Deck 10: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 10: Stockholders Equity

1

Stockholders have limited liability, since there is no personal obligation of a stockholder for the corporation's debts.

True

2

Stockholders' equity is divided into:

A) retained earnings and paid-in capital.

B) retained earnings and common stock.

C) assets and liabilities.

D) common stock and preferred stock.

A) retained earnings and paid-in capital.

B) retained earnings and common stock.

C) assets and liabilities.

D) common stock and preferred stock.

A

3

A stockholder has the right to vote in the election of the board of directors.

True

4

Indicate whether the following characteristics of the corporate form of business are considered to be an advantage or disadvantage.

1. Separate legal entity

2. Ability to raise capital

3. Continuous life

4. Double taxation of corporate earnings

5. Separation of ownership and management

6. Ease of ownership transfer

7. Government regulation

8. Limited liability of stockholders

1. Separate legal entity

2. Ability to raise capital

3. Continuous life

4. Double taxation of corporate earnings

5. Separation of ownership and management

6. Ease of ownership transfer

7. Government regulation

8. Limited liability of stockholders

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

The amount of stock the state charter allows a corporation to issue is called common stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

Preferred stockholders:

A) receive dividends after common stockholders.

B) receive corporate assets upon liquidation after the common stockholders.

C) do not have any stockholder rights.

D) receive a fixed dividend when the board of directors declares the dividend.

A) receive dividends after common stockholders.

B) receive corporate assets upon liquidation after the common stockholders.

C) do not have any stockholder rights.

D) receive a fixed dividend when the board of directors declares the dividend.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

A corporation is not an entity that is separate from its owners.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT considered to be an advantage of forming a corporation?

A) Continuous life

B) Government regulations

C) Separation of ownership and management

D) Limited liability of owners

A) Continuous life

B) Government regulations

C) Separation of ownership and management

D) Limited liability of owners

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

The authority structure of a corporation would show the:

A) board of directors delegating to the stockholders.

B) president delegating to the board of directors.

C) chief financial officer delegating to the board of directors.

D) stockholders delegating to the board of directors.

A) board of directors delegating to the stockholders.

B) president delegating to the board of directors.

C) chief financial officer delegating to the board of directors.

D) stockholders delegating to the board of directors.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

Double taxation means that the:

A) corporation's income tax is allocated to the shareholders based on ownership percentage.

B) corporate earnings are subject to state and federal income tax.

C) corporation pays tax on its earnings and the shareholders pay tax on dividends.

D) shareholder's dividends are taxed at the corporate tax rate.

A) corporation's income tax is allocated to the shareholders based on ownership percentage.

B) corporate earnings are subject to state and federal income tax.

C) corporation pays tax on its earnings and the shareholders pay tax on dividends.

D) shareholder's dividends are taxed at the corporate tax rate.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

The chairperson of the board of directors has the title of:

A) Chief Financial Officer (CFO).

B) President.

C) Chief Executive Officer (CEO).

D) Chief Operating Officer (COO).

A) Chief Financial Officer (CFO).

B) President.

C) Chief Executive Officer (CEO).

D) Chief Operating Officer (COO).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

The arbitrary amount assigned by a company to a share of its stock is the:

A) no-par value.

B) par value.

C) dividend value.

D) capital value.

A) no-par value.

B) par value.

C) dividend value.

D) capital value.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

If a corporation has only one class of stock, it is understood to be:

A) preferred stock.

B) common stock.

C) contributory stock.

D) equity stock.

A) preferred stock.

B) common stock.

C) contributory stock.

D) equity stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

Dividends are declared by the:

A) Chief Accounting Officer.

B) Chief Financial Officer.

C) President.

D) Board of directors.

A) Chief Accounting Officer.

B) Chief Financial Officer.

C) President.

D) Board of directors.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

If a corporation pays taxes on its income, then the stockholders will not have to pay taxes on the dividends received from that corporation.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

The basic unit of ownership for a corporation is:

A) dividends.

B) stock.

C) retained earnings.

D) capital.

A) dividends.

B) stock.

C) retained earnings.

D) capital.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

Stockholders of a corporation directly elect the:

A) Board of directors.

B) President of the corporation.

C) Chief Financial Officer of the corporation

D) Chairperson of the Board.

A) Board of directors.

B) President of the corporation.

C) Chief Financial Officer of the corporation

D) Chairperson of the Board.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

A corporation acts under its own name and not the name of its stockholders.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following is NOT a stockholders' right of ownership in a corporation?

A) To vote and elect the board of directors

B) To receive a proportionate share of the assets upon liquidation

C) To maintain one's proportional share of ownership in the corporation

D) To declare dividends

A) To vote and elect the board of directors

B) To receive a proportionate share of the assets upon liquidation

C) To maintain one's proportional share of ownership in the corporation

D) To declare dividends

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

A new corporation forms every time there is a change in ownership.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

The number of shares of authorized stock of a corporation:

A) changes every time stock is sold.

B) is stated in the charter.

C) has no limit.

D) must be recorded as a journal entry.

A) changes every time stock is sold.

B) is stated in the charter.

C) has no limit.

D) must be recorded as a journal entry.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

A Loss on Issue of Common Stock indicates that the stock was sold for less than its par value.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

When 100 shares of $1 par value Common Stock are issued at $25 per share, Paid-in Capital in Excess of Par value-Common Stock will:

A) increase $100.

B) increase $2,500.

C) increase $2,400.

D) stay the same.

A) increase $100.

B) increase $2,500.

C) increase $2,400.

D) stay the same.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

Corporations may sell stock directly to the stockholders.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

When a company issues common stock greater than its par value, the excess should be credited to:

A) retained earnings.

B) common stock.

C) paid-in capital in excess of par.

D) capital.

A) retained earnings.

B) common stock.

C) paid-in capital in excess of par.

D) capital.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

The terms "authorized stock" and "issued stock" are used synonymously.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

If stock is issued for an asset other than cash, the asset should be recorded on the books of the corporation at:

A) fair market value.

B) cost.

C) par value of the stock.

D) zero.

A) fair market value.

B) cost.

C) par value of the stock.

D) zero.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

Assets, other than cash, should be recorded at the stockholders' cost when received from the issuance of stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

Wolverine Corporation issued 5,000 shares of its $5 par value common stock in payment for attorney services of $40,000. Wolverine stock has been actively trading at $20 per share. This transaction would include a:

A) credit to Paid-in Capital in Excess of Par $40,000.

B) credit to Paid-in Capital in Excess of Par $15,000.

C) credit to Common Stock $100,000.

D) credit to Common Stock $40,000

A) credit to Paid-in Capital in Excess of Par $40,000.

B) credit to Paid-in Capital in Excess of Par $15,000.

C) credit to Common Stock $100,000.

D) credit to Common Stock $40,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

The price that the stockholder pays to acquire stock from the corporation is the:

A) par price.

B) authorized price.

C) offering price.

D) issue price.

A) par price.

B) authorized price.

C) offering price.

D) issue price.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

A company can sell stock only for cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

The entry to record common stock issued at its par value includes a:

A) debit to Retained Earnings.

B) debit to Common Stock.

C) credit to Retained Earnings.

D) credit to Common Stock.

A) debit to Retained Earnings.

B) debit to Common Stock.

C) credit to Retained Earnings.

D) credit to Common Stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

When reporting stockholders' equity on the balance sheet, a corporation lists the accounts in the following order:

A) retained earnings, preferred stock, common stock.

B) common stock, preferred stock, retained earnings.

C) preferred stock, common stock, retained earnings.

D) retained earnings, common stock, paid-in capital in excess of par - common.

A) retained earnings, preferred stock, common stock.

B) common stock, preferred stock, retained earnings.

C) preferred stock, common stock, retained earnings.

D) retained earnings, common stock, paid-in capital in excess of par - common.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

When common stock is issued for services, the corporation usually recognizes an expense for the fair market value of the services provided.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

If a corporation issues 4,000 shares of $1 par value common stock for $8,000, the entry would include a credit to:

A) Common Stock for $8,000.

B) Paid-in Capital in Excess of Par for $8,000.

C) Common Stock for $4,000.

D) Paid-in Capital in Excess of Par for $4,000.

A) Common Stock for $8,000.

B) Paid-in Capital in Excess of Par for $8,000.

C) Common Stock for $4,000.

D) Paid-in Capital in Excess of Par for $4,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

If a corporation issues 5,000 shares of $5 par value common stock for $95,000, the entry would include a credit to:

A) Common Stock for $95,000.

B) Paid-in Capital in Excess of Par for $95,000.

C) Common Stock for $70,000.

D) Paid-in Capital in Excess of Par for $70,000.

A) Common Stock for $95,000.

B) Paid-in Capital in Excess of Par for $95,000.

C) Common Stock for $70,000.

D) Paid-in Capital in Excess of Par for $70,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

Another name for paid-in capital in excess of par is additional common stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

Convertible preferred stock is usually convertible into the company's common stock at the discretion of the preferred stockholder.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

The difference between the issue price of the stock and the par value of the stock is:

A) market value.

B) par value.

C) additional paid-in capital.

D) preferred stock.

A) market value.

B) par value.

C) additional paid-in capital.

D) preferred stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

Wolverine Corporation issued 5,000 shares of its $5 par value common stock in payment for attorney services of $40,000. Wolverine stock has been actively trading at $20 per share. This transaction would include a:

A) debit to Legal Expense $100,000.

B) debit to Legal Expense $40,000.

C) credit to Common Stock $100,000.

D) credit to Common Stock $40,000

A) debit to Legal Expense $100,000.

B) debit to Legal Expense $40,000.

C) credit to Common Stock $100,000.

D) credit to Common Stock $40,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

Treasury stock has a:

A) debit balance, the opposite of other equity accounts.

B) credit balance, the same as other equity accounts.

C) credit balance, the opposite of other equity accounts.

D) debit balance, the same as other equity accounts.

A) debit balance, the opposite of other equity accounts.

B) credit balance, the same as other equity accounts.

C) credit balance, the opposite of other equity accounts.

D) debit balance, the same as other equity accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

Treasury stock increases the number of shares outstanding.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

The purchase of treasury stock by a corporation increases total assets and stockholders' equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

Green Corporation purchases 40,000 shares of its own $10 par value common stock for $25 per share. What will be the effect on stockholders' equity?

A) Increase $400,000

B) Increase $1,000,000

C) Decrease $400,000

D) Decrease $1,000,000

A) Increase $400,000

B) Increase $1,000,000

C) Decrease $400,000

D) Decrease $1,000,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

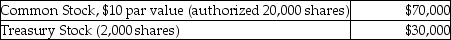

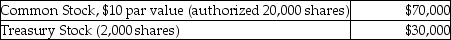

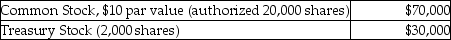

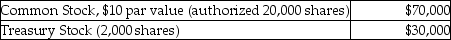

Liberty Corporation has the following information as of December 31, 2012:  Based on the information above, how many shares of common stock have been issued?

Based on the information above, how many shares of common stock have been issued?

A) 20,000.

B) 7,000.

C) 5,000.

D) 2,000.

Based on the information above, how many shares of common stock have been issued?

Based on the information above, how many shares of common stock have been issued?A) 20,000.

B) 7,000.

C) 5,000.

D) 2,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

Wilson Corporation had the following transactions:

1. Issued 7,000 shares of common stock with a stated value of $15 for $155,000.

2. Issued 3,000 shares of $100 par value preferred stock at $117 for cash.

Required: Prepare the journal entries for the above transactions.

1. Issued 7,000 shares of common stock with a stated value of $15 for $155,000.

2. Issued 3,000 shares of $100 par value preferred stock at $117 for cash.

Required: Prepare the journal entries for the above transactions.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

Liberty Corporation has the following information as of December 31, 2012:  Based on the information above, how many shares of common stock are outstanding?

Based on the information above, how many shares of common stock are outstanding?

A) 20,000.

B) 7,000.

C) 5,000.

D) 2,000.

Based on the information above, how many shares of common stock are outstanding?

Based on the information above, how many shares of common stock are outstanding?A) 20,000.

B) 7,000.

C) 5,000.

D) 2,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

ABC Corporation purchases 40,000 shares of its own $10 par value common stock for $25 per share. What will be the effect on stockholders' equity?

A) Increase $400,000

B) Decrease $400,000

C) Increase $1,000.000

D) Decrease $1,000,000

A) Increase $400,000

B) Decrease $400,000

C) Increase $1,000.000

D) Decrease $1,000,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

During the month of February, B & B Builders, Inc. completed the following transactions related to its stock:

• February 2: Issued 3,000 shares of no-par common stock with a stated value of $1 for $15 cash per share.

• February 3: Issued 9,000 shares of no-par common stock with no stated value for $20 per share

• February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required: Prepare journal entries for the above transactions.

• February 2: Issued 3,000 shares of no-par common stock with a stated value of $1 for $15 cash per share.

• February 3: Issued 9,000 shares of no-par common stock with no stated value for $20 per share

• February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required: Prepare journal entries for the above transactions.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

Robertson Corporation incorporated on January 2, 2012. During 2012 Robertson had the following transactions: • issued 30,000 shares of common stock at $25 per share

• purchased 2,000 shares of treasury stock at $28 per share

• had net income of $400,000.

What is the total amount of stockholders' equity as of December 31, 2012?

A) $750,000

B) $400,000

C) $1,094,000

D) $1,206,000

• purchased 2,000 shares of treasury stock at $28 per share

• had net income of $400,000.

What is the total amount of stockholders' equity as of December 31, 2012?

A) $750,000

B) $400,000

C) $1,094,000

D) $1,206,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

Stock that a corporation purchases from shareholders is called:

A) treasury stock.

B) authorized stock.

C) issued stock.

D) outstanding stock.

A) treasury stock.

B) authorized stock.

C) issued stock.

D) outstanding stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

The purchase of treasury stock has the same effect of issuing stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

Casey's Computers purchased 4,000 shares of its own $10 par value common stock for $92,000. As a result of this transaction:

A) Casey's Paid-in Capital in Excess of Par Value account decreased $52,000.

B) Casey's Common Stock decreased $40,000.

C) Casey's Stockholders' Equity decreased $92,000.

D) Casey's Stockholders' equity increased $52,000.

A) Casey's Paid-in Capital in Excess of Par Value account decreased $52,000.

B) Casey's Common Stock decreased $40,000.

C) Casey's Stockholders' Equity decreased $92,000.

D) Casey's Stockholders' equity increased $52,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

Treasury stock accounts for the difference between:

A) issued shares and authorized shares.

B) issued shares and preferred shares.

C) outstanding shares and issued shares.

D) authorized shares and outstanding shares.

A) issued shares and authorized shares.

B) issued shares and preferred shares.

C) outstanding shares and issued shares.

D) authorized shares and outstanding shares.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

Reasons that a company would purchase treasury stock include all of the following EXCEPT:

A) management wants to avoid a takeover by an outside party.

B) it needs the stock for distribution to employees under stock purchase plans.

C) it wants to increase net assets by buying its stock low and reselling it at a higher price.

D) management wants to decrease earnings per share of common stock.

A) management wants to avoid a takeover by an outside party.

B) it needs the stock for distribution to employees under stock purchase plans.

C) it wants to increase net assets by buying its stock low and reselling it at a higher price.

D) management wants to decrease earnings per share of common stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

Nelson Corporation has $1 par value Common Stock and has 100,000 shares authorized and 25,000 shares issued. The entry to record Nelson's purchase of 5,000 shares of common stock at $5 per share would include a:

A) debit to Treasury Stock for $25,000.

B) credit to Common Stock $25,000.

C) credit to Paid-in Capital in Excess of Par Value - Common Stock for $20,000.

D) debit to Common Stock $5,000.

A) debit to Treasury Stock for $25,000.

B) credit to Common Stock $25,000.

C) credit to Paid-in Capital in Excess of Par Value - Common Stock for $20,000.

D) debit to Common Stock $5,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

Treasury stock belongs in the stockholders' equity section of the balance sheet.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

Treasury stock is a contra-stockholders' equity account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

If treasury stock is sold at a price greater than its reacquisition costs, the difference is:

A) debited to Paid-in Capital from Treasury Stock.

B) credited to Paid-in Capital from Treasury Stock.

C) debited to Retained Earnings.

D) credited to Retained Earnings.

A) debited to Paid-in Capital from Treasury Stock.

B) credited to Paid-in Capital from Treasury Stock.

C) debited to Retained Earnings.

D) credited to Retained Earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

Pretzel, Inc. paid $54,000 to buy back 9,000 shares of its $1 par value common stock. The stock was sold later at a selling price of $10 per share. The entry to record the sale would include a:

A) debit to Paid-in Capital - Treasury Stock $54,000.

B) debit to Common Stock $54,000.

C) credit to Paid-in Capital-Treasury Stock $36,000.

D) credit to Common Stock $36,000.

A) debit to Paid-in Capital - Treasury Stock $54,000.

B) debit to Common Stock $54,000.

C) credit to Paid-in Capital-Treasury Stock $36,000.

D) credit to Common Stock $36,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

The retained earnings account is not a reservoir of cash for paying dividends to the stockholders.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

On February 2nd of the current year, Bradley's Video Games, Inc. reacquired 5,000 shares of its $10 par value common stock at $50 per share. On February 23rd, Bradley's Video Games, Inc. sold 1,000 of the reacquired shares at $65 per share. On February 27th, the remaining 4,000 shares were sold at $40 per share.

Required:

1. Prepare the journal entries necessary to record these transactions.

2. What is the balance in the treasury stock account on February 28th?

Required:

1. Prepare the journal entries necessary to record these transactions.

2. What is the balance in the treasury stock account on February 28th?

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

Common stockholders receive dividends even if the total dividend is not large enough to pay the preferred stockholders first.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

On February 3, 2012 Granger Corporation acquired 4,000 shares of its own $1 par value common stock for $30 per share. On May 24, 2012, 1,500 shares of the treasury stock were sold for $35 per share.

Prepare the journal entries to record the purchase and sale of the treasury stock.

Prepare the journal entries to record the purchase and sale of the treasury stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

The total stockholders' equity remains the same before and after a stock split.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

The date when a cash dividend becomes a legal obligation is on the:

A) date of record.

B) declaration date.

C) last day of the corporate year.

D) payment date.

A) date of record.

B) declaration date.

C) last day of the corporate year.

D) payment date.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

A 2-for-1 stock split will increase total stockholders' equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

A debit balance in the Retained Earnings account indicates a deficit.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

There is no journal entry for the dividend date of record.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

Travis Corporation issued 20,000 shares of common stock. Travis purchased 2,000 shares and later reissued 1,000 shares. How many shares are issued and outstanding?

A) 18,000 issued and 18,000 outstanding

B) 20,000 issued and 18,000 outstanding

C) 19,000 issued and 19,000 outstanding

D) 20,000 issued and 19,000 outstanding

A) 18,000 issued and 18,000 outstanding

B) 20,000 issued and 18,000 outstanding

C) 19,000 issued and 19,000 outstanding

D) 20,000 issued and 19,000 outstanding

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

A retirement of common stock:

A) decreases the number of shares of common stock issued.

B) decreases the number of shares of common stock issued and reduces the balance in the common stock account.

C) produces a gain or loss reported on the income statement.

D) reduces the balance in the Common Stock account.

A) decreases the number of shares of common stock issued.

B) decreases the number of shares of common stock issued and reduces the balance in the common stock account.

C) produces a gain or loss reported on the income statement.

D) reduces the balance in the Common Stock account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

Small stock dividends are recorded at market value and large stock dividends are recorded at par value.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

Only stockholders on the record date will receive a dividend.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

A debit balance in Retained Earnings indicates that a company's lifetime earnings exceeded its lifetime losses and dividends issued.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

The authority to declare a dividend lies with the:

A) CFO.

B) shareholders.

C) SEC.

D) Board of Directors.

A) CFO.

B) shareholders.

C) SEC.

D) Board of Directors.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

If a company has a deficit in retained earnings:

A) then retained earnings has a credit balance.

B) the deficit is subtracted to determine total stockholders' equity.

C) the deficit is added to determine total stockholders' equity.

D) then the corporation's lifetime earnings exceed lifetime losses and dividends.

A) then retained earnings has a credit balance.

B) the deficit is subtracted to determine total stockholders' equity.

C) the deficit is added to determine total stockholders' equity.

D) then the corporation's lifetime earnings exceed lifetime losses and dividends.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

The effect of the declaration of a cash dividend is a(n):

A) increase to Liabilities and a decrease to Stockholders' Equity.

B) increase to Liabilities and a decrease to Assets.

C) increase to Assets and a decrease to Liabilities.

D) increase to Stockholders' Equity and a decrease to Assets.

A) increase to Liabilities and a decrease to Stockholders' Equity.

B) increase to Liabilities and a decrease to Assets.

C) increase to Assets and a decrease to Liabilities.

D) increase to Stockholders' Equity and a decrease to Assets.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

If a corporation declares a $100,000 cash dividend, the account to be debited on the date of declaration is:

A) Common Stock.

B) Dividends Payable.

C) Retained Earnings.

D) Paid-in Capital in Excess of Par.

A) Common Stock.

B) Dividends Payable.

C) Retained Earnings.

D) Paid-in Capital in Excess of Par.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

Dividends may be declared and paid in cash only.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

Dividends in arrears on cumulative preferred stock are considered to be a liability.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck