Deck 18: Evaluation of Portfolio Performance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

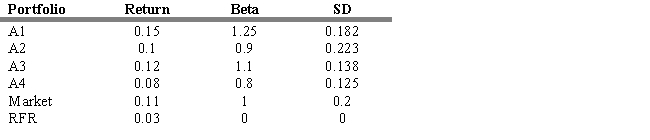

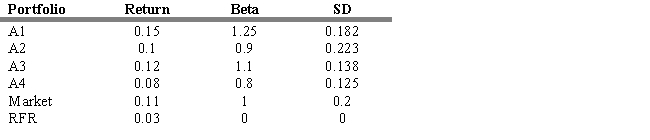

Question

Question

Question

Question

Question

Question

Question

Question

Question

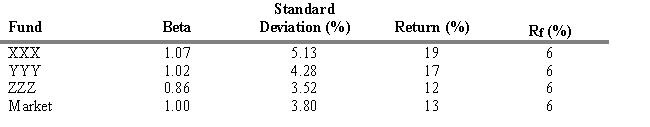

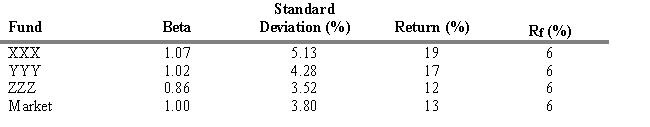

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 18: Evaluation of Portfolio Performance

1

The market rewards investors for bearing total risk.

False

2

The most common manner of evaluating portfolio managers is a peer group comparison.

True

3

The two main questions when assessing the performance of an investment manager are: how did the portfolio manager actually perform, and, why did the portfolio manager perform as he or she did?

True

4

The portfolio performance measure that can be most affected by a benchmark error is the Sharpe measure.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

The Sharpe and Treynor measures always give different rankings.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

Treynor developed the first composite measure of portfolio performance by introducing the capital market line, which defines the relationship between the return of a portfolio over time and the return for the market portfolio.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

The Jensen measure requires that each period's rates of return and risk-free rate be measured, rather than using the long-term averages as in the Treynor and Sharpe measures.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

A negative Treynor measure (negative T) for a portfolio always indicates that the portfolio would plot below the SML.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

Maximum drawdown calculates the largest percentage decline in value-from peak to trough-wherever during the horizon that occurs.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

The typical proxy for the market portfolio is the S&P 500 Index because it is diversified and price weighted.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

The Sharpe measure examines the risk premium per unit of systematic risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

The Sortino ratio takes into account the downside risk exposure in the portfolio.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

The information ratio permits only relative assessments of performance for different portfolios in a style class.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

The Sharpe measure of portfolio performance divides the portfolio's risk premium by the portfolio's beta.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

A peer group comparison collects the returns produced by a representative universe of investors over a specific period of time and displays them in a simple boxplot format.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

Sharpe's performance assumes that all portfolios are completely diversified.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

The ranking differences between the Sharpe, Treynor, and Jensen performance measures occur because of the differences in diversification.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

Treynor's performance measure implicitly assumes a completely diversified portfolio.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

The Sharpe and Treynor measures complement each other and thus both should be used to measure portfolio performance.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

Investors want their portfolio managers to completely diversify their portfolio, that is, eliminate all systematic risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

Normal portfolios, which are customized benchmarks that reflect the specific styles of alternative managers.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

One of the goals of the Global Investment Performance Standards (GIPS) is to obtain worldwide acceptance of a single standard for the calculation and presentation of investment performance based on the principles of fair representation and full disclosure.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Funds with low levels of diversification tend to "beat the market."

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

When applying the Jensen's alpha measure, the alpha level and significance can vary greatly depending on the specification of the return-generating model.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

According to Global Investment Performance Standards (GIPS), time-weighted rates of return must be used.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

Overall performance is the total return above the risk-free rate.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

According to Global Investment Performance Standards (GIPS), time-weighted rates of return must be used.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

The policy effect is a difference in bond portfolio performance from that of a benchmark index due to a difference in duration.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

Two desirable attributes of a portfolio manager's performance are the ability to derive above-average returns for a given risk class and the ability to time the market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

One example of a flawed benchmark is using the median manager from a broad universe in a peer group comparison.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

An appropriate composite risk measure that indicates the relative price volatility for a bond compared to interest rate changes is the bond's yield to maturity.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

Grinblatt and Titman showed that the manager's security selection ability can be established by how they adjusted portfolio weights.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

An advantage of the GT statistic is that it can be computed without reference to any specific benchmark.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

A portfolio manager should be evaluated many times and in a variety of market environments before a final judgment is reached regarding his/her strengths and weaknesses.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

Money-weighted returns set the present value of future cash flows (including future investment contributions and withdrawals) equal to the level of the initial investment.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

Attribution analysis separates a portfolio manager's performance into an allocation effect and selection effect.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

In evaluating bond performance, the Barclays Aggregate Bond Index is an appropriate risk measure.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

A test of bond performance over time indicated that bond portfolio managers are more consistent over time than equity managers.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

Duration is considered a good measure of risk for a bond portfolio because it indicates the relative volatility of the bond or portfolio due to interest rate changes and the rating of the bonds.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

The advantage of evaluating a fund's alpha using a multifactor approach is that it is designed to control for market style (SMB and HML) and momentum (MOM) risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

Treynor showed that rational, risk-averse investors always prefer portfolio possibility lines that have

A) zero slopes.

B) slightly negative slopes.

C) highly negative slopes.

D) highly positive slopes.

E) highly positive slopes.

A) zero slopes.

B) slightly negative slopes.

C) highly negative slopes.

D) highly positive slopes.

E) highly positive slopes.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

Excess return portfolio performance measures

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

The CFA Institute encourages managers to disclose the volatility of the composite return and to identify benchmarks that parallel the risk or investment style that the composite tracks.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

Sharpe's performance measure divides the portfolio's risk premium by the

A) standard deviation of the rate of return.

B) variance of the rate of return.

C) slope of the fund's characteristic line.

D) beta.

E) risk-free rate.

A) standard deviation of the rate of return.

B) variance of the rate of return.

C) slope of the fund's characteristic line.

D) beta.

E) risk-free rate.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose the expected return for the market portfolio and risk-free rate are 13 percent and 3 percent respectively. Stocks A, B, and C have Treynor measures of 0.24, 0.16, and 0.11, respectively. Based on this information, an investor should

A) buy stocks A, B, and C.

B) buy stocks A and B and sell stock C.

C) buy stock A and sell stocks B and C.

D) sell stocks A, B, and C.

E) hold stocks A, B, and C.

A) buy stocks A, B, and C.

B) buy stocks A and B and sell stock C.

C) buy stock A and sell stocks B and C.

D) sell stocks A, B, and C.

E) hold stocks A, B, and C.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

Which measure of portfolio performance allows analysts to determine the statistical significance of abnormal returns?

A) Sharpe measure

B) Jensen measure

C) Fama measure

D) Alternative components model (MCV)

E) Treynor measure

A) Sharpe measure

B) Jensen measure

C) Fama measure

D) Alternative components model (MCV)

E) Treynor measure

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

The major requirements of a portfolio manager include the following, EXCEPT

A) follow the client's policy statement.

B) completely diversify the portfolio to eliminate all unsystematic risk.

C) the ability to derive above-average risk adjusted returns.

D) completely diversify the portfolio to eliminate all systematic risk.

E) deliver on expectations and produce an additional alpha component.

A) follow the client's policy statement.

B) completely diversify the portfolio to eliminate all unsystematic risk.

C) the ability to derive above-average risk adjusted returns.

D) completely diversify the portfolio to eliminate all systematic risk.

E) deliver on expectations and produce an additional alpha component.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

For a poorly diversified portfolio the appropriate measure of portfolio performance would be

A) the Treynor measure because it evaluates portfolio performance on the basis of return and diversification.

B) the Sharpe measure because it evaluates portfolio performance on the basis of return and diversification.

C) the Treynor measure because it uses standard deviation as the risk measure.

D) the Sharpe measure because it uses beta as the risk measure.

E) the Jensen measure because it measures the risk-adjusted performance.

A) the Treynor measure because it evaluates portfolio performance on the basis of return and diversification.

B) the Sharpe measure because it evaluates portfolio performance on the basis of return and diversification.

C) the Treynor measure because it uses standard deviation as the risk measure.

D) the Sharpe measure because it uses beta as the risk measure.

E) the Jensen measure because it measures the risk-adjusted performance.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following performance measures is the most rigorous risk-adjustment process separating systematic and unsystematic risk?

A) Treynor ratio

B) Sharpe ratio

C) Jensen's Alpha

D) Information ratio

E) Sortino ratio

A) Treynor ratio

B) Sharpe ratio

C) Jensen's Alpha

D) Information ratio

E) Sortino ratio

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

The Sortino measure differs from the Sharpe ratio in that

A) it measures the portfolio's average return in excess of a user-selected minimum acceptable return threshold.

B) it measures the portfolio beta.

C) higher values of the Sortino measure are not desirable, while higher values in the Sharpe ratio are desirable.

D) it measures standard deviation of total portfolio return.

E) it measures portfolio beta relative to the market index proxy.

A) it measures the portfolio's average return in excess of a user-selected minimum acceptable return threshold.

B) it measures the portfolio beta.

C) higher values of the Sortino measure are not desirable, while higher values in the Sharpe ratio are desirable.

D) it measures standard deviation of total portfolio return.

E) it measures portfolio beta relative to the market index proxy.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Which portfolio measurement uses the mean excess return in the numerator divided by the amount of residual risk that the investor incurred in pursuit of those excess returns?

A) Jensen measure

B) Fama measure

C) Sharpe measure

D) Treynor ratio

E) Information ratio

A) Jensen measure

B) Fama measure

C) Sharpe measure

D) Treynor ratio

E) Information ratio

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

Information ratio portfolio performance measures

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

The measure of performance that divides the portfolio's risk premium by the portfolio's beta is the

A) Sharpe measure.

B) Jensen measure.

C) Fama measure.

D) Alternative components model (MCV).

E) Treynor measure.

A) Sharpe measure.

B) Jensen measure.

C) Fama measure.

D) Alternative components model (MCV).

E) Treynor measure.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

A more recent adjustment to the Sharpe measurement for portfolio evaluation is

A) to divide the portfolio risk premium by total risk rather than the portfolio's beta.

B) to divide the portfolio risk premium by standard deviation rather than the portfolio's beta.

C) to divide the portfolio risk premium by the excess portfolio return rather than total risk.

D) to divide the excess portfolio return by the portfolio's standard deviation.

E) to divide the excess portfolio return by the portfolio's beta.

A) to divide the portfolio risk premium by total risk rather than the portfolio's beta.

B) to divide the portfolio risk premium by standard deviation rather than the portfolio's beta.

C) to divide the portfolio risk premium by the excess portfolio return rather than total risk.

D) to divide the excess portfolio return by the portfolio's standard deviation.

E) to divide the excess portfolio return by the portfolio's beta.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

Relative return portfolio performance measures

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

A) adjust portfolio risk to match benchmark risk.

B) compare portfolio returns to expected returns under CAPM.

C) evaluate portfolio performance on the basis of return per unit of risk.

D) indicate historic average differential return per unit of historic variability of differential return.

E) the average market beta per unit of risk.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

The cost of active management is the coefficient ER, and it is sometimes referred to as

A) market timing.

B) reward for risk.

C) excess reward.

D) excess risk.

E) tracking error.

A) market timing.

B) reward for risk.

C) excess reward.

D) excess risk.

E) tracking error.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements concerning performance measures is false?

A) The Sharpe measure examines both unsystematic and systematic risk.

B) The Treynor measure examines systematic risk.

C) The Jensen measure examines systematic risk.

D) All three measures examine both unsystematic and systematic risk.

E) None of these are correct.

A) The Sharpe measure examines both unsystematic and systematic risk.

B) The Treynor measure examines systematic risk.

C) The Jensen measure examines systematic risk.

D) All three measures examine both unsystematic and systematic risk.

E) None of these are correct.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

A disadvantage of the Treynor and Sharpe measures is that

A) they produce absolute performance rankings.

B) the beta and standard deviation are static.

C) they are both difficult to compute.

D) they produce relative performance rankings.

E) they give very different measurements for well-diversified portfolios.

A) they produce absolute performance rankings.

B) the beta and standard deviation are static.

C) they are both difficult to compute.

D) they produce relative performance rankings.

E) they give very different measurements for well-diversified portfolios.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

The two questions when assessing the performance measurement of an investment manager include:

A) did the manager follow the client's policy statement?

B) did the manager completely diversify the portfolio to eliminate all unsystematic risk?

C) why did the portfolio manager perform as he or she did?

D) did the manager have the ability to derive above-average risk adjusted returns?

E) did the manager deliver on expectations and produce an additional alpha component?

A) did the manager follow the client's policy statement?

B) did the manager completely diversify the portfolio to eliminate all unsystematic risk?

C) why did the portfolio manager perform as he or she did?

D) did the manager have the ability to derive above-average risk adjusted returns?

E) did the manager deliver on expectations and produce an additional alpha component?

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

Portfolio managers are often evaluated using a boxplot of returns for a universe of investors over a specific period of time which is known as a(n)

A) return adjusted comparison.

B) efficient frontier comparison.

C) time plot comparison.

D) peer group comparison.

E) None of these are correct.

A) return adjusted comparison.

B) efficient frontier comparison.

C) time plot comparison.

D) peer group comparison.

E) None of these are correct.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

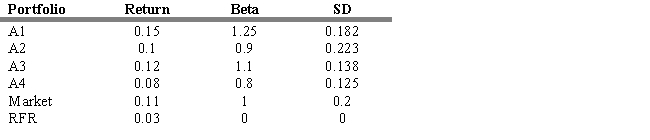

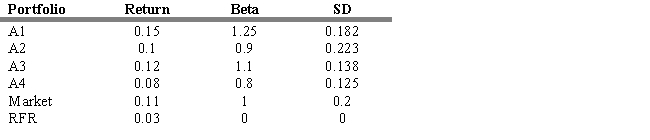

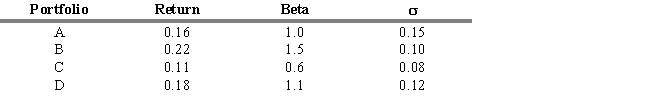

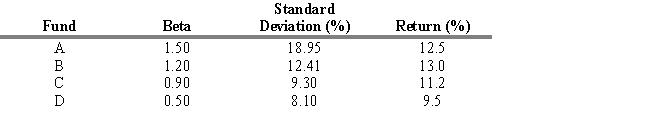

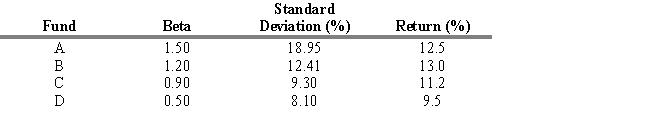

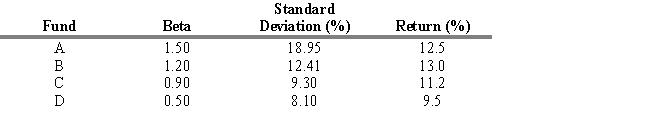

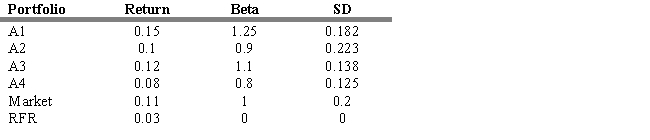

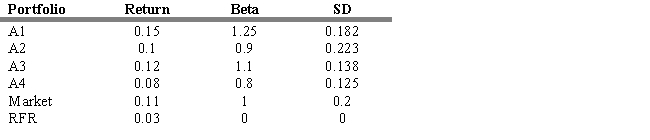

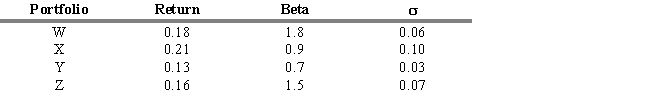

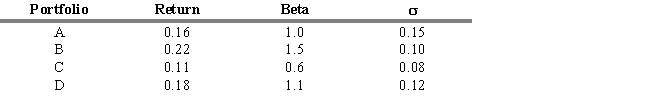

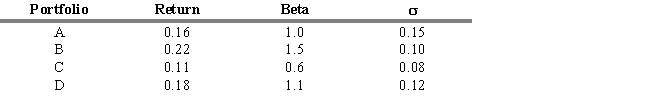

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

-Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio.

A) A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02

B) A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014

C) A1 = 0.02, A2 = - 0.002, A3 = 0.002, A4 = -0.014

D) A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14

E) A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

-Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio.

A) A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02

B) A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014

C) A1 = 0.02, A2 = - 0.002, A3 = 0.002, A4 = -0.014

D) A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14

E) A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

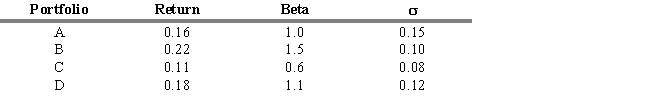

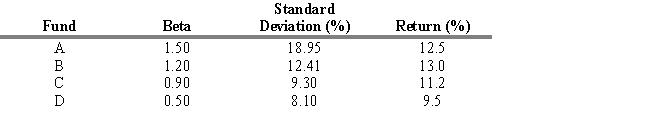

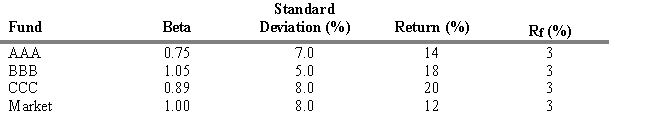

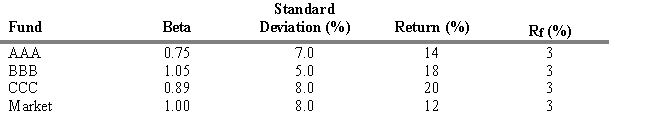

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Jensen Measure for the BBB fund.

A) 2.10

B) 2.74

C) 5.43

D) 2.00

E) 1.65

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Jensen Measure for the BBB fund.

A) 2.10

B) 2.74

C) 5.43

D) 2.00

E) 1.65

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

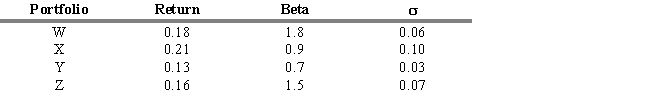

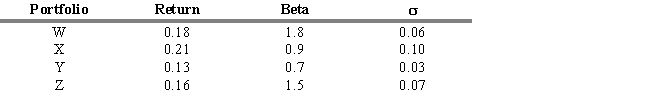

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

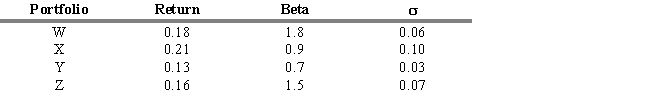

The portfolios identified below are being considered for investment. Assume that during the period under consideration, Rf = .04.

Refer to Exhibit 18.2. According to the Treynor Measure, which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied.

The portfolios identified below are being considered for investment. Assume that during the period under consideration, Rf = .04.

Refer to Exhibit 18.2. According to the Treynor Measure, which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Treynor Measure for the CCC fund.

A) 5.43

B) 2.74

C) 2.19

D) 2.00

E) 1.65

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Treynor Measure for the CCC fund.

A) 5.43

B) 2.74

C) 2.19

D) 2.00

E) 1.65

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

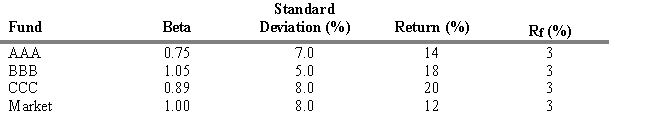

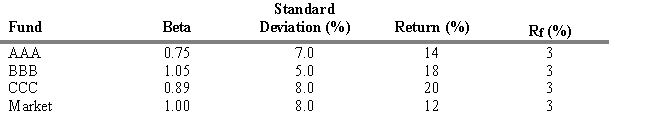

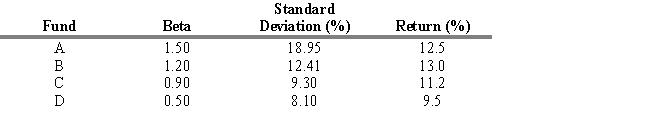

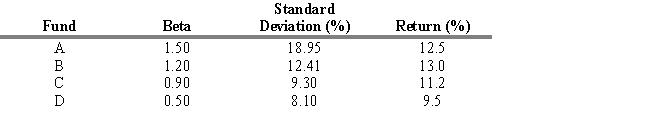

The portfolios identified below are being considered for investment. During the period under consideration, Rf = .03.

Refer to Exhibit 18.1. Using the Sharpe Measure, which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied.

The portfolios identified below are being considered for investment. During the period under consideration, Rf = .03.

Refer to Exhibit 18.1. Using the Sharpe Measure, which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

What is the Sharpe measure for the S&P 500 over the last ten years if the standard deviation was 8 percent and the return was 14 percent?

A) 1.55

B) 1.69

C) 1.75

D) 1.99

E) 2.09

A) 1.55

B) 1.69

C) 1.75

D) 1.99

E) 2.09

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

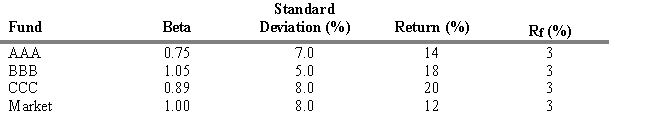

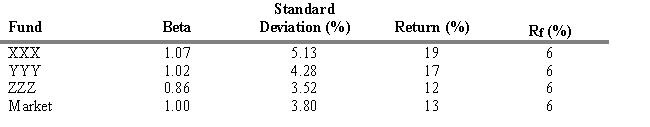

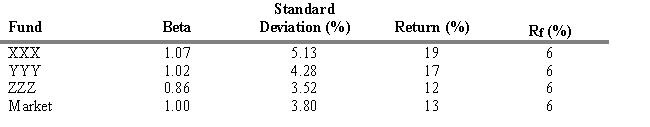

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Treynor Measure for the CCC fund.

A) 14.7

B) 15.3

C) 19.1

D) 17.0

E) 12.7

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Treynor Measure for the CCC fund.

A) 14.7

B) 15.3

C) 19.1

D) 17.0

E) 12.7

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

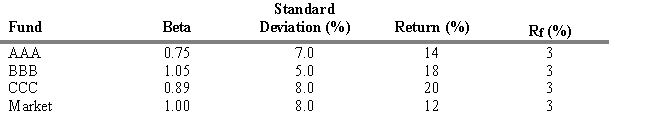

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Treynor Measure for the C fund.

A) 0.012

B) 0.040

C) 0.069

D) 0.396

E) 1.142

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Treynor Measure for the C fund.

A) 0.012

B) 0.040

C) 0.069

D) 0.396

E) 1.142

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Sharpe Measure for the AAA fund.

A) 2.01

B) 2.74

C) 2.91

D) 5.43

E) 1.72

The data presented below has been collected at this point in time.

Refer to Exhibit 18.4. Compute the Sharpe Measure for the AAA fund.

A) 2.01

B) 2.74

C) 2.91

D) 5.43

E) 1.72

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

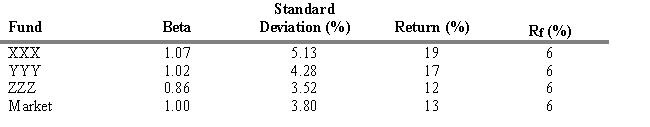

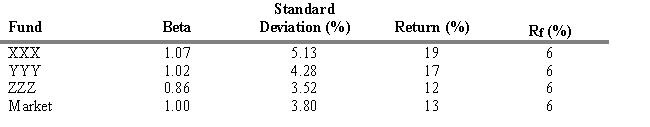

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Jensen Measure for the YYY fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Jensen Measure for the YYY fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Jensen Measure for the B fund.

A) 1.16%

B) 2.31%

C) 6.90%

D) 9.60%

E) 10.13%

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Jensen Measure for the B fund.

A) 1.16%

B) 2.31%

C) 6.90%

D) 9.60%

E) 10.13%

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Sharpe Measure for the AAA fund.

A) 4.49

B) 2.74

C) 1.57

D) 1.70

E) 1.27

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Sharpe Measure for the AAA fund.

A) 4.49

B) 2.74

C) 1.57

D) 1.70

E) 1.27

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

Refer to Exhibit 18.6. Calculate the Treynor Measure for each portfolio.

A) A1 = 0.0625, A2 = 0.0778, A3 = 0.0818, A4 = 0.096

B) A1 = 0.096, A2 = 0.0778, A3 = 0.0818, A4 = 0.0625

C) A1 = 0.096, A2 = 0.0818, A3 = 0.0778, A4 = 0.0625

D) A1 = 0.0778, A2 = 0.096, A3 = 0.0818, A4 = 0.0625

E) A1 = 0.086, A2 = 0.096, A3 = 0.0818, A4 = 0.0625

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

Refer to Exhibit 18.6. Calculate the Treynor Measure for each portfolio.

A) A1 = 0.0625, A2 = 0.0778, A3 = 0.0818, A4 = 0.096

B) A1 = 0.096, A2 = 0.0778, A3 = 0.0818, A4 = 0.0625

C) A1 = 0.096, A2 = 0.0818, A3 = 0.0778, A4 = 0.0625

D) A1 = 0.0778, A2 = 0.096, A3 = 0.0818, A4 = 0.0625

E) A1 = 0.086, A2 = 0.096, A3 = 0.0818, A4 = 0.0625

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Jensen Measure for the BBB fund.

A) 4.49

B) 2.74

C) 4.25

D) 5.55

E) 8.99

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 18.3. Compute the Jensen Measure for the BBB fund.

A) 4.49

B) 2.74

C) 4.25

D) 5.55

E) 8.99

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

Refer to Exhibit 18.6. Calculate the Sharpe Measure for each portfolio.

A) A1 = 0.40, A2 = 0.31, A3 = 0.65, A4 = 0.66

B) A1 = 0.31, A2 = 0.66, A3 = 0.65, A4 = 0.40

C) A1 = 0.66, A2 = 0.65, A3 = 0.31, A4 = 0.40

D) A1 = 0.66, A2 = 0.31, A3 = 0.65, A4 = 0.40

E) A1 = 0.54, A2 = 0.68, A3 = 0.65, A4 = 0.40

Consider the following information for four portfolios, the market, and the risk-free rate (RFR):

Refer to Exhibit 18.6. Calculate the Sharpe Measure for each portfolio.

A) A1 = 0.40, A2 = 0.31, A3 = 0.65, A4 = 0.66

B) A1 = 0.31, A2 = 0.66, A3 = 0.65, A4 = 0.40

C) A1 = 0.66, A2 = 0.65, A3 = 0.31, A4 = 0.40

D) A1 = 0.66, A2 = 0.31, A3 = 0.65, A4 = 0.40

E) A1 = 0.54, A2 = 0.68, A3 = 0.65, A4 = 0.40

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Treynor Measure for the ZZZ fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Treynor Measure for the ZZZ fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The portfolios identified below are being considered for investment. Assume that during the period under consideration, Rf = .04.

Refer to Exhibit 18.2. Using the Sharpe Measure, which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied.

The portfolios identified below are being considered for investment. Assume that during the period under consideration, Rf = .04.

Refer to Exhibit 18.2. Using the Sharpe Measure, which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Sharpe Measure for the A fund.

A) 0.012

B) 0.040

C) 0.069

D) 0.396

E) 1.142

The last year's performance for four mutual funds is presented below. The market return was 10.70 percent, the standard deviation was 13.1 percent last year, and the risk-free rate of return was 5%.

Refer to Exhibit 18.7. Compute the Sharpe Measure for the A fund.

A) 0.012

B) 0.040

C) 0.069

D) 0.396

E) 1.142

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The portfolios identified below are being considered for investment. During the period under consideration, Rf = .03.

Refer to Exhibit 18.1. According to the Treynor Measure, which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

The portfolios identified below are being considered for investment. During the period under consideration, Rf = .03.

Refer to Exhibit 18.1. According to the Treynor Measure, which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Sharpe Measure for the XXX fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

The data presented below has been collected at this point in time.

Refer to Exhibit 18.5. Compute the Sharpe Measure for the XXX fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck