Deck 9: Financial Management of the Multinational Firm

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 9: Financial Management of the Multinational Firm

1

Use the following information to answer questions 10-12.

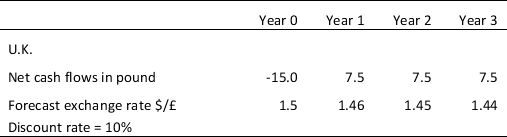

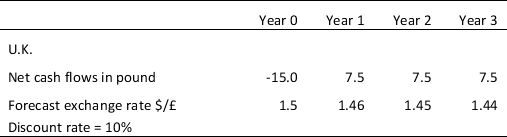

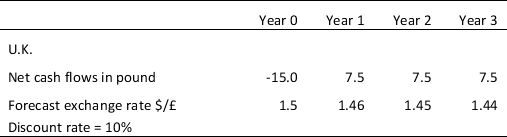

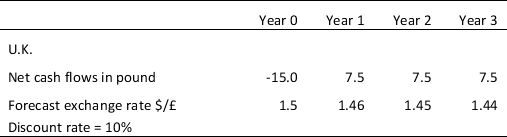

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

Refer to Table 9.1.The net present value NPV of this project in U.S.dollar is estimated at:

A) $2.86 million

B) $3.65 million

C) $4.56 million

D) - $9.21 million

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

Refer to Table 9.1.The net present value NPV of this project in U.S.dollar is estimated at:

A) $2.86 million

B) $3.65 million

C) $4.56 million

D) - $9.21 million

$4.56 million

2

Use this information to answer questions 13-15.

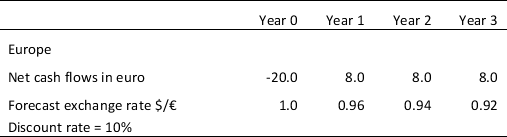

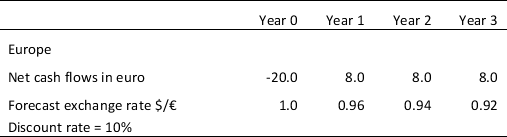

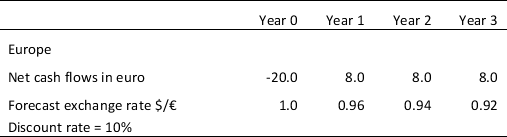

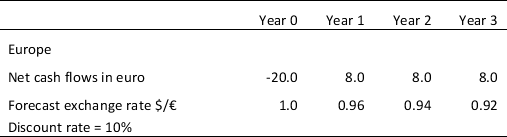

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

Refer to Table 9.2.Based on the net present value,

A) the project can be accepted because the net present value is positive.

B) the project should be rejected because the net present value is negative.

C) the project can be accepted because the net present value is negative.

D) the project should be rejected because the net present value is positive.

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

Refer to Table 9.2.Based on the net present value,

A) the project can be accepted because the net present value is positive.

B) the project should be rejected because the net present value is negative.

C) the project can be accepted because the net present value is negative.

D) the project should be rejected because the net present value is positive.

the project should be rejected because the net present value is negative.

3

Letters of credit are used because:

A) Subsidiaries often have little capital

B) Profits are taxed differently in different countries

C) Contracts are difficult to enforce internationally

D) They prevent seizures by foreign governments

A) Subsidiaries often have little capital

B) Profits are taxed differently in different countries

C) Contracts are difficult to enforce internationally

D) They prevent seizures by foreign governments

Contracts are difficult to enforce internationally

4

Which of the following is probably NOT an example of the use of forward contracts by a multinational corporation MNC?

A) Hedging pound payables by selling pounds forward

B) Hedging peso receivables by selling pesos forward

C) Hedging yen payables by purchasing yen forward

D) All of the above are examples of using forward contracts

A) Hedging pound payables by selling pounds forward

B) Hedging peso receivables by selling pesos forward

C) Hedging yen payables by purchasing yen forward

D) All of the above are examples of using forward contracts

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

An advantage of netting of a multinational corporation and its subsidiaries is that it:

A) increases foreign exchange risk.

B) decreases the total volume of inter-subsidiary fund flows.

C) increases the total amount of currency conversion.

D) decreases the number of employees.

A) increases foreign exchange risk.

B) decreases the total volume of inter-subsidiary fund flows.

C) increases the total amount of currency conversion.

D) decreases the number of employees.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following information to answer questions 10-12.

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

Refer to Table 9.1.Based on the net present value,

A) the project can be accepted because the net present value is positive.

B) the project should be rejected because the net present value is negative.

C) the project can be accepted because the net present value is negative.

D) the project should be rejected because the net present value is positive.

General Candy, Inc., a U.S. firm, manufactures and sells candies worldwide. Because of a rising price of sugar in the U.S., the company is considering to build a new plant in the U.K. The plant will cost £15 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the British government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.1:

Refer to Table 9.1.Based on the net present value,

A) the project can be accepted because the net present value is positive.

B) the project should be rejected because the net present value is negative.

C) the project can be accepted because the net present value is negative.

D) the project should be rejected because the net present value is positive.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

Comparing with information in Table 9.2,if the forecast exchange rate $/£ remains constant at $1.0 per pound throughout the life of the project,which of the following is true?

A) The net present value of this project increases.

B) The net present value of this project decreases.

C) The net present value of this project becomes more positive.

D) The net present value of this project remains unchanged.

A) The net present value of this project increases.

B) The net present value of this project decreases.

C) The net present value of this project becomes more positive.

D) The net present value of this project remains unchanged.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT a step in the capital budgeting process?

A) Identify the initial outlay of the investment project.

B) Estimate net future cash flows over the lifetime of the project.

C) Identify appropriate interest rate to discount the future cash flows.

D) Use foreign inflation rates to discount the future cash flows.

A) Identify the initial outlay of the investment project.

B) Estimate net future cash flows over the lifetime of the project.

C) Identify appropriate interest rate to discount the future cash flows.

D) Use foreign inflation rates to discount the future cash flows.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is correct about a decentralized management style of the financial management over foreign operations?

A) There is no monitoring of subsidiary managers, since an MNC's foreign subsidiaries are separate legal entities.

B) MNCs allow subsidiary managers to make the key decisions about their respective operations, but the decisions may be monitored by the parent's management.

C) Subsidiary foreign managers respond to directive from the top of the parent's management.

D) Financial managers at the parent company make most of the key decisions.

A) There is no monitoring of subsidiary managers, since an MNC's foreign subsidiaries are separate legal entities.

B) MNCs allow subsidiary managers to make the key decisions about their respective operations, but the decisions may be monitored by the parent's management.

C) Subsidiary foreign managers respond to directive from the top of the parent's management.

D) Financial managers at the parent company make most of the key decisions.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Transfer pricing has been used by multinational corporation to:

A) Minimize tax payments in foreign countries

B) Minimize import tariffs

C) Minimize foreign exchange controls

D) All of the above are correct.

A) Minimize tax payments in foreign countries

B) Minimize import tariffs

C) Minimize foreign exchange controls

D) All of the above are correct.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

When the subsidiary manager is focused on meeting goals set by the parent firm,then the multinational firm is probably using an ________ style of management.

A) Multinational cash

B) Decentralized

C) Centralized

D) Goal-orientated

A) Multinational cash

B) Decentralized

C) Centralized

D) Goal-orientated

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

To reduce transfer pricing distortion,multinational firms are supposed to charge prices to their foreign subsidiaries that are __________.

A) Average variable costs

B) Total costs

C) Marginal costs

D) Arm's-length prices

A) Average variable costs

B) Total costs

C) Marginal costs

D) Arm's-length prices

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT an objective of international cash management by MNCs?

A) To increase the firm's liquidity.

B) To increase the firm's returns on investment.

C) To ensure that all subsidiaries have the same pattern of cash flows.

D) To reduce foreign exchange risk.

A) To increase the firm's liquidity.

B) To increase the firm's returns on investment.

C) To ensure that all subsidiaries have the same pattern of cash flows.

D) To reduce foreign exchange risk.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

Political instability and currency conversion are reasons why ________ is more complicated for foreign subsidiaries than domestic ones.

A) Currency lagging

B) Capital budgeting

C) Patterning cash flows

D) Forward financing

A) Currency lagging

B) Capital budgeting

C) Patterning cash flows

D) Forward financing

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

A documentary credit is issued to importer to pay exporter for an amount of GBP 40,000 payable with drafts drawn at 30 days from the date of shipment.Document is presented with bills of lading.This is an example of:

A) Export netting

B) Swap contract

C) Letter of credit

D) Future contract

A) Export netting

B) Swap contract

C) Letter of credit

D) Future contract

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT a reason why capital budgeting for a foreign project is more complicated than a domestic project?

A) Cash flows from the foreign project have to be converted into the domestic currency.

B) The foreign project can be affected by political instability in foreign country.

C) The foreign project involves larger amount of working capital than the domestic project.

D) The foreign project can be affected by different foreign taxes and regulations.

A) Cash flows from the foreign project have to be converted into the domestic currency.

B) The foreign project can be affected by political instability in foreign country.

C) The foreign project involves larger amount of working capital than the domestic project.

D) The foreign project can be affected by different foreign taxes and regulations.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

The goal of a multinational corporation MNC is

A) The minimization of taxes remitted from foreign subsidiaries.

B) The establishment of subsidiaries in any country where operations would provide a return above the cost of capital, even if better projects are available domestically.

C) The maximization of shareholder wealth.

D) The maximization of social benefits to the host country through knowledge spillover effects.

A) The minimization of taxes remitted from foreign subsidiaries.

B) The establishment of subsidiaries in any country where operations would provide a return above the cost of capital, even if better projects are available domestically.

C) The maximization of shareholder wealth.

D) The maximization of social benefits to the host country through knowledge spillover effects.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

Comparing with information in Table 9.1,if the forecast exchange rate $/£ remains constant at $1.5 per pound throughout the life of the project,which of the following is true?

A) The net present value of this project increases.

B) The net present value of this project decreases.

C) The net present value of this project becomes negative.

D) The net present value of this project remains unchanged.

A) The net present value of this project increases.

B) The net present value of this project decreases.

C) The net present value of this project becomes negative.

D) The net present value of this project remains unchanged.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

After considering the long-term implications of the project such as political risk and foreign tax regulations,a multinational firm called Company X decides to purchase a foreign company to merge with its foreign subsidiary.This is an example of:

A) Cash management

B) Projection analysis

C) Capital budgeting

D) Decentralized management

A) Cash management

B) Projection analysis

C) Capital budgeting

D) Decentralized management

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

Use this information to answer questions 13-15.

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

A) - $0.11million

B) - $1.27 million

C) $2.33 million

D) $1.14 million

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

A) - $0.11million

B) - $1.27 million

C) $2.33 million

D) $1.14 million

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following are advantages of netting?

I.Avoiding transaction costs

II.Shifting profits to different subsidiaries

III.Avoiding taxes for the parent firm

IV.Increasing flexibility in the parent firm

A) I only

B) II only

C) I and IV

D) II, III, and IV

I.Avoiding transaction costs

II.Shifting profits to different subsidiaries

III.Avoiding taxes for the parent firm

IV.Increasing flexibility in the parent firm

A) I only

B) II only

C) I and IV

D) II, III, and IV

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

Capital budgeting refers to the evaluation of prospective investment alternatives and the commitment of funds to preferred projects.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

For a multinational firm using a decentralized management style,the subsidiary would be expected to meet goals for key variables such as sales and labor costs.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

When a multinational firm calculates a project for a foreign subsidiary with ________ net value,then the project should probably be ________.

A) Zero, delayed

B) Positive, sold

C) Negative, accepted

D) Positive, accepted

A) Zero, delayed

B) Positive, sold

C) Negative, accepted

D) Positive, accepted

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

If multinational businesses want managers of foreign subsidiaries to be involved in international financing issues,then subsidiary profits should be measured in:

A) The foreign currency

B) The domestic currency

C) U.S. dollars only.

D) Swiss francs only.

A) The foreign currency

B) The domestic currency

C) U.S. dollars only.

D) Swiss francs only.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

Assume a letter of contract is in place.If the importer does not pay the bank,then under the letter of contract the _______ is still obligated to pay the exporter.

A) Domestic government

B) Foreign government

C) Importer

D) Bank

A) Domestic government

B) Foreign government

C) Importer

D) Bank

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

A detailed list of the content that is shipped,and can be used to identify missing or damaged items is called an:

A) Adjusted payment

B) Import contract

C) Contract guarantee

D) Bill of lading

A) Adjusted payment

B) Import contract

C) Contract guarantee

D) Bill of lading

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

The U.S.Internal revenue service requires subsidiaries set transfer prices by charging prices that an unrelated buyer and seller would willingly pay or using:

A) Minimal cost pricing

B) Marginal cost pricing

C) Arm's-length pricing

D) Deposit pricing

A) Minimal cost pricing

B) Marginal cost pricing

C) Arm's-length pricing

D) Deposit pricing

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

For a multinational firm using a decentralized management style,the subsidiary would be expected:

A) To focus on meeting goals set by the parent firm.

B) To make most of the financing and production decisions.

C) To allow the parent firm move resources to maximize total firm value.

D) To operate efficiently under directives from the parent firm.

A) To focus on meeting goals set by the parent firm.

B) To make most of the financing and production decisions.

C) To allow the parent firm move resources to maximize total firm value.

D) To operate efficiently under directives from the parent firm.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

Centralization of cash management allows the parent to offset subsidiary payables and receivables in a process called:

A) Internalizing

B) Outsourcing

C) Risk shifting

D) Netting

A) Internalizing

B) Outsourcing

C) Risk shifting

D) Netting

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

The sum of the project's initial investment cost,the present values of cash flows,and all financial effects related to the investment is called:

A) Subsidiary investment total

B) Transfer total

C) Cost above investment

D) Adjusted present value

A) Subsidiary investment total

B) Transfer total

C) Cost above investment

D) Adjusted present value

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

A contract written by a bank to guarantee that the bank will pay the exporter the amount of money owed by the importer is called a:

A) Letter of credit

B) Export contract

C) Import contract

D) Contract guarantee

A) Letter of credit

B) Export contract

C) Import contract

D) Contract guarantee

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

The sum of the project's initial investment cost,the present values of cash flows,and all financial effects related to the investment is called the adjusted present value.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

A transfer price is the price that one subsidiary charges another subsidiary of internal good transfers.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

Because cash earns no interest,firms engage in multinational cash management to use this liquid resource as efficiently as possible.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

By using netting,firms are able to minimize:

A) Labor costs

B) Penalty payments

C) Transaction costs

D) Transfer prices

A) Labor costs

B) Penalty payments

C) Transaction costs

D) Transfer prices

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose Banana Computers has a foreign subsidiary with a 3 million pound payable due on October 1,as well as 2 million pound receivable due on September 1.One way the firm could avoid transaction costs is:

A) Lagging currency flows

B) Capital budgeting

C) Risk analysis

D) Transfer pricing

A) Lagging currency flows

B) Capital budgeting

C) Risk analysis

D) Transfer pricing

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

An ________ letter of credit where the agreement cannot be modified without the express permission of all parties is considered:

A) Completed

B) Irrevocable

C) Revocable

D) Drafted

A) Completed

B) Irrevocable

C) Revocable

D) Drafted

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

The evaluation of prospective investment alternatives and the commitment of funds to preferred projects is referred to as:

A) Capital budgeting

B) Cash management

C) Flow budgeting

D) Decentralized management

A) Capital budgeting

B) Cash management

C) Flow budgeting

D) Decentralized management

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

The price that one subsidiary charges another subsidiary of internal good transfers is called an:

A) Transfer price

B) Transaction price

C) Strike price

D) Subsidiary price

A) Transfer price

B) Transaction price

C) Strike price

D) Subsidiary price

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

A letter of credit LOC is a contract written by a bank to guarantee that the exporter will pay the importer the amount of money owed.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

The firm's management style determines whether to decentralize or centralize its financial management between the parent and the foreign subsidiaries.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

When a multinational firm calculates a project for a foreign subsidiary with ________ net value,then the project should probably be ________.

A) Zero, delayed

B) Positive, sold

C) Negative, accepted

D) Positive, accepted

A) Zero, delayed

B) Positive, sold

C) Negative, accepted

D) Positive, accepted

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

A contractual obligation of a bank for a future payment is called an:

A) Letter of contract

B) Export netting agreement

C) Transfer price

D) Banker's acceptance

A) Letter of contract

B) Export netting agreement

C) Transfer price

D) Banker's acceptance

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

An ________ letter of credit where the agreement can be modified by the importer of the goods is considered:

A) Completed

B) Irrevocable

C) Revocable

D) Drafted

A) Completed

B) Irrevocable

C) Revocable

D) Drafted

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

In capital budgeting,a multinational firm often:

A) Forecasts exchange rates

B) Ignores capital seizures risks

C) Provides a bill of lading

D) Transfers profits to one foreign subsidiary

A) Forecasts exchange rates

B) Ignores capital seizures risks

C) Provides a bill of lading

D) Transfers profits to one foreign subsidiary

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Multinational cash management involves managing the parent-firm's capital holdings separately from any foreign capital holdings.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

Multinational cash management is used by the firm to move cash to keep overall cash needs low.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

To minimize transaction costs on foreign subsidiary profits in low-tax countries,firms may use transfer prices.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following are advantages of netting?

V.Avoiding transaction costs

VI.Shifting profits to different subsidiaries

VII.Avoiding taxes for the parent firm

VIII.Increasing flexibility in the parent firm

A) I only

B) II only

C) I and IV

D) II, III, and IV

V.Avoiding transaction costs

VI.Shifting profits to different subsidiaries

VII.Avoiding taxes for the parent firm

VIII.Increasing flexibility in the parent firm

A) I only

B) II only

C) I and IV

D) II, III, and IV

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck