Deck 10: Deductions and Losses: Certain Itemized Deductions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 10: Deductions and Losses: Certain Itemized Deductions

1

Shirley pays FICA (employer's share)on the wages she pays her maid to clean and maintain Shirley's personal residence.The FICA payment is not deductible as an itemized deduction.

True

2

Mindy paid an appraiser to determine how much a capital improvement made for medical reasons increased the value of her personal residence.The appraisal fee qualifies as a deductible medical expense.

False

3

The election to itemize is appropriate when total itemized deductions are less than the standard deduction based on the taxpayer's filing status.

False

4

In 2011,Dena traveled 545 miles for specialized medical treatment that was not available in her hometown.She paid $80 for meals during the trip,$125 for a hotel room on Tuesday night,and $15 in parking fees.She did not keep records of other out-of-pocket costs for transportation.Dena can include $235 in computing her medical expenses.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

Fees for automobile inspections,automobile titles and registration,bridge and highway tolls,parking meter deposits,and postage are not deductible if incurred for personal reasons,but they are deductible as deductions for AGI if incurred as a business expense by a self-employed taxpayer.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

Carol pays the medical expenses of her son,Chad.Chad would qualify as Carol's dependent except that he earns $7,500 during the year.Carol may not claim Chad's medical expenses because he is not a dependent.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

Erica,Carol's daughter,has a mild form of autism.Dr.Malone recommends that Carol send Erica to a special school for autistic children when she enters first grade.Erica may include the cost of tuition,meals,and lodging for the special school when computing her medical expense deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

In 2011,Brandon,age 72,paid $3,000 for long-term care insurance premiums.He may include the $3,000 in computing his medical expense deduction for the year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

Any personal expenditures not specifically allowed as itemized deductions by the tax law are nondeductible (unless they are deductible in arriving at AGI).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

Matt,a calendar year taxpayer,pays $9,000 in medical expenses in 2011.He expects $4,000 of these expenses to be reimbursed by an insurance company in 2012.In determining his medical expense deduction for 2011,Matt must reduce his 2011 medical expenses by the amount of the reimbursement he expects in 2012.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

A medical expense does not have to relate to a particular ailment to be deductible.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

Sergio was required by the city to pay $2,000 for the cost of new curbing installed by the city in front of his personal residence.The new curbing was installed throughout Sergio's neighborhood as part of a street upgrade project.Sergio may not deduct $2,000 as a tax,but he may add the $2,000 to the basis of his property.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

George,a sculptor,has an elevator installed in his house to transport heavy materials to his loft studio because he is concerned that he might strain his back by lifting heavy objects.George may deduct the full cost of the elevator as a medical expense.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

Walter traveled to another city to obtain specialized outpatient medical care not available in his hometown.His sister accompanied him because he was too ill to travel alone.He may include the cost of his airfare and lodging (up to $50 per night for himself and up to $50 per night for his sister)in determining his medical expense deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

In 2012,Rhonda received an insurance reimbursement for medical expenses incurred in 2011.She is not required to include the reimbursement in gross income in 2012 if she claimed the standard deduction in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

Betty,who is an accounting firm partner,paid $4,800 for medical insurance coverage for herself.She can include the $4,800 when calculating her itemized medical expense deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

Georgia contributed $2,000 to a qualifying Health Savings Account in 2011.The entire amount qualifies as a medical expense and is potentially deductible as an itemized deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

Upon the recommendation of a physician,Ed has a swimming pool installed at his residence because of a heart condition.If he is allowed to deduct all or part of the cost of the pool,Ed's increase in utility bills due to the operation of the pool qualifies as a medical expense.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

Taxes assessed for local benefits,such as a new sidewalk,are not deductible as real property taxes.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

Tom paid $1,880 of medical expenses for his son,Ted.Ted is married to Ann and they file a joint return.Tom cannot include the $1,880 of expenses when calculating his medical expense deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

Felix sells his personal residence to Julio on July 1,2011.He had paid $9,000 in real property taxes on March 1,2011,the due date for property taxes for 2011.Felix may deduct the portion of the taxes he paid for the period the property was owned by Julio.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

Bob sold a personal residence to Fred and paid points of $2,000 on the loan to help Fred finance the purchase.Bob can deduct the points as interest.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

In January 2012,Pam,a calendar year cash basis taxpayer,made an estimated state income tax payment for 2011.The payment is deductible in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

For purposes of computing the deduction for qualified residence interest,a qualified residence includes only the taxpayer's principal residence.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

Leona borrows $100,000 from First National Bank and uses the proceeds to purchase City of Houston bonds.The interest Leona pays on this loan is deductible as investment interest subject to the investment interest limits.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Albert is the sole proprietor of a grocery store.He cannot deduct real property taxes on his store building and state income taxes related to his net income from the grocery store as a business deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

On December 31,2011,Lynette used her credit card to make a $500 contribution to the United Way,a qualified charitable organization.She will pay her credit card balance in January 2012.If Lynette itemizes,she can deduct the $500 in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

For all of the current year,Randy (a calendar year taxpayer)allowed the Salvation Army to use a building he owns rent-free.The building normally rents for $24,000 a year.Randy will be allowed a charitable contribution deduction this year of $24,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

For purposes of computing the deduction for qualified residence interest,a qualified residence includes the taxpayer's principal residence and two other residences of the taxpayer or spouse.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

Phyllis,a calendar year cash basis taxpayer who itemized deductions,overpaid her 2010 state income tax and is entitled to a refund of $400.Phyllis chooses to apply the $400 overpayment toward her state income taxes for 2011.She is required to recognize that amount as income in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

Joe,a cash basis taxpayer,took out a 12-month business loan on December 1,2011.He prepaid all $3,600 of the interest on the loan on December 1,2011.Joe can deduct all $3,600 of the prepaid interest in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

A taxpayer pays points to obtain financing to purchase a rental house.At the election of the taxpayer,the points can be deducted as interest expense for the year paid.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

Grace's sole source of income is from a restaurant that she owns and operates as a proprietorship.Any state income tax Grace pays on the business net income must be deducted as a business expense rather than as an itemized deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

Tina,whose MAGI is $50,000,paid $3,000 of interest on a qualified education loan in 2011.Tina is single.She may deduct the $3,000 interest as a deduction for AGI.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

Interest paid or accrued during the tax year on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns)is deductible as qualified residence interest.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

If certain conditions are met,a buyer may deduct seller-paid points in the tax year in which they are paid.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Carolyn mailed a check for $1,000 to a qualified charitable organization on December 31,2011.The $1,000 contribution is not deductible on Carolyn's 2011 tax return because the charity does not receive the check until 2012.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

In April 2011,Bart,a calendar year cash basis taxpayer,had to pay the state of Alabama additional income tax for 2010.Even though it relates to 2010,for Federal income tax purposes the payment qualifies as a tax deduction for tax year 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

Letha incurred a $1,600 prepayment penalty to a lending institution because she paid off the mortgage on her home early.The $1,600 is deductible as interest expense.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn.Judy may claim an $80 charitable contribution deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

In applying the percentage limitations,carryovers of charitable contributions must be claimed after contributions in the current year are considered (FIFO rule).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

Patrick and Leah are married and together have AGI of $100,000 in 2011.They have three dependents and file a joint return.They pay $3,000 for a high deductible health insurance policy and contribute $2,400 to a qualified Health Savings Account.During the year,they paid the following amounts for medical care: $8,200 in doctor and dentist bills and hospital expenses,and $2,500 for prescribed medicine and drugs.In December 2011,they received an insurance reimbursement of $3,400 for hospitalization.They expect to receive an additional reimbursement of $1,700 in January 2012.Determine the maximum deduction allowable for medical expenses in 2011.

A) $1,100.

B) $2,800.

C) $5,200.

D) $10,300.

E) None of the above.

A) $1,100.

B) $2,800.

C) $5,200.

D) $10,300.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

In 2011,Dorothy drove 500 miles to volunteer in a project sponsored by a qualified charitable organization in New Mexico.In addition,she spent $200 for meals while away from home.Dorothy may take a charitable contribution deduction of $270 [$200 + (500 miles ´ $.14)].

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

Nancy had an accident while skiing on vacation.She sustained facial injuries that required cosmetic surgery.While having the surgery done to restore her appearance,she had additional surgery done to reshape her nose,which was not injured in the accident.The surgery to restore her appearance cost $12,000 and the surgery to reshape her nose cost $5,000.How much of Nancy's surgical fees will qualify as a deductible medical expense (before application of the 7.5% limitation)?

A) $0.

B) $5,000.

C) $12,000.

D) $17,000.

E) None of the above.

A) $0.

B) $5,000.

C) $12,000.

D) $17,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

The phaseout of certain itemized deductions has been reinstated for years beginning in 2011.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

Jerry pays $5,000 tuition to a parochial school run by his church in order to enable his daughter to attend.This is the amount the school charges all students.Part of the tuition payments can be claimed as a charitable contribution.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

During the year,Victor spent $300 on bingo games sponsored by his church.If all profits went to the church,Victor has a charitable contribution deduction of $300.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

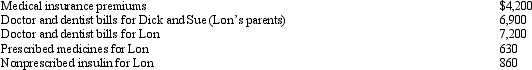

Lon is employed as an accountant.For calendar year 2011,he had AGI of $120,000 and paid the following medical expenses:  Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

A) $5,130.

B) $10,790.

C) $12,730.

D) $19,790.

E) None of the above.

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?A) $5,130.

B) $10,790.

C) $12,730.

D) $19,790.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

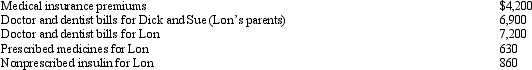

Liz,who is single,travels frequently on business.Art,Liz's 84-year-old dependent grandfather,lived with Liz until this year when he moved to Granite Falls Nursing Home because he needs daily medical and nursing care.During the year,Liz made the following payments to Granite Falls on behalf of Art:  Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?

Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?

A) $5,610.

B) $41,910.

C) $49,170.

D) $49,830.

E) None of the above.

Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?

Granite Falls has medical staff in residence.Disregarding the 7.5% floor,how much,if any,of these expenses qualifies as a medical expense deduction by Liz?A) $5,610.

B) $41,910.

C) $49,170.

D) $49,830.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

Any capital asset donated to a public charity that would result in long-term capital gain if sold,is subject to the 30%-of-AGI ceiling limitation on charitable contributions for individuals.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Bjorn contributed a sculpture to the Minnesota Art Museum of St.Cloud,Minnesota.The sculpture,purchased six years ago,was worth $50,000 when donated,and Bjorn's basis was $10,000.If this sculpture is immediately sold by the museum and the proceeds are placed in the general fund,Bjorn's charitable contribution deduction is $50,000 (subject to percentage limitations).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

Dwayne contributed stock worth $17,000 to a qualified charity.He acquired the stock fourteen months ago for $8,000.He may deduct $17,000 as a charitable contribution deduction (subject to percentage limitations).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

In the year of her death,Maria made significant charitable contributions of capital gain property.In fact,the amount of the contributions exceeds 30% of her AGI.Maria's executor can elect to deduct charitable contributions of up to 50% of Maria's AGI on Maria's final income tax return.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

Excess charitable contributions that come under the 30% of AGI ceiling are always subject to the 30% of AGI ceiling in the carryover year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

During the year,Eve (a resident of Billings,Montana)spends three consecutive weeks in Louisville,Kentucky.One week is spent representing the Billings First Christian Church at the national convention,and two weeks are spent vacationing with relatives.One third of Eve's travel expenses will qualify as a charitable deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

Employee business expenses for travel qualify as itemized deductions subject to the 2% floor if they are not reimbursed.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Gambling losses may be deducted to the extent of the taxpayer's gambling winnings.Such losses are not subject to the 2% floor for miscellaneous itemized deductions.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

Contributions to public charities in excess of 50% of AGI may be carried back 3 years or forward for up to 5 years.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

John gave $1,000 to a family whose house was destroyed by fire.John may claim a charitable deduction of $1,000 on his tax return for the current year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

In order to dissuade his pastor from resigning and taking a position with a larger church,Michael,an ardent leader of the congregation,gives the pastor a new car.The cost of the car is deductible by Michael as a charitable contribution.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

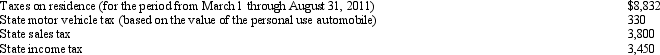

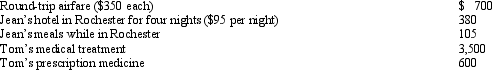

During 2011,Ellen paid the following taxes:  Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?

Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?

A) $12,962.

B) $11,900.

C) $8,450.

D) $4,650.

E) None of the above.

Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?

Ellen sold her personal residence on May 30,2011,under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for 2011 for Ellen?A) $12,962.

B) $11,900.

C) $8,450.

D) $4,650.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

David,a single taxpayer,took out a mortgage on his home for $300,000 nine years ago.In August of this year,when the home had a fair market value of $550,000 and he owed $225,000 on the mortgage,he took out a home equity loan for $350,000.David used the funds to purchase a yacht to be used for recreational purposes.What is the maximum amount of debt on which he can deduct home equity interest?

A) $50,000.

B) $100,000.

C) $325,000.

D) $350,000.

E) None of the above.

A) $50,000.

B) $100,000.

C) $325,000.

D) $350,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

Your friend Scotty informs you that he received a "tax-free" reimbursement in 2011 of some medical expenses he paid in 2010.Which of the following statements best explains why Scotty is not required to report the reimbursement in gross income?

A) Scotty itemized deductions in 2010.

B) Scotty did not itemize deductions in 2010.

C) Scotty itemized deductions in 2011.

D) Scotty did not itemize deductions in 2011.

E) Scotty itemized deductions in 2011 but not in 2010.

A) Scotty itemized deductions in 2010.

B) Scotty did not itemize deductions in 2010.

C) Scotty itemized deductions in 2011.

D) Scotty did not itemize deductions in 2011.

E) Scotty itemized deductions in 2011 but not in 2010.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

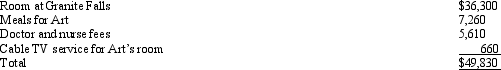

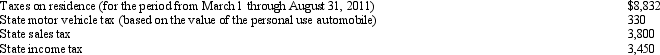

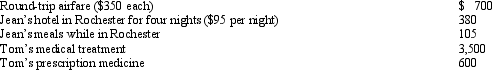

Tom is advised by his family physician that he needs back surgery to correct a problem from his last back surgery.Since Tom is in a wheel chair,he needs his wife,Jean,to accompany him on his trip to Rochester,Minnesota,for in-patient treatment at the Mayo Clinic,which specializes in this type of surgery.Tom incurred the following costs:  Compute Tom's medical expenses for the trip (subject to the 7.5% floor).

Compute Tom's medical expenses for the trip (subject to the 7.5% floor).

A) $4,000.

B) $5,000.

C) $5,180.

D) $5,285.

E) None of the above.

Compute Tom's medical expenses for the trip (subject to the 7.5% floor).

Compute Tom's medical expenses for the trip (subject to the 7.5% floor).A) $4,000.

B) $5,000.

C) $5,180.

D) $5,285.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

Joseph and Sandra,married taxpayers,took out a mortgage on their home for $350,000 in 1989.In May of this year,when the home had a fair market value of $450,000 and they owed $250,000 on the mortgage,they took out a home equity loan for $220,000.They used the funds to purchase a single engine airplane to be used for recreational travel purposes.What is the maximum amount of debt on which they can deduct home equity interest?

A) $50,000.

B) $100,000.

C) $220,000.

D) $230,000.

E) None of the above.

A) $50,000.

B) $100,000.

C) $220,000.

D) $230,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

In 2011,Terry pays $10,000 to become a charter member of Eastern University's Athletic Council.The membership ensures that Terry will receive choice seating at all of Eastern's home basketball games.Also in 2011,Terry pays $1,200 (the regular retail price)for season tickets for himself and his wife.For these items,how much qualifies as a charitable contribution?

A) $6,000.

B) $6,800.

C) $8,000.

D) $10,000.

E) None of the above.

A) $6,000.

B) $6,800.

C) $8,000.

D) $10,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

Dirk,who uses the cash method of accounting,lives in a state that imposes an income tax (including withholding from wages).On April 14,2011,he files his state return for 2010,paying an additional $800 in state income taxes.During 2011,his withholdings for state income tax purposes amount to $4,550.On April 13,2012,he files his state return for 2011,claiming a refund of $900.Dirk receives the refund on August 3,2012.If he itemizes deductions,how much may Dirk claim as a deduction for state income taxes on his Federal income tax return for calendar year 2011 (filed in April 2012)?

A) $4,450.

B) $4,550.

C) $5,350.

D) $6,250.

E) None of the above.

A) $4,450.

B) $4,550.

C) $5,350.

D) $6,250.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

In Shelby County,the real property tax year is the calendar year.The real property tax becomes a personal liability of the owner of real property on January 1 in the current real property tax year,2011.The tax is payable on June 1,2011.On April 30,2011,Julio sells his house to Anita for $230,000.On June 1,2011,Anita pays the entire real estate tax of $7,300 for the year ending December 31,2011.How much of the property taxes may Julio deduct?

A) $0.

B) $2,380.

C) $2,400.

D) $4,920

E) None of the above.

A) $0.

B) $2,380.

C) $2,400.

D) $4,920

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

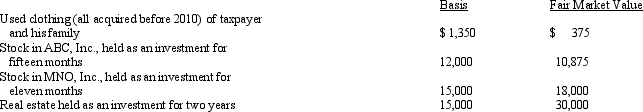

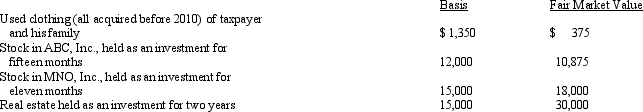

Zeke made the following donations to qualified charitable organizations during 2011:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Pedro's child attends a school operated by the church the family attends.Pedro made a donation of $1,000 to the church in lieu of the normal registration fee of $200.In addition,Pedro paid the regular tuition of $6,000 to the school.Based on this information,what is Pedro's charitable contribution?

A) $0.

B) $800.

C) $1,000.

D) $6,800.

E) $7,000.

A) $0.

B) $800.

C) $1,000.

D) $6,800.

E) $7,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

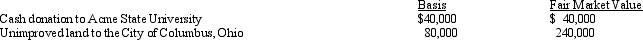

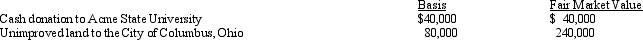

Jennifer,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2011:  The land had been held as an investment and was acquired 3 years ago.Shortly after receipt,the City of Columbus sold the land for $240,000.Jennifer's AGI is $400,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 3 years ago.Shortly after receipt,the City of Columbus sold the land for $240,000.Jennifer's AGI is $400,000.The allowable charitable contribution deduction is:

A) $84,000 if the reduced deduction election is not made.

B) $112,000 if the reduced deduction election is not made.

C) $160,000 if the reduced deduction election is not made.

D) $200,000 if the reduced deduction election is made.

E) None of the above.

The land had been held as an investment and was acquired 3 years ago.Shortly after receipt,the City of Columbus sold the land for $240,000.Jennifer's AGI is $400,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 3 years ago.Shortly after receipt,the City of Columbus sold the land for $240,000.Jennifer's AGI is $400,000.The allowable charitable contribution deduction is:A) $84,000 if the reduced deduction election is not made.

B) $112,000 if the reduced deduction election is not made.

C) $160,000 if the reduced deduction election is not made.

D) $200,000 if the reduced deduction election is made.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

In 2011,Boris pays a $3,800 premium for high-deductible medical insurance for himself and his family.In addition,he contributes $3,400 to a Health Savings Account.Which of the following statements is true?

A) If Boris is self-employed, he may deduct $7,200 as a deduction for AGI.

B) If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical expense deduction.

C) If Boris is an employee, he may deduct $7,200 as a deduction for AGI.

D) If Boris is an employee, he may include $7,200 when calculating his itemized medical expense deduction.

E) None of the above.

A) If Boris is self-employed, he may deduct $7,200 as a deduction for AGI.

B) If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical expense deduction.

C) If Boris is an employee, he may deduct $7,200 as a deduction for AGI.

D) If Boris is an employee, he may include $7,200 when calculating his itemized medical expense deduction.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

Ron and Tom are equal owners in Robin Corporation.On July 1,2011,each loans the corporation $20,000 at annual interest of 10%.Ron and Tom are brothers.Both shareholders are on the cash method of accounting,while Robin Corporation is on the accrual method.All parties use the calendar year for tax purposes.On June 30,2012,Robin repays the loans of $40,000 together with the specified interest of $4,000.How much of the interest can Robin Corporation deduct in 2011?

A) $0.

B) $1,000.

C) $2,000.

D) $4,000.

E) None of the above.

A) $0.

B) $1,000.

C) $2,000.

D) $4,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

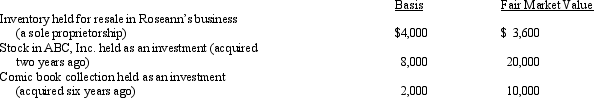

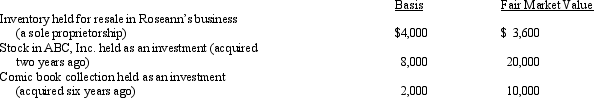

In 2011,Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:

A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Rosie owned stock in Acme Corporation that she donated to a university (a qualified charitable organization)on September 6,2011.What is the amount of Rosie's charitable contribution deduction assuming that she had purchased the stock for $20,100 on October 22,2010,and the stock had a value of $28,200 when she made the donation?

A) $8,100.

B) $20,100.

C) $24,150.

D) $28,200.

E) None of the above.

A) $8,100.

B) $20,100.

C) $24,150.

D) $28,200.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Andrea,who lives in Ohio,volunteered to travel to Arizona in February to work on a home-building project for Habitat for Humanity (a qualified charitable organization).She was in Arizona for three weeks.She normally makes $600 per week as a carpenter's assistant and plans to deduct $1,800 as a charitable contribution.In addition,she incurred the following costs in connection with the trip: $700 for transportation,$820 for lodging,and $340 for meals.What is Andrea's deduction associated with this charitable activity?

A) $700.

B) $1,040.

C) $1,520.

D) $1,860.

E) $3,660.

A) $700.

B) $1,040.

C) $1,520.

D) $1,860.

E) $3,660.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

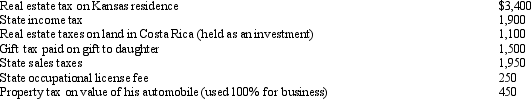

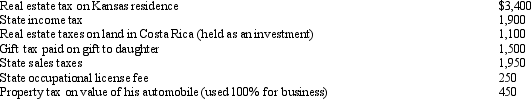

During the current year,Vijay,a self-employed individual,paid the following amounts:  What is the maximum amount Vijay can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Vijay can claim as taxes in itemizing deductions from AGI?

A) $6,450.

B) $6,700.

C) $6,900.

D) $7,150.

E) None of the above.

What is the maximum amount Vijay can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Vijay can claim as taxes in itemizing deductions from AGI?A) $6,450.

B) $6,700.

C) $6,900.

D) $7,150.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Wayne developed heart problems and was unable to climb the stairs to reach his second-floor bedroom.His physician advised him to add a first-floor bedroom to his home.The cost of constructing the room was $42,000.The increase in the value of the residence as a result of the room addition was determined to be $18,000.In addition,Wayne paid the contractor $7,500 to construct an entrance ramp to his home and $10,500 to widen the hallways to accommodate his wheelchair.Wayne's AGI for the year was $120,000.How much of these expenditures can Wayne deduct as a medical expense?

A) $15,000.

B) $24,000.

C) $33,000.

D) $60,000.

E) None of the above.

A) $15,000.

B) $24,000.

C) $33,000.

D) $60,000.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Diego,who is single and lives alone,is physically handicapped as a result of a diving accident.In order to live independently,he modifies his personal residence at a cost of $20,000.The modifications included widening halls and doorways for a wheelchair,installing support bars in the bathroom and kitchen,installing a stairway lift,and rewiring so he could reach electrical outlets and appliances.Diego pays $200 for an appraisal that places the value of the residence at $124,000 before the improvements and $129,000 after.As a result of the operation of the stairway lift,Diego experienced an increase of $475 in his utility bills for the current year.Disregarding percentage limitations,how much of the above expenditures qualify as medical expense deductions?

A) $25,475.

B) $20,475.

C) $15,675.

D) $15,475.

E) None of the above.

A) $25,475.

B) $20,475.

C) $15,675.

D) $15,475.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

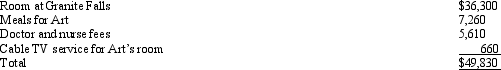

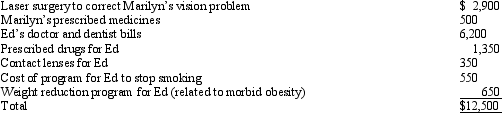

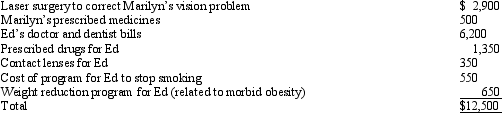

Marilyn,Ed's daughter who would otherwise qualify as his dependent,filed a joint return with her husband Henry.Ed,who had AGI of $150,000,incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

A) $0.

B) $50.

C) $1,250.

D) $12,500.

E) None of the above.

Ed has a medical expense deduction of:

Ed has a medical expense deduction of:A) $0.

B) $50.

C) $1,250.

D) $12,500.

E) None of the above.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck