Deck 18: Public Choice, taxes, and the Distribution of Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/139

Play

Full screen (f)

Deck 18: Public Choice, taxes, and the Distribution of Income

1

Both presidents Kennedy and Reagan proposed significant cuts in income taxes.Opponents of these tax cut proposals argued that

A)the tax cuts would benefit high-income taxpayers.

B)cutting state sales taxes,rather than federal income taxes,would result in greater economic efficiency.

C)while the tax cuts would result in greater economic efficiency,there was too much opposition to the tax cuts in Congress.As it turned out,Congress ultimately approved both tax cut proposals.

D)it would be better to cut taxes on corporate profits.

A)the tax cuts would benefit high-income taxpayers.

B)cutting state sales taxes,rather than federal income taxes,would result in greater economic efficiency.

C)while the tax cuts would result in greater economic efficiency,there was too much opposition to the tax cuts in Congress.As it turned out,Congress ultimately approved both tax cut proposals.

D)it would be better to cut taxes on corporate profits.

the tax cuts would benefit high-income taxpayers.

2

What is the term that explains why voters often lack knowledge of pending legislation,and lack knowledge of the views of candidates for office on a range of issues that affect their own (the voters')welfare?

A)the voting paradox

B)logrolling

C)rational ignorance

D)regulatory capture

A)the voting paradox

B)logrolling

C)rational ignorance

D)regulatory capture

rational ignorance

3

The public choice model assumes that government policy makers

A)must promote the public interest at the expense of their own self-interests in order to be re-elected.

B)will pursue their self-interests in personal affairs but only if it does not conflict with the public interest.

C)will often act irrationally in their personal affairs,but will act rationally when they promote the public interest.

D)are likely to pursue their own self-interests,even if their self-interests conflict with the public interest.

A)must promote the public interest at the expense of their own self-interests in order to be re-elected.

B)will pursue their self-interests in personal affairs but only if it does not conflict with the public interest.

C)will often act irrationally in their personal affairs,but will act rationally when they promote the public interest.

D)are likely to pursue their own self-interests,even if their self-interests conflict with the public interest.

are likely to pursue their own self-interests,even if their self-interests conflict with the public interest.

4

The Arrow impossibility theorem explains

A)why there is no system of voting that will consistently represent the underlying preferences of voters.

B)why government regulation of private markets will always result in a reduction in economic efficiency in these markets.

C)why voters are always rationally ignorant.

D)why it is not possible to provide the economically efficient amount of any public good.

A)why there is no system of voting that will consistently represent the underlying preferences of voters.

B)why government regulation of private markets will always result in a reduction in economic efficiency in these markets.

C)why voters are always rationally ignorant.

D)why it is not possible to provide the economically efficient amount of any public good.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

5

A common belief among political analysts is that someone running for his or her party's nomination for president of the United States must choose a different strategy once the nomination is secured.To be nominated,the candidate must appeal to voters from one party - Democrat or Republican - but in a general election a party's nominee must appeal to voters from both parties as well as independent voters.Which of the following offers the best explanation for this change in strategy?

A)the Arrow impossibility theorem

B)the voting paradox

C)the median voter theorem

D)rent seeking

A)the Arrow impossibility theorem

B)the voting paradox

C)the median voter theorem

D)rent seeking

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

6

The political process is more likely to serve the interests of individuals whose preferences are in the middle,rather than individuals with preferences that are much to the left or right of the political center.This statement is best explained by which of the following?

A)logrolling

B)the voting paradox

C)the Arrow impossibility theorem

D)the median voter theorem

A)logrolling

B)the voting paradox

C)the Arrow impossibility theorem

D)the median voter theorem

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

7

Economist Kenneth Arrow has shown mathematically that no system of voting will consistently represent the underlying preferences of voters.This finding is called

A)the Arrow impossibility theorem.

B)Arrow's median voter model.

C)Arrow's Amendment to the public choice model.

D)Arrow's majority vote paradox.

A)the Arrow impossibility theorem.

B)Arrow's median voter model.

C)Arrow's Amendment to the public choice model.

D)Arrow's majority vote paradox.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements refers to rent seeking?

A)"Laws passed by the federal government often provide benefits for a small number of individuals.These individuals,in turn,have an incentive to contribute to the campaigns of politicians who pass these laws."

B)"The federal government should spend more money on programs that help low income citizens and less money on national defense."

C)"The role of the federal government in the U.S.economy grew significantly after the Great Depression.Government spending and taxes are a much greater proportion of total income today than they were in 1929."

D)"There is an opportunity cost whenever the federal government spends tax revenue.For example,an additional $1 billion spent on national defense means there will be less revenue for highway construction and maintenance or some other program."

A)"Laws passed by the federal government often provide benefits for a small number of individuals.These individuals,in turn,have an incentive to contribute to the campaigns of politicians who pass these laws."

B)"The federal government should spend more money on programs that help low income citizens and less money on national defense."

C)"The role of the federal government in the U.S.economy grew significantly after the Great Depression.Government spending and taxes are a much greater proportion of total income today than they were in 1929."

D)"There is an opportunity cost whenever the federal government spends tax revenue.For example,an additional $1 billion spent on national defense means there will be less revenue for highway construction and maintenance or some other program."

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

9

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

A)the mean (or average)voter theorem.

B)the voting paradox.

C)the Arrow impossibility theorem.

D)the median voter theorem.

A)the mean (or average)voter theorem.

B)the voting paradox.

C)the Arrow impossibility theorem.

D)the median voter theorem.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

10

Some individuals seek to use government action to make themselves better off at the expense of others.The actions of these individuals

A)are examples of fraud; but these individuals usually avoid prosecution because of logrolling and rational ignorance.

B)are examples of rent seeking.

C)offer proof that Adam Smith's "invisible hand" is not valid.

D)are evidence of the voting paradox.

A)are examples of fraud; but these individuals usually avoid prosecution because of logrolling and rational ignorance.

B)are examples of rent seeking.

C)offer proof that Adam Smith's "invisible hand" is not valid.

D)are evidence of the voting paradox.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

11

With respect to the tax cut on dividends that occurred in the early 2000s,President Obama argued that the tax cut ________ the burden on individuals with low and moderate incomes,and ________ the burden on the wealthy and on corporations,thereby increasing the level of income inequality.

A)increased; increased

B)increased; decreased

C)decreased; increased

D)decreased; decreased

A)increased; increased

B)increased; decreased

C)decreased; increased

D)decreased; decreased

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

12

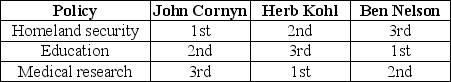

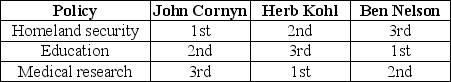

Table 18-1

Refer to Table 18-1.The table above lists three policy alternatives that the U.S.Senate will vote on,along with the ranking of these alternates.The Senate must decide which of these alternatives should receive an additional $1 billion of funding,and there is enough money in the federal budget for only one of these alternatives.If a series of votes is taken in which each pair of alternatives is considered (homeland security and education; homeland security and medical research; education and medical research)which of the following will result from these votes?

A)When the vote is between homeland security and education,the Senators will vote for education to receive funding.

B)The Senators' votes will demonstrate transitivity.

C)The results will illustrate the voting paradox.

D)The results from the voting will illustrate the median voter theorem.

Refer to Table 18-1.The table above lists three policy alternatives that the U.S.Senate will vote on,along with the ranking of these alternates.The Senate must decide which of these alternatives should receive an additional $1 billion of funding,and there is enough money in the federal budget for only one of these alternatives.If a series of votes is taken in which each pair of alternatives is considered (homeland security and education; homeland security and medical research; education and medical research)which of the following will result from these votes?

A)When the vote is between homeland security and education,the Senators will vote for education to receive funding.

B)The Senators' votes will demonstrate transitivity.

C)The results will illustrate the voting paradox.

D)The results from the voting will illustrate the median voter theorem.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is used to argue that the self-interest of public policymakers will often lead to actions that are inconsistent with the preferences of the voters they represent?

A)the voting paradox

B)the median voter theorem

C)rent seeking

D)transitivity of voters' preferences

A)the voting paradox

B)the median voter theorem

C)rent seeking

D)transitivity of voters' preferences

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

14

The Arrow impossibility theorem

A)explains why people can be rational as well as ignorant at the same time.

B)explains why voting systems do not consistently represent the preferences of voters.

C)explains why candidates for public office must represent the preferences of the political middle.

D)explains why it is impossible,in most cases,to eliminate special-interest legislation after it has become law.

A)explains why people can be rational as well as ignorant at the same time.

B)explains why voting systems do not consistently represent the preferences of voters.

C)explains why candidates for public office must represent the preferences of the political middle.

D)explains why it is impossible,in most cases,to eliminate special-interest legislation after it has become law.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

15

Economists James Buchanan and Gordon Tullock are well-known for developing

A)the impossibility theorem.

B)the voting paradox.

C)the public choice model.

D)the concept of government failure.

A)the impossibility theorem.

B)the voting paradox.

C)the public choice model.

D)the concept of government failure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is an example of rent seeking behavior?

A)Apple earned large profits from the development and sale of the iPhone.

B)Amazon introduced the Kindle to compete with Sony's Digital Reader.Amazon was motivated by the desire to earn profits from the Kindle but also increased the choice of digital music players available to consumers.

C)U.S.sugar firms convinced Congress to impose a quota on imports of sugar.

D)Recent increases in cigarette taxes faced little opposition from voters,many of whom were rationally ignorant with respect to the tax.

A)Apple earned large profits from the development and sale of the iPhone.

B)Amazon introduced the Kindle to compete with Sony's Digital Reader.Amazon was motivated by the desire to earn profits from the Kindle but also increased the choice of digital music players available to consumers.

C)U.S.sugar firms convinced Congress to impose a quota on imports of sugar.

D)Recent increases in cigarette taxes faced little opposition from voters,many of whom were rationally ignorant with respect to the tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

17

When members of Congress vote to pass new legislation,they will

A)always vote for the alternative favored by a majority of the voters.

B)fail to consistently represent the underlying preferences of voters.

C)always vote for the alternative favored by a plurality of the voters if there is no majority position.

D)always fail to represent the underlying preferences of voters.

A)always vote for the alternative favored by a majority of the voters.

B)fail to consistently represent the underlying preferences of voters.

C)always vote for the alternative favored by a plurality of the voters if there is no majority position.

D)always fail to represent the underlying preferences of voters.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a consequence of the voting paradox?

A)A majority of voters elect a candidate that does not represent the preferences of the voter who is in the political middle.

B)Politicians support small groups of individuals and firms that benefit from special interest legislation,rather than a much larger group of voters who pay the cost for this legislation.

C)Individuals and firms who benefit from government actions engage in rent seeking.

D)The collective preferences of voters are not transitive and voting outcomes are inconsistent.

A)A majority of voters elect a candidate that does not represent the preferences of the voter who is in the political middle.

B)Politicians support small groups of individuals and firms that benefit from special interest legislation,rather than a much larger group of voters who pay the cost for this legislation.

C)Individuals and firms who benefit from government actions engage in rent seeking.

D)The collective preferences of voters are not transitive and voting outcomes are inconsistent.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

19

Both presidents Kennedy and Reagan proposed significant cuts in income taxes because

A)at the time of their proposals the federal government was experiencing budget surpluses; that is,tax revenue exceeded government expenditures.

B)they wanted to offset their proposals to increase other taxes.

C)state governments had increased their taxes and they believed the tax cuts they proposed would result in most citizens paying about the same total state and federal taxes.

D)they believed that the tax cuts would enhance economic efficiency.

A)at the time of their proposals the federal government was experiencing budget surpluses; that is,tax revenue exceeded government expenditures.

B)they wanted to offset their proposals to increase other taxes.

C)state governments had increased their taxes and they believed the tax cuts they proposed would result in most citizens paying about the same total state and federal taxes.

D)they believed that the tax cuts would enhance economic efficiency.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

20

Congressman Gallstone seeks support from his colleagues for a bill he sponsors that will establish a new national park in his district.He offers to support Congresswoman Disrail's proposal to build a new library in her district in exchange for her vote for his national park bill.This is an example of

A)regulatory capture.

B)logrolling.

C)rational ignorance.

D)government failure.

A)regulatory capture.

B)logrolling.

C)rational ignorance.

D)government failure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

21

What is rent seeking and how is it related to regulatory capture?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

22

Congressman Flack votes for a program that will benefit the constituents of Congressman Walpole.Which of the following explanations for Flack's vote is most consistent with the public choice model?

A)Congressman Flack did not have time to read and understand all of the legislation he voted on.Members of Congress often depend on their staffs to read proposed legislation and recommend how they should vote.

B)Legislators such as Congressman Flack are similar to other decision-makers in that they sometimes make irrational choices.

C)Congressman Flack will support programs of legislators from his own party,regardless of who benefits from these programs.

D)Congressman Flack expects Congressman Walpole's support for programs that will benefit Flack's constituents.

A)Congressman Flack did not have time to read and understand all of the legislation he voted on.Members of Congress often depend on their staffs to read proposed legislation and recommend how they should vote.

B)Legislators such as Congressman Flack are similar to other decision-makers in that they sometimes make irrational choices.

C)Congressman Flack will support programs of legislators from his own party,regardless of who benefits from these programs.

D)Congressman Flack expects Congressman Walpole's support for programs that will benefit Flack's constituents.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

23

Congressman Flack votes for a program that will benefit the constituents of Congressman Walpole.The public choice model suggests that Flack's vote is best explained by which of the following?

A)rational ignorance

B)party loyalty

C)logrolling

D)the voting paradox

A)rational ignorance

B)party loyalty

C)logrolling

D)the voting paradox

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

24

Financial contributions to the campaigns of members of Congress,state legislators and other elected officials by firms that seek special interest legislation that make the firms better off are

A)examples of rent seeking.

B)illegal.

C)the result of the voting paradox.

D)irrational because elected officials will almost always act in the interest of the voters who have to pay the cost of the legislation.

A)examples of rent seeking.

B)illegal.

C)the result of the voting paradox.

D)irrational because elected officials will almost always act in the interest of the voters who have to pay the cost of the legislation.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

25

Many economists believe that when the federal government establishes an agency to regulate a particular industry,the regulated firms try to influence the agency even if these actions do not benefit the public.Economists refer to this result of government regulation by which of the following terms?

A)regulatory capture

B)logrolling

C)special interest regulation

D)the regulatory paradox

A)regulatory capture

B)logrolling

C)special interest regulation

D)the regulatory paradox

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

26

A tax imposed by a state or local government on retail sales of most products is

A)an excise tax.

B)a social service tax.

C)a consumption tax.

D)a sales tax.

A)an excise tax.

B)a social service tax.

C)a consumption tax.

D)a sales tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the source of revenue for Medicare and Social Security in the United States?

A)individual income taxes

B)sales taxes

C)social insurance taxes

D)property taxes

A)individual income taxes

B)sales taxes

C)social insurance taxes

D)property taxes

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

28

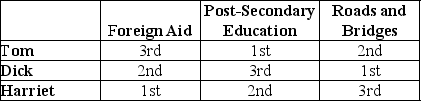

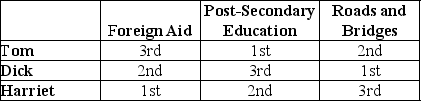

Table 18-2

Refer to Table 18-2.The table above outlines the rankings of three members of the U.S.House of Representatives on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Tom,Dick and Harriet,all members of the House of Representatives,participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Foreign Aid and Post-Secondary Education (2)Foreign Aid and Roads and Bridges and (3)Post-Secondary Education and Roads and Bridges.

Determine whether the voting paradox will occur as a result of these votes.

Refer to Table 18-2.The table above outlines the rankings of three members of the U.S.House of Representatives on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Tom,Dick and Harriet,all members of the House of Representatives,participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Foreign Aid and Post-Secondary Education (2)Foreign Aid and Roads and Bridges and (3)Post-Secondary Education and Roads and Bridges.

Determine whether the voting paradox will occur as a result of these votes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

29

Former Alabama Governor George Wallace ran for president several times,once as a third-party candidate in 1968.Wallace claimed there was "not a dime's worth of difference" between the Democratic and Republican parties during one of his campaigns.How does Wallace's comment relate to the median voter theorem?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

30

Rent seeking behavior,unlike profit maximizing behavior in competitive markets,wastes society's scarce resources.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is the largest source of revenue for the U.S.federal government?

A)the individual income tax

B)social insurance taxes

C)sales taxes

D)property taxes

A)the individual income tax

B)social insurance taxes

C)sales taxes

D)property taxes

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

32

A key assumption of the public choice model is that government policymakers will pursue their own self-interests.Economists assume that consumers and firms pursue their own self-interests when they interact in competitive markets and this interaction results in efficient economic outcomes.Does the pursuit of self-interest by policymakers result in efficient economic outcomes?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

33

Logrolling refers to attempts by individuals to use government action to make themselves better off at the expense of others.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

34

In the United States,the largest source of funds for public schools is

A)the federal income tax.

B)the property tax.

C)the consumption tax.

D)sales taxes.

A)the federal income tax.

B)the property tax.

C)the consumption tax.

D)sales taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

35

A key insight of the public choice model is that public policymakers are likely to pursue the public's interest,even if their self-interests conflict with the public interest.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

36

The public choice model can be used to examine voting models that contrast the manner in which collective decisions are made by governments (state,local and federal)and the manner in which individual choices are made in markets.Which of the following descriptions is consistent with the difference between collective decision-making and decision-making in markets?

A)Everyone who votes must agree with a decision made collectively through government,but in markets individuals can make their own choices.

B)Individuals are less likely to see their preferences represented in the outcomes of government policies than in the outcomes of markets.

C)The cost of a government policy is determined by a majority vote of members of the public; decisions made in markets are based on individual willingness to pay.

D)Choices made through government policies are more important than decisions individuals make through markets.

A)Everyone who votes must agree with a decision made collectively through government,but in markets individuals can make their own choices.

B)Individuals are less likely to see their preferences represented in the outcomes of government policies than in the outcomes of markets.

C)The cost of a government policy is determined by a majority vote of members of the public; decisions made in markets are based on individual willingness to pay.

D)Choices made through government policies are more important than decisions individuals make through markets.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

37

One result of the public choice model is that most economists believe that

A)when market failure occurs,government intervention will always lead to a more efficient outcome.

B)government intervention will always result in a reduction in economic efficiency in regulated markets.

C)policymakers may have incentives to intervene in the economy in ways that do not promote economic efficiency.

D)the voting paradox will prevent voters from selecting the best person for public office.

A)when market failure occurs,government intervention will always lead to a more efficient outcome.

B)government intervention will always result in a reduction in economic efficiency in regulated markets.

C)policymakers may have incentives to intervene in the economy in ways that do not promote economic efficiency.

D)the voting paradox will prevent voters from selecting the best person for public office.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

38

The public choice model raises questions about the government's ability to regulate economic activity efficiently.Which of the following statements represents the views of most economists with regard to the role of government?

A)Congress should abolish the Food and Drug Administration,the Environmental Protection Agency and other agencies and commissions because the costs of their actions exceed the benefits they provide to the public.

B)Government should do more to regulate markets.The public choice model has shown that rent seeking and rational ignorance affect more markets than are currently subject to regulation.

C)U.S.citizens can afford more government regulation if the cost of this regulation is borne mostly by taxpayers with the highest incomes.

D)Agencies such as the Food and Drug Administration and the Environmental Protection Agency can serve a useful purpose,but we need to take the costs of regulation into account along with the benefits.

A)Congress should abolish the Food and Drug Administration,the Environmental Protection Agency and other agencies and commissions because the costs of their actions exceed the benefits they provide to the public.

B)Government should do more to regulate markets.The public choice model has shown that rent seeking and rational ignorance affect more markets than are currently subject to regulation.

C)U.S.citizens can afford more government regulation if the cost of this regulation is borne mostly by taxpayers with the highest incomes.

D)Agencies such as the Food and Drug Administration and the Environmental Protection Agency can serve a useful purpose,but we need to take the costs of regulation into account along with the benefits.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

39

The median voter theorem states that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

40

Economists often analyze the interaction of individuals and firms in markets.Economists also examine the actions of individuals and firms as they attempt to use government to make themselves better off at the expense of others,a process that is referred to as

A)rent seeking.

B)logrolling.

C)government failure.

D)the public choice initiative.

A)rent seeking.

B)logrolling.

C)government failure.

D)the public choice initiative.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

41

According to projections for 2011 by the Tax Policy Center,the 20 percent of U.S.taxpayers who make the highest incomes

A)use loopholes and tax exemptions to reduce their share of federal income taxes to less than 20 percent.

B)pay almost 70 percent of federal income taxes.

C)pay about 90 percent of federal income taxes but only about 20 percent of Social Security and Medicare payroll taxes.

D)pay more in excise and other taxes than they pay in Social Security and Medicare payroll taxes.

A)use loopholes and tax exemptions to reduce their share of federal income taxes to less than 20 percent.

B)pay almost 70 percent of federal income taxes.

C)pay about 90 percent of federal income taxes but only about 20 percent of Social Security and Medicare payroll taxes.

D)pay more in excise and other taxes than they pay in Social Security and Medicare payroll taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

42

The federal government and some state governments levy taxes on specific goods such as gasoline,cigarettes and beer.These are known as

A)sales taxes.

B)sin taxes.

C)specific taxes.

D)excise taxes.

A)sales taxes.

B)sin taxes.

C)specific taxes.

D)excise taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

43

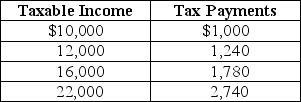

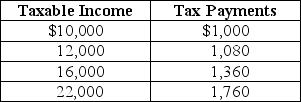

Table 18-4

Table 18-4 shows the amount of taxes paid on various levels of income.

Table 18-4 shows the amount of taxes paid on various levels of income.

Refer to Table 18-4.The tax system is

A)progressive throughout all levels of income.

B)proportional throughout all levels of income.

C)regressive throughout all levels of income.

D)progressive between $10,000 and $12,000 of income and regressive between $16,000 and $22,000.

Table 18-4 shows the amount of taxes paid on various levels of income.

Table 18-4 shows the amount of taxes paid on various levels of income.Refer to Table 18-4.The tax system is

A)progressive throughout all levels of income.

B)proportional throughout all levels of income.

C)regressive throughout all levels of income.

D)progressive between $10,000 and $12,000 of income and regressive between $16,000 and $22,000.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

44

In 2010,over 75 percent of the revenue of the U.S.federal government was raised through

A)individual income and social insurance taxes.

B)property and social insurance taxes.

C)sales and corporate income taxes.

D)individual income and property taxes.

A)individual income and social insurance taxes.

B)property and social insurance taxes.

C)sales and corporate income taxes.

D)individual income and property taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

45

In reference to the federal income tax system,a tax bracket is

A)the estimated amount of federal income tax firms withhold from their employees' paychecks.

B)the formula the federal government uses to determine the dollar amount of the personal exemption and the amounts taxpayers are allowed for deductions from their incomes.

C)used to determine the average tax rate.

D)the income range within which a tax rate applies.

A)the estimated amount of federal income tax firms withhold from their employees' paychecks.

B)the formula the federal government uses to determine the dollar amount of the personal exemption and the amounts taxpayers are allowed for deductions from their incomes.

C)used to determine the average tax rate.

D)the income range within which a tax rate applies.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

46

Since lower-income people spend a larger proportion of their incomes on groceries than do higher-income people,if grocery stores were required by law to charge a 10-cent fee for disposable bags,this fee could be considered a

A)proportional tax.

B)progressive tax.

C)regressive tax.

D)income tax.

A)proportional tax.

B)progressive tax.

C)regressive tax.

D)income tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

47

In the United States,taxpayers are allowed to exclude from taxation a certain amount of income,called

A)the personal income exclusion.

B)the income allowance.

C)the income tax credit.

D)the personal exemption.

A)the personal income exclusion.

B)the income allowance.

C)the income tax credit.

D)the personal exemption.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

48

A proportional tax is a tax for which people with lower incomes

A)pay a higher percentage of their incomes in tax than do people with higher incomes.

B)pay a lower percentage of their incomes in tax than do people with higher incomes.

C)pay the same percentage of their incomes in tax as do people with higher incomes.

D)pay the same amount of taxes as people with higher incomes pay.

A)pay a higher percentage of their incomes in tax than do people with higher incomes.

B)pay a lower percentage of their incomes in tax than do people with higher incomes.

C)pay the same percentage of their incomes in tax as do people with higher incomes.

D)pay the same amount of taxes as people with higher incomes pay.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

49

The largest source of tax revenue for state and local governments in the United States in 2010 was

A)sales taxes.

B)the corporate income tax.

C)the property tax.

D)the individual income tax.

A)sales taxes.

B)the corporate income tax.

C)the property tax.

D)the individual income tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

50

In the United States,the federal income tax is an example of a

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)flat tax.

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)flat tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is an example of a federal mandate?

A)an excise tax

B)the Medicaid program

C)the personal tax exemption

D)the Food and Drug Administration (FDA)

A)an excise tax

B)the Medicaid program

C)the personal tax exemption

D)the Food and Drug Administration (FDA)

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

52

The marginal tax rate is

A)the amount of taxes paid as a percentage of income.

B)the amount of per-capita taxes paid.

C)the amount of taxes paid as a percentage of gross domestic product (GDP).

D)the fraction of each additional dollar of income that must be paid in taxes.

A)the amount of taxes paid as a percentage of income.

B)the amount of per-capita taxes paid.

C)the amount of taxes paid as a percentage of gross domestic product (GDP).

D)the fraction of each additional dollar of income that must be paid in taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

53

When considering changes in tax policy,economists usually focus on

A)the average tax rate.

B)the marginal tax rate.

C)people's willingness to pay taxes.

D)people's ability to pay taxes.

A)the average tax rate.

B)the marginal tax rate.

C)people's willingness to pay taxes.

D)people's ability to pay taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

54

The term "payroll taxes" is often used to refer to

A)individual income taxes that are withheld from paychecks.

B)corporate income taxes.

C)Social Security and Medicare taxes.

D)sales taxes.

A)individual income taxes that are withheld from paychecks.

B)corporate income taxes.

C)Social Security and Medicare taxes.

D)sales taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

55

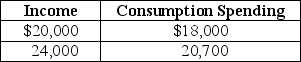

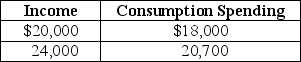

Table 18-3

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Refer to Table 18-3.The consumption tax is

A)proportional.

B)progressive.

C)income neutral.

D)regressive.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.Refer to Table 18-3.The consumption tax is

A)proportional.

B)progressive.

C)income neutral.

D)regressive.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

56

Table 18-5

Table 18-5 shows the amount of taxes paid on various levels of income.

Table 18-5 shows the amount of taxes paid on various levels of income.

Refer to Table 18-5.The tax system is

A)progressive throughout all levels of income.

B)proportional throughout all levels of income.

C)regressive throughout all levels of income.

D)progressive between $10,000 and $12,000 of income and regressive between $12,000 and $22,000.

Table 18-5 shows the amount of taxes paid on various levels of income.

Table 18-5 shows the amount of taxes paid on various levels of income.Refer to Table 18-5.The tax system is

A)progressive throughout all levels of income.

B)proportional throughout all levels of income.

C)regressive throughout all levels of income.

D)progressive between $10,000 and $12,000 of income and regressive between $12,000 and $22,000.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

57

A regressive tax is a tax for which people with lower incomes

A)pay a lower percentage of their incomes in tax than do people with higher incomes.

B)pay a higher percentage of their incomes in tax than do people with higher incomes.

C)pay the same percentage of their incomes in tax as do people with higher incomes.

D)do not have to pay unless their incomes exceeds a certain amount.

A)pay a lower percentage of their incomes in tax than do people with higher incomes.

B)pay a higher percentage of their incomes in tax than do people with higher incomes.

C)pay the same percentage of their incomes in tax as do people with higher incomes.

D)do not have to pay unless their incomes exceeds a certain amount.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

58

In the United States,over the past 40 years federal revenues as a share of gross domestic product have

A)risen steadily and now are about 40 percent.

B)ranged between 17 and 19 percent.

C)fallen below 10 because of rapid economic growth.

D)been limited by law to no more than 20 percent.

A)risen steadily and now are about 40 percent.

B)ranged between 17 and 19 percent.

C)fallen below 10 because of rapid economic growth.

D)been limited by law to no more than 20 percent.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

59

Table 18-3

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Refer to Table 18-3.Calculate the percent of income paid in taxes by a family with $20,000 income and by a family with $24,000 income.

A)The family with a $20,000 income pays 2.7 percent of its income in consumption taxes and the family with a $24,000 income pays 2.6 percent of its income in consumption taxes.

B)Each family pays 3 percent of their respective incomes in consumption taxes.

C)The family with a $20,000 income pays 15 percent of its income in consumption taxes and the family with a $24,000 income pays 33.3 percent of its income in consumption taxes.

D)There is insufficient information to make these calculations.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.

Table 18-3 contains data on household spending at different income levels.Suppose that a 3 percent tax is levied on all consumption spending.Refer to Table 18-3.Calculate the percent of income paid in taxes by a family with $20,000 income and by a family with $24,000 income.

A)The family with a $20,000 income pays 2.7 percent of its income in consumption taxes and the family with a $24,000 income pays 2.6 percent of its income in consumption taxes.

B)Each family pays 3 percent of their respective incomes in consumption taxes.

C)The family with a $20,000 income pays 15 percent of its income in consumption taxes and the family with a $24,000 income pays 33.3 percent of its income in consumption taxes.

D)There is insufficient information to make these calculations.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

60

The average tax rate is calculated as

A)total income divided by the total tax paid.

B)the change in total tax paid divided by the change in income.

C)total tax paid divided by total income.

D)the change in income divided by the change in total tax paid.

A)total income divided by the total tax paid.

B)the change in total tax paid divided by the change in income.

C)total tax paid divided by total income.

D)the change in income divided by the change in total tax paid.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

61

In 2010,which type of tax raised the most revenue for the U.S.federal government? Which type of tax raised the most revenue for state and local governments?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

62

According to the ability-to-pay principle of taxation,

A)individuals who receive the benefit of a good or service should bear a greater share of the tax burden.

B)it is fair to expect a greater share of the tax burden to be borne by people who have a greater ability to pay.

C)people in the same economic situation should bear an equal share of the tax burden.

D)individuals who are willing to bear a greater share of the tax burden should be compensated with non-monetary benefits.

A)individuals who receive the benefit of a good or service should bear a greater share of the tax burden.

B)it is fair to expect a greater share of the tax burden to be borne by people who have a greater ability to pay.

C)people in the same economic situation should bear an equal share of the tax burden.

D)individuals who are willing to bear a greater share of the tax burden should be compensated with non-monetary benefits.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

63

A tax on interest earned from saving is an example of a tax with a high deadweight loss because

A)it compels retired individuals to rely more heavily on Social Security.

B)it encourages people to consume less and save more for their future expenditures.

C)doing so amounts to double taxation since savings often come from income that has already been taxed once.

D)the savings that are taxed could have been spent on capital goods which will benefit society.

A)it compels retired individuals to rely more heavily on Social Security.

B)it encourages people to consume less and save more for their future expenditures.

C)doing so amounts to double taxation since savings often come from income that has already been taxed once.

D)the savings that are taxed could have been spent on capital goods which will benefit society.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

64

A change from an income tax to a consumption tax system would cause the greatest increase in taxes owed by those who currently put part of their savings into 401(k)retirement plans and Individual Retirement Accounts.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

65

Horizontal equity is achieved when taxes are collected from those who benefit from the government expenditure of the tax revenue.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

66

According to the horizontal-equity principle of taxation,

A)individuals who receive the benefits of a good or service should bear a greater share of the tax burden.

B)individuals who are most able to pay should bear a greater share of the tax burden.

C)people in the same economic situation should be treated equally.

D)individuals who are willing to bear a greater share of the tax burden should be compensated with non-monetary benefits.

A)individuals who receive the benefits of a good or service should bear a greater share of the tax burden.

B)individuals who are most able to pay should bear a greater share of the tax burden.

C)people in the same economic situation should be treated equally.

D)individuals who are willing to bear a greater share of the tax burden should be compensated with non-monetary benefits.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

67

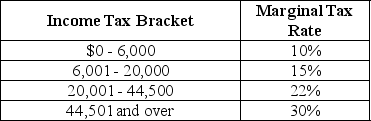

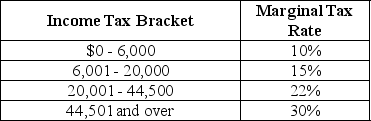

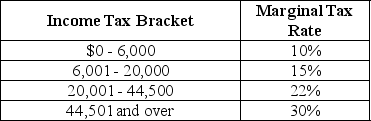

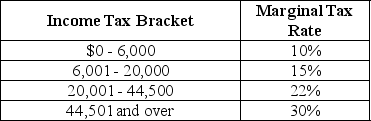

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Refer to Table 18-6.Calculate the income tax paid by Sylvia,a single taxpayer with an income of $70,000.

A)$21,000

B)$15,740

C)$15,400

D)$13,475

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.Refer to Table 18-6.Calculate the income tax paid by Sylvia,a single taxpayer with an income of $70,000.

A)$21,000

B)$15,740

C)$15,400

D)$13,475

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

68

U.S.taxpayers spend many hours during the year maintaining records for tax purposes and preparing their income tax returns.This administrative cost

A)is part of the deadweight loss of taxation.

B)is equal to the value of consumer surplus associated with the income tax system.

C)can be claimed as a deduction on income tax returns.

D)is larger for individuals in the lowest income quintile than for individuals in the highest income quintile.

A)is part of the deadweight loss of taxation.

B)is equal to the value of consumer surplus associated with the income tax system.

C)can be claimed as a deduction on income tax returns.

D)is larger for individuals in the lowest income quintile than for individuals in the highest income quintile.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

69

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Refer to Table 18-6.Sylvia is a single taxpayer with an income of $70,000.What is her marginal tax rate and what is her average tax rate?

A)marginal tax rate = 30%; average tax rate = 30%

B)marginal tax rate = 8%; average tax rate = 19.3%

C)marginal tax rate = 30%; average tax rate = 22.5%

D)marginal tax rate = 20%; average tax rate = 30%

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Monrovia.Refer to Table 18-6.Sylvia is a single taxpayer with an income of $70,000.What is her marginal tax rate and what is her average tax rate?

A)marginal tax rate = 30%; average tax rate = 30%

B)marginal tax rate = 8%; average tax rate = 19.3%

C)marginal tax rate = 30%; average tax rate = 22.5%

D)marginal tax rate = 20%; average tax rate = 30%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

70

Suppose the government wants to finance housing for low-income families by placing a tax on the purchase of luxury homes.Assume the government defines a luxury home as a home that is purchased for at least $1 million.This tax is consistent with the

A)benefits-received principle.

B)social equity principle.

C)ability-to-pay principle.

D)horizontal-equity principle.

A)benefits-received principle.

B)social equity principle.

C)ability-to-pay principle.

D)horizontal-equity principle.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

71

The horizontal-equity principle of taxation is not easy to use in practice because

A)some people engage in rent seeking to reduce their taxes below the level other people pay.

B)people can use tax loopholes to reduce their incomes below the incomes of other taxpayers.

C)different people receive different levels of government benefits even if their incomes are the same.

D)it is difficult to determine whether people are in the same economic situation.

A)some people engage in rent seeking to reduce their taxes below the level other people pay.

B)people can use tax loopholes to reduce their incomes below the incomes of other taxpayers.

C)different people receive different levels of government benefits even if their incomes are the same.

D)it is difficult to determine whether people are in the same economic situation.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

72

The excess burden of a tax

A)measures the efficiency loss to the economy that results from a tax,causing a reduction in the quantity of goods and services produced.

B)is measured by the administrative costs required to implement a tax system.

C)is a measure of the hardship imposed on low-income individuals in a society.

D)is a measure of the foregone consumption as a result of having to pay taxes.

A)measures the efficiency loss to the economy that results from a tax,causing a reduction in the quantity of goods and services produced.

B)is measured by the administrative costs required to implement a tax system.

C)is a measure of the hardship imposed on low-income individuals in a society.

D)is a measure of the foregone consumption as a result of having to pay taxes.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

73

According to the benefits-received principle,those who receive the benefits from a government program should pay the taxes that support the program.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

74

An income tax system is ________ if marginal tax rates increase as income increases.

A)progressive

B)regressive

C)efficient

D)equitable

A)progressive

B)regressive

C)efficient

D)equitable

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

75

For many U.S.individuals and households,replacing the federal income tax with a consumption tax would not make a major change in their tax liability - the amount they would be taxed.Which of the individuals described would be least affected by replacing the income tax with a consumption tax?

A)A person in the lowest income bracket.This person would pay little or no tax under either system.

B)A high-income individual who saves 35 percent of this income and uses his savings to purchase stocks and bonds.

C)A female head of family,with no husband present.

D)A taxpayer who puts part of her savings into a 401(k)retirement plan and in an Individual Retirement Account.

A)A person in the lowest income bracket.This person would pay little or no tax under either system.

B)A high-income individual who saves 35 percent of this income and uses his savings to purchase stocks and bonds.

C)A female head of family,with no husband present.

D)A taxpayer who puts part of her savings into a 401(k)retirement plan and in an Individual Retirement Account.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

76

Vertical-equity is most closely associated with which of the following goals or principles?

A)the horizontal-equity principle

B)the goal of economic efficiency

C)the goal of attaining social objectives

D)the ability-to-pay principle

A)the horizontal-equity principle

B)the goal of economic efficiency

C)the goal of attaining social objectives

D)the ability-to-pay principle

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following explains one difference between a consumption tax and an income tax?

A)An income tax is a regressive tax; a consumption tax is a progressive tax.

B)Under a consumption tax,households pay taxes only on the part of income they spend; under an income tax,households pay taxes on all income earned.

C)Under an income tax,present consumption is taxed more heavily than future consumption; under a consumption tax,future consumption is taxed more heavily than present consumption.

D)Savings are taxed more heavily under a consumption tax than under an income tax.

A)An income tax is a regressive tax; a consumption tax is a progressive tax.

B)Under a consumption tax,households pay taxes only on the part of income they spend; under an income tax,households pay taxes on all income earned.

C)Under an income tax,present consumption is taxed more heavily than future consumption; under a consumption tax,future consumption is taxed more heavily than present consumption.

D)Savings are taxed more heavily under a consumption tax than under an income tax.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

78

A tax is efficient if

A)individuals with the lowest incomes pay proportionately lower taxes than individuals with the highest incomes.

B)it is based on profits earned and not on wages.

C)it encourages saving and investment.

D)it imposes a small excess burden relative to the revenue it raises.

A)individuals with the lowest incomes pay proportionately lower taxes than individuals with the highest incomes.

B)it is based on profits earned and not on wages.

C)it encourages saving and investment.

D)it imposes a small excess burden relative to the revenue it raises.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

79

A tax is efficient if it imposes a small excess burden relative to the tax revenue it raises.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

80

According to the benefits-received principle of taxation,

A)individuals who receive the benefits from a government program should pay the taxes that support the program.

B)because high income individuals receive the most benefits from government programs,they should pay more taxes than lower income individuals.

C)people in the same economic situation should bear an equal share of the tax burden.

D)the benefits of government programs such as national defense are shared equally by all people; therefore,the burden of paying for these programs should be shared equally.

A)individuals who receive the benefits from a government program should pay the taxes that support the program.

B)because high income individuals receive the most benefits from government programs,they should pay more taxes than lower income individuals.

C)people in the same economic situation should bear an equal share of the tax burden.

D)the benefits of government programs such as national defense are shared equally by all people; therefore,the burden of paying for these programs should be shared equally.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck