Deck 6: Intercompany Inventory Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 6: Intercompany Inventory Transactions

1

Consolidated net income may include the parent's separate operating income plus the parent's share of the subsidiary's reported net income:

A) plus the unrealized profit on upstream intercompany sales of inventory made during the current year.

B) plus the profit realized this year from upstream intercompany sales of inventory made last year.

C) plus unrealized profit on downstream intercompany sales of inventory made during the current year.

D) minus the parent's share of profit realized this year from upstream intercompany sales of inventory made last year.

A) plus the unrealized profit on upstream intercompany sales of inventory made during the current year.

B) plus the profit realized this year from upstream intercompany sales of inventory made last year.

C) plus unrealized profit on downstream intercompany sales of inventory made during the current year.

D) minus the parent's share of profit realized this year from upstream intercompany sales of inventory made last year.

B

2

On January 1, 20X1, Picture Company acquired 70 percent ownership of Seven Corporation at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Seven Corporation. On April 25, 20X1, Seven purchased inventory from Picture for $45,000. Seven sold the entire inventory to an unaffiliated company for $58,000 on October 12, 20X1. Picture had produced the inventory sold to Seven for $38,000. The companies had no other transactions during 20X1.

Based on the information given above,what amount of cost of goods sold will be reported in the 20X1 consolidated income statement?

A) $13,000

B) $38,000

C) $45,000

D) $58,000

Based on the information given above,what amount of cost of goods sold will be reported in the 20X1 consolidated income statement?

A) $13,000

B) $38,000

C) $45,000

D) $58,000

B

3

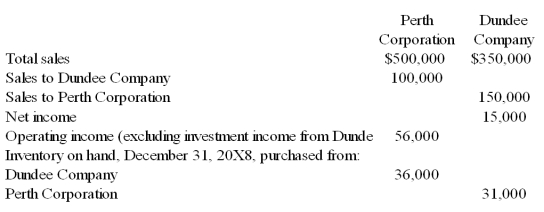

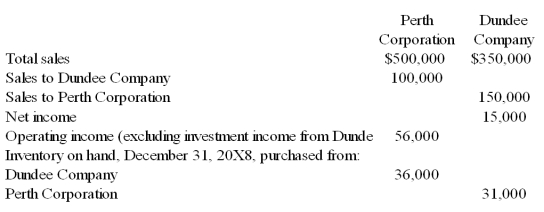

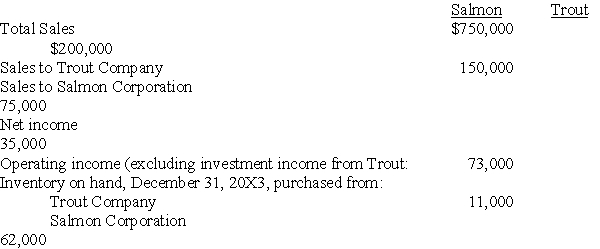

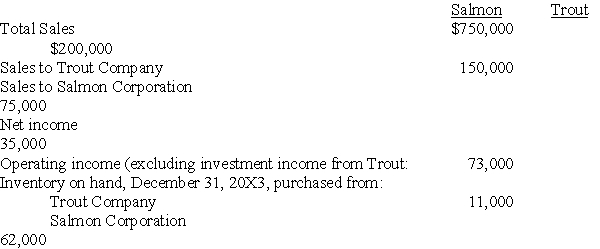

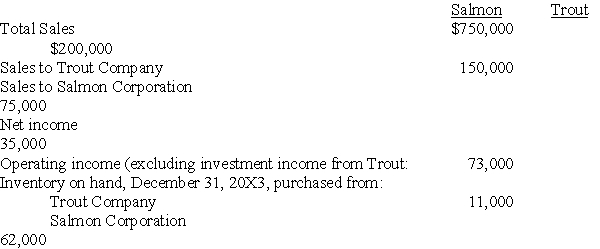

Perth Corporation owns 90 percent of Dundee Company's stock. At the end of 20X8, Perth and Dundee reported the following partial operating results and inventory balances:

Perth regularly prices its products at cost plus a 30 percent markup for profit. Dundee prices its sales at cost plus a 10 percent markup. The total sales reported by Perth and Dundee include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what balance will be reported for inventory in the consolidated balance sheet for December 31,20X8?

A) $56,573

B) $23,846

C) $32,727

D) $67,000

Perth regularly prices its products at cost plus a 30 percent markup for profit. Dundee prices its sales at cost plus a 10 percent markup. The total sales reported by Perth and Dundee include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what balance will be reported for inventory in the consolidated balance sheet for December 31,20X8?

A) $56,573

B) $23,846

C) $32,727

D) $67,000

A

4

During the year a parent makes sales of inventory at a profit to its 75 percent owned subsidiary.The subsidiary also makes sales of inventory at a profit to its parent during the same year.Both the parent and the subsidiary have on hand at the end of the year 20 percent of the inventory acquired from one another.Consolidated revenues for the year should exclude:

A) 80 percent of the total revenues from intercompany sales.

B) total revenues from intercompany sales.

C) only the revenues from the subsidiary's intercompany sales.

D) only the revenues from the parent's intercompany sales.

A) 80 percent of the total revenues from intercompany sales.

B) total revenues from intercompany sales.

C) only the revenues from the subsidiary's intercompany sales.

D) only the revenues from the parent's intercompany sales.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

On January 1, 20X1, Picture Company acquired 70 percent ownership of Seven Corporation at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Seven Corporation. On April 25, 20X1, Seven purchased inventory from Picture for $45,000. Seven sold the entire inventory to an unaffiliated company for $58,000 on October 12, 20X1. Picture had produced the inventory sold to Seven for $38,000. The companies had no other transactions during 20X1.

Based on the information given above,what amount of sales will be reported in the 20X1 consolidated income statement?

A) $13,000

B) $38,000

C) $45,000

D) $58,000

Based on the information given above,what amount of sales will be reported in the 20X1 consolidated income statement?

A) $13,000

B) $38,000

C) $45,000

D) $58,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

On January 1, 20X1, Picture Company acquired 70 percent ownership of Seven Corporation at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Seven Corporation. On April 25, 20X1, Seven purchased inventory from Picture for $45,000. Seven sold the entire inventory to an unaffiliated company for $58,000 on October 12, 20X1. Picture had produced the inventory sold to Seven for $38,000. The companies had no other transactions during 20X1.

Based on the information given above,what amount of consolidated net income will be assigned to the controlling shareholders for 20X1?

A) $14,000

B) $16,100

C) $17,900

D) $20,000

Based on the information given above,what amount of consolidated net income will be assigned to the controlling shareholders for 20X1?

A) $14,000

B) $16,100

C) $17,900

D) $20,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

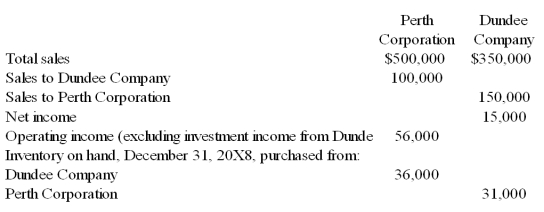

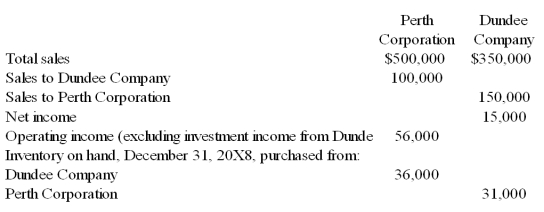

Perth Corporation owns 90 percent of Dundee Company's stock. At the end of 20X8, Perth and Dundee reported the following partial operating results and inventory balances:

Perth regularly prices its products at cost plus a 30 percent markup for profit. Dundee prices its sales at cost plus a 10 percent markup. The total sales reported by Perth and Dundee include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what amount of sales will be reported in the consolidated income statement for 20X8?

A) $500,000

B) $850,000

C) $600,000

D) $800,000

Perth regularly prices its products at cost plus a 30 percent markup for profit. Dundee prices its sales at cost plus a 10 percent markup. The total sales reported by Perth and Dundee include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what amount of sales will be reported in the consolidated income statement for 20X8?

A) $500,000

B) $850,000

C) $600,000

D) $800,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Earth Company owns 100 percent of the capital stock of both Mars Corporation and Venus Corporation. Mars purchases merchandise inventory from Venus at 125 percent of Venus's cost. During 20X8, Venus sold inventory to Mars that it had purchased for $25,000. Mars sold all of this merchandise to unrelated customers for $56,892 during 20X8. In preparing combined financial statements for 20X8, Earth's bookkeeper disregarded the common ownership of Mars and Venus.

Based on the information given above,what amount should be eliminated from cost of goods sold in the combined income statement for 20X8?

A) $31,250

B) $25,000

C) $56,892

D) $6,250

Based on the information given above,what amount should be eliminated from cost of goods sold in the combined income statement for 20X8?

A) $31,250

B) $25,000

C) $56,892

D) $6,250

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

On January 1, 20X8, Parent Company acquired 90 percent ownership of Subsidiary Corporation, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 10 percent of the book value of Subsidiary Corporation. On Mar 17, 20X8, Subsidiary purchased inventory from Parent for $90,000. Subsidiary sold the entire inventory to an unaffiliated company for $120,000 on November 21, 20X8. Parent had produced the inventory sold to Subsidiary for $62,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of sales will be reported in the 20X8 consolidated income statement?

A) $62,000

B) $120,000

C) $90,000

D) $58,000

Based on the information given above,what amount of sales will be reported in the 20X8 consolidated income statement?

A) $62,000

B) $120,000

C) $90,000

D) $58,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

ABC Corporation owns 75 percent of XYZ Company's voting shares. During 20X8, ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each. XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold did ABC record in 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Based on the information given above,what amount of cost of goods sold did ABC record in 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

On January 1, 20X8, Parent Company acquired 90 percent ownership of Subsidiary Corporation, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 10 percent of the book value of Subsidiary Corporation. On Mar 17, 20X8, Subsidiary purchased inventory from Parent for $90,000. Subsidiary sold the entire inventory to an unaffiliated company for $120,000 on November 21, 20X8. Parent had produced the inventory sold to Subsidiary for $62,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of cost of goods sold will be reported in the 20X8 consolidated income statement?

A) $62,000

B) $120,000

C) $90,000

D) $58,000

Based on the information given above,what amount of cost of goods sold will be reported in the 20X8 consolidated income statement?

A) $62,000

B) $120,000

C) $90,000

D) $58,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, 20X8, Parent Company acquired 90 percent ownership of Subsidiary Corporation, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 10 percent of the book value of Subsidiary Corporation. On Mar 17, 20X8, Subsidiary purchased inventory from Parent for $90,000. Subsidiary sold the entire inventory to an unaffiliated company for $120,000 on November 21, 20X8. Parent had produced the inventory sold to Subsidiary for $62,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of consolidated net income will be assigned to the controlling shareholders for 20X8?

A) $58,000

B) $59,000

C) $55,000

D) $52,200

Based on the information given above,what amount of consolidated net income will be assigned to the controlling shareholders for 20X8?

A) $58,000

B) $59,000

C) $55,000

D) $52,200

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

When a parent and its subsidiary use a periodic inventory system rather than a perpetual system,the income and asset balances reported in the consolidated financial statements are:

I)affected only if there are upstream intercompany sales of inventory.

II)affected only if there are downstream intercompany sales of inventory.

A) I

B) II

C) Both I and II

D) Neither I nor II

I)affected only if there are upstream intercompany sales of inventory.

II)affected only if there are downstream intercompany sales of inventory.

A) I

B) II

C) Both I and II

D) Neither I nor II

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

Senior Inc.owns 85 percent of Junior Inc.During 20X8,Senior sold goods with a 25 percent gross profit to Junior.Junior sold all of these goods in 20X8.How should 20X8 consolidated income statement items be adjusted?

A) No adjustment is necessary.

B) Sales and cost of goods sold should be reduced by 85 percent of the intercompany sales.

C) Net income should be reduced by 85 percent of the gross profit on intercompany sales.

D) Sales and cost of goods sold should be reduced by the intercompany sales.

A) No adjustment is necessary.

B) Sales and cost of goods sold should be reduced by 85 percent of the intercompany sales.

C) Net income should be reduced by 85 percent of the gross profit on intercompany sales.

D) Sales and cost of goods sold should be reduced by the intercompany sales.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

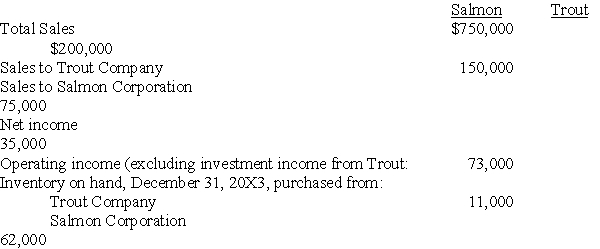

Salmon Corporation owns 65 percent of Trout Company's stock. At the end of 20X3, Salmon and Trout reported the following partial operating results and inventory balances:

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what amount of sales will be reported in the consolidated income statement for 20X3?

A) $725,000

B) $750,000

C) $875,000

D) $950,000

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.Based on the information given above,what amount of sales will be reported in the consolidated income statement for 20X3?

A) $725,000

B) $750,000

C) $875,000

D) $950,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Earth Company owns 100 percent of the capital stock of both Mars Corporation and Venus Corporation. Mars purchases merchandise inventory from Venus at 125 percent of Venus's cost. During 20X8, Venus sold inventory to Mars that it had purchased for $25,000. Mars sold all of this merchandise to unrelated customers for $56,892 during 20X8. In preparing combined financial statements for 20X8, Earth's bookkeeper disregarded the common ownership of Mars and Venus.

Based on the information given above,by what amount was unadjusted revenue overstated in the combined income statement for 20X8?

A) $25,000

B) $56,892

C) $31,250

D) $6,250

Based on the information given above,by what amount was unadjusted revenue overstated in the combined income statement for 20X8?

A) $25,000

B) $56,892

C) $31,250

D) $6,250

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following are examples of intercompany balances and transactions that must be eliminated in preparing consolidated financial statements?

I)Security holdings

II)Interest and dividends

III)Sales and purchases

A) I, II

B) I, III

C) I, II, III

D) II

I)Security holdings

II)Interest and dividends

III)Sales and purchases

A) I, II

B) I, III

C) I, II, III

D) II

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Global Corporation acquired 85 percent of Local Company's voting shares of stock in 20X7.During 20X8,Global purchased 50,000 picture tubes for $15 each and sold 28,000 of them to Local for $20 each.Local sold all of the units to unrelated entities prior to December 31,20X8,for $30 each.Both companies use perpetual inventory systems.

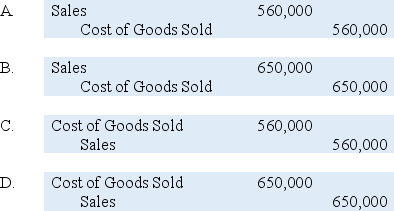

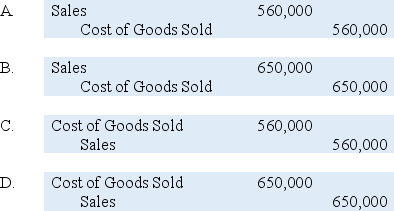

Which worksheet consolidating entry is needed in preparing consolidated financial statements for 20X8 to remove all effects of the intercompany sale?

A) Option A

B) Option B

C) Option C

D) Option D

Which worksheet consolidating entry is needed in preparing consolidated financial statements for 20X8 to remove all effects of the intercompany sale?

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

Consolidated net income for a parent and its 80 percent owned subsidiary should be computed by eliminating:

A) all unrealized profit in downstream intercompany inventory sales, and unrealized profit in upstream intercompany inventory sales made during the current year.

B) all unrealized profit in downstream intercompany inventory sales, and the noncontrolling interest's share of unrealized profit in upstream inventory sales made during the current year.

C) the controlling interest's share of unrealized profit in downstream intercompany sales, and the controlling interest's share of unrealized profit in upstream sales made during the current year.

D) all unrealized profit in downstream intercompany sales, and the noncontrolling interest's share of unrealized profit in upstream sales made during the current year.

A) all unrealized profit in downstream intercompany inventory sales, and unrealized profit in upstream intercompany inventory sales made during the current year.

B) all unrealized profit in downstream intercompany inventory sales, and the noncontrolling interest's share of unrealized profit in upstream inventory sales made during the current year.

C) the controlling interest's share of unrealized profit in downstream intercompany sales, and the controlling interest's share of unrealized profit in upstream sales made during the current year.

D) all unrealized profit in downstream intercompany sales, and the noncontrolling interest's share of unrealized profit in upstream sales made during the current year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Salmon Corporation owns 65 percent of Trout Company's stock. At the end of 20X3, Salmon and Trout reported the following partial operating results and inventory balances:

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Based on the information given above,what balance will be reported for inventory in the consolidated balance sheet for December 31,20X3?

A) $8,800

B) $44,286

C) $53,086

D) $73,000

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.

Salmon regularly prices its products at cost plus a 40 percent markup for profit. Trout prices its sales at cost plus a 25 percent markup. The total sales reported by Salmon and Trout include both intercompany sales and sales to nonaffiliates.Based on the information given above,what balance will be reported for inventory in the consolidated balance sheet for December 31,20X3?

A) $8,800

B) $44,286

C) $53,086

D) $73,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

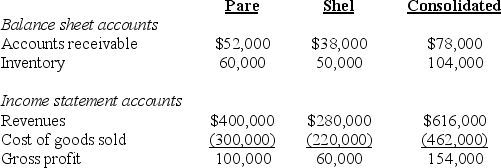

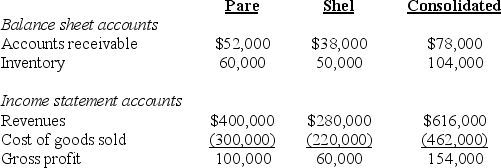

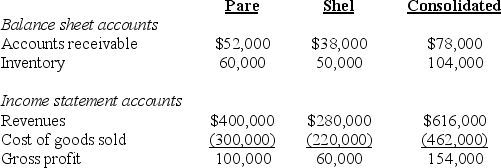

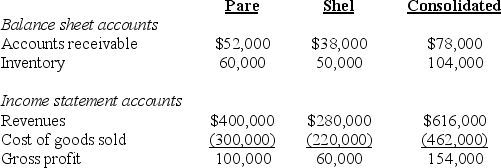

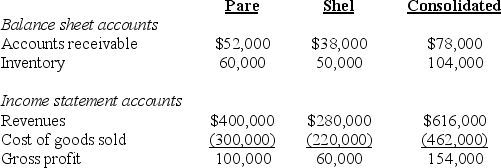

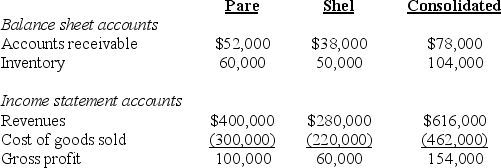

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

What was the amount of intercompany sales from Pare to Shel during 20X5?

A) $12,000

B) $6,000

C) $64,000

D) $58,000

Additional information:

Additional information:During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

What was the amount of intercompany sales from Pare to Shel during 20X5?

A) $12,000

B) $6,000

C) $64,000

D) $58,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

Pilfer Company acquired 90 percent ownership of Scrooge Corporation in 20X7, at underlying book value. On that date, the fair value of noncontrolling interest was equal to 10 percent of the book value of Scrooge Corporation. Pilfer purchased inventory from Scrooge for $90,000 on August 20, 20X8, and resold 70 percent of the inventory to unaffiliated companies on December 1, 20X8, for $100,000. Scrooge produced the inventory sold to Pilfer for $67,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of consolidated net income will be assigned to the controlling interest for 20X8?

A) $51,490

B) $53,100

C) $37,000

D) $20,100

Based on the information given above,what amount of consolidated net income will be assigned to the controlling interest for 20X8?

A) $51,490

B) $53,100

C) $37,000

D) $20,100

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

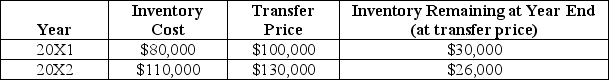

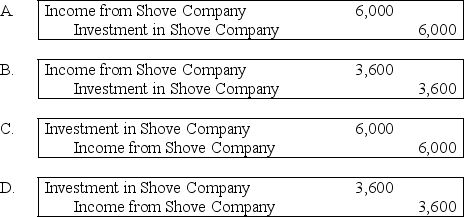

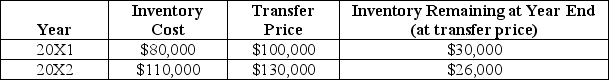

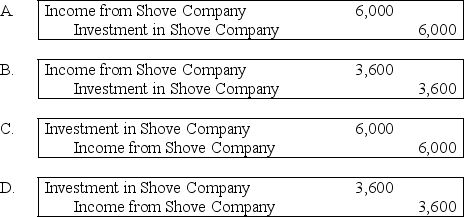

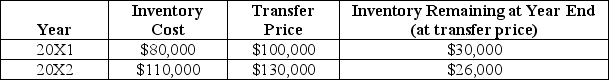

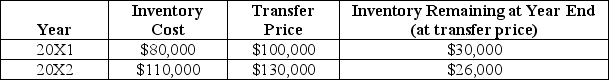

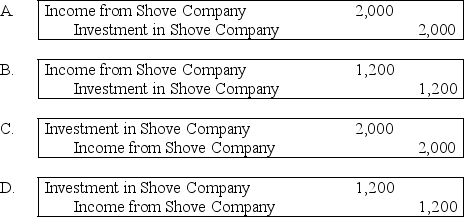

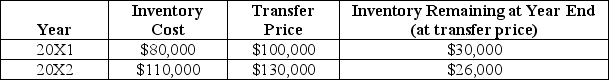

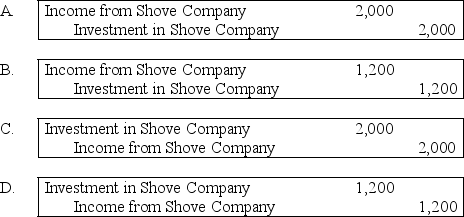

Push Company owns 60% of Shove Company's outstanding common stock. Intra-entity sales are as follows:

Assume Push sold the inventory to Shove.Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

Assume Push sold the inventory to Shove.Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

Pink Corporation owns 80 percent of Sink Company's voting shares. During 20X4, Pink produced 60,000 smart phones at a cost of $62 each and sold 45,000 smart phones to Sink for $93 each. Sink sold 26,000 of the smart phones to unaffiliated companies for $128 each prior to December 31, 20X4, and sold the remainder in early 20X5 to unaffiliated companies for $133 each. Both companies use the perpetual inventory systems.

Based on the information given above,what amount of cost of goods must be eliminated from the consolidated income statement for 20X4?

A) $3,596,000

B) $3,379,000

C) $806,000

D) $589,000

Based on the information given above,what amount of cost of goods must be eliminated from the consolidated income statement for 20X4?

A) $3,596,000

B) $3,379,000

C) $806,000

D) $589,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Pink Corporation owns 80 percent of Sink Company's voting shares. During 20X4, Pink produced 60,000 smart phones at a cost of $62 each and sold 45,000 smart phones to Sink for $93 each. Sink sold 26,000 of the smart phones to unaffiliated companies for $128 each prior to December 31, 20X4, and sold the remainder in early 20X5 to unaffiliated companies for $133 each. Both companies use the perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold must be reported in the consolidated income statement for 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Based on the information given above,what amount of cost of goods sold must be reported in the consolidated income statement for 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

In Pare's consolidating worksheet,what amount of unrealized intercompany profit was eliminated?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Additional information:

Additional information:During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

In Pare's consolidating worksheet,what amount of unrealized intercompany profit was eliminated?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

Pilfer Company acquired 90 percent ownership of Scrooge Corporation in 20X7, at underlying book value. On that date, the fair value of noncontrolling interest was equal to 10 percent of the book value of Scrooge Corporation. Pilfer purchased inventory from Scrooge for $90,000 on August 20, 20X8, and resold 70 percent of the inventory to unaffiliated companies on December 1, 20X8, for $100,000. Scrooge produced the inventory sold to Pilfer for $67,000. The companies had no other transactions during 20X8.

Based on the information given above,what inventory balance will be reported by the consolidated entity on December 31,20X8?

A) $51,490

B) $53,100

C) $37,000

D) $20,100

Based on the information given above,what inventory balance will be reported by the consolidated entity on December 31,20X8?

A) $51,490

B) $53,100

C) $37,000

D) $20,100

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

ABC Corporation owns 75 percent of XYZ Company's voting shares. During 20X8, ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each. XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold must be reported in the consolidated income statement for 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Based on the information given above,what amount of cost of goods sold must be reported in the consolidated income statement for 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

Selected information from the separate and consolidated balance sheets and income statements of Pare, Inc. and its subsidiary, Shel Co., as of December 31, 20X5, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

At December 31,20X5,what was the amount of Shel's payable to Pare for intercompany sales?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Additional information:

Additional information:During 20X5, Pare sold goods to Shel at the same markup on cost that Pare uses for all sales.

At December 31,20X5,what was the amount of Shel's payable to Pare for intercompany sales?

A) $12,000

B) $6,000

C) $58,000

D) $64,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

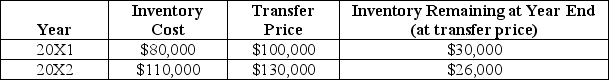

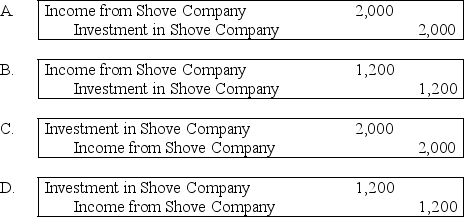

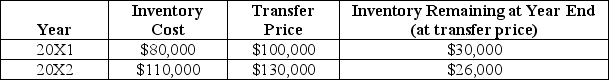

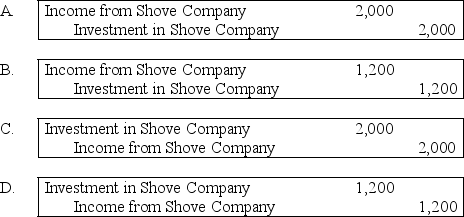

Push Company owns 60% of Shove Company's outstanding common stock. Intra-entity sales are as follows:

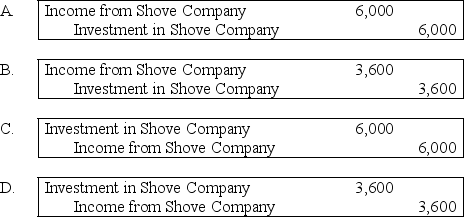

Assume Shove sold the inventory to Push.Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

Assume Shove sold the inventory to Push.Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Pink Corporation owns 80 percent of Sink Company's voting shares. During 20X4, Pink produced 60,000 smart phones at a cost of $62 each and sold 45,000 smart phones to Sink for $93 each. Sink sold 26,000 of the smart phones to unaffiliated companies for $128 each prior to December 31, 20X4, and sold the remainder in early 20X5 to unaffiliated companies for $133 each. Both companies use the perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold did Sink record in 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Based on the information given above,what amount of cost of goods sold did Sink record in 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Pink Corporation owns 80 percent of Sink Company's voting shares. During 20X4, Pink produced 60,000 smart phones at a cost of $62 each and sold 45,000 smart phones to Sink for $93 each. Sink sold 26,000 of the smart phones to unaffiliated companies for $128 each prior to December 31, 20X4, and sold the remainder in early 20X5 to unaffiliated companies for $133 each. Both companies use the perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold did Pink record in 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Based on the information given above,what amount of cost of goods sold did Pink record in 20X4?

A) $1,612,000

B) $2,418,000

C) $2,790,000

D) $3,596,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

Pilfer Company acquired 90 percent ownership of Scrooge Corporation in 20X7, at underlying book value. On that date, the fair value of noncontrolling interest was equal to 10 percent of the book value of Scrooge Corporation. Pilfer purchased inventory from Scrooge for $90,000 on August 20, 20X8, and resold 70 percent of the inventory to unaffiliated companies on December 1, 20X8, for $100,000. Scrooge produced the inventory sold to Pilfer for $67,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of sales will be reported in the 20X8 consolidated income statement?

A) $90,000

B) $120,000

C) $100,000

D) $67,000

Based on the information given above,what amount of sales will be reported in the 20X8 consolidated income statement?

A) $90,000

B) $120,000

C) $100,000

D) $67,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

ABC Corporation owns 75 percent of XYZ Company's voting shares. During 20X8, ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each. XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold did XYZ record in 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Based on the information given above,what amount of cost of goods sold did XYZ record in 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

ABC Corporation owns 75 percent of XYZ Company's voting shares. During 20X8, ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each. XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X9?

A) $187,000

B) $221,000

C) $1,422,000

D) $2,963,000

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X9?

A) $187,000

B) $221,000

C) $1,422,000

D) $2,963,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

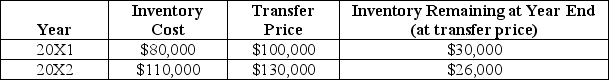

Push Company owns 60% of Shove Company's outstanding common stock. Intra-entity sales are as follows:

Assume Push sold the inventory to Shove.Using the fully adjusted equity method,what journal entry would be recorded by Push to recognize the realization of the 20X1 deferred intercompany profit and to defer the 20X2 unrealized gross profit on inventory sales to Shove?

Assume Push sold the inventory to Shove.Using the fully adjusted equity method,what journal entry would be recorded by Push to recognize the realization of the 20X1 deferred intercompany profit and to defer the 20X2 unrealized gross profit on inventory sales to Shove?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

ABC Corporation owns 75 percent of XYZ Company's voting shares. During 20X8, ABC produced 50,000 chairs at a cost of $79 each and sold 35,000 chairs to XYZ for $90 each. XYZ sold 18,000 of the chairs to unaffiliated companies for $117 each prior to December 31, 20X8, and sold the remainder in early 20X9 to unaffiliated companies for $130 each. Both companies use perpetual inventory systems.

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X8?

A) $2,765,000

B) $1,620,000

C) $1,422,000

D) $2,963,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Pink Corporation owns 80 percent of Sink Company's voting shares. During 20X4, Pink produced 60,000 smart phones at a cost of $62 each and sold 45,000 smart phones to Sink for $93 each. Sink sold 26,000 of the smart phones to unaffiliated companies for $128 each prior to December 31, 20X4, and sold the remainder in early 20X5 to unaffiliated companies for $133 each. Both companies use the perpetual inventory systems.

Based on the information given above,what amount of cost of goods must be eliminated from the consolidated income statement for 20X5?

E) $3,596,000

F) $3,379,000

G) $806,000 H. $589,000

Based on the information given above,what amount of cost of goods must be eliminated from the consolidated income statement for 20X5?

E) $3,596,000

F) $3,379,000

G) $806,000 H. $589,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Pilfer Company acquired 90 percent ownership of Scrooge Corporation in 20X7, at underlying book value. On that date, the fair value of noncontrolling interest was equal to 10 percent of the book value of Scrooge Corporation. Pilfer purchased inventory from Scrooge for $90,000 on August 20, 20X8, and resold 70 percent of the inventory to unaffiliated companies on December 1, 20X8, for $100,000. Scrooge produced the inventory sold to Pilfer for $67,000. The companies had no other transactions during 20X8.

Based on the information given above,what amount of cost of goods sold will be reported in the 20X8 consolidated income statement?

A) $60,900

B) $90,000

C) $46,900

D) $67,000

Based on the information given above,what amount of cost of goods sold will be reported in the 20X8 consolidated income statement?

A) $60,900

B) $90,000

C) $46,900

D) $67,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

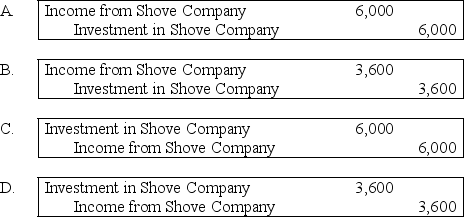

Push Company owns 60% of Shove Company's outstanding common stock. Intra-entity sales are as follows:

Assume Shove sold the inventory to Push.Using the fully adjusted equity method,what journal entry would be recorded by Push to recognize the realization of the 20X1 deferred intercompany profit and to defer the 20X2 unrealized gross profit on inventory sales to Shove?

Assume Shove sold the inventory to Push.Using the fully adjusted equity method,what journal entry would be recorded by Push to recognize the realization of the 20X1 deferred intercompany profit and to defer the 20X2 unrealized gross profit on inventory sales to Shove?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

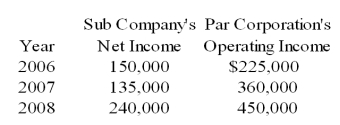

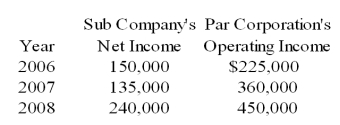

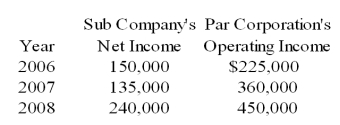

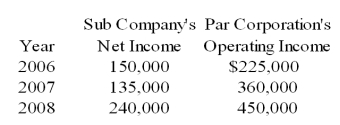

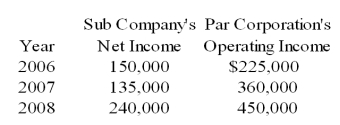

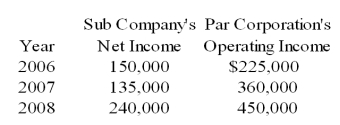

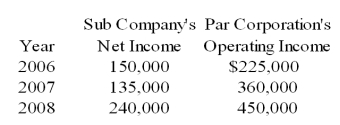

Sub Company sells all its output at 20 percent above cost to Par Corporation. Par purchases its entire inventory from Sub. The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income to controlling interest for 20X8?

A) $615,375

B) $686,250

C) $690,000

D) $694,000

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income to controlling interest for 20X8?

A) $615,375

B) $686,250

C) $690,000

D) $694,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

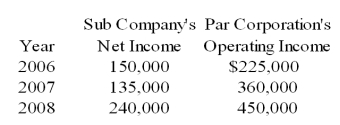

Sub Company sells all its output at 20 percent above cost to Par Corporation. Par purchases its entire inventory from Sub. The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income to noncontrolling interest for 20X8?

A) $39,750

B) $37,875

C) $71,275

D) $70,875

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income to noncontrolling interest for 20X8?

A) $39,750

B) $37,875

C) $71,275

D) $70,875

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

Binary Company acquired 75 percent ownership of Fordham Corporation in 20X5, at underlying book value. On that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Fordham Corporation. Binary purchased inventory from Fordham for $150,000 on July 24, 20X6, and resold 90 percent of the inventory to unaffiliated companies on November 11, 20X6, for $160,000. Fordham produced the inventory sold to Binary for $120,000. The companies had no other transactions during 20X6.

Based on the information given above,what inventory balance will be reported by the consolidated entity on December 31,20X6?

A) $3,000

B) $12,000

C) $15,000

D) $25,000

Based on the information given above,what inventory balance will be reported by the consolidated entity on December 31,20X6?

A) $3,000

B) $12,000

C) $15,000

D) $25,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

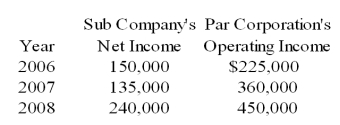

Sub Company sells all its output at 20 percent above cost to Par Corporation. Par purchases its entire inventory from Sub. The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income assigned to controlling interest for 20X7?

A) $448,375

B) $495,000

C) $486,250

D) $615,375

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the income assigned to controlling interest for 20X7?

A) $448,375

B) $495,000

C) $486,250

D) $615,375

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Elvis Company purchases inventory for $70,000 on Mar 19, 20X8 and sells it to Graceland Corporation for $95,000 on May 14, 20X8. Graceland still holds the inventory on December 31, 20X8, and determines that its market value (replacement cost) is $82,000 at that time. Graceland writes the inventory down from $95,000 to its lower market value of $82,000 at the end of the year. Elvis owns 75 percent of Graceland.

Based on the information given above,what amount of inventory should be eliminated in the consolidation worksheet for 20X8?

A) $15,000

B) $14,000

C) $12,000

D) $13,000

Based on the information given above,what amount of inventory should be eliminated in the consolidation worksheet for 20X8?

A) $15,000

B) $14,000

C) $12,000

D) $13,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

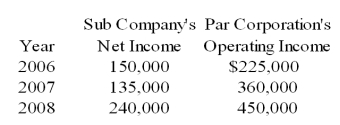

Sub Company sells all its output at 20 percent above cost to Par Corporation. Par purchases its entire inventory from Sub. The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the consolidated net income for 20X7?

A) $495,000

B) $317,750

C) $486,250

D) $690,000

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the consolidated net income for 20X7?

A) $495,000

B) $317,750

C) $486,250

D) $690,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

The consolidation treatment of profits on inventory transfers that occurred before the business combination depends on whether:

I)the companies were independent at that time.

II)the sale transaction was the result of arm's-length bargaining.

A) I

B) II

C) Both I and II

D) Neither I nor II

I)the companies were independent at that time.

II)the sale transaction was the result of arm's-length bargaining.

A) I

B) II

C) Both I and II

D) Neither I nor II

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

Elvis Company purchases inventory for $70,000 on Mar 19, 20X8 and sells it to Graceland Corporation for $95,000 on May 14, 20X8. Graceland still holds the inventory on December 31, 20X8, and determines that its market value (replacement cost) is $82,000 at that time. Graceland writes the inventory down from $95,000 to its lower market value of $82,000 at the end of the year. Elvis owns 75 percent of Graceland.

Based on the information given above,what amount of cost of goods sold should be eliminated in the consolidation worksheet for 20X8?

A) $82,000

B) $70,000

C) $95,000

D) $60,000

Based on the information given above,what amount of cost of goods sold should be eliminated in the consolidation worksheet for 20X8?

A) $82,000

B) $70,000

C) $95,000

D) $60,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock. During 20X8, Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000. Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2. Prior to December 31, 20X8, Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31, 20X8.

Based on the information given above,what amount of inventory must be eliminated from the consolidated balance sheet for 20X8?

A) $2,400

B) $9,000

C) $12,000

D) $3,000

Based on the information given above,what amount of inventory must be eliminated from the consolidated balance sheet for 20X8?

A) $2,400

B) $9,000

C) $12,000

D) $3,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock. During 20X8, Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000. Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2. Prior to December 31, 20X8, Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31, 20X8.

Based on the information given above,what amount should be reported in the 20X8 consolidated income statement as cost of goods sold?

A) $36,000

B) $12,000

C) $48,000

D) $45,000

Based on the information given above,what amount should be reported in the 20X8 consolidated income statement as cost of goods sold?

A) $36,000

B) $12,000

C) $48,000

D) $45,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

Sub Company sells all its output at 20 percent above cost to Par Corporation. Par purchases its entire inventory from Sub. The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the consolidated net income for 20X6?

A) $357,500

B) $375,000

C) $490,000

D) $317,750

Sub Company sold inventory for $300,000, $262,500 and $337,500 in the years 20X6, 20X7, and 20X8 respectively. Par Company reported ending inventory of $105,000, $157,500 and $180,000 for 20X6, 20X7, and 20X8 respectively. Par acquired 70 percent of the ownership of Sub on January 1, 20X6, at underlying book value. The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

Based on the information given above,what will be the consolidated net income for 20X6?

A) $357,500

B) $375,000

C) $490,000

D) $317,750

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock. During 20X8, Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000. Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2. Prior to December 31, 20X8, Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31, 20X8.

Based on the information given above,what amount should be reported in the December 31,20X8,consolidated balance sheet as inventory?

A) $36,000

B) $12,000

C) $15,000

D) $28,000

Based on the information given above,what amount should be reported in the December 31,20X8,consolidated balance sheet as inventory?

A) $36,000

B) $12,000

C) $15,000

D) $28,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

A newly created subsidiary sold all of its inventory to its parent at a profit in its first year of existence.The parent,in turn,sold all but 20 percent of the inventory to unaffiliated companies,recognizing a profit.The parent had no other sales during the year.The amount that should be reported as cost of goods sold in this year's consolidated income statement should be:

A) 80 percent of the amount reported as intercompany sales by the subsidiary.

B) 80 percent of the amount reported as cost of goods sold by the subsidiary.

C) the amount reported as cost of goods sold by the parent minus unrealized profit in the ending inventory of the parent.

D) 80 percent of the amount reported as cost of goods sold by the parent.

A) 80 percent of the amount reported as intercompany sales by the subsidiary.

B) 80 percent of the amount reported as cost of goods sold by the subsidiary.

C) the amount reported as cost of goods sold by the parent minus unrealized profit in the ending inventory of the parent.

D) 80 percent of the amount reported as cost of goods sold by the parent.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Binary Company acquired 75 percent ownership of Fordham Corporation in 20X5, at underlying book value. On that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Fordham Corporation. Binary purchased inventory from Fordham for $150,000 on July 24, 20X6, and resold 90 percent of the inventory to unaffiliated companies on November 11, 20X6, for $160,000. Fordham produced the inventory sold to Binary for $120,000. The companies had no other transactions during 20X6.

Based on the information given above,what amount of sales will be reported in the 20X6 consolidated income statement?

A) $120,000

B) $135,000

C) $150,000

D) $160,000

Based on the information given above,what amount of sales will be reported in the 20X6 consolidated income statement?

A) $120,000

B) $135,000

C) $150,000

D) $160,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

Elvis Company purchases inventory for $70,000 on Mar 19, 20X8 and sells it to Graceland Corporation for $95,000 on May 14, 20X8. Graceland still holds the inventory on December 31, 20X8, and determines that its market value (replacement cost) is $82,000 at that time. Graceland writes the inventory down from $95,000 to its lower market value of $82,000 at the end of the year. Elvis owns 75 percent of Graceland.

Based on the information given above,by what amount should Graceland write down inventory in its books?

A) $14,000

B) $15,000

C) $13,000

D) $16,000

Based on the information given above,by what amount should Graceland write down inventory in its books?

A) $14,000

B) $15,000

C) $13,000

D) $16,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Binary Company acquired 75 percent ownership of Fordham Corporation in 20X5, at underlying book value. On that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Fordham Corporation. Binary purchased inventory from Fordham for $150,000 on July 24, 20X6, and resold 90 percent of the inventory to unaffiliated companies on November 11, 20X6, for $160,000. Fordham produced the inventory sold to Binary for $120,000. The companies had no other transactions during 20X6.

Based on the information given above,what amount of consolidated net income will be assigned to the controlling interest for 20X6?

A) $12,000

B) $25,000

C) $45,250

D) $52,000

Based on the information given above,what amount of consolidated net income will be assigned to the controlling interest for 20X6?

A) $12,000

B) $25,000

C) $45,250

D) $52,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

Clark Co.had the following transactions with affiliated parties during 20X1:

-Sales of $60,000 to Dean,Inc.,with $20,000 gross profit.Dean had $15,000 of this inventory on hand at year end.Clark owns a 15% interest in Dean and does not exert significant influence.

-Purchases of raw materials totaling $240,000 from Kent Corp.,a wholly-owned subsidiary.Kent's gross profit on the sale was $48,000.Clark had $60,000 of this inventory remaining on December 31,20X1.

Before consolidating entries,Clark had consolidated current assets of $320,000.What amount should Clark report in its December 31,20X1,consolidated balance sheet for current assets?

A) $303,000

B) $320,000

C) $317,000

D) $308,000

-Sales of $60,000 to Dean,Inc.,with $20,000 gross profit.Dean had $15,000 of this inventory on hand at year end.Clark owns a 15% interest in Dean and does not exert significant influence.

-Purchases of raw materials totaling $240,000 from Kent Corp.,a wholly-owned subsidiary.Kent's gross profit on the sale was $48,000.Clark had $60,000 of this inventory remaining on December 31,20X1.

Before consolidating entries,Clark had consolidated current assets of $320,000.What amount should Clark report in its December 31,20X1,consolidated balance sheet for current assets?

A) $303,000

B) $320,000

C) $317,000

D) $308,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock. During 20X8, Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000. Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2. Prior to December 31, 20X8, Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31, 20X8.

Based on the information given above,what amount of sales must be eliminated from the consolidated income statement for 20X8?

A) $117,000

B) $120,000

C) $150,000

D) $128,000

Based on the information given above,what amount of sales must be eliminated from the consolidated income statement for 20X8?

A) $117,000

B) $120,000

C) $150,000

D) $128,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

Parent Corporation owns 90 percent of Subsidiary 1 Company's stock and 75 percent of Subsidiary 2 Company's stock. During 20X8, Parent sold inventory purchased in 20X7 for $48,000 to Subsidiary 1 for $60,000. Subsidiary 1 then sold the inventory at its cost of $60,000 to Subsidiary 2. Prior to December 31, 20X8, Subsidiary 2 sold $45,000 of inventory to a nonaffiliate for $67,000 and held $15,000 in inventory at December 31, 20X8.

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X8?

A) $117,000

B) $120,000

C) $150,000

D) $128,000

Based on the information given above,what amount of cost of goods sold must be eliminated from the consolidated income statement for 20X8?

A) $117,000

B) $120,000

C) $150,000

D) $128,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Binary Company acquired 75 percent ownership of Fordham Corporation in 20X5, at underlying book value. On that date, the fair value of the noncontrolling interest was equal to 25 percent of the book value of Fordham Corporation. Binary purchased inventory from Fordham for $150,000 on July 24, 20X6, and resold 90 percent of the inventory to unaffiliated companies on November 11, 20X6, for $160,000. Fordham produced the inventory sold to Binary for $120,000. The companies had no other transactions during 20X6.

Based on the information given above,what amount of cost of goods sold will be reported in the 20X6 consolidated income statement?

A) $90,000

B) $108,000

C) $120,000

D) $135,000

Based on the information given above,what amount of cost of goods sold will be reported in the 20X6 consolidated income statement?

A) $90,000

B) $108,000

C) $120,000

D) $135,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

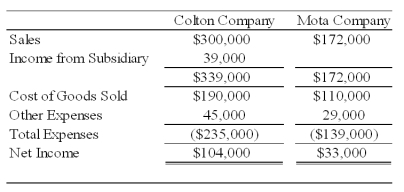

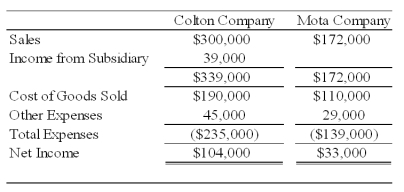

Colton Company acquired 80 percent ownership of Mota Company's voting shares on January 1,2008,at underlying book value.The fair value of the noncontrolling interest on that date was equal to 20 percent of the book value of Mota Company.During 2008,Colton purchased inventory for $30,000 and sold the full amount to Mota Company for $50,000.On December 31,2008,Mota's ending inventory included $10,000 of items purchased from Colton.Also in 2008,Mota purchased inventory for $80,000 and sold the units to Colton for $100,000.Colton included $30,000 of its purchase from Mota in ending inventory on December 31,2008.Summary income statement data for the two companies revealed the following:

Required:

a.Compute the amount to be reported as sales in the 20X8 consolidated income statement.

b.Compute the amount to be reported as cost of goods sold in the 20X8 consolidated income statement.

c.What amount of income will be assigned to the noncontrolling shareholders in the 20X8 consolidated income statement?

d.What amount of income will be assigned to the controlling interest in the 20X8 consolidated income statement?

Problem 63 (continued)

Required:

a.Compute the amount to be reported as sales in the 20X8 consolidated income statement.

b.Compute the amount to be reported as cost of goods sold in the 20X8 consolidated income statement.

c.What amount of income will be assigned to the noncontrolling shareholders in the 20X8 consolidated income statement?

d.What amount of income will be assigned to the controlling interest in the 20X8 consolidated income statement?

Problem 63 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

Pisa Company acquired 75 percent of Siena Company on January 1,20X3 for $712,500.The fair value of the noncontrolling interest was equal to 25 percent of book value.On the date of acquisition,Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000.During 20X3,Siena purchased inventory for $35,000 and sold it to Pisa for $50,000.Of this amount,Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4.In 20X4,Pisa sold inventory it had purchased for $40,000 to Siena for $60,000.Siena sold $45,000 of this inventory in 20X4.

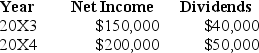

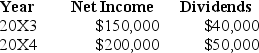

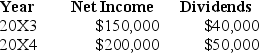

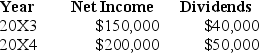

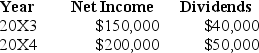

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the modified equity method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 69 (continued)

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the modified equity method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 69 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Pisa Company acquired 75 percent of Siena Company on January 1,20X3 for $712,500.The fair value of the noncontrolling interest was equal to 25 percent of book value.On the date of acquisition,Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000.During 20X3,Siena purchased inventory for $35,000 and sold it to Pisa for $50,000.Of this amount,Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4.In 20X4,Pisa sold inventory it had purchased for $40,000 to Siena for $60,000.Siena sold $45,000 of this inventory in 20X4.

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the fully adjusted equity method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 66 (continued)

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the fully adjusted equity method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 66 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

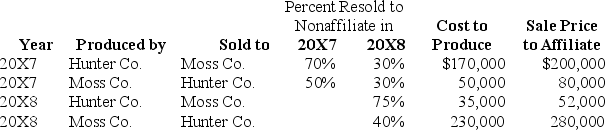

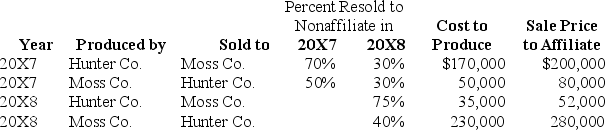

Hunter Company and Moss Company both produce and purchase fabric for resale each period and frequently sell to each other.Since Hunter Company holds 80 percent ownership of Moss Company,Hunter's controller compiled the following information with regard to intercompany transactions between the two companies in 20X7 and 20X8:

Required:

a.Give the consolidating entries required at December 31,20X8,to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b.Compute the amount of cost of goods sold to be reported in the consolidated income statement for 20X8.

Problem 64 (continued)

Required:

a.Give the consolidating entries required at December 31,20X8,to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b.Compute the amount of cost of goods sold to be reported in the consolidated income statement for 20X8.

Problem 64 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

Pisa Company acquired 75 percent of Siena Company on January 1,20X3 for $712,500.The fair value of the noncontrolling interest was equal to 25 percent of book value.On the date of acquisition,Siena had common stock outstanding of $300,000 and a balance in retained earnings of $650,000.During 20X3,Siena purchased inventory for $35,000 and sold it to Pisa for $50,000.Of this amount,Pisa reported $20,000 in ending inventory in 20X3 and later sold it in 20X4.In 20X4,Pisa sold inventory it had purchased for $40,000 to Siena for $60,000.Siena sold $45,000 of this inventory in 20X4.

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the cost method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 70 (continued)

Income and dividend information for Siena for 20X3 and 20X4 are as follows:

Pisa Company uses the cost method.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X3.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X4.

Problem 70 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

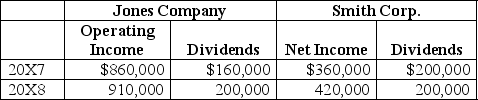

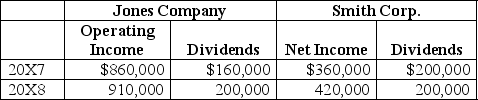

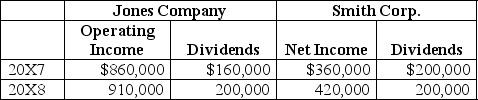

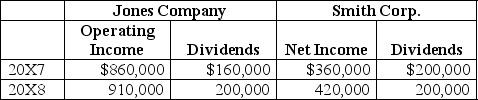

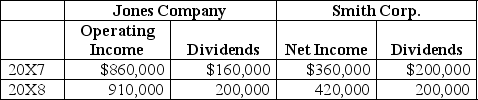

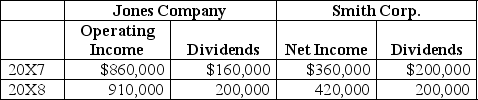

On January 1,20X7,Jones Company acquired 90 percent of the outstanding common stock of Smith Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Smith.At the date of acquisition,Smith had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Smith sold inventory to Jones for $440,000.The inventory originally cost Smith $360,000.By year-end,30 percent was still in Jones' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Jones and Smith use perpetual inventory systems.

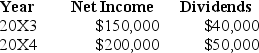

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the modified equity method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 67 (continued)

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the modified equity method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 67 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

On January 1,20X7,Jones Company acquired 90 percent of the outstanding common stock of Smith Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Smith.At the date of acquisition,Smith had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Smith sold inventory to Jones for $440,000.The inventory originally cost Smith $360,000.By year-end,30 percent was still in Jones' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Jones and Smith use perpetual inventory systems.

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the cost method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 68 (continued)

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the cost method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 68 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

On January 1,20X7,Jones Company acquired 90 percent of the outstanding common stock of Smith Corporation for $1,242,000.On that date,the fair value of noncontrolling interest was equal to $138,000.The entire differential was related to land held by Smith.At the date of acquisition,Smith had common stock outstanding of $520,000,additional paid-in capital of $200,000,and retained earnings of $540,000.During 20X7,Smith sold inventory to Jones for $440,000.The inventory originally cost Smith $360,000.By year-end,30 percent was still in Jones' ending inventory.During 20X8,the remaining inventory was resold to an unrelated customer.Both Jones and Smith use perpetual inventory systems.

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the fully adjusted equity method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 65 (continued)

Income and dividend information for both Jones and Smith for 20X7 and 20X8 are as follows:

Assume Jones uses the fully adjusted equity method to account for its investment in Smith.

Required:

a.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

b.Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 65 (continued)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck