Deck 6: Exchange Rates, interest Rates, and Interest Parity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 6: Exchange Rates, interest Rates, and Interest Parity

1

Assume the following: the current spot rate S¥/$ = 100.0 and the annual interest rates: iJAPAN = 2% and iUS = 10%.According to covered interest parity,if an intern at Citibank sets the one-year forward rate: F360¥/$ = 91,then:

A) the intern has correctly set the forward rate.

B) both U.S. and Japan's investment returns are equal.

C) the Japan's investment return exceeds the U.S. investment return

D) the U.S. investment return exceed the Japan's investment return

A) the intern has correctly set the forward rate.

B) both U.S. and Japan's investment returns are equal.

C) the Japan's investment return exceeds the U.S. investment return

D) the U.S. investment return exceed the Japan's investment return

the Japan's investment return exceeds the U.S. investment return

2

Suppose that the one-year U.S.interest rate is 8% and the equivalent one-year India interest rate is 12%.According to covered interest parity,there is:

A) Forward discount on dollar.

B) Forward premium on dollar.

C) Forward premium for Indian rupee.

D) Forward flat on dollar

A) Forward discount on dollar.

B) Forward premium on dollar.

C) Forward premium for Indian rupee.

D) Forward flat on dollar

Forward premium on dollar.

3

Use the following information to answer questions 6-9.

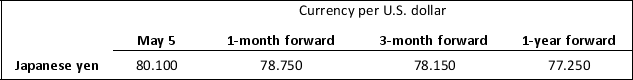

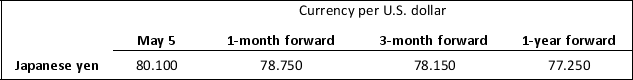

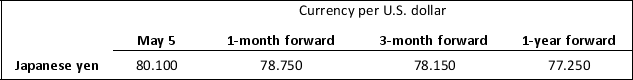

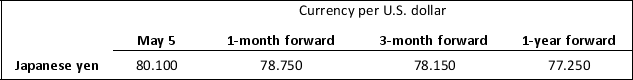

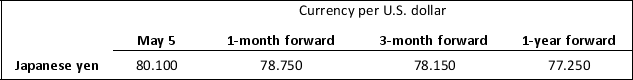

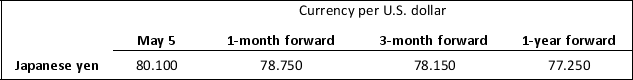

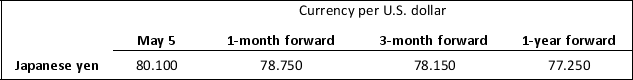

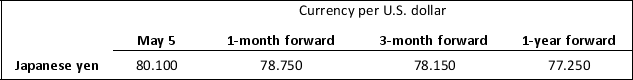

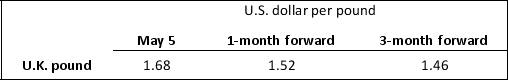

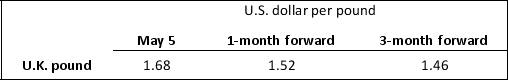

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 1-year forward yen was selling at a:

A) 3.56% premium per annum against the dollar.

B) 3.69% premium per annum against the dollar.

C) 3.56% discount per annum against the dollar.

D) 3.69% discount per annum against the dollar.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 1-year forward yen was selling at a:

A) 3.56% premium per annum against the dollar.

B) 3.69% premium per annum against the dollar.

C) 3.56% discount per annum against the dollar.

D) 3.69% discount per annum against the dollar.

3.56% premium per annum against the dollar.

4

Assume that the 6-month iUS = 10% and the 6-month iSwiss = 20%,and the spot rate is $1.20 per Swiss franc.Using the approximate covered interest rate parity condition,the 6-month forward rate $/Swiss franc is:

A) 1.08

B) 1.14

C) 1.26

D) 1.32

A) 1.08

B) 1.14

C) 1.26

D) 1.32

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that the one-year U.S.interest rate is 8% and the equivalent one-year India interest rate is 12%.Using the exact covered interest parity,the dollar is expected to:

A) depreciate by 3.6%.

B) depreciate by 50%.

C) appreciate by 3.6%

D) appreciate by 50%.

A) depreciate by 3.6%.

B) depreciate by 50%.

C) appreciate by 3.6%

D) appreciate by 50%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose that the one-year U.S.interest rate is 8% and the one-year Swiss interest rate is 10%.If the current spot rate is $1.50 per Swiss franc,what must the one-year forward rate $/SFr be according to the approximate covered interest parity?

A) $1.47

B) $1.50

C) $1.53

D) $4.50

A) $1.47

B) $1.50

C) $1.53

D) $4.50

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

If the U.S.and the U.K.have identical term structures of interest rates,we would expect:

A) the pound to appreciate against the dollar.

B) the pound to depreciate against the dollar.

C) no change in the exchange rate between two currencies.

D) there is not enough information to forecast the direction of the exchange rate.

A) the pound to appreciate against the dollar.

B) the pound to depreciate against the dollar.

C) no change in the exchange rate between two currencies.

D) there is not enough information to forecast the direction of the exchange rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

Assume the following: the current spot rate S$/£ = 2.00 and the annual interest rates: iUS = 4% and iUK = 8%.According to covered interest parity,if an intern at a bank in U.K.sets the 90-day forward: F90$/£ = 1.80,then:

A) the intern has correctly set the forward rate.

B) both U.S. and U.K. investment returns are equal.

C) the British investment return exceeds the U.S. investment return

D) the U.S. investment return exceed the British investment return

A) the intern has correctly set the forward rate.

B) both U.S. and U.K. investment returns are equal.

C) the British investment return exceeds the U.S. investment return

D) the U.S. investment return exceed the British investment return

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following information to answer questions 6-9.

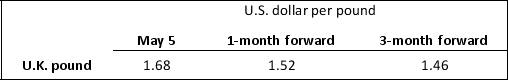

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.Comparing the yen's forward rates against the yen's spot rate,over the period of a forward contract,we would expect the yen's spot rate to:

A) remain constant against the dollar

B) appreciate against the dollar

C) depreciate against the dollar

D) depreciate against the dollar in the first 30 days and then appreciate afterward.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.Comparing the yen's forward rates against the yen's spot rate,over the period of a forward contract,we would expect the yen's spot rate to:

A) remain constant against the dollar

B) appreciate against the dollar

C) depreciate against the dollar

D) depreciate against the dollar in the first 30 days and then appreciate afterward.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Let i be the nominal interest rate,re is real interest rate,and πe is the expected rate of inflation.The Fisher equation is:

A) i=re + πe

B) i=re - πe

C) i=re × πe

D) i=re ÷ πe

A) i=re + πe

B) i=re - πe

C) i=re × πe

D) i=re ÷ πe

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

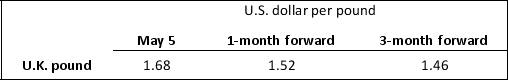

Use the following information to answer questions 6-9.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 1-month forward yen was selling at a:

A) 1.69% premium per annum against the dollar.

B) 20.22% premium per annum against the dollar.

C) 1.69% discount per annum against the dollar.

D) 20.22% discount per annum against the dollar.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 1-month forward yen was selling at a:

A) 1.69% premium per annum against the dollar.

B) 20.22% premium per annum against the dollar.

C) 1.69% discount per annum against the dollar.

D) 20.22% discount per annum against the dollar.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Assume that the 3-month iUS = 8% and the 3-month iUK = 4%,and the spot rate is $1.50 per pound.Using the approximate covered interest rate parity condition,the 3-month forward rate $/pound is:

A) 1.440

B) 1.515

C) 1.527

D) 1.560

A) 1.440

B) 1.515

C) 1.527

D) 1.560

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

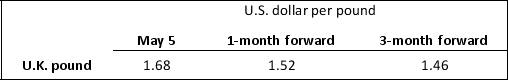

Use the following information to answer questions 6-9.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 3-month forward yen was selling at a:

A) 2.43% premium per annum against the dollar.

B) 9.72% premium per annum against the dollar.

C) 2.43% discount per annum against the dollar.

D) 9.72% discount per annum against the dollar.

Table 6.1: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.1.On May 5,2012,the 3-month forward yen was selling at a:

A) 2.43% premium per annum against the dollar.

B) 9.72% premium per annum against the dollar.

C) 2.43% discount per annum against the dollar.

D) 9.72% discount per annum against the dollar.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that the one-year U.S.interest rate is 10%.If the one-year forward rate against the pound is $1.52 per pound and the spot exchange rate is $1.50 per pound,what must the equivalent British interest rate be according to the approximate covered interest parity?

A) 8.67%

B) 9.95%

C) 10%

D) 11.33%

A) 8.67%

B) 9.95%

C) 10%

D) 11.33%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following information to answer questions 10-12.

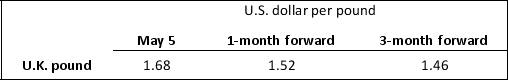

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.On May 5,2012,the 3-month forward yen was selling at a:

A) 13.10% premium per annum against the dollar.

B) 52.40% premium per annum against the dollar.

C) 13.10% discount per annum against the dollar.

D) 52.40% discount per annum against the dollar.

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.On May 5,2012,the 3-month forward yen was selling at a:

A) 13.10% premium per annum against the dollar.

B) 52.40% premium per annum against the dollar.

C) 13.10% discount per annum against the dollar.

D) 52.40% discount per annum against the dollar.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer questions 10-12.

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.On May 5,2012,the 1-month forward pound was selling at a:

A) 9.52% premium per annum against the dollar.

B) 114.24% premium per annum against the dollar.

C) 9.52% discount per annum against the dollar.

D) 114.24% discount per annum against the dollar.

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.On May 5,2012,the 1-month forward pound was selling at a:

A) 9.52% premium per annum against the dollar.

B) 114.24% premium per annum against the dollar.

C) 9.52% discount per annum against the dollar.

D) 114.24% discount per annum against the dollar.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information to answer questions 10-12.

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.Comparing the yen's forward rates against the yen's spot rate,over the period of a forward contract,we would expect the yen's spot rate to:

A) remain constant against the dollar

B) appreciate against the dollar

C) depreciate against the dollar

D) depreciate against the dollar in the first 30 days and then appreciate afterward.

Table 6.2: Spot and Forward Exchange Rates on May 5, 2012.

Refer to Table 6.2.Comparing the yen's forward rates against the yen's spot rate,over the period of a forward contract,we would expect the yen's spot rate to:

A) remain constant against the dollar

B) appreciate against the dollar

C) depreciate against the dollar

D) depreciate against the dollar in the first 30 days and then appreciate afterward.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose that the one-year U.S.interest rate is 9% and the one-year U.K.interest rate is 8%.If the current spot rate is $1.70 per pound,what must the one-year forward rate $/pound be according to the approximate covered interest parity?

A) $1.683

B) $1.717

C) $1.723

D) $3.400

A) $1.683

B) $1.717

C) $1.723

D) $3.400

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

Assume the following:

You have $10,000 to invest.

The current spot rate: S$/£ = 2.00,the 90-day forward: F90$/£ = 1.80,annual interest rates: iUS = 4% and iUK = 8%.

If you invest $10,000 in the U.S.for 90 days,you will get $____________.If you invest in the U.K.and cover in the forward market for 90 days,you will get $__________.

A) $10,100: $10,098

B) $10,400: $9,720

C) $10,100: $10,133

D) $10,400: $10,692

You have $10,000 to invest.

The current spot rate: S$/£ = 2.00,the 90-day forward: F90$/£ = 1.80,annual interest rates: iUS = 4% and iUK = 8%.

If you invest $10,000 in the U.S.for 90 days,you will get $____________.If you invest in the U.K.and cover in the forward market for 90 days,you will get $__________.

A) $10,100: $10,098

B) $10,400: $9,720

C) $10,100: $10,133

D) $10,400: $10,692

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

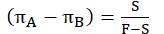

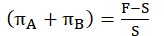

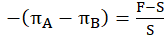

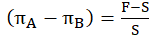

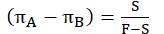

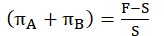

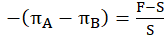

Assume two countries,A and B have the following Fisher equations,where i is nominal interest rate,r is real interest rate,and π is the expected rate of inflation:

iA = rA + πA

iB = rB + πB

Spot and forward rates are expressed as currency A per currency B.When the covered interest parity holds and rA = rB, then

A)

B)

C)

D)

iA = rA + πA

iB = rB + πB

Spot and forward rates are expressed as currency A per currency B.When the covered interest parity holds and rA = rB, then

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

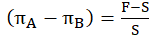

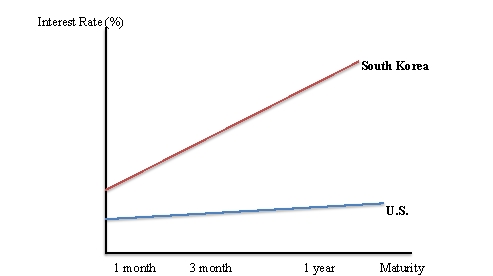

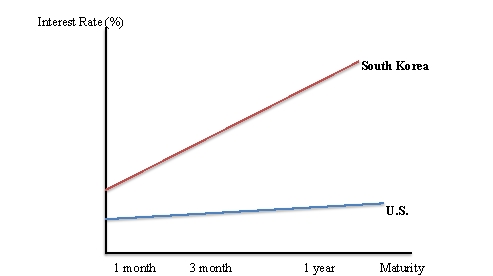

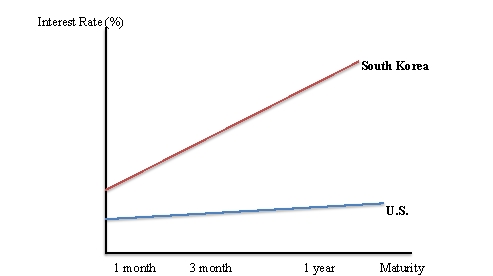

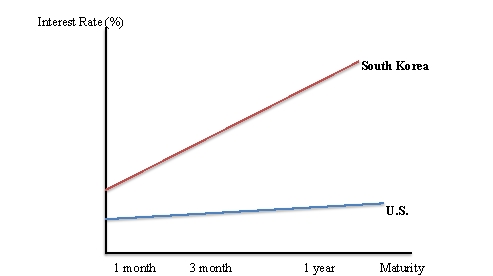

Use the following graph to answer questions 23-24.

Figure 6.1: Yield Curves

Refer to Figure 6.1.The forward _________ on the U.S.dollar becomes ______ at higher maturities.

A) discount, larger

B) discount, smaller

C) premium, larger

D) premium, smaller

Figure 6.1: Yield Curves

Refer to Figure 6.1.The forward _________ on the U.S.dollar becomes ______ at higher maturities.

A) discount, larger

B) discount, smaller

C) premium, larger

D) premium, smaller

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

When investors hedge themselves from risk using forward contracts,the international investment is considered:

A) Flat

B) Discounted

C) A bargain

D) Covered

A) Flat

B) Discounted

C) A bargain

D) Covered

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

If the expected inflation in Brazil in higher than the expected inflation in the U.S.,and the real interest rates are equal across countries,then we would expect the Brazilian real Brazil's currency to:

A) appreciate

B) depreciate

C) remain the same

D) depreciate and then appreciate later.

A) appreciate

B) depreciate

C) remain the same

D) depreciate and then appreciate later.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

Assume a nominal interest rate on one-year U.S.Treasury Bills of 5.30% and a real rate of interest of 1.50%.Using the Fisher Effect Equation,what is the approximate expected rate of inflation in the U.S.over the next year?

A) - 3.80%

B) 3.53%

C) 3.80%

D) 6.80%

A) - 3.80%

B) 3.53%

C) 3.80%

D) 6.80%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following reasons explain why interest rate parity may not hold perfectly?

I.Controls on financial capital flows

II.Offshore risk accounting rules

III.Different tax rates for interest and foreign exchange rate earnings

IV.Time zone fluctuations

A) I only

B) I and III

C) I, II, and III

D) I, III, and IV

I.Controls on financial capital flows

II.Offshore risk accounting rules

III.Different tax rates for interest and foreign exchange rate earnings

IV.Time zone fluctuations

A) I only

B) I and III

C) I, II, and III

D) I, III, and IV

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose that the one-year U.S.interest rate is 5% and the equivalent one-year Swiss interest rate is 4%.According to the covered interest rate parity,there is a ________ on the Swiss franc.

A) 1% forward discount

B) 1% forward premium

C) 9% forward discount

D) Forward flat

A) 1% forward discount

B) 1% forward premium

C) 9% forward discount

D) Forward flat

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose that the one-year U.S.interest rate is 13% and the one-year Swiss interest rate is 2%.If the current spot rate is $1.40 per Swiss franc,what must the one-year forward rate $/SFr be according to the approximate covered interest parity?

A) 1.246

B) 1.330

C) 1.470

D) 2.100

A) 1.246

B) 1.330

C) 1.470

D) 2.100

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

The preferred habit theory of term structure of interest rates suggests that long-term bonds should________ short-term bonds due to investor risk aversion.

A) Hold a premium over

B) Have a discount over

C) Offer the same return as

D) Be entirely separate of

A) Hold a premium over

B) Have a discount over

C) Offer the same return as

D) Be entirely separate of

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

Deviations from interest rate parity could be the result of:

A) different tax treatment of income and foreign exchange earnings

B) political risk

C) transaction costs

D) All of the above are correct.

A) different tax treatment of income and foreign exchange earnings

B) political risk

C) transaction costs

D) All of the above are correct.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose that the one-year U.S.interest rate is 5% and the equivalent one-year Swiss interest rate is 4%.According to the covered interest rate parity,there is a forward discount on the Swiss franc.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose that the one-year U.S.interest rate is 4% and the one-year U.K.interest rate is 6%.If the current spot rate is $1.80 per pound,what must the one-year forward rate $/pound be according to the approximate covered interest parity?

A) 1.360

B) 1.764

C) 1.836

D) 1.980

A) 1.360

B) 1.764

C) 1.836

D) 1.980

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that the one-year U.S.interest rate is 8% and the equivalent one-year U.K.interest rate is 10%.According to the covered interest rate parity,there is a ________ on the U.S dollar.

A) 2% forward discount

B) 2% forward premium

C) 18% forward discount

D) 18% forward premium

A) 2% forward discount

B) 2% forward premium

C) 18% forward discount

D) 18% forward premium

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following graph to answer questions 23-24.

Figure 6.1: Yield Curves

Refer to Figure 6.1.At 3-month maturity,the U.S.dollar sells at a forward ______ and the Korean won sells at a forward _______.

A) discount; discount

B) discount; premium

C) premium; premium

D) premium; discount

Figure 6.1: Yield Curves

Refer to Figure 6.1.At 3-month maturity,the U.S.dollar sells at a forward ______ and the Korean won sells at a forward _______.

A) discount; discount

B) discount; premium

C) premium; premium

D) premium; discount

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose that the one-year Swiss interest rate is 1% and the one-year U.K.interest rate is 11%.If the current spot rate is 0.75 Swiss franc per pound,what must the one-year forward rate SFr/pound be according to the approximate covered interest parity?

A) 0.675

B) 0.730

C) 0.770

D) 0.825

A) 0.675

B) 0.730

C) 0.770

D) 0.825

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

The ________ interest rate is equal to the ________ interest rate minus the expected rate of inflation.

A) Real, nominal

B) Predicted, nominal

C) Standard, nominal

D) Nominal, standard

A) Real, nominal

B) Predicted, nominal

C) Standard, nominal

D) Nominal, standard

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

If the expected inflation in Brazil in higher than the expected inflation in the U.S.,and the real interest rates are equal across countries,then:

A) there is a forward premium on the dollar.

B) there is a forward flat on the dollar.

C) there is a forward discount on the dollar.

D) there is a spot discount on the dollar.

A) there is a forward premium on the dollar.

B) there is a forward flat on the dollar.

C) there is a forward discount on the dollar.

D) there is a spot discount on the dollar.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose interest parity holds.There is a change in U.S.policy that leads to expectations of a lower U.S.inflation rate.The decrease in expected inflation will cause dollar interest rates to _______.

A) Stay the same.

B) Fall.

C) Rise.

D) None of the above.

A) Stay the same.

B) Fall.

C) Rise.

D) None of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose that the covered interest parity holds.If real interest rates are equal in two countries,then:

A) the interest rate differential will equal to expected inflation rate differential.

B) the interest rate differential will equal to the forward premium or discount between two currencies.

C) the expected inflation rate differential will equal to the forward premium or discount between two currencies.

D) All of the above are correct.

A) the interest rate differential will equal to expected inflation rate differential.

B) the interest rate differential will equal to the forward premium or discount between two currencies.

C) the expected inflation rate differential will equal to the forward premium or discount between two currencies.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

A currency is at a ________ when its interest rate is ________ than the interest rate in the other country.

A) Forward flat, lower

B) Forward discount, lower

C) Forward discount, higher

D) Forward premium, higher

A) Forward flat, lower

B) Forward discount, lower

C) Forward discount, higher

D) Forward premium, higher

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

A forward discount occurs when:

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose interest parity holds and there is a sudden change in U.S.policy that leads to expectations of a higher U.S.inflation rate.The increase in expected inflation will cause dollar interest rates to rise.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose interest parity holds.There is a change in U.S.policy that leads to expectations of a higher U.S.inflation rate.The increase in expected inflation will cause dollar interest rates to _______.

A) Stay the same.

B) Fall.

C) Rise.

D) None of the above.

A) Stay the same.

B) Fall.

C) Rise.

D) None of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

Deviations from interest rate parity could come from:

A) Transaction costs

B) Government controls

C) Political risk

D) All of the above.

A) Transaction costs

B) Government controls

C) Political risk

D) All of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

Profit-seeking arbitrage activity ensures:

A) Covered interest rate parity.

B) Decreased competition.

C) Higher interest rates on loans.

D) Increased banking regulation.

A) Covered interest rate parity.

B) Decreased competition.

C) Higher interest rates on loans.

D) Increased banking regulation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following reasons explain why interest rate parity may not hold perfectly?

I.Transaction costs

II.Business loan risks

III.Offshore risk accounting rules

IV.Political risk

A) I only

B) II and III

C) I and IV

D) I, III, and IV

I.Transaction costs

II.Business loan risks

III.Offshore risk accounting rules

IV.Political risk

A) I only

B) II and III

C) I and IV

D) I, III, and IV

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

The real interest rate is equal to the nominal interest rate plus the expected rate of inflation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

The expected exchange rate changes will be reflected in the differences between the term structure of interest rates in two countries.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

The exact and approximate CIRP are close in value when

A) Interest rates are larger

B) Interest rates are smaller

C) Spot rates are larger

D) Spot rates are smaller

A) Interest rates are larger

B) Interest rates are smaller

C) Spot rates are larger

D) Spot rates are smaller

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following reasons explain why interest rate parity may not hold perfectly?

I.Banking practices

II.Government controls

III.Business loan risk

IV.Varying expectations

A) I only

B) II only

C) II and IV

D) I, III, and IV

I.Banking practices

II.Government controls

III.Business loan risk

IV.Varying expectations

A) I only

B) II only

C) II and IV

D) I, III, and IV

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

The structure of interest rates existing on investment opportunities over time is known as the ______ structure of interest rates.

A) Investment

B) Opportunity

C) Fixed

D) Term

A) Investment

B) Opportunity

C) Fixed

D) Term

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

A forward premium occurs when:

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

A currency is at a ________ when its interest rate is ________ than the interest rate in the other country.

A) Forward flat, lower

B) Forward discount, lower

C) Forward flat, higher

D) Forward premium, lower

A) Forward flat, lower

B) Forward discount, lower

C) Forward flat, higher

D) Forward premium, lower

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

The equivalence of the interest differential between two currencies to the forward premium or discount is known as interest rate parity.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

Suppose that the one-year U.S.interest rate is 7% and the one-year Swedish interest rate is 10%.If the current spot rate is 6.80 Swedish krona per dollar,what must the one-year forward rate SKr/$ be according to the approximate covered interest parity?

A) 6.596

B) 6.720

C) 7.004

D) 7.276

A) 6.596

B) 6.720

C) 7.004

D) 7.276

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

The liquidity premium theory of term structure of interest rates suggests that long-term bonds should________ short-term bonds due to investor risk aversion.

A) Hold a premium over

B) Have a discount over

C) Offer the same return as

D) Be entirely separate of

A) Hold a premium over

B) Have a discount over

C) Offer the same return as

D) Be entirely separate of

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

Suppose that the one-year U.S.interest rate is 9% and the one-year U.K.interest rate is 6%.If the current spot rate is $1.80 per pound,what must the one-year forward rate $/pound be according to the approximate covered interest parity?

A) 1.746

B) 1.854

C) 1.908

D) 1.962

A) 1.746

B) 1.854

C) 1.908

D) 1.962

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

A forward flat occurs when:

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

A) The forward rate is greater than the spot rate.

B) The spot rate is greater than the forward rate.

C) The forward and spot rates are equal.

D) None of the above.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

In international finance,covered interest rate parity refers to:

A) The forward rate being in excess of the spot rate.

B) The advantage of one currency over another.

C) The equivalence of the interest differential between two currencies to the forward premium or discount.

D) The difference of the two comparable investments in two different countries.

A) The forward rate being in excess of the spot rate.

B) The advantage of one currency over another.

C) The equivalence of the interest differential between two currencies to the forward premium or discount.

D) The difference of the two comparable investments in two different countries.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose that the one-year U.S.interest rate is 4% and the equivalent one-year U.K.interest rate is 6%.According to the covered interest rate parity,there is a ________ on the British pound.

A) 2% forward discount

B) 2% forward premium

C) 10% forward discount

D) 10% forward premium

A) 2% forward discount

B) 2% forward premium

C) 10% forward discount

D) 10% forward premium

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

Pegging exchange rates at fixed levels by buying and selling to maintain the fixed rate by the central bank means that domestic and foreign currency interest rates will have to adjust to parity levels.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Suppose that the one-year U.S.interest rate is 3% and the equivalent one-year Swiss interest rate is 3%.According to the covered interest rate parity,there is a forward flat on the Swiss franc.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

The real interest rate is equal to the nominal interest rate minus the expected rate of inflation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

If expected inflation in Canada is higher than expected inflation in the U.K.,and the real interest rates are equal,we would expect the Canadian dollar to appreciate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

The structure of interest rates existing on investment opportunities over time is known as the flat structure of interest rates.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck