnson reported net income of $270,000 for 20X4 and paid total dividends of $140,000. Timber uses the equity method to account for this investment.

Based on the preceding information,what amount of investment income will Timber Company report from its investment in Johnson for the year?

A) $140,000

B) $67,500

C) $55,500

D) $35,000

Based on the preceding information,what amount of investment income will Timber Company report from its investment in Johnson for the year?

A) $140,000

B) $67,500

C) $55,500

D) $35,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following observations is NOT consistent with the cost method of accounting?

A) Investee dividends from earnings since acquisition by investor are treated as a reduction of the investment.

B) Investments are carried by the investor at historical cost.

C) No journal entry is made regarding the earnings of the investee.

D) It is consistent with the treatment normally accorded noncurrent assets.

A) Investee dividends from earnings since acquisition by investor are treated as a reduction of the investment.

B) Investments are carried by the investor at historical cost.

C) No journal entry is made regarding the earnings of the investee.

D) It is consistent with the treatment normally accorded noncurrent assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Usually,an investment of 20 to 50 percent in another company's voting stock is reported under the:

A) Cost method

B) Equity method

C) Full consolidation method

D) Fair value method

A) Cost method

B) Equity method

C) Full consolidation method

D) Fair value method

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

If Push Company owned 51 percent of the outstanding common stock of Shove Company,which reporting method would be appropriate?

A) Cost method

B) Consolidation

C) Equity method

D) Merger method

A) Cost method

B) Consolidation

C) Equity method

D) Merger method

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

On July 1,20X4,Denver Corp.purchased 3,000 shares of Eagle Co.'s 10,000 outstanding shares of common stock for $20 per share.On December 15,20X4,Eagle paid $40,000 in dividends to its common stockholders.Eagle's net income for the year ended December 31,20X4,was $120,000,earned evenly throughout the year.In its 20X4 income statement,what amount of income from this investment should Denver report?

A) $12,000

B) $36,000

C) $18,000

D) $6,000

A) $12,000

B) $36,000

C) $18,000

D) $6,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

On January 1, 20X8, William Company acquired 30 percent of eGate Company's common stock, at underlying book value of $100,000. eGate has 100,000 shares of $2 par value, 5 percent cumulative preferred stock outstanding. No dividends are in arrears. eGate reported net income of $150,000 for 20X8 and paid total dividends of $72,000. William uses the equity method to account for this investment.

Based on the preceding information,what amount would be reported by William Company as the balance in its investment account on December 31,20X8?

A) $100,000

B) $123,400

C) $120,400

D) $142,000

Based on the preceding information,what amount would be reported by William Company as the balance in its investment account on December 31,20X8?

A) $100,000

B) $123,400

C) $120,400

D) $142,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

Parent Co. purchases 100 percent of Son Company on January 1, 20X1, when Parent's retained earnings balance is $520,000 and Son's is $150,000. During 20X1, Son reports $15,000 of net income and declares $6,000 of dividends. Parent reports $105,000 of separate operating earnings plus $15,000 of equity-method income from its 100 percent interest in Son; Parent declares dividends of $40,000.

Based on the preceding information,what is Parent's post-closing retained earnings balance on December 31,20X1?

A) $485,000

B) $505,000

C) $525,000

D) $600,000

Based on the preceding information,what is Parent's post-closing retained earnings balance on December 31,20X1?

A) $485,000

B) $505,000

C) $525,000

D) $600,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A) $650,000

B) $880,000

C) $920,000

D) $750,000

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A) $650,000

B) $880,000

C) $920,000

D) $750,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

What portion of the subsidiary stockholders' equity account balances should be eliminated in preparing the consolidated balance sheet?

A) Common stock

B) Additional paid-in capital

C) Retained Earnings

D) All of the balances are eliminated

A) Common stock

B) Additional paid-in capital

C) Retained Earnings

D) All of the balances are eliminated

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

Based on the preceding information,what amount of total assets did Beta report in its balance sheet immediately after the acquisition?

A) $500,000

B) $650,000

C) $750,000

D) $900,000

Based on the preceding information,what amount of total assets did Beta report in its balance sheet immediately after the acquisition?

A) $500,000

B) $650,000

C) $750,000

D) $900,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition?

A) $500,000

B) $530,000

C) $280,000

D) $660,000

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition?

A) $500,000

B) $530,000

C) $280,000

D) $660,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

On January 2,20X1,Pencil Co.purchased 15 percent of Eraser,Inc.'s outstanding common shares for $500,000.Pencil is the largest single shareholder in Eraser and is able to exercise significant influence over Eraser.Eraser reported net income of $400,000 for 20X1 and paid dividends of $100,000.In its December 31,20X1,balance sheet,what amount should Pencil report as investment in Eraser?

A) $485,000

B) $500,000

C) $545,000

D) $560,000

A) $485,000

B) $500,000

C) $545,000

D) $560,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

Alpha Company acquired 100 percent of the voting common shares of Gamma Corporation by issuing bonds with a par value and fair value of $200,000. Immediately prior to the acquisition, Alpha reported total assets of $600,000, liabilities of $370,000, and stockholders' equity of $230,000. At that date, Gamma reported total assets of $500,000, liabilities of $300,000, and stockholders' equity of $200,000. Included in Gamma's liabilities was an account payable to Alpha in the amount of $50,000, which Alpha included in its accounts receivable.

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A) $600,000

B) $800,000

C) $1,050,000

D) $1,150,0000

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A) $600,000

B) $800,000

C) $1,050,000

D) $1,150,0000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

Clocktower Corporation reported net income for the current year of $370,000 and paid cash dividends of $50,000.Slide Company holds 40 percent of the outstanding voting stock of Clocktower.However,another corporation holds the other 60 percent ownership and does not take Slide's wants and wishes into consideration when making financing and operating decisions for Clocktower.What investment income should Slide recognize for the current year?

A) $0

B) $20,000

C) $128,000

D) $148,000

A) $0

B) $20,000

C) $128,000

D) $148,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

The consolidation process consists of all the following except:

A) Combining the financial statements of two or more legally separate companies.

B) Eliminating intercompany transactions and holdings.

C) Closing the individual subsidiary's revenue and expense accounts into the parent's retained earnings.

D) Combining the accounts of separate companies, creating a single set of financial statements.

A) Combining the financial statements of two or more legally separate companies.

B) Eliminating intercompany transactions and holdings.

C) Closing the individual subsidiary's revenue and expense accounts into the parent's retained earnings.

D) Combining the accounts of separate companies, creating a single set of financial statements.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

Alpha Company acquired 100 percent of the voting common shares of Gamma Corporation by issuing bonds with a par value and fair value of $200,000. Immediately prior to the acquisition, Alpha reported total assets of $600,000, liabilities of $370,000, and stockholders' equity of $230,000. At that date, Gamma reported total assets of $500,000, liabilities of $300,000, and stockholders' equity of $200,000. Included in Gamma's liabilities was an account payable to Alpha in the amount of $50,000, which Alpha included in its accounts receivable.

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A) $200,000

B) $230,000

C) $380,000

D) $430,000

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A) $200,000

B) $230,000

C) $380,000

D) $430,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

On October 1,20X7,Chicago Corporation purchased 6,000 shares of Buffalo Company's 15,000 outstanding share of common stock for $25 per share.On December 15,20X7,Buffalo paid $120,000 in dividends to its common stockholders.Buffalo's net income for the year ended December 31,20X7 was $300,000,earned evenly throughout the year.In its 20X7 income statement,what amount of income from this investment should Chicago report?

A) $12,000

B) $30,000

C) $48,000

D) $120,000

A) $12,000

B) $30,000

C) $48,000

D) $120,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

Alpha Company acquired 100 percent of the voting common shares of Gamma Corporation by issuing bonds with a par value and fair value of $200,000. Immediately prior to the acquisition, Alpha reported total assets of $600,000, liabilities of $370,000, and stockholders' equity of $230,000. At that date, Gamma reported total assets of $500,000, liabilities of $300,000, and stockholders' equity of $200,000. Included in Gamma's liabilities was an account payable to Alpha in the amount of $50,000, which Alpha included in its accounts receivable.

Based on the preceding information,what amount of total assets did Alpha report in its balance sheet immediately after the acquisition?

A) $1,100,000

B) $1,000,000

C) $800,000

D) $1600,000

Based on the preceding information,what amount of total assets did Alpha report in its balance sheet immediately after the acquisition?

A) $1,100,000

B) $1,000,000

C) $800,000

D) $1600,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

Alpha Company acquired 100 percent of the voting common shares of Gamma Corporation by issuing bonds with a par value and fair value of $200,000. Immediately prior to the acquisition, Alpha reported total assets of $600,000, liabilities of $370,000, and stockholders' equity of $230,000. At that date, Gamma reported total assets of $500,000, liabilities of $300,000, and stockholders' equity of $200,000. Included in Gamma's liabilities was an account payable to Alpha in the amount of $50,000, which Alpha included in its accounts receivable.

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after the acquisition?

A) $370,000

B) $670,000

C) $820,000

D) $870,000

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after the acquisition?

A) $370,000

B) $670,000

C) $820,000

D) $870,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

The Jamestown Corporation (Jamestown)reported net income for the current year of $200,000 and paid cash dividends of $30,000.The Stadium Company (Stadium)holds 22 percent of the outstanding voting stock of Jamestown.However,another corporation holds the other 78 percent ownership and does not take Stadium's wants and wishes into consideration when making financing and operating decisions for Jamestown.What investment income should Stadium recognize for the current year?

A) $6,600

B) $0

C) $44,000

D) $50,600

A) $6,600

B) $0

C) $44,000

D) $50,600

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

Grant, Inc. acquired 30 percent of South Co.'s voting stock for $200,000 on January 2, 20X4. Grant's 30 percent interest in South gave Grant the ability to exercise significant influence over South's operating and financial policies. During 20X4, South earned $80,000 and paid dividends of $50,000. South reported earnings of $100,000 for the six months ended June 30, 20X5, and $200,000 for the year ended December 31, 20X5. On July 1, 20X5, Grant sold half of its stock in South for $150,000 cash. South paid dividends of $60,000 on October 1, 20X5.

In its 20X5 income statement,what amount should Grant report as a gain from the sale of half of its investment?

A) $35,000

B) $24,500

C) $30,500

D) $45,500

In its 20X5 income statement,what amount should Grant report as a gain from the sale of half of its investment?

A) $35,000

B) $24,500

C) $30,500

D) $45,500

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

Grant, Inc. acquired 30 percent of South Co.'s voting stock for $200,000 on January 2, 20X4. Grant's 30 percent interest in South gave Grant the ability to exercise significant influence over South's operating and financial policies. During 20X4, South earned $80,000 and paid dividends of $50,000. South reported earnings of $100,000 for the six months ended June 30, 20X5, and $200,000 for the year ended December 31, 20X5. On July 1, 20X5, Grant sold half of its stock in South for $150,000 cash. South paid dividends of $60,000 on October 1, 20X5.

In Grant's December 31,20X4,balance sheet,what should be the carrying amount of this investment?

A) $224,000

B) $200,000

C) $234,000

D) $209,000

In Grant's December 31,20X4,balance sheet,what should be the carrying amount of this investment?

A) $224,000

B) $200,000

C) $234,000

D) $209,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation, its bitter rival, by issuing bonds with a par value and fair value of $150,000. Immediately prior to the acquisition, Beta reported total assets of $500,000, liabilities of $280,000, and stockholders' equity of $220,000. At that date, Standard Video reported total assets of $400,000, liabilities of $250,000, and stockholders' equity of $150,000. Included in Standard's liabilities was an account payable to Beta in the amount of $20,000, which Beta included in its accounts receivable.

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A) $220,000

B) $150,000

C) $370,000

D) $350,000

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A) $220,000

B) $150,000

C) $370,000

D) $350,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

On January 2,20X5,Well Co.purchased 10 percent of Rea,Inc.'s outstanding common shares for $400,000.Well is the largest single shareholder in Rea,and Well's officers are a majority on Rea's board of directors.As a result,Well is able to exercise significant influence over Rea.Rea reported net income of $500,000 for 20X5,and paid dividends of $150,000.In its December 31,20X5,balance sheet,what amount should Well report as investment in Rea?

A) $385,000

B) $450,000

C) $400,000

D) $435,000

A) $385,000

B) $450,000

C) $400,000

D) $435,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

Grant, Inc. acquired 30 percent of South Co.'s voting stock for $200,000 on January 2, 20X4. Grant's 30 percent interest in South gave Grant the ability to exercise significant influence over South's operating and financial policies. During 20X4, South earned $80,000 and paid dividends of $50,000. South reported earnings of $100,000 for the six months ended June 30, 20X5, and $200,000 for the year ended December 31, 20X5. On July 1, 20X5, Grant sold half of its stock in South for $150,000 cash. South paid dividends of $60,000 on October 1, 20X5.

What amount should Grant include in its 20X4 income statement as a result of the investment?

A) $15,000

B) $24,000

C) $50,000

D) $80,000

What amount should Grant include in its 20X4 income statement as a result of the investment?

A) $15,000

B) $24,000

C) $50,000

D) $80,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

Parent Co. purchases 100 percent of Son Company on January 1, 20X1, when Parent's retained earnings balance is $520,000 and Son's is $150,000. During 20X1, Son reports $15,000 of net income and declares $6,000 of dividends. Parent reports $105,000 of separate operating earnings plus $15,000 of equity-method income from its 100 percent interest in Son; Parent declares dividends of $40,000.

Based on the preceding information,what is Son's post-closing retained earnings balance on December 31,20X1:

A) $141,000

B) $150,000

C) $159,000

D) $165,000

Based on the preceding information,what is Son's post-closing retained earnings balance on December 31,20X1:

A) $141,000

B) $150,000

C) $159,000

D) $165,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

Phips Co. purchases 100 percent of Sips Company on January 1, 20X2, when Phips' retained earnings balance is $320,000 and Sips' is $120,000. During 20X2, Sips reports $20,000 of net income and declares $8,000 of dividends. Phips reports $125,000 of separate operating earnings plus $20,000 of equity-method income from its 100 percent interest in Sips; Phips declares dividends of $35,000.

Based on the preceding information,what is the consolidated retained earnings balance on December 31,20X2?

A) $402,000

B) $410,000

C) $430,000

D) $562,000

Based on the preceding information,what is the consolidated retained earnings balance on December 31,20X2?

A) $402,000

B) $410,000

C) $430,000

D) $562,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

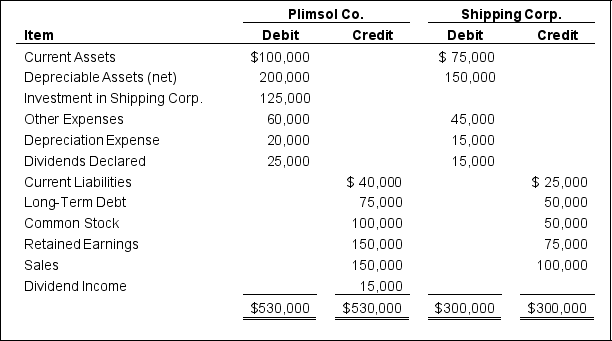

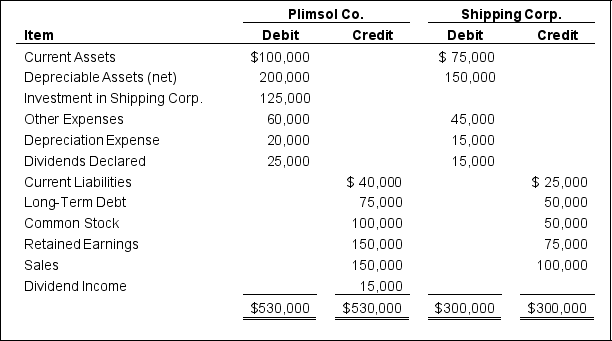

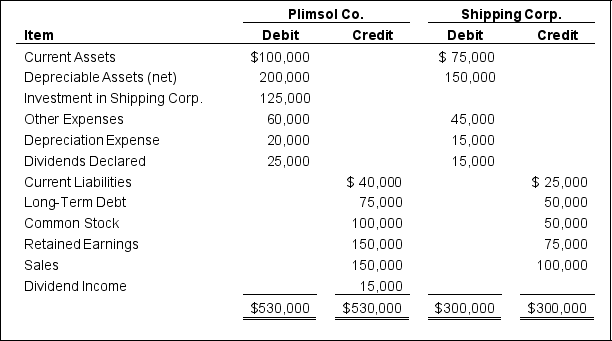

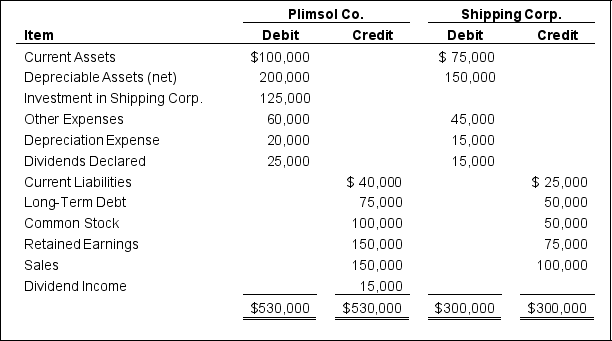

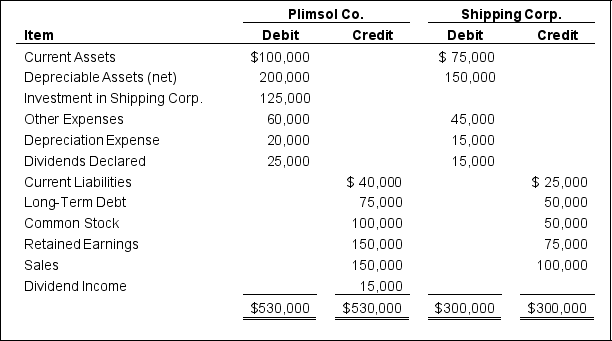

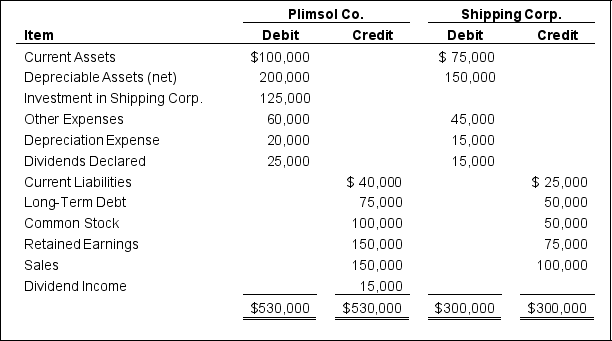

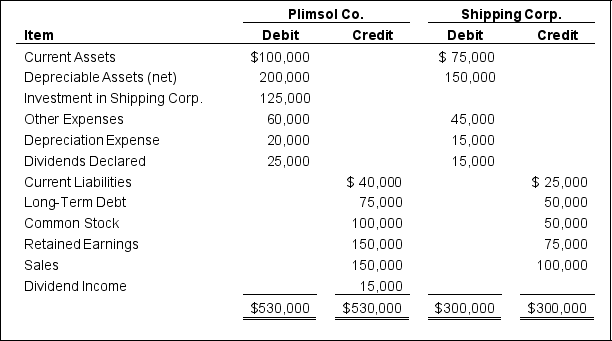

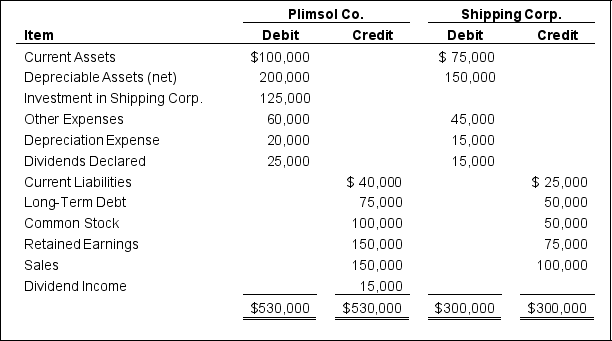

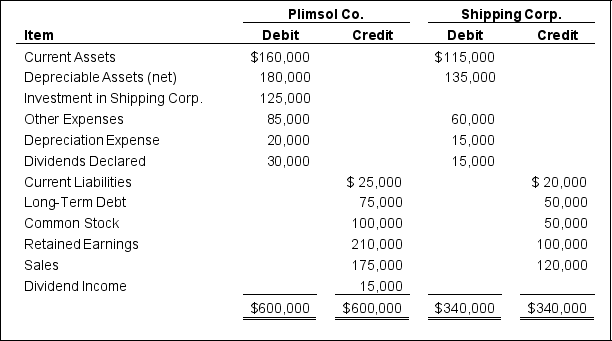

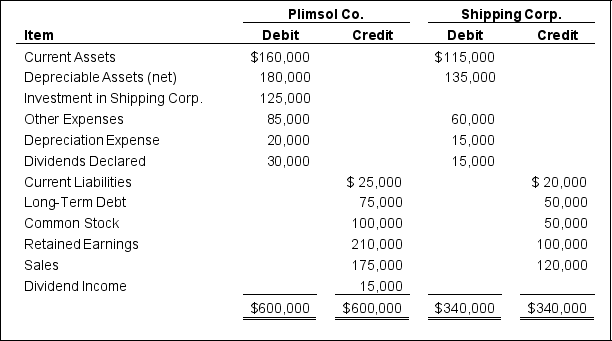

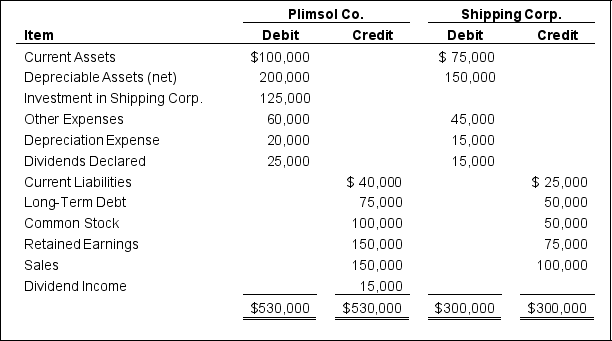

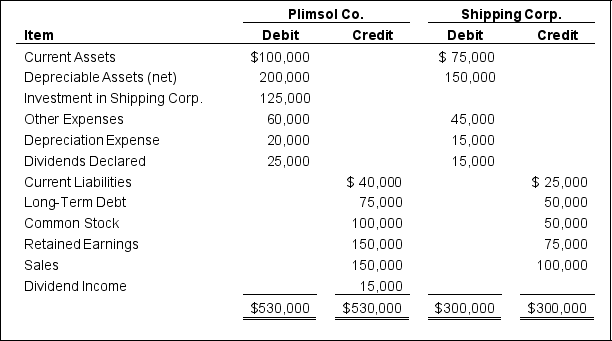

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:

Based on the information provided,what amount of total assets will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $425,000

B) $525,000

C) $650,000

D) $630,000

Based on the information provided,what amount of total assets will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $425,000

B) $525,000

C) $650,000

D) $630,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

Phips Co. purchases 100 percent of Sips Company on January 1, 20X2, when Phips' retained earnings balance is $320,000 and Sips' is $120,000. During 20X2, Sips reports $20,000 of net income and declares $8,000 of dividends. Phips reports $125,000 of separate operating earnings plus $20,000 of equity-method income from its 100 percent interest in Sips; Phips declares dividends of $35,000.

Based on the preceding information,what is Phips' post-closing retained earnings balance on December 31,20X2?

A) $305,000

B) $410,000

C) $430,000

D) $465,000

Based on the preceding information,what is Phips' post-closing retained earnings balance on December 31,20X2?

A) $305,000

B) $410,000

C) $430,000

D) $465,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:

Based on the information provided,what amount of net income will be reported in the consolidated financial statements prepared on December 31,20X4?

A) $100,000

B) $85,000

C) $110,000

D) $125,000

Based on the information provided,what amount of net income will be reported in the consolidated financial statements prepared on December 31,20X4?

A) $100,000

B) $85,000

C) $110,000

D) $125,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

In the absence of other evidence,common stock ownership of between 20 and 50 percent is viewed as indicating that the investor is able to exercise significant influence over the investee.What are some of the other factors that could constitute evidence of the ability to exercise significant influence?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

Pone Company purchased 100 percent of Sone Inc. on January 1, 20X9 for $625,000. Sone reported earnings of $76,000 and declared dividends of $8,000 during 20X9.

Based on the preceding information and assuming Pone uses the cost method to account for its investment in Sone,what is the balance in Pone's Investment in Sone account on December 31,20X9,prior to consolidation?

A) $617,000

B) $625,000

C) $633,000

D) $693,000

Based on the preceding information and assuming Pone uses the cost method to account for its investment in Sone,what is the balance in Pone's Investment in Sone account on December 31,20X9,prior to consolidation?

A) $617,000

B) $625,000

C) $633,000

D) $693,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:

Based on the information provided,what amount of total liabilities will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $525,000

B) $115,000

C) $125,000

D) $190,000

Based on the information provided,what amount of total liabilities will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $525,000

B) $115,000

C) $125,000

D) $190,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:

Based on the information provided,what amount of retained earnings will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $235,000

B) $210,000

C) $310,000

D) $225,000

Based on the information provided,what amount of retained earnings will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $235,000

B) $210,000

C) $310,000

D) $225,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

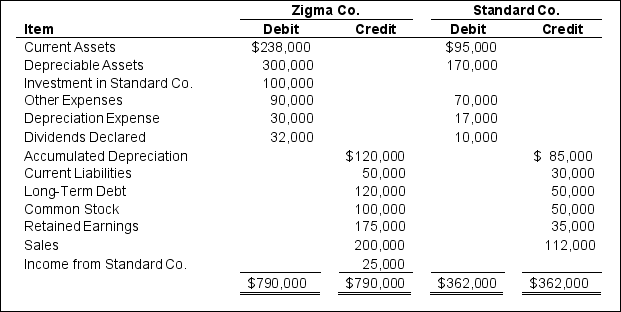

On January 1,20X7,Plimsol Company acquired 100 percent of Shipping Corporation's voting shares,at underlying book value.Plimsol uses the cost method in accounting for its investment in Shipping.Shipping's reported retained earnings of $75,000 on the date of acquisition.The trial balances for Plimsol Company and Shipping Corporation as of December 31,20X8,follow:

Required:

1.Provide all consolidating entries required to prepare a full set of consolidated statements for 20X8.

2.Prepare a three-part consolidation worksheet in good form as of December 31,20X8.

Problem 59 (continued):

Required:

1.Provide all consolidating entries required to prepare a full set of consolidated statements for 20X8.

2.Prepare a three-part consolidation worksheet in good form as of December 31,20X8.

Problem 59 (continued):

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

Parent Company purchased 100 percent of Son Inc. on January 1, 20X2 for $420,000. Son reported earnings of $82,000 and declared dividends of $4,000 during 20X2.

Based on the preceding information and assuming Parent uses the equity method to account for its investment in Son,what is the balance in Parent's Investment in Son account on December 31,20X2,prior to consolidation?

A) $416,000

B) $420,000

C) $424,000

D) $498,000

Based on the preceding information and assuming Parent uses the equity method to account for its investment in Son,what is the balance in Parent's Investment in Son account on December 31,20X2,prior to consolidation?

A) $416,000

B) $420,000

C) $424,000

D) $498,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

Phips Co. purchases 100 percent of Sips Company on January 1, 20X2, when Phips' retained earnings balance is $320,000 and Sips' is $120,000. During 20X2, Sips reports $20,000 of net income and declares $8,000 of dividends. Phips reports $125,000 of separate operating earnings plus $20,000 of equity-method income from its 100 percent interest in Sips; Phips declares dividends of $35,000.

Based on the preceding information,what is Sips' post-closing retained earnings balance on December 31,20X2?

A) $108,000

B) $120,000

C) $132,000

D) $140,000

Based on the preceding information,what is Sips' post-closing retained earnings balance on December 31,20X2?

A) $108,000

B) $120,000

C) $132,000

D) $140,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

The main guidance on equity-method reporting,found in ASC 323 and 325 requires all of the following except:

A) The investor's share of the investee's extraordinary items should be reported.

B) The investor's share of the investee's prior-period adjustments should be reported.

C) Continued use of the equity-method even if continued losses results in a zero or negative balance in the investment account.

D) Preferred dividends of the investee should be deducted from net income before the investor computes its share of investee earnings.

A) The investor's share of the investee's extraordinary items should be reported.

B) The investor's share of the investee's prior-period adjustments should be reported.

C) Continued use of the equity-method even if continued losses results in a zero or negative balance in the investment account.

D) Preferred dividends of the investee should be deducted from net income before the investor computes its share of investee earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

Pone Company purchased 100 percent of Sone Inc. on January 1, 20X9 for $625,000. Sone reported earnings of $76,000 and declared dividends of $8,000 during 20X9.

Based on the preceding information and assuming Pone uses the equity method to account for its investment in Sone,what is the balance in Pone's Investment in Sone account on December 31,20X9,prior to consolidation?

A) $617,000

B) $625,000

C) $633,000

D) $693,000

Based on the preceding information and assuming Pone uses the equity method to account for its investment in Sone,what is the balance in Pone's Investment in Sone account on December 31,20X9,prior to consolidation?

A) $617,000

B) $625,000

C) $633,000

D) $693,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

Parent Company purchased 100 percent of Son Inc. on January 1, 20X2 for $420,000. Son reported earnings of $82,000 and declared dividends of $4,000 during 20X2.

Based on the preceding information and assuming Parent uses the cost method to account for its investment in Son,what is the balance in Parent's Investment in Son account on December 31,20X2,prior to consolidation?

A) $416,000

B) $420,000

C) $424,000

D) $498,000

Based on the preceding information and assuming Parent uses the cost method to account for its investment in Son,what is the balance in Parent's Investment in Son account on December 31,20X2,prior to consolidation?

A) $416,000

B) $420,000

C) $424,000

D) $498,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

A cash dividend returns assets to the stockholders while reducing corporate liquidity.Why are not all cash dividends considered to be "liquidating dividends"? In your response include a discussion of how an investor accounts for a liquidating dividend.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

Dear Corporation acquired 100 percent of the voting shares of Therry Inc.by issuing 10,000 new shares of $5 par value common stock with a $30 market value.

Required:

1.Which company is the parent and which is the subsidiary?

2.Define a subsidiary corporation.

3.Define a parent corporation.

4.Which entity prepares consolidated worksheet?

5.Why are consolidation entries used?

Required:

1.Which company is the parent and which is the subsidiary?

2.Define a subsidiary corporation.

3.Define a parent corporation.

4.Which entity prepares consolidated worksheet?

5.Why are consolidation entries used?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

Parent Co. purchases 100 percent of Son Company on January 1, 20X1, when Parent's retained earnings balance is $520,000 and Son's is $150,000. During 20X1, Son reports $15,000 of net income and declares $6,000 of dividends. Parent reports $105,000 of separate operating earnings plus $15,000 of equity-method income from its 100 percent interest in Son; Parent declares dividends of $40,000.

Based on the preceding information,what is the consolidated retained earnings balance on December 31,20X1?

A) $470,000

B) $585,000

C) $600,000

D) $759,000

Based on the preceding information,what is the consolidated retained earnings balance on December 31,20X1?

A) $470,000

B) $585,000

C) $600,000

D) $759,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

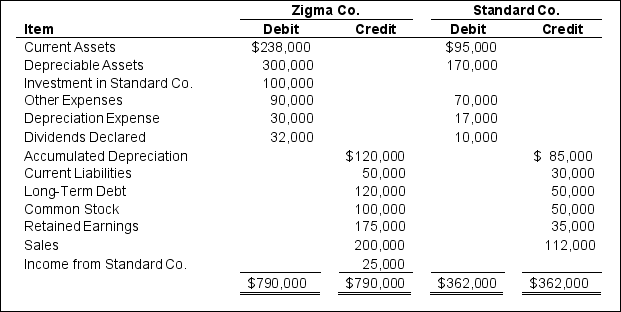

On January 1,20X9,Zigma Company acquired 100 percent of Standard Company's common shares at underlying book value.Zigma uses the equity method in accounting for its ownership of Standard.On December 31,20X9,the trial balances of the two companies are as follows:

Required:

1.Prepare the consolidation entries needed as of December 31,20X9,to complete a consolidation worksheet.

2.Prepare a three-part consolidation worksheet as of December 31,20X9.

Problem 57 (continued):

Required:

1.Prepare the consolidation entries needed as of December 31,20X9,to complete a consolidation worksheet.

2.Prepare a three-part consolidation worksheet as of December 31,20X9.

Problem 57 (continued):

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

On January 1, 20X4, Plimsol Company acquired 100 percent of Shipping Corporation's voting shares, at underlying book value. Plimsol uses the cost method in accounting for its investment in Shipping. Shipping's retained earnings was $75,000 on the date of acquisition. On December 31, 20X4, the trial balance data for the two companies are as follows:

Based on the information provided,what amount of total stockholder's equity will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $190,000

B) $335,000

C) $460,000

D) $310,000

Based on the information provided,what amount of total stockholder's equity will be reported in the consolidated balance sheet prepared on December 31,20X4?

A) $190,000

B) $335,000

C) $460,000

D) $310,000

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck